Global Uninterruptible Power Supply Market Size, Share, And Business Benefits By Type (On-Line Double-Conversion, Line Interactive, Passive Standby), By Capacity (Less than 10 kVA, 10-100 kVA, Above 100 kVA), By End-User (Data Centers, Telecommunication, Industrial, Medical, Marine, Residential and Commercial, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142256

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

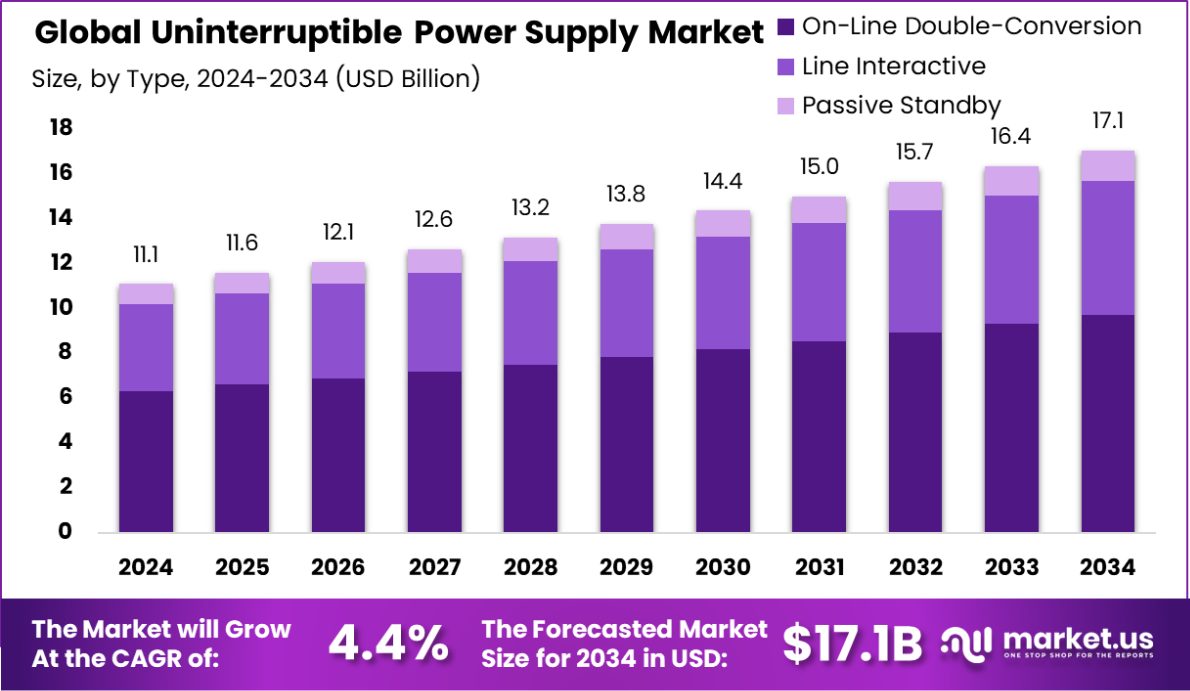

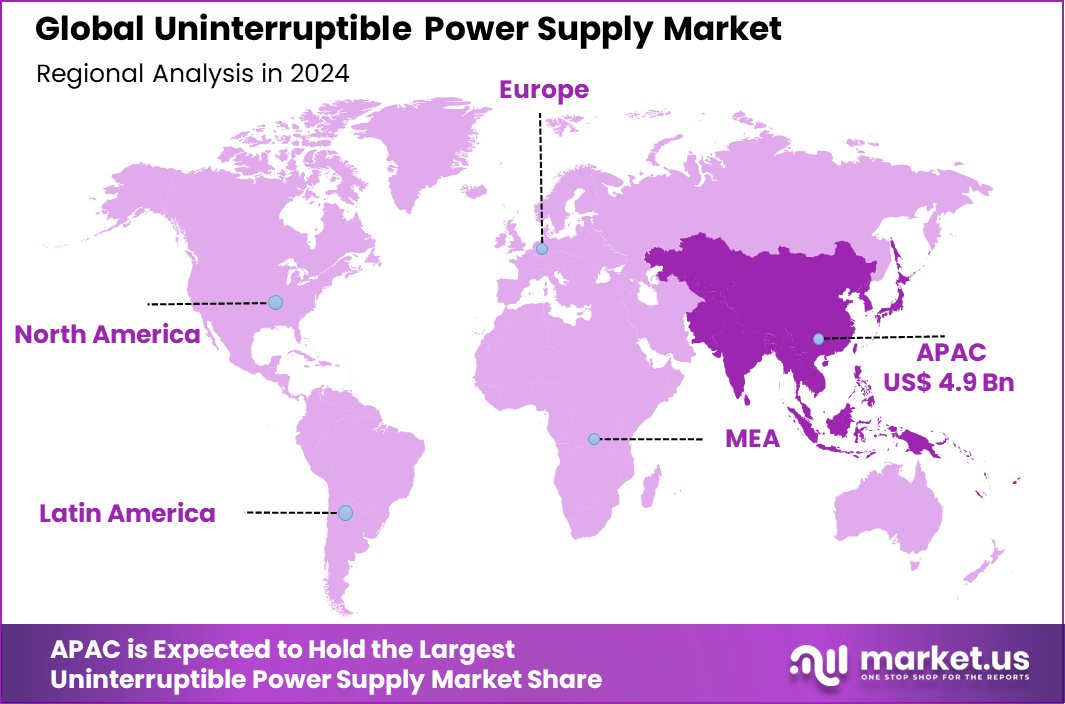

Global Uninterruptible Power Supply Market is expected to be worth around USD 17.1 billion by 2034, up from USD 11.1 billion in 2024, and grow at a CAGR of 4.4% from 2025 to 2034. Asia-Pacific leads in the UPS market with a substantial 44.60% share, amounting to USD 4.9 billion in value.

An Uninterruptible Power Supply (UPS) is a crucial device that provides emergency power to a load when the input power source fails. It ensures the continuity of power for essential equipment, such as computers, medical machinery, and industrial tools, helping to avoid data loss and operational interruptions. UPS systems range in size from small units designed for individual computers to large units powering entire data centers or buildings.

The UPS market is expanding due to increasing reliance on digital technologies, which demand continuous and reliable power to prevent data loss and service interruptions. Several factors are driving the growth of this market, including the rising demand for cloud computing services and the expansion of IT infrastructure in emerging economies.

One significant growth factor for the UPS market is the substantial cost savings associated with energy efficiency. For instance, a 1000 kVA UPS system in a large data center can save $18,000 annually in energy costs. Additionally, improving UPS efficiency from 90% to 95% can reduce annual energy consumption by 768,421 kWh, saving approximately $90,000 at $0.12 per kWh. These savings are vital for businesses looking to reduce operational costs and enhance sustainability.

