Global Fish Powder Market By Fish Species Type (Anchovy, Sand Eel, Horse Mackerel, Sardine, Pilchard, Hilsa, Others), By Species (Short-Lived, Long-Lived, Low-Fat, White Flesh), By Product Type (Fish Protein Powder, Fish Meal Powder), By Application(Animal Feed Industry, Food Industry, Cosmetics and Personal Care, Others), By Distribution Channel (Business to Business (B2B), Business to consumer (B2C)) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 134955

- Number of Pages: 225

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

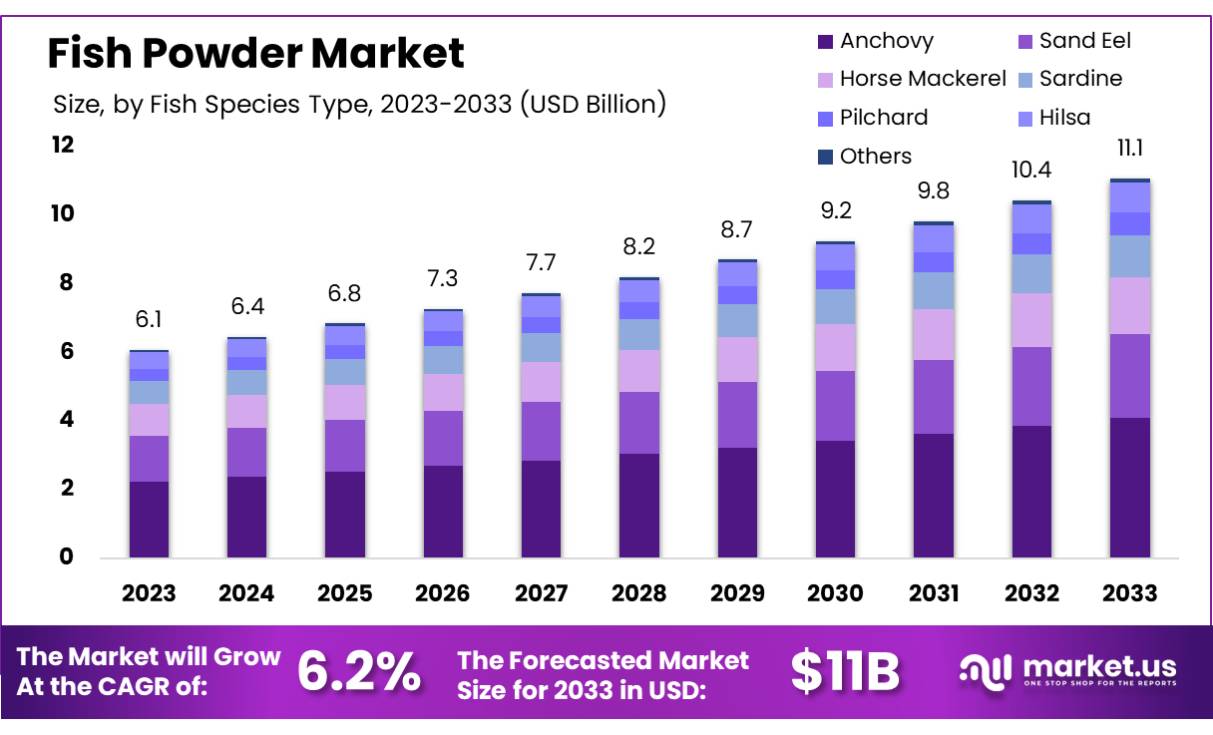

The Global Fish Powder Market size is expected to be worth around USD 11.1 by 2033, from USD 6.1 Bn in 2023, growing at a CAGR of 6.2% during the forecast period from 2024 to 2033.

Fish Powder is a type of meal or powder made from processed fish or fish by-products. It is produced by grinding whole fish or parts of fish, such as bones, heads, and offcuts, after they have been dried or cooked. This powder is rich in proteins, omega-3 fatty acids, and essential minerals, making it valuable for various industries.

In agriculture, fish powder is commonly used as a high-quality animal feed additive, especially for poultry, aquaculture, and livestock. Its excellent nutritional content makes it an essential ingredient in animal diets. Fish powder is also used in fertilizers, as it contains beneficial nutrients that improve soil quality and promote plant growth.

