Global Food And Feed Grade Amino Acids Market Size, Share, And Enhanced Productivity By Type (Food Grade, Feed Grade), By Form (Powdered Amino Acids, Liquid Amino Acids), By Amino Acid Blends (Animal Feed Blends, Nutritional Supplements, Functional Food Blends, Fertilizer Blends, Pharmaceutical Blends, Others), By Application (Flavors, Infant Formula, Animal Feed, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 169828

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

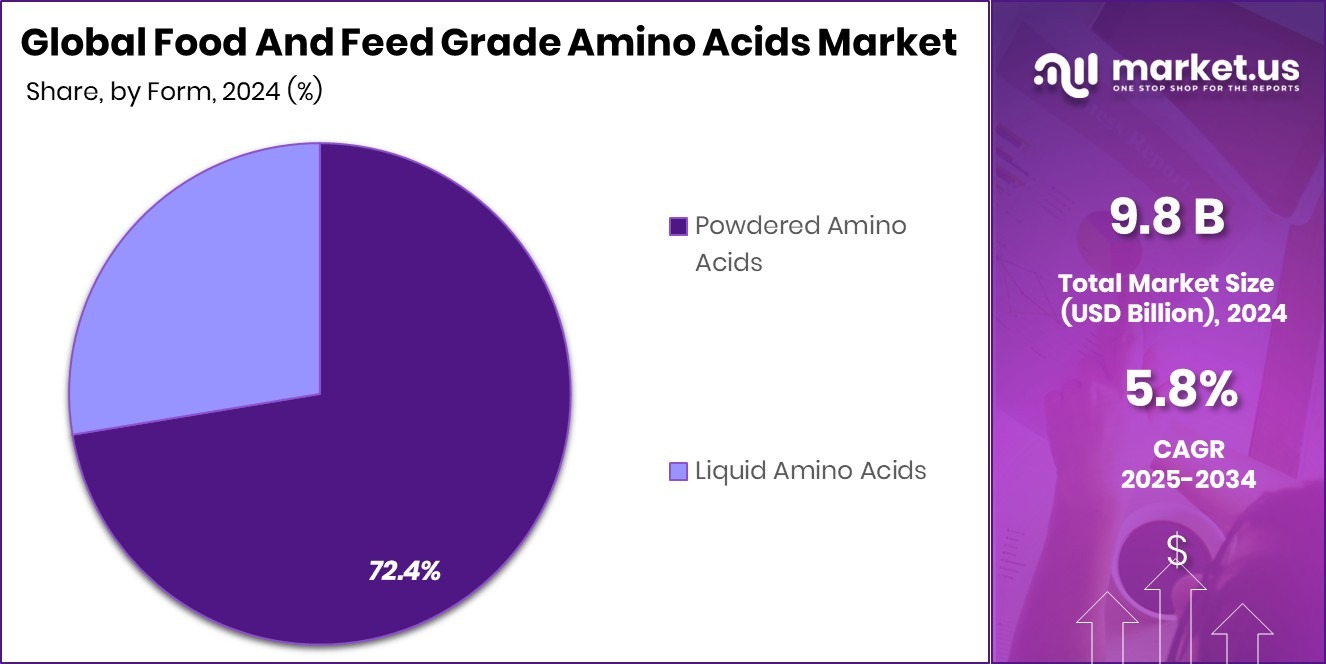

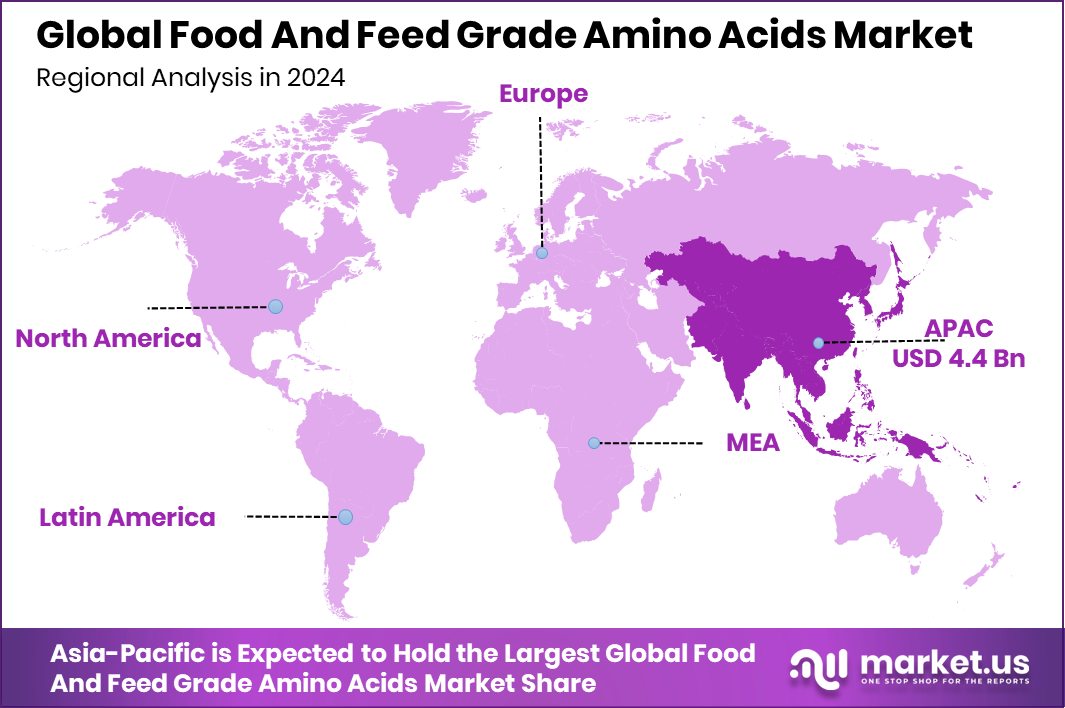

The Global Food And Feed Grade Amino Acids Market is expected to be worth around USD 17.2 billion by 2034, up from USD 9.8 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Asia-Pacific accounted for a 44.90% share as amino acids reached a USD 4.4 Bn market.

Food and Feed Grade Amino Acids are purified nutritional building blocks used in human food products and animal feed to support growth, metabolism, immunity, and overall health. In foods, they help improve protein quality, taste balance, and nutritional value. In animal feed, they support faster growth rates, better feed efficiency, and lower protein waste, making livestock nutrition more precise and sustainable.

The Food and Feed Grade Amino Acids Market covers the production, formulation, and distribution of these amino acids for use in packaged foods, dietary supplements, functional nutrition, pet food, poultry, aqua feed, and livestock diets. The market continues to expand as food producers and farmers focus on nutrition efficiency, clean formulations, and performance-based feeding.

