Global Salmon Feed Market By Types (General Feeds, Compound Feeds), By Ingredient (Fishmeal, Plant-based Ingredients, Animal-based Ingredients, Grains, Others), By Additive (Vitamins, Minerals, Amino Acids, Enzymes, Others), By Sales Channels (Indirect Sales, Direct Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143433

- Number of Pages: 291

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

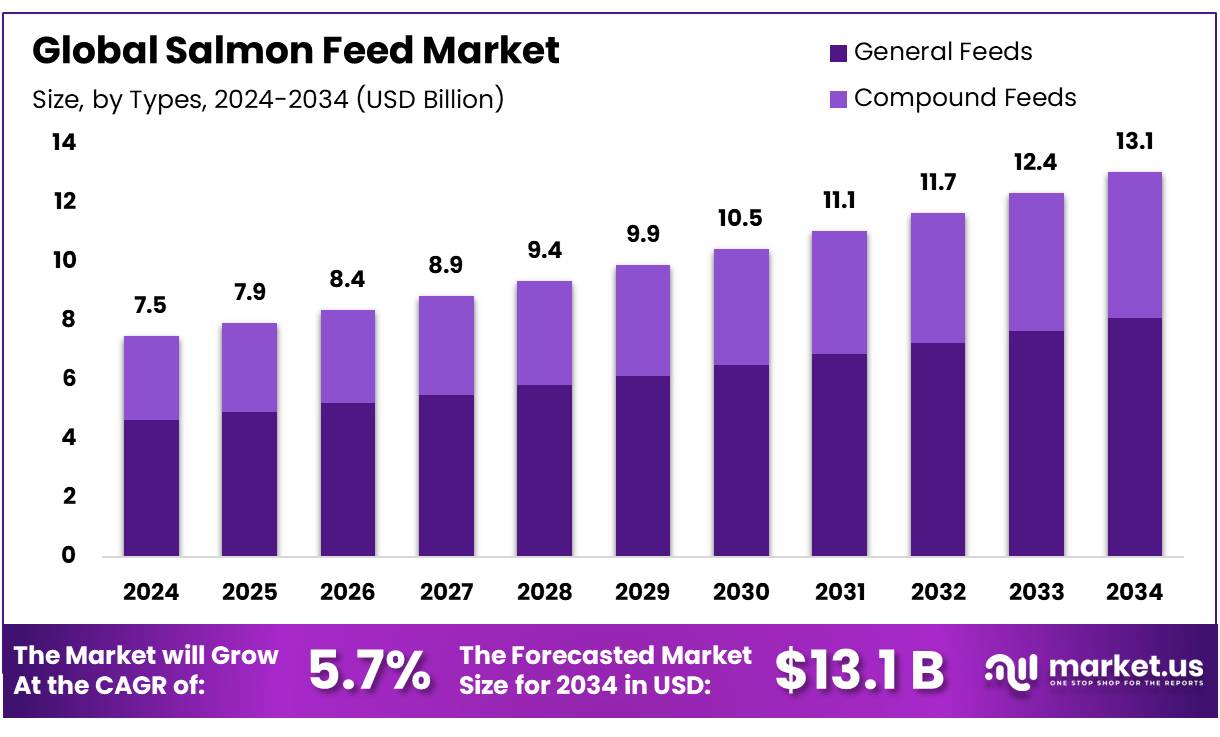

The Global Salmon Feed Market size is expected to be worth around USD 13.1 Bn by 2034, from USD 7.5 Bn in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034.

Salmon feed is a specially formulated diet provided to salmon to ensure their growth, health, and productivity in salmon farming. These feeds are designed to meet the nutritional requirements of the salmon at different stages of their life cycle, from hatchlings to market-ready fish. Salmon feed is typically made from a blend of protein sources (such as fishmeal, plant-based proteins like soybean meal, and animal by-products), lipids (including fish oils and vegetable oils rich in omega-3 fatty acids), and essential nutrients such as vitamins, minerals, amino acids, and antioxidants.

