Diesel Generator Market Report By Power Rating (Below 75 Kva, 75-375 Kva, 375-750 Kva, Above 750 Kva), By Portability (Stationary, Portable), By Application, By End User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2024

- Report ID: 22188

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

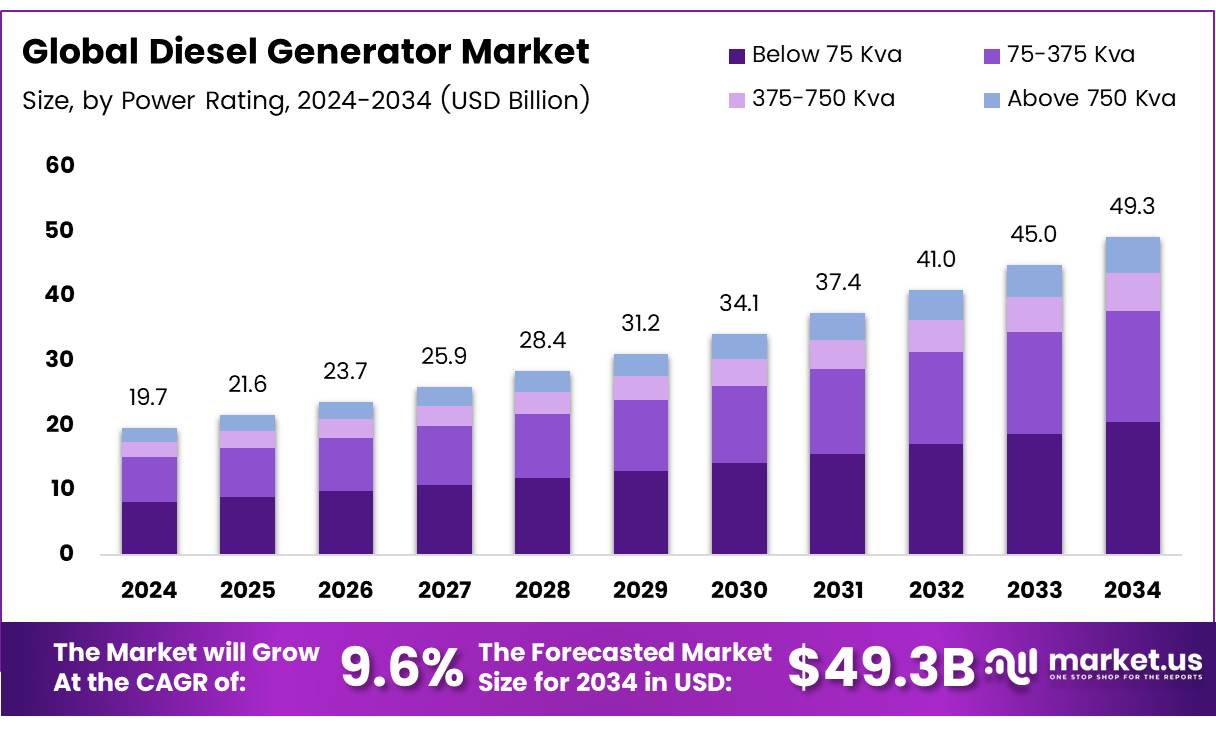

The Global Diesel Generator Market size is expected to be worth around USD 49.3 Billion by 2034, from USD 19.7 Billion in 2024, growing at a CAGR of 9.6% during the forecast period from 2025 to 2034.

The Diesel Generator Market encompasses the global demand and supply of diesel-powered generators, which serve as a reliable source of backup or primary power across various sectors.

These generators are pivotal in providing emergency power during outages, ensuring continuous operations in industries such as healthcare, telecommunications, construction, and data centers, among others. With advancements in technology, the market is seeing innovations aimed at improving fuel efficiency, reducing emissions, and enhancing durability.

In the context of the Diesel Generator Market, the U.S. Energy Information Administration’s 2022 data reveals pivotal insights into primary energy consumption across various sectors in the United States, totaling 100.41 quadrillion British thermal units (Btu).

The distribution of energy consumption—electric power (37.75 quadrillion Btu), transportation (27.47 quadrillion Btu), industrial (23.18 quadrillion Btu), residential (7.11 quadrillion Btu), and commercial (4.90 quadrillion Btu)—underscores the critical demand for reliable power sources across diverse applications.

