Global Building Integrated Photovoltaics (BIPV) Market Size, Share, Statistics Analysis Report By Technology (Crystalline Silicon, Thin Film, Others), By Application (Roof, Windows, Wall, Façade, Others), By End-use (Industrial, Commercial, Residential, Utility) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142543

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

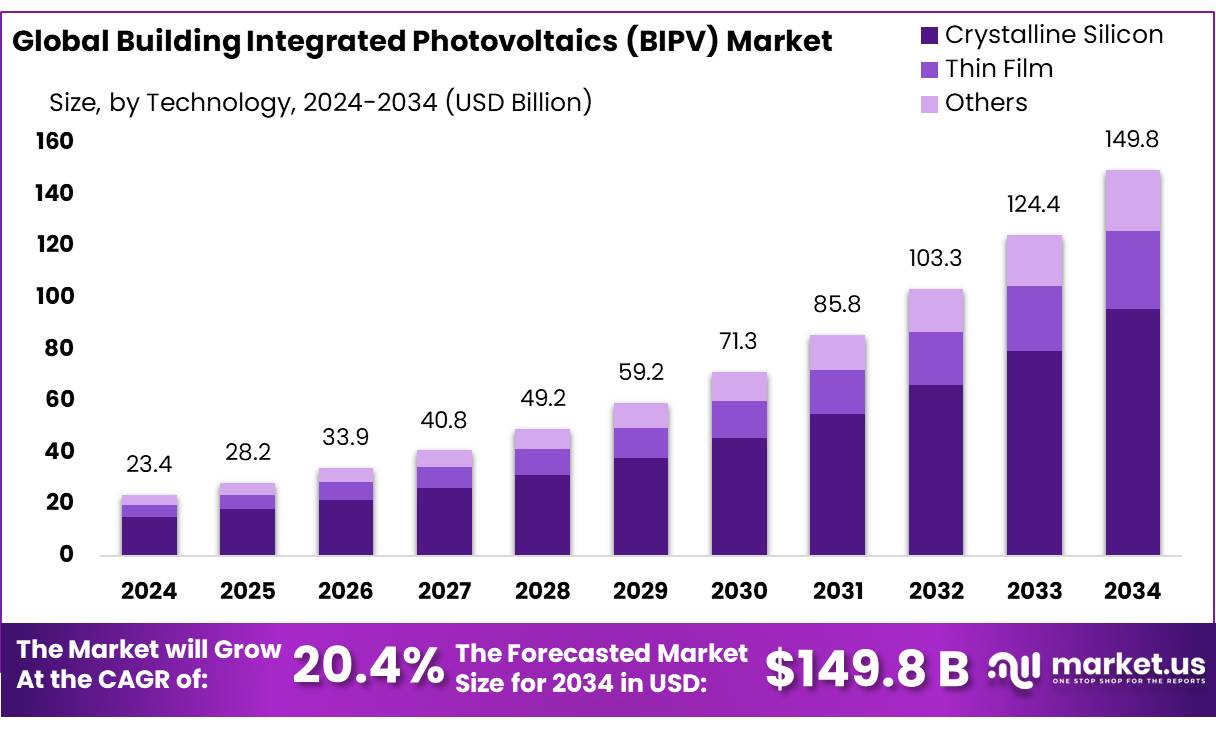

