Global Diesel Market By Type (1 Diesel Fuel, 2 Diesel Fuel, Others), By Application (Passenger Vehicles, Commercial Vehicles, Others), By End-user (Railway, Automotive, Marine, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146030

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

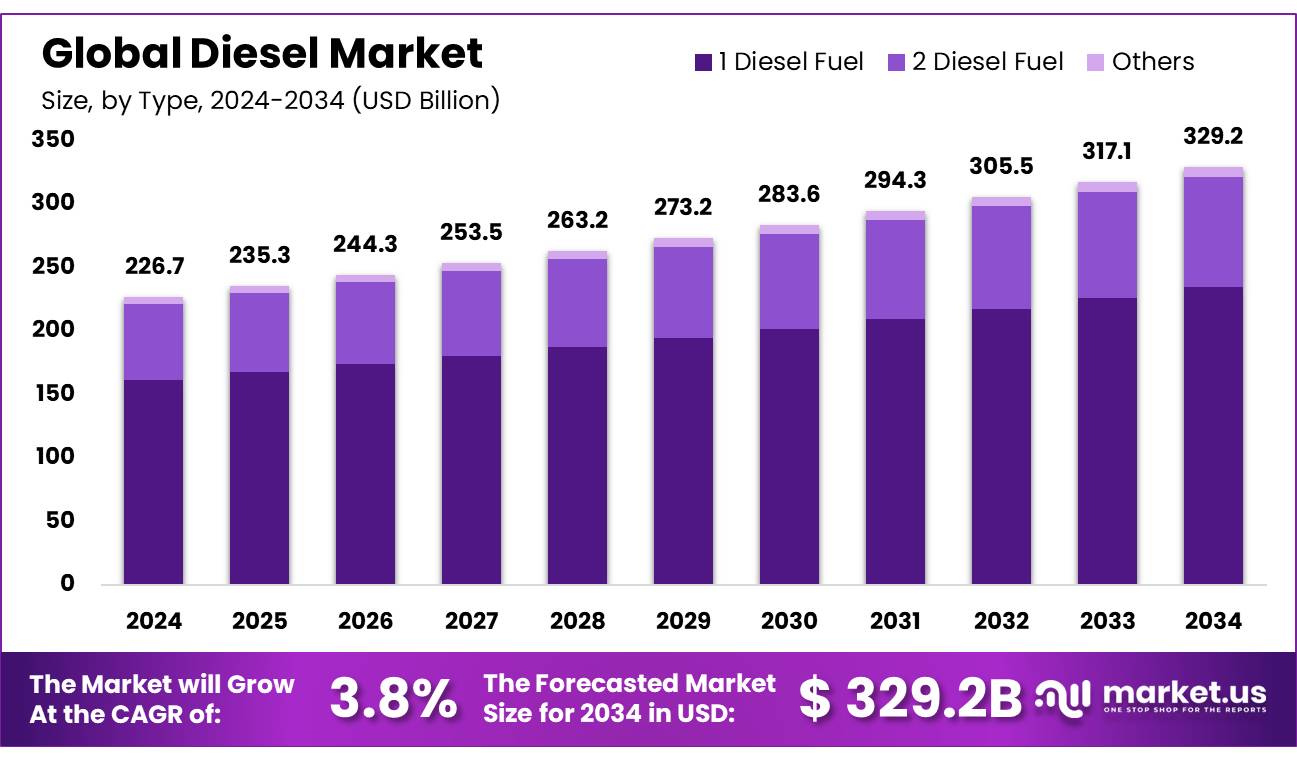

The Global Diesel Market size is expected to be worth around USD 329.2 Bn by 2034, from USD 226.7 Bn in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034.

Diesel is a widely used distillate fuel for transportation, particularly in vehicles equipped with compression ignition engines. This fuel is derived from both crude oil and biomass materials. Diesel fuels are preferred for heavy vehicles and industrial applications due to their high torque, fuel efficiency, and durability. Diesel engines generate more power with better fuel economy by utilizing a higher compression ratio, which enhances thermal efficiency.

Moreover, Diesel fuel has a higher energy density than gasoline, making it more efficient in combustion and typically less expensive to refine. Diesel engines are designed for reliability, with robust construction that reduces wear and tear, leading to a longer lifespan. As a result, diesel engines are commonly used in trucks, trains, ships, and stationary machinery, making them essential for heavy-duty tasks that require sustained power and performance.

