Global Electrochemical Energy Storage Market Size, Share, Statistics Analysis Report By Technology (Lithium-Ion, Sodium Sulfur, Lead Acid, Flow Battery, Others), By Application (Grid Energy Storage, Electric Vehicles (EVs), Consumer Electronics, Renewable Energy Storage (Solar, Wind), Uninterruptible Power Supply (UPS), Others), By End-User (Residential, Commercial, Industrial, Utilities, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 139108

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

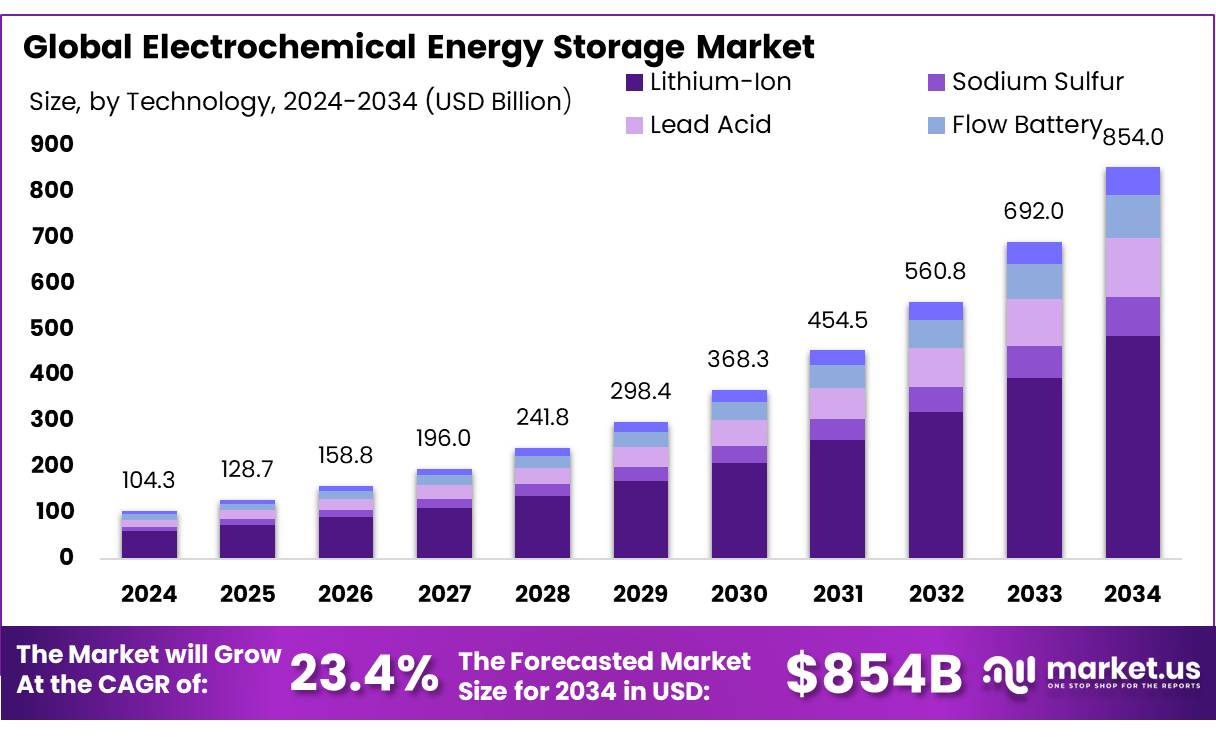

The Global Electrochemical Energy Storage Market size is expected to be worth around USD 854.0 Bn by 2034, from USD 104.3 Bn in 2024, growing at a CAGR of 23.4% during the forecast period from 2025 to 2034.

Electrochemical energy storage (EES) technologies, such as lithium-ion, sodium-ion, flow batteries, and lead-acid, are pivotal in the global shift toward sustainable energy. The market is growing rapidly due to the rising demand for energy storage solutions in grid applications, renewable energy integration, and electric vehicles (EVs). By 2030, the global installed battery storage capacity is expected to exceed 200 GW, up from over 30 GW in 2023, driven by advancements in technology and favorable regulations.