In the animal feed industry, fish powder is a high-protein, high-quality feed ingredient. The global demand for fishmeal, particularly in aquaculture, has surged due to increased fish consumption and expanding seafood markets. Aquaculture accounts for nearly 70% of global fishmeal consumption, with China, Norway, and Vietnam being major consumers and producers.

China is the world’s largest importer of fishmeal. In 2022, the country imported 1.5 million metric tons of fishmeal, valued at approximately USD 2.1 billion. This underscores China’s significant role in the global fishmeal market.

In Europe, the EU has made significant investments in sustainable fish powder production. The European Union aims to increase the use of sustainable fish feed ingredients by 25% by 2025, in line with government initiatives to reduce reliance on wild fish stocks.

The export-import dynamics are crucial for the fish powder market. Peru, one of the world’s largest fishmeal exporters, shipped 1.1 million metric tons in 2022, accounting for 28% of global exports. India and Vietnam have also emerged as key exporters, benefiting from their growing aquaculture industries.

According to the FAO, global fisheries and aquaculture production reached 214 million tonnes, valued at approximately USD 424 billion, highlighting the importance of sustainable practices in the industry.

Countries like the United States and Norway have set strict standards on the quality and sustainability of fishmeal and fish powder. Norway’s government invested USD 150 million in 2023 to support sustainable fishmeal production technologies and reduce the environmental footprint of the fishing industry.

Governments are also investing in initiatives to boost fisheries productivity. For example, Brazil’s government announced a 20-year concession for public fishing ports with an anticipated investment of USD 135.17 million, aimed at improving handling and processing techniques in the fishing sector.

The Indian government has set ambitious targets to increase fish production, aiming for an annual output of 13,000 tonnes within five years. This could potentially generate revenues of USD 65 million, contributing to the growth of the fish powder market in the region.

Key Takeaways

- Fish Powder Market size is expected to be worth around USD 11.1 by 2033, from USD 6.1 Bn in 2023, growing at a CAGR of 6.2%.

- Anchovy held a dominant market position, capturing more than a 37.1% share of the Fish Powder Market.

- Short-Lived species held a dominant market position, capturing more than a 48.2% share of the Fish Powder Market.

- Fish Protein Powder held a dominant market position, capturing more than a 65.4% share of the Fish Powder Market.

