Global Low FODMAP Foods Market Size, Share, And Business Benefits By Type (Dairy, Fruit, Vegetables, Protein, Nuts and Seeds, Grain), By End-use (Household Consumers, Foodservice Industry), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Health Stores, Online Retail, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143355

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

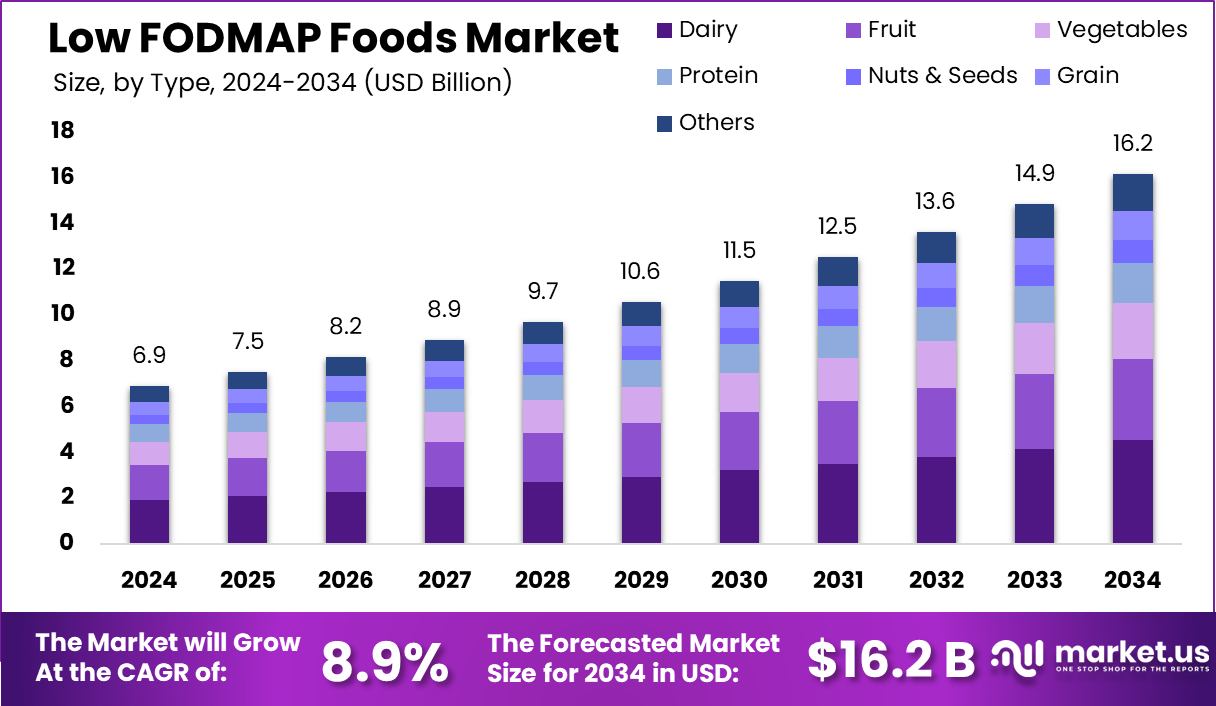

Global Low FODMAP Foods Market is expected to be worth around USD 16.2 billion by 2034, up from USD 6.9 billion in 2024, and grow at a CAGR of 8.9% from 2025 to 2034. The market is valued at USD 2.9 billion in North America.

Low FODMAP foods are dietary items that contain low levels of fermentable oligosaccharides, disaccharides, monosaccharides, and polyols. These short-chain carbohydrates are known to cause discomfort in individuals with sensitive guts, particularly those suffering from Irritable Bowel Syndrome (IBS). Minimizing their intake can help alleviate bloating, gas, and abdominal pain associated with the digestion of high-FODMAP foods.

The Low FODMAP Foods Market caters to consumers seeking dietary solutions that support digestive health without triggering IBS symptoms. This niche segment of the food industry has gained momentum as awareness and diagnosis of digestive health conditions have increased globally. Products in this market range from snacks and beverages to full meal solutions, all designed to be easy on the gut.

One significant growth factor for the Low FODMAP Foods Market is the increasing prevalence of digestive health issues, including IBS. As more people seek relief from these conditions, the demand for foods that do not exacerbate symptoms rises. Additionally, the expanding body of research supporting the effectiveness of a Low FODMAP diet in managing IBS symptoms continues to drive consumer interest and trust in these products.

