Global CO2 Separation Membrane Market Size, Share, Statistics Analysis Report By Material Type (Polymeric, Ceramic, Zeolite, Others), By Module (Hollow Fiber, Spiral Wound, Others), By Application (Pre-combustion Capture, Post-combustion Capture, Industrial Separation), By End-use (Oil and Gas, Chemicals, Power Generation, Food and Beverage, Others) , Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145003

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

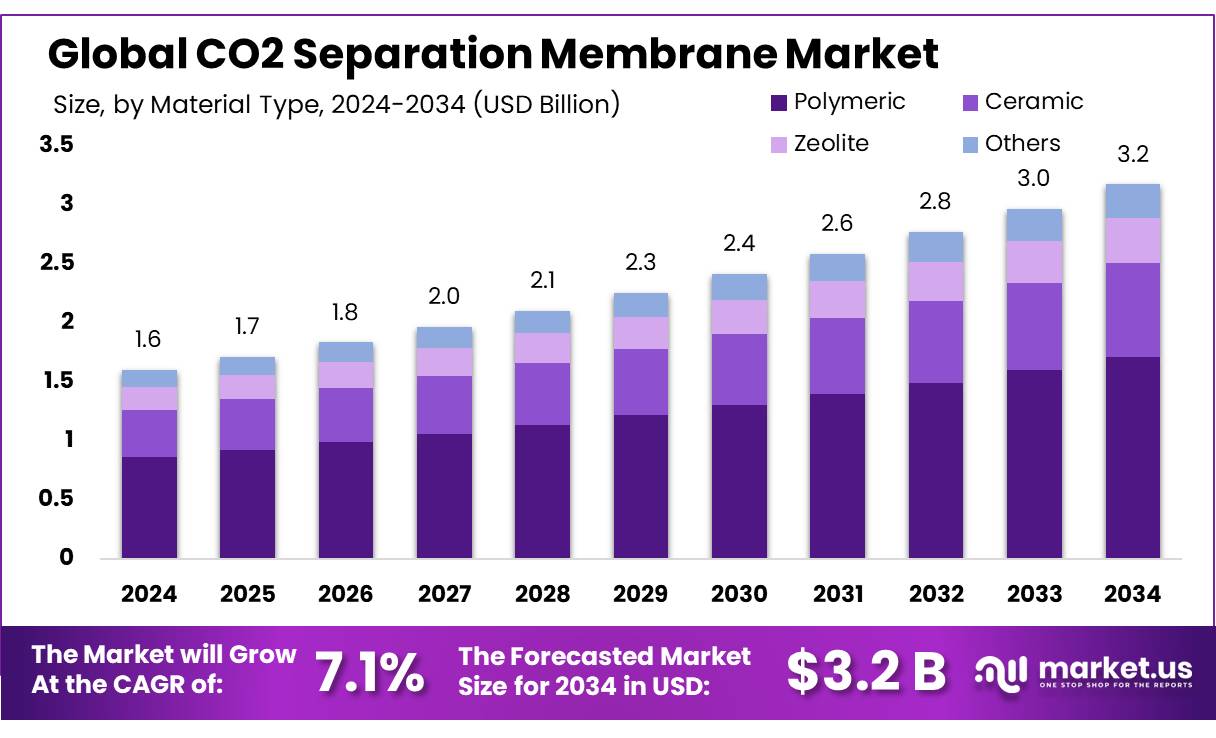

The Global CO2 Separation Membrane Market size is expected to be worth around USD 3.2 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034.

The CO2 separation membrane market is undergoing significant transformation, driven by the increasing urgency to address climate change and the growing demand for sustainable industrial practices. CO2 separation membranes are pivotal in capturing carbon dioxide from gas mixtures, offering a promising solution for industries aiming to reduce greenhouse gas emissions. This technology is employed across various sectors, including power generation, oil and gas, and chemical manufacturing, enhancing the efficiency of carbon capture and storage (CCS) systems.

