Global Organic Coffee Market Size, Share, And Business Benefits By Type (Arabica, Robusta), By Flavor (Flavored, Black Cherry (Papaya, Orange, banana, Vanilla, Chocolate, Others), Unflavored), By Roast (Light, Medium, Dark), By Sales Channels (Hypermarkets/Supermarkets, Departmental and Convenience Stores, Specialty Stores, Online Sales Channels, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143087

- Number of Pages: 357

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

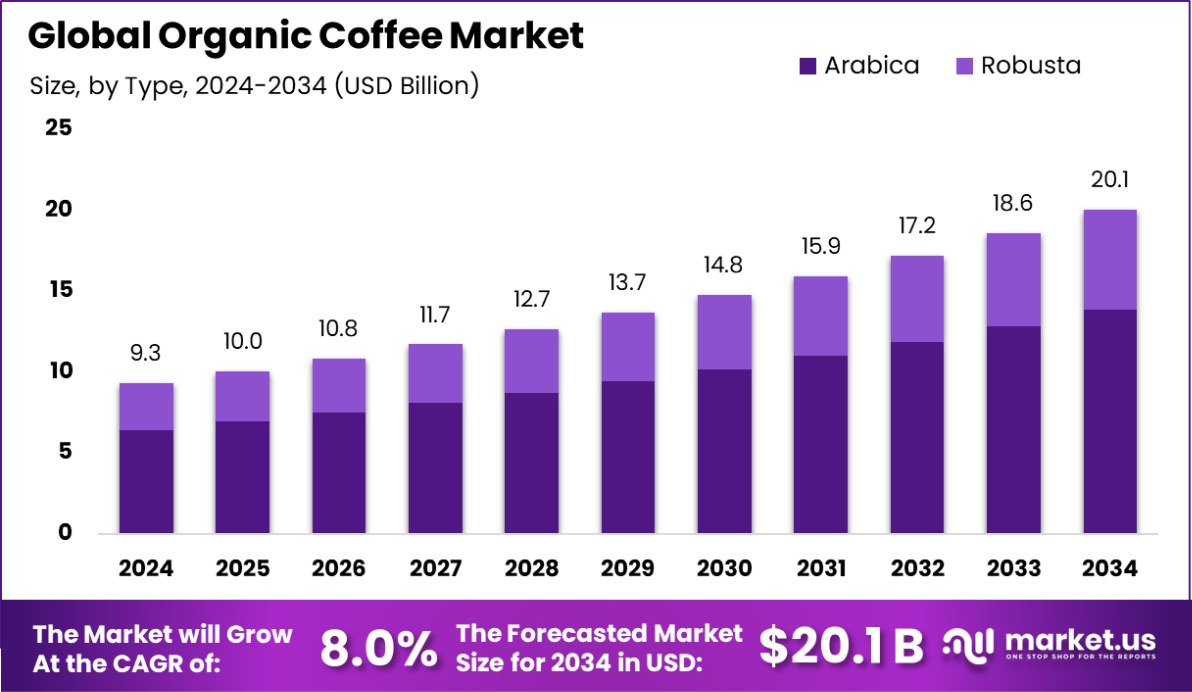

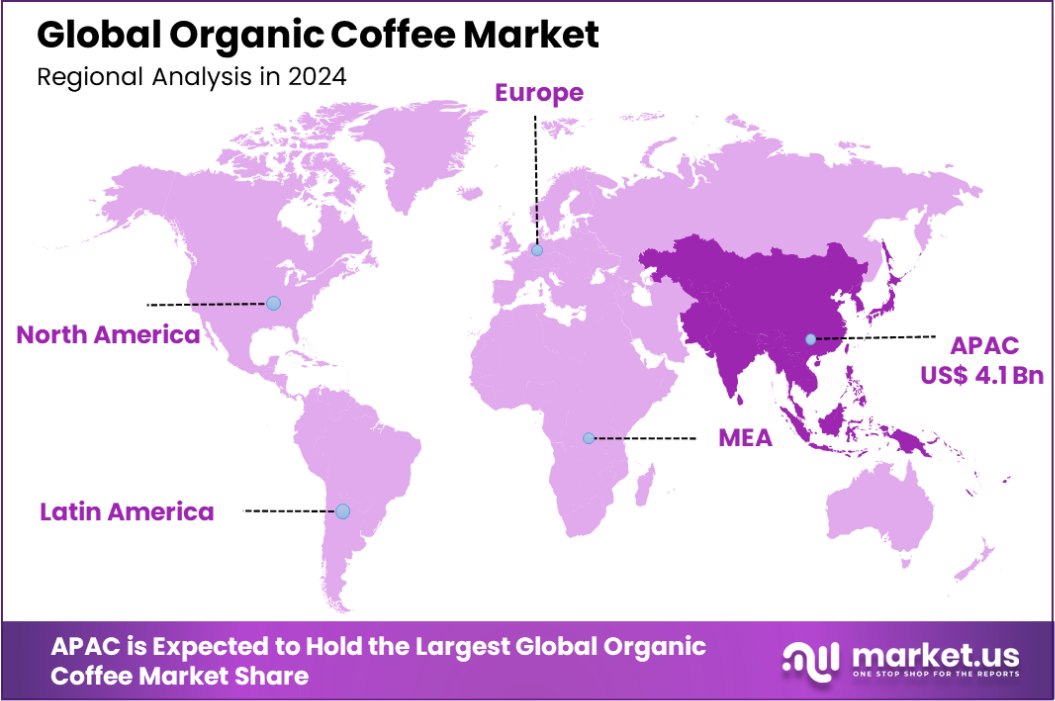

Global Organic Coffee Market is expected to be worth around USD 20.1 billion by 2034, up from USD 9.3 billion in 2024, and grow at a CAGR of 8.0% from 2025 to 2034. In the Organic Coffee Market, Asia-Pacific’s leadership is evident with a 44.30% share and USD 4.1 billion in value.

Organic coffee refers to coffee produced without the use of synthetic pesticides or other prohibited substances. This method focuses on replenishing the soil and maintaining its health through organic practices that emphasize the use of natural fertilizers and organic farming methods. The appeal of organic coffee lies in its sustainability and the cleaner, more natural environment in which the beans are cultivated.

The organic coffee market has been expanding as consumers increasingly prioritize health and environmental sustainability. Factors contributing to the growth of this market include rising awareness of the health benefits associated with organic products and the increasing demand for environmentally friendly farming practices. Additionally, the organic label often attracts a premium price, making it a lucrative sector for coffee growers and retailers.