Furthermore, the diesel market finds applications across various sectors, including diesel-powered engines and generators that cater to the demands of heavy-duty industries requiring an efficient fuel source. Diesel powers a wide range of heavy-duty machinery and equipment, such as tractors, harvesters, agricultural pumps, earthmovers, bulldozers, bucket loaders, backhoes, cranes, pavers, excavators, and motor graders. Diesel boilers and power generators also play a critical role in industrial activities, making diesel an essential component in sectors reliant on heavy machinery.

Additionally, diesel fuel is crucial for powering diesel-engine generators, which are used to generate electricity, particularly in remote locations such as villages and underserved areas. Many industrial facilities, hospitals, large buildings, and electric utilities depend on diesel generators for backup and emergency power supply, underscoring the importance of diesel in ensuring energy security and operational continuity in a wide range of sectors.

Key Takeaways

- The global diesel market was valued at USD 226.7 billion in 2024.

- The global diesel market is projected to grow at a CAGR of 3.80% and is estimated to reach USD 329.2 billion by 2034.

- Among type, 2 diesel fuel accounted for the largest market share of 71.2%.

- By application, commercial vehicles accounted for the largest market share of 58.6%.

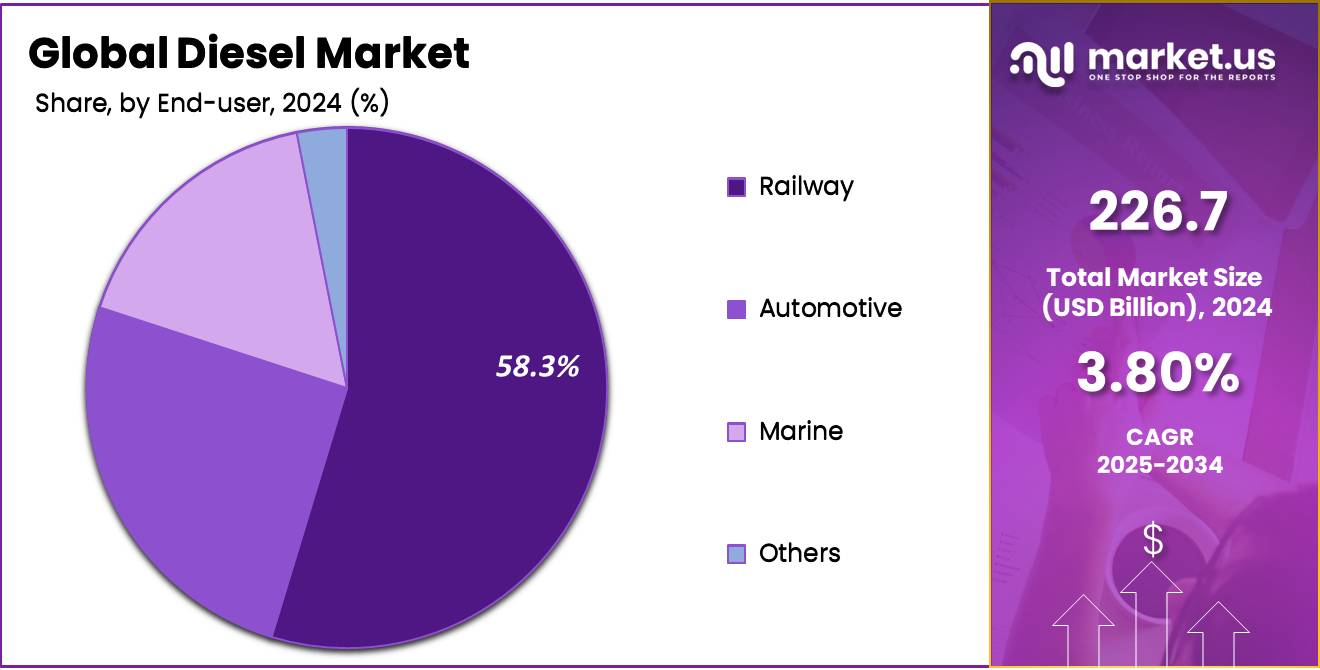

- By end-use, automotive accounted for the majority of the market share at 58.3%.

