Global Pad-Mounted Switchgear Market Size, Share, And Business Benefits Report By Type (Air-insulated, Gas-insulated, Solid-Dielectric, Others), By Voltage (Up to 15 kV, 15-25 kV, 25-38 kV), By Standard (IEC, IEEE, Other Standards), By Application (Industrial, Commercial, Residential), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144372

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

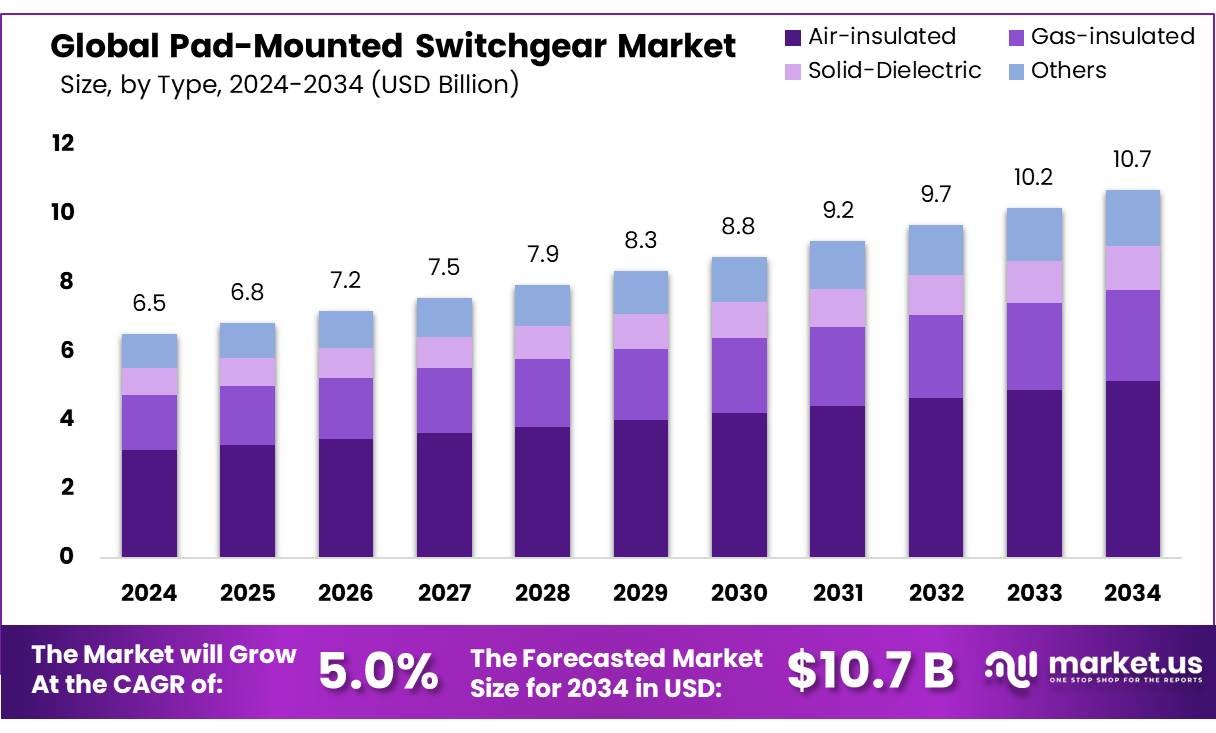

The Global Pad-Mounted Switchgear Market size is expected to be worth around USD 10.7 Billion by 2034, from USD 6.5 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

The pad-mounted switchgear market plays a pivotal role in the electrical distribution sector, providing critical infrastructure for managing, protecting, and controlling power in medium-voltage systems. Pad-mounted switchgear refers to outdoor electrical equipment installed on a concrete pad, typically housing switches, circuit breakers, and transformers within a weather-resistant enclosure.

