Global Insect Farming Market By Insect Type(Crickets, Mealworms, Black Soldier Flies, House Flies, Others), By Application(Animal Feed, Fertiliser, Protein, Biofuels, Others), By End-use(Food and Feed, Agricultural, Pharmaceuticals, Biotechnology, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121278

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

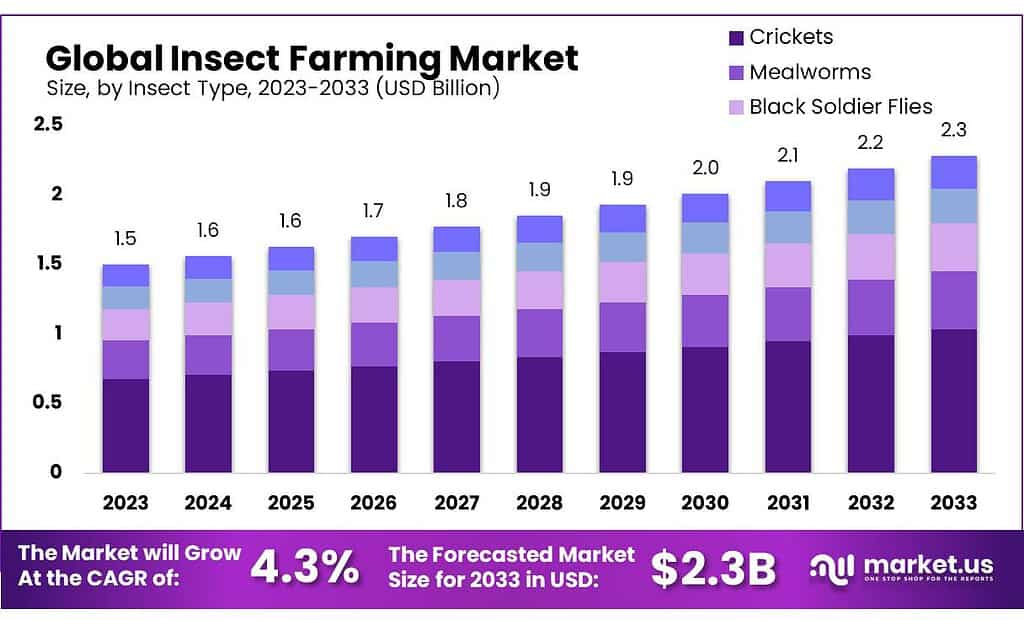

The global Insect Farming Market size is expected to be worth around USD 2 billion by 2033, from USD 1.5 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033.

The insect farming market involves the breeding and rearing of insects for various purposes, such as animal feed, human consumption, agricultural use, and even waste management. This market is gaining popularity due to the sustainability benefits insects offer as an alternative protein source. Insects, like crickets, mealworms, and black soldier flies, require significantly less land, water, and food than traditional livestock, and they emit fewer greenhouse gases during production.

Insect farming serves multiple industries, with the most notable being the animal feed sector, where insect protein is used as feed for poultry, fish, and pets. The high protein content and favorable amino acid profile of insects make them an excellent feed ingredient. Additionally, the human food industry is exploring the use of insects due to their nutritional benefits, including high levels of protein, vitamins, and minerals.

Another important application of insect farming is in waste management. Certain species, like the black soldier fly larvae, can consume large amounts of organic waste, transforming it into valuable biomass that can be used as animal feed or organic fertilizer. This not only helps reduce waste but also contributes to the circular economy by creating valuable outcomes from byproducts.

The growth of the insect farming market is supported by increasing interest in sustainable farming practices and the need for alternative protein sources due to rising global food demands. However, the market faces challenges such as regulatory hurdles, consumer acceptance, and the need for technological innovations to scale up production effectively.

Key Takeaways

- Market Growth: The insect farming market is expected to grow from USD 1.5 billion in 2023 to USD 2 billion by 2033, with a 4.3% CAGR.

- Segmentation: Crickets dominate with over 46.7% market share in 2023, followed by mealworms and black soldier flies.

- Applications: Animal feed leads with over 37.5% market share in 2023, followed by fertilizer, protein, and biofuels.

- End-use: Food and feed industries hold over 41.6% market share in 2023, followed by agriculture, pharmaceuticals, and biotechnology.

- Regional Analysis: Asia Pacific dominates with a 40.9% market share, driven by the adoption of animal feed, pharmaceuticals, and sustainable agriculture.