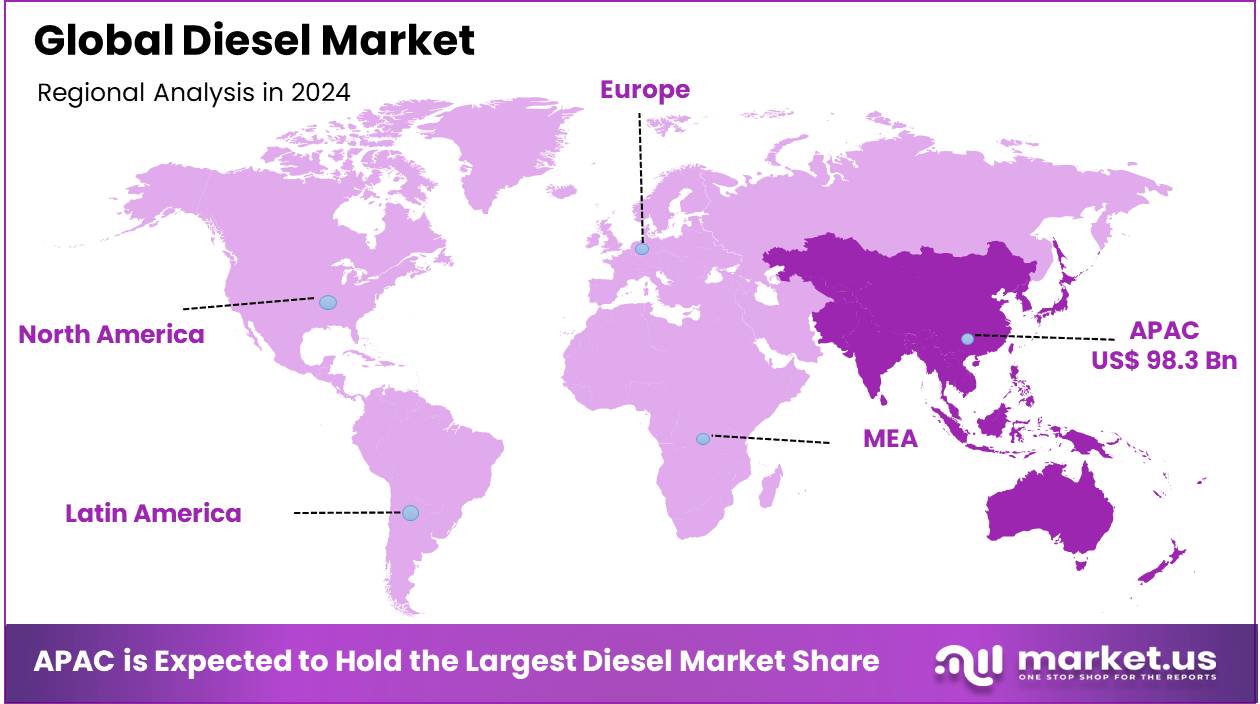

- Asia Pacific is estimated as the largest market for Diesel with a share of 43.4% of the market share.

Product Analysis

The diesel market is segmented based on type into 1 diesel fuel, 2 diesel fuel, and others. In 2024, the 2 diesel fuel segment held a significant revenue share of 71.2%. Due to its widespread adoption across various sectors. This type of diesel is increasingly used in commercial and industrial machinery, including trucks, construction vehicles, and heavy equipment. Their higher energy content and efficient performance make it the preferred choice for long-hour operations where high power and reliability are needed.

This makes type 2 diesel fuel crucial for industries such as transportation, agriculture, and manufacturing, where performance is an important factor. Their controlled viscosity provides good pump lubrication and balanced volatility provides maximum power, making type 2 diesel an attractive option for the transportation of industrial goods.

Furthermore, the demand for 2 diesel fuel is also fueled by global economic growth, which has led to increased industrialization and a rise in transportation needs. In addition to its extensive use in machinery, its relatively cost-effective nature compared to other fuel types has made it a key component in meeting the energy demands of both emerging and established markets. As industries continue to depend on heavy-duty machinery and commercial vehicles, the 2 diesel fuel segment is expected to maintain its dominant position in the diesel market.

