Global Compressed Air Energy Storage Market By Type (Adiabatic, Diabatic, Isothermal), By Technology (Constant-Volume Storage, Constant-Pressure Storage), By Capacity (Up to 10 kW, 10 to 50 kW, Above 50 kW), By Application (Peak Shaving And Valley Filling, Electrical Load Balance, Demand-Side Power Management, Applied to Renewable Energy, Backup Power Supply, Others), By End User (Utilities, Industrial, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142394

- Number of Pages: 287

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

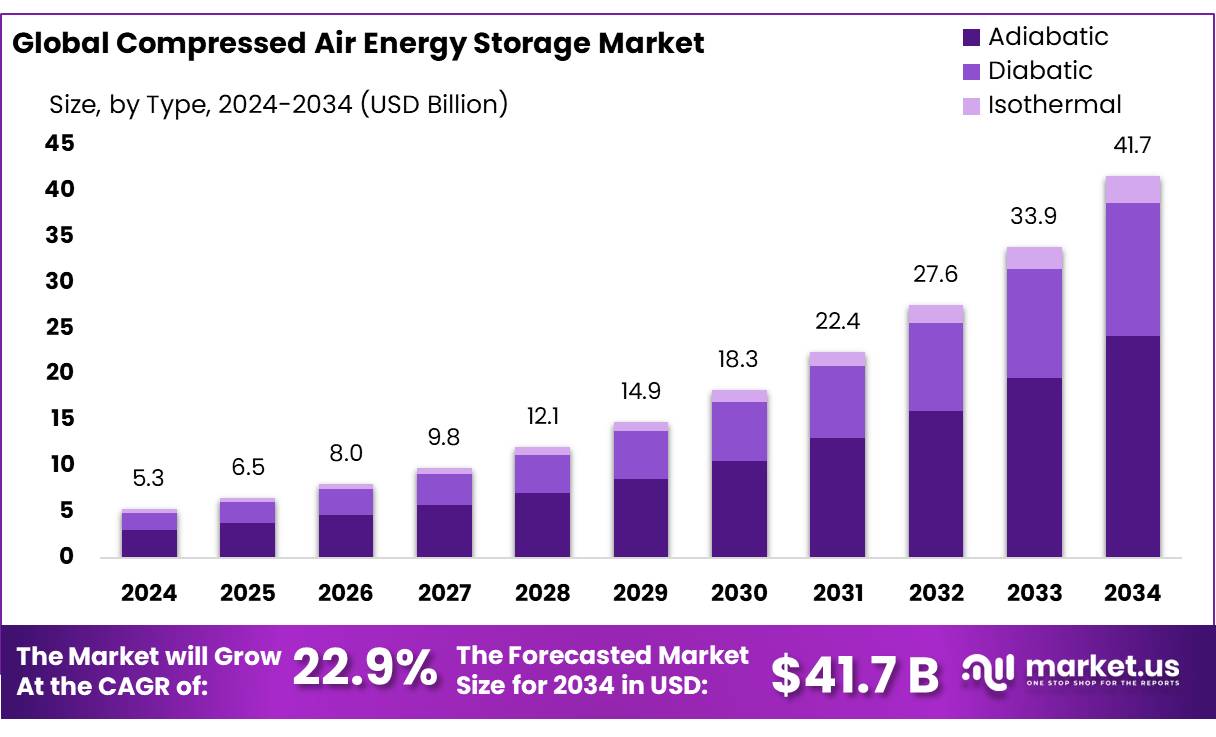

The Global Compressed Air Energy Storage Market size is expected to be worth around USD 41.7 Bn by 2034, from USD 5.3 Bn in 2024, growing at a CAGR of 22.9% during the forecast period from 2025 to 2034.

Compressed air energy storage (CAES) is a way to store energy generated at one time for use at another time. At utility scale, energy generated during periods of low energy demand (off-peak) can be released to meet higher demand (peak load) periods. In a CAES plant, ambient air or another gas is compressed and stored under pressure in an underground cavern or container. When electricity is required, the pressurized air is heated and expanded in an expansion turbine driving a generator for power production.

This is attributed to the increase in the global population and the resulting surge in the overall power demand. According to reports, global energy consumption rose from around 122.8 TWh in 2000 to over 178.8 TWh in 2022.

According to a recent report by the International Energy Agency (IEA), energy storage capacity must triple by 2030 to meet climate goals. Compressed air energy storage, with its potential for large-scale energy storage and ability to provide long-duration energy supply, is well-positioned to play a crucial role in this expansion.

