Soy Lecithin Market Size, Share, And Business Benefits By Form (Liquid, Solid), By Grade (Pharmaceutical Grade, Industrial Grade, Food Grade, Others), By Modification (Genetically Modified, Non-Genetically Modified), By Application (Rubber, Plastics, Detergents, Adhesives, Dyes, Printing Inks, Fabric Treatment, Others), By End-Use Industry (Building and Construction, Transportation, Medical and Healthcare, Cosmetics and Personal Care, Food and Beverage, Textiles, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136360

- Number of Pages: 375

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Soy Lecithin

- By Form Analysis

- By Grade Analysis

- By Modification Analysis

- By Application Analysis

- By End-Use Industry Analysis

- Key Takeaways

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

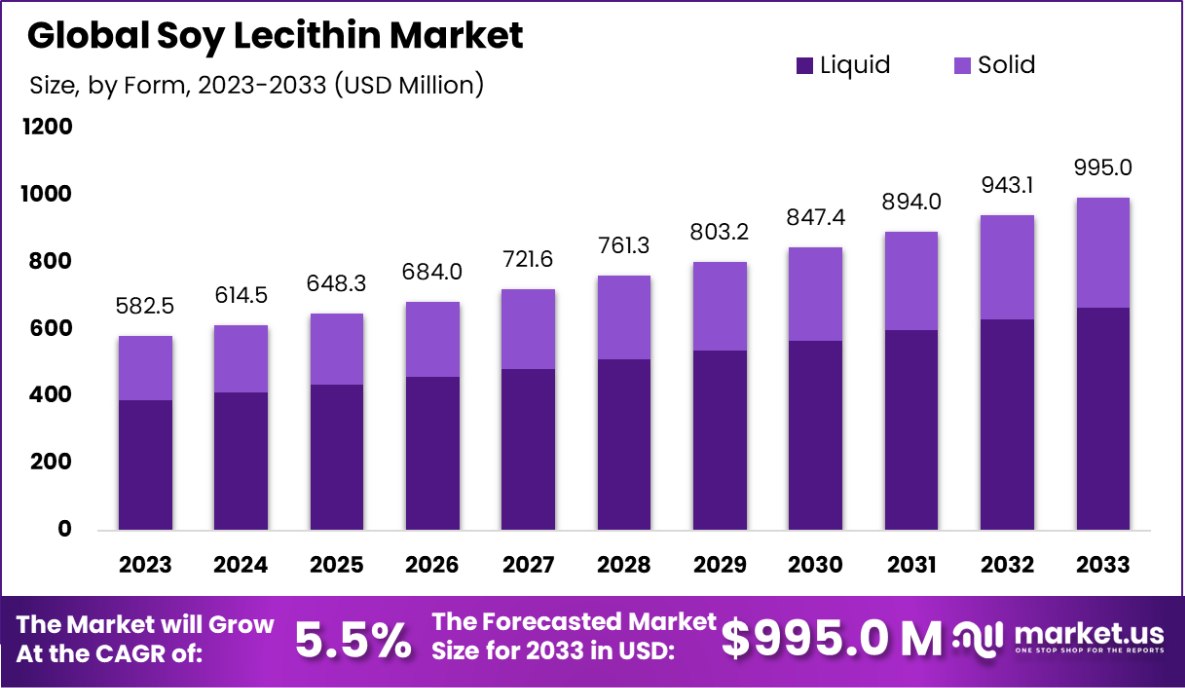

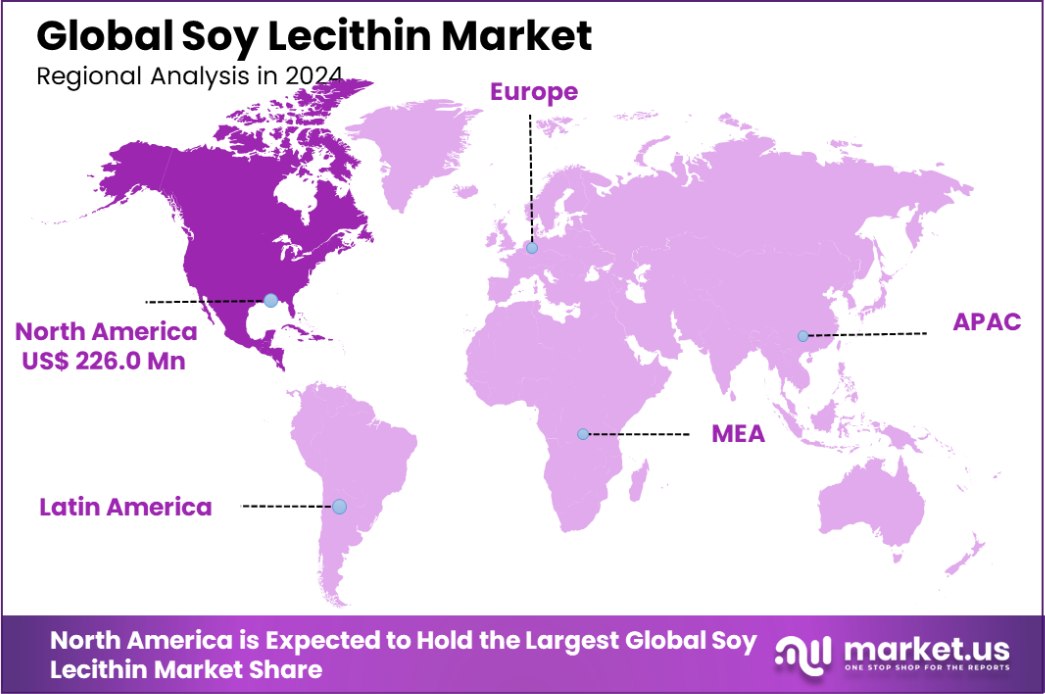

The Global Soy Lecithin Market is expected to be worth around USD 995.0 Million by 2033, up from USD 582.5 Million in 2023, and grow at a CAGR of 5.5% from 2024 to 2033. North America holds 38.8% of the soy lecithin market, USD 226.0 Mn.

Soy lecithin is a byproduct derived from the processing of soybeans, primarily used as an emulsifier in various food products, pharmaceuticals, and cosmetics. It helps to blend ingredients that typically do not mix well, like oil and water. Soy lecithin also has applications in improving texture, and shelf life, and as a release agent in cooking sprays and chocolates.

The soy lecithin market refers to the global industry involved in producing and distributing soy lecithin. It encompasses a range of stakeholders, including raw material suppliers, manufacturers, distributors, and end-users in sectors like food and beverage, pharmaceuticals, and cosmetics. The market dynamics are influenced by the demand for natural emulsifiers and the growing consumer awareness of the functional benefits of soy lecithin.

