Europe and Middle East And Africa Tomatoes Market By Tomato Type (Cherry Tomato, Grape Tomato, Roma Tomato, Beefsteak Tomato, Heirloom Tomato, Green Tomato, Tomato On The Vine, and Others), By Category (Organic, and Conventional), By Application (Fresh Tomatoes, Primary Processed Tomato Category, and Secondary Processed Tomato Category) By End-Use (Food Service Industry, and Household/Retail Industry) By Distribution Channel (Online, and Offline), By Countries and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142691

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

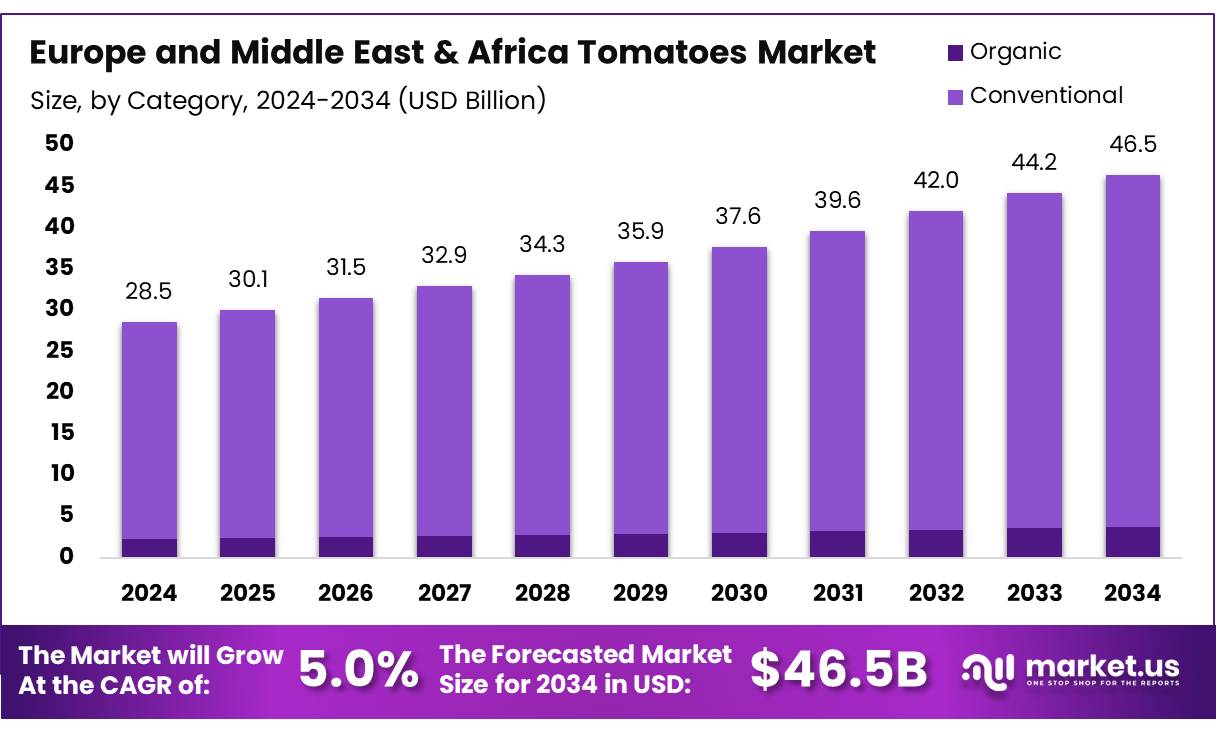

The Europe and Middle East & Africa Tomatoes Market size is expected to be worth around USD 46.5 Billion by 2034, from USD 28.5 Billion in 2024, growing at a CAGR of 5.0% during the forecast period from 2025 to 2034.

Europe is one of the world’s largest producers of tomatoes, with countries like Italy, Spain, and the Netherlands leading in production. The European tomato industry is characterized by a high degree of technological innovation, especially in the Netherlands, where greenhouse cultivation has taken precedence.

