Global Urology Imaging Systems Market Analysis By Product Type (Ultrasound Systems, Fluoroscopy-Based Systems), By End-User (Hospitals, Clinics, Diagnosis Centers, Ambulatory Surgical Centers) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 136781

- Number of Pages: 378

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

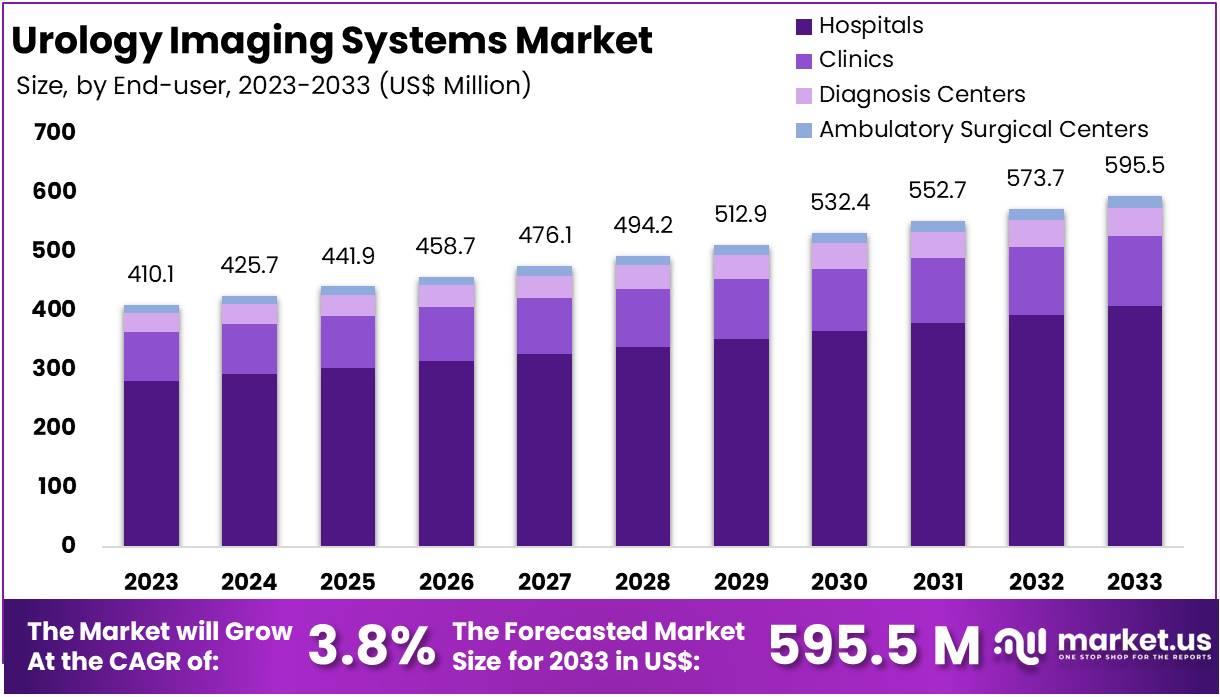

The Global Urology Imaging Systems Market Size is expected to be worth around US$ 595.5 Million by 2033, from US$ 410.1 Million in 2023, growing at a CAGR of 3.8% during the forecast period from 2024 to 2033.

The urology imaging systems market is growing rapidly, driven by advancements in technology and a rising prevalence of urological conditions. These specialized systems include ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and x-rays. They provide detailed visuals of the urinary tract and male reproductive organs, including the kidneys, bladder, and prostate. These visuals are critical for accurate diagnosis and treatment planning, emphasizing their importance in modern healthcare.

According to recent studies, factors such as an aging population and increasing cases of urinary tract infections, kidney stones, and prostate disorders are fueling market demand. The integration of artificial intelligence (AI) and machine learning into imaging systems has further enhanced diagnostic accuracy. This allows for personalized treatment plans, leading to improved patient outcomes. For instance, AI-powered imaging tools can now identify abnormalities with greater precision, reducing diagnostic errors.