This data highlights the substantial role of diesel generators in ensuring uninterrupted power supply, particularly in the electric power, industrial, and commercial sectors. The dependency on diesel generators is accentuated during power outages or in remote locations where grid connectivity is unreliable.

Furthermore, the significant energy requirements of the transportation sector suggest potential growth opportunities for mobile diesel generators, catering to the needs of construction sites, oil and gas exploration, and emergency services.

The Diesel Generator Market is poised for growth, driven by the essential need for backup power solutions across critical sectors. Innovations aimed at enhancing fuel efficiency, reducing emissions, and integrating renewable energy sources are key trends shaping the market’s future.

Key Takeaways

- Global Diesel Generator Market is anticipated to reach approximately USD 49.3 Billion by 2033, exhibiting a robust CAGR of 9.6% from 2024 to 2033.

- Generators below 75 Kva dominate the market with a share of 46.8%, owing to their versatility, affordability, and suitability for various sectors like residential, small commercial establishments, healthcare, and telecommunications.

- Stationary generators hold a dominant market share of 67.9%, driven by their extensive use in industrial, commercial, and infrastructure projects where continuous, reliable power is critical.

- Continuous Load generators command a market share of 53.6%, meeting the critical need for uninterrupted power supply in sectors like healthcare, data centers, and manufacturing facilities.

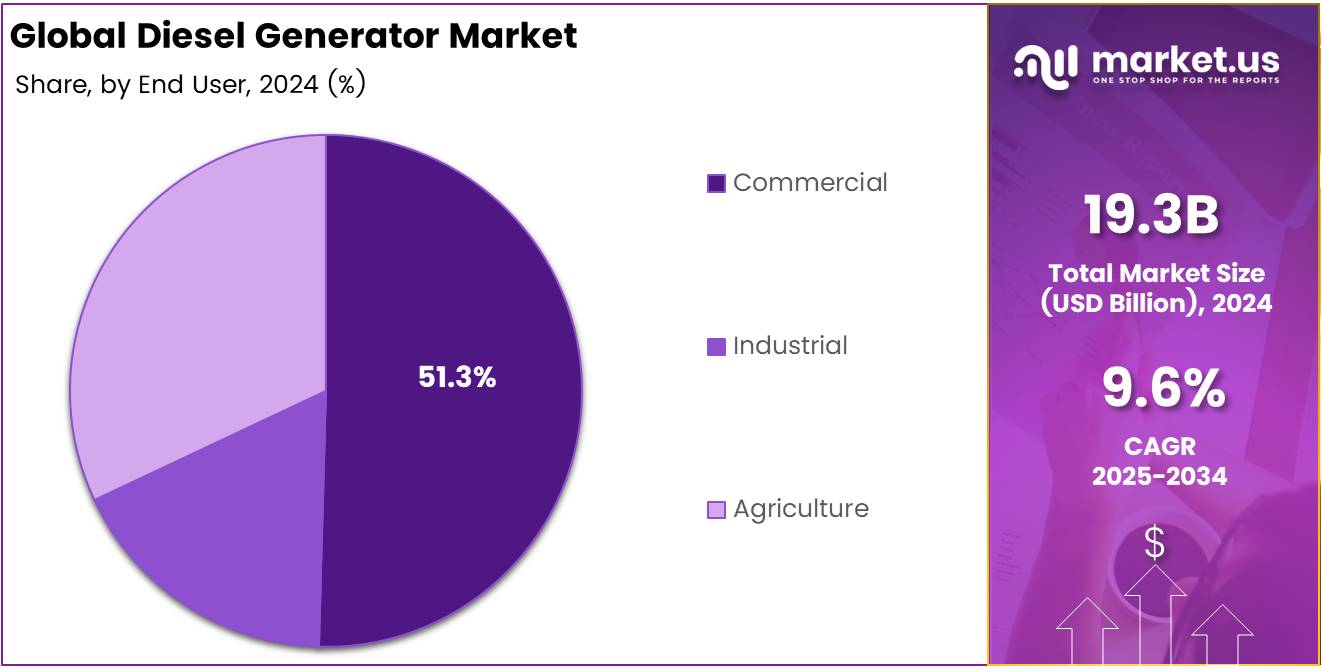

- The Commercial sector holds the largest market share at 51.3%, emphasizing the significant reliance of offices, retail centers, hospitals, and data centers on diesel generators for continuous operations.

