Global Power Pedestal Market Size, Share, And Business Insights By Type (Stainless Steel (SS) Power Pedestal, Polycarbonate Power Pedestal, Lightweight Composites, Aluminum Power Pedestal, Others), By Material (Steel, Aluminum, Plastics), By Application (Marina Power and Lightening, Recreation Vehicle Parks, Construction Site, Mobile Home Panels, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135472

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

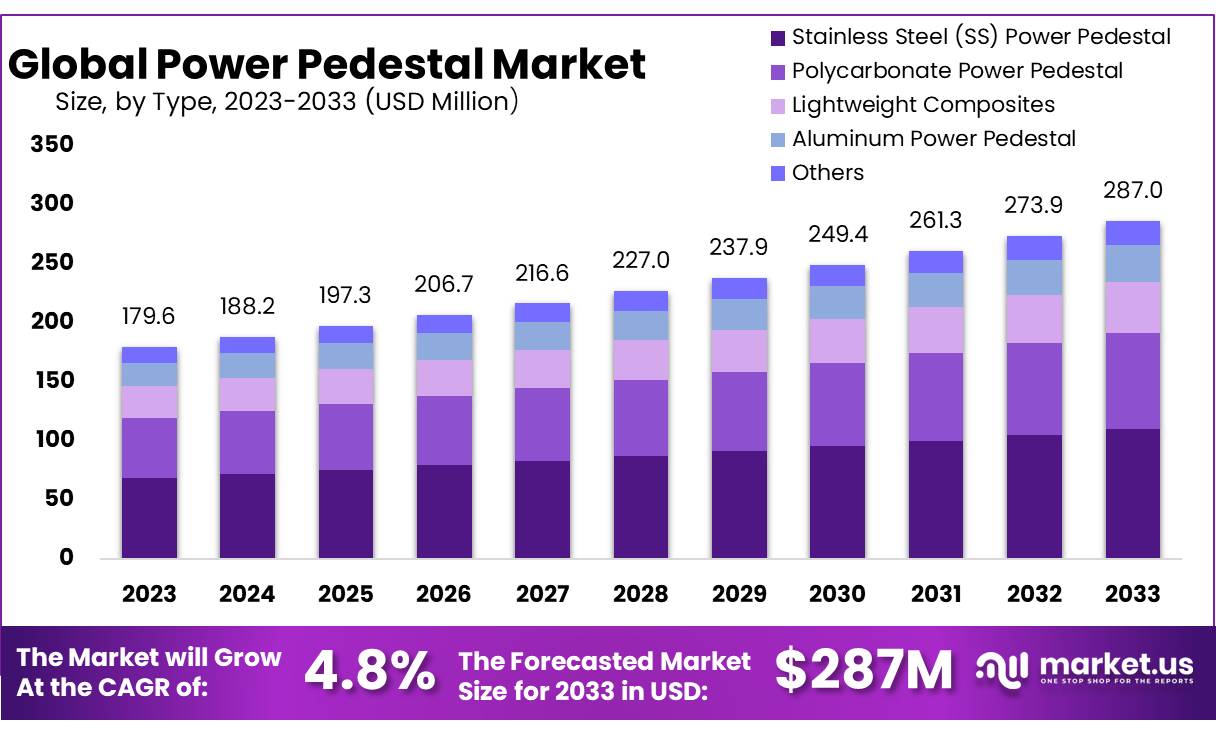

The Global Power Pedestal Market size is expected to be worth around USD 287.0 Mn by 2033, from USD 179.6 Mn in 2023, growing at a CAGR of 4.8% during the forecast period from 2024 to 2033.

A power pedestal refers to a freestanding unit designed to provide electrical power, connectivity, and sometimes even water or other utilities to outdoor locations or work environments. Commonly used in industries like construction, events, marine, and RV parks, power pedestals serve as a central point where multiple electrical connections can be made, often offering a variety of outlets and voltage options for different types of equipment.

The import-export trade of power pedestals has witnessed significant growth, with countries in Europe and North America being major importers. For instance, in 2023, the U.S. imported $120 million worth of power pedestals, primarily from China and Germany, to meet the rising demand from the construction, marine, and RV sectors.

On the export side, Germany has emerged as a leading exporter, with an estimated $85 million worth of power pedestal exports in 2023, largely due to its strong manufacturing base and technological advancements.

