Global Advanced Material Market By Materials Type (Polymers, Metal and Alloys, Glasses, Composites, Ceramics, Others), By End-use (Automotive, Energy, Healthcare, Electronics, Oil and Gas Industry, Defense, Other) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142680

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

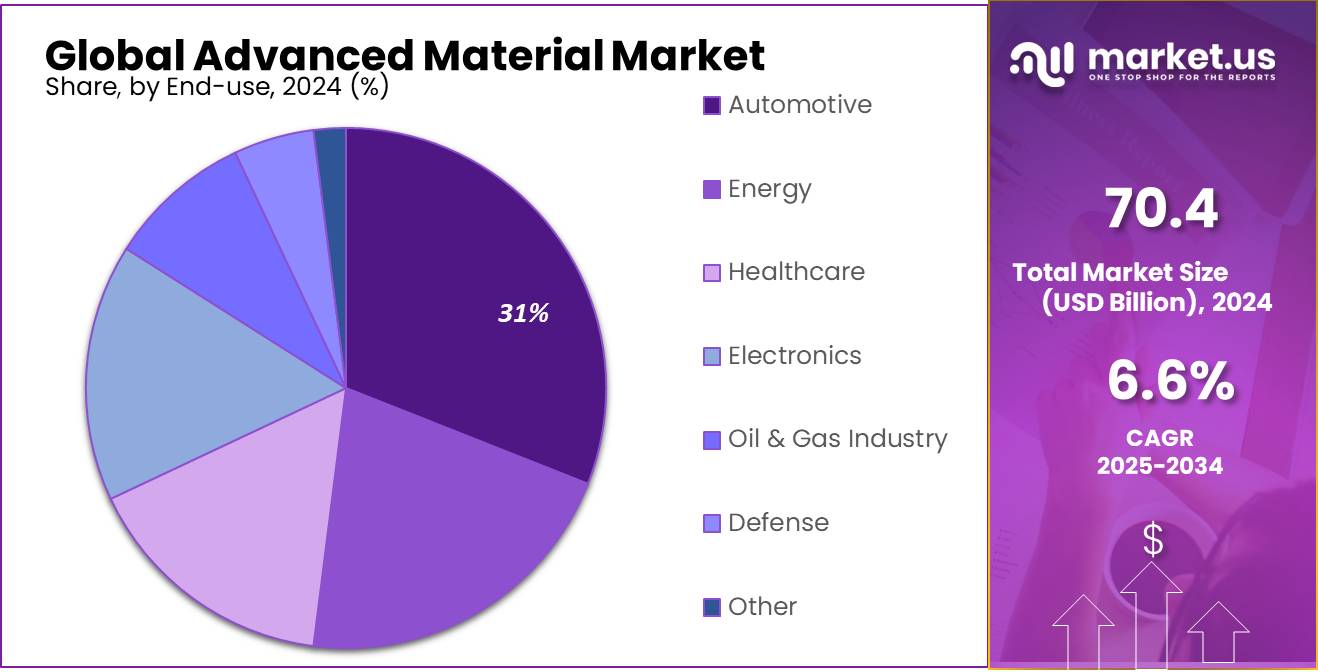

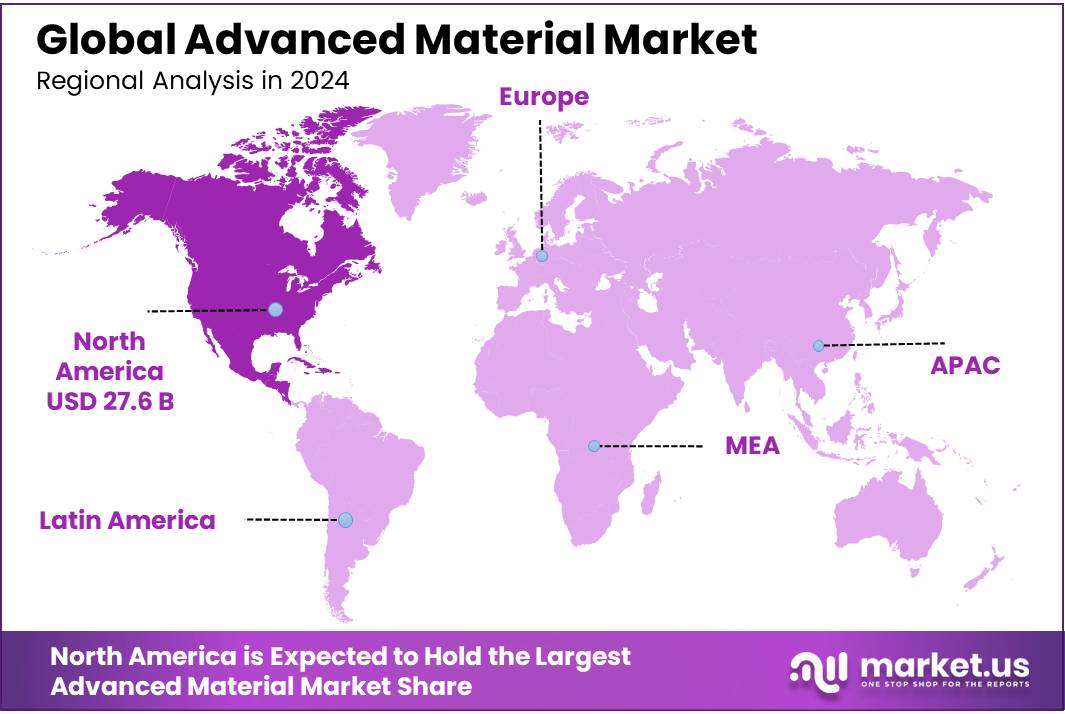

The Global Advanced Material Market size is expected to be worth around USD 133.4 Bn by 2034, from USD 70.4 Bn in 2024, growing at a CAGR of 6.6% during the forecast period from 2025 to 2034. In 2024 North America dominated the market with a 39.30% share, generating USD 27.6 Bn in revenue.

The advanced materials market is at the forefront of a technological revolution in global manufacturing, transitioning from traditional plastics and metals to ceramics and composites for high-performance applications. This sector encompasses a diverse range of high-performance structural materials including metals, polymers, ceramics, and composites, all of which significantly enhance strength and engineering performance. Such advancements are particularly beneficial to industries like automotive, which utilizes materials such as magnesium alloys, aluminum alloys, high-strength steels, and polymer matrix composites to promote energy conservation.

According to recent research, growth in the global advanced materials market, which is projected to expand from 13 Kilo Tons in 2018 to roughly 28 Kilo Tons by 2027. This growth corresponds to a compound annual growth rate (CAGR) of 8.1% over the period from 2019 to 2027.