The growth of the soy lecithin market is driven by the increasing demand for clean-label ingredients and natural emulsifiers in the food industry. Soy lecithin’s functional properties, such as its ability to stabilize emulsions and improve texture, make it a preferred choice for food manufacturers. Additionally, its applications in health supplements for cholesterol management and cognitive function support further fuel its demand.

Demand for soy lecithin is rising due to its versatility and essential role in producing various food products, cosmetics, and pharmaceuticals. The shift towards plant-based ingredients among health-conscious consumers and the increasing adoption of vegan diets have enhanced its appeal and usage across multiple industries.

The market presents significant opportunities for innovation in product formulation and sourcing. There is potential for growth in organic and non-GMO soy lecithin products, catering to the increasing consumer demand for transparency and sustainability in food production. Moreover, expanding applications in nutraceuticals and functional foods offer new avenues for market expansion.

The Soy Lecithin market is poised for substantial growth, driven by increasing consumer demand for natural and organic ingredients across various sectors, including food and beverage, pharmaceuticals, and cosmetics. Soy lecithin, primarily derived from the gum byproduct of soybean oil processing, is lauded for its multifaceted applications due to its emulsifying properties.

Notably, crude soybean lecithin composition includes vital phospholipids such as 18% phosphatidylcholine, 14% phosphatidylethanolamine, and 9% phosphatidylinositol, alongside 37% neutral oil, which underscores its functional versatility and appeal in formulations.