Demand for organic coffee is primarily driven by the health-conscious consumer base and the growing middle class in developing countries. The United States, for instance, leads in total coffee consumption, tallying up to 1,697,000 tonnes in 2022, indicating a substantial market for organic variants as well.

Opportunities within the organic coffee market are plentiful, especially with the increasing consumer inclination toward specialty coffees and unique blends. Startups like Kopi Kenangan have successfully tapped into this trend, securing $333 million across six funding rounds, demonstrating investor confidence in the coffee sector’s growth potential. Similarly, Ember Technologies, focusing on coffee technology, has raised $88.2 million over eight rounds, highlighting the innovation and investment appeal in coffee-related technologies.

Globally, different regions present diverse opportunities, with the Central African Republic having the highest per capita coffee consumption at 52.1 kg/capita in 2022. This statistic underscores significant potential markets for organic coffee, both in high-consumption countries and regions just beginning to embrace coffee culture.

Key Takeaways

- Global Organic Coffee Market is expected to be worth around USD 20.1 billion by 2034, up from USD 9.3 billion in 2024, and grow at a CAGR of 8.0% from 2025 to 2034.

- Arabica dominates the organic coffee market with a substantial share of 69.20% due to its smooth flavor.

- Unflavored organic coffee leads market preferences, capturing 76.20% of sales with its pure and authentic taste.

- Medium roast organic coffee is the most popular, holding 51.20% of the market for its balanced flavor profile.