The industrial scenario for CO2 separation membranes is robust, reflecting a composite annual growth rate of approximately 8% over the past five years. As of 2025, the market size has reached an estimated value of $1.2 billion, underscoring its critical role in environmental management strategies. The integration of these membranes into industrial operations aligns with global efforts to mitigate environmental impact and adhere to increasingly stringent regulatory standards.

Several factors drive the expansion of the CO2 separation membrane market. Firstly, the escalation of regulatory policies aimed at reducing carbon emissions significantly influences the adoption of this technology.

For instance, the European Union’s Green Deal aims to achieve net-zero greenhouse gas emissions by 2050, a target supporting the deployment of advanced carbon capture technologies. Secondly, the technological advancements in membrane materials that offer higher selectivity and durability under harsh operational conditions are propelling the market forward. These innovations enhance the economic viability and efficiency of capturing carbon dioxide at scale.

Moreover, government initiatives play a crucial role in fostering the growth of this market. For example, the U.S. Department of Energy (DOE) recently allocated $24 million towards the development of new technologies to capture carbon efficiently and economically. This funding is part of a broader effort to support clean energy technologies and ensure compliance with national emissions standards. Similarly, in Asia, countries like Japan and South Korea have incorporated CCS strategies into their national climate agendas, further stimulating market growth.

Key Takeaways

- CO2 Separation Membrane Market size is expected to be worth around USD 3.2 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 7.1%.

- Polymeric membranes held a dominant position in the CO2 separation membrane market, capturing more than a 54.30% share.

- Hollow Fiber modules maintained a leading position in the CO2 separation membrane market, capturing more than a 47.20% share.

- Post-combustion Capture held a dominant market position in the CO2 separation membrane market, capturing more than a 44.40% share.