Investments in EES have surged with the increasing adoption of renewable energy and the need for grid stability. In 2023, global battery storage investments surpassed $20 billion, with much of it directed toward grid-scale projects. Governments and companies are heavily funding R&D to improve battery performance, reduce costs, and enhance sustainability, with initiatives like the EU’s Battery 2030+ and the U.S. Energy Storage Grand Challenge. China leads in global battery production, contributing over 40% in 2023.

Key drivers of the electrochemical energy storage market include the need for efficient storage solutions due to the intermittent nature of renewable energy sources like solar and wind. The cost of lithium-ion batteries has fallen by 89% since 2010, making them more affordable for utilities and consumers. Additionally, electric vehicle adoption is growing rapidly, with global EV sales hitting 14 million units in 2023, a 35% increase from the previous year, further boosting battery demand.

Future market growth will be driven by next-gen battery technologies like solid-state, lithium-sulfur, and sodium-ion, which promise to improve energy density, cycle life, and safety while reducing dependence on critical materials like lithium and cobalt. Long-duration storage solutions, such as flow batteries, will play a key role in decarbonizing the power sector. The development of large-scale battery recycling infrastructure will also ensure sustainable supply chains and resource conservation.

Key Takeaways

- Electrochemical Energy Storage Market size is expected to be worth around USD 854.0 Bn by 2034, from USD 104.3 Bn in 2024, growing at a CAGR of 23.4%.

- Lithium-Ion held a dominant market position, capturing more than a 57.4% share of the electrochemical energy storage market.

- Grid Energy Storage held a dominant market position, capturing more than a 38.5% share.