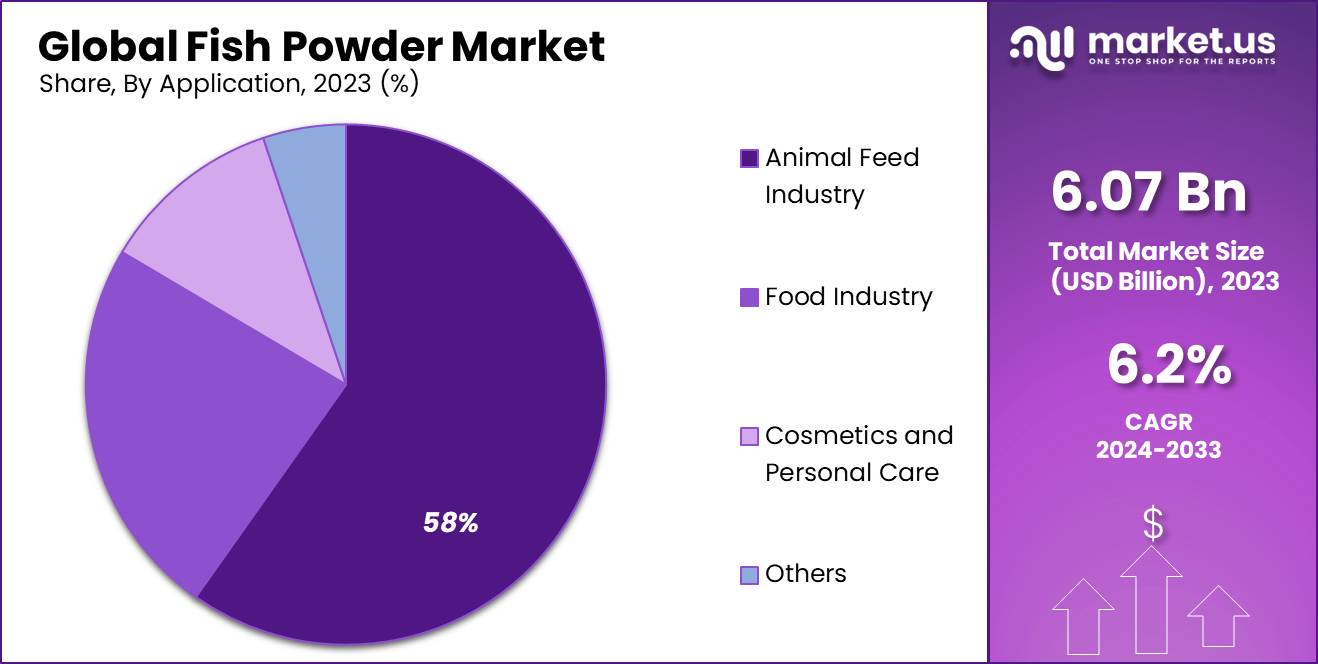

- Animal Feed Industry held a dominant market position, capturing more than a 58.1% share.

- Business to Business (B2B) held a dominant market position, capturing more than a 78.1% share.

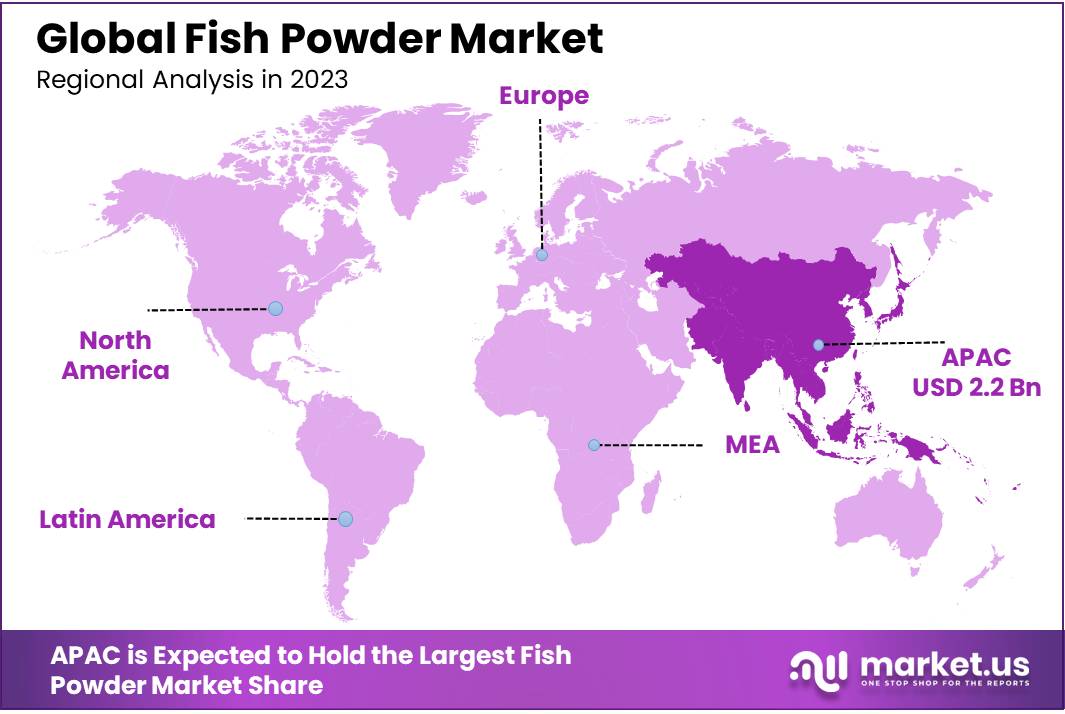

- Asia Pacific (APAC) region held the largest share of the Fish Powder Market, capturing 37.4% of the total market, valued at approximately USD 2.2 billion.