The demand for UPS systems is also influenced by new energy conservation standards that aim to minimize power waste. These standards are estimated to save 0.94 quadrillion BTUs of energy over their lifetime, indicating a 15% reduction in energy consumption compared to older models. This regulatory push towards more efficient technologies is creating a robust demand for newer, more efficient UPS systems.

Moreover, opportunities in the UPS market are linked to the need for modular systems that can adapt to fluctuating IT loads. Traditional UPS systems lose efficiency significantly when operating below 50% load capacity, highlighting the importance of scalable solutions. Modular UPS systems allow businesses to expand their power supply incrementally, which aligns closely with growth in IT demand and can lead to more optimized energy usage.

Lastly, the UPS industry faces financial challenges and opportunities due to compliance costs with new standards. The industry net present value (INPV) for manufacturers is estimated to range from -$409 million to $162 million, indicating a significant impact on profitability based on the company’s ability to innovate and adapt. This variance shows that while there are hurdles, there are also substantial opportunities for manufacturers who can lead in efficiency and scalability.

Key Takeaways

- Global Uninterruptible Power Supply Market is expected to be worth around USD 17.1 billion by 2034, up from USD 11.1 billion in 2024, and grow at a CAGR of 4.4% from 2025 to 2034.

- In the Uninterruptible Power Supply Market, the On-Line Double-Conversion type dominates with a 57.30% share.

- For capacity, units ranging from 10 to 100 kVA represent 42.30% of the market.