Modern salmon feeds are highly digestible, designed to minimize waste, improve flesh pigmentation, and promote fish health these feeds include additives such as astaxanthin. The shift toward plant-based ingredients and reduced reliance on wild-caught fish for feed has made salmon farming more sustainable, addressing environmental concerns and contributing to the industry’s long-term viability. Salmon feeds are customized for specific growth phases, with protein content adjusted for the fish’s maturity. This customization ensures optimal growth, efficient feed utilization, and reduced environmental impact.

The salmon feed is important for the aquaculture industry, supporting large-scale farming operations globally, particularly in regions such as Norway, Chile, and Canada. The industry is evolving with a focus on sustainability, with major feed manufacturers continually innovating to improve feed formulations and meet the growing consumer demand for healthy, omega-3-rich farmed salmon. These rising trends in sustainability and regulatory standards, drive innovation in feed production and ensure the aquaculture industry can meet the increasing global demand for nutritious and eco-friendly farmed salmon.

Key Takeaways

- The global salmon feed market was valued at USD 7.5 billion in 2024.

- The global salmon feed market is projected to grow at a CAGR of 5.7% and is estimated to reach USD 13.1 billion by 2034.

- Among types, compound feed accounted for the largest market share of 62.1%.

- Among ingredients, fishmeal accounted for the majority of the market share at 38.2%.

- By additives, vitamins accounted for the largest market share of 36.2%.

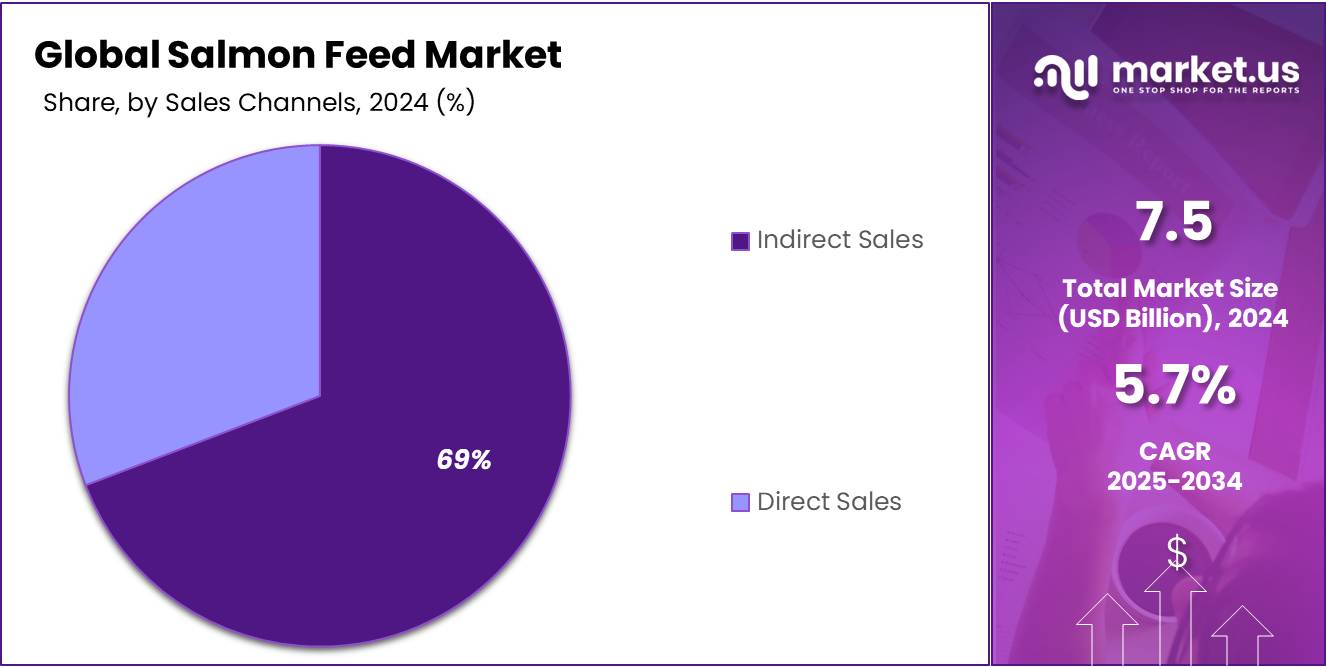

- By distribution channel, indirect sales accounted for the majority of the market share at 69.2%.

