Global Hairy Solar Panels Market By Technology (Photovoltaic, Concentrated Solar Power, Thin Film Solar, Bifacial), By Panel Type (Monocrystalline, Polycrystalline, Bifacial), By Installation Type (Roof Mounted, Ground Mounted, Building Integrated), By Material (Silicon, Gallium Arsenide, Indium Gallium Phosphide, Perovskite, Others), By Grid Connectivity (On-Grid Systems, Off-Grid Systems), By End-Use (Residential, Commercial, Industrial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140159

- Number of Pages: 272

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

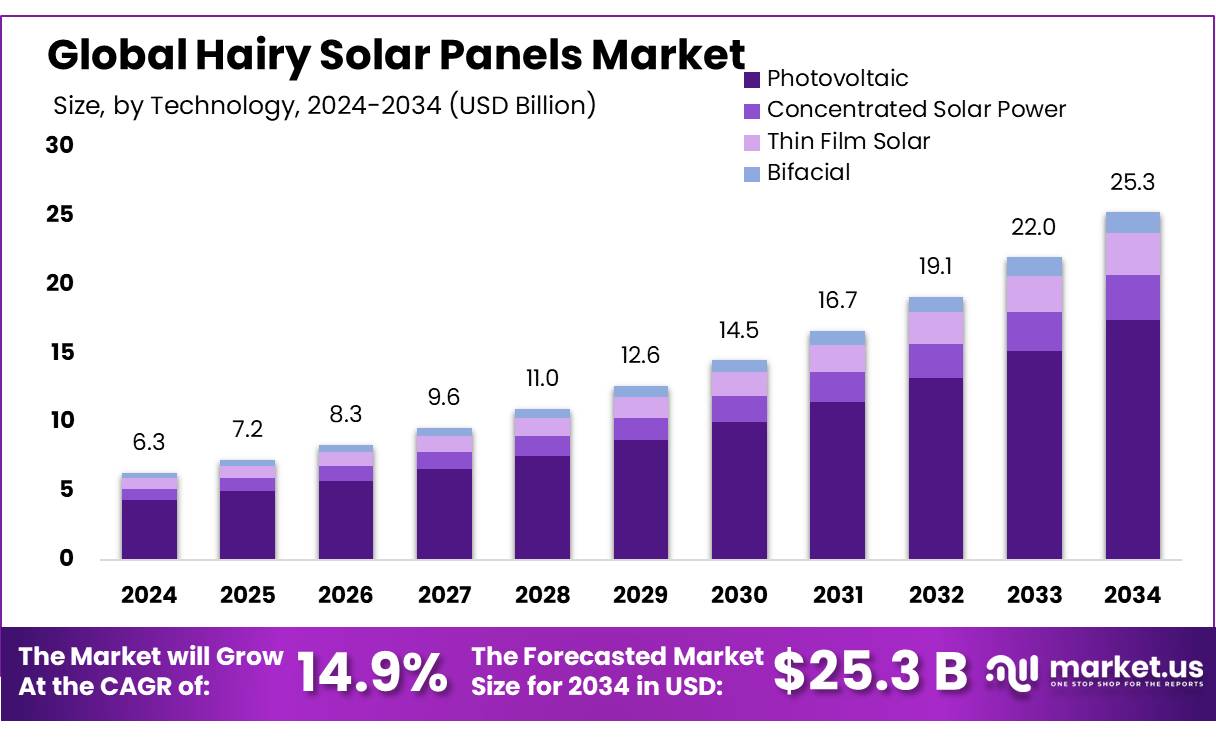

The Global Hairy Solar Panels Market size is expected to be worth around USD 25.3 Bn by 2034, from USD 6.3 Bn in 2024, growing at a CAGR of 14.9% during the forecast period from 2025 to 2034.

Hairy solar panels are created with the aid of nanotechnology, using light-absorbing nanowires placed on carbon-nanotube fabrics. These nanowires are cylindrical in shape, with a diameter approximately 1/10,000th of a human hair. The light-absorbing properties of these nanowires enable them to capture more energy from the sun compared to traditional silicon cells.

The key advantages of hairy solar panels is their flexibility. This flexible structure makes it possible to manufacture the panels using roll-to-roll processes, which helps reduce production costs compared to traditional rigid solar panels. Furthermore, these panels can absorb up to 96% of the solar light that reaches them. This makes hairy solar panels not only highly efficient but also more affordable, making them a viable option for both residential and industrial sectors.