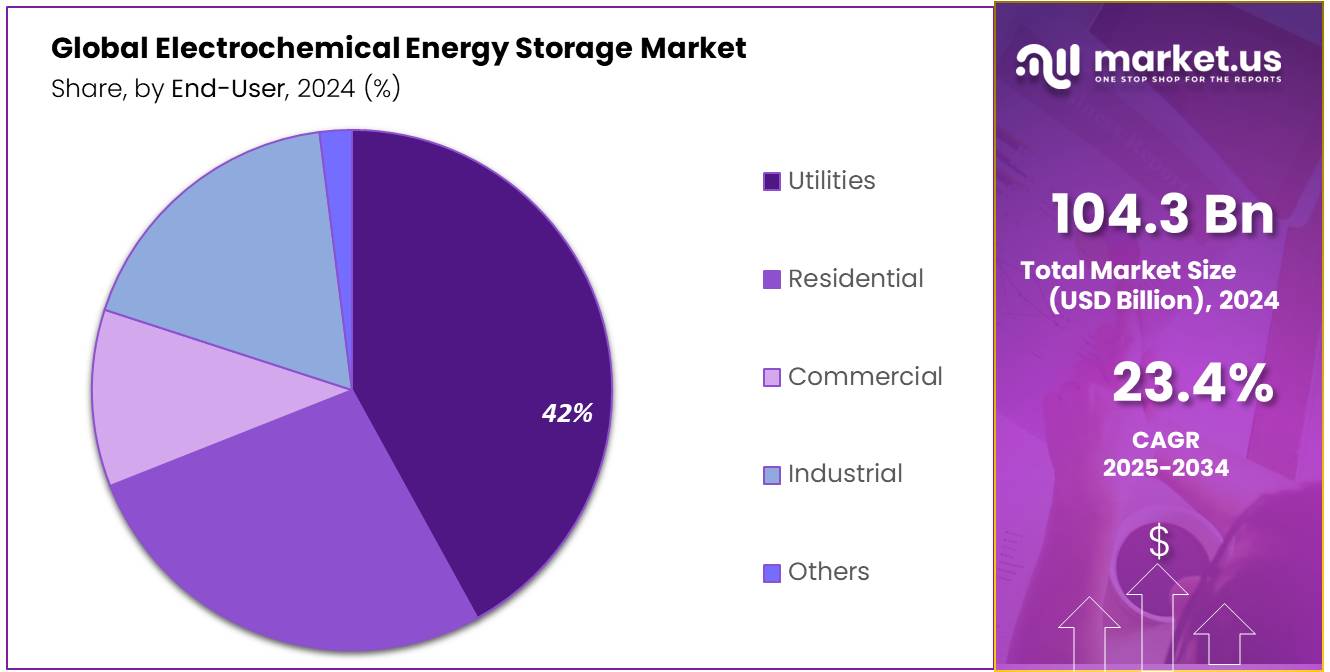

- Utilities held a dominant market position, capturing more than a 42.2% share.

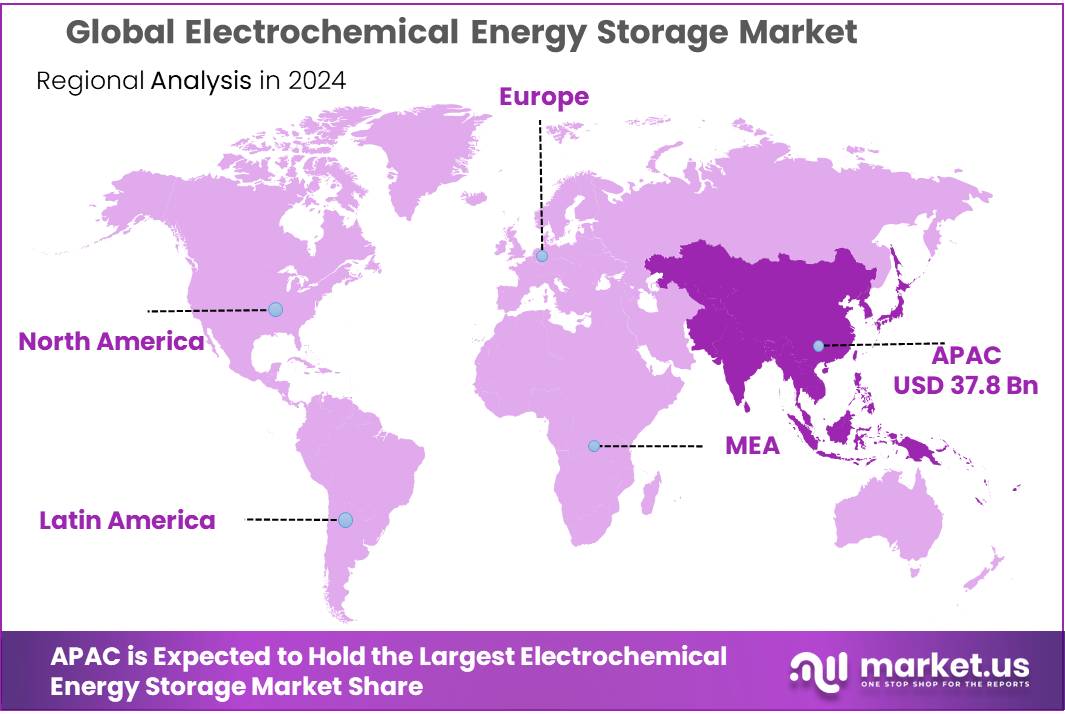

- Asia Pacific (APAC) dominates the electrochemical energy storage market, capturing a market share of 51.2% in 2024, valued at approximately USD 3.8 billion.

By Technology

In 2024, Lithium-Ion held a dominant market position, capturing more than a 57.4% share of the electrochemical energy storage market. This technology continues to benefit from its high energy density, long lifespan, and decreasing costs, which have made it the preferred choice for a wide range of applications, particularly in electric vehicles (EVs) and renewable energy storage.

Sodium-Sulfur (NaS) batteries are expected to maintain a steady presence in the market, although their share remains smaller in comparison to Lithium-Ion. These batteries are primarily used in large-scale stationary energy storage systems due to their high efficiency in storing electricity for extended periods.