Application Analysis

Based on application, the market is further divided into Passenger vehicles, commercial vehicles, and others. The predominance of commercial vehicles, commanding a substantial 58.6% market share in 2024. Due to the increasing demand for transportation and logistics services globally. Commercial vehicles, including trucks, buses, and delivery vans, are essential for moving goods and public transport across various regions, making them a backbone of the global economy. With the rise of e-commerce, urbanization, and the expansion of global supply chains, the demand for commercial vehicles has surged, leading to a higher consumption of diesel fuel in this sector.

Additionally, the dominance of commercial vehicles in the diesel market is also supported by their need for fuel that offers both power and efficiency for long-duration trips, heavy loads, and continuous operation. Diesel fuel, particularly in its type 2 form, is known for its higher energy density and fuel efficiency compared to gasoline, making it the preferred choice for vehicles used in commercial transportation. In addition, the relatively lower operating costs of diesel engines in commercial vehicles further strengthen their market position, ensuring that the commercial vehicle segment remains dominant in the diesel fuel market.

End-Used Analysis

Based on End-Used, the market is further divided into railway, automotive, marine, and others. The predominance of the Automotive commanding a substantial 58.3% market share in 2024. Due to their widespread adoption of diesel-powered vehicles across the globe. Diesel engines are widely favored in the automotive industry, particularly for their fuel efficiency, higher torque, and long-lasting performance. Diesel-powered cars, trucks, and SUVs offer better mileage compared to their gasoline counterparts, making them a popular choice for consumers seeking cost-effective transportation over long distances. Additionally, the continued growth in global car sales, particularly in regions like Europe and parts of Asia, further boosts the demand for diesel in the automotive sector.

Furthermore, ongoing demand for commercial vehicles, such as freight trucks, delivery vans, and buses, which heavily rely on diesel engines. These vehicles require fuel with higher energy density and efficiency to handle long distances, heavy payloads, and continuous operation. As diesel engines are well-suited for such high-demand applications, they continue to dominate the automotive industry, particularly for those requiring durability and performance over time. This ensures that the automotive segment holds a significant share of the diesel market.

Key Market Segments

By Type

- 1 Diesel Fuel

- 2 Diesel Fuel

- Others

By Application

- Passenger Vehicles

- Commercial Vehicles

- Others

By End-user

- Railway

- Automotive

- Marine

- Others

Drivers

Burgeoning transportation and heavy industries.

The burgeoning transportation sector is a key driver for the global diesel market, driven by rapid urbanization, economic activity, freight movement, public transportation needs, and increasing industrialization across various sectors including agriculture and construction. Diesel demand has been steadily rising, especially in emerging economies where energy needs are growing.

Diesel’s higher energy density and efficiency make it the preferred fuel for heavy-duty vehicles, including trucks, buses, and commercial fleets. The growing need for efficient goods transportation is further supported by diesel’s dominance in public and school buses, freight movement, and the transportation of goods.

- For instance, according to U.S. Energy Information Administration reports S., diesel accounted for about 23% of total energy consumption in the transportation sector in 2022, making it the largest consumer of diesel globally.

Furthermore, the chemical nature of diesel is another key factor making it a major fuel in transportation sectors by offering a wide range of performance, efficiency, and safety features, with a greater energy density than other liquid fuels like petroleum and gasoline, providing more energy per unit of volume. In addition, the chemical composition of diesel, consisting of alkanes containing 12 or more carbon atoms, further enhances its effectiveness as a fuel. These compounds have a boiling point between 250°C and 350°C, contributing to diesel’s high energy density and making it the preferred fuel for high-powered vehicles and engines, further boosting its demand in the automotive industry.

Additionally, transportation plays a vital role in economic and social development, the demand for diesel continues to rise due to the growing need for efficient goods transportation. While alternative fuel technologies are being explored, they remain expensive for widespread use, thus continuing to drive the demand for diesel. Despite the growing interest in hydrogen, electric, and other alternative technologies, diesel remains a dominant choice, particularly in the trucking industry, where 97% of large highway tractor-trailers are diesel-powered. Diesel’s combination of high power density, energy efficiency, and reliability, along with its compatibility with low-carbon biodiesel fuels, ensures its continued relevance in the future of global transportation.