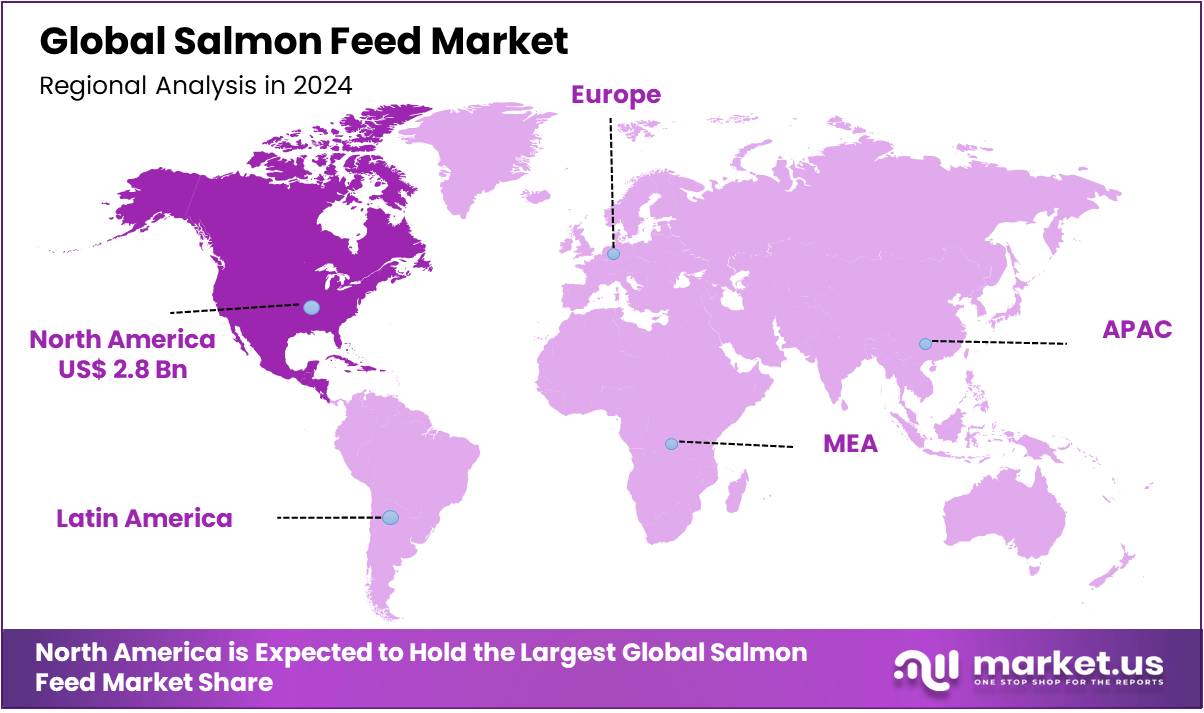

- North America is estimated as the largest market for Salmon Feed with a share of 37.6% of the market share.

Types Analysis

The salmon feed market is segmented based on type into general feeds and compound feeds. In 2024, the compound feeds segment held a significant revenue share of 62.1%. This segment’s dominance is driven by the growing awareness among fish farmers about the benefits of tailored feed formulations for optimizing growth rates and improving feed conversion ratios. Compound feeds are formulated using a combination of raw materials, including proteins, fats, vitamins, and minerals, which are designed to meet the specific nutritional requirements of salmon at various stages of their life cycle.

Moreover, advancements in feed technology and the development of sustainable ingredients have made compound feeds more attractive, offering improved feed efficiency and reduced environmental impact. The rising focus on aquaculture sustainability, along with stricter regulations related to fish health and feed quality, also contributes to the growth of the compound feed segment. As salmon farming continues to expand globally, the demand for compound feeds is expected to remain strong, supported by both technological innovations and the increasing global appetite for high-quality seafood.

Ingredients Analysis

Based on ingredients, the market is further divided into fishmeal, plant-based ingredients, animal-based ingredients, grains, and others. The predominance of the Fishmeal, commanding a substantial 38.2% market share in 2024. Fishmeal’s dominance is also attributed to its historical use in aquaculture, as fishmeal is considered the most efficient and high-quality protein source for salmon feed. Fishmeal, derived from small pelagic fish such as anchovies and sardines, is rich in essential amino acids, omega-3 fatty acids, and other nutrients critical for the growth and health of farmed salmon. These nutritional benefits make fishmeal a preferred ingredient for formulating feed that promotes optimal growth, strong immune function, and high feed conversion efficiency.