In a significant development, the European Commission has announced plans to invest €500 million into a public-private partnership dedicated to research and development in advanced materials. This strategic initiative is designed to reduce Europe’s dependency on international sources for these materials and to spur innovation across various sectors including energy, construction, and electronics.

Key components of this initiative include the formation of a technology council and the creation of a materials commons—a digital platform designed to facilitate collaboration among researchers and innovators.

Key Takeaways

- Advanced Material Market size is expected to be worth around USD 133.4 Bn by 2034, from USD 70.4 Bn in 2024, growing at a CAGR of 6.6%.

- Ceramics held a dominant market position, capturing more than a 27.20% share of the advanced materials market.

- Automotive held a dominant market position, capturing more than a 31.10% share of the advanced materials market.

- North America held a dominant position in the advanced materials market, capturing more than 39.30% of the market share, valued at approximately USD 27.6 billion

By Materials Type

Ceramics lead with a 27.20% market share, driven by demand in automotive, electronics, and healthcare industries.

In 2024, Ceramics held a dominant market position, capturing more than a 27.20% share of the advanced materials market. This strong foothold can be attributed to the growing demand for ceramics across various industries, including automotive, electronics, and healthcare. As a result, the material’s properties, such as high-temperature resistance, durability, and electrical insulation, make it highly sought after for applications in cutting-edge technologies.

