Global Electric Submersible Pump Market By Type (Borewell, Openwell), By Operation (Single-Stage Pumps, Multi-Stage Pumps), By Capacity (High, Medium, Low), By End-use (Water and Wastewater, Residential, Commercial, Chemicals, Oil and Gas, Agriculture, Mining, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145494

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

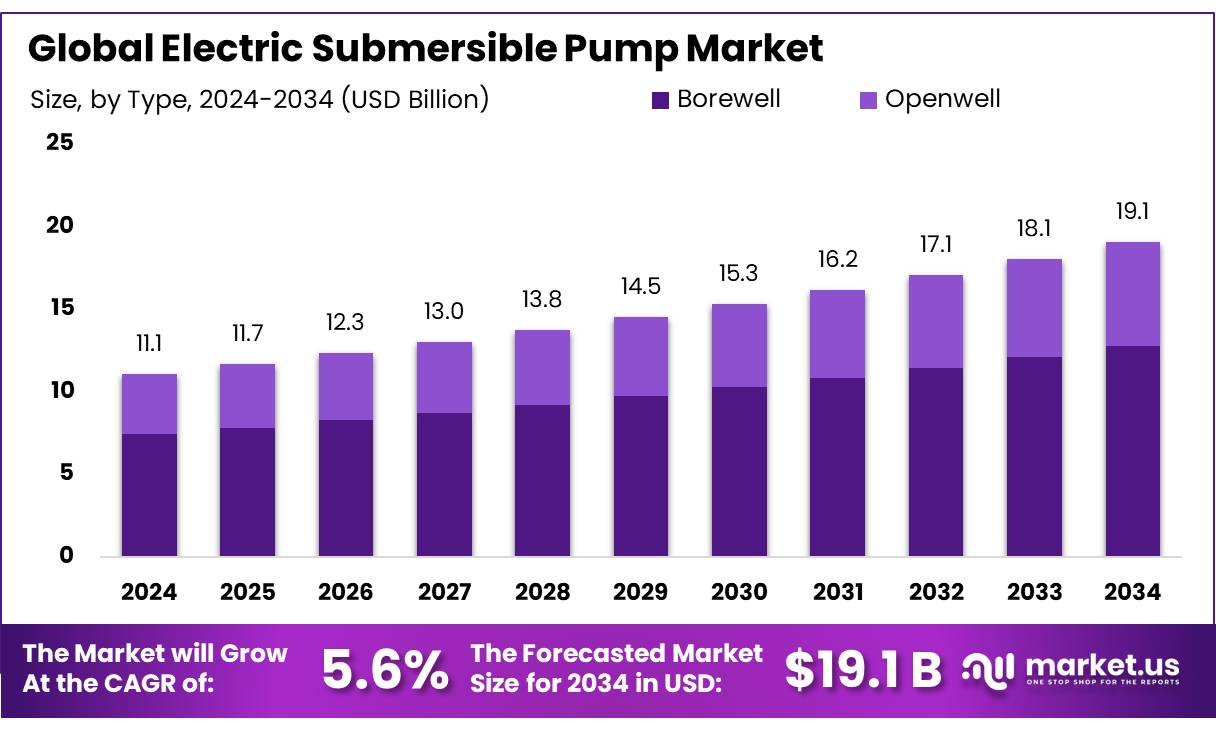

The Global Electric Submersible Pump Market size is expected to be worth around USD 19.1 Bn by 2034, from USD 11.01 Bn in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Electric Submersible Pumps (ESPs) are specialized devices used extensively in various industries, particularly for oil and water extraction. These pumps are designed to operate while submerged in fluid, making them ideal for deep-water drilling and flooded areas. The efficiency of ESPs in handling heavy-duty pumping under harsh conditions underscores their critical role in modern industrial operations.

The ESP market is intricately linked to the dynamics of the oil and gas industry, which remains its primary consumer. As of recent reports, the global demand for oil is expected to rise by approximately 1.2% annually until 2025, indirectly influencing the ESP market.

The integration of ESPs in sectors like mining and agriculture further broadens their application scope, adding layers to their. Moreover, advances in technology have facilitated the development of ESPs that can handle higher temperatures and more corrosive environments, thereby enhancing their deployment in geothermal energy extraction and harsh industrial settings.

Several factors drive the adoption of ESPs across industries. Primarily, the increasing depth of oil wells necessitates robust pumping solutions, a niche that ESPs fill effectively. For instance, some of the deepest oil extractions, now reaching depths of over 10,000 feet, rely on ESPs for fluid transportation.