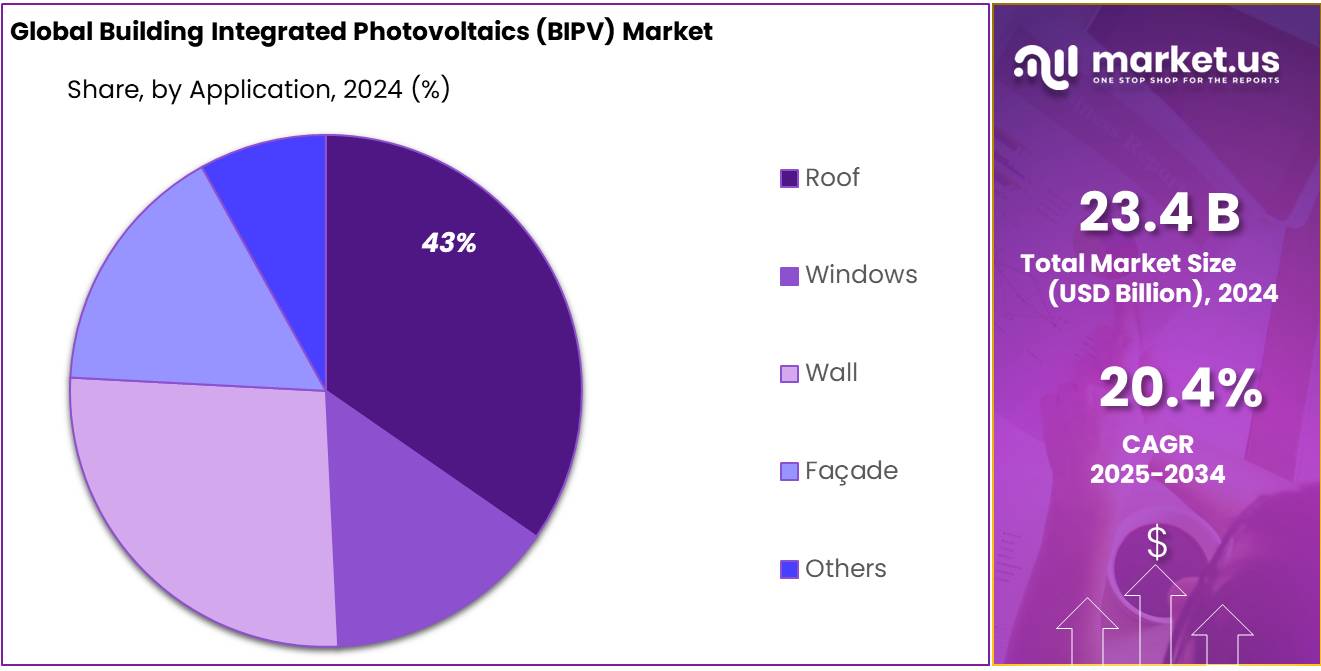

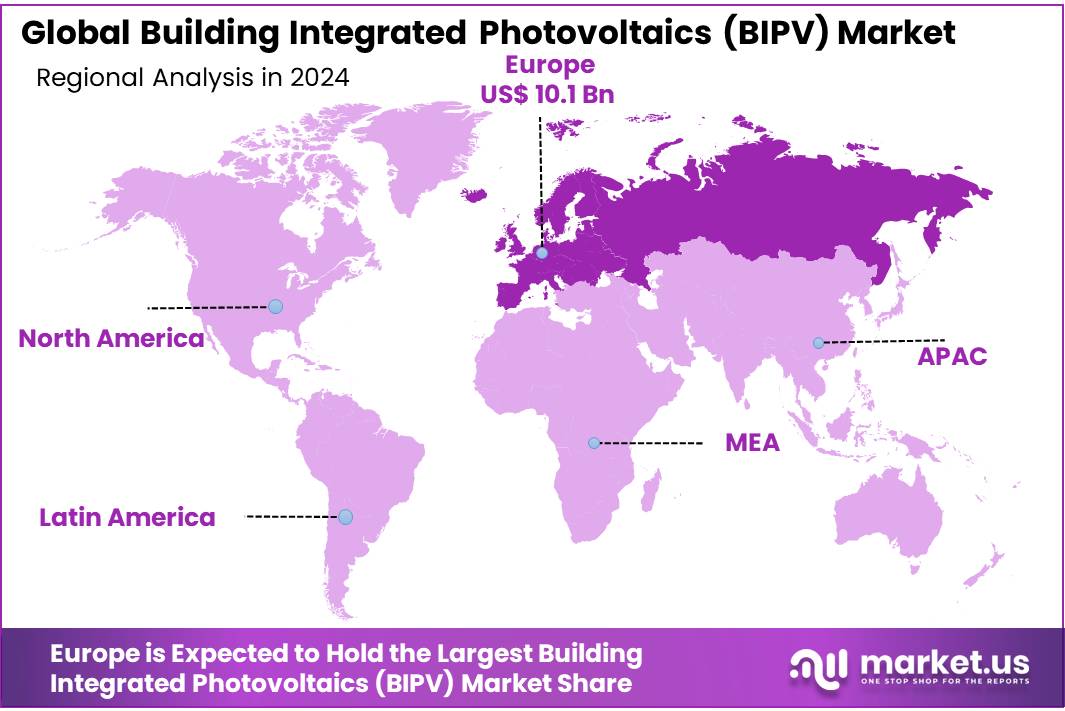

The Global Building Integrated Photovoltaics (BIPV) Market size is expected to be worth around USD 149.8 Bn by 2034, from USD 23.4 Bn in 2024, growing at a CAGR of 20.4% during the forecast period from 2025 to 2034. In 2024, Europe dominated the market with a 43.40% share, generating USD 10.1 Billion in revenue.