Lead-Acid batteries, a traditional energy storage technology, are projected to see a gradual decline in market share due to their relatively lower energy density and shorter lifespan compared to newer technologies like Lithium-Ion. Despite this, Lead-Acid remains a cost-effective solution for applications in off-grid power systems and backup power.

Flow batteries are gaining traction, particularly in stationary energy storage, due to their ability to scale easily for large energy storage systems. These batteries are considered promising for renewable energy storage, especially in applications where long-duration storage is required.

By Application

In 2024, Grid Energy Storage held a dominant market position, capturing more than a 38.5% share of the electrochemical energy storage market. This segment continues to grow as utilities seek reliable and scalable solutions for stabilizing the grid and integrating renewable energy sources like wind and solar. As the world moves toward cleaner energy systems, grid storage technologies are crucial for balancing supply and demand, especially during periods of high demand or intermittent renewable generation.

Electric Vehicles (EVs) are another major application driving the electrochemical energy storage market. In 2024, this sector continues to experience rapid growth, as the adoption of EVs expands globally. EVs accounted for a significant portion of the market, fueled by consumer demand for more sustainable transportation options and advancements in battery technology that increase range and reduce costs.

Consumer Electronics, while a smaller segment compared to grid storage or EVs, still represents a substantial portion of the market. In 2024, this sector captured a considerable share, driven by the demand for high-performance batteries in smartphones, laptops, wearables, and other portable devices. The continuous evolution of consumer electronics, with increasing demand for longer battery life and more compact designs, ensures steady growth in this market segment.

Renewable Energy Storage, particularly for Solar and Wind applications, is another rapidly growing segment. In 2024, renewable energy storage technologies accounted for a significant share of the market, as solar and wind power become more widely adopted as primary sources of clean energy. The ability to store excess energy generated during peak production times and release it when needed is crucial for maximizing the effectiveness of renewable energy sources.

Uninterruptible Power Supply (UPS) systems are another key application of electrochemical energy storage. In 2024, UPS systems represented a substantial portion of the market, providing critical backup power for data centers, hospitals, and other essential infrastructure. The demand for reliable and efficient UPS solutions is growing as businesses and consumers alike require uninterrupted power for sensitive electronic systems.

By End-User

In 2024, Utilities held a dominant market position, capturing more than a 42.2% share of the electrochemical energy storage market. The increasing demand for reliable and sustainable grid management solutions has made energy storage a critical component for utilities. As utilities look to integrate renewable energy sources such as solar and wind into the grid, the ability to store excess power for later use has become essential for ensuring grid stability.

The Residential sector also plays a significant role in the electrochemical energy storage market, with a growing number of homeowners adopting energy storage systems to reduce their reliance on the grid and enhance energy independence. In 2024, the Residential segment accounted for a notable share of the market, driven by the increasing affordability of home battery systems and the rising popularity of solar-plus-storage solutions.

In the Commercial sector, energy storage is becoming more common as businesses seek ways to reduce their energy costs and improve energy reliability. In 2024, the Commercial segment represented a solid share of the market, with small to mid-sized enterprises investing in storage solutions to manage peak demand and lower electricity bills. Additionally, many businesses are integrating storage with on-site renewable energy systems to enhance sustainability.

The Industrial sector is also seeing increasing adoption of electrochemical energy storage systems, particularly among large manufacturing facilities and other energy-intensive industries. In 2024, the Industrial segment held a smaller but steadily growing share of the market. Industrial users are adopting energy storage to manage energy consumption more effectively, especially in areas with high electricity prices or unreliable power grids.

