Global Lighting Contactor Market Size, Share, And Business Benefits By Type (Mechanically Held, Electrically Held), By Technology (Electromechanical Lighting Contactors, Solid State Lighting Contactors, Smart Lighting Contactors), By Voltage Type (Low Voltage, Medium Voltage, High Voltage), By Application (Commercial Lighting, Industrial Lighting, Residential Lighting, Institutional Lighting, Outdoor Lighting, Others), By End Use (Retail, Manufacturing, Healthcare, Transportation, Hospitality, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141439

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

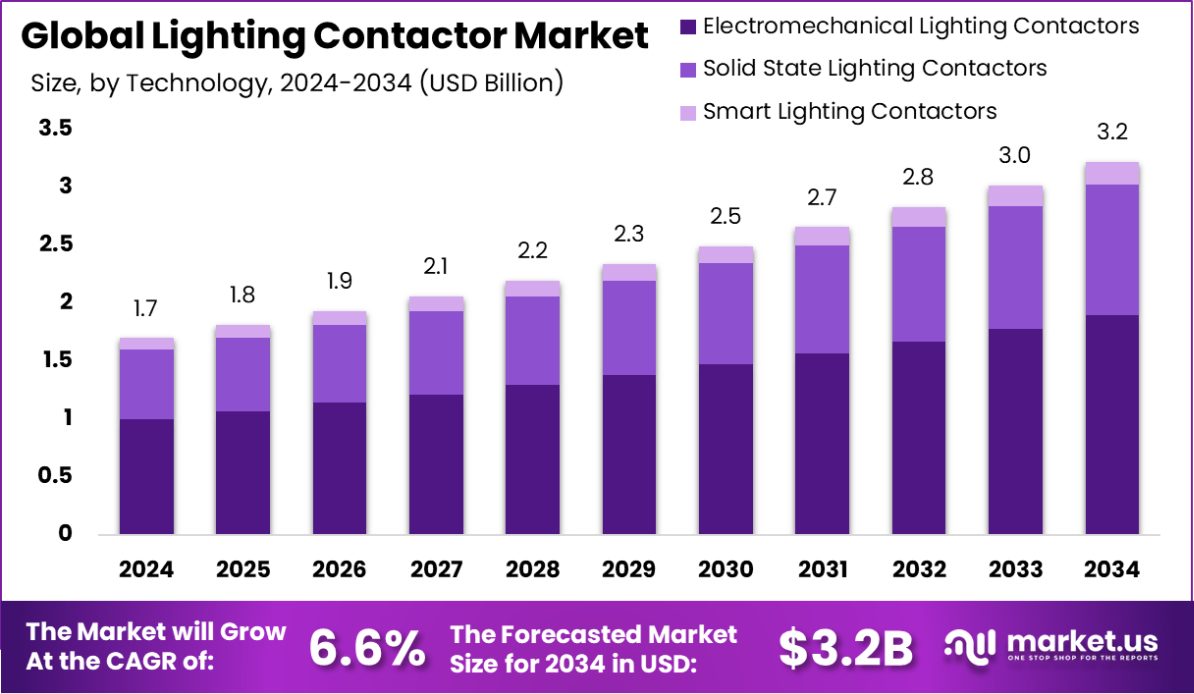

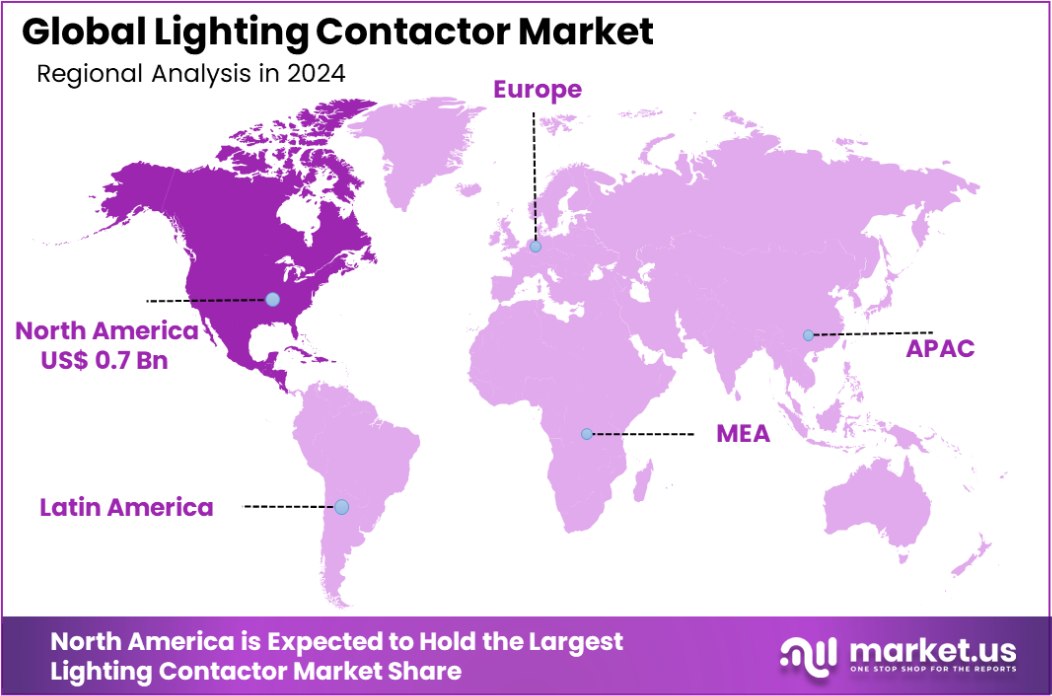

Global Lighting Contactor Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 6.6% from 2025 to 2034. With a market size of USD 0.7 billion, North America’s Lighting Contactor Market leads at 47.1%.

A Lighting Contactor is an electrical switching device used to control lighting systems in commercial, industrial, and residential buildings. It operates by turning the lights on or off based on an electrical signal, often controlled through a timer, sensor, or manual switch. Typically, these devices are designed to handle high inrush currents when switching large lighting loads, ensuring that the lighting systems function efficiently while reducing wear and tear on other components.

The Lighting Contactor Market is experiencing growth driven by increasing demand for energy-efficient lighting solutions and the rise in smart building technologies. The market is also supported by the growing adoption of automated lighting control systems in both commercial and residential sectors. As urbanization continues and energy consumption rises, the need for more efficient and reliable lighting solutions is expected to further fuel the market.

One of the key growth factors for the lighting contactor market is the global push towards energy conservation and sustainability. Governments worldwide are mandating energy-efficient lighting solutions, leading to an increase in demand for lighting contactors that can help optimize energy consumption.