Additionally, the global shift towards maximizing existing oilfield assets rather than investing in new sites has propelled the use of ESPs to enhance oil recovery from mature fields. From a numerical standpoint, the installation of ESPs can increase oil production by up to 30%, demonstrating their efficacy and impact on operational outputs.

Governments worldwide are playing a pivotal role in the ESP market by implementing policies that encourage the adoption of energy-efficient and environmentally sustainable technologies. In the U.S., for example, the Department of Energy has invested over $100 million in technology grants to advance energy efficiency in industrial operations, including enhancements in submersible pumping technologies. Such initiatives not only promote the use of ESPs but also drive innovation in the sector.

Key Takeaways

- Electric Submersible Pump Market size is expected to be worth around USD 19.1 Bn by 2034, from USD 11.01 Bn in 2024, growing at a CAGR of 5.6%.

- Borewell held a dominant market position, capturing more than a 67.40% share in the electric submersible pump market.

- Multi-Stage Pumps held a dominant market position, capturing more than a 63.50% share in the electric submersible pump market.

- Medium capacity pumps held a dominant market position, capturing more than a 54.30% share.

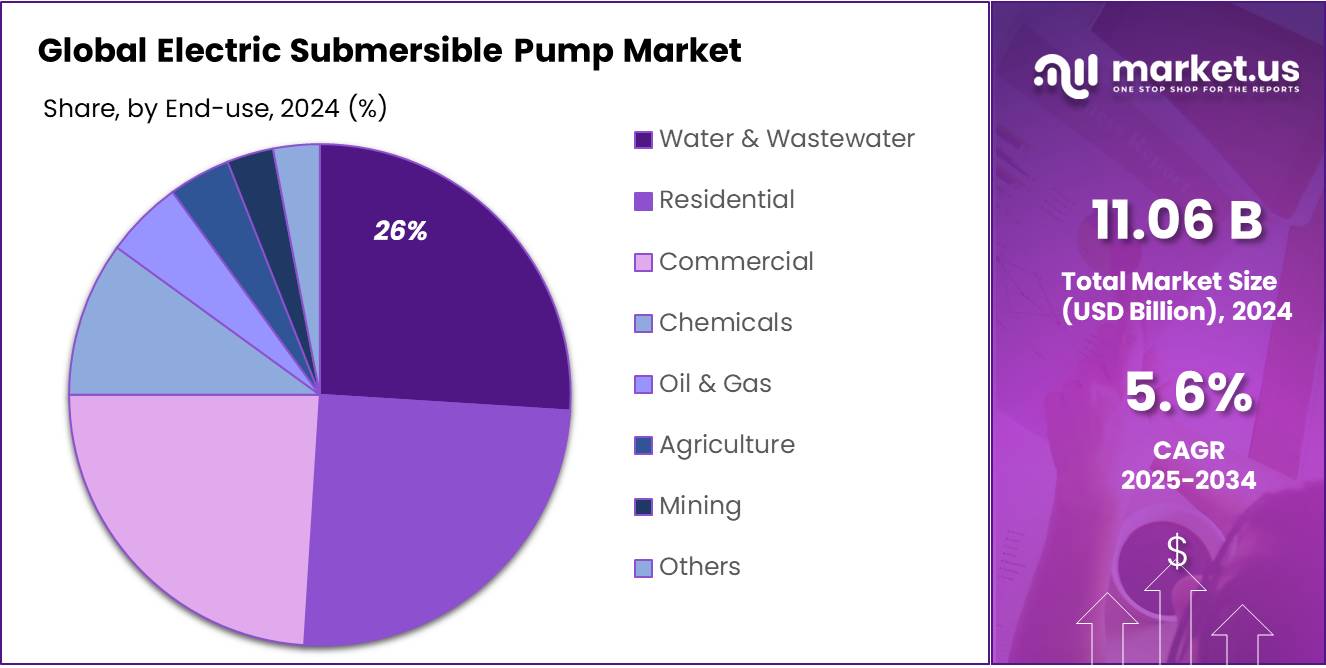

- Water & Wastewater sector held a dominant market position in the electric submersible pump market, capturing more than a 26.50% share.

