Global Progressing Cavity Pumps Market By Product Type (Dosing Pumps, Flanged Pumps, Hopper Pumps, Vertical Pumps, Others), By Stage Type (Single-Stage (90-Psi) Pumps, Double-Stage (180-Psi) Pumps, Four-Stage (360-Psi) Pumps, Eight-Stage (720-Psi) Pumps), By Power Rating (Up to 50 HP, 51 to 100 HP, Above 100 HP), By Pumping Capacity (Up to 500 GPM, 501 to 1000 GPM, Above 1000 GPM), By End-use (Oil and Gas, Midstream , Downstream, Water and Wastewater, Pumping Sludge, Sewage Sludge, Food and Beverage, Pulp And Paper, Chemicals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143672

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

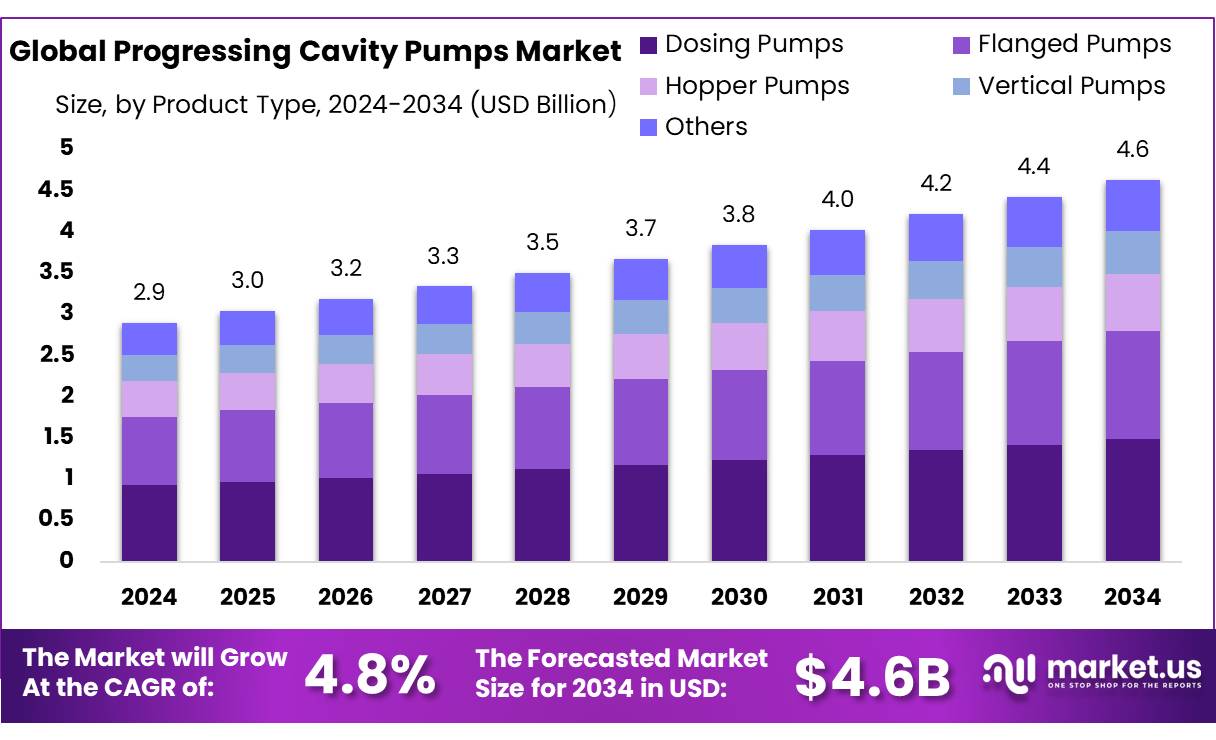

The Global Progressing Cavity Pumps Market size is expected to be worth around USD 4.6 Bn by 2034, from USD 2.9 Bn in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Progressing Cavity Pumps (PCPs) are positive displacement pumps widely used for handling viscous, abrasive, and shear-sensitive fluids. Characterized by a rotor-stator mechanism, these pumps provide consistent flow even under high pressure, making them particularly valuable across sectors such as oil & gas, food & beverage, wastewater treatment, and chemicals. In the food processing industry, their ability to handle delicate fluids like fruit pulp, dairy slurries, and meat emulsions without degrading product quality underscores their growing preference over traditional pump types. The sanitary-grade design, compliance with food safety regulations, and ability to transfer materials with minimal pulsation are key reasons for their increasing demand.