Several Driving factors are the growth and interest in hairy solar panels. First, the demand for clean energy solutions is at an all-time high due to the global push for carbon neutrality and sustainable energy systems. Governments around the world are offering substantial incentives and subsidies to promote the adoption of renewable energy technologies. For instance, the U.S. government’s Solar Energy Technologies Office (SETO) allocated over USD 100 million in 2022 for advancing solar technologies, including innovative solutions like hairy solar panels.

The future of hairy solar panels looks promising, with several opportunities for growth. As the cost of production continues to decrease, these bio-inspired panels could potentially be adopted on a larger scale for both residential and commercial applications. Research into hybrid systems that combine the efficiency of hairy solar panels with other renewable technologies, such as wind or energy storage systems, could create highly integrated and sustainable energy solutions.

Key Takeaways

- The hairy solar panels market is projected to grow from USD 6.3 billion in 2024 to USD 25.3 billion by 2034, at a CAGR of 14.9%.

- In 2024, photovoltaic technology captured more than a 69.2% market share.

- Monocrystalline panels held a 56.2% market share in 2024.

- Roof-mounted installations captured over 63.3% of the market in 2024.

- Silicon accounted for more than 72.1% of the market share by material in 2024.

- On-grid systems held a 73.2% share of the market in 2024.

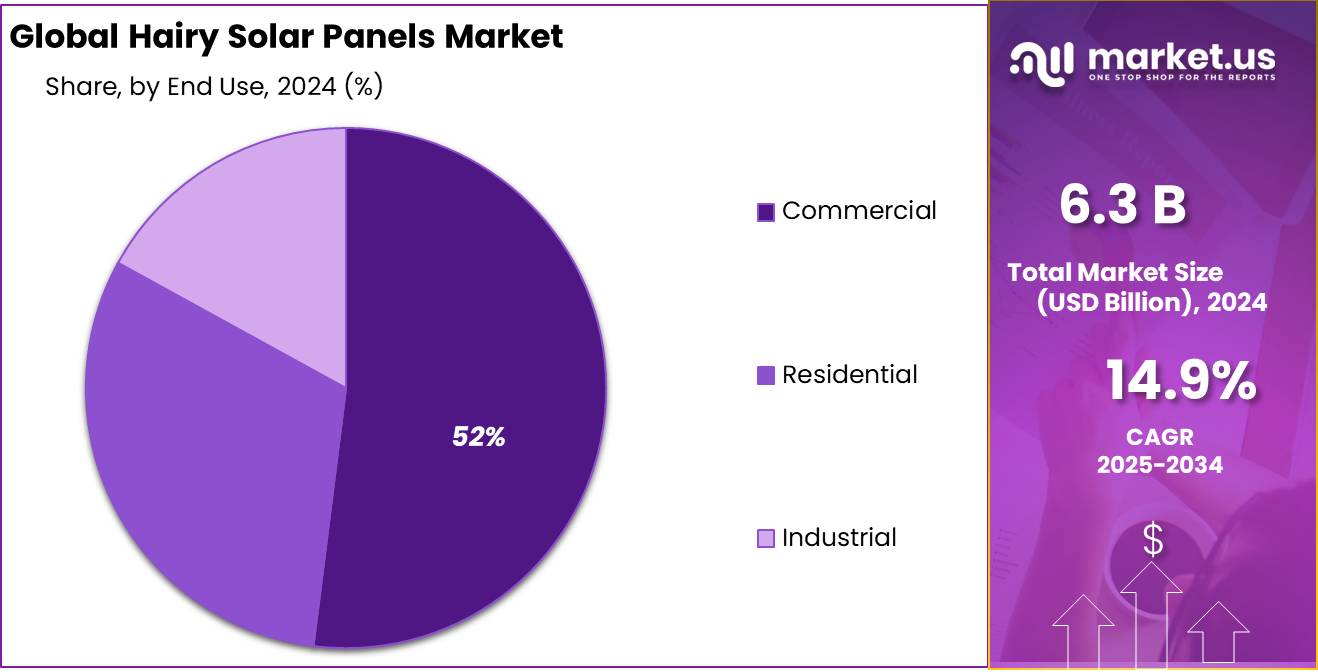

- Commercial applications held a 52.1% market share in 2024.