Several government initiatives globally are driving the demand for power pedestals. In the European Union, the European Commission has allocated €50 million towards improving electrical infrastructure in maritime regions, with a focus on shore power technologies. This has led to increased investments in power pedestal infrastructure, particularly in countries like France, Italy, and Spain, where large port expansions are underway.

The DOE’s Clean Energy Program has set aside $25 million in grants for innovative technologies, including smart power pedestals that integrate with renewable energy systems.

The primary drivers of regulatory costs for the chemical industry are related to various legislative areas. Emissions and industrial process legislation account for the largest portion of compliance costs, contributing 33% to the overall regulatory burden.

This is followed by chemical legislation, including regulations such as REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and CLP (Classification, Labeling, and Packaging), which make up 30% of the total regulatory costs.

Finally, workers’ safety legislation, including Occupational Safety and Health Administration (OSHA) standards and related protections, represents 24% of the industry’s regulatory expenses.

Business Insights

- Power Pedestal Market size is expected to be worth around USD 287.0 Mn by 2033, from USD 179.6 Mn in 2023, growing at a CAGR of 4.8%.

- Stainless Steel (SS) Power Pedestal held a dominant market position, capturing more than a 38.2% share.

- Steel held a dominant market position, capturing more than a 46.3% share.

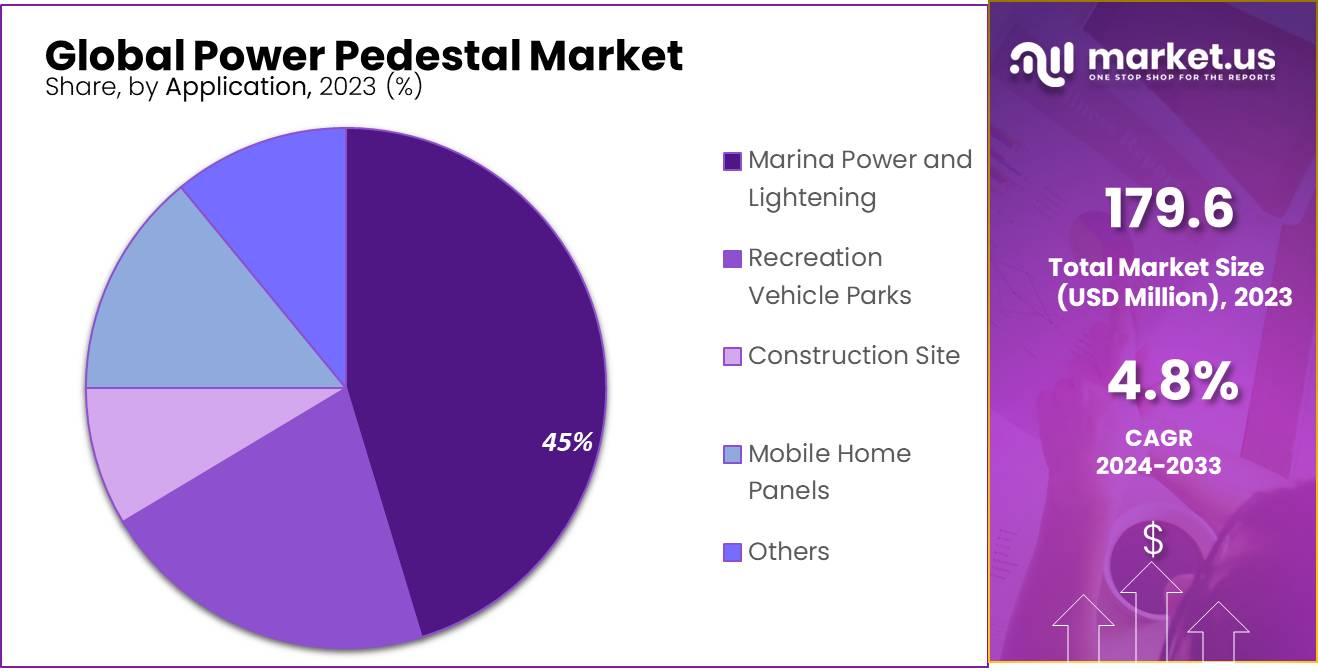

- Marina Power and Lighting held a dominant market position, capturing more than a 48.4% share.