Governments worldwide are implementing policies and incentives to encourage the adoption of renewable energy technologies, which in turn drives the need for efficient and cost-effective energy storage solutions like CAES. For example, the European Union’s Green Deal and the United States’ renewable energy incentives under various legislative acts support the development of energy storage technologies, including CAES.

The future of the CAES market looks promising with several growth opportunities on the horizon. One significant area is the development of advanced materials and technologies that reduce the cost and increase the efficiency of CAES systems. Innovations such as isothermal compression and the use of alternative materials for air storage containers could revolutionize the market.

Key Takeaways

- Compressed Air Energy Storage Market size is expected to be worth around USD 41.7 Bn by 2034, from USD 5.3 Bn in 2024, growing at a CAGR of 22.9%.

- Adiabatic segment held a dominant position in the compressed air energy storage market, capturing more than a 58.30% share.

- Constant-Volume Storage secured a dominant position in the compressed air energy storage market, with a substantial 59.30% market share.

- 10 to 50 kW capacity range for compressed air energy storage systems held a dominant market position, capturing more than a 46.30% share.

- Peak Shaving & Valley Filling held a dominant market position, capturing more than a 32.20% share.

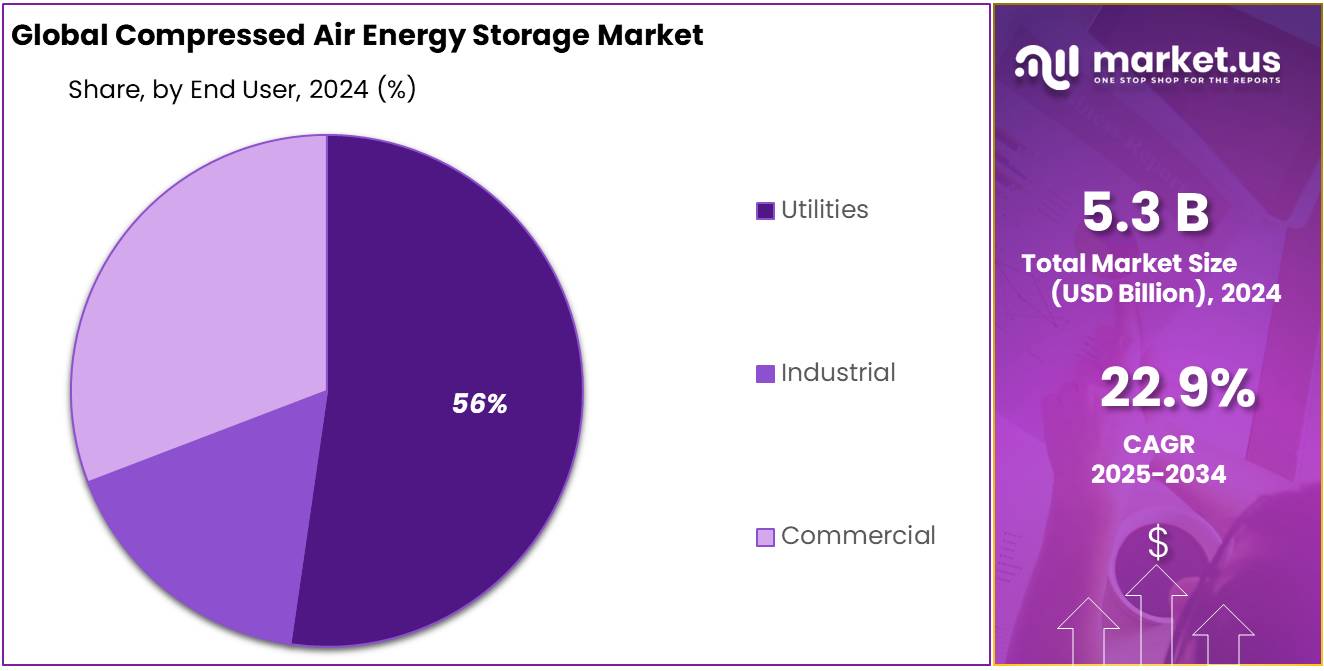

- Utilities held a dominant market position, capturing more than a 56.20% share in the compressed air energy storage market.