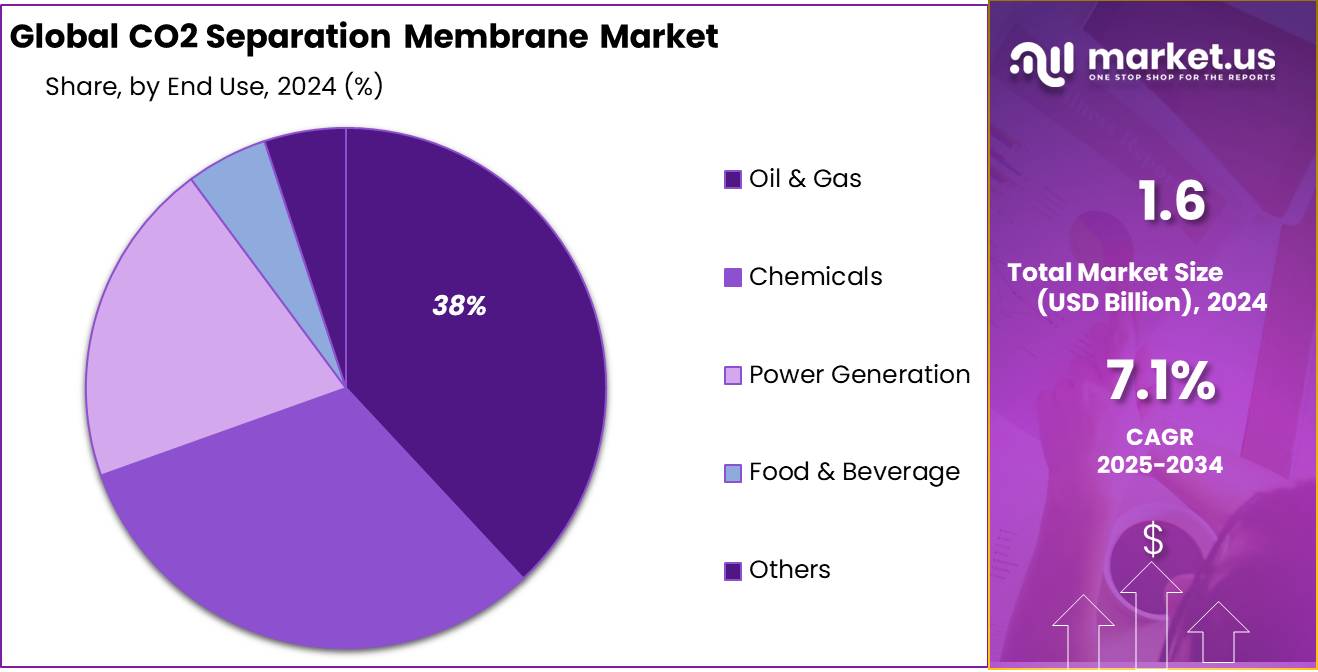

- Oil & Gas sector held a dominant market position in the CO2 separation membrane market, capturing more than a 37.50% share.

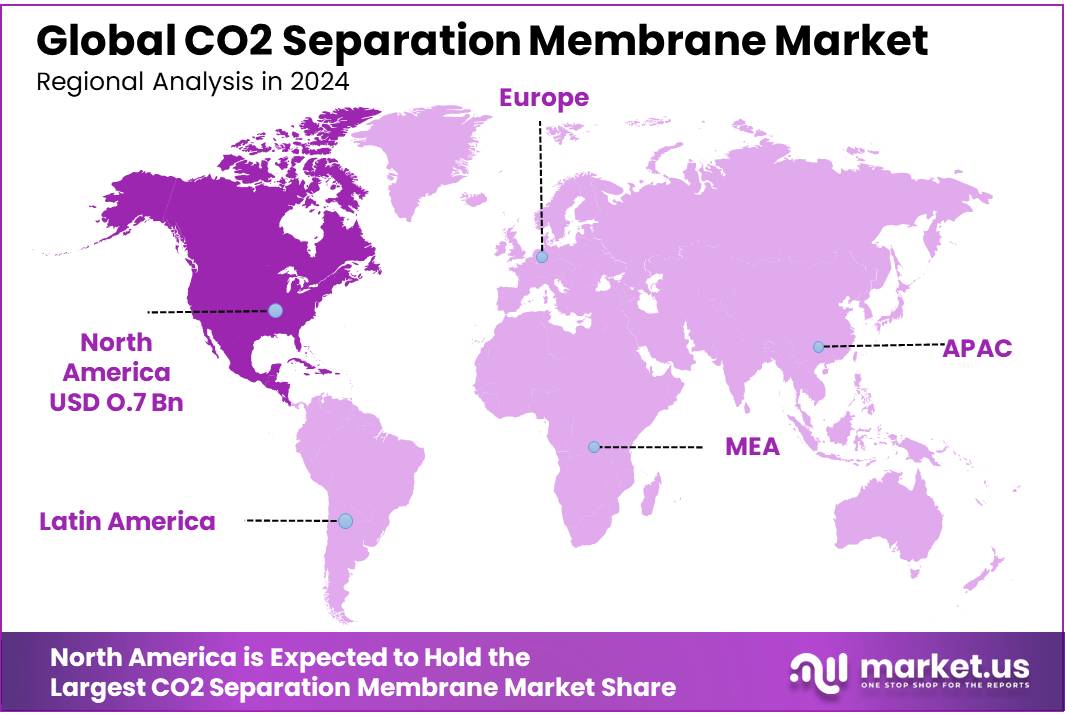

- North America emerged as a dominant force in the CO2 Separation Membrane market, capturing an impressive 46.44% share, which translated into a market value of approximately USD 0.7 billion.

By Material Type

Polymeric Membranes Lead with Over Half the Market Share in CO2 Separation

In 2024, Polymeric membranes held a dominant position in the CO2 separation membrane market, capturing more than a 54.30% share. This significant market presence is primarily attributed to their efficient gas separation properties and durability, which make them highly suitable for large-scale industrial applications. Over the years, these membranes have been refined to offer better performance under varying pressures and temperatures, enhancing their appeal across diverse sectors. Looking ahead to 2025, advancements in polymeric material science are expected to further solidify their market dominance by improving their separation efficiency and operational lifespan.