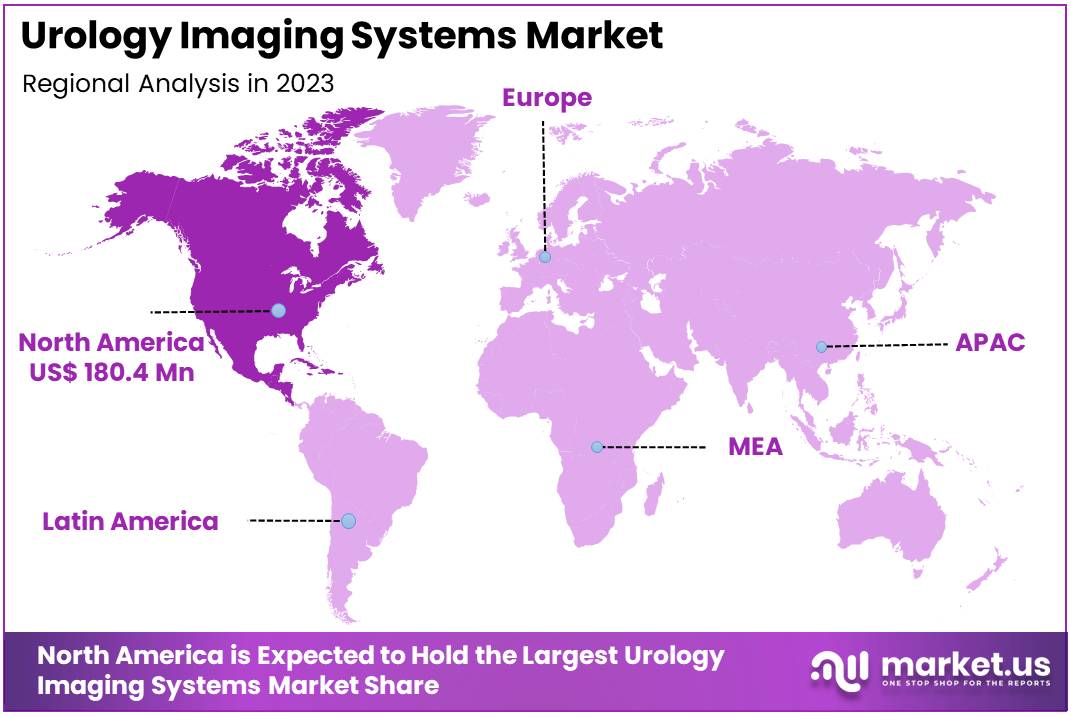

Market trends highlight a shift towards non-invasive diagnostic methods, boosting demand for sophisticated imaging solutions. North America currently dominates the market due to its advanced healthcare infrastructure and high expenditure on medical technologies. However, the Asia-Pacific region is anticipated to experience the fastest growth, attributed to rising healthcare awareness and improving medical facilities.

Key players in this dynamic market include GE Healthcare, Siemens Healthineers, Philips Healthcare, and Toshiba Medical Systems. These companies focus heavily on research and development, continually innovating their imaging technologies to stay competitive. For example, in 2023, the American Urological Association (AUA) supported 66 researchers with $1.3 million in grants, fostering innovation in urology research. Half of these grants were awarded to women, showcasing a commitment to diversity in the field.

The urology imaging systems market shows significant growth potential. It is propelled by technological advancements, increasing disease burden, and trends toward digitalization and non-invasive diagnostics. With ongoing research support and innovations, this sector is poised for continued expansion, promising better diagnostic tools and improved patient care globally.

Key Takeaways

- The Global Urology Imaging Systems Market is projected to reach US$ 595.5 million by 2033, up from US$ 410.1 million in 2023, growing at a 3.8% CAGR.

