Global Yeast Ingredients Market Size, Share Analysis Report By Type (Yeast Extracts, Yeast Autolysates, Yeast Beta-glucan, Yeast Derivatives, Others), By Source (Baker’s yeast, Brewer’s yeast), By Application (Food, Feed, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145896

- Number of Pages: 396

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

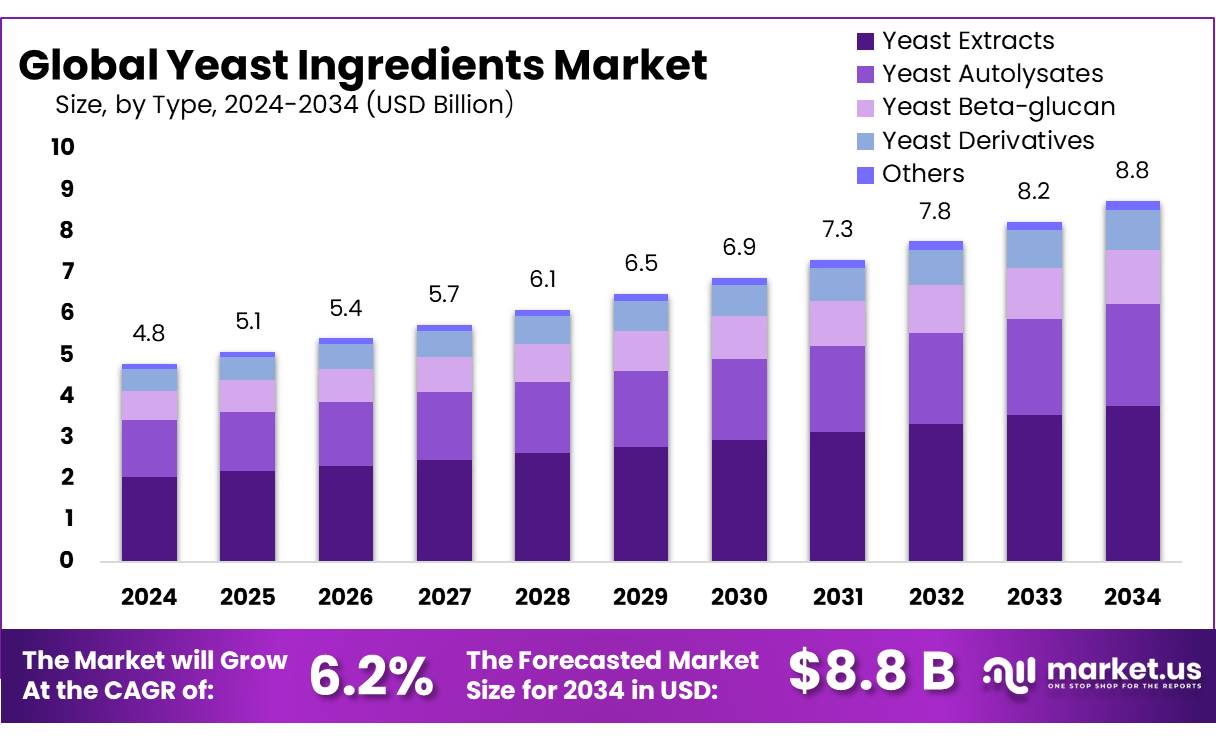

The Global Yeast Ingredients Market size is expected to be worth around USD 8.8 Bn by 2034, from USD 4.8 Bn in 2024, growing at a CAGR of 6.2% from 2025 to 2034.

The yeast ingredients industry plays a critical role in global food and beverage manufacturing, functioning as a key additive for flavor, fermentation, nutrition enhancement, and shelf-life extension. Derived primarily from Saccharomyces cerevisiae, yeast ingredients include yeast extracts, autolyzed yeast, nutritional yeast, and yeast-based flavor enhancers. These ingredients are widely used across bakery, processed foods, beverages, dairy, and savory applications, with expanding interest in plant-based and clean-label products further fueling demand.