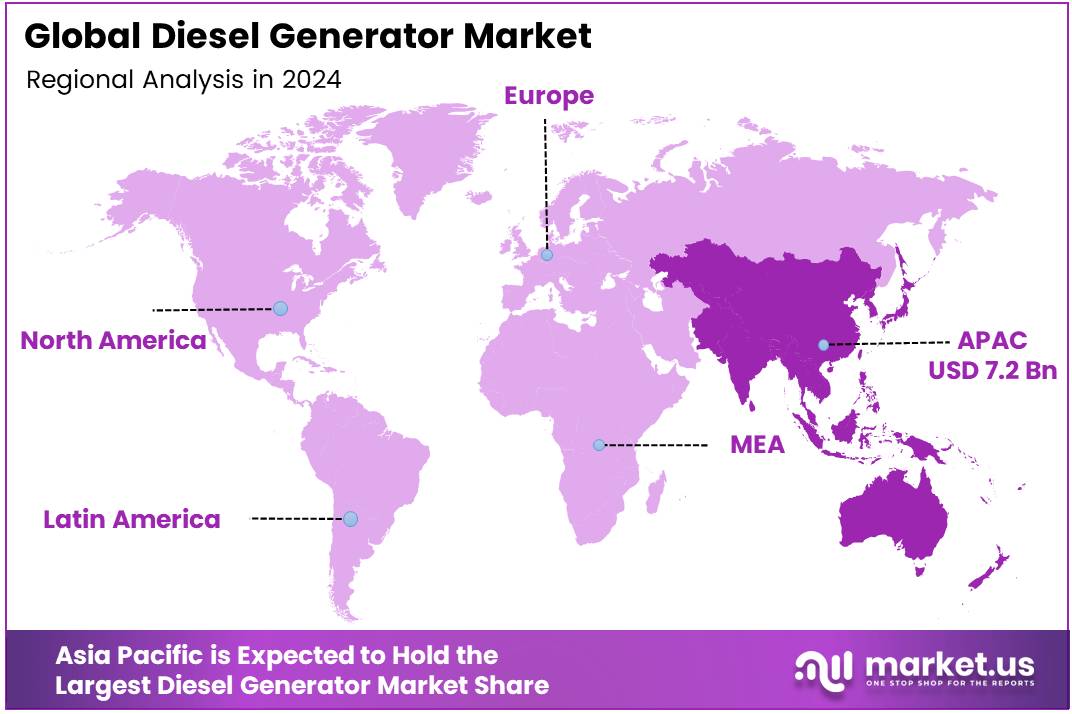

- Asia Pacific dominates the market with a 37.8% share, driven by rapid industrialization, extensive infrastructure development, and increasing demand for reliable power sources, particularly in emerging economies like China and India.

Driving Factors

Growing Demand for Backup Power Supply Drives Market Growth

The increasing frequency of power outages significantly contributes to the growth of the Diesel Generator Market. The American Society of Civil Engineers highlighted that in 2015, there were 3,571 total power outages in the U.S., with an average duration of 49 minutes. Diesel generators, known for their reliability and quick startup time, are essential in providing immediate backup power during such outages.

As electrical grid reliability becomes a concern with aging infrastructure and extreme weather events, the demand for diesel generators as a reliable backup power solution is witnessing a marked increase. This trend underscores the critical role of diesel generators in ensuring uninterrupted power supply across various sectors, driving market expansion.

Expansion of Telecom Sector Fuels Diesel Generator Demand

The rapid expansion of the telecom sector is a major driver for the Diesel Generator Market. Telecom towers and data centers, which require continuous power to ensure uninterrupted service, extensively use diesel generators for backup power.

With the growth in telecom infrastructure, as evidenced by companies like American Tower and Crown Castle operating tens of thousands of towers in the United States, the need for reliable backup power solutions is more pressing than ever. The proliferation of mobile devices and the expansion of digital networks globally necessitate robust power backup solutions, propelling the demand for diesel generators in the telecom industry.