Key Market Segments

By Technology

- Lithium-Ion

- Sodium Sulfur

- Lead Acid

- Flow Battery

- Others

By Application

- Grid Energy Storage

- Electric Vehicles (EVs)

- Consumer Electronics

- Renewable Energy Storage (Solar, Wind)

- Uninterruptible Power Supply (UPS)

- Others

By End-User

- Residential

- Commercial

- Industrial

- Utilities

- Others

Drivers

Government Initiatives and Regulatory Support Driving the Electrochemical Energy Storage Market

One of the major driving factors behind the growth of the electrochemical energy storage market is the strong support from government initiatives and regulatory frameworks worldwide. Governments around the globe are increasingly implementing policies to encourage the use of energy storage systems, particularly electrochemical batteries, as part of their efforts to decarbonize the energy sector and transition to renewable energy sources. These initiatives are critical for achieving sustainability goals, managing the integration of renewable energy into the grid, and ensuring energy security.

Governments have realized that energy storage is essential for overcoming the intermittent nature of renewable energy sources like wind and solar. These technologies generate power when conditions are favorable (i.e., when the sun is shining or the wind is blowing) but require reliable storage solutions to be effectively used when demand peaks or renewable generation slows down. Energy storage systems, especially those based on electrochemical technologies such as lithium-ion and flow batteries, offer a practical and scalable solution to this challenge. They can store excess energy during periods of high renewable generation and release it when needed, ensuring a stable and reliable energy supply.

In the U.S., the federal government has rolled out several policies to promote energy storage adoption. The Energy Storage Grand Challenge by the U.S. Department of Energy (DOE) is a prime example. Launched in 2020, the initiative aims to accelerate the development and deployment of energy storage technologies. The goal of this challenge is to make energy storage a central part of the clean energy ecosystem by enabling cost-competitive, grid-scale storage solutions. As part of this initiative, the DOE has allocated significant funding to support research, development, and commercialization of energy storage technologies, including electrochemical systems.

The European Commission has also earmarked €1.8 billion for the Horizon Europe program, which supports projects aimed at advancing energy storage technologies, including electrochemical solutions. As of 2024, this funding has helped numerous startups and established companies accelerate the deployment of electrochemical storage solutions across the region.

Restraints

High Initial Costs of Electrochemical Energy Storage Systems

One of the major restraining factors in the widespread adoption of electrochemical energy storage systems is the high initial cost of these technologies, particularly for large-scale applications. Although electrochemical batteries, such as lithium-ion and flow batteries, offer long-term cost savings and efficiency, the upfront capital required for installation remains a significant barrier for many businesses, governments, and consumers. This financial hurdle slows the pace of adoption, particularly in regions where economic conditions may limit the availability of investment in clean energy technologies.

For residential users, the price of home battery systems like Tesla’s Powerwall or LG Chem’s RESU can range from $10,000 to $15,000 per unit, including installation. While the cost of these systems has been steadily decreasing, it remains prohibitive for many homeowners, especially those in lower-income brackets or in regions with less favorable financial incentives. Without substantial subsidies or financial support, many potential users may choose to delay or forgo the installation of energy storage systems altogether.

Government incentives and rebates are critical in helping to offset these high upfront costs, but in many cases, these programs are not yet widespread enough to make a significant difference. For example, the U.S. government offers a federal tax credit for residential energy storage systems, but this is limited in scope and amount. Similarly, countries like Germany and the U.K. have introduced incentives to encourage solar-plus-storage systems, but these programs are often oversubscribed or have stringent eligibility requirements.

According to the International Energy Agency (IEA), the cost of utility-scale lithium-ion batteries fell from over $1,100 per kWh in 2010 to less than $150 per kWh in 2024. However, for widespread adoption in diverse markets, a further reduction to under $100 per kWh will be needed to make electrochemical storage more economically competitive.

Opportunity

Expansion of Renewable Energy Integration Driving Growth in Electrochemical Energy Storage

One of the most promising growth opportunities for the electrochemical energy storage market lies in the ongoing expansion of renewable energy sources like solar and wind. As nations around the world commit to decarbonizing their energy sectors and moving away from fossil fuels, the integration of renewable energy into existing power grids is becoming a central focus. Electrochemical energy storage systems are poised to play a pivotal role in this transition by enabling the efficient storage of energy generated from renewable sources, which are inherently intermittent.