In terms of demand, the shift towards smart lighting solutions, which integrate with IoT (Internet of Things) technology, is driving up the need for more advanced lighting contractors that can be seamlessly controlled remotely or through automation systems.

As for opportunities, the expanding construction industry, particularly in emerging economies, offers significant growth potential. Furthermore, the increasing adoption of green building standards, such as LEED (Leadership in Energy and Environmental Design), creates new avenues for lighting contractor manufacturers to meet sustainability requirements.

The Lighting Contractor Market is influenced by energy efficiency programs, which often set minimum operational requirements for commercial and industrial lighting projects. For instance, to qualify for incentives, projects typically need a minimum of 2,000 operating hours annually.

The Performance Lighting Plus program offers incentives of up to $0.55 per gross kWh saved for projects that meet 40% below code standards. Additionally, the National Grid’s 2022 Commercial and Industrial Energy Efficiency Solutions program allocated a gas budget of $437,398 for energy efficiency initiatives, driving the demand for efficient lighting solutions within this sector.

Key Takeaways

- Global Lighting Contactor Market is expected to be worth around USD 3.2 billion by 2034, up from USD 1.7 billion in 2024, and grow at a CAGR of 6.6% from 2025 to 2034.

- The Lighting Contactor Market is dominated by mechanically held types, which account for 61.3% of the market share.

- Electromechanical lighting contactors represent 59.6% of the market, offering reliable performance in various electrical applications.

- Low voltage lighting contactors lead the market with a substantial share of 64.6%, catering to energy-efficient systems.