Growth factors include rising protein consumption, wider use of fortified foods, and better awareness of amino acid balance in diets. Funding activity across functional foods supports this shift. While Lo! Foods secured $3.5 million to grow functional food offerings. Awake Chocolate added $6 million for product innovation, strengthening amino-acid-enriched snack development.

Demand is driven by livestock productivity needs, sports nutrition, and alternative protein applications. Demand for functional protein and amino acid solutions. Meatiply’s $3.75 million funding reflects growing interest in cultured and precision nutrition inputs.

Opportunities are strongest in functional beverages, plant-based foods, and upcycled nutrition. Alpha Foods raised $28 million, Odyssey reached $14 million total funding, Olipop achieved a near $2 billion valuation, and Kaffe Bueno secured €1.1 million, all signaling long-term space for amino acids in modern food systems.

- HealthKart – $25 million: Expands direct-to-consumer nutrition products, improving access to amino-acid-based supplements across digital and retail channels.

- Revyve—€24 million: Accelerates commercial rollout of functional yeast proteins, supporting broader use of amino acids in mainstream food formulations.

Key Takeaways

- The Global Food And Feed Grade Amino Acids Market is expected to be worth around USD 17.2 billion by 2034, up from USD 9.8 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the Food And Feed Grade Amino Acids Market, food-grade products dominate with 66.9%.

- Within the Food And Feed Grade Amino Acids Market, powdered amino acids lead at 72.4%.