By Module

Hollow Fiber Modules Command Nearly Half the Market with a 47.20% Share

In 2024, Hollow Fiber modules maintained a leading position in the CO2 separation membrane market, capturing more than a 47.20% share. This type of module is favored for its high surface-area-to-volume ratio, which significantly enhances the efficiency of gas separation processes. The structure of hollow fiber membranes, consisting of tiny fibers, allows for optimal contact with CO2, making them ideal for applications requiring high throughput and selectivity. As we progress into 2025, the ongoing technological improvements in membrane fabrication are expected to boost their performance further, reinforcing their widespread adoption in industries aiming to reduce carbon emissions efficiently.

By Application

Post-combustion Capture Takes the Lead with a 44.40% Market Share

In 2024, Post-combustion Capture held a dominant market position in the CO2 separation membrane market, capturing more than a 44.40% share. This application is particularly crucial in mitigating climate change, as it allows for the capture of CO2 from power plant emissions and other industrial processes after combustion. The effectiveness of post-combustion capture technology, coupled with increasing regulatory pressures to lower greenhouse gas emissions, has made it a preferred choice in the industry. Moving into 2025, the market is likely to see continued growth as technological advancements enhance the efficiency and affordability of CO2 capture processes, solidifying its pivotal role in achieving global sustainability targets.

By End-use

Oil & Gas Sector Predominates with a 37.50% Stake in CO2 Separation Membrane Market

In 2024, the Oil & Gas sector held a dominant market position in the CO2 separation membrane market, capturing more than a 37.50% share. This sector’s substantial investment in CO2 separation technologies reflects its urgent need to comply with environmental regulations and its commitment to reducing carbon footprints. The adoption of CO2 separation membranes in oil and gas operations, particularly in natural gas purification and enhanced oil recovery, underscores their critical role in these industries. As we look towards 2025, the sector’s ongoing push for cleaner technologies is expected to keep driving substantial demand for efficient and effective CO2 separation solutions.

Key Market Segments

By Material Type

- Polymeric

- Ceramic

- Zeolite

- Others

By Module

- Hollow Fiber

- Spiral Wound

- Others

By Application

- Pre-combustion Capture

- Post-combustion Capture

- Industrial Separation

By End-use

- Oil & Gas

- Chemicals

- Power Generation

- Food & Beverage

- Others

Drivers

Growing Emphasis on Environmental Regulations Drives Demand for CO2 Separation Membranes

A major driving factor for the CO2 separation membrane market is the increasing global emphasis on environmental regulations aimed at combating climate change. Governments and industries are actively seeking technologies that can reduce carbon emissions effectively, with CO2 separation membranes playing a crucial role in this area.

In particular, the carbon dioxide removal segment of the gas separation membrane market is experiencing rapid growth. This surge is fueled by stringent environmental policies and the rising adoption of carbon capture and storage (CCUS) technologies. These membranes are essential for industrial applications such as natural gas processing, where they remove CO2 to prevent corrosion and improve the quality of natural gas.

Technological advancements in membrane materials and designs have significantly enhanced their efficiency and cost-effectiveness, making them more attractive than traditional CO2 removal methods. The development and implementation of innovative materials like Polydimethylsiloxane (PDMS) and improvements in existing materials such as polyimide and polyamide have led to membranes that can operate under harsher conditions and offer higher selectivity and durability.

Moreover, the implementation of governmental initiatives across regions like the United States and Canada, which are leading in the annual carbon capture capacity, underscores the importance of these technologies in national strategies for reducing greenhouse gas emissions. These factors collectively ensure that CO2 separation membranes will remain a vital technology in the global effort to mitigate environmental impact.