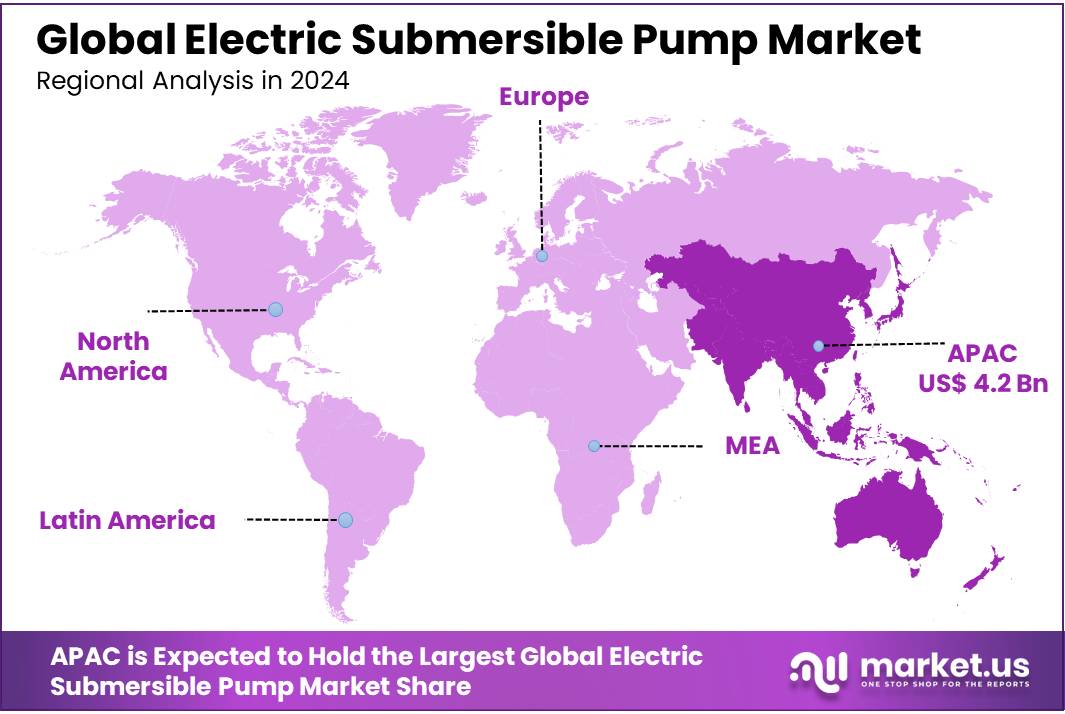

- Asia-Pacific (APAC) region stands out as a dominant force, capturing a significant market share of 38.40% with a valuation of USD 4.2 billion.

By Type

Borewell dominates with 67.40% share in 2024 owing to its deep-water access and strong rural demand.

In 2024, Borewell held a dominant market position, capturing more than a 67.40% share in the electric submersible pump market. The segment’s growth was mainly supported by increasing demand for deep-well pumping solutions across agricultural regions and semi-urban landscapes.

Borewell pumps are widely used for drawing underground water in areas where surface water sources are limited or seasonal. Their ability to operate at greater depths and deliver high water output made them a preferred choice among users, especially in countries with large agricultural zones like India, China, and Brazil.

By Operation

Multi-Stage Pumps lead with 63.50% in 2024 thanks to their efficiency in high-pressure and deep-well operations.

In 2024, Multi-Stage Pumps held a dominant market position, capturing more than a 63.50% share in the electric submersible pump market. Their ability to generate high pressure by using multiple impellers in a single unit made them a reliable solution for deep-well water lifting and heavy-duty operations. These pumps are commonly used in oil wells, agriculture, and municipal water systems where consistent pressure and high flow rates are essential. Their long-term durability and energy-saving performance also appealed to industries looking for low-maintenance solutions.

By Capacity

Medium capacity pumps dominate with 54.30% in 2024, favored for their versatility across multiple applications.

In 2024, Medium capacity pumps held a dominant market position, capturing more than a 54.30% share in the electric submersible pump market. This segment’s success is attributed to the balance these pumps strike between power and energy efficiency, making them suitable for a wide range of applications from municipal water management to commercial building services. Their capacity to handle moderate flow rates with considerable head heights allows them to serve both small-scale industrial operations and large residential complexes effectively.

By End-use

Water & Wastewater sector leads with 26.50% in 2024, crucial for sustainable management practices.

In 2024, the Water & Wastewater sector held a dominant market position in the electric submersible pump market, capturing more than a 26.50% share. This significant market share stems from the critical role these pumps play in managing and treating water and wastewater efficiently. They are indispensable in sewage treatment plants, stormwater handling, and flood management applications, where reliability and durability are paramount. Additionally, the ongoing global focus on water conservation and wastewater treatment as part of environmental sustainability efforts has bolstered the demand for these robust pumping solutions.