Further bolstering the market’s prospects is the substantial acetone-insoluble material in soybean oil, approximately 60%, translating into 2-3% of commercial lecithin, a key indicator of the robust supply chain potential. The burgeoning organic segment, in particular, showcases significant promise.

According to the United States Department of Agriculture, global organic soy production has reached over 2 billion pounds annually. This substantial volume hints at an available organic lecithin supply nearing 9 million pounds, marking a lucrative niche in an otherwise competitive market.

Organic lecithin’s market traction is expected to amplify, driven by consumer preferences shifting towards cleaner labels and traceable sourcing. Manufacturers and stakeholders are thus encouraged to enhance their supply chain transparency and increase investment in sustainable practices to capitalize on this growing segment.

The data supports a strategic focus on expanding organic lecithin production capacities and reinforcing R&D initiatives to innovate and improve product offerings tailored to evolving market needs.

Key Takeaways

- The Global Soy Lecithin Market is expected to be worth around USD 995.0 Million by 2033, up from USD 582.5 Million in 2023, and grow at a CAGR of 5.5% from 2024 to 2033.

- In the soy lecithin market, liquid form dominates with a 67.4% share globally.

- Food-grade soy lecithin is preferred, holding a substantial 56.5% of the market.

- Non-GMO soy lecithin leads to modifications, comprising 69.5% of the market sector.

- Additionally, soy lecithin finds applications in the rubber industry, capturing 36.3% of the market.

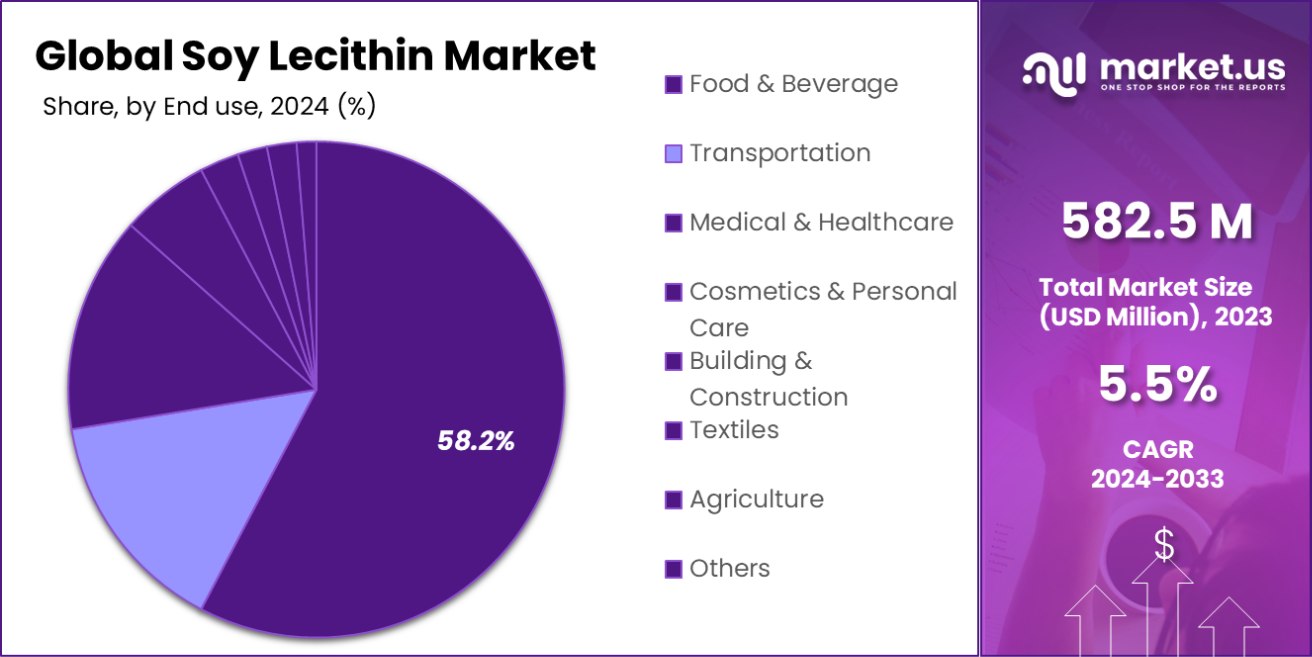

- The food and beverage industry is the largest end-user, consuming 58.2% of soy lecithin.