Restraints

Stringent Emission Regulation

The stringent emission regulations implementations by various countries are one of the important restraint factors for the growth of the global diesel market. Diesel engines, being one of the largest sources of harmful pollutants such as nitrogen oxides (NOX), particulate matter (PM), and ground-level ozone, have come under increasing scrutiny.

Governments worldwide have set regulations for targeting net-zero emissions and gradually limiting the use of diesel in heavy-duty vehicles. The U.S. Environmental Protection Agency (EPA) and similar regulatory bodies have introduced stricter sulfur content standards and emissions guidelines for new diesel engines. These regulations are rising adoption of cleaner, alternative fuels like biofuels, electric-powered vehicles, and renewable energy, thus reducing diesel’s demands in the transportation sector.

Furthermore, rising environmental concerns associated with diesel emissions, including their impact on human health and climate change, are prompting nations to adopt more stringent measures. Countries such as Paris and Mexico City banned diesel vehicles and the European Parliament has voted to prohibit the sale of diesel cargo trucks by 2040. In the U.S., the EPA is proposing to ban a significant portion of new gasoline and diesel vehicles in the coming years.

These regulatory shifts, combined with technological advancements in cleaner fuel options, are significantly limiting diesel adoption in various industries, particularly in the transportation sector. The introduction of Euro 6/VI emission standards, aimed at reducing NOX and PM emissions, will further encourage the transition to cleaner alternatives, impacting the market growth of diesel.

Opportunity

Biodiesel and Renewable Diesel Growth

The growth of biodiesel and renewable diesel presents significant opportunities for the global diesel market, driven by their environmental benefits and increasing demand for sustainable fuel solutions across various industries. Biodiesel, which can be blended with petroleum diesel in varying concentrations such as B5 and B20, offers advantages including improved fuel lubricity, reduced engine wear, and enhanced combustion efficiency. It has been shown to lower carbon dioxide emissions by up to 74%, making it a key player in reducing greenhouse gas emissions in the transportation sector. Furthermore, biodiesel’s higher flashpoint and cleaner burn contribute to safety benefits, while its positive energy balance supports energy security by reducing reliance on petroleum.

Additionally, Renewable diesel, chemically identical to petroleum diesel but produced from fats and oils via advanced processes like hydro treating and pyrolysis, also supports the reduction of carbon emissions, with a decrease of up to 65% in CO2 and nitrogen oxide emissions compared to traditional diesel. With growing production capacities and increasing governmental support under programs like the Low Carbon Fuel Standard and the Renewable Fuel Standard, renewable diesel is emerging as a flexible alternative that seamlessly integrates with existing diesel infrastructure.

These fuels not only contribute to environmental goals but are also supported by various government incentives, such as the Clean Fuel Production Credit and USDA Biorefinery Assistance Program, further accelerating their growth. This shift towards biodiesel and renewable diesel is opening up new market opportunities, promoting a sustainable and low-emission future for the global diesel market.

- For instance, recently, Neste introduced Neste MY Renewable Diesel™ to the Italian market in partnership with Firmin, an Italian fuel distributor. This partnership presents a significant growth opportunity for the global diesel market by offering a sustainable, low-emission alternative to fossil diesel, and supporting decarbonization without requiring fleet modifications. It aligns with the growing demand for cleaner energy solutions in the transport sector.

Trends

Shift towards Ultra-Low Sulfur Diesel

The global diesel market is experiencing significant growth, largely driven by the shift to ultra-low sulfur diesel (ULSD), which contains sulfur levels of 15 parts per million (ppm) or less. This transition has been primarily fueled by stringent environmental regulations aimed at reducing harmful emissions such as soot, particulate matter, and nitrogen oxides (NOx). ULSD’s environmental benefits, including a 90% reduction in particulate emissions and a substantial decrease in sulfur dioxide (SO2) emissions, have made it a key solution for improving air quality and public health.

As regulations tighten globally, particularly in the U.S., Europe, and Asia, ULSD has become the standard fuel, with all diesel-powered engines manufactured from 2007 onward requiring its use to prevent engine damage from higher-sulfur fuels. Furthermore, global demand for ULSD is increasing across multiple sectors, including transportation, agriculture, and power generation, as industries comply with environmental standards. This demand is further supported by advancements in refining technologies, making ULSD production more cost-effective.

