Global Cold Brew Coffee Market Size, Share, Trends Analysis Report By Product (Arabica, Robusta, Others), By Preparation Mode (Drip Coffee Makers, Single Cup Brewers, Cold Brewing, Espresso, Others), By Packaging (Glass Bottles, BPA-free, Recyclable Plastic Bottles, Aluminium Cans, Flexible, Spouted Pouches, Bag-in-box, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: March 2025

- Report ID: 143194

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

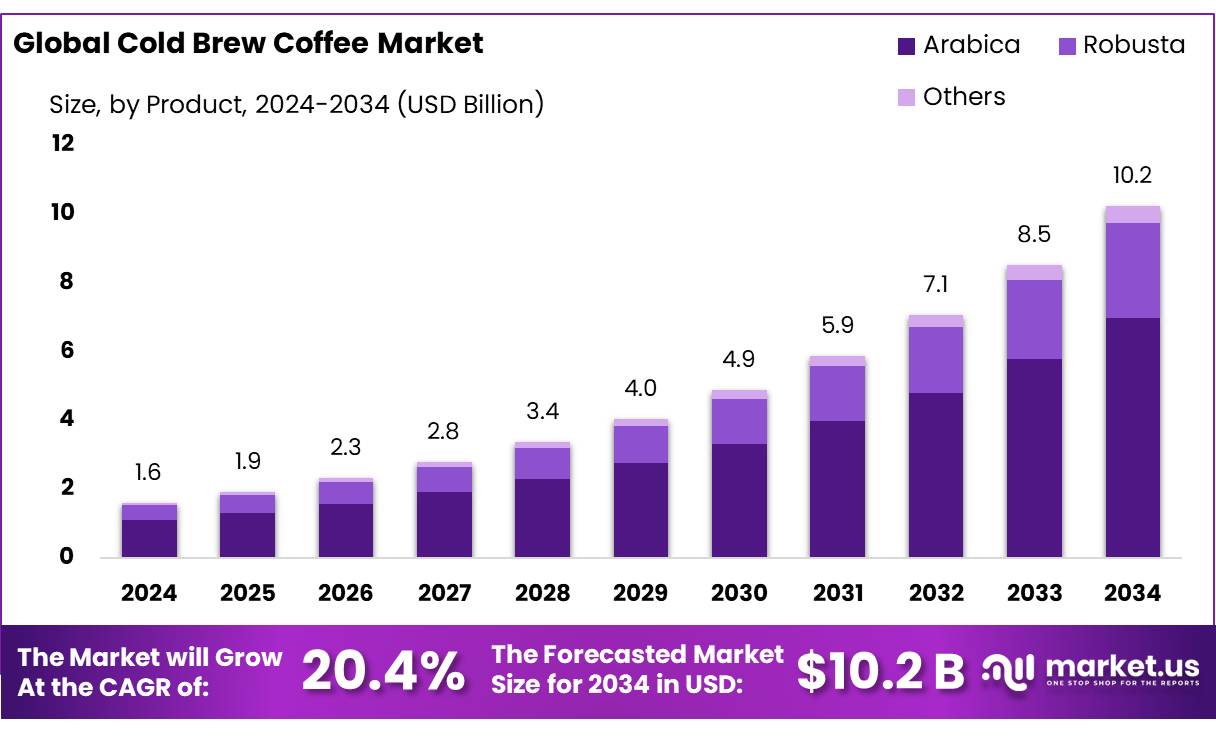

The Global Cold Brew Coffee Market size is expected to be worth around USD 10.2 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 20.4% during the forecast period from 2025 to 2034.

Cold brew coffee, renowned for its smoother and sweeter taste compared to traditional hot brewed coffee, has significantly grown in popularity. This brewing method, which avoids high temperatures, produces coffee that is notably less bitter and acidic, with studies showing a 50-67% reduction in acidity. Originating in Japan in the 1600s under the name ‘Kyoto,’ cold brew has evolved from a local specialty into a globally embraced beverage, complete with dedicated cold brew machines and public brewing displays.