According to the European Food and Drink Industry 2023 report, the food and beverage industry in Europe alone accounted for €1.1 trillion in turnover and over 4.3 million jobs. The sector’s consistent expansion, especially in processed food and dairy segments, has pushed manufacturers to adopt advanced pumping technologies like PCPs for their gentle, hygienic handling capabilities. Similarly, in North America, the U.S. Department of Agriculture (USDA) reported food and beverage manufacturing shipments valued at over $1.1 trillion in 2022, with high demand in processed dairy, meats, and beverages—each relying heavily on robust, low-shear pumping solutions.

Among the primary drivers fueling PCP market growth is the push for process automation and precision in fluid transfer, particularly in the food sector where quality retention is paramount. Additionally, regulatory bodies such as the FDA and EFSA have mandated stringent hygiene standards, prompting food manufacturers to upgrade to sanitary PCP systems compliant with 3-A sanitary standards and EHEDG guidelines. The trend toward cleaner processing and reduced waste aligns closely with PCP capabilities, bolstering adoption further.

Government initiatives supporting manufacturing modernization and sustainable industrial practices have also played a role in boosting PCP demand. In Europe, the “Farm to Fork” strategy under the European Green Deal aims to reduce food waste and ensure sustainable processing. This has increased funding for advanced processing technologies, including efficient pump systems. In India, the government’s Production Linked Incentive (PLI) scheme for the food processing industry, with an outlay of INR 10,900 crore, is expected to enhance infrastructure and adoption of modern equipment like PCPs over the next five years.

Key Takeaways

- Progressing Cavity Pumps Market size is expected to be worth around USD 4.6 Bn by 2034, from USD 2.9 Bn in 2024, growing at a CAGR of 4.8%.

- Dosing Pumps held a dominant market position, capturing more than a 32.20% share in the Progressing Cavity Pumps market.

- Single-Stage (90-Psi) Pumps secured a commanding position in the Progressing Cavity Pumps market, accounting for over 43.30% of the market share.

- pumps with a power rating of up to 50 HP captured a significant portion of the Progressing Cavity Pumps market, holding more than a 45.60% share.

- progressing cavity pumps with a capacity of up to 500 gallons per minute (GPM) held a dominant market position, capturing more than a 47.30% share.