- Animal feed blends hold relevance in the Food And Feed Grade Amino Acids Market at 37.1%.

- Flavor applications drive usage in the Food And Feed Grade Amino Acids Market, capturing 47.8%.

- In the Asia-Pacific, strong nutrition demand drove a USD 4.4 Bn market holding 44.90% share.

By Type Analysis

Food grade dominates Food And Feed Amino Acids Market with 66.9% share.

In 2024, Food Grade held a dominant market position in the By Type segment of the Food And Feed Grade Amino Acids Market, with a 66.9% share, reflecting its strong integration into human nutrition and food processing applications. Food grade amino acids are widely used to enhance protein quality, improve taste profiles, and support nutritional labeling requirements in packaged and functional foods. Their role in dietary supplements, sports nutrition, and fortified beverages has grown steadily as consumers increasingly focus on balanced amino acid intake and clean ingredient formulations.

The high share of food grade products is also supported by their use in specialized nutrition categories such as clinical nutrition, infant formula, and wellness-focused foods. Regulatory acceptance and safety standards further encourage manufacturers to prioritize food grade amino acids over alternative inputs. As food companies emphasize nutrition density, digestibility, and product differentiation, food grade amino acids continue to remain the preferred choice across value-added food applications, sustaining their leading position within the overall market structure.

By Form Analysis

Powdered form leads Food And Feed Amino Acids Market, holding 72.4% share.

In 2024, Powdered Amino Acids held a dominant market position in the By Form segment of the Food And Feed Grade Amino Acids Market, with a 72.4% share, supported by their ease of handling, long shelf life, and consistent quality across food and feed applications. Powdered forms are widely preferred due to their stability during storage and transportation, making them suitable for large-scale manufacturing and distributed supply chains.

This dominance is further reinforced by their flexibility in formulation, allowing precise dosage control in food processing, dietary supplements, and animal feed blending. Powdered amino acids integrate smoothly into dry mixes, premixes, and compound feeds without compromising product uniformity. Their compatibility with automated processing systems and reduced risk of degradation during production strengthens their central role, ensuring continued preference within the market framework.

By Amino Acid Blends Analysis

Animal feed blends drive Food And Feed Amino Acids Market at 37.1%.

In 2024, Animal Feed Blends held a dominant market position in the By Amino Acid Blends segment of the Food And Feed Grade Amino Acids Market, with a 37.1% share, driven by their role in improving feed efficiency and supporting balanced nutrition for livestock. These blends are designed to deliver a precise combination of essential amino acids, helping farmers optimize growth performance while reducing excessive protein use in animal diets.

The strong market presence of animal feed blends also reflects their importance in modern animal nutrition strategies that focus on cost control and sustainability. By ensuring targeted amino acid intake, these blends help improve feed conversion and support animal health across production cycles. Their standardized formulation and ease of inclusion in compound feeds continue to reinforce their leading position within this segment.

By Application Analysis

Flavor applications dominate Food and Feed Amino Acids Market, contributing 47.8 of % demand.

In 2024, Flavors held a dominant market position in the By Application segment of the Food And Feed Grade Amino Acids Market, with a 47.8% share, supported by their functional role in enhancing taste, mouthfeel, and overall sensory quality in food products. Amino acids are widely used in flavor applications to balance sweetness, reduce bitterness, and improve savory profiles, making them essential in packaged foods and processed formulations.

The strong share of flavors also reflects rising demand for palatable and nutrition-focused food products. Amino acids contribute to clean taste enhancement while supporting reduced salt and sugar formulations. Their ability to improve flavor consistency across batches helps food manufacturers maintain product quality, reinforcing the leading position of flavor applications within the market.