Restraints

High Initial Investment: A Major Barrier in CO2 Separation Membrane Adoption

One significant restraining factor for the CO2 separation membrane market is the high initial capital required for the deployment and scaling of these technologies. The development and installation of CO2 separation systems involve substantial financial investment, which can be a deterrent for many industries, especially small and medium-sized enterprises that might struggle with funding these capital-intensive projects.

This challenge is compounded by the complexity and technological sophistication involved in fabricating and maintaining these membrane systems. Advanced materials like polyimide and polyamide, commonly used in these membranes, while effective, add to the cost due to their high chemical and thermal stability requirements. Moreover, the need for specialized facilities to manufacture and handle these materials further escalates the overall expenses.

The financial burden is not limited to setup costs but extends to operational expenses as well, including maintenance and potential upgrades to cope with evolving environmental standards and operational demands. The cost-effectiveness of these systems often comes into question, especially when compared to other technologies that might offer lower upfront costs, albeit potentially higher long-term operational costs.

Opportunity

Expanding Opportunities in CO2 Separation Membrane Market through Food and Beverage Applications

A significant growth opportunity for the CO2 separation membrane market lies in its applications within the food and beverage industry. This sector increasingly relies on advanced membrane technologies for processes such as nitrogen blanketing in food preservation and CO2 recovery during beverage carbonation.

The demand for enhanced food safety and extended shelf life drives the adoption of nitrogen blanketing. This process involves displacing oxygen in food packaging with nitrogen to prevent oxidation and spoilage. CO2 separation membranes facilitate this by efficiently separating nitrogen from air, ensuring purity and quality in food preservation efforts.

Moreover, the beverage industry utilizes these membranes for carbonation processes. The ability of CO2 separation membranes to recover and purify CO2 from fermentation processes not only optimizes production costs but also enhances the sustainability of operations by reducing the need for external CO2 supply.

These applications are part of a broader trend where the food and beverage industry seeks more energy-efficient and environmentally friendly technologies. By integrating CO2 separation membranes, businesses can achieve compliance with stringent environmental regulations while enhancing operational efficiency.

The growing emphasis on sustainability and cost-efficiency in the food and beverage sector represents a lucrative avenue for the expansion and further innovation in CO2 separation membrane technologies. As industries worldwide push towards greener practices, the role of advanced membrane technologies in environmental management and operational optimization becomes increasingly vital.

Trends

Eco-Efficiency and Innovation: Driving Trends in CO2 Separation Membrane Market

A prominent trend in the CO2 separation membrane market is the push towards greater environmental efficiency and technological innovation. This movement is significantly propelled by the increasing global emphasis on sustainable practices and the reduction of carbon footprints across industries. Particularly in the food and beverage sector, there is a notable shift towards using CO2 separation technologies for applications such as carbon dioxide recovery during beverage carbonation and nitrogen blanketing for food preservation.

Innovations in membrane technology, especially the development of high-performance polymeric membranes and mixed-matrix membranes, are setting new standards for efficiency and durability in challenging conditions. These advancements not only enhance the operational capabilities of CO2 separation membranes but also contribute to their economic viability and environmental impact reduction.

Furthermore, the integration of nano-engineered membranes that utilize nanotechnology for improved gas selectivity and reduced fouling represents a significant leap forward. These membranes are increasingly favored in industries that require precise separation processes, including the food and beverage sector, where purity and efficiency are paramount.

The alignment of these technological advancements with the United Nations’ Sustainable Development Goals (SDGs) underscores the broader industry commitment to sustainable development. By improving the environmental profile of industrial processes through advanced CO2 separation technologies, companies not only comply with stringent global regulations but also gain competitive advantages in efficiency and sustainability.

Regional Analysis

In 2024, North America emerged as a dominant force in the CO2 Separation Membrane market, capturing an impressive 46.44% share, which translated into a market value of approximately USD 0.7 billion. This substantial market presence is largely attributed to the region’s advanced technological infrastructure and stringent environmental regulations, which have spurred significant investments in carbon capture and storage (CCS) technologies.