In the global food industry landscape, yeast-derived ingredients have grown significantly due to their natural origin and rich umami profile. According to the Food and Agriculture Organization (FAO), global yeast production for food applications surpassed 1.9 million metric tons in 2022, driven largely by bakery and beverage sectors. Europe and Asia remain key manufacturing hubs, with China producing over 250,000 metric tons of yeast products in 2023, as per China’s Ministry of Agriculture and Rural Affairs.

Additionally, the demand for yeast extracts as salt-reduction agents aligns with the World Health Organization’s (WHO) global target of reducing sodium intake by 30% by 2025. Yeast-based products serve as effective salt replacers without compromising taste, making them favorable in low-sodium formulations.

Government regulations and policies also play a crucial role in the industrial growth of yeast ingredients. In India, the Ministry of Food Processing Industries (MoFPI) approved Rs. 10,900 crore (approx. USD 1.3 billion) under the Production Linked Incentive (PLI) scheme for food processing, encouraging domestic production of fermentation-based ingredients, including yeast. Similarly, the U.S. Department of Agriculture (USDA) promotes clean-label fermentation solutions, indirectly supporting the yeast ingredients market via R&D grants and pilot initiatives.

The growing focus on gut health and functional foods has further opened new opportunities. According to the European Food Safety Authority (EFSA), functional food sales in the EU reached over EUR 20 billion in 2023, with yeast beta-glucans being widely recognized for their immune-boosting and cholesterol-lowering properties. Such attributes are drawing attention from nutraceutical and pharmaceutical companies, thereby diversifying yeast ingredient applications beyond food and beverages.

Key Takeaways

- Yeast Ingredients Market size is expected to be worth around USD 8.8 Bn by 2034, from USD 4.8 Bn in 2024, growing at a CAGR of 6.2%.

- Yeast extracts solidified their market leadership in the yeast ingredients sector, seizing more than a 43.60% share.

- Baker’s yeasts continued to dominate the yeast ingredients market, securing over a 68.50% share.

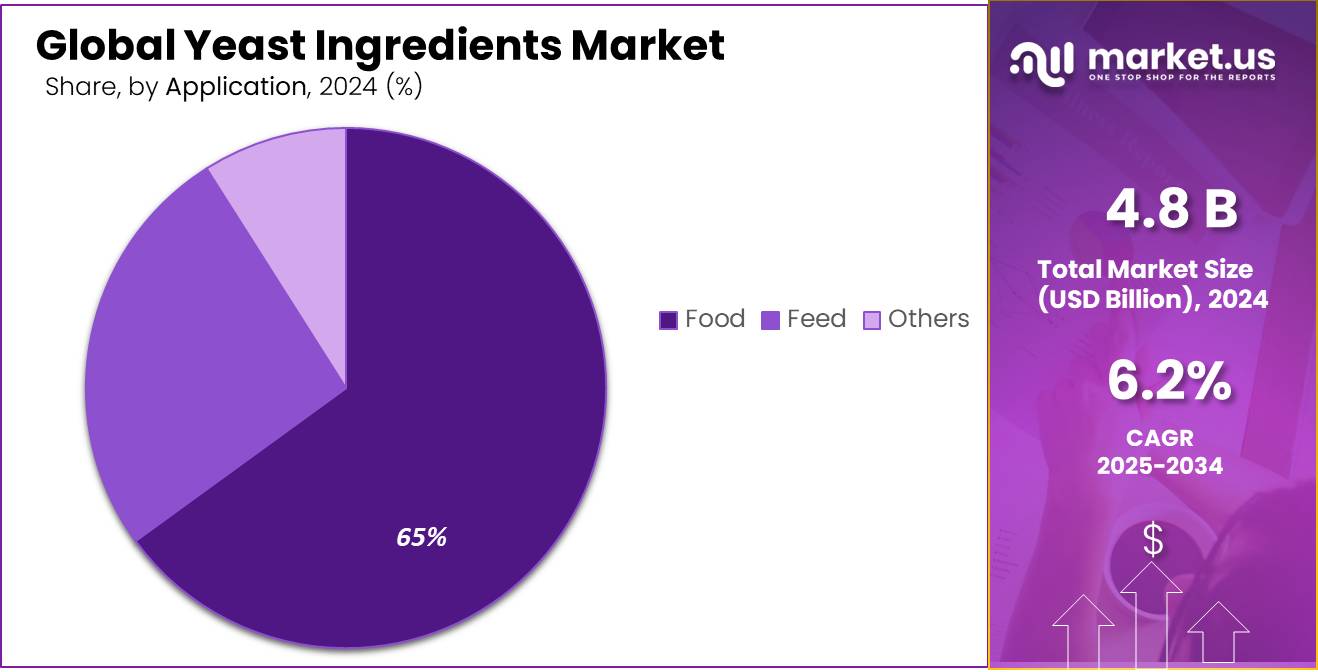

- Food sector maintained a commanding lead, capturing over 65.40% of the market.

