Global Industrial Waste Recycling and Services Market By Type (Hazardous, Non-hazardous), By Product (Metals, Paper and Paperboard, Glass, Bulbs and Batteries, Electronics, Yard Trimmings, Food Products, Others), By End-User (Manufacturing, Construction, Automotive, Oil and Gas, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144544

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

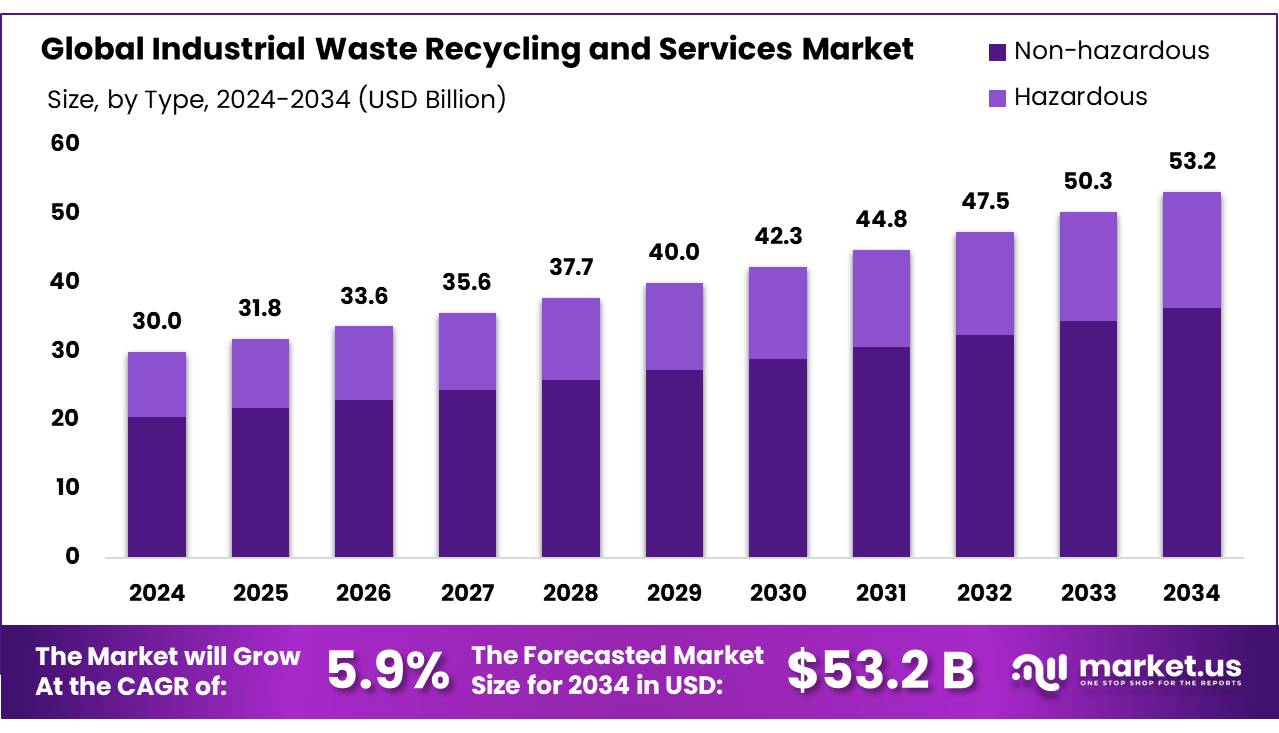

The Global Industrial Waste Recycling and Services Market size is expected to be worth around USD 53.2 Bn by 2034, from USD 30.0 Bn in 2024, growing at a CAGR of 5.90% from 2025 to 2034.

Industrial waste recycling and services involve collecting, sorting, treating, recycling, and disposing of waste materials generated from industrial processes. These services provide significant benefits by reusing industrial waste in the manufacturing and repair of infrastructure such as buildings, roads, bridges, and consumer products.

The market for industrial waste recycling spans multiple sectors, including manufacturing, construction, energy, and electronics, where recycled materials help produce goods, build infrastructure, and generate energy. As environmental awareness grows, governments are implementing waste management regulations and offering incentives, driving the growth of the industrial waste recycling market.

Moreover, the importance of industrial waste recycling and services in the market has increased due to rising environmental concerns, as industrial waste negatively impacts public health and ecosystems. With rapid industrial growth worldwide, the need for efficient waste management solutions is more critical than ever. Industrial waste recycling offers several key advantages, including reducing landfill waste, lowering disposal costs (such as landfill taxes), improving corporate reputation through demonstrated environmental responsibility, and ensuring legal compliance to avoid fines.