This method not only enhances yield and quality but also allows for year-round production, reducing dependency on seasonal cycles. For instance, the use of hydroponics and controlled environment agriculture in the Netherlands enables precise nutrient management and climate control, significantly boosting efficiency.

The Middle East, particularly countries such as Turkey and Israel, also contributes significantly to the tomato market. The region adapts its agricultural practices to arid conditions, focusing on sustainability and water conservation. Israel, for instance, is renowned for its drip irrigation technology, which is crucial for maximizing water usage efficiency in tomato cultivation. This technology not only conserves water but also ensures that plants receive a direct and precise supply of nutrients.

Key Takeaways

- The Europe and Middle East & Africa tomatoes market was valued at US$ 28.5 billion in 2024.

- The Europe and Middle East & Africa tomatoes market is projected to reach US$ 46.5 billion by 2034.

- Among tomato types, the beefsteak held the majority of revenue share in 2024, with a market share of 42.0%.

- Based on categories, conventional tomatoes accounted for the majority of the market share with 92.0% owing to its higher affordability, large-scale production, and widespread availability.

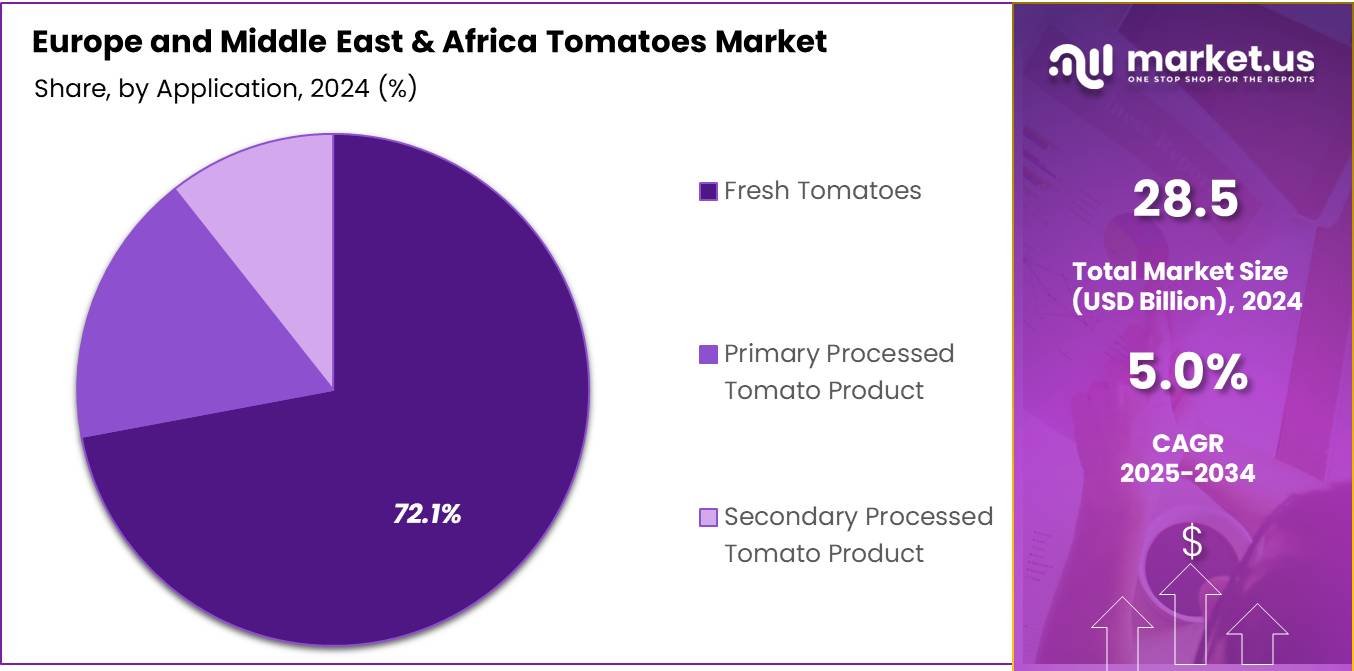

- Among applications, fresh tomatoes accounted for the majority of the Tomatoes market share with 71.9%.