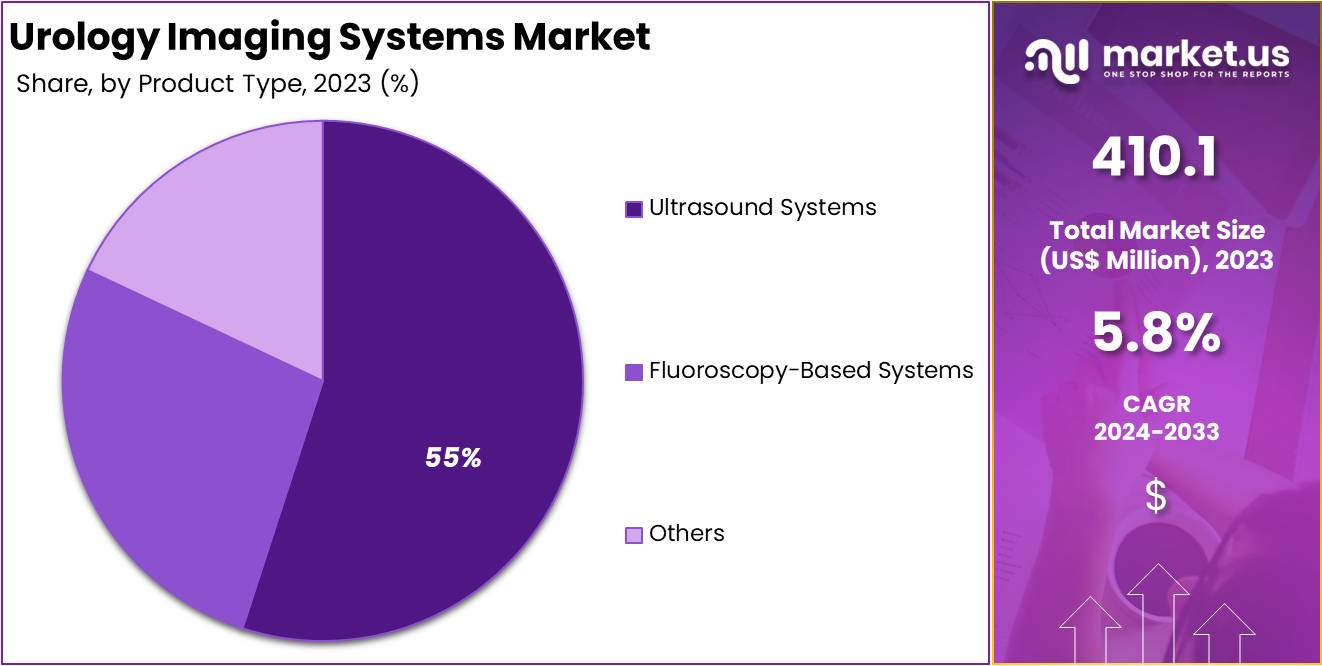

- In 2023, Ultrasound Systems dominated the Urology Imaging Systems Market, accounting for over 55% of the market share in the product type segment.

- Hospitals led the Urology Imaging Systems Market’s end-user segment in 2023, capturing more than 68% of the overall market share.

- North America maintained a dominant market position in 2023, holding over 44% of the market and a value of US$ 180.4 million.

Product Type Analysis

In 2023, Ultrasound Systems held a dominant market position in the Product Type Segment of the Urology Imaging Systems Market, capturing more than a 55% share. This dominance is due to their non-invasive nature, cost-effectiveness, and ability to provide real-time imaging. Ultrasound systems are widely used in urology to diagnose kidney stones, bladder conditions, and other urinary tract disorders. Their versatility and accessibility make them a preferred choice for many healthcare providers.

Fluoroscopy-Based Systems follow closely in market share. These systems provide detailed, high-contrast images, which are essential for guiding urological procedures. Fluoroscopy is commonly used for catheter insertion, stone removal, and other diagnostic procedures. The ability to offer real-time imaging with precision makes fluoroscopy an important tool in urology. Its continued demand reflects its effectiveness in providing accurate results during complex procedures.