The market is witnessing steady growth, driven by the increasing demand for efficient power distribution systems amid rapid industrialization and urbanization worldwide. Technological advancements, such as the integration of IoT-enabled monitoring systems, are further propelling market growth. The replacement of aging infrastructure in developed economies presents significant opportunities. The U.S. Department of Energy estimates that 70% of the nation’s grid infrastructure is over 25 years old, necessitating upgrades.

The global push for grid modernization has accelerated investments in transmission and distribution infrastructure, with underground systems gaining preference for their resilience and aesthetic appeal. In 2024, global electricity demand rose by approximately 3.6%, reaching 28,500 terawatt-hours (TWh), necessitating reliable switchgear solutions. The shift toward renewable energy sources, which accounted for 30% of global power generation in 2024, underscores the need for advanced switchgear to manage variable outputs.

Industrialization in emerging economies, particularly in Asia-Pacific, where industrial energy consumption grew by 5.2% annually, further fuels demand. Government initiatives promoting energy efficiency and safety standards also contribute significantly to market expansion. The rise of eco-friendly solutions, such as solid dielectric switchgear, aligns with sustainability goals, reducing greenhouse gas emissions by up to 15% compared to traditional gas-insulated systems. As industries prioritize automation and resilience, the pad-mounted switchgear market is poised for sustained growth, supported by innovation and infrastructure development.

Key Takeaways

- The global Pad-Mounted Switchgear Market is projected to grow from USD 6.5 billion in 2024 to USD 10.7 billion by 2034, at a 5.0% CAGR.

- Gas-insulated switchgear led the market in 2024 with a 48.2% share due to its reliability and space efficiency in urban areas.

- The up to 15 kV segment held a 42.5% share in 2024, favored for residential and light commercial applications.

- IEC standards dominated with a 47.8% share, valued for their global safety and reliability benchmarks.