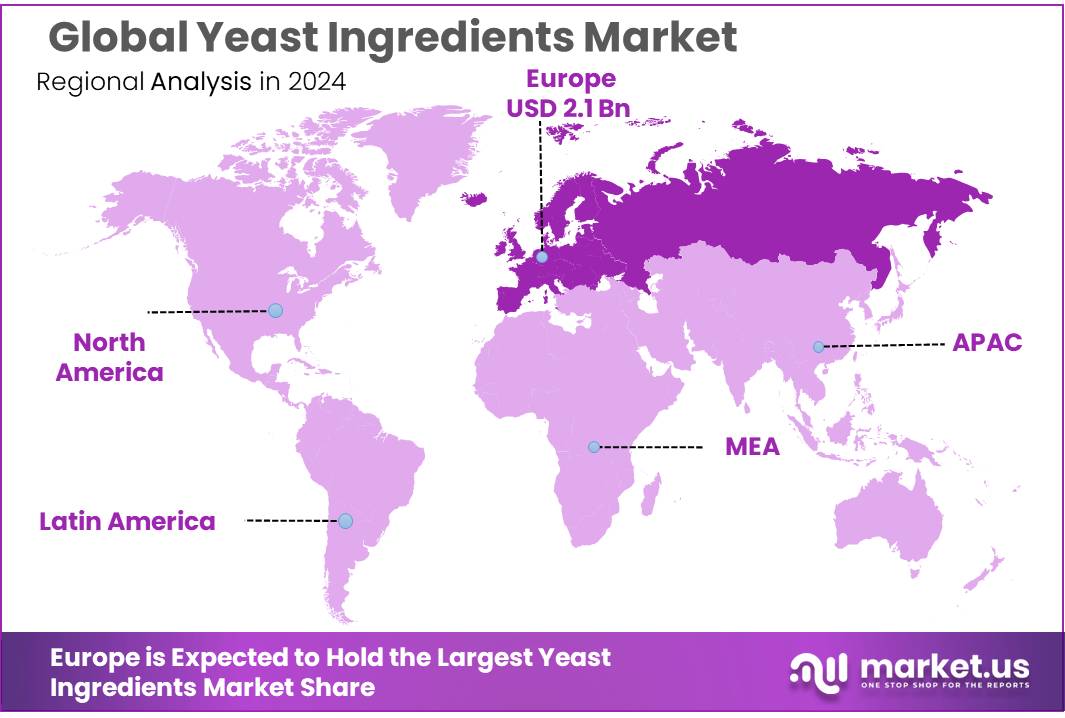

- European market for yeast ingredients exhibited robust growth, securing a dominant share of 44.60%, equivalent to a market valuation of approximately USD 2.1 billion.

Analysts’ Viewpoint

From an investment perspective, the yeast ingredients market presents a robust growth trajectory with significant opportunities and inherent risks. The market is projected to grow substantially, driven by increasing demand for convenience foods and baked goods. This demand is a reflection of changing consumer lifestyles where quick and easy meals are preferred, pushing the need for yeast-based food enhancers.

Investment opportunities are also ripe in the expanding sectors of plant-based and vegan foods. Yeast ingredients like extracts and autolysates are key in enhancing the flavor profiles and nutritional content of these foods, which are becoming increasingly popular due to rising health and environmental consciousness among consumers.

However, investors should also be mindful of the risks involved. The yeast ingredients sector faces challenges such as fluctuating raw material prices, which can affect production costs and profit margins. Additionally, the market is subject to stringent global food safety and quality regulations that could impact operational flexibility and cost.