- In North America, the soy lecithin market holds a 38.8% share, valued at USD 226.0 million.

Business Benefits of Soy Lecithin

Soy lecithin, derived from soybeans, serves as a natural emulsifier in various industries, enhancing product quality and shelf life. In the food sector, it stabilizes emulsions in products like chocolates and baked goods, improving texture and consistency. In pharmaceuticals, soy lecithin acts as a wetting and stabilizing agent, facilitating effective drug delivery. Its applications extend to cosmetics, where it enhances the texture and moisture retention of skincare products.

The Indian government has recognized the economic potential of soy-based products, including soy lecithin. Rajasthan, as the third-largest soybean-producing state in India, contributes significantly to the soybean processing industry.

Approximately 85% of the soybean produced in the country is processed into value-added products, with nearly 20% of this processing occurring in Rajasthan. This indicates a substantial engagement in soybean processing within the state.

Furthermore, the Indian Institute of Soybean Research reports that soybean cultivation spans around 12 million hectares in India, yielding approximately 14.9 million tons as of the 2022-23 estimates. This substantial production capacity underscores the availability of raw materials for soy lecithin extraction, supporting its industrial applications and contributing to economic growth.

These developments highlight the government’s role in promoting soybean cultivation and processing, fostering the growth of industries reliant on soy derivatives like soy lecithin.

By Form Analysis

Liquid form dominates the soy lecithin market, representing 67.4% due to its ease of use in applications.

In 2023, Liquid held a dominant market position in the By Form segment of the Soy Lecithin Market, capturing a 67.4% share. This preference for liquid soy lecithin is largely attributed to its ease of integration into various industrial processes, where it acts as an emulsifying agent, improving texture and consistency in products ranging from foods to cosmetics.

On the other hand, Solid soy lecithin accounted for the remaining 32.6% of the market. The solid form is favored in applications requiring more precise dosages and where storage stability is paramount. It is extensively used in dietary supplements and certain food applications, where it functions as an emulsifier, preservative, and release agent.

The distinct physical properties of liquid and solid forms of soy lecithin drive their adoption in different application sectors, reflecting varying preferences based on process needs and end-product specifications.

This segmentation highlights the diverse utility of soy lecithin in industrial applications, underpinning its essential role across multiple industries. As the market evolves, the demand dynamics between these two forms continue to reflect broader trends in food technology and industrial applications.

By Grade Analysis

Food grade soy lecithin leads with a 56.5% market share, favored for its purity and safety in consumables.

In 2023, Food Grade held a dominant market position in the By Grade segment of the Soy Lecithin Market, with a 56.5% share. This segment’s strength stems from the widespread use of soy lecithin in the food and beverage industry, where it serves as a critical emulsifier, stabilizer, and viscosity reducer.

Its utility in improving texture and shelf-life, as well as facilitating oil and water mixing in products such as chocolates, baked goods, and dressings, drives its substantial market share.

Pharmaceutical-grade soy lecithin, with a market share of 24.3%, is utilized for its beneficial properties in drug formulations, including enhancing the bioavailability of active ingredients and serving as a natural emulsifier in nutritional supplements.

Industrial Grade, capturing a 19.2% share, finds its application in non-food products like paints, coatings, and plastics, where it acts as a dispersing agent to improve processing characteristics.

The varying functionalities and regulatory requirements across these grades underline the segmented nature of the market. The predominance of the Food Grade segment highlights its critical role in consumer products, anchoring soy lecithin’s importance in daily dietary and manufacturing processes.

As industries continue to innovate, the demand for specific grades of soy lecithin is expected to evolve in line with new applications and regulatory landscapes.

By Modification Analysis

Non-GMO soy lecithin holds a 69.5% share, preferred for its natural extraction and consumer health benefits.