Ceramics are expected to maintain a significant presence in the market, potentially increasing their share as industries continue to innovate and incorporate advanced materials into their products. With applications expanding in areas like renewable energy and aerospace, the demand for ceramics is projected to rise steadily, reinforcing its position as one of the key materials in the advanced materials landscape.

By End-use

Automotive leads with a 31.10% market share, fueled by demand for lightweight materials, fuel efficiency, and electric vehicles.

In 2024, Automotive held a dominant market position, capturing more than a 31.10% share of the advanced materials market. The automotive industry’s increasing focus on lightweight materials, fuel efficiency, and sustainability has significantly contributed to the growing demand for advanced materials. These materials, which include composites, high-strength steels, and specialty alloys, are being widely used in vehicle manufacturing to enhance performance, reduce emissions, and improve safety features.

The automotive sector is expected to maintain its leading position, with continued advancements in EV technology and the expansion of autonomous vehicle development. The push for sustainability and environmental goals will likely drive further innovation in advanced materials, ensuring that the automotive industry continues to dominate this segment.

Key Market Segments

By Materials Type

- Polymers

- Polymers of Intrinsic Microporosity

- Polyimides

- Thermally Rearranged

- Polyurethanes

- Polyacetylenes

- Others

- Metal & Alloys

- Aluminum Alloys

- Titanium Alloys

- Steel Alloys

- Specialty Metals

- Others

- Glasses

- Specialty Glasses

- Glass-Ceramics

- Photonic Glasses

- Others

- Composites

- Polymer Matrix Composites (PMCs)

- Metal Matrix Composites (MMCs)

- Ceramic Matrix Composites (CMCs)

- Others

- Ceramics

- Others

By End-use

- Automotive

- Energy

- Healthcare

- Electronics

- Oil & Gas Industry

- Defense

- Other

Drivers

Government Initiatives Supporting Advanced Materials in the Automotive Sector

One of the major driving factors for the growth of the advanced materials market is the increasing number of government initiatives aimed at promoting sustainability and reducing carbon emissions. Governments worldwide are focusing on improving fuel efficiency and transitioning to greener alternatives, which heavily depend on the use of advanced materials. This is particularly evident in the automotive industry, where materials such as lightweight composites and high-strength steel play a critical role in enhancing vehicle fuel efficiency and reducing the overall carbon footprint.

For instance, the U.S. government has introduced various programs under its Department of Energy (DOE) to support the research and development of advanced materials, especially in the automotive sector. The DOE’s Advanced Research Projects Agency-Energy (ARPA-E) has funded several projects that focus on the development of high-performance materials for electric vehicles (EVs) and energy-efficient technologies. According to the U.S. DOE, lightweight materials are expected to reduce vehicle weight by up to 40%, which directly contributes to a decrease in fuel consumption and emissions.

Additionally, the European Union’s Horizon 2020 program has allocated substantial funding to projects that support the use of advanced materials in industries like automotive, aerospace, and manufacturing. The EU is particularly focused on achieving climate neutrality by 2050, with a key part of this plan being the reduction of greenhouse gas emissions from the transportation sector. As a result, automakers are being encouraged to invest in advanced materials that can help meet these ambitious environmental targets.

Restraints

High Cost of Advanced Materials in the Food Industry

One of the key restraining factors for the growth of the advanced materials market is the high cost associated with these materials, particularly in the food industry. Advanced materials, which include high-performance plastics, composites, and bio-based materials, are often more expensive to produce compared to traditional materials. This cost burden makes it challenging for food manufacturers, especially small and medium-sized enterprises (SMEs), to adopt these materials on a large scale.

For example, the use of high-quality biodegradable packaging made from advanced materials like polylactic acid (PLA) or plant-based polymers can increase packaging costs significantly. According to the European Bioplastics association, while biodegradable plastics can reduce environmental impact, their production costs are currently 2 to 3 times higher than conventional plastics. This price gap presents a challenge for food manufacturers trying to balance cost-efficiency with sustainability goals. In fact, the overall cost of using such advanced materials in packaging can sometimes outweigh the potential savings in waste disposal and environmental impact.