By Insect Type

In 2023, Crickets held a dominant market position, capturing more than a 46.7% share. This segment benefits from high consumer acceptance, especially in regions where eating insects is culturally normalized. Crickets are popular due to their nutty flavor and are often used in snacks, flour, and protein bars.

Mealworms are also significant in the insect farming market, known for their versatility in both human food and animal feed. They are rich in protein and fat, making them ideal for nutritional supplements and as a feed ingredient in aquaculture and poultry.

Black Soldier Flies (BSF) have rapidly gained market share due to their role in waste management. The larvae of BSF are effective in converting organic waste into high-quality protein, which is then processed into animal feed or organic fertilizers, supporting sustainable agriculture practices.

House Flies are primarily valued in the market for their larvae, which, like BSF, are used in waste reduction through bioconversion. They help in managing animal waste by converting it into usable biomass, reducing environmental impact.

By Application

n 2023, Animal Feed held a dominant market position, capturing more than a 37.5% share. This segment utilizes insects as a high-protein, sustainable feed option for livestock, poultry, and aquaculture, helping to reduce reliance on traditional feedstocks like soy and fishmeal.

Fertilizer applications of insect farming are growing due to the use of insect waste as an organic fertilizer that enriches soil health without the environmental downsides of chemical fertilizers. Insect frass (waste) is nutrient-rich and promotes plant growth naturally.

In the Protein segment, insects are processed into powders and meals for use in human nutrition and sports supplements. This segment capitalizes on the high protein content of insects, offering a more sustainable protein source compared to traditional livestock.

Biofuels represent an innovative application of insect farming, where insect biomass is converted into bioenergy. This segment explores the potential of insects as a bioresource for producing renewable energy, thereby contributing to the reduction of fossil fuel dependence.

By End-use

In 2023, Food and Feed held a dominant market position, capturing more than a 41.6% share. This segment leverages insects as a sustainable source for both human food and animal feed, highlighting insects’ nutritional benefits and lower ecological footprint.

The Agricultural segment utilizes insects primarily in pest management and soil enrichment, where certain insects help control pest populations naturally without harsh chemicals, and others enrich soil health through their biological activity.

In Pharmaceuticals, insects are researched for their unique compounds that can be used in drug development. Substances derived from insects are being explored for their potential to treat a range of diseases, harnessing insects’ biological properties.

Biotechnology sees insects used in genetic research and protein production. The segment explores how insects can be engineered or utilized in bioprocesses to produce enzymes, vaccines, and other biologically important proteins.

Key Market Segments

By Insect Type

- Crickets

- Mealworms

- Black Soldier Flies

- House Flies

- Others

By Application

- Animal Feed

- Fertiliser

- Protein

- Biofuels

- Others

By End-use

- Food and Feed

- Agricultural

- Pharmaceuticals

- Biotechnology

- Others

Drivers

Major Driver for Insect Farming Market: Sustainability and Environmental Benefits

One of the most significant drivers of the insect farming market is the sustainability and environmental benefits associated with insect cultivation. As global awareness about environmental conservation intensifies, the demand for sustainable and eco-friendly products has surged. Insect farming emerges as a pivotal solution in this context, offering a sustainable alternative to conventional livestock farming, which is often criticized for its high carbon footprint, extensive land use, and substantial water consumption.

Insects are heralded for their remarkable efficiency in converting feed into protein, requiring substantially less feed compared to traditional livestock. For example, crickets need six times less feed than cattle, four times less than sheep, and two times less than pigs to produce the same amount of protein, making them an eco-friendly alternative. This efficiency translates into fewer resources used and a lower environmental impact. Moreover, insects emit negligible amounts of greenhouse gases such as methane and ammonia compared to cattle, further underscoring their role in mitigating climate change impacts.

The water usage in insect farming is also minimal compared to traditional animal farming. Insects naturally require less water, and the closed systems used for farming insects further reduce water wastage, making it a viable option in regions facing water scarcity. This aspect of insect farming is particularly crucial as water scarcity becomes an increasingly pressing issue worldwide.

In addition to their low environmental footprint, insects are also capable of biodegrading organic waste, transforming it into high-quality protein and fertilizers, thus contributing to waste reduction and the circular economy. The ability of certain species, like the Black Soldier Fly larvae, to feed on organic waste and convert it into valuable byproducts not only helps in managing waste but also produces organic fertilizer, contributing to sustainable agriculture practices.