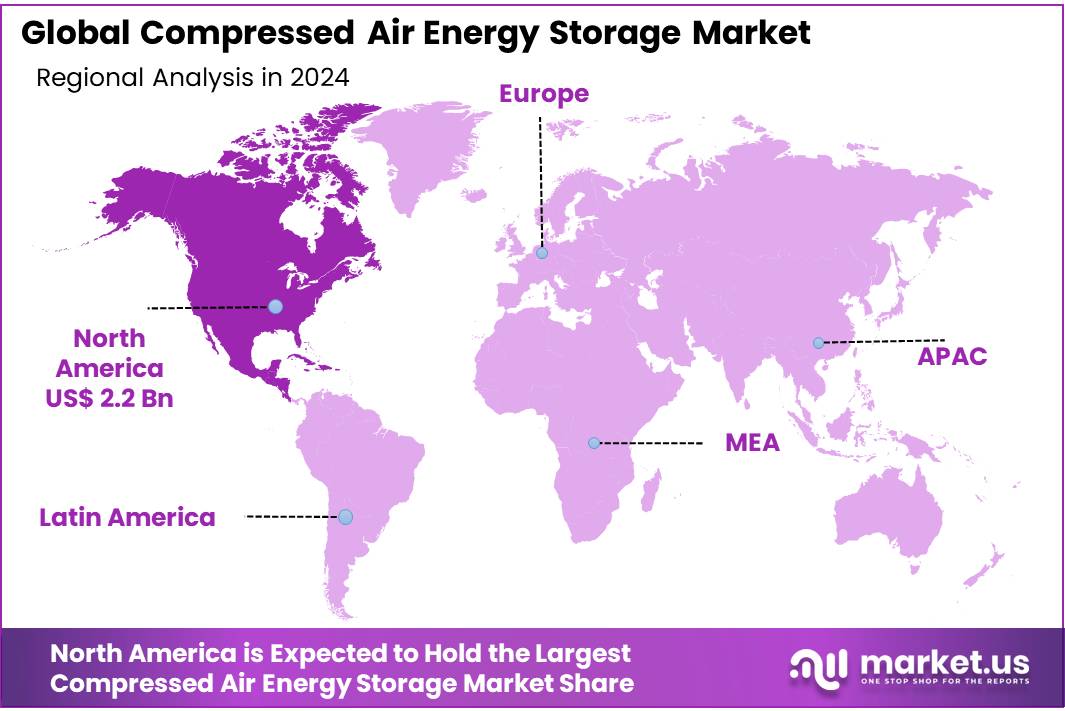

- North America emerged as the leading region in the compressed air energy storage (CAES) market, capturing a substantial 43.20% share, equivalent to approximately USD 2.2 billion.

By Type

In 2024, the Adiabatic segment held a dominant position in the compressed air energy storage market, capturing more than a 58.30% share. This segment benefits significantly from its efficiency in storing and retrieving energy without losing heat. As industries increasingly focus on sustainable and efficient energy solutions, the adoption of adiabatic technology has seen considerable growth. This method is particularly favored for its ability to maintain the temperature of compressed air during the storage process, leading to higher energy recovery rates compared to other types.

The market is expected to see continued expansion. The growing demand for reliable and cost-effective energy storage solutions drives this segment. Innovations in material science and improved system designs are likely to further enhance the performance and decrease the costs associated with adiabatic compressed air energy storage systems, potentially increasing their market share. This growth is underpinned by the increasing integration of renewable energy sources into the power grid, necessitating more robust and efficient energy storage solutions that adiabatic systems can provide.

By Technology

In 2024, Constant-Volume Storage secured a dominant position in the compressed air energy storage market, with a substantial 59.30% market share. This technology’s appeal lies in its ability to maintain the volume of the storage container constant, thereby ensuring stable energy discharge rates. As industries seek more reliable energy storage methods that can deliver power consistently, the relevance of constant-volume storage systems has increased. These systems are particularly advantageous in applications where space constraints and safety considerations play a crucial role, as they can be efficiently scaled and safely managed.

The market for constant-volume storage is expected to grow steadily. This projection is supported by ongoing advancements in sealing technology that reduce air leakage and improve overall system efficiency. The need for dependable energy storage solutions continues to drive this segment, especially in sectors that require uninterrupted power for critical operations. As the technology matures and more industries recognize its benefits, further adoption and market expansion are likely.

By Capacity

In 2024, the 10 to 50 kW capacity range for compressed air energy storage systems held a dominant market position, capturing more than a 46.30% share. This segment caters primarily to small and medium-scale operations that require a moderate amount of energy storage. The popularity of this capacity range stems from its versatility and affordability, making it an ideal choice for businesses looking to enhance their energy efficiency without a significant upfront investment. Systems within this capacity are also favored for their compact size, which makes them suitable for urban installations or areas with limited space.