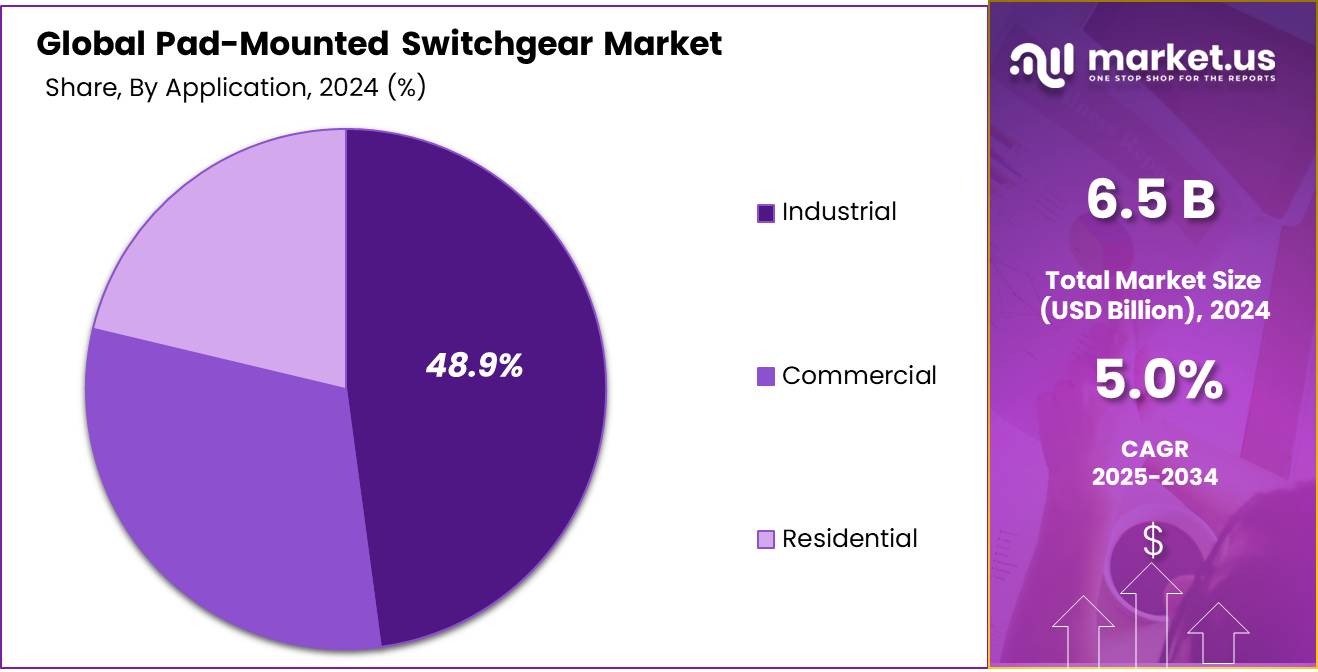

- The industrial sector accounted for 48.9% of the market in 2024, driven by demand for robust power distribution in manufacturing and mining.

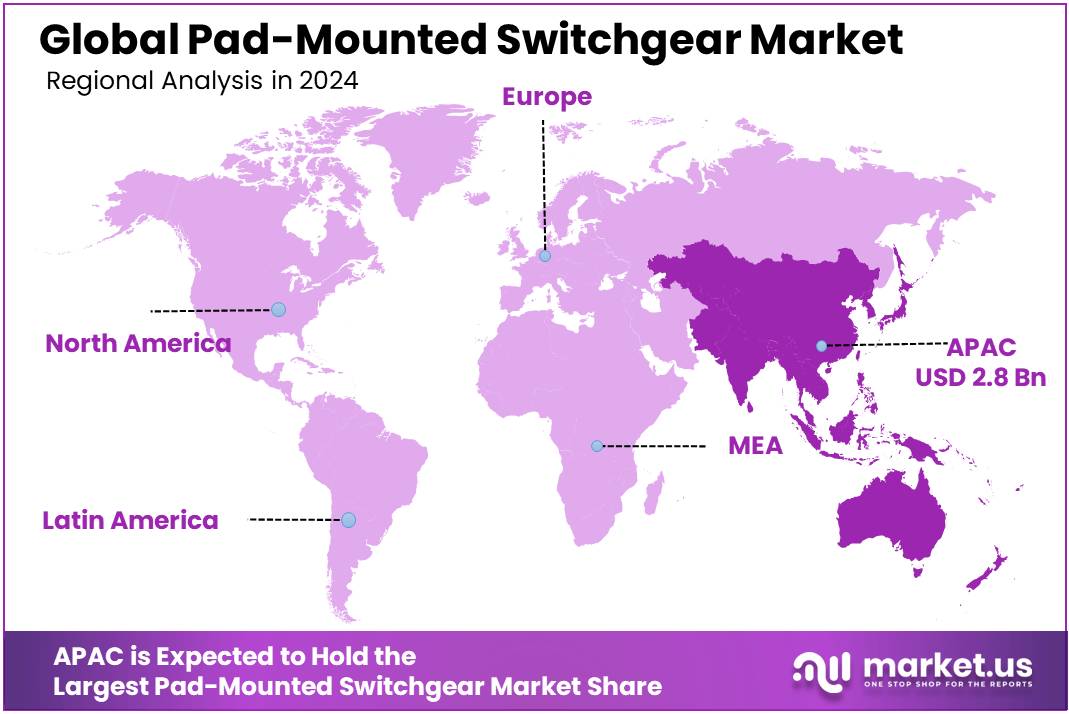

- APAC held a 43.7% market share of USD 2.8 billion in 2024, fueled by rapid urbanization and infrastructure growth in China, India, and Southeast Asia.

By Type

In 2024, the Gas-Insulated segment held a dominant position in the Pad-Mounted Switchgear market, securing over a 48.2% share. This type of switchgear is favored for its reliability and efficiency in managing electrical supply systems. It is especially prevalent in urban settings where space is at a premium and the need for dependable power distribution is critical.