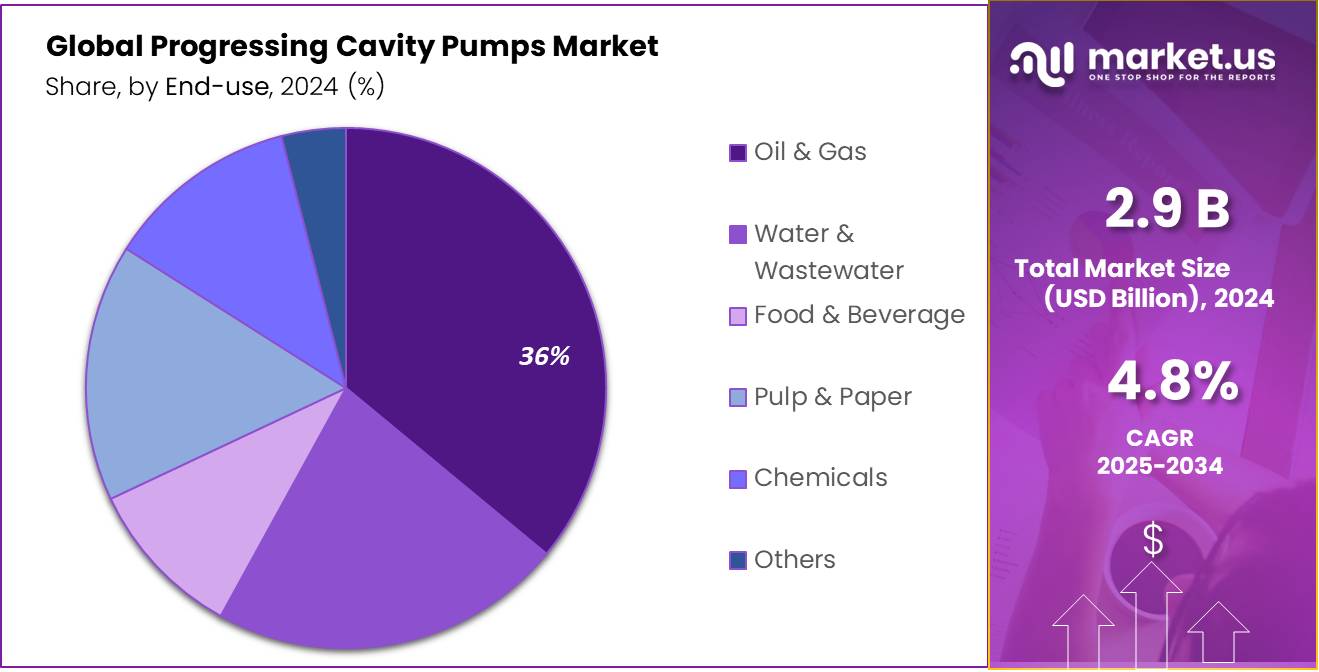

- Oil & Gas sector maintained a strong foothold in the Progressing Cavity Pumps market, capturing more than a 36.70% share.

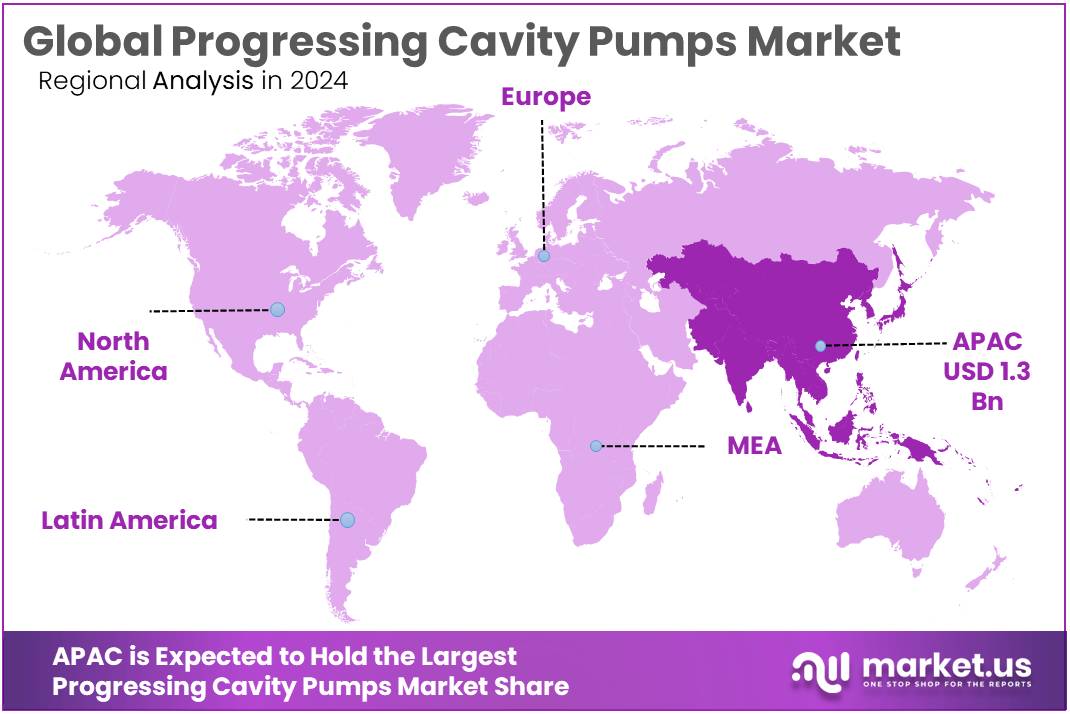

- Asia-Pacific (APAC) region stands out as the dominant player, capturing a substantial 46.20% market share, which translates to a market value of approximately USD 1.3 billion.