The trend towards ready-to-drink (RTD) beverages has further propelled cold brew coffee into the spotlight. Consumers’ increasing preference for convenience has boosted sales, with companies packaging cold brew in user-friendly formats like cans and bottles that cater to on-the-go consumption. This shift underscores the broader trend of adapting products to fit busy lifestyles.

In response to the climbing demand, coffee manufacturers are diversifying their offerings. For instance, in July 2024, Bones Coffee Co. introduced a new range of RTD cold brew lattes at Walmart, featuring innovative flavors such as Holy Cannoli and French Toast. These products are made exclusively from beans cold-brewed in Brazil, highlighting the company’s commitment to quality and flavor innovation.

Key Takeaways

- Cold Brew Coffee Market size is expected to be worth around USD 10.2 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 20.4%.

- Arabica variety maintained a strong foothold in the cold brew coffee market, securing over 68.10% of the total market share.

- Drip Coffee Makers secured a significant segment in the cold brew coffee market, capturing more than 41.10% of the market share.

- glass bottles emerged as a preferred packaging option in the cold brew coffee market, holding a substantial 37.20% market share.

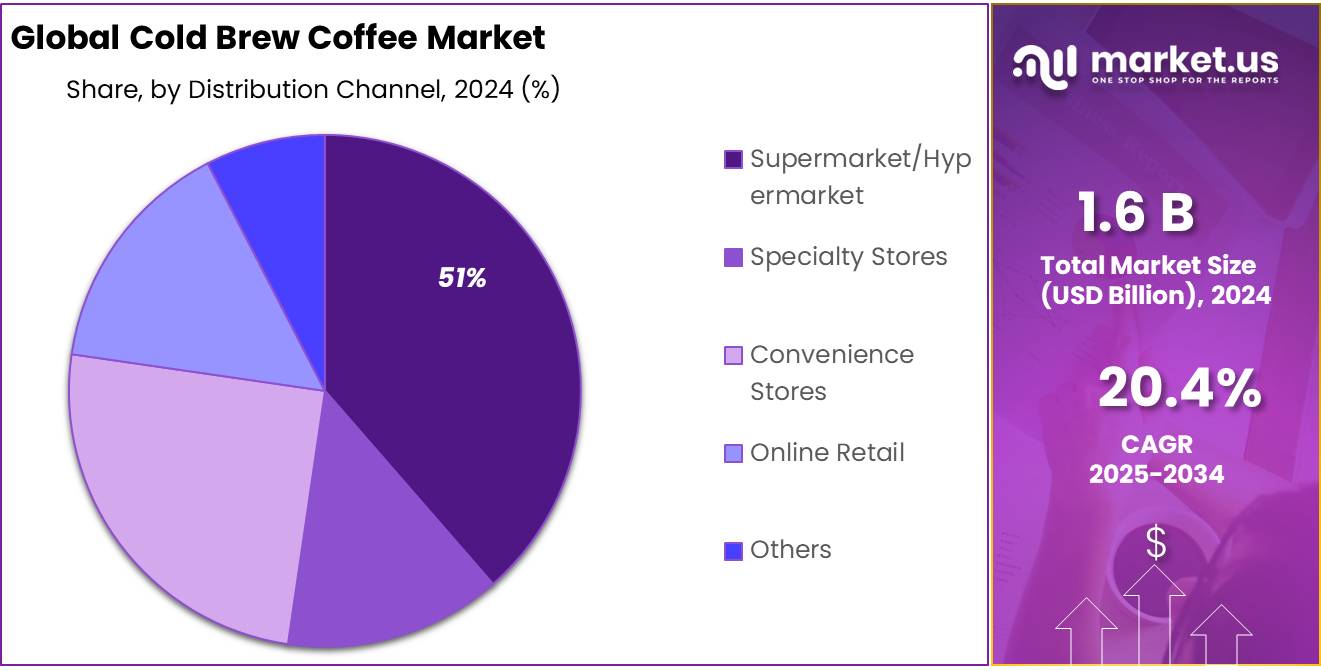

- supermarkets and hypermarkets held a dominant position as a distribution channel for cold brew coffee, capturing more than 51.50% of the market share.