Gas-insulated switchgear is compact, which makes it ideal for use in environments where land is costly or scarce. Its design reduces the risk of faults and maintenance requirements compared to other types, leading to its significant market share. This trend is likely to continue as urban infrastructure demands grow and technology in electrical components improves, maintaining its strong market presence.

By Voltage

In 2024, the Up to 15 kV segment of the Pad-Mounted Switchgear market held a dominant position, capturing more than a 42.5% share. This voltage range is commonly used across residential and light commercial applications, where lower voltage levels are sufficient for daily power needs. The popularity of this segment stems from its widespread application in distribution networks that supply electricity to smaller consumers who require a reliable power flow without the complexity and cost of higher voltage systems.

This segment’s robust performance is supported by the ongoing expansion of urban residential areas and the increasing electrification of rural regions, making it a key player in the overall market landscape. As infrastructural developments continue, the demand for up to 15 kV switchgear is expected to remain strong, reinforcing its significant market share.

By Standard

In 2024, the IEC standard in the Pad-Mounted Switchgear market held a dominant market position, capturing more than a 47.8% share. This standard is highly regarded for its robust guidelines, which ensure safety, reliability, and efficiency in electrical installations. The widespread adoption of IEC standards is driven by their international acceptance, which facilitates easier compliance for manufacturers and fosters trust among users globally.

Utilities and industrial sectors predominantly rely on these standards to maintain system compatibility and to meet rigorous safety regulations, contributing to the high market share of this segment. As global markets continue to emphasize regulatory compliance and system interoperability, the IEC standard segment is expected to maintain a strong foothold in the industry.

By Application

In 2024, the Industrial segment of the Pad-Mounted Switchgear market held a dominant position, capturing more than a 48.9% share. This segment’s strong performance is largely due to the essential role that pad-mounted switchgear plays in industrial settings, where robust, reliable electrical distribution is critical. Industries such as manufacturing, processing, and mining depend heavily on these systems to ensure continuous operation, minimize downtime, and support heavy machinery.

The compact and secure nature of pad-mounted switchgear makes it ideal for industrial applications, as it not only saves space but also offers enhanced safety features, crucial in environments where safety is paramount. As industrial activities expand and modernize, especially in emerging economies, the demand for reliable power solutions like pad-mounted switchgear is expected to remain high, keeping this segment at the forefront of the market.

Key Market Segments

By Type

- Air-insulated

- Gas-insulated

- Solid-Dielectric

- Others

By Voltage

- Up to 15 kV

- 15-25 kV

- 25-38 kV

By Standard

- IEC

- IEEE

- Other Standards

By Application

- Industrial

- Commercial

- Residential

Drivers

Expansion of Renewable Energy Projects as a Key Driver for Pad-Mounted Switchgear Demand

One major driving factor for the growth of the pad-mounted switchgear market is the rapid expansion of renewable energy projects around the world. Governments and private sectors are increasingly investing in renewable energy sources such as wind and solar to meet their energy needs while reducing carbon emissions.

According to the International Energy Agency (IEA), global renewable energy capacity is projected to expand by nearly 50%, an increase driven by supportive government policies and ongoing cost reductions for solar and wind power technologies. This surge in renewable energy projects necessitates the development of new infrastructure to connect generated power with grids and to ensure reliable energy distribution.

Pad-mounted switch gears are crucial in these setups because they offer a protected, enclosed system that is vital for handling the intermittent power supply that is characteristic of renewable sources. Their compact and robust design allows for installation in varied environments, often close to the energy source, minimizing energy loss over transmission distances.

Restraints

High Installation Costs: A Major Restraint in the Adoption of Pad-Mounted Switchgear

A significant restraint facing the pad-mounted switchgear market is the high cost associated with its installation. Pad-mounted switchgear units are encapsulated and often require specialized installation procedures, which can be considerably more expensive than other types of switchgear.