In 2023, Non-Genetically Modified (Non-GMO) held a dominant market position in the By Modification segment of the Soy Lecithin Market, with a 49.2% share. This preference for non-GMO soy lecithin is driven by growing consumer demand for natural and organic products, particularly in North America and Europe where there is a strong focus on health and wellness.

Non-GMO soy lecithin is extensively used in food products, dietary supplements, and health foods, where it serves as an emulsifier, moisture retainer, and anti-caking agent.

Genetically Modified (GM) soy lecithin, holding a slightly smaller market share of 50.8%, continues to be important due to its cost-effectiveness and higher yield benefits. GM soy lecithin is preferred in large-scale industrial applications and in markets where the regulatory environments are more accommodating of genetically modified ingredients.

The competition between non-GMO and GM soy lecithin segments highlights the diverse consumer preferences and regulatory influences shaping the market. As the global landscape becomes more receptive to non-genetically modified ingredients, the non-GMO segment could see increased growth, reflecting a broader industry shift towards cleaner labels and more transparent sourcing practices.

By Application Analysis

Rubber 36.3% Soy lecithin finds notable usage in rubber applications, accounting for 36.3% of its market.

In 2023, Rubber held a dominant market position in the By Application segment of the Soy Lecithin Market, capturing a 36.3% share. This significant market share is attributed to soy lecithin’s role as a processing aid in the rubber industry, where it enhances the elasticity and pliability of rubber compounds.

It serves as a dispersant in the mixing stage and a release agent during molding and vulcanization, improving overall manufacturing efficiency and product quality.

The Plastics segment followed, with a 21.1% share, utilizing soy lecithin to improve the plasticity and flow of materials during fabrication. In Detergents, accounting for 15.6% of the market, soy lecithin acts as a natural emulsifier and helps in removing oils and greases from surfaces.

Adhesives and Dyes each held about 9.2% and 8.4% shares, respectively, benefiting from soy lecithin’s properties as a stabilizer and a pigment dispersant. Printing Inks and Fabric Treatment segments, with smaller shares of 5.2% and 4.2% respectively, use soy lecithin to enhance the consistency and application properties of their products.

This distribution highlights soy lecithin’s versatile application across various industries, driven by its functional properties that cater to specific industrial needs, particularly in enhancing product performance and manufacturing processes.

By End-Use Industry Analysis

In the soy lecithin market, the food & beverage industry is the largest end-user, accounting for 58.2%.

In 2023, Food and Beverage held a dominant market position in the By End-Use Industry segment of the Soy Lecithin Market, with a commanding 58.2% share. The substantial share reflects soy lecithin’s essential role as an emulsifier, moisture retainer, and anti-spattering agent in a wide array of food products such as chocolates, baked goods, dressings, and spreads.

Its natural origin and non-toxic profile make it particularly appealing in this sector, aligning with the growing consumer demand for clean-label ingredients.

Cosmetics and Personal Care emerged as the next significant segment, securing a 12.3% market share. Here, soy lecithin is prized for its moisturizing and emollient properties, enhancing the texture and application of skincare and cosmetic products.

Medical and Healthcare accounted for 10.8% of the market, utilizing soy lecithin in pharmaceutical formulations to improve the bioavailability of active ingredients. Smart Transportation, Building and Construction, Textile, and Agriculture segments followed with shares of 6.1%, 5.5%, 4.7%, and 2.4% respectively, each benefiting from soy lecithin’s multifunctional uses ranging from lubricants to protective coatings.

The dominance of the Food and Beverage sector underscores the critical role of soy lecithin in meeting both industrial demands and consumer preferences for safer, more sustainable ingredients across diverse applications.

Key Takeaways

By Form

- Liquid

- Solid

By Grade

- Pharmaceutical Grade

- Industrial Grade

- Food Grade

- Others

By Modification

- Genetically Modified

- Non-Genetically Modified

By Application

- Rubber

- Plastics

- Detergents

- Adhesives

- Dyes

- Printing Inks

- Fabric Treatment

- Others

By End-Use Industry

- Building & Construction

- Transportation

- Medical & Healthcare

- Cosmetics & Personal Care

- Food & Beverage

- Textiles

- Agriculture

- Others

Driving Factors

Growing Demand for Clean Label Ingredients

The surge in consumer preference for natural and organic products is significantly driving the growth of the soy lecithin market. As awareness of food ingredients increases, consumers are seeking products with labels that list familiar and minimally processed ingredients.