Mining Sector Growth Catalyzes Diesel Generator Market Expansion

The global expansion of mining activities, especially in remote locations, is a key driver for the Diesel Generator Market. Mines require a continuous power supply for operations and mining equipment. Here, diesel generators are the preferred source for backup power due to their reliability and the ability to operate in challenging environments.

The Latin American mining sector’s expected growth at a 5.6% CAGR through 2025 exemplifies the broader trend of increased mining activity worldwide. This growth not only highlights the sector’s reliance on diesel generators for power but also indicates the potential for market expansion as mining companies invest in ensuring their operations remain powered under all circumstances.

Restraining Factors

High Noise and Emission Levels Restrain Market Growth

The significant noise and emissions produced by diesel generators, including NOx, CO2, and particulate matter, pose substantial challenges to the Diesel Generator Market. These environmental and health concerns have prompted governments worldwide to implement stricter emission control policies.

For example, Japan has set ambitious targets to reduce NOx emissions from generators by 50% by 2023. Such regulations not only increase the cost of compliance for manufacturers but also limit the deployment of diesel generators, particularly in urban and environmentally sensitive areas. This regulatory environment acts as a major restraint on market growth, pushing the industry towards cleaner, more sustainable alternatives.

Growing Adoption of Renewable Energy Limits Diesel Generator Demand

The shift towards renewable energy sources, such as solar and wind power, significantly limits the demand for diesel generators, especially in developed markets where the installation of renewable systems is rapidly increasing.

In 2019, renewable energy contributed to 20% of the UK’s total electricity generation, illustrating a broader trend away from conventional fossil-fuel-based power sources. This transition reduces reliance on diesel generators for backup power, as renewables coupled with energy storage technologies offer a cleaner, more sustainable alternative.

Power Rating Analysis

Generators Below 75 Kva Dominate Market with 46.8% Share Due to Versatility and Cost-Effectiveness

The sub-segment of diesel generators with a power rating below 75 Kva holds a dominant market share of 46.8%, underscoring its pivotal role in the Diesel Generator Market. This dominance is attributed to the versatility and widespread application of these generators across various sectors, including residential, small commercial establishments, and as backup power sources for critical operations in sectors like healthcare and telecommunications.

The demand for generators in this power range is driven by their affordability, portability, and suitability for a wide range of power needs, making them a preferred choice for emergency power backup and day-to-day operations where power requirements are moderate.

Generators with higher power ratings, such as 75-375 Kva, 375-750 Kva, and above 750 Kva, cater to more extensive industrial, construction, and large-scale commercial operations, where the power demand significantly exceeds what lower-rated generators can supply. While these segments are essential for specific high-capacity applications, their growth is more niche compared to the below 75 Kva segment, which appeals to a broader audience due to its adaptability and cost-effectiveness.

Portability Analysis

Stationary Diesel Generators Lead Portability Segment with 67.9% Market Share, Driven by Industrial and Infrastructure Demand

Stationary diesel generators, with a market share of 67.9%, represent the dominant portability segment within the Diesel Generator Market. This dominance is primarily due to the extensive use of stationary generators in industrial, commercial, and infrastructure projects, where continuous, reliable power is critical, and mobility is not a primary concern.

These generators are often integrated into the existing power infrastructure to provide emergency backup or supplemental power, necessitating high-capacity, durable units that can operate for extended periods.

Portable generators, while not dominating the market share, play a crucial role in providing flexible, on-demand power solutions for applications ranging from small-scale construction sites and outdoor events to emergency power for homes and businesses during outages. Their mobility adds significant value in scenarios where temporary power is required, or where power needs can vary significantly from one location to another.

Application Analysis

Continuous Load Applications Dominate with 53.6% Market Share, Driven by Demand for Uninterrupted Power in Critical Sectors

In the application segment of the Diesel Generator Market, Continuous Load emerges as the dominant sub-segment, commanding a market share of 53.6%. This dominance can be attributed to the critical need for uninterrupted power supply in various sectors, including healthcare, data centers, and manufacturing facilities.

Here even brief moments of power disruption can lead to significant operational losses or safety hazards. Continuous load generators are designed to operate as the primary power source, especially in areas with unreliable grid infrastructure or in remote locations where grid power is unavailable.

The other application segments, Peak Load and Stand By Load, serve essential but distinct needs. Peak Load generators are used to supplement the primary power source during periods of high demand, preventing overloading and ensuring stability within the power system. Stand By Load generators, on the other hand, are reserved for emergencies, providing a backup power supply during outages to prevent operational disruptions and protect critical data and systems.