By Product Type

Dosing Pumps Continue to Lead with Over 32.20% Market Share Due to Precision and Control

In 2024, Dosing Pumps held a dominant market position, capturing more than a 32.20% share in the Progressing Cavity Pumps market. This segment benefits significantly from the precision and control that dosing pumps offer, essential in industries requiring exact fluid handling solutions, such as pharmaceuticals and water treatment.

As industries increasingly prioritize accuracy in fluid dispensation to enhance efficiency and reduce waste, the demand for dosing pumps has seen a substantial upsurge. Their ability to handle a wide range of viscosities and materials also contributes to their widespread use across various applications, reinforcing their strong presence in the market.

By Stage Type

Single-Stage (90-Psi) Pumps Dominate with a 43.30% Share Due to Their Efficiency and Versatility

In 2024, Single-Stage (90-Psi) Pumps secured a commanding position in the Progressing Cavity Pumps market, accounting for over 43.30% of the market share. This type of pump is favored for its operational efficiency and versatility, making it a preferred choice in various sectors, including wastewater management, oil and gas, and food processing.

The simplicity of the single-stage design contributes to lower maintenance costs and ease of use, which are critical factors driving their adoption in numerous applications where cost-effectiveness and reliable performance are paramount. These attributes underscore the continuing popularity and dependability of Single-Stage (90-Psi) Pumps in the industry.

By Power Rating

Up to 50 HP Pumps Lead with 45.60% Market Share for Their Compact Size and Energy Efficiency

In 2024, pumps with a power rating of up to 50 HP captured a significant portion of the Progressing Cavity Pumps market, holding more than a 45.60% share. These pumps are highly sought after due to their compact size and energy efficiency, making them ideal for a wide range of applications including residential, commercial, and light industrial uses.

The up to 50 HP category is particularly popular in sectors that require moderate fluid handling capabilities without the extensive energy consumption of higher-powered models. Their ability to provide sufficient power while keeping operational costs low drives their dominant market position.

By Pumping Capacity

Up to 500 GPM Pumps Command a 47.30% Market Share with Broad Applicability and Efficiency

In 2024, progressing cavity pumps with a capacity of up to 500 gallons per minute (GPM) held a dominant market position, capturing more than a 47.30% share. This pump capacity is particularly favored for its versatility and efficiency in a variety of applications, ranging from municipal water management to industrial processes. The up to 500 GPM category meets the needs of most medium-scale operations, offering an optimal balance between flow rate and energy consumption. This efficiency, coupled with their ability to handle a diverse range of media, solidifies their widespread adoption and leading status in the market.

By End-Use

Oil & Gas Sector Leads with 36.70% Share in Progressing Cavity Pumps Market for High Reliability

In 2024, the Oil & Gas sector maintained a strong foothold in the Progressing Cavity Pumps market, capturing more than a 36.70% share. This substantial market share is largely due to the critical role these pumps play in oil and gas operations, where they are prized for their reliability and effectiveness in handling viscous fluids and abrasive slurries. The ability of progressing cavity pumps to ensure consistent flow rates and withstand the harsh conditions of oil fields makes them indispensable in the sector. Their robust design and operational efficiency drive their prevalent use in oil and gas extraction and processing, solidifying their dominant position in this segment of the market.