By Type

Yeast Extracts Lead with 43.60% Share Owing to Versatility and Health Benefits

In 2024, yeast extracts solidified their market leadership in the yeast ingredients sector, seizing more than a 43.60% share. This substantial market presence can be attributed to their widespread use across various food and beverage applications, where they serve as flavor enhancers and nutritional supplements. Yeast extracts are highly favored in the food industry for their ability to impart a rich umami flavor without adding artificial additives, aligning with the growing consumer demand for clean-label products.

Their application extends beyond taste enhancement to health-oriented products, as they are a rich source of vitamins and minerals. This dual functionality—enhancing both flavor and nutritional profile—positions yeast extracts as a key component in the formulation of healthier, more natural food products. As we look to 2025, the continued innovation in yeast extract applications is expected to further drive their dominance in the market.

By Source

Baker’s Yeasts Command 68.50% Market Share Due to Essential Role in Baking

In 2024, Baker’s yeasts continued to dominate the yeast ingredients market, securing over a 68.50% share. This prominent position is largely due to their indispensable role in the baking industry. Baker’s yeast is crucial for fermenting bread and other baked goods, where it not only helps the dough rise but also enhances the texture and flavor of the final products.

The versatility of Baker’s yeast extends to various forms, including fresh yeast, dry yeast, and instant yeast, each catering to different baking needs and preferences. Its consistent demand is reinforced by the global rise in bread consumption and the expanding variety of baked goods influenced by both regional and international cuisines. As consumer preferences shift towards healthier and artisanal bread varieties, the reliance on Baker’s yeast is expected to remain robust into 2025, underpinning its continued market leadership.

By Application

Food Applications Secure 65.40% of Market, Driven by Diverse Culinary Uses

In 2024, the application of yeast ingredients in the food sector maintained a commanding lead, capturing over 65.40% of the market. This dominance is primarily attributed to yeast’s multifaceted role in culinary practices. Yeast is essential not only in baking but also in the production of alcoholic beverages like beer and wine, where it is crucial for fermentation.

Additionally, yeast extracts, which are derived from yeast, are increasingly used as flavor enhancers and nutritional additives in a wide range of food products, from soups and broths to snacks and ready-to-eat meals. The growing consumer awareness of the health benefits associated with yeast, such as improved digestion and nutrient absorption, has further propelled its inclusion in dietary regimes. As the food industry continues to innovate with flavors and healthier food options, the role of yeast ingredients is expected to expand, reinforcing its substantial market share into 2025.

Key Market Segments

By Type

- Yeast Extracts

- Yeast Autolysates

- Yeast Beta-glucan

- Yeast Derivatives

- Others

By Source

- Baker’s yeast

- Brewer’s yeast

By Application

- Food

- Bakery Products

- Prepared Meals

- Beverages

- Others

- Feed

- Swine

- Poultry

- Cattle

- Others

- Others

Drivers

Health-Conscious Consumer Trends Propel Yeast Ingredient Demand

One of the primary driving factors for the growth of the yeast ingredients market is the increasing health consciousness among consumers globally. As people become more aware of what they consume and the impact of their diet on their health, there is a rising demand for natural and nutrient-rich ingredients. Yeast ingredients, known for their natural origin and health benefits, have become a popular choice in various food applications.

According to data from the World Health Organization (WHO) and the Food and Agriculture Organization (FAO), there has been a noticeable shift in dietary patterns towards healthier alternatives that support immune function and overall wellness. Yeast ingredients, such as yeast extracts and autolyzed yeast, are rich in vitamins, minerals, and antioxidants, making them beneficial for health-conscious diets. The WHO has emphasized the importance of balanced diets that include micronutrient-rich foods, which has indirectly favored the yeast ingredients sector.

Additionally, government initiatives that promote healthy eating habits have also spurred the use of yeast ingredients in the food industry. For instance, the U.S. Department of Agriculture (USDA) has been involved in various programs that encourage food manufacturers to reduce sodium and sugar content in food products. Yeast extracts, which are known for their natural flavor-enhancing properties, offer an effective solution for reducing added sodium without compromising taste.