Moreover, recycling materials like aluminum saves energy compared to using raw materials, making it an essential part of sustainable business practices. The market’s growth is fueled by these benefits and the increasing need for eco-friendly solutions across industries.

Key Takeaways

- The global industrial waste recycling and services market was valued at US$ 30.0 Billion in 2024.

- The global industrial waste recycling and services market is projected to grow at a CAGR of 5.90 % and is estimated to reach US$ 53.2 Billion by 2034.

- Among types, non-hazardous accounted for the largest market share of 68.4%.

- Among products, metals accounted for the majority of the market share at 38.5%.

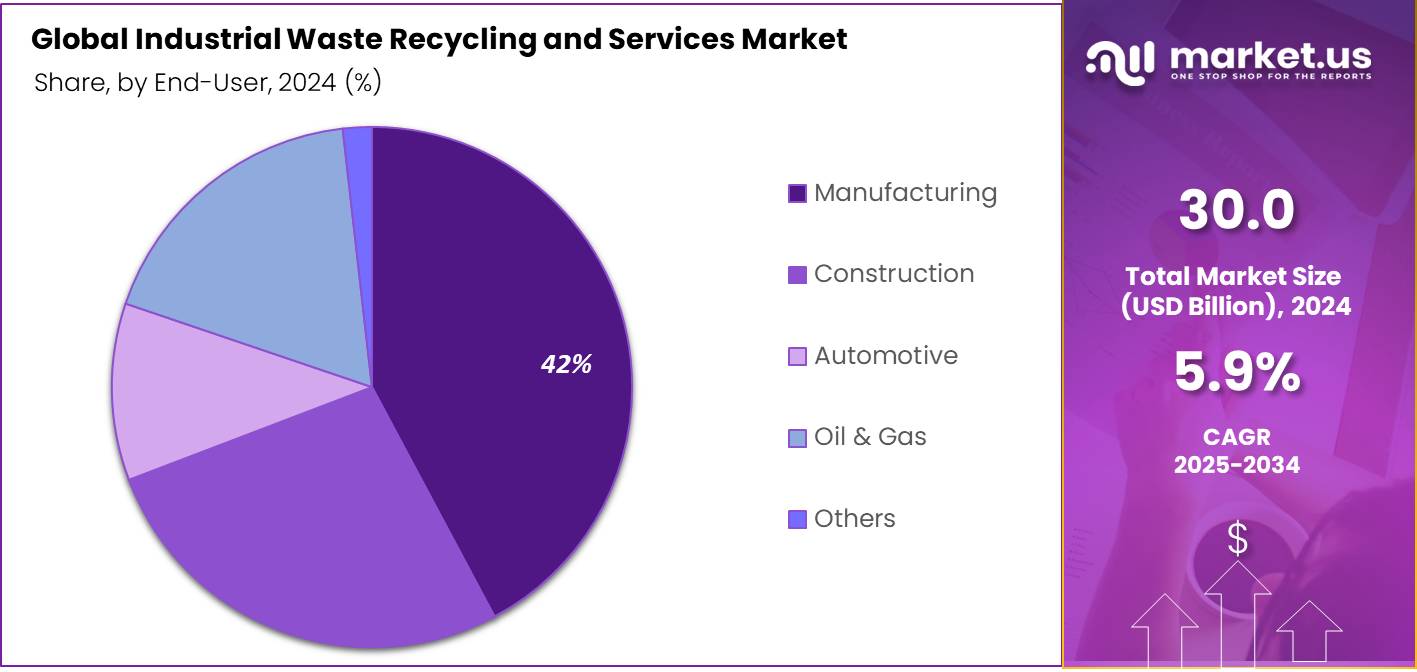

- By end-user, manufacturing accounted for the largest market share of 42.2%.