In particular, lithium-ion batteries, which are widely used for renewable energy storage, have experienced rapid technological advancements in terms of efficiency and cost. The price of lithium-ion batteries has dropped by approximately 80% over the past decade, making them more accessible and affordable for large-scale applications. As of 2024, the cost of lithium-ion batteries has fallen to less than $150 per kilowatt-hour (kWh), which is a crucial development for accelerating the adoption of energy storage systems. The decreasing cost trend, combined with improvements in battery performance, positions lithium-ion batteries as a leading technology for large-scale renewable energy storage.

Government policies and regulatory frameworks also provide substantial growth opportunities for electrochemical energy storage systems. For instance, the U.S. government has made significant strides in supporting the adoption of renewable energy storage through various financial incentives, tax credits, and grant programs. The federal Investment Tax Credit (ITC) provides a 30% tax credit for the installation of energy storage systems when paired with renewable energy systems like solar. This incentive is expected to remain in place through 2034, giving both residential and commercial customers a strong financial reason to invest in energy storage solutions.

Trends

Growing Demand for Sustainable and Long-Duration Energy Storage Solutions

Long-duration storage systems are designed to store energy for longer periods, from several hours up to multiple days, and discharge it when needed. Flow batteries, a promising technology within the electrochemical space, are particularly well-suited for this application. Unlike traditional lithium-ion batteries, flow batteries store energy in liquid electrolytes, which allows for greater scalability and longer storage durations. These systems are especially beneficial for utilities that need to manage longer-term imbalances between energy production and demand.

The growing interest in long-duration storage has been accelerated by several key developments. For one, the cost of flow batteries and other emerging storage technologies has been steadily decreasing. As of 2024, flow battery prices have dropped by more than 40% over the last five years, making them a more affordable option for grid-scale applications.

According to the U.S. Department of Energy’s (DOE) Grid Storage Launchpad initiative, research and development into flow batteries and other LDES technologies is receiving increased funding, with a focus on improving their efficiency and lowering costs. The DOE has allocated $100 million in grants to support the commercialization of long-duration storage technologies in 2024 alone, signaling strong governmental support for this innovation.

Another factor contributing to the demand for LDES is the growing need for resilience in energy systems. Extreme weather events, such as the Texas winter storm in 2021 or Hurricane Ida, have highlighted the vulnerabilities of existing power grids. Long-duration storage can help mitigate these risks by providing a backup power source during emergencies or disruptions in renewable energy generation.

In addition to flow batteries, other electrochemical technologies, such as lithium iron phosphate (LFP) batteries, are gaining attention for their potential in long-duration storage. LFP batteries are known for their stability, safety, and cost-effectiveness, making them an attractive option for applications that require extended energy storage. As of 2024, LFP batteries are becoming more widely adopted in both residential and utility-scale storage projects, thanks to their long lifespan and ability to handle deep cycling, which is essential for long-term energy storage.

Regional Analysis

Asia Pacific (APAC) dominates the electrochemical energy storage market, capturing a market share of 51.2% in 2024, valued at approximately USD 3.8 billion. This region’s leadership is primarily driven by the rapid adoption of renewable energy technologies and the significant investments in energy storage infrastructure, particularly in countries like China and India. China, in particular, is a global leader in the deployment of lithium-ion batteries, with substantial government support aimed at enhancing energy storage capabilities and scaling up renewable energy integration.

North America holds a significant market position, contributing to a growing demand for energy storage technologies, particularly in the United States. The U.S. is actively advancing energy storage projects with strong government initiatives such as the Energy Storage Grand Challenge, further driving the adoption of electrochemical storage systems. By 2024, the North American market is expected to see consistent growth, supported by favorable regulatory policies and financial incentives for both residential and utility-scale energy storage projects.

Europe is witnessing steady progress in energy storage adoption, particularly in countries like Germany, the U.K., and France, which are at the forefront of the renewable energy transition. The European Union’s ambitious Green Deal and renewable energy targets are catalyzing the need for advanced storage systems to balance intermittent renewable generation. The European market is expected to continue growing as governments allocate funding for research and development in energy storage technologies.