Demand for compressed air energy storage systems within the 10 to 50 kW range is expected to continue growing. This trend is driven by the increasing adoption of renewable energy sources like solar and wind, which require efficient energy storage solutions to manage supply variability. Advances in technology are making these systems even more reliable and cost-effective, further boosting their appeal to potential users. With enhanced performance and decreasing costs, the market for these mid-range capacity systems is poised for further expansion, particularly in commercial and industrial sectors looking for sustainable energy solutions.

By Application

Peak Shaving & Valley Filling held a dominant market position, capturing more than a 32.20% share in the compressed air energy storage market. This application is widely used by industries and utilities to balance energy demand and supply efficiently. By storing excess energy during off-peak hours when electricity demand is low and releasing it during peak hours when demand is high, this method helps reduce strain on the power grid and lowers operational costs. The increasing need for energy cost optimization and grid stability has been a major factor driving the growth of this segment.

The demand for Peak Shaving & Valley Filling applications is expected to grow further as industries and utilities continue to focus on energy management strategies. With electricity prices fluctuating and energy grids facing increased pressure due to the rising integration of renewable sources, the role of compressed air energy storage in peak shaving and valley filling is becoming more crucial. Companies are investing in advanced storage technologies to enhance efficiency and maximize savings, ensuring continued expansion of this segment in the coming years.

By End User

In 2024, Utilities held a dominant market position, capturing more than a 56.20% share in the compressed air energy storage market. The sector has been increasingly adopting energy storage solutions to enhance grid stability, improve power reliability, and integrate renewable energy sources more efficiently. With the growing pressure to transition toward cleaner energy and manage fluctuating power demand, utilities have turned to compressed air energy storage as a cost-effective and scalable solution. These systems help in balancing electricity supply and demand, reducing dependence on fossil fuel-based power plants during peak hours, and ensuring a steady power supply.

The role of Utilities in the market is expected to strengthen further. Governments and regulatory bodies worldwide are implementing policies that encourage large-scale energy storage projects to support renewable energy expansion. As more utilities invest in advanced energy storage infrastructure, the demand for compressed air energy storage solutions is likely to rise. Technological advancements and cost reductions in storage systems will further drive adoption, positioning utilities as a key end-user segment contributing to the continued market growth.

Key Market Segments

By Type

- Adiabatic

- Diabatic

- Isothermal

By Technology

- Constant-Volume Storage

- Constant-Pressure Storage

By Capacity

- Up to 10 kW

- 10 to 50 kW

- Above 50 kW

By Application

- Peak Shaving & Valley Filling

- Electrical Load Balance

- Demand-Side Power Management

- Applied to Renewable Energy

- Backup Power Supply

- Others

By End User

- Utilities

- Industrial

- Commercial

Drivers

Government Initiatives Driving Compressed Air Energy Storage (CAES) Adoption

One of the major driving factors for the adoption of Compressed Air Energy Storage (CAES) systems is the proactive support and initiatives from governments aiming to enhance energy efficiency and sustainability across various industries, including the food sector.

In the United States, the Department of Energy (DOE) has been instrumental in promoting energy-efficient practices. Through programs like the Better Plants Initiative, the DOE collaborates with manufacturers to improve energy performance. A notable example is the implementation of energy efficiency measures in compressed air systems within California’s food industry. These measures led to a 22% annual reduction in air system costs, resulting in nearly $8,000 in annual savings for companies like Stanislaus Food Products.

Furthermore, the DOE has recognized the potential of CAES in enhancing grid reliability and integrating renewable energy sources. In 2009, the DOE awarded a $29.4 million grant for a 300-MW CAES project in Kern County, California, highlighting the government’s commitment to advancing this technology.

Internationally, governments are also acknowledging the importance of energy storage solutions. For instance, the European Union has funded projects like the RICAS initiative in Austria, which focuses on adiabatic CAES technology, aiming to achieve efficiencies between 70–80%.

These government initiatives not only provide financial support but also create a favorable regulatory environment that encourages industries to adopt CAES technologies. By investing in research, offering grants, and setting efficiency standards, governments play a pivotal role in driving the adoption of CAES, leading to enhanced energy efficiency, cost savings, and a more sustainable energy landscape.