Building-integrated photovoltaics (BIPVs) are solar power components embedded in building structures like roofs, facades, and skylights. These systems typically consist of photovoltaic modules, backup generators, charge controllers, energy storage solutions, and other essential hardware. BIPV materials offer several advantages over conventional options, including better architectural integration, on-site power generation, zero emissions, substantial energy savings, and enhanced shading.

The growing demand for BIPVs is driven by rapid technological advancements in photovoltaic (PV) materials and strong governmental support that encourages the widespread adoption of these systems. Additionally, the increasing adoption of green building practices is expected to further contribute to the growth of this market, providing new opportunities for expansion.

Leading market players are adopting strategies such as launching new products, mergers and acquisitions, and forming strategic partnerships to strengthen their market positions. For example, in June 2022, Mitrex, a Canadian company specializing in BIPV systems, introduced the largest tandem photovoltaic panel capable of generating up to 800W of power. These panels feature unique anti-reflecting technology and are crafted from monocrystalline silicon solar cells, optimizing electrical energy generation.

In June 2024, an international alliance of major green building rating system organizations launched a global guide aimed at assisting the $35 trillion investment needed by 2030 to achieve global energy transition goals. The International Energy Agency (IEA) has warned that buildings account for over 30% of global energy consumption and more than 25% of emissions. Many current structures will remain in use by 2050, which will require significant investments in sustainable upgrades to meet climate objectives.

Technological advancements in solar panels and materials have greatly improved their integration and efficiency, driving wider adoption of BIPV systems. As a result, these innovations are playing a pivotal role in supporting sustainable building practices and contributing to global energy transition efforts. The continued growth of the BIPV market is expected to be fueled by the ongoing advancements in solar technology and increasing governmental incentives aimed at reducing emissions and promoting energy efficiency.

Key Takeaways

- Building Integrated Photovoltaics (BIPV) Market size is expected to be worth around USD 149.8 Bn by 2034, from USD 23.4 Bn in 2024, growing at a CAGR of 20.4%.

- Power Building Integrated Photovoltaics (BIPV) held a dominant market position, capturing more than a 35.20% share.

- Conductor Materials held a dominant market position, capturing more than a 43.20% share.

- Commercial sector held a dominant market position in the Building Integrated Photovoltaics (BIPV) market, capturing more than a 38.40% share.

- Europe stands out as a dominant region, commanding a significant 43.40% market share with a valuation of approximately USD 10.1 billion.

Analysts’ Viewpoint

The Building Integrated Photovoltaics (BIPV) market is experiencing significant momentum, driven by the global shift towards sustainable energy solutions and the increasing demand for energy-efficient buildings. As urbanization accelerates and environmental concerns become more pressing, BIPV technology presents a unique opportunity to seamlessly integrate renewable energy generation into the built environment, offering both energy savings and aesthetic benefits.

Technological advancements in solar panel efficiency and integration techniques have positioned BIPV as a promising alternative to traditional solar installations. These innovations allow solar cells to be directly incorporated into building materials such as windows, rooftops, and facades, thus enhancing the building’s overall energy performance without compromising its design. The growing adoption of BIPV systems in both residential and commercial sectors is a clear reflection of the market’s potential to revolutionize the way buildings are designed and constructed.

Key drivers for the BIPV market include the increasing demand for energy-efficient buildings, government incentives and regulations promoting renewable energy, and advancements in photovoltaic technology. As cities around the world strive to meet carbon reduction targets, BIPV is becoming a crucial element in achieving net-zero energy buildings. Furthermore, the continuous development of flexible, lightweight, and aesthetically appealing solar products is expected to expand BIPV’s adoption across a wider range of architectural designs.

By Technology

Power BIPV leads with 35.20%, driven by demand for sustainable and energy-efficient building solutions.