Latin America and Middle East & Africa are emerging markets, with smaller shares of the global market. However, both regions are making strides towards energy storage adoption, particularly as energy infrastructure modernization and renewable energy penetration increase.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The electrochemical energy storage market is highly competitive, with several key players driving innovation and growth across different segments of the industry. Major companies such as ABB, AES Corporation, Fluence Energy, and GE Renewable Energy are leading the way in providing large-scale energy storage systems, focusing on both utility and commercial applications.

Tesla, Inc., LG Energy Solutions, and Samsung SDI dominate the residential and commercial storage markets, providing high-performance lithium-ion batteries for both solar and non-solar applications. Tesla, in particular, has gained significant market share with its Powerwall and Powerpack products, which cater to consumers and utilities looking for efficient, sustainable storage options.

BYD Company Ltd., Johnson Controls, and Panasonic Corporation, are also crucial in the market, with substantial involvement in the production of battery technologies and energy storage systems. NextEra Energy, a major player in the renewable energy sector, has been expanding its energy storage capacity as part of its strategy to enhance renewable energy reliability.

Lockheed Martin Corporation, Vestas, and Toshiba Corporation are investing in next-generation technologies, such as long-duration energy storage, to address the growing need for sustainable and scalable storage solutions. The ongoing research and partnerships between these companies ensure the development of more efficient, affordable, and durable electrochemical storage systems, which will continue to accelerate the transition to a cleaner, more resilient energy infrastructure.

Top Key Players

- ABB

- AES Corporation

- BYD Company Ltd.

- Duracell, Inc.

- Durapower Group

- Enphase Energy

- Exide Technologies

- Fluence Energy

- Furukawa Battery Co., Ltd.

- GE Renewable Energy

- Hitachi Energy Ltd.

- Invinity Energy Systems

- Jena Batteries GmbH

- Johnson Controls

- LG Energy Solutions

- Lockheed Martin Corporation

- NextEra Energy

- Panasonic Corporation

- Samsung SDI Co., Ltd

- SCHMID Group

- Siemens Energy

- Tesla, Inc.

- Toshiba Corporation

- Vestas

Recent Developments

{{Recent_Dev}}

Report Scope

Report Features Description Market Value (2024) USD 104.3 Bn Forecast Revenue (2034) USD 854.0 Bn CAGR (2025-2034) 23.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Lithium-Ion, Sodium Sulfur, Lead Acid, Flow Battery, Others), By Application (Grid Energy Storage, Electric Vehicles (EVs), Consumer Electronics, Renewable Energy Storage (Solar, Wind), Uninterruptible Power Supply (UPS), Others), By End-User (Residential, Commercial, Industrial, Utilities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, AES Corporation, BYD Company Ltd., Duracell, Inc., Durapower Group, Enphase Energy, Exide Technologies, Fluence Energy, Furukawa Battery Co., Ltd., GE Renewable Energy, Hitachi Energy Ltd., Invinity Energy Systems, Jena Batteries GmbH, Johnson Controls, LG Energy Solutions, Lockheed Martin Corporation, NextEra Energy, Panasonic Corporation, Samsung SDI Co., Ltd, SCHMID Group, Siemens Energy, Tesla, Inc., Toshiba Corporation, Vestas Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electrochemical Energy Storage MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Electrochemical Energy Storage MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- AES Corporation

- BYD Company Ltd.

- Duracell, Inc.

- Durapower Group

- Enphase Energy

- Exide Technologies

- Fluence Energy

- Furukawa Battery Co., Ltd.

- GE Renewable Energy

- Hitachi Energy Ltd.

- Invinity Energy Systems

- Jena Batteries GmbH

- Johnson Controls

- LG Energy Solutions

- Lockheed Martin Corporation

- NextEra Energy

- Panasonic Corporation

- Samsung SDI Co., Ltd

- SCHMID Group

- Siemens Energy

- Tesla, Inc.

- Toshiba Corporation

- Vestas