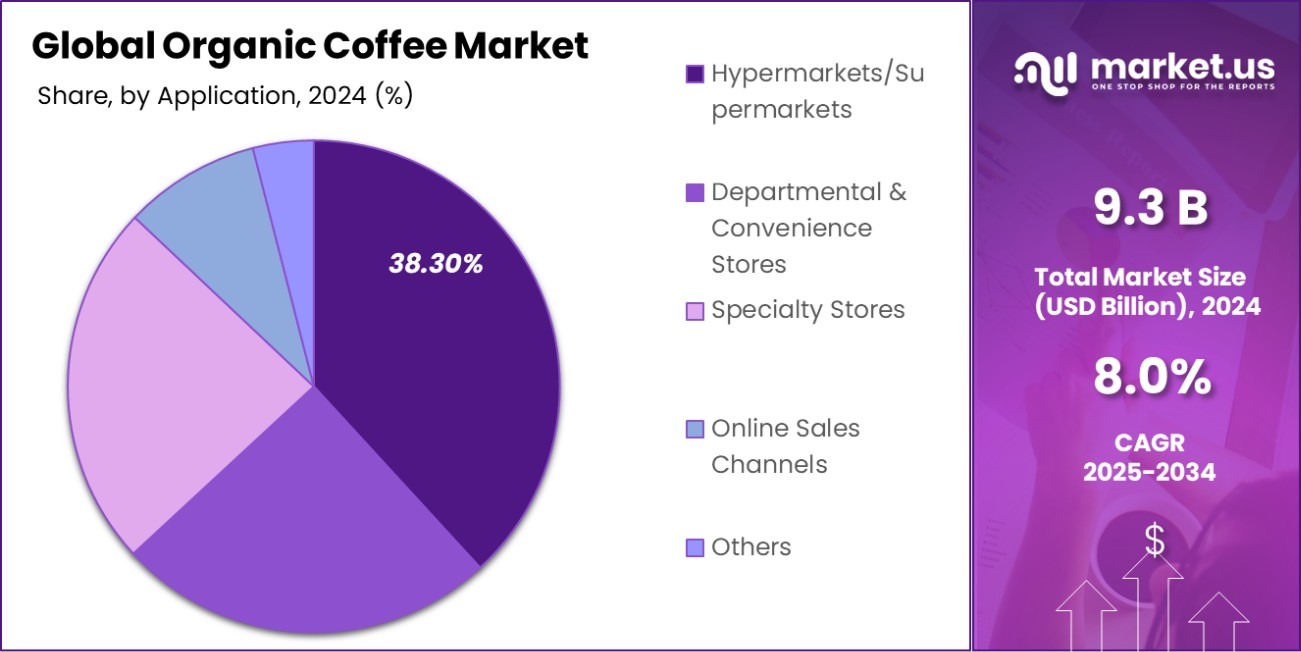

- Hypermarkets and supermarkets are major sales channels, distributing 38.30% of organic coffee to a broad consumer base.

- Holding a 44.30% market share, Asia-Pacific leads in Organic Coffee, representing a value of USD 4.1 billion.

By Type Analysis

Arabica beans dominate the organic coffee market, holding a 69.20% share.

In 2024, Arabica held a dominant market position in the By Type segment of the Organic Coffee Market, with a 69.20% share. This significant market share is attributed to Arabica coffee’s superior flavor and aroma, which are highly valued by coffee enthusiasts worldwide. Arabica coffee beans are known for their sweeter, softer taste and higher acidity compared to other coffee types, making them a preferred choice among consumers seeking quality organic coffee.

The preference for Arabica beans in the organic coffee market is further supported by their widespread cultivation in Latin America, where many countries have invested heavily in sustainable farming practices. These practices not only align with the global shift towards organic agriculture but also enhance the appeal of Arabica coffee to environmentally conscious consumers. The region’s favorable climatic conditions and rich soil contribute to the production of high-quality organic Arabica beans, reinforcing its leading position in the market.