However, the growing concerns about the sustainability of fishmeal production, driven by overfishing and environmental impacts, have led to increased research into alternative ingredients, such as plant-based proteins and insect meal. Despite this, fishmeal remains a dominant ingredient in the salmon feed market, as they proved their effectiveness in promoting superior fish performance and maintaining feed quality.

Additives Analysis

Based on additives, the market is further divided into vitamins, minerals, amino acids, enzymes, and others. The predominance of the vitamins, commanding a substantial 36.2% market share in 2024. due to their essential role in promoting the overall health, growth, and immune function of farmed salmon. Vitamins such as A, D, E, and C are crucial for metabolic processes, disease resistance, and bone development. They help improve growth rates, feed conversion efficiency, and stress resilience, which are vital for maintaining fish health in intensive farming conditions.

As the aquaculture industry focuses on high-quality seafood and sustainable practices, the demand for vitamin-enriched feeds has grown. In addition, Vitamins also offer a cost-effective solution for enhancing nutritional value without significantly raising feed costs, making them a preferred choice among fish farmers. Furthermore, technological advancements have improved the bioavailability of vitamins in feed, further driving their widespread use in the market.

Sales Channels Analysis

Based on the distribution channel, the market is further divided into indirect sales and direct sales. The predominance of the Indirect sales commanding a substantial 69.2% market share in 2024. This dominance can be attributed to several factors that make this distribution channel more effective and widely used in the salmon feed market. Indirect sales typically involve intermediaries such as distributors, wholesalers, and retail partners, which help reach a larger network of fish farmers and aquaculture businesses, especially in diverse geographical regions. These intermediaries have established relationships, logistical networks, and local market knowledge, which makes it easier to deliver products in bulk and cater to a wide range of customers.

Furthermore, indirect sales offer the benefit of reduced operational costs and the ability to leverage established marketing and distribution channels without the need for the manufacturer to invest heavily in infrastructure. This is especially advantageous for companies looking to expand their market reach efficiently. Additionally, the growing complexity of global trade and the need for localized support in various regions has driven the dominance of indirect sales, as distributors and partners play a critical role in navigating regulatory requirements and providing tailored customer service.

Key Market Segments

By Types

- General Feeds

- Compound Feeds

By Ingredient

- Fishmeal

- Plant-based Ingredients

- Animal-based Ingredients

- Grains

- Others

By Additive

- Vitamins

- Minerals

- Amino Acids

- Enzymes

- Others

By Sales Channels

- Indirect Sales

- Direct Sales

Drivers

Growing consumption of salmon boosts the feed market.

The growing consumption of salmon is a primary driver behind the expansion of the salmon feed market. As global populations rise and disposable incomes increase, particularly in developing regions, there is a noticeable shift toward healthier protein options. Salmon, rich in omega-3 fatty acids and known for its health benefits, is becoming a preferred choice over other meats like beef and poultry. The increasing popularity of salmon in diverse cuisines, from sushi to more traditional dishes, is fueling the demand for this nutritious fish.

As more consumers prefer salmon in food due to a healthier and sustainable protein source, to meet these growing needs aquaculture industry adopts salmon feeds to improve the quality of fish, driving the salmon feed market growth.

- For instance, according to FAO reports by 2025, developing countries are expected to account for 93% of the additional fish consumption, and this growing demand for fish, particularly salmon, is a primary driver behind the expansion of the salmon feed market.

Furthermore, the rising demand for specialized and efficient feed ingredients is another important factor propelling the growth of salmon feeds. as traditional feed sources, like fishmeal, are under pressure due to the rising competition for raw materials and sustainability concerns. This has led to the adoption of alternative feed ingredients such as plant-based proteins, including soybean protein concentrate (SPC), and even insects or algae-based omega-3, to reduce reliance on fishmeal.