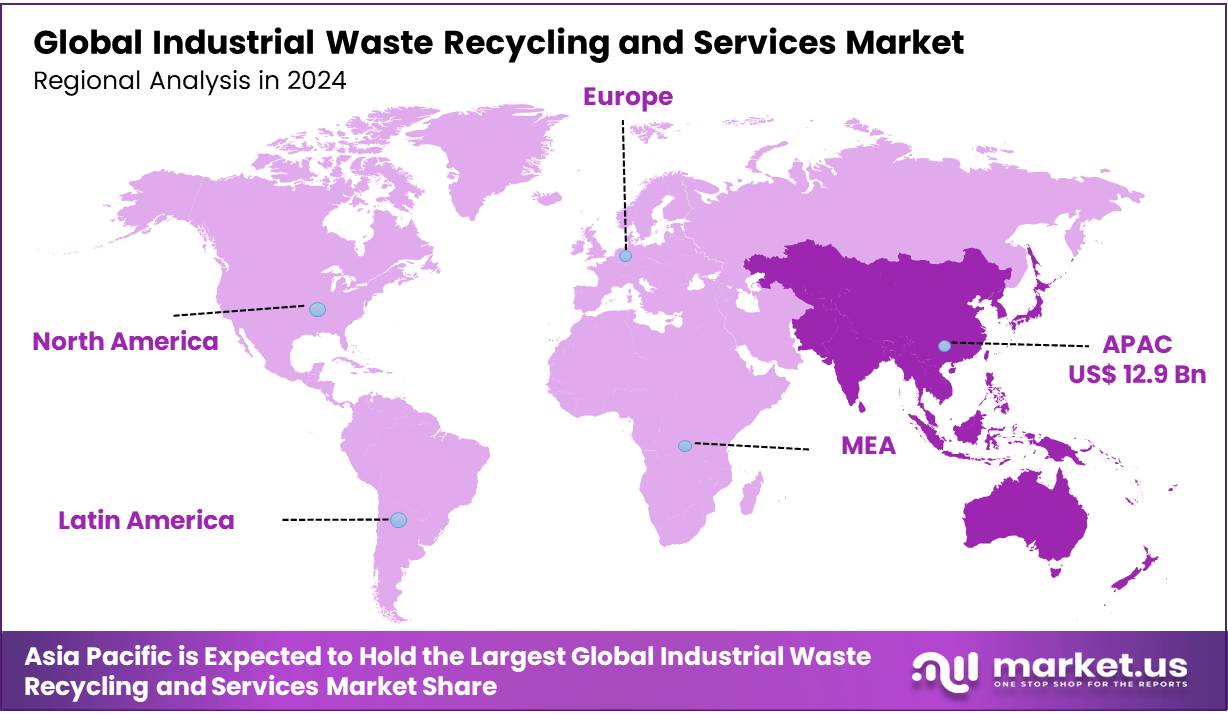

- Asia Pacific is estimated as the largest market for industrial waste recycling and services with a share of 43.3% of the market share.

Type Analysis

The industrial waste recycling and services market is segmented based on type into hazardous and non-hazardous. In 2024, the non-hazardous segment held a significant revenue share of 68.4%. Due to the increasing adoption of non-hazardous waste recycling across various industries. This growth can be attributed to the rising focus on sustainability, lower disposal costs, and the growing recognition of the environmental benefits of recycling non-hazardous materials.

Furthermore, government regulations and incentives encouraging the recycling of non-hazardous waste further contribute to its market dominance. The non-hazardous waste segment is also driven by the growing public awareness regarding the environmental impact of waste disposal and the increasing adoption of circular economy practices. Non-hazardous waste, such as plastics, metals, and e-waste, is easier to manage and recycle compared to hazardous materials, making it a preferred choice for industries aiming to reduce their carbon footprint and comply with strict environmental regulations. Furthermore, advancements in recycling technologies have made it more cost-effective and efficient to process non-hazardous waste, encouraging companies to invest in recycling solutions.

Product Analysis

Based on product, the market is further divided into metals, paper and paperboard, glass, bulbs & batteries, electronics, yard trimmings, food, and others. The dominance of the metal exerts significant control over 38.5% market share in 2024. Due to their high recycling ability and demand for metals such as aluminum, steel, and copper. Metals are widely used across various industries, including construction, automotive, and manufacturing, making them a critical component of recycling efforts.

Moreover, the economic value of metals, combined with the environmental benefits of recycling, such as reducing the need for mining and conserving natural resources, contributes to their significant market share. The increased focus on sustainable practices and regulatory pressures to reduce waste are further driving the recycling of metals, ensuring their continued dominance in the market.

Additionally, paper and paperboard are other important segments in the market as their recycling is easy due to the high demand for recycled paper in the packaging and printing industries, which helps reduce deforestation. In addition, paper and paperboard glass recycling also emerge as equally important segments, as their characteristic recycling ability makes them useful without losing their quality, making them key materials in reducing landfill waste.