Moreover, as consumers increasingly demand transparency and ethical production, the traceability of Arabica coffee through certifications like Fair Trade and Rainforest Alliance adds to its market strength. These factors collectively ensure that Arabica remains a leading choice in the organic coffee market, holding a predominant share and driving growth within the segment.

By Flavor Analysis

Unflavored organic coffee leads in flavor preference, capturing 76.20% of the market.

In 2024, Unflavored held a dominant market position in the By Flavor segment of the Organic Coffee Market, with a 76.20% share. This overwhelming preference for unflavored organic coffee underscores a significant consumer trend toward purity and authenticity in coffee consumption.

Unflavored organic coffee is appreciated for its natural taste, which allows the consumer to experience the true, untouched flavor profile of the coffee bean, influenced solely by its origin and roasting process. This preference highlights the consumer’s desire for an unaltered and authentic coffee experience, which is particularly valued within the organic sector, where the emphasis is on natural processes and ingredients.

The strong performance of unflavored coffee in the market is also reflective of the growing consumer interest in health and wellness. Many consumers opt for unflavored organic coffee to avoid additives and artificial flavors that might conflict with their dietary preferences or health goals. The simplicity of unflavored coffee makes it a versatile choice for both home brewing and in cafes, ensuring its continued popularity and dominant market share.

Additionally, the sustainability aspect of organic coffee aligns well with the minimalistic approach of unflavored varieties, further bolstering its appeal to environmentally conscious consumers. This segment’s dominance is likely to persist as more consumers turn towards more natural and eco-friendly products.

By Roast Analysis

Medium roast is the most popular in the organic coffee market at 51.20%.

In 2024, Medium roast held a dominant market position in the By Roast segment of the Organic Coffee Market, with a 51.20% share. This prevalence is attributed to the balanced flavor profile of medium roast coffee, which captures a perfect middle ground between the milder light roasts and the more intense dark roasts.

Medium roast coffee offers a rich, aromatic flavor without the bitterness that can accompany darker roasts, making it widely appealing to a broad spectrum of coffee drinkers. This roast level enhances the intrinsic flavors of the coffee bean while introducing a slight sweetness that is often lost in darker roasts.

The preference for medium roast in the organic segment particularly resonates with consumers who seek both the health benefits associated with less roasted, antioxidant-rich coffee and the robust taste that coffee aficionados cherish. The organic coffee market’s inclination toward medium roast is further reinforced by its versatility in various brewing methods, from classic drip to espresso, making it a favorite in both home and commercial settings.

Furthermore, the dominance of medium roast in the organic coffee market is supported by its appeal to both traditional coffee drinkers and new consumers, ensuring a steady demand and maintaining its substantial market share. As consumers continue to gravitate towards balanced flavors and sustainable choices, medium roast organic coffee remains a leading choice in the market.

By Sales Channels Analysis

Hypermarkets and supermarkets are key sales channels, accounting for 38.30% of sales.

In 2024, Hypermarkets/Supermarkets held a dominant market position in the By Sales Channels segment of the Organic Coffee Market, with a 38.30% share. This significant market share is primarily due to the convenience and accessibility that these outlets offer to the average consumer. Hypermarkets and supermarkets are pivotal in making organic coffee readily available to a wide demographic, showcasing a variety of brands and types under one roof, which allows consumers to compare and select based on preference and price.

The dominance of hypermarkets and supermarkets is also bolstered by the trust and reliability consumers place in these shopping formats. They provide a consistent shopping experience, backed by the assurance of quality and freshness, which is especially important for organic products like coffee. Additionally, the ability of these retailers to offer competitive pricing through economies of scale further attracts consumers, enhancing their market share in the organic coffee sector.

Moreover, the strategic location of these outlets in high-traffic areas ensures that organic coffee is accessible to a large base of potential buyers, thereby increasing consumer exposure to organic products. The ongoing trend of one-stop shopping, where consumers prefer to buy all necessities in a single trip, also supports the strong position of hypermarkets and supermarkets in the organic coffee market.