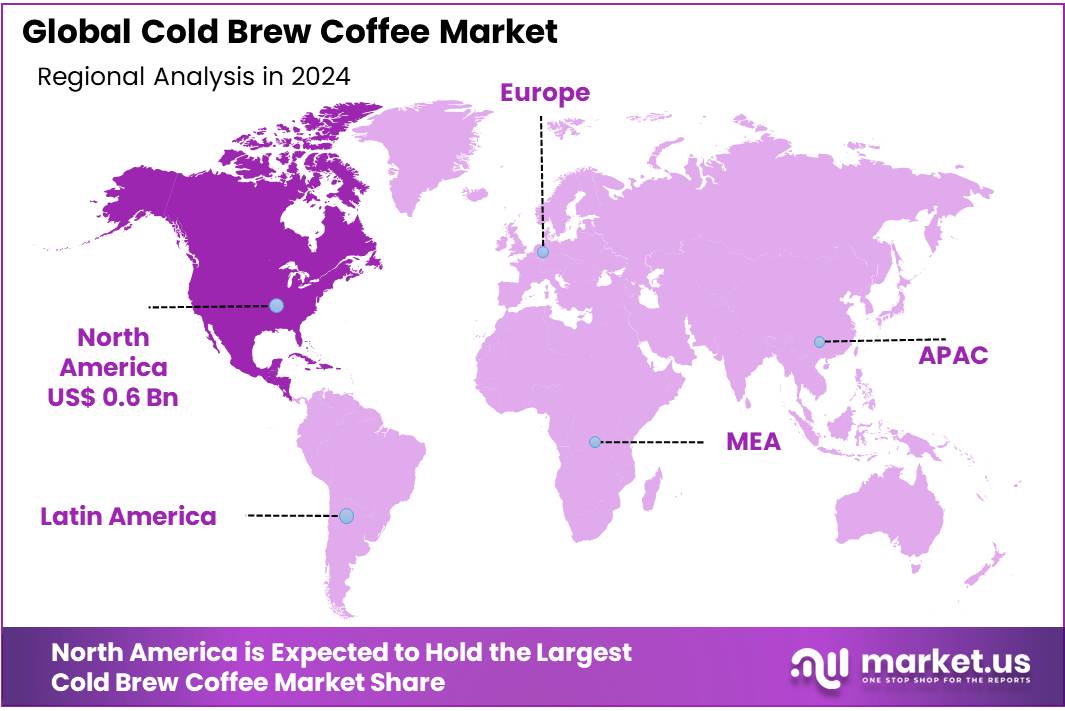

- North America dominates the global cold brew coffee market, holding a significant 38.40% share and generating approximately USD 0.6 billion in revenue.

By Product

Arabica Cold Brew Coffee Leads with a 68.10% Market Share

In 2024, the Arabica variety maintained a strong foothold in the cold brew coffee market, securing over 68.10% of the total market share. This dominance is attributed to Arabica’s superior flavor profile, which is highly sought after by cold brew aficionados. The bean’s naturally sweet and complex flavor nuances make it particularly suitable for cold brewing, which tends to highlight the subtle tastes and aromas of the coffee. As cold brew continues to rise in popularity, Arabica’s prominence in the market is a clear reflection of consumer preferences for high-quality, flavorful coffee experiences.