Key Market Segments

By Type

- Food Grade

- Feed Grade

By Form

- Powdered Amino Acids

- Liquid Amino Acids

By Amino Acid Blends

- Animal Feed Blends

- Nutritional Supplements

- Functional Food Blends

- Fertilizer Blends

- Pharmaceutical Blends

- Others

By Application

- Flavors

- Infant Formula

- Animal Feed

- Others

Driving Factors

Demand for Safer, High-Quality Protein Nutrition

A key driving factor for the Food and Feed Grade Amino Acids Market is the growing demand for safe, high-quality protein nutrition. A recent study found that 70% of 36 popular protein supplements sold in India were mislabeled, and 14% contained toxins, raising serious concerns about protein quality and transparency. This has pushed food and nutrition brands to rely more on certified amino acids that offer precise composition, safety assurance, and nutritional accuracy. Amino acids help brands correct protein balance, improve digestibility, and meet clean-label expectations in both human food and animal feed.

Investment trends further support this shift toward science-backed nutrition. Startups and biotech firms are investing heavily in fermentation, peptide discovery, and novel protein platforms that depend on amino acid inputs.

- Nature’s Fynd – $350 million: Supports microbial fermentation proteins, increasing demand for purified amino acids in sustainable food systems.

- Nuritas – $45 million: Accelerates plant-based peptide discovery for healthier foods, strengthening amino-acid-driven nutrition innovation.

Additional momentum comes from a $4.2 million funding round by At One Ventures and Chancery Hill Ventures, taking cumulative funding to $6.2 million, highlighting continued investor confidence in clean and accurate protein solutions.

Restraining Factors

High Costs and Regulatory Complexity Slow Adoption

One major restraining factor for the Food and Feed Grade Amino Acids Market is the high cost of advanced production and the complexity of regulatory approval. Many amino acids used in food and feed rely on precision fermentation and controlled processing, which demand significant investment in R&D, pilot plants, and compliance testing. This increases manufacturing costs, especially for newer applications linked to alternative proteins and cultivated nutrition ingredients, making price stability difficult for producers and end users.

Recent funding activity highlights this challenge rather than removing it. Companies must raise large capital just to reach regulatory readiness and scale. Simple Planet in South Korea raised $6 million in a Pre-Series A round to push R&D for cultivated meat powder, showing how early-stage amino acid applications remain capital-intensive.

- Farmless – €4.8M: Supports a pilot plant and R&D for microbial protein, underlining long timelines and regulatory hurdles before commercialization.

Growth Opportunity

Expanding Plant-Based And Targeted Nutrition Solutions

A major growth opportunity for the Food and Feed Grade Amino Acids Market lies in the rapid expansion of plant-based and targeted nutrition products. Consumers are increasingly looking for clean, focused nutrition that supports immunity, digestion, energy, and women’s health. Amino acids act as core building blocks in these formulations, helping brands create precise, plant-based supplements without relying on complex protein blends. This shift is also visible in large healthcare systems where supplement-based nutrition is becoming more mainstream, increasing demand for high-purity amino acids with consistent performance.

Funding activity strongly reinforces this opportunity. Earthful secured INR 5 crore to expand clean, plant-based nutrition offerings, directly supporting amino-acid-driven supplement innovation. Growing focus on specific health categories further opens space for customized amino acid formulations.

- Moom Health – S$3.5 million: Enables development of women-focused supplements, increasing demand for targeted amino acids in hormone and wellness solutions.

Latest Trends

Rise Of Personalized And Regional Nutrition Support

A key latest trend in the Food and Feed Grade Amino Acids Market is the growing focus on personalized and community-driven nutrition. Amino acids are increasingly used in targeted supplements that support life-stage needs such as pregnancy, sleep, stress, and fertility. This shift reflects a broader move away from generic nutrition toward tailored solutions designed around specific health outcomes. Community-backed funding programs are also encouraging localized nutrition access, helping smaller brands develop amino-acid-based products that meet regional dietary needs.

Startup activity and funding strongly reflect this trend. Needed raised $5.8 million in Seed funding to expand perinatal nutrition, addressing stress, sleep, and fertility, areas where balanced amino acid intake is essential.

- GetSupp – Rs 9.5 crore: Supports expansion of personalized nutrition platforms, increasing use of targeted amino acid formulations.

Regional Analysis

Asia-Pacific led the amino acids market with a 44.90% share, valued at USD 4.4 Bn overall.