Additionally, significant research is being conducted into more efficient desulfurization methods to meet rising ULSD demand and optimize production. As ULSD becomes more widespread, its role in reducing emissions and enhancing diesel engine performance will continue to grow, positioning it as a key component of the cleaner energy transition.

Expansion of LNG-Diesel Duel fuel engines

The expansion of LNG-diesel dual-fuel engines is a significant trend in the global diesel market, driven by the increasing need for more efficient, cleaner, and cost-effective fuel solutions. LNG (Liquefied Natural Gas) is gaining traction as a low-emission alternative to diesel, offering substantial reductions in carbon dioxide (CO2), nitrogen oxides (NOx), and particulate matter (PM) emissions compared to traditional diesel engines. Dual-fuel engines, typically based on diesel technology, are designed to run on a mix of 80% LNG and 20% diesel.

This dual-fuel engine technology enables vehicles and machinery to operate on both LNG and diesel, providing flexibility and cost savings while reducing environmental impact. This trend is particularly prominent in sectors such as shipping, transportation, and heavy-duty industries, where LNG-diesel engines are being adopted for trucks, vessels, and industrial machinery. The shipping industry, in particular, is accelerating its shift to LNG-diesel dual-fuel engines due to stricter environmental regulations and the need to meet International Maritime Organization (IMO) emission standards.

Similarly, the transportation sector is exploring dual-fuel engines for long-haul trucking to reduce fuel costs and emissions. LNG propulsion has already proven cost-effective in Emission Control Areas (ECAs) in regions like the U.S. and Europe.

Geopolitical Impact Analysis

Geopolitical disruptions, climate change policies, and domestic energy decisions are driving volatility and shaping the global diesel market.

Geopolitical events have significant impacts on the global diesel market, influencing both supply and demand dynamics. Domestic disruptions, such as hurricane seasons in the U.S., can cause short-term fluctuations in freight operations and diesel prices. For instance, hurricanes like Helene and Milton have temporarily halted offshore oil production, disrupting supply chains and leading to a spike in diesel prices due to pre-storm demand.

Furthermore, geopolitical tensions such as the Russia-Ukraine war have resulted in substantial disruptions to global energy markets, particularly in Europe. Russia’s reduced oil supply to Europe following sanctions has caused a significant supply gap, which pushed global diesel prices higher as European countries seek alternative sources.

Additionally, international efforts to combat climate change, like the Paris Climate Agreement, are reshaping the global energy landscape, driving the transition from fossil fuels to renewable energy sources. While this shift helps reduce long-term carbon emissions, it can lead to temporary energy price spikes as renewable infrastructure develops and fossil fuels remain essential for a limited time.

Moreover, the geopolitical competition for raw materials essential to renewable technologies, such as lithium, cobalt, and rare earth elements, is adding a new layer of complexity to the global energy supply chain, giving resource-rich countries significant influence over energy prices. In addition, domestic political decisions, including fuel subsidies and renewable energy incentives, can affect global markets by keeping domestic energy prices artificially low, increasing global demand, and potentially driving price volatility. These factors contribute to the ongoing complexity of the global diesel market.

Regional Analysis

In 2024, Asia Pacific dominated the global diesel market, accounting for 43.4% of the total market share, driven by factors such as industrialization, infrastructure development, transportation needs, and power generation. Governments from the region are incentivizing clean energy transitions and supporting net-zero emissions goals, which are boosting t research and development activities in the diesel industries.

Advancements in Ultra-Low Sulfur Diesel and LNG-Diesel Duel fuel engines support the government’s new zero-emission programs. The growing focus on biodiesel and renewable diesel is further enhancing diesel demand across both public and private sectors, as these cleaner alternatives gain traction in meeting environmental targets.

Additionally, Rapid industrialization and economic expansion in countries like India, China, Vietnam, and Australia are also major contributors to the rise in diesel demand. Sectors such as construction, mining, agriculture, and transportation depend heavily on diesel-powered machinery. Large-scale infrastructure projects, including the construction of bridges, road networks, and railways, are driving increased demand for diesel-powered equipment, essential for heavy-duty operations. These developments highlight the critical role of diesel in supporting economic growth and modernization.