The sustainability of insect farming extends beyond environmental benefits to encompass economic advantages. The lower cost of production, due to minimal resource requirements, and the rising demand for sustainable protein sources make insect farming economically viable. This economic aspect is crucial for the scalability and mainstream adoption of insect farming.

Restraints

Major Restraint for Insect Farming Market: Consumer Acceptance and Regulatory Hurdles

One of the primary restraints facing the insect farming market is consumer acceptance and regulatory hurdles. Despite the sustainability benefits and the efficiency of insects as a protein source, the ‘yuck factor’ associated with eating insects or using products derived from them poses a significant challenge. In many Western cultures, there is a strong psychological barrier against consuming insects, which are often associated with dirt and decay rather than with food. Overcoming these deeply ingrained cultural perceptions requires extensive education and marketing efforts to change consumer attitudes and demonstrate the safety, nutritional benefits, and environmental advantages of insect-based products.

The challenge of consumer acceptance is compounded by regulatory hurdles. Insect farming and the sale of insect-based products are subject to strict regulatory frameworks that vary significantly from one region to another. These regulations can affect everything from how insects are farmed and processed to how products are labeled and marketed. For instance, in the European Union, insects as food ingredients fall under the novel food regulations, requiring a comprehensive risk assessment before being approved for market entry. This process can be lengthy and costly, slowing down the introduction of new insect-based products to the market.

Moreover, the lack of standardized regulations across different countries creates additional complexities for companies operating internationally. They must navigate a patchwork of regulations, which can hinder scalability and global expansion efforts. This not only affects the supply chain and distribution but also impacts investment in insect farming businesses, as potential investors may be cautious due to regulatory uncertainties.

Additionally, there is a need for more research on the long-term health effects of consuming insects, which is crucial for regulatory approval and consumer acceptance. While insects are consumed in many parts of the world without known adverse effects, comprehensive studies are needed to assess allergies and other potential health risks associated with a broader dietary inclusion of insects in regions where they are not traditionally consumed.

Despite these challenges, ongoing efforts in consumer education, coupled with growing environmental concerns and the increasing need for sustainable food sources, are gradually breaking down barriers. As more information becomes available and more products enter the market, consumer perceptions are slowly changing. Moreover, as the industry grows, there is a push for more harmonized regulations that could facilitate easier market access and trade in insect-based products.

Opportunity

Major Opportunity for Insect Farming Market: Expansion into Alternative Protein Markets

A significant opportunity for the insect farming market lies in its potential expansion into alternative protein markets, catering to the increasing global demand for sustainable and environmentally friendly protein sources. As the global population continues to grow, traditional livestock farming is becoming unsustainable due to its high demand for land, water, and feed, as well as its considerable contribution to greenhouse gas emissions. Insects offer a viable solution due to their high feed conversion efficiency, low environmental footprint, and the ability to be farmed vertically in urban settings, thereby minimizing land use.

The use of insects as a source of protein in human diets, pet foods, and as livestock feed presents a substantial market opportunity. Insects are not only rich in protein but also in essential amino acids, vitamins, and minerals, making them an excellent nutritional supplement. The growing health-consciousness among consumers, coupled with an interest in sustainable eating practices, has led to an openness to alternative proteins, which insect protein can fulfill.

Furthermore, the scalability of insect farming operations presents another opportunity. Innovations in biotechnology and the modular nature of insect farming allow for operations to scale up efficiently to meet market demand. This scalability, combined with relatively low startup and operational costs, makes insect farming an attractive venture for new entrants and existing agricultural businesses looking to diversify their product offerings.

Additionally, insects can be used in the production of non-food products such as biofuels and bioplastics. Their ability to process organic waste materials into valuable by-products positions the insect farming industry at the forefront of the circular economy, turning waste into high-value products.

The regulatory landscape is also gradually becoming more favorable as more governments and international bodies recognize the benefits of insect farming. This evolving regulatory environment could soon provide a clearer pathway for the commercialization and wider acceptance of insect-based products.

Trends

Major Trend in the Insect Farming Market: Integration of Technology and Automation

A significant trend in the insect farming market is the increasing integration of technology and automation within farming practices. As the industry grows, technological advancements are becoming crucial for optimizing production, enhancing yield, and ensuring the sustainability of operations. Modern insect farms are beginning to utilize sophisticated systems that monitor and control environmental conditions, such as temperature, humidity, and light, which are essential for maximizing insect growth and reproduction rates.