As the demand for salmon continues to grow, farmers and feed manufacturers are focusing on producing sustainable, cost-effective feed solutions that align with global trends of reducing the environmental footprint of aquaculture. These sustainable feed innovations further boost the market for salmon feeds. Additionally, technological advancements in breeding, feeding techniques, and farm management are enhancing the efficiency and sustainability of salmon farming, driving the demand for specialized, high-quality salmon feeds. As farming practices become more cost-effective, the need for efficient and nutritionally balanced feeds increases to meet the growing global demand for seafood.

Government incentives, research funding, and sustainability regulations further promote the development of advanced feed formulations. In addition, ongoing efforts for environmental sustainability by using alternative feed sources and reducing waste contribute to the growth of the salmon feed market, aligning with consumer preferences for responsible farming practices.

Restraints

Strict Environmental Regulation Limit Expansion

Strict environmental regulations are becoming a significant restraint on the expansion of the salmon feed market. Regulatory bodies like the Scottish Environmental Protection Agency (SEPA) and the National Oceanic and Atmospheric Administration (NOAA) are imposing stringent rules to mitigate the environmental impact of salmon farming. These regulations focus on controlling pollutants like chemicals used to treat sea lice, reducing waste, and limiting water discharge from farms, all of which influence the overall productivity and operational scope of salmon farming.

As regulations strengthen, farmers face the challenge of adopting sustainable farming practices, due to higher operational costs and slower growth for the industry. These restrictions can limit the ability of salmon feeds to meet growing global demand. Additionally, new regulations may limit the expansion of salmon farms into areas with suitable conditions for growth, such as shallow coastal regions or areas that were previously ideal for aquaculture.

For instance, SEPA’s proposal to move farms to deeper waters with stronger tides could complicate farm siting, increasing operational costs and limiting access to optimal locations for farming salmon. Such changes not only affect farm output but also have a direct impact on the demand for salmon feed, as less land available for farming could limit the number of fish that can be raised and, therefore, the feed needed.

Opportunities

Expansion in sustainable Aquaculture innovative practices

The expansion of sustainable aquaculture is presenting significant growth opportunities for the salmon feed market. As the demand for farmed salmon increases, there is a rising need for cost-effective and sustainable feed options. Traditional marine ingredients like fish meal and fish oil are becoming less available due to sustainability concerns and the pressure on wild fish stocks. This has boosted demand for alternative feed sources, such as plant-based ingredients, algae, insects, and other innovative options. These alternatives not only help reduce the environmental impact but also offer a nutritional profile that can improve salmon health and feed efficiency. Additionally, Innovative aquaculture practices like Integrated Multi-Trophic Aquaculture (IMTA) and Recirculating Aquaculture Systems (RAS) present new opportunities for the salmon feed market.

IMTA, which integrates species like seaweed and bivalves, can improve water quality and generate additional revenue streams, promoting sustainability. In addition, RAS offers a controlled, land-based farming method that minimizes water usage, reduces disease risks, and optimizes feed and waste management. These systems open avenues for feed producers to develop specialized, eco-friendly feeds that align with sustainable practices.

Furthermore, the emphasis on sustainability certification schemes, such as those from the Aquaculture Stewardship Council (ASC), Marine Stewardship Council (MSC), and Marin Trust, is driving the need for responsibly sourced ingredients in salmon feed. These certifications ensure traceability and responsible sourcing, which are increasingly demanded by consumers and regulators.

Additionally, advancements in biotechnology, such as selective breeding, feed optimization, and genetically engineered ingredients, are poised to enhance feed efficiency and reduce reliance on marine-based ingredients, offering both economic and environmental benefits. These shifts toward alternative feed ingredients, innovative farming systems, and sustainable certification will be key drivers of market expansion, positioning the sector as a promising area for investment and development.

Trends

Bio fortification of Feeds

The bio fortification of fish feed is emerging as a significant trend in the salmon feed market, driven by growing consumer demand for healthier, more sustainable seafood options. As fish farming increasingly incorporates biofortified feeds, salmon producers are looking to improve the nutritional profile of the fish and reduce the accumulation of toxic metals, such as mercury (Hg), cadmium (Cd), and lead (Pb), in fish meat.