Demand for low FODMAP foods is driven primarily by the growing number of individuals diagnosed with IBS and other similar health conditions. The global rise in health consciousness has also made consumers more aware of how diet affects their well-being, prompting many to seek out foods that contribute to gut health. Moreover, the inclusion of these products in health and wellness stores and mainstream supermarkets has made them more accessible to a broader audience.

In the Low FODMAP Foods Market, around 70% of IBS patients noted over a 10 mm decrease in symptoms via the Visual Analogue Scale on a low FODMAP diet. Moreover, 80% experienced a 50-point drop in their IBS Symptom Severity Score after a 6-week diet trial.

There’s a substantial opportunity in the Low FODMAP Foods Market to innovate and expand product offerings. As the diet’s popularity grows, there’s space for new entrants and existing companies to explore different categories such as organic and vegan FODMAP foods, which could appeal to a wider health-conscious consumer base. Additionally, educational initiatives about digestive health could further enhance market growth by informing potential consumers about the benefits of low FODMAP diets, thereby expanding the market’s reach.

Key Takeaways

- Global Low FODMAP Foods Market is expected to be worth around USD 16.2 billion by 2034, up from USD 6.9 billion in 2024, and grow at a CAGR of 8.9% from 2025 to 2034.

- Dairy products hold a 28.20% share in the Low FODMAP Foods Market by type.

- Household consumers dominate, comprising 68.30% of the market’s end-use segment.

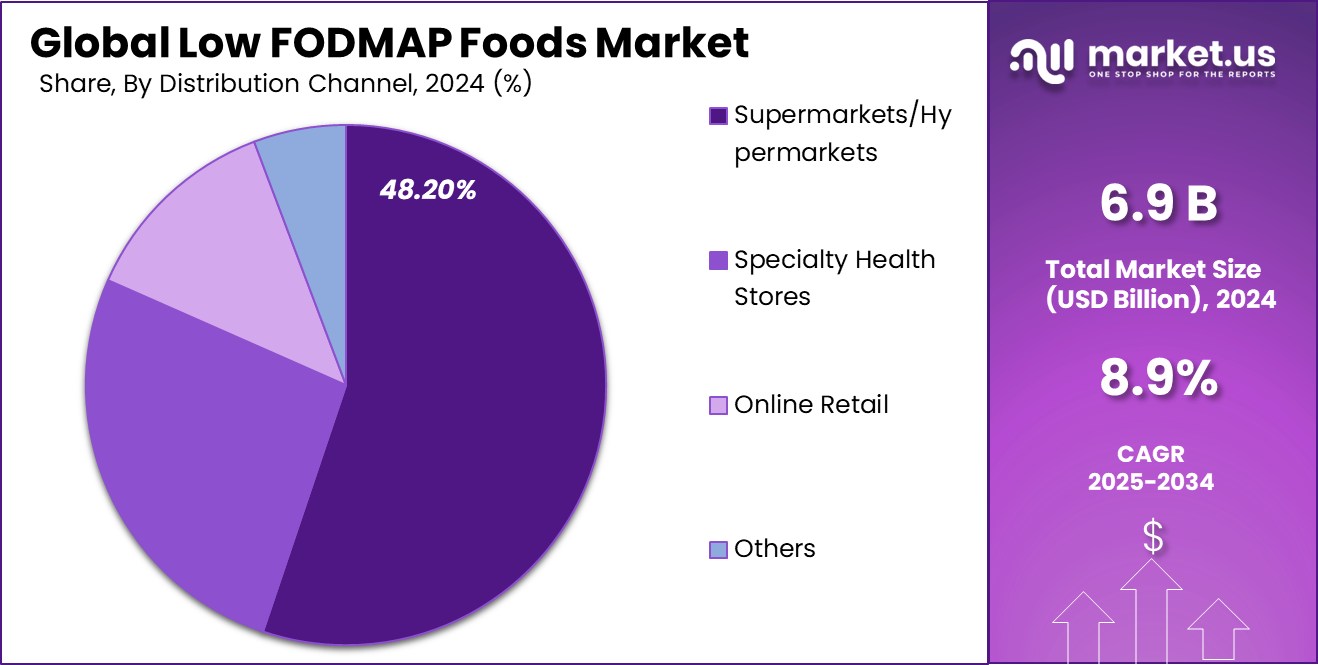

- Supermarkets and hypermarkets lead distribution, capturing 48.20% of the market channel.