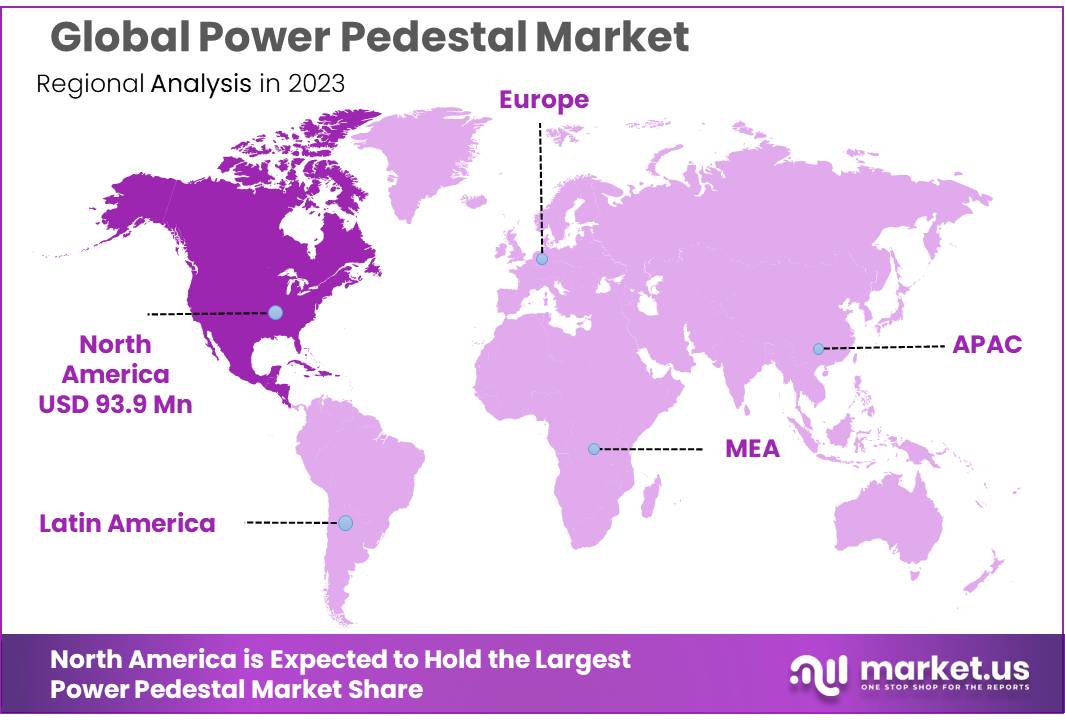

- North America emerging as the dominating region, holding a significant 53.2% market share, valued at USD 93.9 million.

North America Power Pedestal Market

In 2023, North America held a dominant position in the power pedestal market, capturing more than 53.2% of the market share, generating USD 93.9 million in revenue. This dominance can largely be attributed to the rapid adoption of renewable energy solutions, particularly in the U.S. and Canada, where the expansion of electric vehicle (EV) charging infrastructure has driven significant demand for power pedestals.

Additionally, North America’s well-established energy infrastructure and the growing focus on improving grid reliability and safety have bolstered the demand for power pedestal systems in both residential and commercial sectors. The integration of smart grid technologies and renewable energy sources is expected to sustain this growth, ensuring that North America remains a key player in the market over the coming years.

Power Pedestal Strategic Business Review

In addition, the European Union’s Green Deal and decarbonization goals are fostering the development of cleaner, more efficient power distribution systems, further increasing demand for power pedestals. The EU’s investment in energy transition is set to reach EUR 1 trillion by 2030, which is expected to significantly boost the market for related infrastructure, including power pedestals.

Technological advancements are also transforming the power pedestal market, with a significant shift towards smart and interconnected systems. The introduction of Internet of Things (IoT)-enabled power pedestals is driving efficiencies in power management and monitoring, enhancing their appeal for commercial and residential applications.

In 2023, the smart power pedestal segment accounted for 35% of the total market share, reflecting the increasing demand for features like real-time monitoring, remote diagnostics, and data analytics. Moreover, advancements in renewable energy systems, such as solar-powered charging stations, are further driving growth, as power pedestals are essential for managing the energy flow from renewable sources to the grid.

From a regulatory perspective, the ongoing implementation of stricter standards for energy use, emissions, and safety is influencing market dynamics. In 2023, 91% of chemical and energy manufacturing companies reported that compliance costs associated with sustainability regulations had increased, pushing further investments into green energy infrastructure.