By Fish Species Type

In 2023, Anchovy held a dominant market position, capturing more than a 37.1% share of the Fish Powder Market. The high demand for anchovy-based fish powder in aquaculture and animal feed applications contributed to its strong market presence. Anchovy is rich in protein and essential fatty acids, making it a preferred choice for nutritional products.

Sand Eel followed, accounting for a significant portion of the market. Its availability in European waters and its use in producing fishmeal for livestock and pet food helped boost its demand. The Sand Eel’s role in the marine ecosystem also enhances its value in sustainable fish farming.

Horse Mackerel, with its high oil content, was another key player. It saw steady growth due to its nutritional value, particularly in animal feed. Its versatile applications in various industries, including human consumption, further supported its market share.

Sardine and Pilchard segments showed healthy demand, particularly in the production of health supplements. Both species are rich in Omega-3 fatty acids, driving their use in food and pet products.

Hilsa, primarily found in South Asia, had a smaller but growing share due to its regional consumption and increasing use in aquaculture feed. The “Others” category includes species like mackerel and tuna, which collectively contributed to the remaining market share, expanding as demand for fish powders diversified.

By Species

In 2023, Short-Lived species held a dominant market position, capturing more than a 48.2% share of the Fish Powder Market. Short-Lived species, such as anchovy and sand eel, are commonly used due to their rapid growth and high yield in fish powder production. Their shorter life cycles make them more sustainable and cost-effective for aquaculture and animal feed applications.

Long-Lived species followed with a considerable market share. These species, like mackerel and tuna, have a slower growth rate but are valued for their high nutritional content. They are often used in premium fish powders, especially in the human nutrition and health supplement sectors. The longer lifespan of these species contributes to their higher market value.

Low-Fat species, including some types of sardine and pilchard, held a growing portion of the market. With increasing consumer demand for lower-fat fish products, these species are in demand for both animal feed and dietary supplements. Their lean profile makes them a healthier option for both livestock and human consumption.

White Flesh species, such as cod and haddock, also contributed to the market. Their mild taste and versatility make them popular in the production of fish powders, particularly for pet food and culinary products. As consumer preferences shift toward clean-label and natural products, white flesh fish are gaining more attention for their quality and mild flavor.

By Product Type

In 2023, Fish Protein Powder held a dominant market position, capturing more than a 65.4% share of the Fish Powder Market. This product type is highly sought after due to its rich nutritional content, including high-quality protein and essential amino acids. Fish protein powder is widely used in animal feed, aquaculture, and health supplements, driving its strong market demand. The increasing focus on protein-rich diets in both livestock and human nutrition continues to fuel its growth.

Fish Meal Powder followed as a significant product segment. While its market share is smaller than that of fish protein powder, fish meal powder is still a key ingredient in the animal feed industry. It is a valuable source of protein and essential nutrients for livestock, poultry, and aquaculture. The use of fish meal powder is particularly popular in sustainable farming practices, as it provides a cost-effective and nutrient-dense option for feeding animals.

By Application

In 2023, the Animal Feed Industry held a dominant market position, capturing more than a 58.1% share of the Fish Powder Market. Fish powder is widely used in animal feed due to its high protein content and essential nutrients. It is a key ingredient in livestock, poultry, and aquaculture feed, helping to promote growth, health, and overall productivity. The demand for sustainable and nutritious feed continues to drive the growth of this segment, especially in aquaculture, where fish-based powders are crucial for the growth of marine species.

The Food Industry followed as the second-largest segment. Fish powder is increasingly used in the production of health supplements, functional foods, and protein-rich snacks. It is valued for its high-quality protein, Omega-3 fatty acids, and other essential nutrients. The rising consumer demand for natural and protein-enriched foods is supporting the growth of this segment, particularly in regions with high health awareness.

The Cosmetics and Personal Care segment showed a growing interest in fish powder. Fish-derived ingredients, particularly collagen and protein, are increasingly being used in skincare and haircare products. Fish powder’s high collagen content is valued for its anti-aging and skin-repairing properties. As consumer preferences shift toward natural and sustainable beauty products, the demand for fish-based ingredients is expected to rise.