In 2024, Power Building Integrated Photovoltaics (BIPV) held a dominant market position, capturing more than a 35.20% share. This segment has thrived due to increasing demand for sustainable architectural solutions that integrate solar power generation directly into building materials. The Power BIPV products are particularly popular in commercial and residential constructions where energy efficiency is a priority.

Over the year, advancements in technology and materials science have allowed Power BIPV systems to become more cost-effective and efficient, which has further driven their market penetration. The ease of installation and the long-term savings on energy costs have made them a favored choice among architects and property developers looking to meet stricter energy regulations and sustainability goals.

By Application

Conductor Materials lead with 43.20%, driven by their crucial role in efficient BIPV roofing solutions.

In 2024, Conductor Materials held a dominant market position, capturing more than a 43.20% share. This segment’s significant market share is driven by the crucial role that conductor materials play in the efficiency and performance of Building Integrated Photovoltaics (BIPV) systems, particularly in roofing applications. The increased focus on energy-efficient buildings and the integration of renewable energy sources directly into building envelopes have heightened the demand for these materials.

Conductor materials, essential for transmitting the electricity generated by BIPV cells, have seen innovations aimed at enhancing their efficiency and durability, making them more appealing for both residential and commercial construction. As buildings aim to meet green energy standards and reduce carbon footprints, the reliance on effective conductor materials in BIPV systems is projected to grow.

By End-use

Commercial sector leads with 38.40%, fueled by the push for energy-efficient and sustainable buildings.

In 2024, the commercial sector held a dominant market position in the Building Integrated Photovoltaics (BIPV) market, capturing more than a 38.40% share. This prominence is largely attributed to the growing emphasis on sustainable development and energy efficiency in commercial construction projects. Commercial buildings, including offices, shopping centers, and hospitality venues, increasingly integrate BIPV technologies to reduce operational costs and enhance environmental credentials.

The adoption of BIPV in the commercial sector is driven by not only regulatory pressures and incentives for green building practices but also by the economic benefits associated with lower energy bills and potential tax advantages. As more companies commit to carbon neutrality and energy independence, the demand for integrated photovoltaic solutions that do not compromise building aesthetics continues to rise.

Key Market Segments

By Technology

- Crystalline Silicon

- Single CrystalCrystalline Silicon

- PolycrystallineThin Film

- MicrocrystallineOthers

- Others

- Thin Film

- Cadmium Telluride

- Copper Indium Gallium Selenide

- Amorphous Silicon

- Gallium Arsenide

- Others

- Others

By Application

- Roof

- Windows

- Wall

- Façade

- Others

By End-use

- Industrial

- Commercial

- Residential

- Utility

Drivers

Increasing Demand for Energy-Efficient Buildings

One of the major driving factors for the adoption of Building Integrated Photovoltaics (BIPV) is the escalating demand for energy-efficient buildings across the globe. As concerns over energy consumption and carbon emissions intensify, governments and organizations are implementing stricter energy regulations and standards for new constructions and renovations. For instance, according to data from the International Energy Agency (IEA), buildings account for nearly 28% of global energy-related CO2 emissions, and enhancing building efficiency could significantly reduce this footprint.

Recognizing the potential of energy savings and emissions reduction, several government initiatives worldwide are promoting the integration of renewable energy solutions like BIPV into buildings. For example, the European Union’s directive on the energy performance of buildings mandates that all new buildings constructed within the EU from 2020 onwards must be nearly zero-energy buildings (NZEBs). This has greatly fueled the integration of photovoltaic systems into building skins, not just as additions but as essential components of the building envelope.

Moreover, prominent building and construction organizations advocate for sustainable building practices that include BIPV technologies. These organizations highlight the dual benefits of BIPV: reducing energy costs and enhancing the aesthetic appeal of buildings. The BIPV technology seamlessly integrates into roofs, facades, and windows, transforming ordinary building materials into energy-producing assets. As the cost of photovoltaic technology continues to decline and its efficiency improves, the economic case for BIPV strengthens, making it a compelling choice for both new constructions and retrofitting existing buildings.

Restraints

High Initial Costs and Market Adoption Challenges

One significant restraining factor for the widespread adoption of Building Integrated Photovoltaics (BIPV) is the high initial cost associated with its installation and integration. Despite the long-term benefits of energy savings and reduced carbon emissions, the upfront investment required for BIPV systems can be a considerable barrier for many stakeholders, particularly in the residential and small to medium-sized commercial sectors.