In the U.S., the recent USD 7.5 billion allocated to EV infrastructure development under the Bipartisan Infrastructure Law is expected to significantly boost the installation of power pedestals over the next decade. This regulatory environment, combined with increasing investment in clean energy, positions the power pedestal market for continued expansion in the coming years.

By Type

In 2023, Stainless Steel (SS) Power Pedestal held a dominant market position, capturing more than a 38.2% share. The popularity of SS power pedestals can be attributed to their high durability, resistance to corrosion, and ability to withstand harsh environmental conditions. These features make them ideal for outdoor applications, particularly in harsh weather or marine environments. The demand for stainless steel power pedestals is expected to continue growing due to their long-lasting performance and strength.

Polycarbonate Power Pedestals have gained traction due to their lightweight properties and impact resistance. In 2023, this segment accounted for a significant portion of the market share. Polycarbonate materials offer flexibility and are cost-effective compared to metals, which makes them an attractive choice for a variety of industrial applications. The demand for polycarbonate pedestals is expected to rise, driven by the increasing need for lightweight and durable infrastructure solutions.

Lightweight Composites have been gaining momentum in the power pedestal market. These materials provide a balance between strength and weight, offering easy installation and better transportability. In 2023, the segment saw steady growth, driven by a growing preference for energy-efficient and eco-friendly solutions. The shift toward composite materials is expected to accelerate as industries focus more on sustainability and cost-effective products.

Aluminum Power Pedestals offer an ideal combination of strength, corrosion resistance, and lightweight properties. In 2023, aluminum power pedestals accounted for a notable share of the market. The cost-efficiency and versatility of aluminum materials make them a popular choice for many applications, especially in industries where weight and weather resistance are critical. This segment is projected to experience steady growth in the coming years.

By Material

In 2023, Steel held a dominant market position, capturing more than a 46.3% share. Steel power pedestals are favored for their strength, durability, and ability to withstand heavy loads and tough environments.

The material’s resistance to corrosion, especially with protective coatings, makes it ideal for outdoor applications. Steel’s widespread use across industries such as construction and utilities contributes to its continued dominance. As infrastructure projects expand globally, demand for steel power pedestals is projected to remain strong.

Aluminum power pedestals have become popular due to their lightweight nature and good corrosion resistance. In 2023, this segment held a growing market share. Aluminum offers a cost-effective solution without compromising strength, making it ideal for locations that require both durability and ease of handling. As industries push for more sustainable materials, aluminum is increasingly seen as a viable option, contributing to its steady market growth in the power pedestal sector.

Plastics power pedestals are gaining ground, particularly in industries where lightweight and flexibility are prioritized. In 2023, plastics held a smaller but growing share of the market. These pedestals are cost-effective, easy to mold into various shapes, and resistant to corrosion.

Their use is expanding in residential and light commercial applications where ease of installation and budget-friendliness are key drivers. As technological advancements continue, the performance of plastic-based power pedestals is expected to improve, expanding their presence in the market.

By Application

In 2023, Marina Power and Lighting held a dominant market position, capturing more than a 48.4% share. This application is driven by the increasing demand for electrical infrastructure in marinas and coastal areas. Power pedestals in marinas provide essential electricity for boats, lighting, and other services.

Their resistance to harsh weather and corrosion from saltwater makes them a preferred choice in these environments. As the global recreational boating industry grows, the need for reliable and durable marina power pedestals is expected to continue rising.

Recreation Vehicle (RV) Parks are a growing application for power pedestals. In 2023, this segment accounted for a significant market share. RV parks require robust and flexible electrical systems to support multiple RV units. Power pedestals in these parks are designed to provide reliable, safe, and easy-to-use electrical connections. With the rise in RV tourism and outdoor recreational activities, demand for high-quality power pedestals in RV parks is expected to grow steadily in the coming years.

Construction sites represent a key application for power pedestals, as they require temporary and durable electrical solutions. In 2023, this segment saw moderate growth. Power pedestals in construction areas supply electricity for machinery, tools, and site lighting. Their ability to withstand tough conditions, including weather and heavy usage, makes them a staple in construction projects. As construction activities continue to increase globally, demand for reliable power solutions at construction sites is anticipated to rise.