By Distribution Channel

In 2023, Business to Business (B2B) held a dominant market position, capturing more than a 78.1% share of the Fish Powder Market. The B2B segment is driven by bulk purchases for industrial use, particularly in the animal feed industry, aquaculture, and food manufacturing. Manufacturers and distributors of animal feed, health supplements, and functional foods rely heavily on fish powder suppliers for large-scale procurement. This segment remains strong due to the long-term relationships and contracts between producers and businesses, ensuring a steady demand for fish powder in various industrial applications.

The Business to Consumer (B2C) segment followed, with a smaller but growing market share. This segment involves direct sales of fish powder to end consumers, particularly in the form of dietary supplements, health foods, and cosmetic products. As consumer interest in natural and protein-rich products increases, the B2C market for fish powder is expected to grow. E-commerce platforms and retail stores are becoming more popular channels for consumers to access fish powder-based products.

Key Market Segments

By Fish Species Type

- Anchovy

- Sand Eel

- Horse Mackerel

- Sardine

- Pilchard

- Hilsa

- Others

By Species

- Short-Lived

- Long-Lived

- Low-Fat

- White Flesh

By Product Type

- Fish Protein Powder

- Fish Meal Powder

By Application

- Animal Feed Industry

- Food Industry

- Cosmetics and Personal Care

- Others

By Distribution Channel

- Business to Business (B2B)

- Business to consumer (B2C)

Drivers

Rising Demand for Protein-Rich Animal Feed

The growing demand for high-protein animal feed is one of the major driving factors for the Fish Powder Market. As the global population increases, the need for efficient and sustainable animal protein production intensifies.

According to the Food and Agriculture Organization (FAO), global meat consumption is expected to increase by 70% by 2050, which places greater pressure on livestock and aquaculture industries to supply adequate nutrition for animals. Fish powder, with its high protein content, is a preferred ingredient in feed formulations for aquaculture and livestock.

The European Commission reports that the European Union is the largest importer of fishmeal and fish oil, accounting for over 50% of the global trade in fishmeal. This highlights the critical role of fish powder in meeting the nutritional needs of farmed animals, particularly in the aquaculture industry. Aquaculture production is projected to grow at a 5.1% CAGR through 2030, according to the FAO.

Expansion of Health-Conscious Consumer Base

According to the World Health Organization (WHO), protein requirements for adults range from 50 grams to 100 grams per day, depending on age, sex, and physical activity level. As consumers become more health-conscious, the demand for protein-rich food products, including those containing fish powder, has surged.

Fish powder, known for its nutritional density, is a key ingredient in many health supplements and functional foods. The United Nations Food and Agriculture Organization (FAO) highlighted that fish and seafood provide essential nutrients, including protein, omega-3 fatty acids, vitamins, and minerals, which are increasingly sought after in modern diets.

The rise in plant-based diets and alternatives has also increased the demand for animal-sourced protein supplements. Additionally, the trend toward natural and sustainable food ingredients is expected to further boost the popularity of fish powder. This is evident as the market for fish protein powders in the food and supplement sectors is projected to grow by 7.5% CAGR globally over the next few years.

Government Support and Sustainable Aquaculture Initiatives

The U.S. National Oceanic and Atmospheric Administration (NOAA) has reported that sustainable fisheries provide about 90% of the seafood consumed in the U.S., reinforcing the importance of responsible sourcing of fish for powder production. This trend is expected to continue as governments around the world incentivize sustainable aquaculture practices.

These government-led efforts help ensure a stable supply of raw materials for the Fish Powder Market. Moreover, the European Union has introduced regulations aimed at improving sustainability in fishmeal production, such as the Marine Strategy Framework Directive, which aims to protect the marine environment and ensure sustainable fisheries management.

Restraints

Fluctuations in Fish Raw Material Supply

According to the Food and Agriculture Organization (FAO), fish stocks globally have been under increasing pressure due to overfishing. In 2022, nearly 34% of global fish stocks were overfished, meaning they were harvested beyond sustainable limits. This impacts the availability of key fish species such as anchovy, sardine, and mackerel, which are crucial for fish powder production.

In addition, climate change is further exacerbating the situation by altering fish migration patterns and reducing fish populations in certain regions. The Intergovernmental Panel on Climate Change (IPCC) has warned that warming oceans and changing ecosystems will affect fishery yields, making fish powder production more dependent on sustainable sources.