Key Market Segments

By Type

- Arabica

- Robusta

By Flavor

- Flavored

- Black Cherry

- Papaya

- Orange

- banana

- Vanilla

- Chocolate

- Others

- Unflavored

By Roast

- Light

- Medium

- Dark

By Sales Channels

- Hypermarkets/Supermarkets

- Departmental and Convenience Stores

- Specialty Stores

- Online Sales Channels

- Others

Driving Factors

Growing Demand for Health-Conscious Consumption Choices

One of the top driving factors for the Organic Coffee Market is the growing consumer demand for health-conscious consumption choices. Today’s consumers are more informed and aware of the impacts of their food and beverage choices, not just on their health but also on the environment. Organic coffee appeals to this demographic due to its production without harmful pesticides and chemicals.

This method not only preserves the natural integrity of the coffee but also supports sustainable farming practices that are better for the planet. As health trends continue to rise and more consumers opt for products that offer both health benefits and environmental sustainability, the demand for organic coffee is expected to grow, driving the market forward.

Restraining Factors

High Cost of Organic Coffee Limits Demand

A significant restraining factor for the Organic Coffee Market is the high cost associated with organic coffee compared to non-organic options. The methods used in organic farming are more labor-intensive and have lower yields, which contribute to higher production costs. These costs are passed on to the consumer, making organic coffee a premium product.

For many consumers, especially in price-sensitive markets, the higher price point can be a deterrent, limiting the overall demand for organic coffee. While there is a growing segment of consumers willing to pay extra for organic products due to their perceived health and environmental benefits, the cost issue remains a substantial barrier to widespread adoption in the global market.

Growth Opportunity

Expansion into Emerging Markets Boosts Growth Opportunities

A prime growth opportunity for the Organic Coffee Market lies in expanding into emerging markets. As economic conditions improve in these regions, there is an increasing segment of the population with disposable income and a growing interest in premium and health-conscious products. Introducing organic coffee to these markets, where consumption is on the rise, can tap into new customer bases eager for quality and sustainability.

Moreover, as awareness about organic products grows globally, these emerging markets present a fresh and lucrative avenue for organic coffee brands looking to expand their reach and influence. Capturing market share early in these regions could lead to significant growth, as the trend for healthier lifestyle choices continues to gain momentum worldwide.

Latest Trends

Ready-to-Drink Organic Coffee Gains Market Traction

One of the latest trends in the Organic Coffee Market is the rising popularity of ready-to-drink (RTD) organic coffee products. This trend caters to the busy lifestyle of modern consumers who seek convenience without compromising on the quality or ethical standards of their coffee.

RTD organic coffee products offer a quick, accessible option for enjoying high-quality organic coffee on the go. These products are typically packaged in environmentally friendly materials, aligning with the values of eco-conscious consumers.

The convenience factor, combined with a strong preference for sustainable products, makes RTD organic coffee an appealing choice for a growing segment of the market, driving increased sales and broadening the consumer base for organic coffee.

Regional Analysis

Asia-Pacific dominates the Organic Coffee Market with a 44.30% share, valued at USD 4.1 billion.

In the Organic Coffee Market, regional dynamics play a significant role in shaping the industry landscape. Asia-Pacific emerges as the dominating region, holding a substantial 44.30% market share, with a valuation of USD 4.1 billion.

This dominance is driven by a growing middle-class population with increasing disposable income and a burgeoning cafe culture, particularly in countries like China, Japan, and South Korea. Consumers in this region are rapidly embracing organic products due to heightened health awareness and environmental concerns.

In contrast, North America and Europe also present significant shares in the organic coffee market, supported by well-established health-conscious consumer bases and stringent organic farming regulations, which ensure high-quality product offerings. These regions boast a mature market with consumers willing to pay a premium for sustainably sourced products.

Meanwhile, Latin America, being a primary producer of coffee, shows potential growth in domestic consumption. The region benefits from its rich coffee-growing heritage and is increasingly marketing organic coffee both locally and globally.