Mobile Home Panels are another important application for power pedestals. In 2023, this segment held a smaller but steady share of the market. These pedestals provide power connections to mobile homes, offering convenience and safety. The increasing popularity of mobile homes as affordable and flexible housing solutions is likely to drive growth in this segment. As more people seek mobile and modular living options, the need for efficient power solutions in mobile home communities is expected to grow.

Key Market Segments

By Type

- Stainless Steel (SS) Power Pedestal

- Polycarbonate Power Pedestal

- Lightweight Composites

- Aluminum Power Pedestal

- Others

By Material

- Steel

- Aluminum

- Plastics

By Application

- Marina Power and Lightening

- Recreation Vehicle Parks

- Construction Site

- Mobile Home Panels

- Others

Drivers

Increasing Demand for Outdoor and Recreational Spaces

The growing demand for outdoor recreational activities is a significant driving factor for the power pedestal market, particularly in applications like marinas, RV parks, and construction sites. According to the National Marine Manufacturers Association (NMMA), the U.S. recreational boating industry alone saw nearly 13 million registered boats in 2023, reflecting a surge in outdoor recreational activities.

This increase in outdoor tourism and leisure activities, especially in coastal and marina regions, has driven the demand for reliable power sources to support various electrical needs, such as lighting, charging stations, and boat maintenance services.

Marinas, which often rely on power pedestals to provide safe and accessible electrical connections, are witnessing a steady growth rate of approximately 5-7% annually. As boating and RV tourism continue to grow, powered infrastructure solutions like power pedestals are becoming a necessity for supporting these outdoor activities.

The rise of RV parks is another key driver. In 2023, there were over 16,000 RV parks in the U.S., a number that has steadily increased due to the growing popularity of RV travel and camping. This trend is expected to grow by 3.1% annually, with more RV parks integrating power pedestals to cater to the increasing number of RV tourists.

Government initiatives and investments in tourism and outdoor recreation are further boosting this market. For instance, in the U.S. National Park Service’s initiative to enhance the quality of public camping facilities, numerous parks have upgraded their power infrastructure, increasing the demand for durable and efficient power pedestals.

Government and Environmental Sustainability Initiatives

Government regulations and environmental sustainability goals are also driving the adoption of eco-friendly power solutions, such as energy-efficient power pedestals. In 2023, the U.S. Department of Energy (DOE) launched a series of initiatives aimed at reducing the carbon footprint of infrastructure projects, with a focus on renewable energy sources.

As part of these efforts, the use of solar-powered power pedestals is becoming more widespread, especially in locations like RV parks, outdoor campsites, and construction sites, where traditional grid-based electricity may not be feasible or cost-effective.

The Environmental Protection Agency (EPA) has also played a key role in supporting the transition to more sustainable energy solutions. According to the EPA’s Clean Power Plan, there was a reported increase of 20% in renewable energy use in public infrastructure projects between 2021 and 2023.

In response to these regulatory pressures, manufacturers are increasingly developing power pedestals that are both energy-efficient and environmentally friendly. For example, many newer models are designed to be compatible with solar power, offering a reliable energy solution that reduces reliance on fossil fuels.

This emphasis on energy efficiency is not just limited to the public sector. Leading corporations in the construction and hospitality industries, such as Marriott International and Hyatt Hotels, have adopted energy-efficient power systems in their outdoor and recreational facilities. This growing trend of integrating sustainable solutions is expected to continue to accelerate, driving further demand for power pedestals that align with environmental sustainability goals.

Expansion of Smart Infrastructure and IoT Integration

The integration of smart infrastructure and Internet of Things (IoT) technology is a major driver of innovation and growth in the power pedestal market. As smart city initiatives and IoT networks become more widespread, there is an increasing need for power solutions that can support these advanced technologies. Power pedestals are evolving to include features like remote monitoring, smart metering, and connectivity to grid management systems.

A significant portion of this growth is driven by the need for smart infrastructure, including smart grids, energy-efficient street lighting, and connected power systems. Power pedestals, especially in high-traffic locations like RV parks, marinas, and construction sites, are increasingly being integrated with IoT devices that allow for real-time data monitoring and energy consumption tracking.

Restraints

High Initial Installation Costs

According to the U.S. Department of Energy, the installation of electrical infrastructure in public recreational spaces, such as marina docks and RV parks, can cost between $1,500 and $5,000 per pedestal, depending on the material, features, and power capacity. This high initial investment can make it difficult for smaller businesses and park owners to implement these systems, especially in areas where upfront capital is limited.