End-User Analysis

Based on end-users, the market is further divided into manufacturing, construction, automotive, oil & gas, and others. The manufacturing ascendency, occupying a commanding position in 62.3% market share in 2024. The high volume of industrial waste generated during production processes across various manufacturing industries. The demand for recycled materials such as metals, plastics, and paper in the manufacturing sector is driven by the need for cost-effective, sustainable resources.

Additionally, regulations and increasing consumer demand for environmentally friendly products are pushing manufacturers to adopt recycling practices. The growing emphasis on circular economy principles, where waste is minimized and resources are reused, further supports the manufacturing sector’s dominance in the industrial waste recycling and services market.

Furthermore, the construction, automotive, and oil & gas sectors are other important segments that hold a significant share in the industrial waste recycling market. The construction industry generates substantial waste, including metals and plastics, which can be recycled for future use.

The automotive sector focuses on recycling materials such as metals and plastics from vehicle production and disposal. In the oil and gas industry, recycling efforts target hazardous waste and oil-contaminated materials, aiming to improve sustainability and reduce environmental impacts. These sectors drive demand for advanced recycling technologies to enhance waste management practices.

Key Market Segments

By Type

- Hazardous

- Non-hazardous

By Product

- Metals

- Paper and Paperboard

- Glass

- Bulbs & Batteries

- Electronics

- Yard Trimmings

- Food Products

- Others

By End-User

- Manufacturing

- Construction

- Automotive

- Oil & Gas

- Others

Drivers

Growing Consumer Awareness About Environmental Issues

The growing awareness among consumers about the environmental impacts of industrial waste is a major driver for the expansion of the industrial waste recycling and services market. As consumers become more aware of the negative effects of waste on the environment, they are increasingly demanding products made from recycled materials. This shift toward sustainability is encouraging industries to adopt recycling practices and reduce their reliance on virgin materials, pushing industrial manufacturing toward waste-recycling-based product development.

- For instance, according to UNESCO, plastic debris kills over 1 million seabirds and more than 100,000 marine mammals each year. This environmental impact of industrial plastic waste has led to a rise need for waste recycled services. Governments are also playing a key role by implementing regulations and offering incentives to encourage recycling efforts, further driving demand for industrial waste recycling services.

Furthermore, environmental concerns gain more attention and waste generation continues to rise globally, waste reduction has become a top priority another important factor fueling the growth of the global industrial waste recycling and services market. Rapid urbanization, industrialization, and increasing waste generation are contributing to the environmental crisis.

The World Bank projects that by 2050, municipal solid waste will increase by 70%, with developing countries facing significant challenges due to inadequate waste management infrastructure. The UNEP’s Global Waste Management Outlook 2024 indicates that municipal waste will grow by two-thirds, and its associated costs will nearly double in the coming decades, particularly in developing countries where waste management systems are underdeveloped.

Restraints

Lack of Recycling Structure

The lack of recycling infrastructure in many regions, particularly in developing countries, is a significant restraint on the growth of the global industrial waste recycling and services market. Inadequate access to recycling or composting facilities often leads to an increase in landfill waste that could otherwise be diverted for recycling or composting. This not only exacerbates the burden on landfill space but also contributes to environmental degradation. Furthermore, insufficient recycling efforts, often due to poor infrastructure and a lack of public awareness or education, can result in recyclable materials becoming contaminated and ultimately discarded, worsening the waste crisis.

Additionally, waste management companies are facing rising operational costs related to waste collection, transportation, and treatment. Factors such as higher fuel prices and increasing labor costs are placing additional financial strain on these companies. These escalating costs can negatively impact profitability, and service quality, and make waste management services less affordable for both residential and commercial customers. As a result, customer dissatisfaction may rise, which in turn could reduce customer loyalty and hinder the overall expansion of the recycling market.

Opportunity

Investments in Smart Waste Management Solutions

The advent of Artificial Intelligence (AI) is significantly transforming the waste management industry, offering innovative solutions to improve efficiency, sustainability, and resource utilization. AI technologies are being used to enhance waste collection processes, optimize recycling, and reduce inefficiencies in waste management systems. AI-powered waste collection systems can optimize routing and scheduling, ensuring more efficient pickups and reducing fuel consumption.

Additionally, AI-driven sorting technologies can identify and separate recyclable materials more accurately, improving recycling rates and minimizing contamination. These advancements not only boost operational efficiency but also help in achieving higher sustainability goals, making AI a crucial element in the future of waste management.