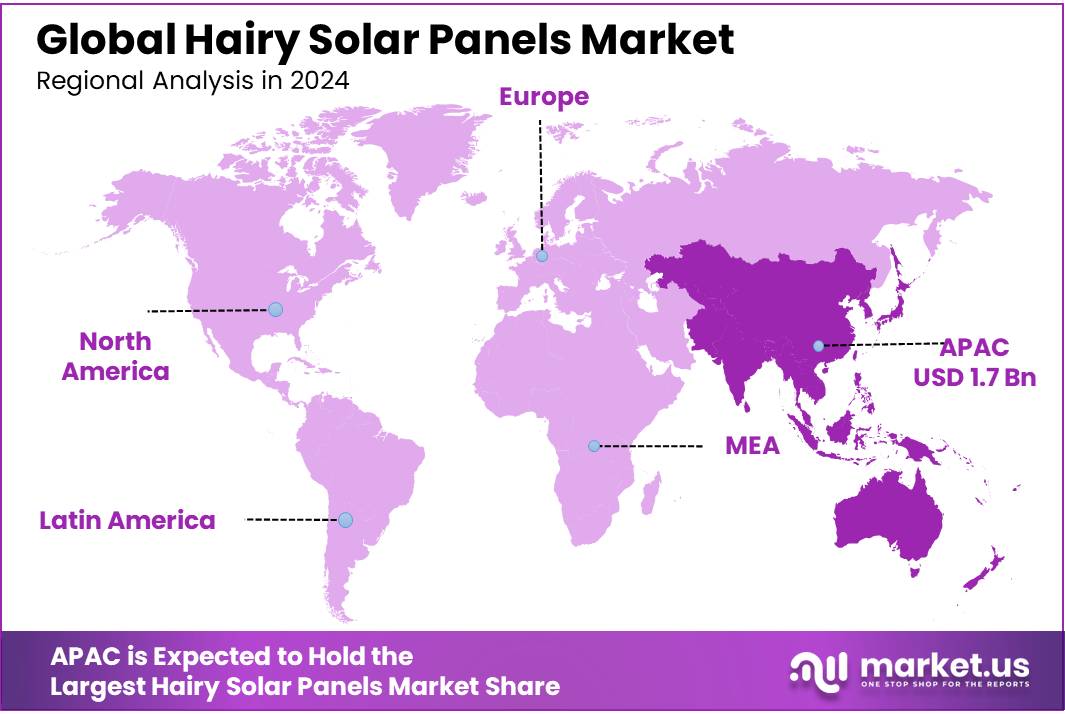

- The Asia Pacific region captured 47.2% of the market share, valued at approximately $2.9 billion in 2024.

By Technology

In 2024, Photovoltaic (PV) technology held a dominant market position in the hairy solar panels sector, capturing more than a 69.2% share. Photovoltaic panels, which convert sunlight directly into electricity, continue to be the most widely adopted solar technology. This is largely due to their versatility, cost-effectiveness, and efficiency. PV systems are used in a variety of applications, from residential rooftops to large-scale solar farms, making them the go-to choice for both commercial and residential installations.

Concentrated Solar Power (CSP) technology, while not as dominant as PV, is steadily gaining ground. CSP systems, which use mirrors or lenses to concentrate sunlight onto a small area to generate heat, are mainly used in large-scale solar power plants. CSP offers the potential for energy storage, making it an attractive option for grid stability and providing energy even when the sun isn’t shining.

Thin Film Solar technology, which involves applying photovoltaic material to a variety of surfaces in a lightweight, flexible format, represents another growing segment. This technology is expected to capture an increasing share of the market by 2025, particularly in applications where traditional silicon panels are not ideal due to space or weight limitations.

Finally, Bifacial Solar Panels, which can capture sunlight on both sides of the panel for greater energy production, are an emerging trend. Although still a niche technology in 2024, bifacial solar panels are expected to experience faster growth in the coming years as they offer higher efficiency and are increasingly used in large-scale commercial and utility projects.

By Panel Type

In 2024, Monocrystalline panels held a dominant market position, capturing more than a 56.2% share of the hairy solar panels market. Known for their high efficiency and sleek black appearance, monocrystalline panels are the preferred choice for both residential and commercial solar installations. These panels are made from a single continuous crystal structure, which allows them to produce more power per square meter than other types of panels.