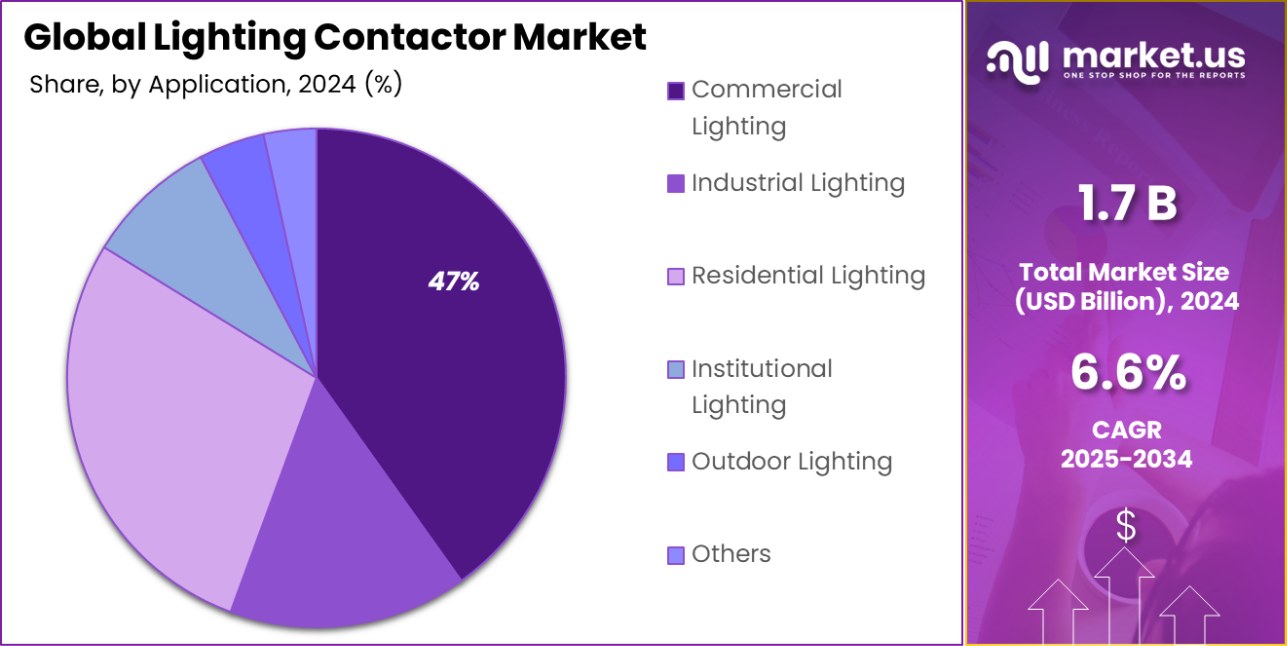

- Commercial lighting applications are the largest segment, with 47.6% of the lighting contactor market driven by businesses.

- Retail end-use accounts for 32.5% of the market, highlighting the growing demand for effective lighting control solutions.

- The North American Lighting Contactor Market is valued at USD 0.7 billion, driven by energy efficiency demand.

By Type Analysis

The lighting contactor market is dominated by mechanically held systems, accounting for 61.3%.

In 2024, Mechanically Held lighting contactors held a dominant market position in the By Type segment of the Lighting Contactor Market, with a 61.3% share. Mechanically Held contactors are widely favored due to their reliability, cost-effectiveness, and ease of installation. These contactors utilize a mechanical latching system to hold the contact in place, ensuring stability and reducing the need for continuous power supply to maintain the connection. Their robustness and relatively simple design make them ideal for various applications in commercial and industrial lighting systems.

This type of contractor is especially prevalent in applications where power savings and long-term durability are essential. The increasing demand for energy-efficient and cost-effective solutions in the commercial sector has significantly contributed to the growth of the mechanically held lighting contactor segment. Furthermore, their ability to withstand high inrush currents and handle larger lighting loads effectively supports their widespread adoption.

As smart building technologies continue to gain traction, the preference for mechanically held contactors remains strong as they provide a reliable and economical solution for integrating with lighting control systems. The segment is expected to continue to dominate due to these favorable factors, as well as the increasing need for automated and energy-efficient lighting systems across multiple industries.

By Technology Analysis

Electromechanical lighting contactors lead the market, capturing 59.6% of the technology share.

In 2024, Electromechanical Lighting Contactors held a dominant market position in the By Technology segment of the Lighting Contactor Market, with a 59.6% share. Electromechanical contactors, known for their robust design and reliability, are widely adopted in both residential and commercial applications. These contractors use electromagnetic coils to control the switching mechanism, providing efficient and quick operation when managing lighting systems.