The Middle East and Africa are gradually catching up, with increasing awareness and growing health trends among the affluent and expatriate populations driving the demand for organic coffee in these regions. This diverse regional presence underlines the global appeal and growing penetration of organic coffee across varied markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Organic Coffee Market saw significant contributions from key players, each enhancing the market’s growth and diversity through unique strategies and product offerings. Among these, Allegro Coffee Company stood out with its commitment to sustainable sourcing practices, offering a range of single-origin and blend coffees that cater to a sophisticated palette. Their dedication to ethical practices and high-quality beans has solidified their position as a favorite among eco-conscious consumers.

Burke Brands LLC, operating under the Don Pablo brand, has carved a niche in the organic segment by focusing on small-batch production, which ensures a consistently fresh and flavorful product. Their approach not only emphasizes quality but also supports small-scale farmers, thereby reinforcing their brand as both premium and principled.

Camano Island Coffee Roasters LLC has leveraged its commitment to the environment and social responsibility to build a strong customer base. Their ‘Pound for Pound’ program, where a portion of proceeds goes towards poverty alleviation, showcases their model of business that cares, appealing to consumers who value corporate responsibility alongside quality.

Counter Culture Coffee has been a pioneer in transparency and education in the organic coffee industry. Their direct-trade coffee and extensive farmer-support initiatives, coupled with their commitment to providing comprehensive coffee education, have made them a leader in both innovation and ethical practices.

Lastly, Dean’s Beans Organic Coffee Co. has utilized a radical business model where social, environmental, and economic responsibilities are intertwined with their operations, setting high standards for ethical practices in the coffee industry. Their approach not only appeals to socially conscious consumers but also drives significant change within the coffee farming communities.

Top Key Players in the Market

- Allegro Coffee Company

- Burke Brands Llc.

- Camano Island Coffee Roasters Llc.

- Counter Culture Coffee

- Dean’s Beans Organic Coffee

- Death Wish Coffee Co.

- Equal Exchange Co-op

- Ethical Bean Coffee

- Jim’s Organic Coffee

- Keurig Green Mountain, Inc.

- Nestlé S.A.

- Starbucks Corporation

- The J.M. Smucker Company

Recent Developments

- In January 2025, Equal Exchange expanded its product line to include over 100 organic and fairly traded items, such as coffee, tea, and chocolate. The company also announced plans to emphasize social impact through events, activism, and grant initiatives supporting farming communities

- In September 2024, Death Wish Coffee launched its first-ever light roast blend. This new product features a three-bean blend highlighting Colombian, Peruvian, and Robusta coffees, targeting younger consumers with shifting flavor preferences.

- In October 2023, Whole Foods Market rebranded its in-house coffee line, dropping the Allegro Coffee name. The new branding emphasizes sustainability with certifications like Rainforest Alliance and Fair Trade for its blends and single-origin coffees.

Report Scope

Report Features Description Market Value (2024) USD 9.3 Billion Forecast Revenue (2034) USD 20.1 Billion CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Arabica, Robusta), By Flavor (Flavored, Black Cherry (Papaya, Orange, banana, Vanilla, Chocolate, Others), Unflavored), By Roast (Light, Medium, Dark), By Sales Channels (Hypermarkets/Supermarkets, Departmental and Convenience Stores, Specialty Stores, Online Sales Channels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Allegro Coffee Company, Burke Brands Llc., Camano Island Coffee Roasters Llc., Counter Culture Coffee, Dean’s Beans Organic Coffee, Death Wish Coffee Co., Equal Exchange Co-op, Ethical Bean Coffee, Jim’s Organic Coffee, Keurig Green Mountain, Inc., Nestlé S.A., Starbucks Corporation, The J.M. Smucker Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Allegro Coffee Company

- Burke Brands Llc.

- Camano Island Coffee Roasters Llc.

- Counter Culture Coffee

- Dean's Beans Organic Coffee

- Death Wish Coffee Co.

- Equal Exchange Co-op

- Ethical Bean Coffee

- Jim’s Organic Coffee

- Keurig Green Mountain, Inc.

- Nestlé S.A.

- Starbucks Corporation

- The J.M. Smucker Company