Furthermore, municipalities and industries invest in smart waste management solutions, and the market for industrial waste recycling and services is poised for significant growth. AI technologies are promoting smarter recycling initiatives by enabling automation and data-driven decision-making, which improves the overall effectiveness and economic viability of recycling processes.

The integration of smart sorting systems, machine learning algorithms, and mobile apps for tracking recycling activities is encouraging greater participation in recycling programs. These innovations help municipalities increase recycling rates, reduce landfill waste, and contribute to sustainability efforts. As more businesses and governments adopt AI technologies, the industrial waste recycling and services market is expected to expand, driven by both technological advancements and the growing demand for eco-friendly solutions.

Trends

Emphasis on Circular Economy

The growing emphasis on the circular economy is significantly driving the expansion of the industrial waste recycling and services market. This shift from the traditional “take-make-waste” model to a circular approach focuses on reducing waste by encouraging the repurposing, reusing, and recycling of materials. Sustainable product design plays a central role in this transition, ensuring that products are not only durable but also recyclable, thus allowing them to re-enter the production cycle rather than ending up in landfills. Businesses are increasingly adopting strategies such as offering products as a service or implementing take-back schemes, which encourage the return and reuse of products.

Consumers, who are becoming more conscious of their environmental impact, are also pushing for products with a lower carbon footprint. This increased demand for sustainability is motivating companies to integrate circular economy principles into their operations, which in turn fuels the growth of the industrial waste recycling and services market. As industries and consumers alike prioritize sustainability, the circular economy is proving to be a powerful driver for more efficient waste management solutions, resource recovery, and the reduction of environmental harm.

Geopolitical Impact Analysis

Geopolitical Impact Affects The Supply Chain Activities, Resource Availability, and The Adoption Of Sustainable Practices In The Industrial Waste Recycling And Services Market.

Geopolitical factors play an important role in shaping the industrial waste recycling and services market, impacting trade dynamics, resource availability, and the adoption of sustainable practices. Trade restrictions, such as China’s ban on plastic waste imports, disrupt global recycling supply chains, forcing companies to revise their waste management strategies. These geopolitical challenges lead to higher recycling costs, as industries are compelled to process more waste domestically. Moreover, differing regulatory frameworks across regions result in varying recycling standards, influencing market growth and investment opportunities in different geographies.

As a result, shifts in trade policies and regulatory changes are increasingly driving demand for innovative, localized recycling solutions. Additionally, the rise of informal recycling networks in regions with limited regulatory oversight presents both challenges and opportunities within the industrial waste recycling market.

While these informal operations can lead to inefficiencies, environmental risks, and labor concerns, they also open avenues for market players to develop scalable, localized waste management solutions, especially in emerging markets. Geopolitical tensions thus emphasize the need for international collaboration to address waste management challenges, encouraging the development of innovative technologies and cross-border regulatory frameworks to streamline recycling processes and promote sustainability in the industry.

Regional Analysis

In 2024, Asia Pacific dominated the global industrial waste recycling and services market, accounting for 43.3% of the total market share, driven by rapid industrialization, increasing environmental awareness, and stringent government regulations. As the region’s manufacturing and production sectors expand, there is a growing demand for efficient waste management solutions to handle the rising volumes of industrial waste. Key countries, including China, Japan, India, and South Korea, are leading the market, with strong government support for sustainable practices, such as circular economy initiatives and waste-to-energy projects.

Furthermore, stricter environmental regulations and the push for more sustainable industrial operations are prompting businesses to invest in advanced recycling technologies and services. The growth of the Asia Pacific industrial waste recycling market is also being fueled by a shift towards resource recovery and material reuse, reducing the dependence on virgin raw materials. As the region continues to face challenges related to waste disposal and pollution, industrial recycling offers a sustainable solution that aligns with the increasing demand for eco-friendly practices.

Additionally, the market benefits from international partnerships and collaborations to improve waste management infrastructure, enhance recycling efficiency, and foster innovation in waste processing technologies. With rising urbanization, regulatory pressure, and a growing emphasis on sustainability, the industrial waste recycling and services market in Asia Pacific is poised for continued expansion in the coming years.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the Industrial Waste Recycling and Services market focus on offering recyclable and sustainable products to effectively manage industrial waste.

Key players in the industrial waste recycling and services market, such as Advanced Recycled Services and Eurokey Recycling Ltd., focus on offering recycled products while emphasizing efficient waste management technologies and services. They adopt a circular economy model to ensure a steady, environmentally responsible supply of materials. These companies primarily target non-hazardous waste, such as metals, plastics, and paper, which are easily recyclable and manageable.