Key Market Segments

By Product Type

- Dosing Pumps

- Flanged Pumps

- Hopper Pumps

- Vertical Pumps

- Others

By Stage Type

- Single-Stage (90-Psi) Pumps

- Double-Stage (180-Psi) Pumps

- Four-Stage (360-Psi) Pumps

- Eight-Stage (720-Psi) Pumps

By Power Rating

- Up to 50 HP

- 51 to 100 HP

- Above 100 HP

By Pumping Capacity

- Up to 500 GPM

- 501 to 1000 GPM

- Above 1000 GPM

By End-use

- Oil & Gas

- Midstream

- Downstream

- Water & Wastewater

- Pumping Sludge

- Sewage Sludge

- Food & Beverage

- Pulp & Paper

- Chemicals

- Others

Drivers

Increasing Demand in Food Processing Drives Progressing Cavity Pump Market Growth

One of the primary driving factors for the Progressing Cavity Pumps market is the expanding demand within the food processing industry. According to the Food and Agriculture Organization (FAO), the global volume of food production is projected to increase by 70% by 2050 to meet the growing population demands. This surge necessitates the adoption of efficient and reliable machinery to handle the processing and transfer of various food products.

Progressing cavity pumps are particularly favored in food processing for their ability to handle fluids with varying viscosities and solids without damaging the product. For instance, they are used for transferring everything from sauces and dairy products to fruit pulps and meat emulsions. Their gentle handling preserves the integrity and quality of food products, which is essential for maintaining industry standards and consumer satisfaction.

Additionally, government initiatives aimed at boosting food production efficiency have led to increased investments in food processing technology. For example, the U.S. Department of Agriculture (USDA) offers various grants and loans to food processors to adopt newer, more efficient technologies, including advanced pumping systems that can increase output and reduce waste.

Moreover, leading food organizations are continuously adopting these pumps to ensure compliance with hygiene regulations and to enhance operational efficiencies. These organizations focus on minimizing downtime and maintenance costs, which are further facilitated by the robust construction and long service life of progressing cavity pumps.

This trend is reflected in the strategies of major food producers. For example, Nestlé’s continuous improvement program includes upgrading their fluid handling systems to progressing cavity pumps to achieve a smoother, more hygienic production flow, which underscores the growing adoption in this sector.

Restraints

High Maintenance Costs Limit Adoption of Progressing Cavity Pumps in Small-Scale Industries

One significant restraining factor in the adoption of progressing cavity pumps is their relatively high maintenance and repair costs. These pumps consist of intricate components like rotors and stators, which require regular upkeep to ensure optimal performance. For small-scale industries, particularly in the food sector, the cost implications of such maintenance can be prohibitive.

According to insights from the Small Business Administration (SBA), small enterprises often operate with limited capital and tight budgets, making it challenging to justify the higher upfront costs associated with progressing cavity pumps. The SBA highlights that about 30% of small businesses emphasize cost control as crucial for survival, indicating a reluctance to invest in high-maintenance equipment unless absolutely necessary.

Moreover, the complex design of these pumps makes them susceptible to wear and tear when handling abrasive or corrosive fluids, common in food processing environments. For instance, processing foods with high sugar content or acidity can accelerate the deterioration of pump components, leading to frequent replacements or repairs. This not only increases operational downtime but also adds to the long-term operational costs.

Government initiatives focusing on assisting small to medium-sized enterprises (SMEs) in adopting advanced technologies often overlook the specific needs of these businesses regarding maintenance support and cost management. While there are grants and subsidies available to promote technological upgrades, they rarely cover ongoing maintenance costs, which form a significant part of the total cost of ownership.

This economic burden can deter smaller food producers from adopting progressing cavity pumps, despite their advantages in handling viscous and delicate food products efficiently. Instead, these producers may opt for less efficient but more economical pump types that align better with their financial constraints and maintenance capabilities.

Opportunity

Expansion into Emerging Markets Presents Major Growth Opportunity for Progressing Cavity Pumps

A significant growth opportunity for the progressing cavity pumps market lies in expanding into emerging economies. These regions are experiencing rapid industrial growth, urbanization, and increased investments in infrastructure development, which includes substantial enhancements in the food and beverage industry.

Countries such as India and China are leading the way in these developments. According to the World Bank, these nations have seen an average growth in industrialization of approximately 6% annually, with considerable contributions from the food processing sector. This growth is supported by government initiatives aimed at modernizing food production to increase output and efficiency while ensuring food safety.