Automation technology in insect farming includes automated feeding systems, climate control systems, and even robotic harvesting. These technologies reduce the need for manual labor, decrease production costs, and increase the efficiency of insect farms. For instance, automated feeding systems ensure that insects receive the optimal amount of nutrients required for their growth at the correct times, without human intervention. This not only improves the scalability of operations but also enhances the consistency and quality of the insect output.

Moreover, the use of data analytics and IoT (Internet of Things) technologies is transforming insect farming into a more data-driven industry. Sensors collect data on various aspects of the farming environment and the growth parameters of the insects. This data is then analyzed to optimize the growth conditions and improve the health and yield of the insects. Predictive analytics are used to foresee potential issues before they become problematic, such as predicting the outbreak of disease, thereby allowing for timely interventions.

Artificial intelligence (AI) is also making its way into the insect farming sector, with algorithms designed to optimize breeding patterns and genetic selection to produce strains of insects that grow faster, consume less food, or are richer in specific nutrients. This genetic optimization further boosts the efficiency and profitability of insect farming.

The trend towards technology and automation is driven by the need to meet the growing demand for insect protein efficiently and sustainably. As more companies enter the insect farming market, technological differentiation becomes a key factor in gaining a competitive edge. This trend not only supports the scale-up of operations to commercial levels but also aligns with global efforts towards more sustainable agricultural practices.

Regional Analysis

In the realm of insect farming, the Asia Pacific region emerges as a dominant force, securing a significant market share of 40.9%. Projections suggest that by the conclusion of the forecast period, the market is poised to achieve a valuation of USD 613 billion. This growth is chiefly propelled by substantial adoption across pivotal sectors such as animal feed, pharmaceuticals, and sustainable agriculture.

Key economies in the region, including China, India, Japan, and South Korea, are spearheading this growth trajectory. These nations demonstrate a notable surge in insect farming practices, reflecting the escalating demand for insect-derived products across diverse industries. Furthermore, the region’s commitment to innovative farming techniques and export-oriented strategies further reinforces its position in the global insect farming market.

In North America, the insect farming market is witnessing steady expansion. This upward trajectory is fueled by increasing demand from industries utilizing insects for protein production, animal feed supplements, and sustainable food alternatives. The region’s robust agricultural infrastructure and advancements in insect rearing methods play pivotal roles in driving the adoption of insect farming practices.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the insect farming market, several key players stand out, driving innovation and shaping industry trends. Among these prominent entities, companies such as Entomo Farms, Ynsect, Protix, AgriProtein, and Beta Hatch are noteworthy for their comprehensive approach to insect cultivation and product development.

Market Key Players

- Bayer

- Ynsect

- Beta Hatch

- Farmers Business Network

- Flourish Farm

- Bioag Pty Ltd

- Innovafeed

- Hargol

- Growmark

- Walters Gardens, Inc

- Grubbly Farms

- Hexafly

- Protenga

- Aspire Food Group

Recent Developments

In January 2023, Bayer intensified its focus on insect farming research and development, aiming to enhance pest control solutions through sustainable methods.

By July 2023, Ynsect had secured significant investments from venture capitalists, enabling the company to further innovate its farming techniques and product offerings.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 Bn Forecast Revenue (2033) US$ 35.3 Bn CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Insect Type(Crickets, Mealworms, Black Soldier Flies, House Flies, Others), By Application(Animal Feed, Fertiliser, Protein, Biofuels, Others), By End-use(Food and Feed, Agricultural, Pharmaceuticals, Biotechnology, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Bayer, Ynsect, Beta Hatch, Farmers Business Network, Flourish Farm, Bioag Pty Ltd, Innovafeed, Hargol, Growmark, Walters Gardens, Inc, Grubbly Farms, Hexafly, Protenga, Aspire Food Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Insect Farming Market?Insect Farming Market size is expected to be worth around USD 35.3 billion by 2033, from USD 1.5 billion in 2023

What is the CAGR for the Insect Farming Market?The Insect Farming Market is expected to grow at a CAGR of 4.3% during 2024-2033.

Name the major industry players in the Insect Farming Market?Bayer, Ynsect, Beta Hatch, Farmers Business Network, Flourish Farm, Bioag Pty Ltd, Innovafeed, Hargol, Growmark, Walters Gardens, Inc, Grubbly Farms, Hexafly, Protenga, Aspire Food Group

-

-

- Bayer

- Ynsect

- Beta Hatch

- Farmers Business Network

- Flourish Farm

- Bioag Pty Ltd

- Innovafeed

- Hargol

- Growmark

- Walters Gardens, Inc

- Grubbly Farms

- Hexafly

- Protenga

- Aspire Food Group