The European Commission reports that global fish meal production has been volatile, with a decline in production in 2020 due to disruptions in the supply chain caused by factors such as fishing restrictions and environmental changes. These uncertainties in supply can lead to price fluctuations, impacting the profitability of fish powder production and leading to market instability.

Environmental Concerns and Sustainability Issues

According to the United Nations Food and Agriculture Organization (FAO), the fishing industry causes over 40% of marine pollution. This has led to stricter regulations on fish harvesting practices, which in turn affect the availability and cost of fish-derived ingredients such as fish powder.

For example, the Marine Stewardship Council (MSC), an organization that certifies sustainable seafood, estimates that only 13% of global fisheries are certified as sustainable. With growing demand for eco-friendly products, manufacturers in the Fish Powder Market must adopt more sustainable sourcing practices. While this is beneficial in the long run, it can significantly increase the cost of production in the short term.

The European Union’s Common Fisheries Policy (CFP), which aims to achieve sustainable fisheries management, has imposed stricter quotas and catch limits, potentially limiting the amount of fish available for fish powder production. These environmental regulations contribute to higher costs and market volatility.

Increasing Competition from Plant-Based Alternatives

The rise of plant-based protein alternatives is another factor limiting the growth of the Fish Powder Market. As consumers increasingly adopt plant-based diets, demand for alternative protein sources such as soy, peas, and lentils has surged.

According to the FAO, plant-based protein consumption is expected to increase by 12.2% annually through 2030. This shift is particularly notable in the food and dietary supplement sectors, where fish powder has historically been a key ingredient in protein supplements.

According to Euromonitor, plant-based protein products in Europe grew by 12.3% in 2022, further illustrating the growing shift toward plant-based diets. This trend puts pressure on the Fish Powder Market to innovate and remain competitive in an increasingly plant-protein-dominated market.

Opportunity

Growing Demand for Aquaculture Feed

One of the major growth opportunities for the Fish Powder Market lies in the increasing demand for aquaculture feed. The global aquaculture industry has been expanding rapidly to meet the rising global demand for seafood.

According to the Food and Agriculture Organization (FAO), aquaculture production has grown by 5.8% annually over the past decade and is projected to account for 60% of the world’s seafood production by 2030. Fish powder plays a crucial role in aquaculture feed as it is rich in protein and essential fatty acids, which are vital for the growth and health of fish.

In particular, fishmeal, derived from small fish species like anchovy and sardine, is used extensively in fish feed to ensure optimal growth in farmed fish. The FAO also estimates that global fishmeal production increased by 3% in 2022, indicating strong demand from the aquaculture sector. As more countries expand their aquaculture industries to meet domestic and international seafood demand, the need for fish powder in aquaculture feed is expected to grow.

Increasing Use in Functional Foods and Supplements

Another promising growth opportunity for the Fish Powder Market is its use in the production of functional foods and dietary supplements. Consumers are becoming more health-conscious and seeking natural, protein-rich, and nutrient-dense products.

According to the World Health Organization (WHO), there is a growing global demand for high-protein foods, especially those containing essential amino acids, omega-3 fatty acids, and micronutrients. Fish powder, with its high nutritional profile, fits perfectly into this trend.

In 2021, the global dietary supplements market was valued at approximately $140 billion, and it is expected to grow at a 7.1% CAGR until 2028. Fish powder, particularly from species like anchovy and sardine, is becoming increasingly popular in the formulation of protein supplements, omega-3 products, and other functional foods.

Fish protein is considered a high-quality protein source, making it desirable in the formulation of protein powders, smoothies, and nutrition bars. Additionally, fish collagen, derived from fish powder, is gaining popularity in the beauty and wellness market due to its skin and joint health benefits.

Governments, particularly in Europe and North America, are promoting the consumption of healthy foods, which is likely to encourage further growth in the demand for fish-based products in functional foods and supplements.

Government Initiatives Supporting Sustainable Fishmeal Production

Government initiatives aimed at promoting sustainable fisheries and responsible fishmeal production are opening up significant growth opportunities for the Fish Powder Market. According to the United Nations Food and Agriculture Organization (FAO), about 34% of global fish stocks are overfished, and sustainable fishing practices are becoming a priority to ensure long-term industry viability.