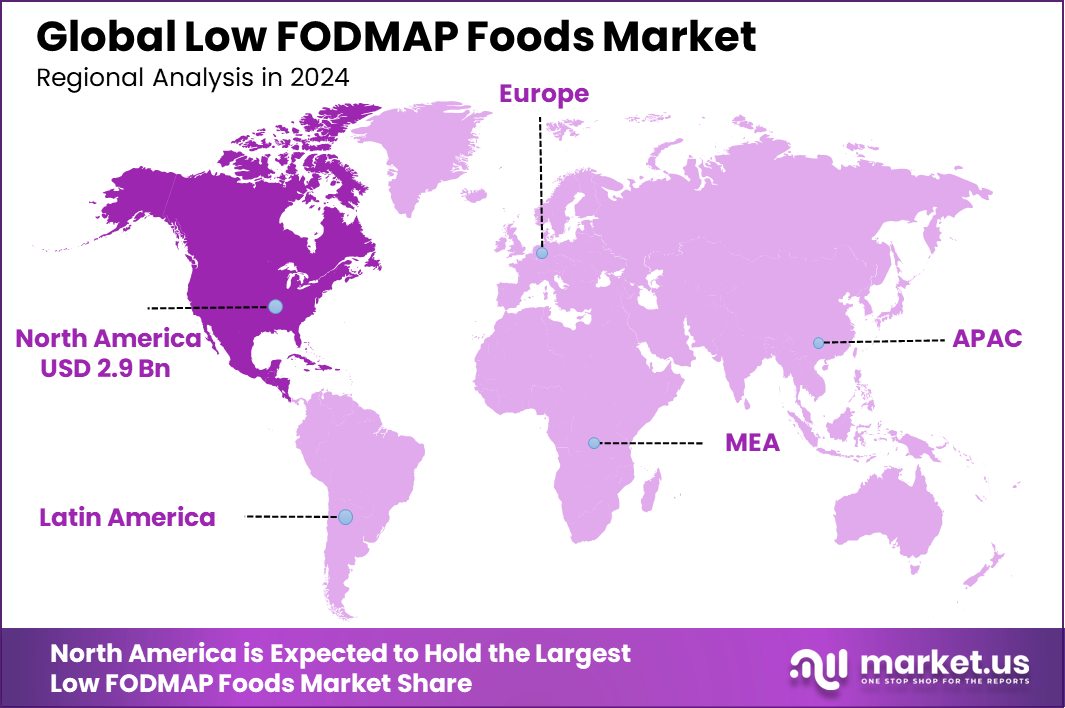

- The Low FODMAP Foods Market in North America holds a 42.40% share. Valued at USD 2.9 billion, it dominates the regional market landscape

By Type Analysis

Dairy dominates the Low FODMAP Foods market with a 28.20% share.

In 2024, Dairy held a dominant market position in the “By Type” segment of the Low FODMAP Foods Market, capturing a significant 28.20% share. This substantial market share underscores the critical role dairy alternatives play within the sector, catering specifically to individuals with lactose intolerance and those adhering to a Low FODMAP diet to manage digestive symptoms.

Dairy-free products, which include lactose-free milk, cheeses, and yogurts, have become increasingly popular as consumers seek options that are gentle on the gut yet allow them to enjoy traditional dairy flavors and textures.

The prominence of dairy in the Low FODMAP market is also indicative of the broader trends in consumer health and dietary preferences. As awareness of digestive health continues to grow, so does the demand for products that can offer relief from gastrointestinal discomfort associated with higher FODMAP ingredients.

Dairy alternatives in the Low FODMAP category not only appeal to those with specific dietary restrictions but also to a wider audience seeking healthier, more digestible food choices. This trend is expected to continue, as ongoing research and development in FODMAP-friendly foods drive innovation, particularly in the formulation of dairy alternatives that do not compromise on taste or quality.

By End-use Analysis

Household consumers lead the end-use segment, holding 68.30% of market demand.

In 2024, Household Consumers held a dominant market position in the “By End-use” segment of the Low FODMAP Foods Market, with an impressive 68.30% share. This substantial segmental dominance reflects the significant penetration of Low FODMAP products into everyday consumer shopping habits, particularly among households seeking dietary solutions for members suffering from digestive disorders such as Irritable Bowel Syndrome (IBS).

The increasing awareness of the Low FODMAP diet’s benefits has led many families to incorporate these foods into their daily diets, supporting a lifestyle aimed at minimizing gastrointestinal symptoms associated with high FODMAP intake.

The strong preference for FODMAP foods among household consumers is also influenced by the growing availability and variety of these products in supermarkets and online platforms, making them more accessible to the average consumer. As households continue to prioritize health and wellness, the demand within this segment is expected to remain robust.

Companies focusing on this market have an opportunity to expand their reach by continuing to educate consumers on the benefits of a Low FODMAP diet and by offering a wider range of products that cater to the tastes and dietary needs of diverse households.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 48.20% of low-FODMAP products.