The dominance of electromechanical contactors can be attributed to their versatility, cost-effectiveness, and proven performance in a wide range of environments. They are particularly favored in traditional lighting control systems where straightforward operation and maintenance are crucial. Additionally, electromechanical lighting contactors are capable of handling high inrush currents, which is a critical feature in large-scale lighting installations.

As the demand for automated and energy-efficient solutions increases, electromechanical lighting contactors remain the preferred choice due to their integration capabilities with existing building systems. Their relatively lower cost compared to other technologies and their long-standing presence in the market further contribute to their dominant share in the segment.

By Voltage Type Analysis

Low voltage lighting contactors hold the largest market share at 64.6% globally.

In 2024, Low Voltage held a dominant market position in the By Voltage Type segment of the Lighting Contactor Market, with a 64.6% share. Low voltage lighting contractors are widely preferred in residential, commercial, and industrial applications due to their safety, efficiency, and cost-effectiveness. These contractors typically operate at voltages below 1,000V, which aligns with the standard requirements of most modern lighting systems.

The growth of the low voltage segment can be attributed to several key factors, including the increasing adoption of energy-efficient lighting systems and the rising demand for smart lighting solutions. Low voltage systems offer enhanced safety features, reducing the risk of electrical hazards, which makes them ideal for use in environments with strict safety standards.

Additionally, low voltage lighting contactors are often more compatible with building automation systems, which further boosts their demand in the growing market for smart homes and commercial spaces.

Their relatively lower operational cost, along with the ability to easily integrate with advanced control technologies, has cemented their position as the preferred choice in the lighting contactor market.

By Application Analysis

Commercial lighting applications drive substantial demand, contributing to 47.6% of market growth.

In 2024, Commercial Lighting held a dominant market position in the By Application segment of the Lighting Contactor Market, with a 47.6% share. Commercial lighting applications, including office buildings, retail spaces, and hospitality venues, are the largest consumers of lighting contactors due to their large-scale lighting requirements and the need for efficient control systems.

The dominance of the commercial lighting segment is driven by the growing emphasis on energy-efficient lighting solutions and the increasing adoption of automated lighting control systems in commercial infrastructures.

Businesses are increasingly prioritizing energy savings, cost reductions, and sustainability, which has boosted the demand for advanced lighting control systems that integrate seamlessly with lighting contactors.

Furthermore, commercial buildings often require more complex lighting systems that include features such as dimming, automated scheduling, and sensor-based control, all of which are supported by lighting contactors.

The rise of smart building technologies and green building standards also plays a significant role in the growth of this segment, as they demand highly efficient and customizable lighting solutions.

By End-Use Analysis

Retail end-use accounts for 32.5%, showing significant lighting control needs in retail spaces.

In 2024, Retail held a dominant market position in the By End Use segment of the Lighting Contactor Market, with a 32.5% share. The retail sector has become a significant driver of demand for lighting contactors as businesses seek to optimize their lighting systems for energy efficiency, customer experience, and cost management.

Retail establishments, such as supermarkets, shopping malls, and specialty stores, require robust and flexible lighting solutions to accommodate high foot traffic, enhance product displays, and maintain operational efficiency.

The dominance of the retail sector is largely attributed to the growing trend of energy-efficient lighting systems that reduce operational costs. Retailers are increasingly turning to automated lighting control systems that integrate with lighting contactors to optimize lighting usage throughout the day, adjusting based on factors such as time of day, ambient light levels, and occupancy. This not only helps reduce energy consumption but also supports sustainability goals.

Moreover, the rise of smart lighting solutions and IoT technology in retail spaces further boosts the demand for advanced lighting contactors that enable remote control, scheduling, and system integration.

As the retail industry continues to evolve with digitalization and sustainability initiatives, the demand for reliable and efficient lighting systems is expected to grow, further strengthening the market position of the retail segment within the lighting contractor market.

Key Market Segments

By Type

- Mechanically Held

- Electrically Held

By Technology

- Electromechanical Lighting Contactors

- Solid State Lighting Contactors

- Smart Lighting Contactors

By Voltage Type

- Low Voltage

- Medium Voltage

- High Voltage

By Application

- Commercial Lighting

- Industrial Lighting

- Residential Lighting

- Institutional Lighting

- Outdoor Lighting

- Others

By End Use

- Retail

- Manufacturing

- Healthcare

- Transportation

- Hospitality

- Others

Driving Factors

Growing Demand for Energy-Efficient Solutions

The increasing focus on energy conservation is one of the key driving factors for the Lighting Contactor Market. As global energy consumption continues to rise, there is an increasing demand for solutions that help reduce energy waste.