Biofortification involves enriching fish diets with essential trace minerals such as iodine and selenium, as well as omega-3 fatty acids, through natural and sustainable sources like seaweed, microalgae, and brewery by-products. This approach not only boosts the health benefits of farmed salmon but also aligns with sustainability goals by utilizing eco-friendly ingredients that reduce the reliance on traditional marine-based feeds.

Additionally biofortified salmon is becoming more widely available, it is attracting attention for its enhanced health benefits, offering a higher contribution to essential nutrient intake without compromising safety. However, consumer acceptance is influenced by factors like taste, flavor, and odor, as well as information about the biofortification process. As demand for healthier fish grows, biofortification is set to play a key role in shaping the future of the salmon feed market, with farmers adopting sustainable practices to meet evolving consumer expectations.

Automated Feeding System

The automated feeding systems in the salmon feed market are emerging as a key trend driven by the growing demand for enhanced operational efficiency, precision, and sustainability within aquaculture. These systems, typically operated through RF transmitters and integrated with video transmitters for navigational ease, enable remote fish feeding, significantly reducing labor costs while ensuring precise and optimized feed distribution. The ability to minimize feed wastage and optimize feed utilization not only enhances fish growth rates but also contributes to a reduction in the environmental footprint of farming operations. As a result, these systems present significant cost-saving potential and improve overall resource management in salmon farming operations.

Moreover, the versatility of automated feeding systems in accommodating both solid and liquid feed, including medicated feed, positions them as highly attractive solutions for the industry. Real-time monitoring capabilities further enable farmers to track feed consumption, fine-tune feeding schedules, and make data-driven decisions for improved operational performance. The increasing shift toward sustainable aquaculture practices, along with the rising demand for efficiency and data-driven insights, underscores the pivotal role automated feeding systems are expected to play in the continued development of the salmon farming market. These advancements are anticipated to support the industry’s growth, with a strong focus on improving profitability while maintaining environmental sustainability.

Geopolitical Impact Analysis

Geopolitical factors impact the salmon feed market by affecting supply chains, costs, and trade stability, influencing feed availability and pricing.

The geopolitical landscape has a significant impact on the salmon feed market, influencing supply chains, production costs, and international trade policies. As major salmon farming regions like Norway, Chile, and Canada rely heavily on imports of raw materials for fish feed, any disruption in global trade due to geopolitical tensions or policy shifts can lead to price volatility and supply shortages. Trade disputes, sanctions, or border restrictions can cause delays in the delivery of essential ingredients such as fishmeal and soybean, driving up feed costs and affecting the profitability of aquaculture operations. For instance, the ongoing trade tensions between the U.S. and China have led to shifts in global feed ingredient pricing, which can have ripple effects on the salmon feed sector.

Additionally, the impact of environmental regulations and sustainability initiatives within different regions also plays a role in shaping the market. Geopolitical forces can influence how countries approach environmental policies, such as carbon emissions regulations or restrictions on overfishing. Countries with stringent environmental policies may impose higher costs on salmon feed producers to comply with sustainability standards, which can further increase feed prices. Conversely, nations that prioritize sustainability in aquaculture, such as Norway, have seen increased investment in eco-friendly and efficient feeding technologies, which could help reduce geopolitical risks by creating a more resilient domestic supply chain.

Regional Analysis

North America Held the Largest Share of the Global Salmon Feed Market

In 2024, North America dominated the global Salmon Feed market, accounting for 48.5% of the total market share, The rising demand for salmon as a high-protein, nutrient-rich seafood option is driving significant growth in the North American salmon feed market. As North American consumers increasingly prioritize health-conscious diets, the consumption of salmon continues to rise, consequently boosting the demand for high-quality feed that enhances the overall quality and growth of farmed salmon.

The growing popularity of aquaculture as a sustainable alternative to wild-caught fish is prompting salmon farmers across North America to invest in nutritionally balanced and efficient feed formulations to ensure optimal growth and long-term sustainability in farming operations.

Another key factor propelling the expansion of the salmon feed market in North America is advancements in feed technologies and ingredients. The industry in the region is undergoing a shift toward more sustainable and alternative feed sources, such as plant-based proteins, insect meals, algae-based omega-3s, and microalgae, aimed at reducing reliance on traditional fishmeal and fish oil.