Several governments, including those in Norway, Chile, and the European Union, have implemented policies and regulations to encourage sustainable fishmeal production, which is essential for ensuring a steady supply of raw materials for fish powder.

Trends

Increased Use of Fish Powder in Plant-Based Alternatives

A significant trend in the Fish Powder Market is its increasing incorporation into plant-based food alternatives. As more consumers adopt plant-based diets, there is a growing demand for protein-rich substitutes that can mimic the nutritional profile of animal products. Fish powder, particularly fish protein, is gaining popularity as an ingredient in plant-based seafood and protein supplements due to its high-quality amino acids, omega-3 fatty acids, and overall nutritional benefits.

According to the United Nations Food and Agriculture Organization (FAO), global plant-based protein consumption has risen by 12.2% annually, reflecting the shift toward more sustainable diets. The market for plant-based meat alternatives alone is expected to grow from $4.3 billion in 2023 to $10.2 billion by 2030, with fish-derived protein emerging as a preferred ingredient.

Fish Collagen Gaining Popularity in Skincare and Supplements

Another key trend is the rising popularity of fish collagen, derived from fish powder, in the beauty and wellness industries. Fish collagen, which is often extracted from fish scales and skin, is a more sustainable and bioavailable form of collagen compared to other sources like bovine or porcine collagen. It has gained traction in the skincare and dietary supplement markets due to its potential benefits in improving skin elasticity, reducing wrinkles, and promoting joint health.

According to the World Health Organization (WHO), the global market for collagen is projected to grow at a 6.9% CAGR from 2021 to 2028. The demand for fish-based collagen in particular has seen a rise, driven by consumers seeking natural and sustainable beauty products.

The European Union and United States are key markets for fish collagen, with manufacturers highlighting its eco-friendly and health-promoting qualities. For example, fish collagen is increasingly being added to skincare products such as anti-aging creams and serums. The growing interest in natural beauty solutions is likely to further expand the use of fish collagen, positioning fish powder as a key ingredient in both beauty and health supplement markets.

Sustainability and Eco-Friendly Sourcing of Fish Powder

Sustainability is becoming a critical trend in the production and consumption of fish powder. With growing concerns about overfishing and the environmental impact of the fishing industry, there has been a push towards more sustainable sourcing practices. The Marine Stewardship Council (MSC) has reported that only 13% of the world’s fisheries are certified as sustainable, highlighting the need for eco-friendly sourcing in the fishmeal and fish powder industries.

Governments, particularly in Europe and North America, are implementing stricter regulations to ensure that fishmeal and fish powder production adheres to sustainable practices. For instance, the European Union’s Common Fisheries Policy (CFP) mandates sustainable fishery management to prevent overfishing and promote the conservation of marine ecosystems.

As a result, the demand for sustainably sourced fish powder has been growing, as companies and consumers increasingly prioritize eco-friendly products. The Norwegian Seafood Council reports that over 60% of fishmeal production in Norway is certified as sustainable, setting an example for the rest of the industry. This trend is driving innovation in fish powder production, as manufacturers seek to meet growing demand for responsibly sourced products while maintaining profitability.

Regional Analysis

In 2023, the Asia Pacific (APAC) region held the largest share of the Fish Powder Market, capturing 37.4% of the total market, valued at approximately USD 2.2 billion. This dominance is driven by the rapidly expanding aquaculture industry in countries like China, India, and Vietnam, which are major consumers of fishmeal and fish powder for animal feed.

The region’s significant fish production and consumption, coupled with growing demand for protein-rich diets, make it a key player in the global market. The FAO reports that the APAC region accounts for over 70% of global aquaculture production, further propelling the demand for fish powder in animal feed and nutritional supplements.

North America is another key market for fish powder, holding a substantial share due to the rising demand for high-protein products in animal feed and dietary supplements. The United States is one of the largest consumers of fish-based products, with the feed industry contributing significantly to the regional market.

The growing trend of health-conscious consumers and the increasing use of fish protein in functional foods and pet care are key factors driving this market.