This aspect poses a substantial barrier, particularly for smaller utilities and in developing regions where budget constraints are more pronounced. For instance, the installation of pad-mounted switchgear not only involves the cost of the units themselves but also the ancillary expenses related to site preparation, protective enclosures, and integration into existing electrical systems.

According to data from leading energy and power organizations, the initial installation costs of pad-mounted switchgear can be up to 30% higher than conventional overhead switchgear systems. These figures reflect the significant financial investment required, which can deter potential adopters, especially in markets sensitive to initial capital outlays.

Opportunity

Urbanization and Infrastructure Development: Catalysts for Pad-Mounted Switchgear Growth

A major growth factor for the pad-mounted switchgear market is the rapid pace of urbanization and the corresponding need for robust urban electrical infrastructure. As cities expand and new urban areas are developed, the demand for efficient, reliable, and safe power distribution systems increases significantly.

Pad-mounted switchgear is integral to these systems, offering a compact and less obtrusive solution that fits well in urban environments. Urbanization is accelerating globally, with the United Nations projecting that 68% of the world’s population will live in urban areas by 2050.

This demographic shift drives the construction of residential and commercial buildings, necessitating the expansion of electrical infrastructure to serve these new developments. Pad-mounted switchgear is particularly suited for these applications due to its ground-level installation, which is less intrusive compared to pole-mounted systems and, therefore, more compatible with urban aesthetic and safety standards.

Trends

Integration of Smart Technologies in Pad-Mounted Switchgear

A significant emerging factor in the pad-mounted switchgear market is the integration of smart technologies. As the global energy sector shifts towards smarter and more efficient systems, pad-mounted switchgear equipped with advanced monitoring and control capabilities is becoming increasingly popular. These smart switch gears are capable of providing real-time data on power usage and system performance, enhancing operational efficiency and reliability.

The integration of IoT (Internet of Things) technologies allows for remote monitoring and management of power distribution networks. This capability is crucial in minimizing downtime and improving service delivery in both urban and remote settings. Energy and power organizations highlight that smart pad-mounted switch gears can reduce operational costs by up to 25% through improved fault detection and maintenance scheduling.

Regional Analysis

Robust Growth in APAC’s Pad-Mounted Switchgear Market

In the Asia-Pacific (APAC) region, the pad-mounted switchgear market has experienced significant growth, capturing a dominant 43.7% market share, valued at approximately USD 2.8 billion. This substantial market presence is driven by rapid industrialization and urbanization across major economies such as China, India, and Southeast Asia.

The region’s commitment to enhancing electrical infrastructure and increasing investments in renewable energy projects further supports the demand for pad-mounted switchgear. Governments in APAC have launched numerous initiatives aimed at expanding and modernizing power grids to accommodate the growing population and the escalating energy consumption.

The push towards rural electrification in countries like India and Indonesia presents additional opportunities for the expansion of the pad-mounted switchgear market. These efforts are part of broader national strategies to ensure comprehensive access to electricity and to boost economic growth through enhanced energy security.

APAC’s strategic focus on building sustainable and smart cities also plays a crucial role in the adoption of innovative and compact pad-mounted switchgear solutions suitable for densely populated urban areas. As the region continues to develop at a brisk pace, the demand for sophisticated and reliable electrical infrastructure is expected to keep driving the pad-mounted switchgear market forward, solidifying APAC’s position as a leading market in this sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- ABB is a leading figure in the global pad-mounted switchgear market, renowned for its innovative electrical products and solutions. The company leverages advanced technology to deliver high-performance switchgear that meets the stringent demands of modern power distribution networks. ABB’s offerings are designed to enhance reliability, efficiency, and safety in various applications, from urban infrastructure to industrial projects, solidifying its position as a key player in the industry.

- Actom stands out in the pad-mounted switchgear market with its comprehensive range of solutions tailored to both local and international markets. The company focuses on sustainable and efficient power delivery, making significant contributions to infrastructure projects across multiple regions. Actom’s commitment to quality and its customer-centric approach have helped it maintain a strong market presence and continue to drive innovation in electrical distribution.