Building and construction industry reports indicate that the cost of BIPV systems can be up to 50% higher than traditional photovoltaic installations, primarily due to the specialized materials and the complexity of integration into building facades, roofs, and windows. This high initial cost not only affects the decision-making of individual homeowners but also impacts developers and builders who may be hesitant to invest in more expensive technologies that could increase the overall cost of construction projects.

Furthermore, while government initiatives and incentives aim to reduce the financial burden and encourage the adoption of renewable energy technologies, these programs can vary significantly by region and may not always fully offset the higher costs of BIPV systems. For example, in some areas, subsidies and tax incentives are substantial, making BIPV a more attractive option. However, in regions without robust support, the economic case for BIPV becomes less compelling.

The adoption of BIPV is also hindered by a lack of awareness and technical expertise in integrating these systems into diverse building architectures. Many architects, engineers, and builders are still unfamiliar with the best practices for installing BIPV, which can lead to hesitancy in recommending or implementing these solutions.

Opportunity

Technological Advancements and Regulatory Support Enhancing BIPV Adoption

A significant growth opportunity for the Building Integrated Photovoltaics (BIPV) market lies in the ongoing technological advancements and increasing regulatory support for green building practices. As technology progresses, the efficiency of BIPV systems is improving, and their costs are gradually decreasing, making them more accessible and appealing to a broader range of consumers and industries.

Leading building and construction organizations highlight that modern BIPV systems not only serve as energy generators but also replace conventional building materials with aesthetically pleasing, functional alternatives. For example, BIPV can be integrated into glass windows, roofs, and facades without compromising building design. This dual functionality—energy production and structural utility—provides a compelling value proposition to architects and builders looking to meet both the aesthetic and functional requirements of modern buildings.

Government initiatives around the world are also playing a crucial role in fostering the growth of the BIPV market. In regions like the European Union and several states in the USA, regulations and building codes are increasingly mandating the incorporation of renewable energy solutions in new constructions and major renovations. For instance, the European Commission has set ambitious targets for reducing greenhouse gas emissions, with a significant focus on increasing the energy efficiency of buildings, thereby promoting the adoption of technologies like BIPV.

Additionally, governments are providing incentives such as tax breaks, subsidies, and enhanced feed-in tariffs specifically for renewable energy technologies integrated into buildings, which further reduce the financial hurdles associated with BIPV systems. These supportive measures are crucial for encouraging investments in BIPV projects and enhancing their economic viability.

Trends

Aesthetic Integration and Smart Building Compatibility

One of the latest trends in the Building Integrated Photovoltaics (BIPV) market is the focus on aesthetic integration and compatibility with smart building technologies. As the push for more environmentally friendly building solutions grows, BIPV systems are increasingly being designed to blend seamlessly into the architecture of buildings without compromising their aesthetic appeal or functionality.

This trend is driven by advancements in BIPV technology that allow photovoltaic materials to be incorporated into architectural elements such as glass facades, shading systems, and roofing tiles. These elements are not only functional, generating electricity, but also visually appealing, offering a range of colors and textures that enhance the building’s design. According to industry reports from leading building and construction organizations, there has been a significant uptick in the demand for customizable photovoltaic materials that can adapt to various architectural styles and preferences.

Furthermore, integration with smart building technologies is enhancing the appeal of BIPV systems. Modern BIPV solutions are increasingly being equipped with sensors and connected technologies that enable them to be integrated into the building’s overall energy management systems. This allows for more efficient use of the energy generated by the BIPV systems and aligns with the broader trends towards smart buildings that optimize energy consumption and indoor environmental quality.

Government initiatives that promote energy efficiency in buildings are also supporting this trend. For instance, various national and regional policies encourage the integration of renewable energy sources into both new and existing buildings as part of broader efforts to achieve energy independence and reduce carbon footprints.

Regional Analysis

In the Building Integrated Photovoltaics (BIPV) market, Europe stands out as a dominant region, commanding a significant 43.40% market share with a valuation of approximately USD 10.1 billion. This robust market position can be attributed to a combination of advanced environmental regulations, high energy costs, and strong government support for renewable energy technologies across the continent.