By Preparation Mode

Drip Coffee Makers Lead with 41.10% in Cold Brew Coffee Market

In 2024, Drip Coffee Makers secured a significant segment in the cold brew coffee market, capturing more than 41.10% of the market share. This method’s popularity stems from its simplicity and effectiveness in brewing rich, flavorful coffee. Drip coffee makers are favored for their precision in controlling the brewing time and temperature, factors crucial for achieving the optimal extraction of cold brew’s distinct sweet and smooth profile. The convenience and reliability of drip coffee makers appeal to both home brewers and commercial establishments, solidifying their dominant status in the market.

By Packaging

Glass Bottles Capture 37.20% of Cold Brew Coffee Market

In 2024, glass bottles emerged as a preferred packaging option in the cold brew coffee market, holding a substantial 37.20% market share. This preference is largely due to the premium perception and sustainability appeal of glass packaging. Consumers tend to associate glass bottles with higher quality and better taste preservation, key factors when choosing cold brew coffee. Additionally, the environmental benefits of glass being recyclable contribute to its popularity among eco-conscious buyers, further solidifying its significant position in the market.

By Distribution Channel

Supermarkets/Hypermarkets Dominate with 51.50% in Cold Brew Coffee Distribution

In 2024, supermarkets and hypermarkets held a dominant position as a distribution channel for cold brew coffee, capturing more than 51.50% of the market share. This dominance is attributed to the widespread availability and accessibility of these retail formats. Supermarkets and hypermarkets offer a diverse range of cold brew coffee brands and packaging options, catering to a broad consumer base. Their ability to provide convenience and variety makes them a popular choice for customers looking to purchase cold brew coffee alongside their regular grocery shopping, ensuring their continued leadership in the market.

Key Market Segments

By Product

- Arabica

- Robusta

- Others

By Preparation Mode

- Drip Coffee Makers

- Single Cup Brewers

- Cold Brewing

- Espresso

- Others

By Packaging

- Glass Bottles

- BPA-free, Recyclable Plastic Bottles

- Aluminium Cans

- Flexible, Spouted Pouches

- Bag-in-box

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- Online Retail

- Others

Drivers

Health Benefits Drive Cold Brew Coffee Popularity

One of the major driving factors behind the surging popularity of cold brew coffee is its health benefits. Compared to its hot-brewed counterpart, cold brew coffee is often cited as being easier on the digestive system due to its lower acidity and bitterness. Research from the National Coffee Association suggests that cold brew contains compounds that may reduce the risk of heart disease and improve mental health.

Cold brew’s lower acidity is particularly appealing for consumers with sensitive stomachs or those prone to acid reflux, making it a more accessible option for a wider audience. This has been corroborated by findings from the Food and Agriculture Organization (FAO), which indicate that the smooth taste and digestive-friendly properties of cold brew are attracting health-conscious consumers globally.

Additionally, government health initiatives promoting the reduction of dietary acid intake for better health have inadvertently boosted the popularity of cold brew. These initiatives often highlight the benefits of choosing less acidic alternatives in daily diets, framing cold brew as a beneficial choice for coffee lovers looking to maintain a balanced lifestyle.

The cold brew coffee market has also been supported by an increasing number of consumers looking for natural, less processed options. Cold brew’s simple preparation method, which avoids the use of high temperatures and preserves more natural antioxidants compared to traditional brewing methods, aligns well with this trend.

Moreover, the ongoing innovation in cold brew products, including the introduction of added health-focused ingredients such as vitamins and adaptogens, continues to align with the broader consumer shift towards functional beverages. This ongoing trend underscores the role of health considerations in the growth of the cold brew coffee market, making it a staple choice for health-oriented consumers.

Restraints

High Production Costs Challenge Cold Brew Coffee Market Growth

A significant restraining factor for the expansion of the cold brew coffee market is the high cost of production. Cold brew coffee requires a substantially larger quantity of coffee grounds compared to traditional hot brewing methods. According to industry estimates, producing cold brew can consume twice as many coffee beans per serving. This increased usage of raw materials significantly drives up production costs, making cold brew a more expensive option for both consumers and manufacturers.