The combined influence of consumer trends and supportive government policies is driving innovation in the yeast ingredients market, as manufacturers are continually developing new products that cater to health-conscious consumers. This trend is expected to continue, reinforcing the significant role of yeast ingredients in the evolving food industry landscape.

Restraints

Supply Chain Instabilities Impact Yeast Ingredients Market

A significant restraining factor for the growth of the yeast ingredients market is the instability in global supply chains. This challenge has been particularly pronounced in the wake of disruptions caused by global events such as the COVID-19 pandemic and geopolitical tensions. These disruptions have affected the availability and consistency of raw materials needed for yeast production, such as molasses, which is a primary substrate in the fermentation process used to produce yeast.

The Food and Agriculture Organization (FAO) has reported fluctuations in global commodity prices and trade flows, which have directly impacted the yeast industry. For instance, the FAO’s Food Price Index, which tracks monthly changes in international prices of commonly-traded food commodities, has shown considerable volatility in recent years. This volatility affects the cost inputs for yeast production, leading to challenges in pricing and supply chain planning for yeast ingredient manufacturers.

Additionally, government policies and trade restrictions can further complicate the supply scenario. For example, import tariffs on key raw materials can increase the production costs for yeast ingredients, making them less competitive compared to synthetic or alternative additives.

These supply chain challenges not only affect the production side but also impact the manufacturers’ ability to meet the growing demand from food producers seeking natural and health-enhancing ingredients. The ripple effects are seen in the form of delayed production schedules and increased costs, which can restrain market growth.

Opportunity

Expanding Functional Food Sector Opens Doors for Yeast Ingredients

One of the most promising growth opportunities for the yeast ingredients market lies within the expanding functional food sector. As consumers increasingly seek foods that offer health benefits beyond basic nutrition, the demand for functional ingredients like yeast extracts and autolysates is on the rise. These yeast derivatives are rich in vitamins, minerals, and antioxidants, making them ideal for enhancing the nutritional profile of foods without compromising on taste.

According to a recent report by the United Nations Food and Agriculture Organization (FAO), the global functional food market is experiencing rapid growth due to rising health awareness and a growing aging population looking for dietary ways to prevent age-related diseases. The report highlights that functional foods that support immune health, enhance gut health, and provide enhanced nutritional value are particularly in demand.

Governments worldwide are also supporting the trend towards healthier foods. For example, initiatives like the U.S. National Institutes of Health’s (NIH) research on nutrition and health aim to improve understanding of how functional foods can play a role in preventing chronic diseases. These government-backed research initiatives can increase consumer trust and drive demand for fortified and functional foods, thereby creating a favorable environment for the use of yeast ingredients.

Yeast ingredients are well-positioned to capitalize on these trends due to their natural composition and health benefits. They can be easily incorporated into a wide range of products, from baked goods to beverages, without altering the fundamental characteristics of the food. As the market for functional foods continues to grow, yeast ingredient manufacturers have the opportunity to innovate and expand their product offerings to meet this demand.

Trends

Sustainability Trends Shape the Future of Yeast Ingredients

One of the latest and most impactful trends in the yeast ingredients market is the shift toward sustainable production practices. As environmental concerns become more central to consumer choices and regulatory policies, companies are adopting more eco-friendly methods in the production of yeast ingredients. This trend is not only driven by consumer preference but also supported by various governmental initiatives aiming to reduce environmental footprints across industries.

The Food and Agriculture Organization (FAO) has been actively promoting sustainable practices in food production and processing. According to FAO, sustainable practices include optimizing the use of natural resources, reducing waste, and minimizing the ecological impact of production processes. In response to these guidelines, yeast ingredient manufacturers are increasingly investing in technologies that reduce energy consumption and waste generation during the fermentation process, which is central to yeast production.

Another aspect of sustainability that is gaining traction is the utilization of by-products from other industries as raw materials for yeast production. For instance, molasses, a by-product of sugar manufacturing, and spent grains from breweries are being used as nutrient sources for cultivating yeast. This not only helps in reducing waste but also in lowering the production costs associated with yeast ingredients, making them more competitive and sustainable.

Furthermore, there is an increasing emphasis on the lifecycle analysis of food ingredients by regulatory bodies and industry groups, pushing manufacturers to consider the environmental impact of their products from production to disposal. This lifecycle approach is influencing innovations in packaging and distribution as well, with companies exploring biodegradable and recyclable materials to further enhance the sustainability of their products.