- Based on end-use, the household/retail industry dominated the market with a share of 62.6%.

- Among distribution channels, offline channels are more preffered by conusmers hence, they accounted for the majority of the tomatoes market share with 87.6%.

Tomato Type Analysis

Beefsteak Tomatoes Held The Major Share

The tomatoes market is segmented based on tomato type into cherry tomato, grape tomato, roma tomato, beefsteak tomato, heirloom tomato, green tomato, tomato on the vine, and others. Among these, the beefsteak tomato type held the majority of revenue share in 2024, with a market share of 42.0% due to its high demand in both fresh consumption and food processing industries. Known for its large size, meaty texture, and rich flavor, beefsteak tomatoes are widely used in sandwiches, burgers, and salads, making them a preferred choice in the foodservice sector, including restaurants and fast-food chains.

Additionally, their higher yield per plant, longer shelf life, and robust disease resistance contribute to their strong market presence. The growing consumer preference for organic and gourmet varieties has also fueled the demand for beefsteak tomatoes in supermarkets and specialty grocery stores.

Category Analysis

Conventional Tomatoes Accounted for a Largest Share in the Tomatoes Market

Based on categories, the market is segmented into organic and conventional. Among these categories, conventional accounted for the majority of the market share with 92.0% owing to its higher affordability, large-scale production, and widespread availability. Conventional tomatoes are cultivated using traditional farming methods with synthetic fertilizers and pesticides, allowing for higher yields, lower production costs, and greater market penetration.

These factors make them the preferred choice for mass-market distribution through supermarkets, grocery stores, and food processing industries. Additionally, the foodservice sector, including restaurants and fast-food chains, heavily relies on conventional tomatoes due to their cost-effectiveness and year-round availability. While organic tomatoes are gaining popularity due to increasing health consciousness and demand for chemical-free produce, higher costs and limited production capacity have restricted their market share. Moreover, in developing regions, price-sensitive consumers continue to drive the demand for conventional tomatoes, further reinforcing their strong position in the global tomatoes market.

Application Analysis

The Europe & MEA Market has been divided based on applications in to fresh tomatoes, primary processed tomato product & secondary processed tomato product. In 2024, the fresh tomatoes segment dominated the Europe & MEA market, accounting for 71.9% of the total market share, driven by high consumer demand for fresh and natural produce. Fresh tomatoes are widely consumed in households, restaurants, and foodservice establishments, making them a staple in everyday diets. The increasing preference for organic and locally sourced vegetables has further boosted their demand.

Additionally, the Mediterranean diet, which emphasizes fresh vegetables, including tomatoes, is widely followed in Europe and parts of the Middle East, contributing to their strong market presence. The growth of farmers’ markets, supermarkets, and direct-to-consumer sales channels has also expanded the accessibility of fresh tomatoes. While processed tomato products such as sauces, pastes, and canned tomatoes are growing in demand, the preference for healthier, minimally processed, and fresh food options continues to drive the dominance of fresh tomatoes in the Europe & MEA market.

End-Use Analysis

By end-users, the market was divided into food service industry and household. In the previous year, the household/retail industry emerged as the dominant end-user of tomatoes, holding a 62.6% market share primarily due to the rising global demand for fresh and processed tomatoes in home cooking. With the increasing trend of home-cooked meals, healthy eating habits, and plant-based diets, more consumers are incorporating fresh tomatoes, canned tomatoes, and tomato-based products into their daily meals.

Additionally, the growing popularity of organic and locally sourced produce has encouraged consumers to buy fresh tomatoes from supermarkets, farmers’ markets, and online grocery platforms. The versatility of tomatoes, used in salads, sauces, soups, and various cuisines worldwide, has cemented their position as a staple household ingredient, driving higher sales in the retail segment.