Other imaging systems, like CT and MRI, also contribute to the urology imaging market. While they are not as widely used as ultrasound or fluoroscopy, they are still valuable for complex diagnostic purposes. CT and MRI systems offer high-resolution images, which are crucial for planning advanced urological treatments. These systems are typically used in cases requiring more detailed imaging, such as detecting tumors or assessing damage to the urinary tract.

Overall, the ultrasound systems segment leads the market due to its affordability, portability, and broad usage in diagnostics. Fluoroscopy-based systems, however, play a critical role in guiding urological procedures. They ensure that doctors can perform treatments with accuracy and confidence. The urology imaging systems market is characterized by these two dominant technologies, with each serving a specific and important role in patient care.

End-User Type Analysis

In 2023, hospitals held a dominant market position in the End-User Segment of the Urology Imaging Systems Market, capturing more than a 68% share. This dominance can be attributed to the large number of patients seeking urological care in hospitals. Hospitals are well-equipped with advanced technology and specialized departments. This makes them the preferred choice for comprehensive urological diagnostics and procedures.

Clinics represent the second-largest segment in the market. The growing trend of outpatient care is boosting their popularity. Patients increasingly choose clinics for their cost-effectiveness and convenience. These facilities offer personalized care in a more accessible setting. As demand for non-emergency urological services rises, clinics are becoming an important player in the Urology Imaging Systems market.

Diagnosis centers also have a significant presence in the market. With a focus on providing precise and timely imaging, these centers cater to the rising demand for specialized diagnostic services. They play a crucial role in detecting various urological conditions. As more patients seek accurate diagnostics, the demand for advanced imaging systems in diagnosis centers continues to grow steadily.

Ambulatory Surgical Centers (ASCs) are experiencing rapid growth. Equipped with the latest medical technology, ASCs are becoming capable of performing complex urological procedures. These centers offer shorter hospital stays and faster recovery times. Patients benefit from reduced costs and improved convenience. As a result, ASCs are emerging as a strong alternative to traditional hospital settings for urological care.

Key Market Segments

By Product Type

- Ultrasound Systems

- Fluoroscopy-Based Systems

By End-User

- Hospitals

- Clinics

- Diagnosis Centers

- Ambulatory Surgical Centers

Drivers

Technological Advancements in Imaging Systems

Technological advancements in imaging systems play a crucial role in the growth of the urology imaging systems market. The development of high-definition ultrasound, MRI, and CT scans has greatly improved the precision of medical diagnoses. These innovations allow healthcare providers to detect urological conditions with greater accuracy, leading to better treatment outcomes. As a result, there is an increasing demand for advanced imaging technologies in urology, driving market growth.

The integration of cutting-edge imaging technologies into urology practices has revolutionized diagnostic capabilities. High-definition ultrasound allows for clearer imaging of soft tissue, while MRI and CT scans provide detailed views of the urinary system. These technologies enable early detection of urological diseases, such as kidney stones, prostate cancer, and bladder disorders, which helps in initiating timely interventions. Consequently, the adoption of these advanced imaging systems is on the rise, boosting market expansion.

In addition to improving diagnostic accuracy, these technological advancements offer enhanced patient comfort and safety. Modern imaging systems are non-invasive and provide faster results, reducing the need for multiple procedures. As healthcare providers increasingly prioritize patient-centered care, the demand for urology imaging systems continues to grow. This trend is expected to accelerate, further fueling the urology imaging systems market and contributing to ongoing innovations in the field.

Restraints

High Cost of Urology Imaging Systems

The high cost of acquiring and maintaining advanced urology imaging systems is a significant restraint for the urology imaging systems market. Many healthcare institutions, especially in developing regions, struggle to afford these sophisticated technologies. The initial purchase price of these systems can be prohibitively expensive, and the cost of maintenance and upgrades adds to the financial burden. This limits the widespread adoption of advanced imaging solutions, particularly among smaller hospitals and clinics with constrained budgets.

Moreover, the high cost of urology imaging systems affects healthcare providers’ ability to stay competitive. Institutions that cannot afford regular upgrades may lag behind in terms of technology and patient care. As a result, they may face challenges in attracting patients and retaining top talent. This technological gap can widen the disparity in healthcare quality between affluent and underprivileged regions, further limiting access to advanced urology imaging services.