Lighting contractors play a significant role in this transition by ensuring lighting systems operate efficiently, either through automated scheduling, dimming, or integration with smart control systems. In both commercial and industrial settings, businesses are keen to lower their electricity costs while maintaining optimal lighting conditions.

Government regulations and initiatives supporting energy efficiency, such as incentives for using energy-saving technologies, have further spurred this demand. With rising concerns over environmental impact and energy resources, both businesses and consumers are prioritizing energy-efficient lighting systems that can be easily integrated with lighting contractors.

This market trend is expected to accelerate as more industries adopt green building standards and sustainability practices, positioning lighting contactors as an essential part of energy-efficient infrastructure.

Restraining Factors

High Initial Installation Costs for Systems

One of the primary restraining factors for the Lighting Contactor Market is the high initial installation costs associated with advanced lighting systems. While lighting contactors provide long-term energy savings and operational benefits, the upfront expense of integrating them into existing infrastructure can be a significant barrier, particularly for small to medium-sized businesses and residential users.

Incorporating automated or smart lighting control systems, which often require more sophisticated lighting contactors, may involve substantial investment in both equipment and labor for installation. This can discourage businesses and property owners from upgrading or replacing their existing lighting systems, especially if they are operating on tight budgets. Additionally, the maintenance costs of advanced systems may deter some users from investing in these technologies.

As a result, despite the potential long-term savings, the high initial costs remain a significant challenge for widespread adoption. This factor is likely to slow the growth of the market, particularly in regions where cost-sensitive consumers dominate the market.

Growth Opportunity

Rise in Smart Building and IoT Integration

A significant growth opportunity for the Lighting Contactor Market lies in the rise of smart buildings and the integration of Internet of Things (IoT) technology. As the demand for connected, automated, and energy-efficient systems increases across commercial, industrial, and residential sectors, there is a growing need for advanced lighting control solutions that can be seamlessly integrated with IoT-enabled devices.

Lighting contactors are essential components in these smart lighting systems, allowing for remote control, automated scheduling, and energy optimization. By incorporating IoT technology, these systems enable users to manage lighting from smartphones, tablets, or centralized platforms, further enhancing user convenience and efficiency. Additionally, the ability to collect data on energy consumption patterns opens up new opportunities for energy-saving strategies and predictive maintenance.

With the ongoing global trend toward smart cities and smart homes, the demand for intelligent lighting systems is expected to soar. This presents a promising opportunity for lighting contactors to play a central role in the future of building automation and energy management.

Latest Trends

Growing Adoption of Wireless Lighting Control Systems

One of the latest trends in the Lighting Contactor Market is the growing adoption of wireless lighting control systems. These systems offer significant advantages over traditional wired systems, such as reduced installation time, lower upfront costs, and greater flexibility in control. Wireless technology, often integrated with IoT, enables users to manage and adjust lighting remotely using mobile apps or centralized platforms.

The shift toward wireless control is particularly evident in commercial and residential buildings looking to enhance energy efficiency and reduce maintenance costs. By eliminating the need for extensive wiring, wireless systems offer easy retrofitting options for existing infrastructures, making them attractive to businesses and homeowners alike. Additionally, the ability to control lighting from anywhere, at any time provides enhanced convenience and energy savings.

This trend is expected to grow as smart home and building automation technologies become more mainstream. As consumers and businesses increasingly prioritize convenience and sustainability, wireless lighting control systems paired with advanced lighting contactors will become a key feature in the evolving lighting landscape.

Regional Analysis

In 2024, North America held a dominant share of 47.1% in the Lighting Contactor Market, valued at USD 0.7 billion.

In 2024, North America dominated the Lighting Contactor Market, accounting for 47.1% of the market share, valued at approximately USD 0.7 billion. The region’s dominance can be attributed to the rapid adoption of energy-efficient lighting solutions, growing smart building infrastructure, and strong regulatory support for energy conservation.

Additionally, North America’s focus on sustainability and the integration of advanced lighting technologies, including smart lighting systems and IoT, further fuels market growth.