The robust industrial base in North America, particularly in the United States and Canada, has been instrumental in driving the demand for CO2 separation membranes. These countries have been at the forefront of implementing innovative solutions to address climate change, with a strong focus on reducing industrial carbon emissions. The regional market is further bolstered by government initiatives and funding in research and development projects aimed at enhancing the efficiency and affordability of carbon capture technologies.

Additionally, the presence of major players in the CO2 separation membrane market within the region contributes to its leading position. These companies are not only pioneers in the industry but also actively engage in strategic partnerships and expansions to innovate and improve their offerings.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

UBE Corporation is renowned for its engineering and manufacturing prowess in the field of CO2 separation membranes. They focus on advanced materials and chemicals, providing innovative solutions for environmental management. UBE’s membranes are specifically engineered to enhance the efficiency of carbon capture technologies, crucial for reducing greenhouse gas emissions. Their commitment to sustainability is reflected in their continuous investment in R&D, aiming to improve both the performance and cost-effectiveness of their products.

BORSIG GmbH, a leading German engineering company, offers high-performance membrane technology for gas separation, including CO2. Their solutions are tailored for complex industrial applications, emphasizing reliability and efficiency. BORSIG’s membranes are integral to processes that require precise gas separations, such as in petrochemicals and refining. The company’s focus on innovation and quality has established them as a key player in the global market.

Toray Industries, Inc. is a global leader in organic synthetic chemistry, polymer chemistry, and biochemistry. Their CO2 separation membrane technology is widely used in environmental and energy sectors for its high selectivity and durability. Toray’s commitment to technological advancement is evident in their ongoing development of more efficient and environmentally friendly membrane solutions.

Top Key Players

- UBE Corporation

- BORSIG GmbH

- Toray Industries, Inc.

- NGK INSULATORS, LTD.

- Pall Corporation

- Fujifilm Holdings Corporation

- SLB

- Air Liquide Advanced Separations

- GENERON

- JGC HOLDINGS CORPORATION

- Evonik Industries AG

- Membrane Technology and Research, Inc.

- Grasys

- Other Key Players

Recent Developments

In 2024, UBE continued to innovate within the gas separation membrane sector, particularly focusing on CO2 separation technologies crucial for sustainable energy solutions like biomethane production.

In 2024, Toray Industries, Inc. continued to advance its position in the CO2 separation membrane market, particularly focusing on the development and application of its all-carbon CO2 separation membranes.

In 2024, Pall Corporation continued to enhance its role in the CO2 separation membrane market by leveraging its extensive expertise in membrane technology. The company is renowned for its innovative approaches in the filtration and separation industries, contributing significantly to environmental management, particularly in the CO2 separation sector.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 3.2 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Polymeric, Ceramic, Zeolite, Others), By Module (Hollow Fiber, Spiral Wound, Others), By Application (Pre-combustion Capture, Post-combustion Capture, Industrial Separation), By End-use (Oil and Gas, Chemicals, Power Generation, Food and Beverage, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape UBE Corporation, BORSIG GmbH, Toray Industries, Inc., NGK INSULATORS, LTD., Pall Corporation, Fujifilm Holdings Corporation, SLB, Air Liquide Advanced Separations, GENERON, JGC HOLDINGS CORPORATION, Evonik Industries AG, Membrane Technology and Research, Inc., Grasys, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  CO2 Separation Membrane MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

CO2 Separation Membrane MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- UBE Corporation

- BORSIG GmbH

- Toray Industries, Inc.

- NGK INSULATORS, LTD.

- Pall Corporation

- Fujifilm Holdings Corporation

- SLB

- Air Liquide Advanced Separations

- GENERON

- JGC HOLDINGS CORPORATION

- Evonik Industries AG

- Membrane Technology and Research, Inc.

- Grasys

- Other Key Players