The financial challenges associated with expensive urology imaging systems can also impede research and development in the field. Healthcare institutions and research organizations may be hesitant to invest in these systems due to their significant upfront and ongoing costs. This slows down innovation and the development of newer, more efficient urology imaging technologies. As a result, the market’s growth potential is constrained by the affordability barrier, preventing faster adoption of cutting-edge solutions that could benefit both healthcare providers and patients.

Opportunities

Rising Incidence of Urological Disorders

The rising incidence of urological disorders presents a significant opportunity for the Urology Imaging Systems Market. With conditions like kidney stones, bladder cancer, and prostate issues becoming more common, the demand for effective diagnostic tools is increasing. As these disorders affect a large portion of the population, healthcare providers are seeking advanced imaging technologies to aid in early detection and treatment planning. This trend creates a favorable environment for the development and adoption of innovative urology imaging systems.

As the global population ages, the prevalence of urological conditions is expected to rise further. Older individuals are more susceptible to these disorders, especially prostate-related issues. The increasing awareness and focus on early diagnosis are driving the market for urology imaging systems. Healthcare professionals need accurate, non-invasive imaging solutions to diagnose and monitor urological conditions effectively. This growing need for precision in diagnosis and treatment is fueling demand for advanced imaging technologies in the urology sector.

The market for urology imaging systems is expanding due to advancements in imaging technologies such as MRI, CT scans, and ultrasound. These technologies offer enhanced accuracy and clarity in detecting urological disorders. As the healthcare industry continues to prioritize patient outcomes and efficiency, the demand for state-of-the-art imaging tools will rise. Companies that innovate in this space can capitalize on the increasing incidence of urological disorders, providing solutions that meet the needs of healthcare providers and patients alike.

Trends

Integration of Artificial Intelligence (AI) in Imaging

The integration of Artificial Intelligence (AI) in urology imaging systems is revolutionizing the field of diagnostics. AI-driven technologies, such as machine learning and deep learning, are being utilized to enhance image analysis. These systems can automatically detect abnormalities like tumors, stones, or other urological conditions with high accuracy. As a result, healthcare professionals can provide quicker, more reliable diagnoses, improving patient outcomes. This shift towards AI-powered imaging is driving growth in the urology imaging systems market.

AI integration is streamlining workflow processes in urology imaging. Traditionally, imaging systems required manual interpretation by radiologists, which could be time-consuming and prone to human error. AI algorithms can analyze large volumes of imaging data in a fraction of the time, reducing workload and increasing efficiency. These AI systems continuously learn and improve, ensuring more accurate results over time. As demand for faster diagnostics grows, the adoption of AI in urology imaging systems is becoming a key market trend.

The increasing precision offered by AI in urology imaging is expanding its applications. AI algorithms can detect subtle changes in imaging data that might otherwise go unnoticed. This capability helps in early disease detection, leading to better treatment planning and outcomes. The AI-driven systems are also helping reduce unnecessary procedures, lowering costs for healthcare providers. As AI technology continues to evolve, it is expected to play a major role in shaping the future of the urology imaging systems market.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 44% share and holding a market value of US$ 180.4 million for the year. The region’s strong position is largely due to its advanced healthcare infrastructure. Hospitals and clinics in the region are quick to adopt new technologies, which helps drive the demand for sophisticated urology imaging systems.

The U.S. plays a major role in North America’s dominance. Several leading companies are based here, contributing to the market’s growth. These companies focus on innovation, offering improved imaging solutions. This results in a steady increase in the availability of advanced urology imaging systems across the country.

North America’s healthcare policies further support market growth. The region enjoys favorable reimbursement policies that make it easier for hospitals and clinics to acquire these high-tech systems. As a result, healthcare providers are more likely to invest in the latest urology imaging systems to offer better services.