Their initiatives are improving waste recycling rates and services. Furthermore, key players in the market have formed strategic partnerships with governments and the private sector, enhancing their visibility and reputation. Innovation in recycling and waste management technologies helps attract new customers, while their commitment to environmental well-being and the circular economy ensures strong market growth.

Major players in the industry

- Advanced Disposal Services, Inc.

- Amdahl Corporation

- Biffa plc

- Casella Waste Systems, Inc.

- Clean Harbors, Inc.

- Cleanaway Waste Management Limited

- Collins & Aikman

- Covanta Holding Corporation

- EnviroServ Waste Management (Pty) Ltd

- Epson, Inc.

- Eurokey Recycling, Ltd.

- FCC Environment (UK) Limited

- Fetzer Vineyards

- GFL Environmental Inc.

- Interface, Inc.

- Northstar Recycling

- Remondis SE & Co. KG

- Renewi plc

- Republic Services, Inc.

- RU Recycling- und Umweltdienst GmbH

- Rubicon Global

- Rumpke Consolidated Companies, Inc.

- Sims Metal Management Limited

- Stericycle, Inc.

- SUEZ Environnement Company

- Triple M Metal LP

- US Ecology, Inc.

- Veolia Environnement S.A.

- Waste Connections, Inc.

- Xerox Corp.

- Zanker Road Landfill

- Others

Recent Development

- In March 2025 – MTM Critical Metals formed a partnership with Vedanta to explore Red Mud recycling solutions using its proprietary Flash Joule Heating (FJH) technology. The collaboration aims to recover critical metals and produce green cement, potentially transforming Red Mud into valuable resources for various industries.

- In September 2024 – Recommerce X secured $3.6 million in seed funding to enhance its technology and scale operations, focusing on recycling industrial waste like plastics, metals, and e-waste. The startup aims to set new industry standards by providing traceable, tax-compliant recycled materials for medium to large manufacturers.

Report Scope

Report Features Description Market Value (2024) US$ 30.0 Bn Forecast Revenue (2034) US$ 53.2 Bn CAGR (2025-2034) 5.90% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Hazardous, Non-hazardous), By Product (Metals, Paper and Paperboard, Glass, Bulbs & Batteries, Electronics, Yard Trimmings, Food, Others), By End-User (Manufacturing, Construction, Automotive, Oil & Gas, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Advanced Disposal Services, Inc., Amdahl Corporation, Biffa plc, Casella Waste Systems, Inc., Clean Harbors, Inc., Cleanaway Waste Management Limited, Collins & Aikman, Covanta Holding Corporation, EnviroServ Waste Management (Pty) Ltd, Epson, Inc., Eurokey Recycling, Ltd., OCP Environment (UK) Limited, Fetzer Vineyards, GFL Environmental Inc., Interface, Inc., Northstar Recycling, Remondis SE & Co. KG, Renewi plc, Republic Services, Inc., RU Recycling- und Umweltdienst GmbH, Rubicon Global, Rumpke Consolidated Companies, Inc., Sims Metal Management Limited, Stericycle, Inc., SUEZ Environnement Company, Triple M Metal LP, US Ecology, Inc., Veolia Environnement S.A., Waste Connections, Inc., Xerox Corp., Zanker Road Landfill Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Industrial Waste Recycling and Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Industrial Waste Recycling and Services MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advanced Disposal Services, Inc.

- Amdahl Corporation

- Biffa plc

- Casella Waste Systems, Inc.

- Clean Harbors, Inc.

- Cleanaway Waste Management Limited

- Collins & Aikman

- Covanta Holding Corporation

- EnviroServ Waste Management (Pty) Ltd

- Epson, Inc.

- Eurokey Recycling, Ltd.

- FCC Environment (UK) Limited

- Fetzer Vineyards

- GFL Environmental Inc.

- Interface, Inc.

- Northstar Recycling

- Remondis SE & Co. KG

- Renewi plc

- Republic Services, Inc.

- RU Recycling- und Umweltdienst GmbH

- Rubicon Global

- Rumpke Consolidated Companies, Inc.

- Sims Metal Management Limited

- Stericycle, Inc.

- SUEZ Environnement Company

- Triple M Metal LP

- US Ecology, Inc.

- Veolia Environnement S.A.

- Waste Connections, Inc.

- Xerox Corp.

- Zanker Road Landfill

- Others