Additionally, the process of cold brewing takes considerably longer than hot brewing—often requiring 12 to 24 hours. This extended production time can lead to increased labor and operational costs for coffee shops and manufacturers. The slower production rate can also limit the ability of producers to rapidly meet high consumer demand, especially in peak consumption periods.

Furthermore, the specialized equipment needed for large-scale cold brew production represents another substantial investment. While many small cafes can use manual setups, scaling up requires significant capital investment in more sophisticated and automated brewing systems.

Governmental health regulations and standards also indirectly impact the cost structure of cold brew coffee. Regulations regarding the safe production, storage, and distribution of cold beverages are stringent, given the potential for bacterial growth in improperly handled drinks. Compliance with these health and safety standards can further inflate production costs, making cold brew less competitive price-wise compared to other coffee types.

Opportunity

Expansion into Emerging Markets Presents Major Growth Opportunity for Cold Brew Coffee

As the global coffee market continues to evolve, cold brew coffee stands out as a significant growth opportunity, particularly in emerging markets. While traditionally popular in North American and European countries, the appeal of cold brew is rapidly spreading to Asia, Latin America, and Africa. These regions have witnessed a surge in coffee culture, coupled with rising middle-class populations and increasing disposable incomes.

One of the key drivers for this expansion is the changing consumer preferences toward premium and specialty coffee products. According to data from the International Coffee Organization, the consumption of specialty coffee is growing at a faster rate in these emerging markets compared to more established markets. This shift is fueled by a younger demographic, often more open to exploring new coffee experiences and flavors, which cold brew coffee can uniquely provide.

Moreover, governments in these regions are increasingly promoting the coffee sector as a part of their economic development plans. For instance, several African and Asian countries have introduced initiatives to support local coffee production, not just for export but also for domestic consumption, creating a favorable environment for the introduction of innovative coffee products like cold brew.

The versatility of cold brew coffee also makes it a prime candidate for local flavor adaptations. Manufacturers have the opportunity to infuse local flavors and ingredients, further tailoring the product to regional tastes and increasing its appeal. This customization not only enhances consumer interest but also boosts local economies by integrating indigenous resources.

Trends

Nitro Cold Brew Coffee: A Fizzy Revolution in the Coffee Industry

One of the latest trends sweeping through the coffee industry is the rise of nitro cold brew coffee. This innovative twist on traditional cold brew involves infusing cold brew coffee with nitrogen gas, creating a creamy, smooth texture and a frothy head similar to that of a draft beer. This trend has not only captured the interest of coffee enthusiasts but has also seen adoption in mainstream coffee chains and independent cafes alike.

The Specialty Coffee Association, nitro cold brew has experienced a significant surge in popularity, particularly among younger consumers who are drawn to its unique sensory experience and Instagram-worthy presentation. The nitrogen infusion not only enhances the coffee’s taste and mouthfeel but also adds a visual appeal that resonates well with social media trends, making it highly popular in digital marketing campaigns.

Government health bodies have also noted nitro cold brew’s potential health benefits. Unlike traditional coffee, nitro cold brew is typically served without sugar and cream, appealing to health-conscious consumers looking for lower-calorie beverage options. This aspect aligns with various health initiatives promoting reduced sugar intake among the population.

The growth in popularity of nitro cold brew coffee is also a reflection of the broader trend towards innovative beverage formats that prioritize both flavor and functionality. As more consumers seek out novel and premium beverage experiences, nitro cold brew stands out as a key player in the evolution of the coffee market.

Regional Analysis

North America dominates the global cold brew coffee market, holding a significant 38.40% share and generating approximately USD 0.6 billion in revenue. The region’s strong market position is driven by increasing consumer preference for premium, ready-to-drink (RTD) coffee options, supported by a well-established coffee culture. The U.S. leads the regional market, accounting for the largest consumption due to a surge in specialty coffee chains, independent cafés, and retail expansions by key players.