End User Analysis

Commercial Sector Leads Diesel Generator Market with 51.3% Share, Driven by Need for Reliable Power in Critical Operations

Among end users, the Commercial sector holds the largest share at 51.3%, highlighting its significant impact on the Diesel Generator Market. Commercial entities, including offices, retail centers, hospitals, and data centers, rely heavily on diesel generators to ensure continuous operations, particularly in regions prone to power instability.

The critical nature of power in these settings, from supporting basic operational needs to safeguarding sensitive data and ensuring patient safety, underpins the high demand for reliable power solutions.

Industrial and Agriculture sectors, while not as dominant, represent vital components of the market. Industrial users leverage diesel generators for manufacturing processes, often in heavy-duty applications requiring high power output. In Agriculture, generators support irrigation, crop processing, and farm operations, especially in rural or off-grid areas.

Key Market Segments

By Power Rating

- Below 75 Kva

- 75-375 Kva

- 375-750 Kva

- Above 750 Kva

By Portability

- Stationary

- Portable

By Application

- Continuous load

- Peak load

- Stand by load

By End User

- Commercial

- Industrial

- Agriculture

Growth Opportunities

Stringent Emissions Regulations Offer Growth Opportunity

The introduction of stringent emissions regulations across the globe presents a significant growth opportunity for the Diesel Generator Market. As governments enforce tighter emissions standards to combat pollution, there’s a pronounced trend towards replacing older, high-emitting diesel generators with newer, less-polluting models.

India’s ambitious goal to reduce industrial emissions by 30-35% by 2030 exemplifies this shift. This regulatory landscape compels industries and facilities reliant on diesel generators for power to invest in modern, eco-friendly alternatives.

Increased Manufacturing Output Drives Diesel Generator Demand

The resurgence of global manufacturing output post-pandemic is a key driver of demand within the Diesel Generator Market. Manufacturing facilities, which require constant power to maintain operational efficiency and protect against losses due to power outages, are increasingly investing in diesel generators.

The rise in China’s manufacturing PMI to 50.2 in May 2020, indicating expansion, reflects the broader recovery and growth in manufacturing sectors worldwide. This uptick in manufacturing activity translates to heightened demand for reliable backup power solutions.

Trending Factors

Hybrid Generators Gaining Traction Are Trending Factors

The emergence of hybrid diesel-solar generators marks a significant trend in the Diesel Generator Market, offering a more sustainable power solution by integrating solar energy to reduce diesel consumption.

These systems are particularly gaining momentum in regions like the Middle East, Africa, and Asia-Pacific, where abundant solar resources can be harnessed effectively. Caterpillar, among other key players, has introduced hybrid offerings, acknowledging the growing demand for environmentally friendly and cost-effective power solutions.

Growing Residential Demand Drives Market Trends

The rising demand for home standby generators in North America and Europe is a notable trend, driven by aging electricity infrastructure and an increase in power disruptions. This shift towards ensuring uninterrupted power supply at home has led companies like Generac to expand their residential generator offerings.

The growing awareness among homeowners of the risks associated with power outages, coupled with the desire for convenience and safety, is propelling the residential diesel generator market.

Regional Analysis

Asia Pacific Dominates with 37.8% Market Share

Asia Pacific’s dominance in the Diesel Generator Market, with a 37.8% share valued USD 7.2 Billion, is attributed to rapid industrialization, extensive infrastructure development, and the increasing demand for reliable power sources across the region. The expansive growth in construction, telecommunications, and manufacturing sectors, especially in emerging economies like China and India, significantly contributes to the demand for diesel generators.

The region’s susceptibility to natural disasters, which often disrupt power supply, and the need for continuous power in remote and off-grid areas, further elevate the necessity for diesel generators.

The Asia Pacific region is poised to continue its leadership in the market due to ongoing economic development, urbanization, and the critical need for backup power solutions. Innovations in diesel generator efficiency, emissions reduction, and integration with renewable energy sources are expected to drive future market expansion.

North America’s market is driven by advanced infrastructure development, increasing residential demand for standby power solutions, and stringent emissions regulations pushing for cleaner, more efficient diesel generator technologies.