Europe follows closely, with a notable demand for sustainable and responsibly sourced fish powder. The European Union has stringent regulations in place to ensure the sustainability of fishmeal production, creating a favorable environment for eco-conscious consumers and businesses.

Latin America and the Middle East & Africa represent smaller but growing markets, driven by increasing awareness of fish powder’s nutritional benefits and expanding feed and food industries in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Fish Powder Market is highly competitive, with several prominent players driving growth through innovations in product offerings, strategic acquisitions, and geographic expansion. Aksha Fish Meal and Oil and Austevoll Seafood ASA are among the leading producers, known for their high-quality fishmeal and fish oil products used in animal feed and dietary supplements.

Austevoll Seafood ASA, a major player in the fishmeal industry, focuses on sustainable sourcing practices, contributing to its significant market share. Other notable players like Croda International Plc. and FMC Corporation bring cutting-edge technologies and global distribution networks to the market, with a strong focus on the nutraceuticals and feed industries.

GC Rieber Oil, VivoMega AS, and Marvesa have carved out a niche in the premium fish powder segment, with a focus on omega-3 fatty acids and fish-derived proteins used in functional foods, supplements, and animal nutrition.

Oceana Group Limited and Omega Protein Corporation, both major suppliers of fishmeal, dominate the North American and European markets, focusing on sustainability and high-quality raw materials. Pelagia AS, Polfish, and Rongcheng Hisheng Feed also contribute significantly to the global market by expanding their product portfolios to cater to diverse regional needs.

Companies such as Sürsan, TASA, and The Scoular Company are well-established in the market, with a focus on optimizing fishmeal production through advanced processing techniques. Additionally, Zhejiang FengYu Halobios is emerging as a key player in Asia, leveraging its strong presence in the Chinese market. Together, these companies are pushing forward the growth of the Fish Powder Market through a mix of sustainable practices, technological advancements, and strategic market positioning.

Top Key Players in the Market

- Aksha Fish Meal and Oil

- Austevoll Seafood ASA

- Croda International Plc.

- FMC Corporation

- GC Rieber Oil

- VivoMega AS

- Marvesa

- Oceana Group Limited

- Omega Protein Corporation

- Pelagia AS

- Polfish and Oceana Group.

- Rongcheng Hisheng Feed

- Sürsan

- TASA

- The Scoular Company

- Zhejiang FengYu Halobios

Recent Developments

In 2024, Aksha Fish Meal and Oil is expected to increase its annual production by an additional 15%, as it continues to invest in new technologies and production methods.

In 2024, Austevoll is expected to continue expanding its production capacity by 10% annually as part of its strategic growth plan, further solidifying its leadership position in the fish powder industry.

Report Scope

Report Features Description Market Value (2023) USD 6.1 Bn Forecast Revenue (2033) USD 11.1 Bn CAGR (2024-2033) 6.2% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fish Species Type (Anchovy, Sand Eel, Horse Mackerel, Sardine, Pilchard, Hilsa, Others), By Species (Short-Lived, Long-Lived, Low-Fat, White Flesh), By Product Type (Fish Protein Powder, Fish Meal Powder), By Application(Animal Feed Industry, Food Industry, Cosmetics and Personal Care, Others), By Distribution Channel (Business to Business (B2B), Business to consumer (B2C)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aksha Fish Meal and Oil, Austevoll Seafood ASA, Croda International Plc., FMC Corporation, GC Rieber Oil, VivoMega AS, Marvesa, Oceana Group Limited, Omega Protein Corporation, Pelagia AS, Polfish and Oceana Group., Rongcheng Hisheng Feed, Sürsan, TASA, The Scoular Company, Zhejiang FengYu Halobios Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aksha Fish Meal and Oil

- Austevoll Seafood ASA

- Croda International Plc.

- FMC Corporation

- GC Rieber Oil

- VivoMega AS

- Marvesa

- Oceana Group Limited

- Omega Protein Corporation

- Pelagia AS

- Polfish and Oceana Group.

- Rongcheng Hisheng Feed

- Sürsan

- TASA

- The Scoular Company

- Zhejiang FengYu Halobios