Restraints

High Initial Capital Costs as a Restraining Factor for Compressed Air Energy Storage (CAES)

One significant barrier to the widespread adoption of Compressed Air Energy Storage (CAES) systems is the substantial initial capital investment required. Establishing a CAES facility involves considerable expenses, primarily due to the need for suitable geological formations for air storage and the construction of specialized infrastructure. These high upfront costs can deter potential investors and stakeholders, especially when compared to other energy storage technologies with lower initial financial requirements.

en.wikipedia.orgFor instance, the construction of a CAES plant necessitates the development of underground storage caverns, compression and expansion equipment, and thermal energy storage units. The costs associated with these components can vary significantly based on site-specific geological conditions and the scale of the facility. According to available data, initial capital expenditures for large-scale CAES systems often range from $500 to $1,200 per kW. This substantial financial commitment poses a challenge for industries considering the implementation of CAES technology.

In the food industry, where profit margins can be tight, such high initial costs may be particularly prohibitive. Food processing plants require reliable and cost-effective energy solutions to maintain operations, and the prospect of investing heavily in CAES infrastructure may not align with their financial strategies. Consequently, despite the potential benefits of CAES, including enhanced energy efficiency and sustainability, the financial burden associated with its implementation can act as a significant restraining factor.

To mitigate this issue, government initiatives and incentives play a crucial role. By providing financial support, subsidies, or tax incentives, governments can alleviate some of the financial pressures associated with the high capital costs of CAES projects. For example, the U.S. Department of Energy has recognized the potential of CAES in enhancing grid reliability and integrating renewable energy sources. In 2009, the DOE awarded a $29.4 million grant for a 300-MW CAES project in Kern County, California, highlighting the government’s commitment to advancing this technology.

Opportunity

Integration of Renewable Energy Sources as a Growth Opportunity for Compressed Air Energy Storage (CAES)

One significant growth opportunity for Compressed Air Energy Storage (CAES) systems lies in their potential to facilitate the integration of renewable energy sources into the power grid. As the world shifts towards sustainable energy, managing the intermittent nature of renewable sources like wind and solar power becomes crucial. CAES offers a viable solution by storing excess energy generated during periods of low demand and releasing it during peak times, thereby ensuring a stable and reliable energy supply.

In the United States, the Department of Energy (DOE) has recognized the importance of energy storage in enhancing grid reliability and supporting renewable energy integration. Through initiatives like the Advanced Energy Storage Program, the DOE aims to improve and promote the widespread use of energy storage technologies, including CAES. This program focuses on integrating energy storage with fossil energy applications to increase facility flexibility, enhance power grid resiliency, achieve cost savings, and reduce greenhouse gas emissions.

The food industry, a significant energy consumer, stands to benefit from CAES technology. Compressed air is extensively used in food processing and packaging operations. Implementing CAES systems can lead to substantial energy savings and improved operational efficiency. For example, a food processing company that upgraded its compressed air systems experienced enhanced reliability, enabling the company to keep pace with growth while conserving energy.

Government support further amplifies the growth prospects of CAES. For instance, the U.S. DOE’s Energy Storage Grand Challenge includes CAES as a key focus area for research and development funding. Such initiatives aim to accelerate the development and deployment of advanced energy storage technologies, recognizing their critical role in achieving a reliable and resilient energy infrastructure.

Trends

Advancements in Adiabatic Compressed Air Energy Storage (A-CAES) Technology

One of the latest trends in the energy storage sector is the development and implementation of Adiabatic Compressed Air Energy Storage (A-CAES) systems. Unlike traditional CAES, which dissipates the heat generated during air compression, A-CAES captures and stores this thermal energy, significantly enhancing overall system efficiency. This innovation addresses the inefficiencies of earlier CAES models by reusing the stored heat during the air expansion phase, leading to improved performance and sustainability.

A notable example of this advancement is the European Union-funded RICAS project in Austria, which focuses on adiabatic CAES technology. This project aims to achieve efficiencies between 70–80%, a significant improvement over traditional CAES systems. The RICAS initiative utilizes crushed rock to store heat from the compression process, enhancing the system’s efficiency and reliability.

In the food industry, the application of A-CAES technology presents promising opportunities. Compressed air is extensively used in food processing and packaging operations, necessitating contaminant-free and efficient systems. Implementing A-CAES can lead to substantial energy savings and improved operational efficiency. For instance, a food processing company that upgraded its compressed air systems experienced enhanced reliability, enabling the company to keep pace with growth while conserving energy.