The rising prevalence of urological diseases in the region also fuels demand. With an aging population, the need for early diagnosis increases. As people become more aware of the importance of regular health check-ups, the demand for advanced urology imaging systems is expected to grow, keeping North America at the forefront of the market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Urology Imaging Systems Market is shaped by major players who provide cutting-edge technologies for diagnostic and therapeutic applications. GE Healthcare stands out with its wide portfolio of imaging solutions, particularly in ultrasound and CT systems. The company focuses on innovation and has a robust distribution network. Its global presence helps it maintain a strong market share, providing high-quality imaging tools to hospitals and healthcare centers worldwide.

Toshiba Corporation, now part of Canon Medical Systems, is another key player in the market. The company is known for its advanced imaging systems, which offer high accuracy and efficiency. Toshiba’s focus on precision imaging technologies makes it a trusted choice for urology applications. With a strong reputation in medical imaging, Toshiba continues to deliver reliable solutions tailored to the needs of healthcare professionals in urology diagnostics.

Esaote SpA is a significant player specializing in ultrasound and MRI technologies. The company focuses on providing cost-effective solutions suitable for emerging markets. Esaote’s emphasis on research and development ensures that its systems meet the increasing demand for high-performance urology imaging. Its ability to offer affordable and reliable systems has made it a popular choice among healthcare providers seeking quality imaging solutions at competitive prices.

Shenzhen Mindray Bio-Medical Electronics Co. Ltd. is rapidly gaining ground in the urology imaging systems market. Known for its affordable, advanced imaging systems, Mindray offers strong competition with its cost-effective solutions. The company’s focus on expanding into new regions has contributed to its growing market share. By providing high-quality imaging technology at competitive prices, Mindray is well-positioned to meet the needs of healthcare facilities across the globe, particularly in developing markets.

Market Key Players

- GE Healthcare

- Toshiba Corporation

- Esaote SpA

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- Koninklijke Philips N.V.

- BK Ultrasound

- Fujifilm Holdings Corporation

- Verathon Inc.

- LABORIE

- Samsung Medison

Recent Developments

- In July 2024: Acquisition of Intelligent Ultrasound’s Clinical AI Business

GE HealthCare finalized an agreement to acquire the clinical artificial intelligence (AI) software business from Intelligent Ultrasound Group PLC for approximately $51 million. This acquisition is aimed at enhancing the AI capabilities across GE HealthCare’s ultrasound portfolio, including advancements in AI-driven image analysis to improve clinical workflows and patient outcomes. The transaction is scheduled to close in Q4 2024 and will be funded by GE HealthCare with cash on hand. - In December 2023: Esaote achieved a significant milestone by increasing its investment in research and development by 9.8%, totaling €32.9 million. This investment, representing 12% of their turnover, underlines their strategy to focus on innovation and quality, specifically targeting growth in high-potential markets, which includes advancements in imaging technologies like those used in urology.

- In September 2021: GE Healthcare acquired BK Medical for $1.45 billion. This acquisition aimed to expand GE’s capabilities into the surgical and therapeutic interventions space, beyond their existing diagnostic focus. BK Medical, known for its advanced intraoperative ultrasound technology, was seen as a strategic fit to enhance GE’s ultrasound offerings, particularly in surgical visualization.

Report Scope

Report Features Description Market Value (2023) US$ 410.1 Million Forecast Revenue (2033) US$ 595.5 Million CAGR (2024-2033) 3.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By product type (Ultrasound Systems, Fluoroscopy-Based Systems), By end-user (Hospitals, Clinics, Diagnosis Centers, Ambulatory Surgical Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GE Healthcare, Toshiba Corporation, Esaote SpA, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Koninklijke Philips N.V., BK Ultrasound, Fujifilm Holdings Corporation, Verathon Inc., LABORIE, Samsung Medison Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Urology Imaging Systems MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Urology Imaging Systems MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- Toshiba Corporation

- Esaote SpA

- Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

- Koninklijke Philips N.V.

- BK Ultrasound

- Fujifilm Holdings Corporation

- Verathon Inc.

- LABORIE

- Samsung Medison