Europe’s focus on reducing emissions and integrating diesel generators with renewable energy sources shapes its market. The region’s stringent environmental standards and the push for energy efficiency stimulate the adoption of advanced generator technologies.

In the Middle East & Africa, demand is fueled by infrastructure development, the oil & gas sector, and resource extraction activities, with an increasing interest in hybrid generators to reduce operational costs and emissions.

Latin America’s market growth is tied to economic development, energy infrastructure expansion, and the need for reliable power in remote locations, with significant opportunities in the construction and mining sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the Diesel Generator Market, companies such as Caterpillar Inc, Cummins Inc, and Generac Power Systems are recognized as key players due to their significant impact, strategic market positioning, and influence. These companies have established a strong presence globally through a wide range of diesel generator offerings, catering to various applications from residential backup power to industrial and commercial use.

Caterpillar Inc, known for its robust and reliable machinery, leads with a comprehensive portfolio that meets diverse market needs, emphasizing innovation and sustainability. Cummins Inc distinguishes itself with high-performance engines and generators, focusing on energy efficiency and reduced emissions, aligning with global environmental standards.

Generac Power Systems has carved out a niche in residential and commercial markets, offering standby and portable generators that are highly regarded for their reliability and advanced features. Other notable companies like Aggreko and PRAMAC contribute to the market dynamics by providing temporary power solutions and specialized generators, respectively, addressing specific customer needs in events, construction, and emergency power situations.

Market Key Players

- Caterpillar Inc

- Aggreko

- Cummins Inc

- Himoinsa

- John Deere

- Kohler-SDMO

- PRAMAC

- Kirloskar Electric Co.ltd

- Generac Power Systems

- FG Wilson

- Atlas Copso

- Briggs and Straton

Recent Developments

- Cummins India has received various CPCB IV+ compliance certifications from the Automotive Research Association of India (ARAI) for its genset products. The certifications affirm the company’s readiness to provide CPCB IV+ emission norms compliant gensets, effective from July 1, 2023, when the new regulations will come into effect

- Vice Chief Naval Staff (VCNS) VAdm SN Ghormade visited Hindustan Shipyard Limited (HSL) and gave the first start to a 2 MW Diesel Generator on the Nistar, a Diving Support Vessel (yard 11190), being constructed at HSL.

- On May 2023, Loop Energy and MYNT have announced a strategic partnership for the manufacturing of hydrogen electric power generators in Australia. Under this agreement, Loop Energy’s hydrogen fuel cell modules will be integrated into MYNT’s lineup of Purple H2 generators.

Report Scope

Report Features Description Market Value (2024) USD 19.7 Billion Forecast Revenue (2034) USD 49.3 Billion CAGR (2025-2034) 9.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Power Rating (Below 75 Kva, 75-375 Kva, 375-750 Kva, Above 750 Kva), By Portability (Stationary, Portable), By Application (Continuous load, Peak load, Stand by load), By End User (Commercial, Industrial, Agriculture) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Caterpillar Inc, Aggreko, Cummins Inc, Himoinsa, John Deere, Kohler-SDMO, PRAMAC, Kirloskar Electric Co.ltd, Generac Power Systems, FG Wilson, Atlas Copso, Briggs and Straton Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the expected size of the Global Diesel Generator Market?The Global Diesel Generator Market is expected to reach around USD 44.0 Billion by 2033, from USD 18.0 Billion in 2023, growing at a CAGR of 9.60% during the forecast period from 2024 to 2033.

What sectors rely heavily on diesel generators for backup or primary power?Diesel generators are pivotal in providing emergency power during outages, ensuring continuous operations in industries such as healthcare, telecommunications, construction, and data centers.

What region dominates the Diesel Generator Market?Asia Pacific dominates with a 37.8% share, driven by rapid industrialization, extensive infrastructure development, and increasing demand for reliable power sources.

What growth opportunities exist for the Diesel Generator Market?Stringent emissions regulations and increased manufacturing output present significant growth opportunities for the market.

-

-

- Caterpillar Inc

- Aggreko

- Cummins Inc

- Himoinsa

- John Deere

- Kohler-SDMO

- PRAMAC

- Kirloskar Electric Co.ltd

- Generac Power Systems

- FG Wilson

- Atlas Copso

- Briggs and Straton