Moreover, the growing reliance on diesel-powered generators is becoming a significant factor in market expansion. Countries such as India, Indonesia, and Australia, which experience frequent power outages, increasingly turn to diesel generators as a reliable power source. These generators are particularly crucial for ensuring uninterrupted power supply to critical sectors like hospitals and industries, reinforcing diesel’s role as a dependable energy solution in times of power disruptions. These combined factors contribute to the continued growth of the diesel market, with rising demand across various sectors highlighting diesel’s indispensable role in modern industrial economies.

- For instance, Sterling Generators, a leading power generator company in India, announced its adoption of Perkins 4000 Series diesel engines for its DG (diesel generator) sets. These engines are designed to provide reliable and efficient power solutions for various industries, including homes, hotels, stadiums, airports, and data centers.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players focus on expanding production, improving fuel efficiency, regional growth, and diversifying into alternative fuels.

Key players in the global diesel market focus on expanding production capacity and optimizing supply chains to meet growing demand. They invest heavily in technological advancements to improve fuel efficiency, meet environmental standards, and reduce emissions. Regional market expansion, particularly in emerging markets, is a key strategy, with companies focusing on partnerships and acquisitions to strengthen their presence. Additionally, players are diversifying their portfolios by exploring alternative fuels like bio-diesel and renewable energy, ensuring alignment with sustainability trends while maintaining dominance in the diesel sector.

Major Players in the Industry

- Chevron Corporation (Hess)

- Exxon Mobil Corporation

- PetroChina Company Limited

- Qatar Petroleum

- Shell Plc.

- Conoco Phillips

- Reliance Industries Limited

- Fredenberg

- JSC Mozyer Oil Refinery

- Denso

- Bosch

- MAHLE

- Universe Filter

- Fredenberg

- TOYOTA BOSHOKU

- ALCO Filters

- YBM

- Baowang

- Others

Recent Development

- In August 2024 – Imperial Oil is constructing Canada’s largest renewable diesel facility near Edmonton, with a $720-million investment, this facility helps to produce over one billion liters annually using local feedstocks and low-carbon hydrogen. This project aligns with Canada’s clean fuel standards, offering Imperial a competitive advantage in the renewable energy market.

- In May 2024 – GWM has announcements for diesel engine developments for its Tank 300 4×4 SUV, potentially boosting its appeal in markets like Australia, where diesel is popular. The new 2.4-liter turbo-diesel engine, producing 135kW and 480Nm, could enhance the SUV’s economy, range, and towing capacity. The diesel variant aligns with GWM’s export strategy, with possible plans for other models like the Tank 500.

- In January 2023 – ExxonMobil announced $560 million investments in Canada’s largest renewable diesel facility at the Strathcona refinery, expected to produce 20,000 barrels per day starting in 2025. This project aims to reduce greenhouse gas emissions by 3 million metric tons annually, using low-carbon hydrogen and carbon capture technology.

Report Scope

Report Features Description Market Value (2024) USD 226.7 Bn Market Volume (2024) XX Tons Forecast Revenue (2034) USD 329.2 Bn CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (1 Diesel Fuel, 2 Diesel Fuel, Others), By Application (Passenger Vehicles, Commercial Vehicles, Others), By End-user (Railway, Automotive, Marine, Others), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Chevron Corporation (Hess), Exxon Mobil Corporation, PetroChina Company Limited, Qatar Petroleum, Shell Plc., Conoco Phillips, Reliance Industries Limited, Fredenberg, JSC Mozyer Oil Refinery, Denso, Bosch, MAHLE, Universe Filter, Fredenberg, TOYOTA BOSHOKU, ALCO Filters, YBM, Baowang, etc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Chevron Corporation (Hess)

- Exxon Mobil Corporation

- PetroChina Company Limited

- Qatar Petroleum

- Shell Plc.

- Conoco Phillips

- Reliance Industries Limited

- Fredenberg

- JSC Mozyer Oil Refinery

- Denso

- Bosch

- MAHLE

- Universe Filter

- Fredenberg

- TOYOTA BOSHOKU

- ALCO Filters

- YBM

- Baowang

- Others