Distribution Channel Analysis

The tomatoes market was further categorized based on distribution channels such as online and offline. In 2024, the offline segment dominated the tomatoes market, accounting for a 87.6% market share, primarily due to the widespread presence of supermarkets, grocery stores, hypermarkets, and local farmers’ markets. Consumers prefer purchasing fresh produce in-person, allowing them to inspect the quality, ripeness, and freshness before making a purchase.

Additionally, offline retail channels offer a consistent and reliable supply of tomatoes, catering to both household consumers and businesses in the food service industry. The dominance of traditional brick-and-mortar stores is further reinforced by their extensive distribution networks and established supply chains, ensuring steady availability of tomatoes across urban and rural areas. While online grocery shopping has been growing, logistics challenges, concerns over freshness, and consumer preference for physical selection have limited its market penetration. Offline sales continue to be the preferred distribution channel as they offer convenience, affordability, and immediate access to fresh tomatoes, reinforcing their strong market share.

Key Market Segments

By Tomato Types

- Tomato Types

- Cherry Tomato

- Grape Tomato

- Roma Tomato

- Beefsteak Tomato

- Heirloom Tomato

- Green Tomato

- Tomato On the Vine

- Others

By Category

- Organic

- Conventional

By Application

- Fresh Tomatoes

- Primary Processed Tomato Category

- Dried/Dehydrated Tomato

- Puree, Pulp & Concentrate

- Canned Tomatoes

- Paste

- Others

- Secondary Processed Tomato Category

- Ketchup & Sauces

- Juice

- Pickles

- Soup

- Others

By End-Use

- Food Service Industry

- Household/Retail Industry

By Distribution Channel

- Online

- E-Commerce Websites

- Company-Owned Websites

- Offline

- Supermarket/Hypermarket

- Retail Stores

- Convenience Stores

- Others

Drivers

Demand from the Food Processing Industry

Tomatoes are a fundamental ingredient in a variety of processed foods, including sauces, pastes, juices, and canned goods. In Europe, particularly in countries like Italy and Spain, the demand for processed tomato products is extensive due to the cultural prominence of tomato-based dishes like pasta sauces and pizza. Moreover, Italian companies use vast quantities of tomato paste and sauce in their product lines, driving consistent demand for high-quality tomatoes.

The rise of convenience foods is a significant driver in both regions. Ready-to-eat meals, frozen pizzas, and similar products require substantial amounts of tomato ingredients, which in turn boosts the demand for tomatoes. For instance, major food retailers and manufacturers in Europe, such as Nestlé and Unilever, incorporate tomato products into a variety of ready meals sold across the continent.

Governments in both Europe and the Middle East have implemented policies to support local agricultural sectors, which indirectly boosts the tomato market. Subsidies for sustainable farming practices or tariffs on imported agricultural goods encourage local production and processing of tomatoes. This is seen in the EU’s Common Agricultural Policy (CAP), which provides support for tomato farmers in southern Europe, aiding in the stability of supply for the food processing industry.

Restraints

Climate Change and Associated Water Shortages Impact the Tomato Cultivation

The Middle East is facing a severe water crisis due to climate change, with countries such as Iran experiencing dramatic declines in major water bodies like Lake Urmia. This water scarcity is impacting agricultural production, including tomato crops, across the region. In Iraq, extreme heat waves have caused tomato prices, with costs rising from $0.56 per kilo to $2.50 per kilo. Similar price spikes have occurred in other Middle Eastern countries such as Egypt and Morocco due to climate-related impacts on tomato harvests.

The water crisis is not limited to the Middle East – it is also affecting major tomato producers like Turkey that supply Europe and the Middle East. Climate change is driving severe water stress and drought in Turkey, depleting groundwater and drying up rivers and lakes. This has led to declining tomato yields, with 97% of Turkish farmers reporting reduced harvests due to climate impacts. The resulting food price inflation in Turkey threatens its role as a key tomato exporter to Europe and the Middle East.