Soy lecithin is valued in this space for its non-toxic, plant-based origin, making it a preferred choice in food production, cosmetics, and health supplements, catering to the clean label trend that emphasizes transparency and natural composition in consumer goods.

Expansion in Food Industry Applications

Soy lecithin’s versatility as an emulsifier, stabilizer, and preservative makes it indispensable in the food industry, which is a major factor propelling its market growth. It is extensively utilized to improve texture, extend shelf life, and aid in the homogeneous mixing of ingredients in products such as chocolates, baked goods, and dressings.

The ongoing innovation in food technology, along with rising food production to meet global demands, continues to amplify the use of soy lecithin, thereby driving market expansion.

Rise in Non-GMO Product Popularity

There is an increasing consumer shift towards non-genetically modified (non-GMO) products due to health and environmental concerns. Soy lecithin derived from non-GMO sources aligns with this trend, fostering its demand across various sectors, including food and beverages and pharmaceuticals.

This movement is supported by stringent regulations in several regions that mandate clear labeling of GMO ingredients, compelling manufacturers to adopt non-GMO soy lecithin to comply with regulatory standards and consumer preferences.

Restraining Factors

Allergenic Concerns Limiting Consumer Acceptance

Soy lecithin, derived from soybeans, is a common allergen, that poses significant challenges in its market growth. Consumers with soy allergies are compelled to avoid products containing soy lecithin, which restricts its use in food, pharmaceutical, and personal care products.

The need for allergen-free labeling also complicates manufacturing processes, as it requires rigorous segregation and testing to prevent cross-contamination, thus adding to production costs and potentially limiting market expansion.

Competition from Synthetic and Alternative Emulsifiers

The market for soy lecithin faces stiff competition from synthetic and other natural emulsifiers that can offer similar or superior functionalities. Manufacturers may opt for these alternatives not only due to cost considerations but also for their potential to provide more consistent quality and performance under a broader range of conditions.

This competition can restrain the growth of the soy lecithin market as formulators weigh the benefits of alternative ingredients over soy lecithin in their product development.

Fluctuations in Soybean Supply and Prices

The availability and price stability of soybeans directly impact the soy lecithin market, given its derivation from this commodity. Factors such as adverse weather conditions, trade disputes, and economic fluctuations affecting soybean production can lead to volatility in soy lecithin prices.

This unpredictability can deter manufacturers from relying heavily on soy lecithin, preferring more stable alternatives, and can restrain market growth as companies seek to mitigate supply chain risks.

Growth Opportunity

Expanding Markets in Emerging Economies

Emerging economies present a significant growth opportunity for the soy lecithin market. As countries like India, China, and Brazil experience economic growth, urbanization, and increased consumer spending, the demand for processed foods, pharmaceuticals, and personal care products also rises.

Soy lecithin, utilized extensively in these industries, stands to benefit from such growth trends. Efforts to cater to these markets with tailored food products and health solutions that incorporate soy lecithin could drive substantial market expansion and diversification.

Innovations in Organic and Non-GMO Lecithin

The growing consumer inclination towards organic and non-GMO products opens new avenues for the soy lecithin market. By focusing on the development and marketing of organic and non-GMO soy lecithin, manufacturers can tap into premium segments that command higher prices and loyal consumer bases.

Innovations that improve the extraction and processing of soy lecithin to meet organic standards can differentiate products in the marketplace, attracting health-conscious consumers and creating lucrative growth opportunities.

Increasing Applications in Nutraceuticals

The nutraceutical industry’s expansion provides a promising growth opportunity for soy lecithin. Its application as a natural emulsifier and bioavailability enhancer in dietary supplements is becoming increasingly valuable.