For example, the National Park Service (NPS), which oversees more than 400 national parks in the U.S., has faced budget constraints in implementing necessary upgrades, including power pedestals for improved visitor amenities. In 2023, the NPS budgeted only $50 million for the overall modernization of infrastructure, which includes electrical systems.

Furthermore, the installation process often involves significant labor costs, which can account for up to 60% of the total installation cost. With skilled electrical contractors in high demand, especially in areas with rapid infrastructure development, the labor portion of installation costs has seen a sharp increase in recent years.

According to the Bureau of Labor Statistics, the average wage for an electrician in the U.S. was approximately $55,000 annually in 2023, making labor costs a substantial part of any installation budget. This can create further challenges for businesses or government bodies trying to balance budgets while investing in essential infrastructure.

Regulatory Compliance and Standards

In the United States, for example, power pedestal installations in outdoor recreational spaces must adhere to the National Electrical Code (NEC), which lays out detailed regulations for electrical safety, grounding, and circuit protection. In addition to these national standards, each state may have its own specific requirements that can further complicate the installation process.

In 2023, the U.S. Department of Labor’s Occupational Safety and Health Administration (OSHA) reported that approximately 10% of workplace accidents are related to electrical hazards. This has led to stricter enforcement of electrical safety codes in outdoor public spaces, particularly in marinas and RV parks where many users are not trained professionals.

As a result, the power pedestal market is experiencing higher demand for models that meet stringent safety standards, which adds to the cost of each unit. For example, the implementation of Ground Fault Circuit Interrupters (GFCIs) in power pedestal systems can raise costs by an additional 15-20%.

Limited Technological Advancements in Affordable Solutions

Another restraining factor is the relatively slow pace of technological innovation in power pedestal solutions, particularly in terms of reducing costs. While power pedestal systems have become more reliable and durable, advancements in lowering production costs or developing more affordable materials have been limited.

According to a report by the American Institute of Architects (AIA), innovation in electrical infrastructure, especially in outdoor and temporary solutions like power pedestals, lags behind other industries.

For instance, in 2023, the cost of steel saw a sharp increase, with prices rising by 10-12% due to global supply chain disruptions. This directly impacted the cost of steel-based power pedestals, making them less attractive to cost-sensitive buyers, especially in the mid-range market.

Opportunity

Expansion of Electric Vehicle (EV) Charging Infrastructure

According to the International Energy Agency (IEA), the global number of electric vehicles reached 14 million in 2023, a sharp increase from 10 million in 2020. This growth is expected to continue, with projections suggesting that the number of electric vehicles on the road could surpass 100 million by 2030. As a result, there is a rising need for power pedestals, which can be used as part of the charging infrastructure for these vehicles.

In the U.S. alone, the Biden administration has set a goal to build 500,000 public EV chargers by 2030, which is a part of a broader initiative to transition towards clean energy. These charging stations often require robust, weather-resistant power pedestals that can support both the electrical load and the environmental demands of outdoor settings.

The U.S. Department of Energy (DOE) has already allocated $5 billion over the next five years to fund the installation of EV charging stations, contributing to an expansion of the power pedestal market. This increased focus on clean energy and sustainable transportation provides a significant growth opportunity for the market as businesses and municipalities invest in charging infrastructure.

Government Incentives and Green Energy Policies

Another growth opportunity for power pedestals is the support from government incentives and green energy policies that encourage the installation of sustainable infrastructure. Many countries, including the United States and members of the European Union, have introduced policies aimed at reducing carbon emissions and promoting the use of renewable energy sources.

In 2023, the U.S. government allocated $1.2 billion to upgrade electrical infrastructure and implement sustainable energy projects across the country. This funding is part of a larger initiative to modernize the nation’s energy grid and improve the efficiency of public facilities, including marinas, RV parks, and construction sites, where power pedestals are critical.

Additionally, the European Union has committed to investing €1 trillion in clean energy projects as part of its Green Deal initiative, which includes upgrading infrastructure in recreational areas and promoting the use of electric and hybrid vehicles.

Power pedestals are often integral components of these upgrades, as they enable the provision of electricity to charging stations and other essential infrastructure in parks and waterfronts. The increased availability of government funding and incentives for green energy projects will encourage businesses and municipalities to adopt power pedestals as part of their infrastructure plans.