Europe has been at the forefront of integrating renewable energy solutions into building designs, driven by stringent EU directives aimed at reducing carbon emissions and enhancing energy efficiency in buildings. The European Union’s ambitious targets for energy reduction and its mandate that all new buildings be nearly zero-energy by 2020 have significantly fueled the adoption of BIPV technologies. Countries like Germany, the United Kingdom, and France lead in the implementation, supported by favorable policies such as feed-in tariffs and tax incentives for green building practices.

Furthermore, the European market benefits from high public and corporate awareness regarding the advantages of sustainable construction, making BIPV a preferred choice among architects and developers. This is complemented by the presence of numerous leading BIPV manufacturers and suppliers in Europe who are continuously innovating in terms of materials and photovoltaic technology, thus pushing the boundaries of what BIPV can achieve in terms of aesthetics and efficiency.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AGC Solar is renowned for its pioneering role in the BIPV market, providing advanced glass solutions that integrate photovoltaic cells. These products are favored for their aesthetic appeal and high efficiency, making them suitable for both commercial and residential buildings. AGC Solar’s commitment to innovation and sustainability has positioned it as a leader in the solar glass industry, helping architects and builders meet energy efficiency standards while maintaining design integrity.

Canadian Solar Inc. stands out in the global BIPV market with its comprehensive range of solar solutions that cater to both utility-scale projects and individual residential needs. Known for its robust, high-efficiency panels, Canadian Solar also offers BIPV modules that integrate seamlessly into building facades and rooftops. The company’s global reach and strong focus on sustainable technology development make it a key player in driving forward the adoption of integrated photovoltaic solutions.

Carmanah Technologies Corporation is a key player in the renewable energy sector, specializing in solar lighting and building-integrated photovoltaic solutions for industrial, commercial, and municipal applications. Their BIPV products are highly regarded for their reliability and efficiency, enhancing building aesthetics while contributing to substantial energy savings. Carmanah’s commitment to high-quality, durable products has earned them a reputable status in the industry.

Top Key Players

- Agc Solar

- Ankara Solar AS

- Canadian Solar Inc.

- Carmanah Technologies Corporation

- Changzhou Almaden Co limited

- Ertex Solartechnik Gmbh

- Hanergy Mobile Energy Holding Group Limited

- Heliatek Gmbh

- Merck KGaA

- Nano PV Solar Inc.

- Onyx Solar Group

- Solar day

- Solaria Corporation

- Solarwindow Technologies, Inc.

- Tesla Inc

- The Solaria Corporation

- Onyx Solar Group LLC.

Recent Developments

In 2024, Canadian Solar reported a healthy gross margin of 16.4%, exceeding their projected range.

Ankara Solar AS is emerging as a significant player in the Building Integrated Photovoltaics (BIPV) market, particularly noted for its innovative approach to integrating photovoltaic systems into building designs.

Report Scope

Report Features Description Market Value (2024) USD 23.4 Bn Forecast Revenue (2034) USD 149.8 Bn CAGR (2025-2034) 20.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Crystalline Silicon, Thin Film, Others), By Application (Roof, Windows, Wall, Façade, Others), By End-use (Industrial, Commercial, Residential, Utility) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agc Solar, Ankara Solar AS, Canadian Solar Inc., Carmanah Technologies Corporation, Changzhou Almaden Co limited, Ertex Solartechnik Gmbh, Hanergy Mobile Energy Holding Group Limited, Heliatek Gmbh, Merck KGaA, Nano PV Solar Inc., Onyx Solar Group, Solar day, Solaria Corporation, Solarwindow Technologies, Inc., Tesla Inc, The Solaria Corporation, Onyx Solar Group LLC. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Building Integrated Photovoltaics (BIPV) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Building Integrated Photovoltaics (BIPV) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Agc Solar

- Ankara Solar AS

- Canadian Solar Inc.

- Carmanah Technologies Corporation

- Changzhou Almaden Co limited

- Ertex Solartechnik Gmbh

- Hanergy Mobile Energy Holding Group Limited

- Heliatek Gmbh

- Merck KGaA

- Nano PV Solar Inc.

- Onyx Solar Group

- Solar day

- Solaria Corporation

- Solarwindow Technologies, Inc.

- Tesla Inc

- The Solaria Corporation

- Onyx Solar Group LLC.