As the global population ages and the focus on health and wellness intensifies, the demand for supplements that incorporate natural ingredients like soy lecithin is expected to rise. Capitalizing on this trend by developing specialized lecithin formulations for nutraceuticals could lead to significant market growth and higher penetration in health-oriented consumer segments.

Latest Trends

Surge in Clean Label Product Demand

A major trend in the soy lecithin market is the rising demand for clean label products, which prioritize simple, natural ingredients that are easily recognizable to consumers. Soy lecithin benefits from this trend as it is perceived as a more natural alternative to synthetic emulsifiers.

Food manufacturers are increasingly reformulating their products to include ingredients like soy lecithin that align with consumer demand for transparency and healthfulness. This shift is influencing product offerings across food, beverages, and even personal care products, driving innovation and product development in these sectors.

Enhanced Focus on Sustainability in Supply Chains

Sustainability has become a critical factor in consumer purchasing decisions, influencing trends in the soy lecithin market. Companies are now more actively disclosing their sourcing practices and striving to ensure that their supply chains are environmentally friendly and ethically sound.

This includes adopting practices such as sustainable farming, reducing carbon footprints, and ensuring fair labor conditions. For soy lecithin, this trend means a push towards sourcing from certified sustainable soy crops, which can attract a more environmentally conscious consumer base and enhance brand reputation.

Growth in Plant-based Product Popularity

The increasing popularity of plant-based diets is significantly impacting the soy lecithin market. As more consumers opt for vegetarian and vegan lifestyles, the demand for plant-based food additives like soy lecithin is growing.

This trend is particularly strong in the development of plant-based alternatives to dairy and meat products, where soy lecithin is used to enhance texture and stability. This shift not only opens new markets for soy lecithin in food applications but also in areas like nutrition supplements and health foods, where plant-based ingredients are highly valued.

Regional Analysis

In North America, the Soy Lecithin Market reached USD 226.0 million, accounting for 38.8%.

The global soy lecithin market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, each exhibiting distinct market dynamics and growth potentials.

North America dominates the soy lecithin market, holding a 38.8% share with a market value of USD 226.0 million. This region’s market leadership is driven by a robust food processing industry and a high demand for clean-label and non-GMO products. Europe follows closely, with a strong emphasis on food safety regulations that favor the adoption of natural emulsifiers like soy lecithin in food and pharmaceutical applications.

Asia Pacific is experiencing rapid growth in the soy lecithin market due to increasing urbanization and changes in dietary habits, particularly in countries like China and India. This region benefits from expanding industrial activities and a growing middle class, which increases the demand for processed and convenience foods, thereby driving the need for soy lecithin.

The markets in the Middle East & Africa and Latin America are smaller but growing steadily, influenced by increasing industrialization and the gradual shift towards healthier, plant-based diets. These regions present new opportunities for market expansion as awareness and demand for food additives like soy lecithin increase.

Overall, North America’s significant market share highlights its critical role in the global soy lecithin landscape, supported by advanced food technology and consumer health consciousness.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global soy lecithin market is characterized by the presence of several key players, each contributing unique strengths and strategies to capture market share. Notable among these are Archer Daniels Midland Company, Bunge Limited, and Cargill, Incorporated, which are pivotal in driving the market due to their expansive global footprints and integrated supply chains.

These companies excel in operational efficiency and have significant control over raw material sourcing, which gives them an edge in maintaining product quality and cost competitiveness.

Archer Daniels Midland Company and Bunge Limited, with their robust processing capabilities, continue to innovate in the extraction and application of soy lecithin, thereby enhancing its applicability across diverse industries, including food and beverage and pharmaceuticals.

Cargill, Incorporated, meanwhile, leverages its vast distribution network to ensure the availability of soy lecithin in various markets, particularly focusing on emerging regions where there is heightened demand for processed foods and health-oriented products.

Other significant players like DuPont de Nemours, Inc., and Lipoid GmbH play crucial roles in the specialty segment, focusing on high-quality, non-GMO, and organic soy lecithin products, catering to niche markets that demand stringent quality and traceability.

Emerging companies such as VAV Life Sciences Pvt Ltd and Lasenor EMUL., S.L., are carving out their own niches by focusing on technological advancements and customer-specific formulations, thereby enhancing their presence in the market.