- For instance, Cermaq Canada has adopted Cargill’s salmon feed enriched with Veramaris algal oil to reduce reliance on marine fish oils. This move is part of efforts to enhance sustainability in aquaculture.

Additionally, innovations in precision feeding, artificial intelligence (AI), and data analytics are transforming feed production in North America by optimizing nutritional efficiency and reducing waste. The demand for specialized salmon feeds is further driven by regions in North America with favorable conditions for salmon farming, where there is a critical need for nutritionally balanced formulations that meet the specific protein requirements of salmon at various life stages.

Moreover, biofortified feeds are gaining traction in North America due to their health benefits and eco-friendly composition, adding another layer of growth potential to the market. The increasing focus on feed efficiency, reducing environmental impact, and the rising adoption of sustainable aquaculture practices continue to propel the expansion of the salmon feed market across the region.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the salmon feed market dominate with innovation, sustainability, and advanced technologies, focusing on eco-friendly formulations and strong industry partnerships.

Key players in the salmon feed market include major feed manufacturers such as Cargill, Nutreco, Skretting, and Mowi. These companies focus on developing high-quality, eco-friendly feed formulations to meet the growing global demand for farmed salmon while adhering to regulatory standards. They are heavily invested in R&D, with a focus on improving feed efficiency, nutritional balance, and environmental impact.

Their strategies also include adopting alternative ingredients, such as plant-based proteins and insect meal, to reduce reliance on traditional fishmeal. Additionally, strong partnerships with aquaculture farms help these players expand their market reach and maintain a competitive edge. Their commitment to sustainable practices and cutting-edge technologies positions them as industry leaders, driving long-term growth in the market.

The following are some of the major players in the industry

- Aller Aqua Ewos

- Biomar

- BioMar Group

- Cargill Inc.

- EWOS

- Grobest Group

- Guangdong Haid Group

- Mowi

- Nutreco

- Ridley Corporation

- Salmofood

- Shandong Fengmaole

- Shandong Homey Aquatic

- Shandong Longda

- Skretting Averoy

- Tongwei Group

- Yadong Group

- Others

Recent Development

- In February 2025- Cargill is leveraging data to optimize salmon nutrition and enhance farm efficiency, aiming to set new standards in the aquaculture industry. The company focuses on improving sustainability and performance through advanced nutritional solutions.

- In December 2024 –Nofima is exploring the use of microalgae as a sustainable alternative to fish oil in salmon feed through the Millennial Salmon project. Early results from feeding trials show that salmon responded well to the algae-based feed, indicating its potential for broader use in aquaculture.

- In December 2024-BioMar launched SmartCare Endurance, a new salmon feed designed to improve fish resilience against diseases like SRS and IPN. The feed, which enhances immune response and reduces oxidative stress, will first be available in Chile.

- In April 2024- Skretting Chile incorporated insect meal into its salmon aquafeeds, partnering with Cermaq in 2023. The new ingredient is also featured in their Coho diets for freshwater, supporting sustainable aquaculture practices.

Report Scope

Report Features Description Market Value (2024) USD 7.5 Bn Forecast Revenue (2034) USD 13.1 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (General Feeds, Compound Feeds), By Ingredient (Fishmeal, Plant-based Ingredients, Animal-based Ingredients, Grains, Others), By Additive (Vitamins, Minerals, Amino Acids, Enzymes, Others), Sales Channels (Indirect Sales, Direct Sales), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Aller Aqua Ewos, Biomar, BioMar Group, Cargill, EWOS, Grobest Group, Guangdong Haid Group, Mowi, Nutreco, Ridley Corporation, Salmofood, Shandong Fengmaole, Shandong Homey Aquatic, Shandong Longda, Skretting, Skretting Averoy, Tongwei Group, Yadong Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aller Aqua Ewos

- Biomar

- BioMar Group

- Cargill Inc.

- EWOS

- Grobest Group

- Guangdong Haid Group

- Mowi

- Nutreco

- Ridley Corporation

- Salmofood

- Shandong Fengmaole

- Shandong Homey Aquatic

- Shandong Longda

- Skretting Averoy

- Tongwei Group

- Yadong Group

- Others