In 2024, Supermarkets/Hypermarkets held a dominant market position in the “By Distribution Channel” segment of the Low FODMAP Foods Market, with a commanding 48.20% share. This dominance illustrates the critical role these retail formats play in making FODMAP foods accessible to a broad consumer base. Supermarkets and hypermarkets are pivotal in driving awareness and availability of these specialty dietary products, providing a diverse range of options under one roof.

The strategic placement and extensive reach of supermarkets and hypermarkets allow consumers to easily incorporate FODMAP foods into their regular shopping routines. These retail giants typically offer an extensive selection, from fresh produce to packaged goods, which are suitable for individuals with digestive sensitivities. The convenience of finding multiple Low FODMAP options in a single visit significantly enhances consumer engagement and drives sales in this category.

As these retail channels continue to expand their Low FODMAP food sections, they not only cater to the growing demand for digestive health products but also educate the public about the benefits of such diets. This ongoing expansion and the consumer-friendly environment they provide are expected to maintain their leading position in the market’s distribution landscape.

Key Market Segments

By Type

- Dairy

- Almond Milk

- Lactose-Free Milk

- Rice Milk

- Coconut Milk

- Lactose-Free Yogurt

- Hard Cheeses

- Others

- Fruit

- Bananas

- Blueberries

- Cantaloupe

- Grapefruit

- Honeydew

- Kiwi

- Lemon

- Lime

- Oranges

- Strawberries

- Others

- Vegetables

- Bamboo Shoots

- Bean Sprouts

- Bok Choy

- Carrots

- Chives

- Cucumbers

- Eggplant

- Ginger

- Lettuce

- Olives

- Parsnips

- Potatoes

- Spring Onions

- Turnips

- Others

- Protein

- Beef

- Pork

- Chicken

- Fish

- Eggs

- Tofu

- Others

- Nuts & Seeds

- Almonds

- Macadamia Nuts

- Peanuts

- Pine Nuts

- Walnuts

- Others

- Grain

-

- Oats

- Oat Bran

- Rice Bran

- Gluten-Free Pasta

- Quinoa

- White Rice

- Corn Flour

- Others

By End-use

- Household Consumers

- Foodservice Industry

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Health Stores

- Online Retail

- Others

Driving Factors

Rising Awareness of Digestive Health Concerns

One of the top driving factors for the growth of the Low FODMAP Foods Market is the increasing awareness of digestive health issues, including conditions like Irritable Bowel Syndrome (IBS). As more individuals become aware of the connection between diet and digestive health, there is a growing interest in foods that can alleviate or prevent the discomfort associated with such conditions.

Low FODMAP foods, which are specifically formulated to be low in certain sugars and carbohydrates that can trigger digestive symptoms, are gaining popularity. This shift is supported by healthcare professionals and dietitians who recommend the Low FODMAP diet as an effective management strategy, further boosting consumer confidence and market growth.

Restraining Factors

High Cost and Limited Availability Hinder Growth

A significant restraining factor in the Low FODMAP Foods Market is the high cost and limited availability of these products. Specialized ingredients and the complexity of formulating products that meet Low FODMAP standards often lead to higher prices compared to regular food items. This price difference can deter budget-conscious consumers from regularly purchasing these products.

Additionally, the availability of FODMAP foods is often constrained to specialty stores or select sections in supermarkets, making it challenging for potential consumers to find these products easily. Such barriers not only restrict the market’s reach but also slow down the adoption rate among individuals who might benefit from a Low FODMAP diet but find access and affordability prohibitive.

Growth Opportunity

Expanding Product Lines in Mainstream Retail Outlets

A prime growth opportunity in the Low FODMAP Foods Market lies in expanding product lines within mainstream retail outlets. As awareness of digestive health issues like IBS increases, there is a growing consumer demand for accessible solutions that are easily incorporated into daily diets. By introducing a wider range of Low FODMAP products into well-trafficked retail channels such as major supermarket chains, companies can tap into a broader consumer base.

This expansion not only enhances visibility but also educates the general public about the benefits of Low FODMAP diets. Making these products more readily available and at competitive prices can significantly increase market penetration and consumer adoption, ultimately driving market growth.

Latest Trends

Innovative Low FODMAP Snacks and Convenience Foods

A notable trend in the Low FODMAP Foods Market is the emergence of innovative snack options and convenience foods. As the market evolves, manufacturers are expanding beyond basic staples to include a variety of snackable and ready-to-eat products. This trend caters to the busy lifestyles of modern consumers who seek quick, convenient, and healthy eating options that fit within their dietary restrictions.