Key Market Segments

By Type

- Borewell

- Openwell

By Operation

- Single-Stage Pumps

- Multi-Stage Pumps

By Capacity

- High

- Medium

- Low

By End-use

- Water & Wastewater

- Residential

- Commercial

- Chemicals

- Oil & Gas

- Agriculture

- Mining

- Others

Drivers

Infrastructure Development and Urbanization Fuel Demand for Electric Submersible Pumps

One major driving factor for the growth of the electric submersible pump market is the rapid pace of global infrastructure development and urbanization. As cities expand and new urban areas are developed, there is a significant increase in the demand for efficient water management systems, which are crucial for supplying water to residential areas and handling wastewater and stormwater drainage.

For instance, government initiatives like the “Smart Cities Mission” in India, which aims to drive economic growth and improve the quality of life by enabling local area development and harnessing technology, have led to increased investments in water infrastructure. Such projects typically require robust pumping solutions, thus propelling the demand for electric submersible pumps. According to the United Nations, 68% of the world’s population is projected to live in urban areas by 2050, further emphasizing the critical need for sustainable water management solutions that can support such dense populations.

Additionally, the focus on environmental sustainability has led to stricter regulations regarding water usage and wastewater treatment, especially in industries such as manufacturing and chemicals. Regulations enforced by environmental protection agencies globally mandate the treatment of wastewater before discharge, which requires reliable pumping systems. For example, the U.S. Environmental Protection Agency (EPA) has established guidelines under the Clean Water Act that significantly impact the industrial and municipal sectors, necessitating the adoption of advanced pumping technologies to comply with these standards.

Restraints

High Maintenance Costs and Environmental Concerns Hinder Electric Submersible Pump Market Growth

One significant restraining factor impacting the electric submersible pump market is the high maintenance costs associated with these pumps, coupled with growing environmental concerns. Electric submersible pumps are often deployed in challenging environments where they are exposed to abrasive materials and harsh conditions. This exposure necessitates frequent maintenance and replacement of parts, which can be costly over the pump’s operational lifetime.

The financial burden of maintaining these pumps is a particular concern for small and medium enterprises (SMEs) that operate with tighter budgets and may find the upfront and ongoing costs prohibitive. For instance, a typical submersible pump used in a municipal water supply system might require regular servicing to prevent failures due to sediment build-up or wear and tear on electrical components, adding to operational costs.

Furthermore, environmental concerns regarding the energy consumption and carbon footprint of electric submersible pumps also pose a challenge. As global awareness and regulations around energy efficiency and environmental impact tighten, industries are pressured to adopt more sustainable practices. Regulations such as the European Union’s Ecodesign Directive, which sets mandatory ecological requirements for energy-using and related products, influence manufacturers to develop more energy-efficient and less environmentally harmful solutions.

Opportunity

Renewable Energy Projects Offer Significant Growth Opportunities for Electric Submersible Pumps

A significant growth opportunity for the electric submersible pump market is emerging from the renewable energy sector, particularly in geothermal and hydropower projects. These projects require robust, efficient, and reliable water management systems, for which submersible pumps are ideally suited due to their ability to operate effectively under harsh conditions and at great depths.

For example, geothermal energy production, which involves extracting heat from beneath the earth’s surface, relies heavily on pumps to circulate water through underground reservoirs to generate steam. According to the U.S. Department of Energy, the United States aims to grow its geothermal electricity generation capacity by 26 gigawatts by 2050, indicating substantial investments in this sector. Each of these projects will potentially require multiple high-capacity submersible pumps, highlighting a direct growth pathway for the pump market.

Similarly, in hydropower plants, submersible pumps help maintain water levels and manage flow within the system. With global initiatives to increase the share of renewable energy, governments worldwide are investing in hydropower projects. For instance, China’s commitment to increasing its renewable energy output includes the construction and expansion of numerous hydropower facilities, as outlined in their latest Five-Year Plan.

Trends

Smart and Connected Electric Submersible Pumps: A Trend Reshaping the Market

A prominent trend in the electric submersible pump market is the increasing integration of smart technologies and connectivity features. This trend is driven by the need for enhanced efficiency, remote monitoring capabilities, and predictive maintenance in pumping systems. Smart electric submersible pumps equipped with sensors and IoT (Internet of Things) connectivity are becoming increasingly popular in various industries, including agriculture, oil and gas, and municipal water management.

These smart pumps offer real-time data collection and analysis, enabling operators to monitor operational parameters such as pressure, temperature, and flow rates remotely. This capability is crucial for optimizing pump performance, reducing downtime, and preempting potential failures through predictive maintenance strategies. For instance, in the oil and gas industry, where pumps are critical for operations and are often located in remote areas, the ability to monitor and manage these devices remotely drastically improves operational efficiency and safety.