For instance, China’s Five-Year Plan prioritizes agricultural modernization and food safety, which encourages the adoption of advanced technologies like progressing cavity pumps. These pumps are essential for handling a variety of food products, ensuring precise and hygienic processing. Their ability to pump at a constant rate and handle solids without degradation makes them ideal for the expanding processed food market in these regions.

Moreover, the increasing focus on wastewater management in food processing also offers a vast potential for the deployment of progressing cavity pumps. As governments enforce stricter regulations on waste disposal and recycling, food processing plants are compelled to upgrade their systems to include equipment capable of handling waste products efficiently and in compliance with new standards.

By tapping into these emerging markets, manufacturers of progressing cavity pumps can leverage the ongoing industrial growth, modernization initiatives, and regulatory frameworks to expand their customer base and increase market penetration. The key to capitalizing on this opportunity will be offering cost-effective, durable, and easy-to-maintain pump solutions that meet the specific needs of food producers in these rapidly developing regions.

Trends

Digital Integration and IoT Adoption Shape Future Trends in Progressing Cavity Pumps

A transformative trend within the progressing cavity pumps market is the integration of digital technologies and the Internet of Things (IoT). This evolution is redefining how these pumps operate within various industries, particularly in the food sector, where precision and efficiency are paramount.

Digital tools and IoT-enabled pumps are becoming increasingly popular as they provide significant improvements in monitoring, maintenance, and operation. For example, IoT sensors can detect changes in pump performance and predict failures before they occur, reducing downtime and maintenance costs. According to a report by the Food and Agriculture Organization (FAO), incorporating digital technologies can enhance production efficiency by up to 20% by minimizing breakdowns and optimizing energy use.

Furthermore, government initiatives across the globe are promoting the adoption of smart technologies in industrial applications. In the European Union, the Digital Europe program aims to bolster digitalization across all sectors, including food processing. This initiative supports the deployment of smart systems like IoT-enabled progressing cavity pumps to ensure more sustainable and efficient production practices.

These technologies also support compliance with increasingly stringent food safety standards, providing traceable and controlled processing environments that enhance product integrity and safety. Real-time data collected from IoT-enabled systems allows for better regulatory compliance and quality assurance, making these pumps more appealing to food producers who must adhere to strict hygiene regulations.

Regional Analysis

In the Progressing Cavity Pumps market, the Asia-Pacific (APAC) region stands out as the dominant player, capturing a substantial 46.20% market share, which translates to a market value of approximately USD 1.3 billion. This impressive dominance is driven by a combination of factors including rapid industrial growth, expanding infrastructure projects, and escalating investments in sectors such as water management, oil and gas, and particularly food processing.

The growth in APAC is notably powered by the major economies of China and India, which are spearheading the industrial boom in the region. These countries are focusing on enhancing their infrastructure and industrial capabilities, which in turn increases the demand for efficient pumping solutions like progressing cavity pumps. The need for reliable and efficient fluid handling in industries such as wastewater treatment, chemical processing, and mining contributes significantly to the region’s market expansion.

Furthermore, the region’s commitment to improving environmental standards and increasing investments in wastewater management systems are pivotal to the growth of the progressing cavity pumps market. Governments across APAC are implementing stricter regulations on waste management and encouraging the adoption of technologies that contribute to more sustainable practices.

The Asia-Pacific region’s strategic emphasis on modernizing agriculture and increasing the efficiency of food production processes also plays a critical role in the adoption of these pumps. As the food industry continues to grow, driven by increasing population and urbanization, the requirement for sophisticated and sanitary pumping solutions becomes more critical, thereby bolstering the market growth in this region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SLB, a leading player in the progressing cavity pumps market, specializes in providing advanced pumping solutions primarily for the oil and gas industry. Known for their innovative approach, SLB focuses on enhancing fluid handling efficiencies and reducing operational costs through technology-driven solutions. Their pumps are crucial in applications demanding high durability and performance under challenging conditions, making them a preferred choice in energy sectors worldwide.

ChampionX is prominent in the progressing cavity pumps market for its robust solutions tailored to the needs of the oil and gas sector. Their pumps are designed to cope with the rigorous demands of upstream and midstream applications, offering high efficiency and reduced downtime. ChampionX’s strong focus on customer-centric innovations and operational excellence drives their leadership in this segment.