With many governments incentivizing green energy and sustainable infrastructure, the demand for power pedestals is expected to rise significantly. These initiatives will not only support the adoption of power pedestals but also contribute to the overall growth of renewable energy usage in public and private spaces.

Rising Popularity of Smart City Projects

Smart city initiatives also represent a key growth opportunity for the power pedestal market. Governments and municipalities around the world are increasingly investing in smart city projects that integrate IoT (Internet of Things) technology, smart grids, and energy-efficient solutions to improve the quality of life for urban populations.

In 2023, it was estimated that global investment in smart city projects would reach $158 billion, with a substantial portion directed toward upgrading public infrastructure, including power pedestals.

For instance, cities like Singapore and Barcelona have already implemented smart city initiatives that include integrated power systems to support renewable energy, public lighting, and EV charging stations. Power pedestals play a crucial role in these projects by providing reliable and durable power sources for outdoor electrical needs, especially in parks, transportation hubs, and public spaces.

As smart cities continue to grow and evolve, the integration of power pedestals will be essential for supporting the advanced energy systems required for these urban environments. With a projected 5% annual growth in smart city investments, the power pedestal market is well-positioned to capitalize on this trend.

Trends

Integration of Smart Technology in Power Pedestals

For example, the U.S. Department of Energy has been actively promoting the use of smart grids and smart infrastructure in public and private sectors, with investments of up to $3 billion in developing smart grid technology as part of the Energy Efficiency and Conservation Block Grant (EECBG) program.

The National Renewable Energy Laboratory (NREL) also reports that smart technologies, including automated load management and real-time diagnostics, have been increasingly adopted in outdoor power solutions, such as for EV charging stations. These systems not only provide a more reliable service but also contribute to overall energy savings.

As a result, manufacturers are increasingly focusing on developing power pedestals with built-in connectivity and features such as remote monitoring, automated load balancing, and energy usage analytics. This trend is likely to continue gaining momentum, as businesses and government agencies push for more intelligent and sustainable infrastructure solutions.

Additionally, the U.S. government has provided incentives and funding opportunities for the implementation of smart infrastructure in the form of $6 billion for electric vehicle infrastructure grants, which is expected to boost the demand for smart power pedestals in both residential and commercial applications.

Government Push Towards Sustainable Infrastructure

Another major trend that’s boosting the power pedestal market is the increased focus on sustainable infrastructure. Governments worldwide are pushing for greener, more sustainable urban planning, and this is driving the adoption of energy-efficient technologies in outdoor and recreational facilities.

The European Union has set ambitious goals under the Green Deal, which includes reducing carbon emissions by 55% by 2030, making energy-efficient solutions a priority in public spaces.

For instance, Germany’s Clean Energy Export Initiative has allocated approximately €1 billion to promote clean and energy-efficient technologies in the construction sector, including the development of energy-efficient power pedestals. These pedestals often incorporate sustainable materials and energy-efficient designs that minimize environmental impact while meeting the growing demand for electrical infrastructure.

Growing Need for EV Charging Infrastructure

The growing adoption of electric vehicles (EVs) is another key trend influencing the power pedestal market. As more consumers switch to electric vehicles, the need for charging infrastructure, particularly in public and outdoor settings, is rising. The U.S. government has set an ambitious goal of deploying 500,000 public EV chargers by 2030, a move that will directly benefit the power pedestal market. These charging stations often rely on power pedestals to deliver a safe and reliable electricity supply.

The U.S. Department of Energy has already allocated $7.5 billion to develop EV infrastructure across the country, contributing to the growth of power pedestal installations in public spaces and along highways.

By 2023, Norway had reached a milestone where 54% of all new cars sold were electric, and the country plans to have over 200,000 EV charging points by 2030. This trend is boosting demand for power pedestals designed to support EV charging stations, offering another growth opportunity for the market.

Regional Analysis

The global Power Pedestal market showcases diverse regional dynamics and growth opportunities, with North America emerging as the dominating region, holding a significant 53.2% market share, valued at USD 93.9 million.

This region’s dominance is largely attributed to the well-established maritime and recreational vehicle (RV) sectors, coupled with stringent regulations that mandate advanced power management solutions. North American market growth is further propelled by innovations in smart power pedestals, which cater to increasing demand for efficient energy solutions in public and private marinas and RV parks.