In Europe, the market is driven by strict energy efficiency regulations and a significant push towards green building standards. The European market is expected to grow steadily, with countries like Germany, France, and the UK leading the demand for lighting contactors. The increasing emphasis on automation in residential and commercial buildings enhances the region’s growth prospects.

Asia Pacific is witnessing rapid growth due to urbanization, industrialization, and the expansion of the commercial sector in countries such as China and India. The rising adoption of smart city projects and energy-efficient systems is expected to drive the demand for lighting contactors.

Middle East & Africa are also experiencing growth, primarily in the commercial and industrial sectors, as more infrastructure projects adopt energy-efficient solutions. Similarly, Latin America is projected to see moderate growth, driven by ongoing development in urban centers and demand for energy-saving technologies.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, several key players are shaping the global Lighting Contactor Market, with Honeywell, Omron, Panasonic, and Philips Lighting leading the way. These companies are leveraging their extensive experience in automation, energy management, and smart technologies to drive the adoption of advanced lighting solutions across various sectors.

Honeywell, with its broad portfolio in building management systems, continues to be a key player in the market. The company’s integration of lighting control solutions with its broader building automation systems gives it a competitive edge. Honeywell’s commitment to energy efficiency and sustainability aligns with the growing demand for smarter, more efficient lighting control solutions, positioning it as a leader in the market.

Omron, known for its industrial automation and electronic components, offers reliable lighting control systems with advanced features. The company’s focus on IoT and automation technologies positions it well in the rapidly growing smart lighting segment. Omron’s ability to provide integrated solutions that optimize energy consumption further strengthens its presence in the market.

Panasonic, with its strong presence in the global electronics and energy sectors, continues to expand its footprint in the lighting control market. Panasonic’s focus on energy-efficient and user-friendly lighting systems has made it a favored choice for commercial and residential applications. The company’s innovations in smart lighting solutions and wireless control systems are expected to boost its market share.

Philips Lighting, now Signify, remains a dominant force in the Lighting contractor market. Its leadership in connected lighting systems, coupled with a strong focus on sustainability, allows it to capture a significant market share. Signify’s products continue to set the benchmark for smart lighting solutions, driving significant demand across commercial and industrial sectors.

Top Key Players in the Market

- ABB

- Acuity

- Belden

- Cree Inc.

- Eaton

- Federal Electric

- General Electric

- Hager

- Honeywell

- Legrand

- Lutron Electronics

- Mersen

- NSI Industries

- Omron

- Panasonic

- Philips Lighting

- Ripley Lighting Controls

- Rockwell Automation

- Schneider Electric

- Siemens

- Southwire

- Sprecher Schuh

Recent Developments

- In June 2024, Omron is set to showcase innovative solutions for EV charging, electricity storage systems, and solar applications at the Smarter E Europe Exhibition. They will present the G9KC PCB power relay for AC wall boxes and demonstrate the B5L Time of Flight sensor for EV charging stations

- In May 2024, Belden launched new solutions, including OSDP and fire alarm cables, as well as Hirschmann IT railway radios and managed switches, to support robust and reliable communications.

Report Scope

Report Features Description Market Value (2024) USD 1.7 Billion Forecast Revenue (2034) USD 3.2 Billion CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mechanically Held, Electrically Held), By Technology (Electromechanical Lighting Contactors, Solid State Lighting Contactors, Smart Lighting Contactors), By Voltage Type (Low Voltage, Medium Voltage, High Voltage), By Application (Commercial Lighting, Industrial Lighting, Residential Lighting, Institutional Lighting, Outdoor Lighting, Others), By End Use (Retail, Manufacturing, Healthcare, Transportation, Hospitality, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Acuity, Belden, Cree Inc., Eaton, Federal Electric, General Electric, Hager, Honeywell, Legrand, Lutron Electronics, Mersen, NSI Industries, Omron, Panasonic, Philips Lighting, Ripley Lighting Controls, Rockwell Automation, Schneider Electric, Siemens, Southwire, Sprecher Schuh Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Lighting Contactor MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample

Lighting Contactor MarketPublished date: February 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Acuity

- Belden

- Cree Inc.

- Eaton

- Federal Electric

- General Electric

- Hager

- Honeywell

- Legrand

- Lutron Electronics

- Mersen

- NSI Industries

- Omron

- Panasonic

- Philips Lighting

- Ripley Lighting Controls

- Rockwell Automation

- Schneider Electric

- Siemens

- Southwire

- Sprecher Schuh