Retail sales of RTD coffee in North America have been experiencing steady growth, with major brands such as Starbucks, Nestlé, and Stok Cold Brew expanding their product portfolios to cater to evolving consumer preferences. The increasing penetration of e-commerce platforms and grocery stores stocking premium cold brew variants has further supported market expansion.

The market’s growth trajectory is also influenced by seasonal demand patterns, with higher consumption during summer months and increased innovation in flavor offerings. Canada, while a smaller segment, is also seeing robust growth, particularly in urban centers where specialty coffee trends are expanding. With strong brand presence, product innovation, and evolving retail strategies, North America is expected to maintain its dominance in the global cold brew coffee market over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Blue Bottle Coffee, Inc. stands out in the cold brew coffee market for its commitment to freshness and quality. Known for its artisanal approach, the company sources single-origin coffee beans and focuses on sustainable practices. Blue Bottle has gained a strong following for its distinctively smooth and rich cold brew, available in both ready-to-drink bottles and in-store offerings, positioning it as a premium brand in the specialty coffee space.

Califia Farms is renowned for its plant-based products and has made significant strides in the cold brew coffee market with its innovative and health-focused offerings. Their cold brew coffee line includes a variety of flavors, often combined with almond or oat milks, catering to a health-conscious audience. Califia Farms emphasizes sustainability in its production processes, appealing to eco-aware consumers.

Finlay’s is recognized in the cold brew coffee market for its dual expertise in both tea and coffee. The company offers a variety of cold brew options, focusing on sustainability and ethical sourcing of its beans. Finlay’s cold brew solutions are popular in both retail and food service segments, providing robust flavors and high-quality beverages to a diverse client base.

Top Key Players

- Blue Bottle Coffee, Inc.

- Califia Farms, LLC

- CoolBrew

- Finlay’s

- Heartland Food Products Group.

- HighBrewCoffee

- JAB Holding Company

- Javy Coffee Company

- Kohana Coffee

- La Colombe Coffee Roasters.

- Nestle S.A.

- RISE Brewing Co..

- Sleepy Owl Coffee

- Starbucks Corporation

- The J. M. Smucker Company

- Wandering Bear Coffee

Recent Developments

Blue Bottle Coffee’s cold brew segment in 2024 are not publicly disclosed, the company’s overall estimated revenue stood at $367.6 million in the same year.

Califia Farms’ cold brew segment in 2024 are not publicly disclosed, the company’s overall market presence is significant, holding a 3% share of the U.S. ready-to-drink coffee market in 2024.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 10.2 Bn CAGR (2025-2034) 20.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Arabica, Robusta, Others), By Preparation Mode (Drip Coffee Makers, Single Cup Brewers, Cold Brewing, Espresso, Others), By Packaging (Glass Bottles, BPA-free, Recyclable Plastic Bottles, Aluminium Cans, Flexible, Spouted Pouches, Bag-in-box, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Stores, Convenience Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Blue Bottle Coffee, Inc., Califia Farms, LLC, CoolBrew, Finlay’s, Heartland Food Products Group., HighBrewCoffee, JAB Holding Company, Javy Coffee Company, Kohana Coffee, La Colombe Coffee Roasters., Nestle S.A., RISE Brewing Co.., Sleepy Owl Coffee, Starbucks Corporation, The J. M. Smucker Company, Wandering Bear Coffee Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Blue Bottle Coffee, Inc.

- Califia Farms, LLC

- CoolBrew

- Finlay's

- Heartland Food Products Group.

- HighBrewCoffee

- JAB Holding Company

- Javy Coffee Company

- Kohana Coffee

- La Colombe Coffee Roasters.

- Nestle S.A.

- RISE Brewing Co..

- Sleepy Owl Coffee

- Starbucks Corporation

- The J. M. Smucker Company

- Wandering Bear Coffee