In Europe, the market is driven by the rising focus on sustainable and energy-efficient infrastructure, particularly in tourist-heavy countries with numerous marinas and camping sites. The adoption of power pedestals in Europe is also boosted by the EU’s push towards enhancing electrical safety standards in recreational and commercial spaces.

The Asia Pacific region presents a rapidly expanding market, driven by increasing investments in marine and leisure infrastructure, especially in countries like China, Japan, and Australia. The region’s growth is amplified by the burgeoning tourism industry and a shift towards luxury and convenience in travel accommodations, prompting higher installations of power pedestals.

In contrast, the Middle East & Africa and Latin America are emerging markets with significant growth potential. These regions are experiencing gradual adoption due to increasing government initiatives aimed at boosting tourism and enhancing local infrastructure. The Middle East, with its focus on luxury tourism and high-profile projects, is particularly poised for growth in the adoption of advanced power pedestal systems.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The power pedestal market is highly competitive, with several key players contributing to its growth across various regions. ABB and Eaton, two industry giants, have established strong positions in the market with their extensive range of electrical solutions, including power pedestals designed for both industrial and recreational applications.

ABB’s global footprint and innovative technologies allow it to meet the diverse needs of marinas, RV parks, and construction sites, while Eaton focuses on providing energy-efficient and sustainable solutions. General Electric, with its long history in electrical systems, also plays a significant role by offering reliable, durable power pedestal solutions for outdoor and marine applications.

Other notable players in the market include Accmar Equipment Co, Attwood Corporation, and Dock Boxes Unlimited, who specialize in providing high-quality power pedestals tailored for marinas and recreational spaces. Legrand North America LLC and Leviton are also prominent names, with their products used widely in residential and commercial sectors, particularly for outdoor electrical systems.

Additionally, Rolec Services Ltd. and HydroHoist Marine Group cater to the marina sector with their advanced power pedestal solutions designed for harsh marine environments. Pedestal Solutions Inc. and Power Marine Centre Inc. focus on offering customizable power pedestal units, providing flexible and tailored solutions for a variety of applications.

Top Key Players

- ABB

- Accmar Equipment Co

- Ace Manufacturing Metals Ltd

- Attwood Corporation

- Dock Boxes Unlimited

- Eaton

- General Electric

- Gescan a Division of Sonepar Canada Inc

- HydroHoist Marine Group

- Legrand North America LLC

- Leviton

- Marina Electrical Equipment Inc.

- MonoSystems Inc.

- Pedestal Solutions Inc.

- Power Marine Centre Inc.

- Rolec Services Ltd.

- TallyKey

Recent Developments

In 2023, ABB’s global revenue from electrical solutions reached approximately USD 31.9 billion, with a portion of this revenue attributed to its power systems and products.

In 2023, Accmar’s revenue from its marine and recreational equipment division was estimated to be around USD 16.2 million, reflecting the strong demand for its products in the North American and European markets.

Report Scope

Report Features Description Market Value (2023) USD 179.6 Mn Forecast Revenue (2033) USD 287.0 Mn CAGR (2024-2033) 4.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Stainless Steel (SS) Power Pedestal, Polycarbonate Power Pedestal, Lightweight Composites, Aluminum Power Pedestal, Others), By Material (Steel, Aluminum, Plastics), By Application (Marina Power and Lightening, Recreation Vehicle Parks, Construction Site, Mobile Home Panels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Accmar Equipment Co, Ace Manufacturing Metals Ltd, Attwood Corporation, Dock Boxes Unlimited, Eaton, General Electric, Gescan a Division of Sonepar Canada Inc, HydroHoist Marine Group, Legrand North America LLC, Leviton, Marina Electrical Equipment Inc., MonoSystems Inc., Pedestal Solutions Inc., Power Marine Centre Inc., Rolec Services Ltd., TallyKey Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB

- Accmar Equipment Co

- Ace Manufacturing Metals Ltd

- Attwood Corporation

- Dock Boxes Unlimited

- Eaton

- General Electric

- Gescan a Division of Sonepar Canada Inc

- HydroHoist Marine Group

- Legrand North America LLC

- Leviton

- Marina Electrical Equipment Inc.

- MonoSystems Inc.

- Pedestal Solutions Inc.

- Power Marine Centre Inc.

- Rolec Services Ltd.

- TallyKey