In regions such as the Middle East, where water scarcity is a prevalent issue, the availability of water for irrigation becomes a critical constraint. For instance, countries such as Saudi Arabia and the UAE have traditionally relied on non-renewable groundwater for irrigation, a practice that is not sustainable in the long run given the arid climate and high water usage of tomato farming. The high cost of desalination and the need to import water can significantly increase production costs.

Opportunity

Rising Technological Advancements Creates Lucrative Opportunities In the Market

Technological advancements in precision agriculture are playing a pivotal role in transforming tomato cultivation. This includes the use of GPS technology, drones, and IoT sensors that provide precise data on soil health, moisture levels, and crop health. Such data-driven insights enable farmers to optimize water usage, fertilizer application, and pest management, enhancing the yield and quality of tomato crops. The adoption of hydroponics and other forms of CEA is becoming more prevalent in the European and Middle Eastern markets. These technologies allow for the cultivation of tomatoes in controlled environments, reducing dependency on soil quality and water supply. This is particularly beneficial in arid regions of the Middle East where arable land is scarce. CEA technologies ensure year-round production, reducing seasonal fluctuations and stabilizing supply chains.

Advancements in genetic engineering have led to the development of tomato varieties with enhanced qualities such as improved resistance to diseases and pests, longer shelf life, and better nutritional profiles. These genetically modified tomatoes are more suited to the climatic and soil conditions of specific regions, potentially increasing agricultural output and efficiency.

The integration of robotics and automation in tomato harvesting and processing is reducing labor costs and increasing precision in the handling of fruits. This minimizes damage during picking, leading to higher quality produce reaching the market. Automation also addresses labor shortages, a significant challenge in many agricultural sectors across Europe.

Trends

Increasing Adoption of Greenhouse Farming Influencing The Market

According to a study, the EU’s cultivation area for greenhouse tomatoes has contracted by 84.08% over the past decade, indicating a region-wide trend of diminishing greenhouse space. However, this has prompted a push for more efficient and productive greenhouse farming practices to meet the ongoing demand for tomatoes. The top 10 European countries with the largest greenhouse tomato cultivation areas are Turkey, Spain, the Netherlands, France, Poland, Italy, Greece, Germany, Romania, and Austria. Turkey, in particular, has consistently increased its greenhouse tomato production, reaching a high of 4,369,000 tonnes in 2021 before a minor drop to 4,104,000 tonnes in 2022.

Europe experiences seasonal shortages in tomato supply, particularly during the winter months when domestic production is limited to heated and lit greenhouses. This creates opportunities for non-European suppliers to export tomatoes to Europe during the off-season to meet the demand. For example, in 2022, imports from developing countries increased by 77,000 tonnes (7%) as European production fell by around 10% compared to 2021.

Saudi Arabia has seen a huge increase in tomato production by using targeted, computer-controlled irrigation in greenhouses. This has allowed them to produce up to 80 kg of tomatoes per square meter annually, compared to the usual 15-25 kg, while using much less water.

Geopolitical Impact Analysis

Geopolitical Tensions Significantly Impact the Growth of the Tomatoes Market

Geopolitical conflicts often lead to disruptions in supply chains. For tomatoes, this can mean interruptions in the transportation of fresh produce from farms to markets or export terminals, especially if the regions involved are key transit routes or producers. For example, conflict zones can impede logistics through closed borders or unsafe travel routes, delaying or preventing the delivery of fresh tomatoes and thereby affecting their availability and quality upon reaching the market.

In Europe and the MEA, where many countries rely on a complex network of suppliers, any disruption can significantly impact the entire supply chain. In regions directly affected by conflicts, agricultural production can decline due to factors like labor shortages, as local populations may be displaced or involved in the conflict. Farms may also face destruction or abandonment in war-torn areas, directly reducing the output of fresh tomatoes. Additionally, input supplies such as seeds, fertilizers, and agricultural chemicals can become scarce or more expensive, further hindering production capabilities.