Collectively, these companies’ strategic initiatives, including expansions, new product launches, and collaborations, are vital for staying competitive in a market that is becoming increasingly crowded and dynamic.

The emphasis on sustainability and clean-label products is also a significant trend that these companies are capitalizing on to cater to evolving consumer preferences. As the market continues to grow, adaptability and innovation will be key differentiators for these players in maintaining and expanding their market positions.

Top Key Players in the Market

- AKK Soya International

- American Lecithin Company

- Archer Daniels Midland Company,

- Bunge Limited

- Cargill, Incorporated

- Ceresking Ecology & Technology Co. Ltd.

- Denofa

- DuPont de Nemours, Inc.

- Fishmer Lecithin

- Global River Food Ingredients

- Haneil Soyatech Pvt. Ltd.

- Imcopo Food Ingredients B.V.

- Lasenor EMUL., S.L.

- Lecico GmbH

- Lipoid GmbH

- NOW Foods

- Orison Chemicals Limited

- Ruchi Soya Industries

- Sime Darby Unimills B.V.

- Sternchemie GmbH & Co. KG

- Thew Arnott & Co. Ltd.

- VAV Life Sciences Pvt Ltd.

- Wilmar International Limited

Recent Developments

- In 2023, Cargill showcased its Topcithin™ NGM Lecithin, a non-GM, liquid soy lecithin product, which is highly valued for its hygienic and sanitary qualities in various food applications. This product is part of Cargill’s broad selection of high-quality lecithins, known for their versatility and functionality across multiple industries including food, pharmaceuticals, and more.

- In 2024, Bunge plans to expand its deoiled lecithin capacity at a fully integrated facility in Bellevue, Ohio, emphasizing their commitment to sustainability with lower-carbon soy lecithin production. This development aims to support clients in meeting their carbon reduction goals while offering high-purity lecithin products, facilitated by Bunge’s deep expertise and advanced facilities.

Report Scope

Report Features Description Market Value (2023) USD 582.5 Million Forecast Revenue (2033) USD 995.0 Million CAGR (2024-2033) 5.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Liquid, Solid), By Grade (Pharmaceutical Grade, Industrial Grade, Food Grade, Others), By Modification (Genetically Modified, Non-Genetically Modified), By Application (Rubber, Plastics, Detergents, Adhesives, Dyes, Printing Inks, Fabric Treatment, Others), By End-Use Industry (Building and Construction, Transportation, Medical and Healthcare, Cosmetics and Personal Care, Food and Beverage, Textiles, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AKK Soya International, American Lecithin Company, Archer Daniels Midland Company, Bunge Limited, Cargill, Incorporated, Ceresking Ecology & Technology Co. Ltd., Denofa, DuPont de Nemours, Inc., Fishmer Lecithin, Global River Food Ingredients, Haneil Soyatech Pvt. Ltd., Imcopo Food Ingredients B.V., Lasenor EMUL., S.L., Lecico GmbH, Lipoid GmbH, NOW Foods, Orison Chemicals Limited, Ruchi Soya Industries, Sime Darby Unimills B.V., Sternchemie GmbH & Co. KG, Thew Arnott & Co. Ltd., VAV Life Sciences Pvt Ltd., Wilmar International Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AKK Soya International

- American Lecithin Company

- Archer Daniels Midland Company,

- Bunge Limited

- Cargill, Incorporated

- Ceresking Ecology & Technology Co. Ltd.

- Denofa

- DuPont de Nemours, Inc.

- Fishmer Lecithin

- Global River Food Ingredients

- Haneil Soyatech Pvt. Ltd.

- Imcopo Food Ingredients B.V.

- Lasenor EMUL., S.L.

- Lecico GmbH

- Lipoid GmbH

- NOW Foods

- Orison Chemicals Limited

- Ruchi Soya Industries

- Sime Darby Unimills B.V.

- Sternchemie GmbH & Co. KG

- Thew Arnott & Co. Ltd.

- VAV Life Sciences Pvt Ltd.

- Wilmar International Limited