Asia-Pacific dominates the Food and Feed Grade Amino Acids Market, accounting for 44.90% share and valued at USD 4.4 Bn. The region benefits from strong food processing expansion, rising population-driven protein demand, and large-scale livestock and aquaculture activity. Growing focus on nutrition efficiency, fortified foods, and feed optimization supports steady consumption of amino acids across food and feed applications, reinforcing Asia-Pacific’s clear leadership position.

North America represents a mature but stable regional market, supported by advanced food formulation practices and high awareness of nutritional quality in both human food and animal feed. The region emphasizes standardized amino acid use for dietary supplements, packaged foods, and precision feeding systems, helping maintain consistent demand levels.

Europe follows closely, driven by strict food quality standards and structured livestock nutrition programs. The region’s focus on ingredient transparency and controlled feed formulations supports steady adoption of food and feed-grade amino acids across multiple end uses.

The Middle East & Africa market is gradually expanding, supported by improving food security initiatives and growing livestock production. Latin America shows similar progress, with increasing feed optimization needs in poultry and animal farming driving amino acid consumption across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill Incorporated continues to hold a strong strategic position in the Food and Feed Grade Amino Acids Market through its deep integration across agricultural sourcing, food ingredients, and animal nutrition. In 2024, Cargill’s strength lies in its ability to link raw material procurement with advanced nutrition solutions, allowing consistent supply and quality control. Its focus on sustainable production practices and nutrition efficiency supports growing demand from food manufacturers and livestock producers seeking reliable amino acid inputs for balanced formulations.

Archer Daniels Midland Company (ADM) plays a critical role by combining large-scale processing capabilities with nutrition-focused innovation. The company’s operations span plant-based proteins, fermentation-derived ingredients, and animal nutrition, positioning it well within amino acid value chains. In 2024, ADM’s emphasis on improving protein utilization and feed efficiency supports both food and feed applications, particularly as customers demand cleaner labels, traceable ingredients, and functional nutrition solutions.

BASF SE brings a science-led approach to the amino acids market, leveraging its strong expertise in industrial biotechnology and chemical innovation. In 2024, BASF focuses on high-performance amino acid solutions that support precision nutrition in animal feed and functional benefits in food applications. Its commitment to research-driven development and process optimization allows BASF to address evolving nutritional and sustainability expectations across global food systems.

Top Key Players in the Market

- Cargill Incorporated

- Archer Daniels Midland Company

- BASF SE

- Sumitomo Chemical Co. Ltd.

- CJ CheilJedang Corporation

- Evonik Industries AG

- Ajinomoto Co. Inc.

- Lonza Group AG

- Wacker Chemie AG

- Fufeng Group Limited

Recent Developments

- In September 2024, Cargill acquired two feed mills from Compana Pet Brands — one in Denver and the other in Kansas City, Kansas — strengthening its U.S. animal-nutrition manufacturing and distribution capacity.

- In September 2025, ADM announced a planned joint venture with Alltech: it will place its 11 U.S. feed mills into this new venture — shifting from direct operations to a specialized animal-nutrition joint business.

Report Scope

Report Features Description Market Value (2024) USD 9.8 Billion Forecast Revenue (2034) USD 17.2 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Food Grade, Feed Grade), By Form (Powdered Amino Acids, Liquid Amino Acids), By Amino Acid Blends (Animal Feed Blends, Nutritional Supplements, Functional Food Blends, Fertilizer Blends, Pharmaceutical Blends, Others), By Application (Flavors, Infant Formula, Animal Feed, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill Incorporated, Archer Daniels Midland Company, BASF SE, Sumitomo Chemical Co. Ltd., CJ CheilJedang Corporation, Evonik Industries AG, Ajinomoto Co. Inc., Lonza Group AG, Wacker Chemie AG, Fufeng Group Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food And Feed Grade Amino Acids MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample

Food And Feed Grade Amino Acids MarketPublished date: December 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Cargill Incorporated

- Archer Daniels Midland Company

- BASF SE

- Sumitomo Chemical Co. Ltd.

- CJ CheilJedang Corporation

- Evonik Industries AG

- Ajinomoto Co. Inc.

- Lonza Group AG

- Wacker Chemie AG

- Fufeng Group Limited