In addition to production costs, there are also expenses related to the research and development (R&D) of advanced materials. R&D efforts to create more sustainable food packaging materials often require significant investment in both time and resources. The high costs involved can limit the ability of smaller companies to innovate and integrate new materials into their processes.

Despite these challenges, governments and organizations are working to mitigate the cost factor through initiatives and funding. For instance, the U.S. Department of Agriculture (USDA) has been actively supporting the development of sustainable materials in food packaging through grants and research programs. These efforts aim to reduce the overall cost of advanced materials and make them more accessible to the food industry in the long run.

Opportunity

Growth Opportunities in Sustainable Packaging for the Food Industry

A significant growth opportunity for advanced materials in the food industry lies in the increasing demand for sustainable packaging solutions. As consumers become more environmentally conscious, the pressure on food companies to adopt eco-friendly packaging materials has escalated. Advanced materials, such as biodegradable plastics, plant-based polymers, and recycled materials, are emerging as alternatives to traditional plastic packaging, offering an effective solution to the growing environmental concerns.

The shift towards sustainable packaging is not only driven by consumer preferences but also by stricter government regulations. For example, the European Union’s Green Deal includes measures aimed at reducing plastic waste and promoting the use of recyclable or biodegradable materials. The EU aims to ensure that all plastic packaging is reusable or recyclable by 2030, creating a strong incentive for food companies to explore advanced packaging materials.

In line with this, the European Bioplastics association projects that the demand for bioplastics, including packaging for food, will grow at an annual rate of 20% over the next few years, with the market potentially reaching over 2.3 million tons by 2025. This growth presents a significant opportunity for manufacturers and innovators in the advanced materials space.

Furthermore, the U.S. Food and Drug Administration (FDA) is also exploring new materials that are both safe for food use and environmentally sustainable. The FDA has been actively supporting research into food-safe bioplastics, which could replace conventional plastics in food packaging. The growing support from both governmental bodies and consumers is expected to drive innovation in the food packaging sector, presenting lucrative opportunities for companies specializing in advanced materials.

Trends

Adoption of Plant-Based and Biodegradable Materials in Food Packaging

A significant trend in the advanced materials sector, especially in the food industry, is the growing shift towards plant-based and biodegradable materials for packaging. This trend is fueled by both consumer demand for environmentally friendly products and stricter government regulations aimed at reducing plastic waste. As sustainability becomes a major concern for both consumers and businesses, food companies are increasingly seeking alternatives to traditional plastic packaging.

According to the European Bioplastics association, the global market for bioplastics is expected to grow at an annual rate of 20%, with the bioplastics market reaching 2.3 million tons by 2025. A significant portion of this growth is driven by the food packaging industry, where demand for eco-friendly materials is rising. In particular, bioplastics like polylactic acid (PLA) and polyhydroxyalkanoates (PHA) are being used to create packaging that is not only biodegradable but also safe for food contact. These materials help reduce the environmental impact of food packaging while ensuring that safety and quality standards are met.

Governments worldwide are also supporting the use of sustainable packaging materials through various initiatives. In the United States, the U.S. Department of Agriculture (USDA) has launched programs to promote the use of bioplastics in food packaging, including providing grants to companies researching and developing plant-based alternatives. Similarly, the European Union’s Green Deal aims to reduce plastic waste and increase the use of recyclable and biodegradable packaging materials by 2030. These government initiatives, combined with growing consumer awareness, are driving the widespread adoption of plant-based materials in the food industry.

Regional Analysis

In 2024, North America held a dominant position in the advanced materials market, capturing more than 39.30% of the market share, valued at approximately USD 27.6 billion. This strong market presence can be attributed to the region’s advanced technological infrastructure, high industrialization, and the continuous demand for innovative materials across sectors such as automotive, aerospace, electronics, and healthcare. The growing focus on sustainability and the increasing adoption of lightweight, high-performance materials have further accelerated the market’s expansion in North America.