Government initiatives promoting industrial automation and digitalization further bolster this trend. For example, the European Union’s Digital Single Market strategy aims to enhance Europe’s position as a world leader in the digital economy by encouraging the adoption of digital technologies across business sectors. This strategy includes support for IoT applications in industrial operations, directly benefiting the adoption of smart pump technologies.

Regional Analysis

In the electric submersible pump market, the Asia-Pacific (APAC) region stands out as a dominant force, capturing a significant market share of 38.40% with a valuation of USD 4.2 billion. This strong performance is fueled by rapid industrialization, urbanization, and agricultural expansion across major economies such as China, India, and Southeast Asia. These countries are witnessing substantial investments in water infrastructure and energy projects, which drive the demand for reliable and efficient submersible pumping solutions.

China, as the largest market in the region, continues to expand its infrastructure related to water management and energy production, particularly in renewable energy sectors like hydro and geothermal energy, which extensively use submersible pumps. India follows suit with its governmental initiatives aimed at enhancing agricultural productivity and water conservation, further bolstering the market for submersible pumps. The government’s focus on improving irrigation facilities and ensuring water supply to remote areas underpins the growth in this market segment.

Furthermore, the region benefits from the presence of several key players in the pump manufacturing industry, which contribute to technological advancements and availability of a wide range of products. Local manufacturers are increasingly adopting smart and energy-efficient technologies in pump designs, aligning with global trends and regulatory standards for energy consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

C.R.I. Pumps Private Limited is a global leader in fluid management solutions, headquartered in India. The company specializes in the manufacturing and marketing of a wide range of submersible pumps used in various sectors such as agriculture, residential, and industrial applications. Known for its innovative approach, C.R.I. has established a strong presence in over 120 countries, providing technologically advanced products that ensure reliability and energy efficiency.

Baker Hughes stands as a major player in the oilfield services sector, offering advanced submersible pump technologies primarily for the oil and gas industry. Their expertise extends to developing highly durable pumps capable of withstanding the rigorous conditions of downhole operations. The company’s commitment to continuous innovation in hydraulic and electrical submersible pump systems marks its prominence in enhancing production efficiency and reservoir performance globally.

Xylem Inc. is renowned for its water technology solutions, focusing on addressing the world’s most challenging water issues. Based in the United States, Xylem manufactures a comprehensive line of electric submersible pumps that serve municipal, residential, and commercial markets. Their pumps are pivotal in water and wastewater applications, emphasizing sustainability and smart technology integration to optimize water usage and treatment processes.

Top Key Players

- C.R.I. Pumps Private Limited

- Baker Hughes

- Xylem Inc.

- Schlumberger NV

- Halliburton

- ChampionX

- Tsurumi Pump

- Kirloskar Group

- Crompton Greaves Consumer Electricals Limited

- Grundfos

- Hitachi, Ltd.

- Franklin Electric

- Others

Recent Developments

In 2024, Xylem Inc. continued to solidify its role as a key player in the global electric submersible pump market, particularly renowned for its innovation in water management technologies. The company has been instrumental in addressing critical water infrastructure challenges, providing a comprehensive range of water pumps, treatment systems, and analytics solutions.

In 2024, Baker Hughes solidified its position in the electric submersible pump (ESP) market, particularly within the oil and gas sector, where its technology plays a pivotal role in maximizing hydrocarbon recovery.

In 2024, Schlumberger NV continued to excel in the electric submersible pump (ESP) market, particularly within the oil and gas sector. The company’s strong commitment to research and development has allowed it to offer advanced ESP technologies that enhance the efficiency and reliability of oil and gas extraction

Report Scope

Report Features Description Market Value (2024) USD 11.1 Bn Forecast Revenue (2034) USD 19.1 Bn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Borewell, Openwell), By Operation (Single-Stage Pumps, Multi-Stage Pumps), By Capacity (High, Medium, Low), By End-use (Water and Wastewater, Residential, Commercial, Chemicals, Oil and Gas, Agriculture, Mining, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape C.R.I. Pumps Private Limited, Baker Hughes, Xylem Inc., Schlumberger NV, Halliburton, ChampionX, Tsurumi Pump, Kirloskar Group, Crompton Greaves Consumer Electricals Limited, Grundfos, Hitachi, Ltd., Franklin Electric, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Submersible Pump MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Submersible Pump MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- C.R.I. Pumps Private Limited

- Baker Hughes

- Xylem Inc.

- Schlumberger NV

- Halliburton

- ChampionX

- Tsurumi Pump

- Kirloskar Group

- Crompton Greaves Consumer Electricals Limited

- Grundfos

- Hitachi, Ltd.

- Franklin Electric

- Others