Regional Analysis

In 2024, the European market for yeast ingredients exhibited robust growth, securing a dominant share of 44.60%, equivalent to a market valuation of approximately USD 2.1 billion. This substantial market presence is primarily driven by Europe’s strong tradition in the bakery and brewing industries, where yeast plays a critical role. The region’s sophisticated food processing sector, coupled with a high consumer preference for natural and clean-label ingredients, further bolsters the demand for yeast ingredients.

Europe’s focus on sustainable food production practices also contributes significantly to the market’s growth. Many European consumers are increasingly favoring products that are produced through environmentally friendly processes, which yeast ingredients can offer due to their natural fermentation process. This aligns well with the EU’s regulatory framework that encourages the reduction of artificial additives in food products.

Additionally, the rising trend of health and wellness among European consumers has led to increased demand for functional foods, where yeast ingredients are used due to their nutritional benefits such as high vitamin B content and essential minerals. The growth in this sector is supported by numerous health campaigns by governments across the region, aiming to reduce non-communicable diseases.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AngelYeast Co., Ltd., headquartered in China, is a prominent player in the global yeast ingredients market. Renowned for its wide range of yeast products, the company caters to various sectors including baking, beverage, and nutrition. Their commitment to innovation is evident in their advanced bio-fermentation processes. AngelYeast is dedicated to sustainability and improving the ecological impact of their production practices, making them a leader in both technology and environmental stewardship in the yeast industry.

Royal DSM is a global science-based company active in health, nutrition, and materials. Within the yeast ingredients sector, DSM stands out for its innovative solutions that enhance food and beverage products. DSM’s yeast-based ingredients are geared toward improving taste, texture, and nutritional content, supporting cleaner labels and catering to health-conscious consumers. DSM’s commitment to sustainability is integral to their operations, aiming to drive economic prosperity, environmental progress, and social advances to create sustainable value.

Leiber GmbH, based in Germany, specializes in the refinement of brewer’s yeast into high-quality yeast extracts. Their products find applications across the food, beverage, and health industries. Leiber is known for combining traditional brewing knowledge with modern technology to produce yeast extracts that enhance flavor and nutritional value. Their focus on research and development allows them to offer tailored solutions that meet the specific needs of their diverse client base.

Top Key Players

- AngelYeast Co., Ltd

- Leiber

- DSM

- Associated British Foods plc

- Lesaffre Yeast Corporation

- Lallemand Inc.

- Synergy Flavors

- Sensient Technologies Corporation

- Chr. Hansen Holding A/S

- AB Vista

- Kerry Group plc

- Alltech

- Foodchem International Corporation

- BASF SE

- ADM

- Other Key Players

Recent Developments

Leiber GmbH, a German company situated in Bramsche, Niedersachsen, has solidified its reputation in the yeast ingredients market by specializing in the manufacture and distribution of brewer’s yeast products.

AngelYeast Co., Ltd., a leading company in the yeast ingredients market, has demonstrated strong financial performance in 2024. Based in China, AngelYeast specializes in the production and distribution of various yeast products, catering to industries like baking, fermentation, and nutrition.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 8.8 Bn CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Yeast Extracts, Yeast Autolysates, Yeast Beta-glucan, Yeast Derivatives, Others), By Source (Baker’s yeast, Brewer’s yeast), By Application (Food, Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AngelYeast Co., Ltd, Leiber, DSM, Associated British Foods plc, Lesaffre Yeast Corporation, Lallemand Inc., Synergy Flavors, Sensient Technologies Corporation, Chr. Hansen Holding A/S, AB Vista, Kerry Group plc, Alltech, Foodchem International Corporation, BASF SE, ADM, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AngelYeast Co., Ltd

- Leiber

- DSM

- Associated British Foods plc

- Lesaffre Yeast Corporation

- Lallemand Inc.

- Synergy Flavors

- Sensient Technologies Corporation

- Chr. Hansen Holding A/S

- AB Vista

- Kerry Group plc

- Alltech

- Foodchem International Corporation

- BASF SE

- ADM

- Other Key Players