- Beijing Kylin Power & Technology specializes in the development and manufacturing of pad-mounted switchgear suited for a diverse set of applications. The company is committed to advancing power distribution technologies in China and beyond, focusing on reliability and performance. With a strong emphasis on research and development, Beijing Kylin is rapidly emerging as a key competitor in the Asian market.

- Eaton is a global powerhouse in power management solutions, including pad-mounted switchgear. The company’s products are integral to managing electrical power efficiently across various sectors. Eaton’s dedication to sustainability and smart power solutions enables it to offer products that not only meet but also exceed the evolving demands of the energy sector, making it a vital player in the market.

- Eaton Corporation PLC continues to drive advancements in the pad-mounted switchgear market with its robust and reliable products. The company focuses on innovative technologies that promote safe and efficient energy management in several critical areas, including commercial buildings and renewable energy installations. Eaton Corporation PLC’s global reach and strong focus on technological innovation keep it at the forefront of the industry.

Top Key Players in the Market

- ABB

- Actom

- Beijing Kylin Power & Technology

- Eaton

- Eaton Corporation PLC.

- Entec Electric & Electronic Co.

- Federal Pacific

- G Electric

- G&W Electric

- Ghorit Electricals

- Hubbel Incorporated

- KDM Steel

- Ningbo Tianan Group

- NOJA Power

- Ormazabal

- Park Detroit and Park Electric

- Powell

- Power Grid Solution Inc.

- S Electric Company

- S&C Electric

- Switchgear Power Systems

- Telawne Power Equipments Pvt. Ltd.

- TIEPCO

- Trayer Engineering Corporation

Recent Developments

- In 2024, ABB announced enhancements to its UniGear switchgear portfolio, integrating eco-efficient technologies like AirPlus, a gas-insulated solution reducing environmental impact. This aligns with global decarbonization trends. ABB deployed these solutions in several European utility projects in 2024, improving grid reliability.

- In 2024, Actom reported the completion of a major contract to supply medium-voltage switchgear, including pad-mounted units, for a rural electrification project in South Africa. This project, backed by the South African Department of Mineral Resources and Energy, underscores Actom’s role in expanding reliable power access.

Report Scope

Report Features Description Market Value (2024) USD 6.5 Billion Forecast Revenue (2034) USD 10.7 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Air-insulated, Gas-insulated, Solid-Dielectric, Others), By Voltage (Up to 15 kV, 15-25 kV, 25-38 kV), By Standard (IEC, IEEE, Other Standards), By Application (Industrial, Commercial, Residential) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB, Actom, Beijing Kylin Power & Technology, Eaton, Eaton Corporation PLC., Entec Electric & Electronic Co., Federal Pacific, G Electric, G&W Electric, Ghorit Electricals, Hubbel Incorporated, KDM Steel, Ningbo Tianan Group, NOJA Power, Ormazabal, Park Detroit and Park Electric, Powell, Power Grid Solution Inc., S Electric Company, S&C Electric, Switchgear Power Systems, Telawne Power Equipments Pvt. Ltd., TIEPCO, Trayer Engineering Corporation Customization Scope Customization for segments, regional/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), and Corporate Use License (Unlimited Users and Printable PDF)  Pad-Mounted Switchgear MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Pad-Mounted Switchgear MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Actom

- Beijing Kylin Power & Technology

- Eaton

- Eaton Corporation PLC.

- Entec Electric & Electronic Co.

- Federal Pacific

- G Electric

- G&W Electric

- Ghorit Electricals

- Hubbel Incorporated

- KDM Steel

- Ningbo Tianan Group

- NOJA Power

- Ormazabal

- Park Detroit and Park Electric

- Powell

- Power Grid Solution Inc.

- S Electric Company

- S&C Electric

- Switchgear Power Systems

- Telawne Power Equipments Pvt. Ltd.

- TIEPCO

- Trayer Engineering Corporation