Polycrystalline panels, while still widely used, hold a smaller share of the market compared to monocrystalline panels. Polycrystalline panels are made from silicon crystals that are melted and poured into molds, creating a less uniform structure. As a result, they are slightly less efficient than monocrystalline panels but are more affordable.

Bifacial panels are an emerging technology in the solar panel market. These panels can capture sunlight from both the front and rear sides, significantly increasing their overall energy output. Though they currently hold a smaller market share compared to monocrystalline and polycrystalline panels, bifacial panels are expected to experience significant growth by 2025.

By Installation Type

In 2024, Roof Mounted installations held a dominant market position, capturing more than a 63.3% share of the hairy solar panels market. This installation type remains the most popular due to its cost-effectiveness, ease of installation, and the growing number of residential and commercial buildings adopting solar energy solutions. Roof-mounted systems are typically the go-to choice for homeowners and small businesses because they do not require additional land space, making them ideal for urban environments where space is limited.

Ground Mounted installations, while still important, capture a smaller share of the market compared to roof-mounted systems. These installations are often used for larger solar farms or in rural areas where land is more readily available. Ground-mounted systems are ideal for maximizing the energy output from solar panels, as they can be positioned at optimal angles and adjusted as needed for maximum sunlight exposure.

Building Integrated installations represent a smaller but growing segment of the market. These systems integrate solar panels directly into the building’s architecture, such as solar windows, walls, and roofs. Building-integrated solar panels (BIPV) offer both aesthetic and functional benefits, as they blend seamlessly with the building’s design while generating energy.

By Material

In 2024, Silicon held a dominant market position in the hairy solar panels sector, capturing more than a 72.1% share. Silicon remains the most widely used material in solar panels due to its proven efficiency, reliability, and cost-effectiveness. Both monocrystalline and polycrystalline silicon-based panels continue to dominate the market, with silicon being the core material for most commercial and residential solar installations.

Gallium Arsenide is a high-performance material often used in specialized applications, particularly for concentrated solar power systems or in space technology. Although it holds a smaller share of the market, its efficiency—higher than silicon—makes it a promising material for high-efficiency solar cells. In 2024, the gallium arsenide segment remains niche, but it is expected to see gradual growth as research into high-efficiency, multi-junction solar cells continues to progress.

Indium Gallium Phosphide (InGaP), often used in tandem with gallium arsenide in multi-junction solar cells, captures a small yet significant share of the market. InGaP is known for its excellent efficiency in converting sunlight into electricity, particularly in concentrated solar power (CSP) systems. In 2024, this material is seeing growth within high-efficiency solar applications and is expected to continue gaining traction through 2025 as the demand for high-performing panels in niche markets grows.

Perovskite materials, a new frontier in solar technology, are gaining attention due to their potential for low-cost, high-efficiency solar cells. Although the perovskite segment still holds a small share in 2024, it is expected to see rapid growth through 2025. This material offers significant advantages in terms of efficiency and ease of manufacturing, with several pilot projects and research initiatives underway to scale up production.

By Grid Connectivity

In 2024, On-Grid Systems held a dominant market position, capturing more than a 73.2% share of the hairy solar panels market. On-grid systems, also known as grid-tied systems, are the most common type of solar installation because they are cost-effective and allow for easy integration into existing power grids. These systems generate electricity that is used both on-site and sent back to the grid, offering homeowners, businesses, and utilities the ability to offset electricity costs and earn credits or compensation for excess power.

Off-Grid Systems, while accounting for a smaller share of the market, are becoming increasingly popular in areas where grid connectivity is unreliable or unavailable. In 2024, off-grid systems are expected to hold a growing market segment, especially in remote or rural locations where extending the grid is not feasible. Off-grid solar systems, which are typically combined with battery storage to ensure a steady power supply, offer independence from the utility grid and are particularly attractive for remote homes, businesses, and disaster relief efforts.

By End-Use

In 2024, Commercial applications held a dominant market position in the hairy solar panels sector, capturing more than a 52.1% share. The commercial segment includes a wide range of businesses, from office buildings to retail stores, and even large-scale commercial farms. These users typically install larger solar systems to offset their significant energy consumption and reduce long-term operational costs.