From low FODMAP bars, cookies, and chips to prepared meals that can be heated and served, these new product lines are making it easier for individuals with sensitive digestive systems to maintain their diet without sacrificing convenience or taste. The introduction of these innovative products is rapidly changing the landscape, making the Low FODMAP diet more accessible and appealing to a wider audience.

Regional Analysis

North America holds 42.40% of the Low FODMAP Foods Market share.

The Low FODMAP Foods Market exhibits varied growth dynamics across different regions, with North America, Europe, Asia Pacific, Middle East & Africa, and Latin America each presenting unique opportunities and challenges.

North America dominates the market with a substantial 42.40% share, amounting to USD 2.9 billion, driven by high consumer awareness and a well-established health and wellness industry. This region benefits from robust healthcare recommendations and the presence of numerous dietary specialists advocating for Low FODMAP diets, which has spurred significant consumer uptake.

In Europe, the market is growing steadily due to increasing dietary sensitivities among the population and greater consumer education about digestive health. Asia Pacific shows promising growth potential, fueled by rising health consciousness and improvements in retail infrastructure, making Low FODMAP foods more accessible.

Meanwhile, the Middle East & Africa and Latin America are still nascent markets. These regions show slower adoption rates, primarily due to limited awareness and availability of these specialized food products. However, as global trends toward health and wellness continue to influence dietary habits worldwide, these regions offer untapped potential for growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Low FODMAP Foods Market has seen notable contributions from key players such as WK Kellogg Co, FODILICIOUS LIMITED, and Bay’s Kitchen, each playing a pivotal role in shaping the industry landscape.

WK Kellogg Co has capitalized on its extensive distribution network and brand recognition to make significant inroads into the Low FODMAP market. Leveraging its expertise in cereal and snack production, Kellogg’s has introduced a range of Low FODMAP certified products that cater to consumers seeking both healthful options and convenience. The company’s commitment to innovation and marketing has helped raise awareness and accessibility of Low FODMAP foods, making it a leading force in expanding the market in North America and Europe.

FODILICIOUS LIMITED, a smaller yet influential player, specializes in creating gourmet FODMAP foods that cater to a niche market looking for premium options. Their dedication to quality and adherence to strict Low FODMAP guidelines has earned them a loyal customer base. As a result, FODILICIOUS has carved out a distinct space in the UK market, with potential for expansion into other European countries as awareness of the Low FODMAP diet increases.

Bay’s Kitchen, known for its award-winning Low FODMAP sauces and condiments, has effectively filled a gap in the market for flavor-rich yet digestible food options. Their product range addresses one of the key challenges for individuals following a Low FODMAP diet: finding foods that add variety and taste without triggering symptoms. Bay’s Kitchen’s success in the UK and its expanding presence in online markets underscore the potential for specialized Low FODMAP products to gain a foothold globally.

Top Key Players in the Market

- WK Kellogg Co

- FODILICIOUS LIMITED

- Bay’s Kitchen

- Tate & Lyle

- Fody Foods

- Rachel Pauls Food

- Casa de Sante

- Belliwelli

- Nestlé Health Science

- Fria Bread

- Kez’s Kitchen

- Schar

- Massel

Recent Developments

- In October 2024, Bay’s Kitchen Secured £350k investment to expand retail distribution in the UK and internationally. Plans include rebranding, new product development beyond sauces/condiments, and digital marketing campaigns.

- In October 2024, WK Kellogg Co. partnered with Monash University to launch Low FODMAP-certified cereals, including options like Frosted Flakes and Froot Loops. These cater to IBS sufferers seeking convenient breakfast solutions.

Report Scope

Report Features Description Market Value (2024) USD 6.9 Billion Forecast Revenue (2034) USD 16.2 Billion CAGR (2025-2034) 8.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dairy, Fruit, Vegetables, Protein, Nuts & Seeds, Grain), By End-use (Household Consumers, Foodservice Industry), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Health Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape WK Kellogg Co, FODILICIOUS LIMITED, Bay’s Kitchen, Tate & Lyle, Fody Foods, Rachel Pauls Food, Casa de Sante, Belliwelli, Nestlé Health Science, Fria Bread, Kez’s Kitchen, Schar, Massel Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- WK Kellogg Co

- FODILICIOUS LIMITED

- Bay’s Kitchen

- Tate & Lyle

- Fody Foods

- Rachel Pauls Food

- Casa de Sante

- Belliwelli

- Nestlé Health Science

- Fria Bread

- Kez’s Kitchen

- Schar

- Massel