Key Countries Covered

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- Middle East & Africa

- Turkey

- Morocco

- GCC

- South Africa

- Egypt

- Rest of Middle East & Africa

Key Players Analysis

Market Players In The Tomatoes Industry Are Developing Through Various Strategies

Market players in the tomatoes industry are developing through various strategic approaches, including technological advancements, sustainable farming practices, and market expansion initiatives. Many companies are investing in controlled environment agriculture (CEA), such as greenhouses and vertical farming, to enhance yield, reduce water consumption, and ensure year-round production. The adoption of hydroponic and aeroponic farming techniques has further improved productivity while minimizing resource usage.

Market Key Players

- Fresh Del Monte Produce

- Dole plc

- Mission Produce

- Chiquita Brands

- Greenyard

- RO-TEL

- Global Fresh Fruits & Vegetables L.L.C

- Global Green Company

- Azura Group

- ZZ2

- Houwelings

- Ontario Processing Vegetable Growers

- CASALASCO – SOCIETÀ AGRICOLA S.p.A.

- Tomato Growers Supply Company

- Sahyadri Farms Post Harvest Care Ltd.

- PACIFIC RIM PRODUCE

- Duijvestijn Tomaten

- Mucci Inc

- Other Key Players

Recent Development

- In January, 2024, ZZ2, the largest tomato producer in the southern hemisphere, has expanded into avocado planting and trading. They’ve recently completed a new R128-million processing facility in Limpopo for avocados and tomatoes, boasting an impressive 11,200m² of floor space. This facility underscores ZZ2’s penchant for large-scale operations in all aspects of their business.

- In July, 2024, Global Green Company announced that it has reached an agreement with Fresh Express Incorporated to terminate the previously announced deal in which Fresh Express would have acquired Dole’s Fresh Vegetables Division.

- In November, 2023, Casalasco S.p.A., Italy’s first integrated supply chain for industrial tomato processing, has agreed to acquire a 70% stake in De Martino S.r.l., a well-established trading company specializing in Italian food preserves. This acquisition aims to strengthen Casalasco’s supply chain and enhance its presence in Far Eastern and Northern European markets, particularly in Japan and Scandinavia.

Report Scope

Report Features Description Market Value (2024) US$ 28.5 Bn Market Volume (Tons) XX Forecast Revenue (2034) US$ 46.5 Bn CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tomato Type (Cherry Tomato, Grape Tomato, Roma Tomato, Beefsteak Tomato, Heirloom Tomato, Green Tomato, Tomato On The Vine, and Others), By Category (Organic, and Conventional), By Application (Fresh Tomatoes, Primary Processed Tomato Category, and Secondary Processed Tomato Category) By End-Use (Food Service Industry, and Household/Retail Industry) By Distribution Channel (Online, and Offline) Country Analysis Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe Middle East & Africa – Turkey, Morocco, GCC, South Africa, Egypt and Rest of Middle East & Africa

Competitive Landscape Fresh Del Monte Produce, Dole plc, Mission Produce, Chiquita Brands, Greenyard , RO-TEL, Global Fresh Fruits & Vegetables L.L.C, Global Green Company , Azura Group, and Houwelings, Ontario Processing Vegetable Growers, CASALASCO – SOCIETÀ AGRICOLA S.p.A., Tomato Growers Supply Company, Sahyadri Farms Post Harvest Care Ltd., PACIFIC RIM PRODUCE, Duijvestijn Tomaten, Mucci Inc., and others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate User License (Unlimited User and Printable PDF)  Europe and Middle East & Africa Tomatoes MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Europe and Middle East & Africa Tomatoes MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample- Fresh Del Monte Produce

- Dole plc

- Mission Produce

- Chiquita Brands

- Greenyard

- RO-TEL

- Global Fresh Fruits & Vegetables L.L.C

- Global Green Company

- Azura Group

- ZZ2

- Houwelings

- Ontario Processing Vegetable Growers

- CASALASCO - SOCIETÀ AGRICOLA S.p.A.

- Tomato Growers Supply Company

- Sahyadri Farms Post Harvest Care Ltd.

- PACIFIC RIM PRODUCE

- Duijvestijn Tomaten

- Mucci Inc

- Other Key Players