The Residential segment, while smaller in comparison to commercial installations, is also experiencing growth, especially as more homeowners seek to reduce energy bills and rely less on traditional power grids. In 2024, residential solar panel installations are expected to grow steadily as government subsidies and tax incentives make solar systems more accessible to the average homeowner.

The Industrial segment, though holding a smaller market share, is also seeing an increase in adoption. Industrial applications often require large-scale, high-capacity solar installations to power factories, warehouses, and manufacturing plants. As industries look for ways to meet energy demands while lowering operational costs, industrial solar installations are becoming a more attractive option.

Key Market Segments

By Technology

- Photovoltaic

- Concentrated Solar Power

- Thin Film Solar

- Bifacial

By Panel Type

- Monocrystalline

- Polycrystalline

- Bifacial

By Installation Type

- Roof Mounted

- Ground Mounted

- Building Integrated

By Material

- Silicon

- Gallium Arsenide

- Indium Gallium Phosphide

- Perovskite

- Others

By Grid Connectivity

- On-Grid Systems

- Off-Grid Systems

By End-Use

- Residential

- Commercial

- Industrial

Drivers

Increasing Demand for Renewable Energy

One of the major driving factors for the growing adoption of hairy solar panels is the global shift toward renewable energy, fueled by both environmental concerns and the need for energy security. Governments, businesses, and individuals are increasingly recognizing the importance of sustainable energy solutions to reduce reliance on fossil fuels and mitigate the impacts of climate change. This transition is supported by favorable government policies, subsidies, and incentives that encourage the installation of solar power systems.

For example, in the United States, the federal government offers a 30% solar investment tax credit (ITC), which significantly reduces the upfront cost of solar installations for residential, commercial, and industrial customers.

The European Union is also accelerating its push towards renewable energy. The EU has set ambitious goals, including achieving 55% emissions reduction by 2030, with solar power being a key component of this strategy. In 2024, Germany alone is expected to add over 5 gigawatts of new solar capacity, as part of its efforts to increase renewable energy adoption. Similarly, India has set a target of 500 GW of non-fossil fuel capacity by 2030, with a significant portion expected to come from solar power. These initiatives are encouraging the global spread of solar technologies, including hairy solar panels.

As governments continue to provide incentives and as technology continues to advance, the adoption of solar power, particularly hairy solar panels, will continue to increase. With the combined effort of governments and industries, the growth of the solar energy market is poised to be a central component of global sustainability efforts in the coming years.

Restraints

High Initial Costs of Solar Panel Installation

One of the primary restraining factors for the widespread adoption of hairy solar panels is the high initial installation cost. While the cost of solar panels has significantly decreased over the past decade, the upfront investment required for a solar system—particularly for residential and commercial installations—remains a major barrier for many individuals and businesses. Even with government incentives and tax credits, the initial costs can still be prohibitive for many households, particularly in developing economies.

In the United States, while the solar investment tax credit (ITC) can reduce upfront costs by 30%, the total cost of a residential solar system averages between $15,000 and $25,000 before any incentives. This high initial outlay can discourage homeowners, especially those in lower-income brackets, from making the switch to solar energy. Additionally, businesses looking to install solar panels may face significant capital expenditures, even though long-term savings are possible. According to the U.S. Solar Energy Industries Association (SEIA), while large-scale commercial solar installations are growing, only about 2% of U.S. commercial buildings currently utilize solar power despite the potential for significant energy savings.

This issue is compounded in emerging economies where access to financing options or government incentives may be limited. In countries like India and parts of Africa, the initial costs can make it difficult for smaller businesses or homeowners to transition to solar energy. In 2024, the Indian government aims to increase solar capacity but still faces challenges in ensuring affordability and financing for small-scale projects, especially in rural areas. With India targeting 500 GW of renewable energy capacity by 2030, ensuring affordable financing solutions will be key to overcoming this barrier.

Opportunity

Expansion of Solar Energy in Emerging Markets

One of the most significant growth opportunities for hairy solar panels is the increasing adoption of solar energy in emerging markets. Countries in Asia, Africa, and Latin America are becoming key players in the global solar market, offering vast untapped potential for solar panel installations, including hairy solar panels. With many of these regions having high levels of solar irradiance and significant electricity supply gaps, solar energy is becoming a key part of their strategy for achieving energy independence and addressing sustainability challenges.