The United States, in particular, plays a central role in driving market growth due to substantial investments in research and development, alongside significant government support for innovation in materials science. Programs like the U.S. Department of Energy’s (DOE) ARPA-E (Advanced Research Projects Agency-Energy) have been pivotal in funding the development of next-generation materials, including advanced composites and sustainable materials. The region’s automotive and aerospace industries are also adopting advanced materials to improve fuel efficiency, reduce emissions, and enhance overall performance, with North American companies at the forefront of these developments.

In addition, the North American market benefits from a robust manufacturing sector, which supports the growth of advanced materials for various applications, from medical devices to renewable energy solutions. The region’s commitment to technological advancement and sustainability will likely maintain its dominant position in the global advanced materials market over the next several years. With an expanding focus on electric vehicles (EVs) and green technologies, North America is expected to remain a key player in shaping the future of advanced materials.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3A Composites Holding AG is a leading manufacturer of advanced materials, particularly in the composites sector. The company specializes in producing high-performance core materials used in industries such as aerospace, automotive, and construction. 3A Composites focuses on providing lightweight, durable, and sustainable solutions that meet the growing demand for efficient and environmentally friendly materials. Its expertise in composite materials positions the company as a key player in the advanced materials market.

Akzo Nobel N.V. is a global leader in performance coatings and specialty chemicals, with a strong presence in the advanced materials market. The company develops innovative solutions for industries such as automotive, aerospace, and electronics, with a focus on sustainability and energy efficiency. Akzo Nobel’s advanced materials, including coatings and resins, enhance product performance, durability, and protection. Its commitment to sustainable development and cutting-edge technologies solidifies its position in the market.

Applied Materials is a major player in the advanced materials market, primarily serving the semiconductor and electronics industries. The company provides advanced materials and equipment essential for manufacturing semiconductor devices, flat-panel displays, and solar products. Applied Materials specializes in innovative technologies, such as atomic layer deposition and etching, which are crucial for the production of highly efficient materials used in electronics and energy applications. Its technology-driven solutions support global advances in material science.

Top Key Players in the Market

- 3A Composites Holding AG

- Akzo Nobel N.V.

- Applied Materials

- Applied Nanotech Holdings

- BASF SE

- Cambridge Display Technology

- CPS Technologies Corporation

- DowDuPont Inc.

- Hanwha Group

- Hexcel Corporation

- Kyocera Corporation

- Materion Corporation

- Momentive Performance Materials Inc.

- Morgan Advanced Materials

- PyroGenesis Canada Inc.

Recent Developments

3A Composites Holding AG, a prominent player in the advanced materials sector, reported net sales of CHF 527.8 million for the first half of 2024, a 6% decrease from CHF 559.5 million in the same period of 2023.

Akzo Nobel N.V., a global leader in paints and coatings, reported a 14% decline in Q4 2024 organic sales, primarily due to reduced demand in China. However, the company achieved a full-year adjusted EBITDA of approximately €1.5 billion, aligning with its target range of €1.5 to €1.65 billion.

Report Scope

Report Features Description Market Value (2024) USD 70.4 Bn Forecast Revenue (2034) USD 133.4 Bn CAGR (2025-2034) 6.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Materials Type (Polymers, Metal and Alloys, Glasses, Composites, Ceramics, Others), By End-use (Automotive, Energy, Healthcare, Electronics, Oil and Gas Industry, Defense, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3A Composites Holding AG, Akzo Nobel N.V., Applied Materials, Applied Nanotech Holdings, BASF SE, Cambridge Display Technology, CPS Technologies Corporation, DowDuPont Inc., Hanwha Group, Hexcel Corporation, Kyocera Corporation, Materion Corporation, Momentive Performance Materials Inc., Morgan Advanced Materials, PyroGenesis Canada Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3A Composites Holding AG

- Akzo Nobel N.V.

- Applied Materials

- Applied Nanotech Holdings

- BASF SE

- Cambridge Display Technology

- CPS Technologies Corporation

- DowDuPont Inc.

- Hanwha Group

- Hexcel Corporation

- Kyocera Corporation

- Materion Corporation

- Momentive Performance Materials Inc.

- Morgan Advanced Materials

- PyroGenesis Canada Inc.