Government initiatives are also playing a crucial role in promoting A-CAES technology. The U.S. Department of Energy has recognized the potential of CAES in enhancing grid reliability and integrating renewable energy sources. In 2009, the DOE awarded a $29.4 million grant for a 300-MW CAES project in Kern County, California, highlighting the government’s commitment to advancing this technology.

Regional Analysis

In 2024, North America emerged as the leading region in the compressed air energy storage (CAES) market, capturing a substantial 43.20% share, equivalent to approximately USD 2.2 billion. This dominance is primarily attributed to the region’s robust energy infrastructure, increasing integration of renewable energy sources, and supportive governmental policies promoting energy storage solutions.

The United States, in particular, has been at the forefront of adopting CAES technologies. The U.S. Department of Energy has recognized the potential of CAES in enhancing grid reliability and integrating renewable energy sources.

Canada also contributes significantly to North America’s CAES market share. The country’s focus on sustainable energy solutions and reducing greenhouse gas emissions has led to increased interest in energy storage technologies, including CAES. Collaborations between government bodies and private enterprises aim to develop efficient energy storage systems to support the growing renewable energy sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ALACAES is a Swiss company specializing in advanced adiabatic compressed air energy storage (AA-CAES) solutions for large-scale electricity storage. Their patented technology utilizes mountain caverns as pressure chambers and incorporates proprietary thermal energy storage, achieving a round-trip efficiency exceeding 72% without greenhouse gas emissions. In 2016, they successfully tested the world’s first AA-CAES pilot plant in the Swiss Alps.

APEX CAES is a U.S.-based company focusing on developing and operating CAES systems to provide grid-scale energy storage solutions. Their technology aims to enhance grid reliability and support the integration of renewable energy sources by storing excess energy and releasing it during peak demand periods. APEX CAES is recognized among the top CAES companies globally.

AUGWIND Energy, based in Israel, specializes in energy storage and management solutions, including compressed air energy storage systems. Their innovative approach focuses on optimizing energy consumption and enhancing efficiency for various industries. AUGWIND Energy is acknowledged as one of the prominent CAES system designers and suppliers.

Top Key Players

- ALACAES

- APEX CAES

- AUGWIND Energy

- Cheesecake Energy

- MAN Energy Solutions

- Green-Y Energy

- Hydrostor

- Magnum Development LLC.

- Sherwood Power

- Siemens AG

- Storelectric Ltd

- TerraStor Energy

Recent Developments

Apex CAES Bethel Energy Center near Palestine, Texas, is designed to provide 324 megawatts (MW) of power with a storage capacity of 15,000 megawatt-hours (MWh). This facility utilizes renewable energy to compress air into an underground salt dome, offering a cost-effective and efficient energy storage solution. The upfront cost for such storage media is approximately $2 per kilowatt-hour (kWh), significantly lower than the $200–$250 per kWh range for lithium-ion batteries.

In early 2024, Augwind recommissioned their pilot AirBattery system in southern Israel, achieving a round-trip efficiency greater than 47%. The company has secured agreements totaling over 200 megawatt-hours (MWh) of energy storage projects in Israel, including an $8 million deal with the Israel Electric Corporation for a 40 MWh storage facility in Dimona, set for construction in 2023.

Report Scope

Report Features Description Market Value (2024) USD 5.3 Bn Forecast Revenue (2034) USD 41.7 Bn CAGR (2025-2034) 22.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Adiabatic, Diabatic, Isothermal), By Technology (Constant-Volume Storage, Constant-Pressure Storage), By Capacity (Up to 10 kW, 10 to 50 kW, Above 50 kW), By Application (Peak Shaving And Valley Filling, Electrical Load Balance, Demand-Side Power Management, Applied to Renewable Energy, Backup Power Supply, Others), By End User (Utilities, Industrial, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ALACAES, APEX CAES, AUGWIND Energy, Cheesecake Energy, MAN Energy Solutions, Green-Y Energy, Hydrostor, Magnum Development LLC., Sherwood Power, Siemens AG, Storelectric Ltd, TerraStor Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Compressed Air Energy Storage MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Compressed Air Energy Storage MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ALACAES

- APEX CAES

- AUGWIND Energy

- Cheesecake Energy

- MAN Energy Solutions

- Green-Y Energy

- Hydrostor

- Magnum Development LLC.

- Sherwood Power

- Siemens AG

- Storelectric Ltd

- TerraStor Energy