For example, India has set an ambitious target to achieve 500 GW of renewable energy capacity by 2030, with a major focus on solar power. As of 2024, India has already become one of the fastest-growing solar markets globally, and the demand for solar energy solutions continues to rise. With over 1.3 billion people and many rural areas still lacking reliable electricity, solar panels, including hairy solar panels, present an ideal solution. The Indian government has introduced various schemes such as the Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan (PM KUSUM), which incentivizes farmers to install solar panels. These initiatives will significantly drive the demand for solar energy in the coming years.

Similarly, in Africa, where many countries face energy access issues, solar power is quickly becoming a preferred solution. According to the International Energy Agency (IEA), about 600 million people in Africa still lack access to electricity, making the market for solar energy solutions, including off-grid solar, highly attractive. In countries like Kenya and Nigeria, solar energy is being embraced as a cost-effective and sustainable solution to provide power in remote areas. The rapid growth of solar projects in these regions opens up new markets for solar companies to expand their product offerings, including hairy solar panels.

Trends

Integration of Solar Power with Energy Storage Solutions

One of the latest trends in the hairy solar panels market is the increasing integration of solar power with energy storage solutions. As solar energy adoption grows, so does the need for reliable energy storage systems that can store excess power generated during sunny hours and provide it when sunlight is limited, such as at night or during cloudy weather. This trend is becoming particularly significant in both residential and commercial sectors, as energy independence and grid resilience become top priorities.

In 2024, solar-plus-storage systems are seeing rapid growth. According to the U.S. Solar Energy Industries Association (SEIA), the residential solar storage market grew by 40% in 2023, driven by the increasing affordability of lithium-ion batteries and growing consumer demand for off-grid or grid-tied energy storage. Homeowners are increasingly seeking to combine solar panel systems with battery storage to avoid power outages, reduce reliance on the grid, and lower their energy bills. In the commercial sector, companies are looking to solar-plus-storage solutions to enhance energy security and cut costs, especially in regions with unreliable grids.

The U.S. government has been a key driver of this trend, with incentives like the Solar Investment Tax Credit (ITC) allowing tax credits for both solar and energy storage installations. In 2024, the ITC continues to offer a 30% tax credit, making solar-plus-storage solutions more affordable for homeowners and businesses alike. This policy, along with local incentives in states like California and New York, has accelerated the adoption of both solar panels and energy storage systems.

Globally, this trend is also visible in countries like Germany, which has integrated battery storage systems in many of its solar installations as part of its transition to renewable energy. The growth of energy storage technologies alongside solar panels is a significant trend that will continue to evolve, making renewable energy more reliable and accessible worldwide.

Regional Analysis

In 2024, the Asia Pacific (APAC) region held a dominant position in the hairy solar panels market, capturing more than 47.2% of the total market share, valued at approximately $2.9 billion. This dominance is largely driven by countries like China, India, and Japan, where the adoption of solar energy is being heavily supported by favorable government policies, substantial investments, and high solar irradiation.

North America, with the U.S. as the key market player, follows APAC in market share, capturing a significant portion of the market due to strong government incentives and subsidies like the Solar Investment Tax Credit (ITC). The U.S. market is expected to continue expanding, driven by both residential and commercial demand for solar energy solutions.

Europe holds a notable share of the market, driven by leading countries such as Germany, France, and Spain, which have been actively pursuing renewable energy targets. In 2024, Europe is expected to continue expanding its solar energy adoption, aided by EU-wide policies promoting sustainability and green energy initiatives.

Middle East & Africa and Latin America are witnessing slower growth but are steadily increasing their share due to growing awareness of the benefits of solar energy, with countries like South Africa and Brazil leading the way. These regions are expected to see gradual growth in the coming years, as infrastructure and investment in renewable energy solutions continue to improve.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The hairy solar panels market is highly competitive, with several leading global players contributing to its growth and innovation. Canadian Solar, First Solar, and JinkoSolar are some of the key players driving market advancements with their cutting-edge solar technologies. Canadian Solar, for instance, has expanded its presence globally, providing high-performance solar modules and energy storage solutions.

Enphase Energy and SolarEdge Technologies stand out in the solar energy sector for their expertise in energy management systems and inverters, which are essential for optimizing the performance of solar panel systems. Additionally, Hanwha Q CELLS, JA Solar, and LONGi Green Energy have secured substantial shares in the market by focusing on high-efficiency panels and consistent innovation in solar technologies.