Xylem stands out in the progressing cavity pumps market with a strong emphasis on water technology solutions. Their pumps are integral to municipal and industrial water management, helping clients manage water efficiently and sustainably. Xylem’s focus on innovation in water-centric applications makes them a key contributor to the global push towards smarter infrastructure.

WILO SE is a global leader in the manufacture of high-tech pumps and pump systems for building services, water management, and industrial sectors. Their progressing cavity pumps are known for their energy efficiency and reliability, tailored to meet the demands of heating, cooling, and water supply applications. WILO’s commitment to digitalization and system solutions positions them at the forefront of technological advancements in the pump industry.

Top Key Players in the Market

- SLB

- SEEPEX GMBH (INGERSOLL RAND INC.)

- CHAMPIONX

- SULZER

- XYLEM

- WILO SE

- VERDER LIQUIDS

- VARISCO

- DELTA PD PUMPS

- NOVA ROTORS

- ROTO PUMPS

- NETZSCH

- PCM

- NOV INC.

- CIRCOR INTERNATIONAL

- VOGELSANG

- INOXPA INDIA PVT. LTD.

- TAPFLO

- SPI PUMPS

- ZHEJIANG YONJOU TECHNOLOGY CO., LTD

- FRISTUM PUMPS INDIA PVT. LTD.

- PSP PUMPS

- SPX FLOW, INC.

- GEA GERMANY GMBH

Recent Developments

In 2024, ChampionX continued to distinguish itself in the progressing cavity pumps sector, particularly within the oil and gas industry. Their comprehensive offerings in artificial lift technologies, including progressing cavity pumps, demonstrate a significant commitment to technological advancement and market leadership.

In 2024, Xylem Inc. continued to strengthen its position in the progressing cavity pumps market, leveraging its expertise in water technology and smart pump solutions to meet diverse industrial demands.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 4.6 Bn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dosing Pumps, Flanged Pumps, Hopper Pumps, Vertical Pumps, Others), By Stage Type (Single-Stage (90-Psi) Pumps, Double-Stage (180-Psi) Pumps, Four-Stage (360-Psi) Pumps, Eight-Stage (720-Psi) Pumps), By Power Rating (Up to 50 HP, 51 to 100 HP, Above 100 HP), By Pumping Capacity (Up to 500 GPM, 501 to 1000 GPM, Above 1000 GPM), By End-use (Oil and Gas, Midstream , Downstream, Water and Wastewater, Pumping Sludge, Sewage Sludge, Food and Beverage, Pulp And Paper, Chemicals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SLB, SEEPEX GMBH (INGERSOLL RAND INC.), CHAMPIONX, SULZER, XYLEM, WILO SE, VERDER LIQUIDS, VARISCO, DELTA PD PUMPS, NOVA ROTORS, ROTO PUMPS, NETZSCH, PCM, NOV INC., CIRCOR INTERNATIONAL, VOGELSANG, INOXPA INDIA PVT. LTD., TAPFLO, SPI PUMPS, ZHEJIANG YONJOU TECHNOLOGY CO., LTD, FRISTUM PUMPS INDIA PVT. LTD., PSP PUMPS, SPX FLOW, INC., GEA GERMANY GMBH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Progressing Cavity Pumps MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Progressing Cavity Pumps MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- SLB

- SEEPEX GMBH (INGERSOLL RAND INC.)

- CHAMPIONX

- SULZER

- XYLEM

- WILO SE

- VERDER LIQUIDS

- VARISCO

- DELTA PD PUMPS

- NOVA ROTORS

- ROTO PUMPS

- NETZSCH

- PCM

- NOV INC.

- CIRCOR INTERNATIONAL

- VOGELSANG

- INOXPA INDIA PVT. LTD.

- TAPFLO

- SPI PUMPS

- ZHEJIANG YONJOU TECHNOLOGY CO., LTD

- FRISTUM PUMPS INDIA PVT. LTD.

- PSP PUMPS

- SPX FLOW, INC.

- GEA GERMANY GMBH