Maxeon Solar Technologies, Panasonic, and LG Electronics are also prominent players, known for their focus on high-efficiency panels and premium solar products, catering to residential, commercial, and industrial sectors. Trina Solar, Suntech Power, and Tata Power Solar play a significant role in expanding solar capacity, particularly in emerging markets like India and China. Sharp Corporation, a longstanding leader in electronics, has made strides in solar energy, further consolidating its position with innovative products aimed at both residential and commercial sectors.

REC Solar, ReneSola, Vivint Solar, and Meyer Burger Technology continue to support the market with new solutions, partnerships, and sustainable practices. Collectively, these companies are shaping the future of the solar energy industry, contributing to increasing global capacity and pushing for affordable, scalable, and high-performing solar systems worldwide. Their continuous focus on research and development, along with strategic partnerships, ensures the steady growth of the hairy solar panels market.

Top Key Players

- Canadian Solar

- Enphase Energy

- First Solar, Inc.

- GCL-Poly Energy Holdings Limited

- Hanwha Q CELLS

- JA Solar Holdings Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Kyocera Corporation

- LG Electronics

- LONGI Green Energy

- LONGi Solar

- Maxeon Solar Technologies

- Meyer Burger Technology AG

- NanoFlex Power Corporation

- Panasonic Corporation

- REC Solar Holdings AS

- ReneSola Ltd.

- Sharp Corporation

- SolarEdge Technologies

- Solaria Corporation

- SunPower Corporation

- Suntech Power

- Tata Power Solar Systems Ltd.

- Trina Solar

- Trina Solar Limited

- Vivint Solar

Recent Developments

In 2024, Canadian Solar plans to expand its annual production capacity to over 20 GW, further solidifying its role as a major supplier of solar solutions globally. Canadian Solar has been making significant strides in smart energy solutions and energy storage systems, enhancing the appeal of its solar panel offerings in both residential and commercial sectors.

In 2023, Enphase shipped over 50 million microinverters, and in 2024, it is expected to ship more than 60 million, expanding its market share globally. Their products are increasingly being paired with high-efficiency solar panels, including those with bifacial and hairy structures, to provide a more robust solution for energy generation.

Report Scope

Report Features Description Market Value (2024) USD 6.3 Bn Forecast Revenue (2034) USD 25.3 Bn CAGR (2025-2034) 14.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Photovoltaic, Concentrated Solar Power, Thin Film Solar, Bifacial), By Panel Type (Monocrystalline, Polycrystalline, Bifacial), By Installation Type (Roof Mounted, Ground Mounted, Building Integrated), By Material (Silicon, Gallium Arsenide, Indium Gallium Phosphide, Perovskite, Others), By Grid Connectivity (On-Grid Systems, Off-Grid Systems), By End-Use (Residential, Commercial, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Canadian Solar, Enphase Energy, First Solar, Inc., GCL-Poly Energy Holdings Limited, Hanwha Q CELLS, JA Solar Holdings Co., Ltd., JinkoSolar Holding Co., Ltd., Kyocera Corporation, LG Electronics, LONGI Green Energy, LONGi Solar, Maxeon Solar Technologies, Meyer Burger Technology AG, NanoFlex Power Corporation, Panasonic Corporation, REC Solar Holdings AS, ReneSola Ltd., Sharp Corporation, SolarEdge Technologies, Solaria Corporation, SunPower Corporation, Suntech Power, Tata Power Solar Systems Ltd., Trina Solar, Trina Solar Limited, Vivint Solar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Canadian Solar

- Enphase Energy

- First Solar, Inc.

- GCL-Poly Energy Holdings Limited

- Hanwha Q CELLS

- JA Solar Holdings Co., Ltd.

- JinkoSolar Holding Co., Ltd.

- Kyocera Corporation

- LG Electronics

- LONGI Green Energy

- LONGi Solar

- Maxeon Solar Technologies

- Meyer Burger Technology AG

- NanoFlex Power Corporation

- Panasonic Corporation

- REC Solar Holdings AS

- ReneSola Ltd.

- Sharp Corporation

- SolarEdge Technologies

- Solaria Corporation

- SunPower Corporation

- Suntech Power

- Tata Power Solar Systems Ltd.

- Trina Solar

- Trina Solar Limited

- Vivint Solar