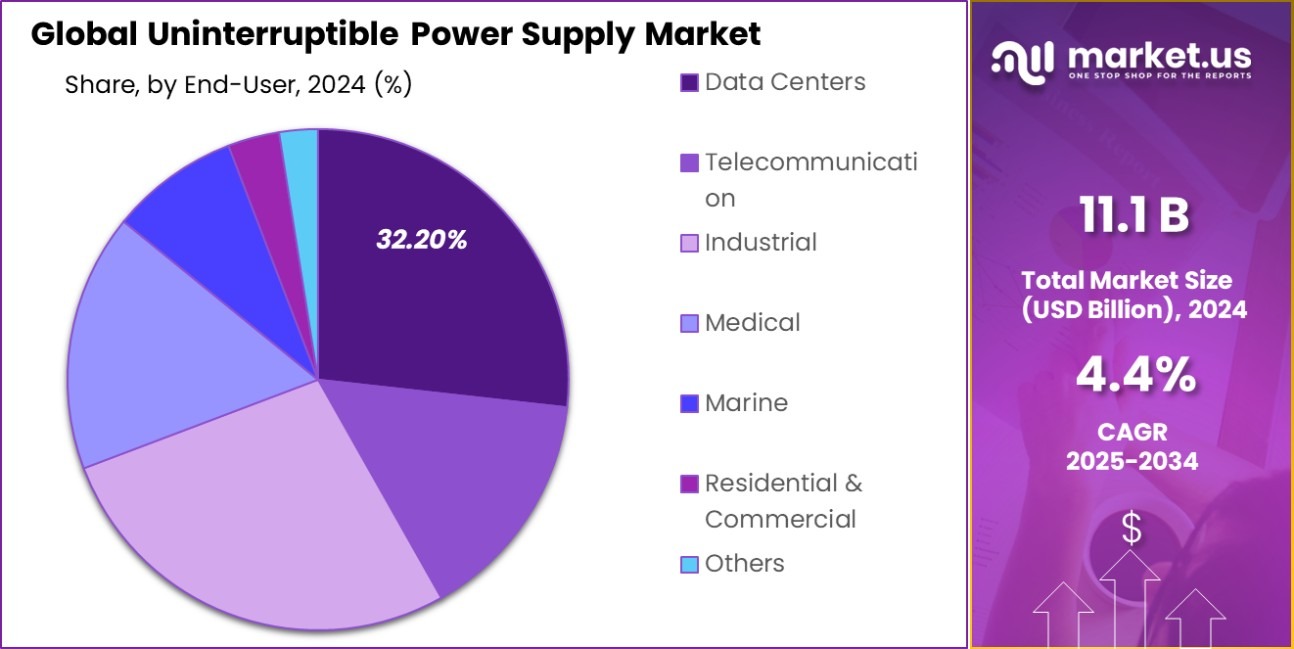

- Data centers, as end-users, account for 32.20% of the market demand for UPS systems.

- Holding 44.60% of the market, Asia-Pacific’s UPS sector is valued impressively at USD 4.9 billion.

By Type Analysis

In the Uninterruptible Power Supply Market, online double-conversion types dominate with a 57.30% share.

In 2024, the online double-conversion UPS type held a dominant position in the Uninterruptible Power Supply Market, capturing a substantial 57.30% share. This significant market dominance is attributed to its comprehensive protection capabilities and reliability in providing high-quality, continuous power without any interruptions.

Online double-conversion UPS systems are particularly favored in environments where electrical isolation is necessary, and power quality is critical, such as in data centers, medical facilities, and telecommunications infrastructures.

The superior performance of online double-conversion UPS systems stems from their ability to convert incoming AC power to DC to charge the batteries and then back to AC before powering connected devices. This double conversion process effectively isolates and shields critical loads from all forms of power quality issues, including voltage spikes, noise, and frequency fluctuations, which are common in less stable utility environments.

The robustness of this UPS type in ensuring uninterrupted power supply with zero transfer time to batteries makes it indispensable for operations that cannot tolerate even the slightest interruption or power quality issues, thereby driving its strong market share within the UPS landscape.

By Capacity Analysis

The 10-100 kVA capacity segment holds a significant 42.30% of the market.

In 2024, the 10-100 kVA range held a dominant market position in the By Capacity segment of the Uninterruptible Power Supply Market, securing a 42.30% share. This segment’s prominence is primarily due to its versatility and adequacy for a wide range of applications, from small to medium-sized data centers to commercial buildings and industrial facilities.

The 10-100 kVA UPS systems strike an optimal balance between capacity and affordability, making them a preferred choice for businesses that require reliable power protection but do not have the high power demands that necessitate larger, more expensive systems.

The preference for 10-100 kVA UPS units is also driven by their capability to handle the power requirements of server rooms and network closets, which are critical components of the IT infrastructure in various sectors. Moreover, the rise in the number of small and medium-sized enterprises (SMEs) adopting sophisticated technologies to ensure operational continuity has spurred the demand for this capacity range.

These enterprises find the 10-100 kVA UPS systems ideally suited to their needs, providing them with a cost-effective solution to safeguard against potential downtime and data loss due to power disruptions.

By End-User Analysis

Data centers, as end-users, account for 32.20% of the UPS market demand.

In 2024, Data Centers held a dominant market position in the By End-User segment of the Uninterruptible Power Supply Market, with a 32.20% share. This commanding presence underscores the critical role of UPS systems in supporting the high availability requirements and operational continuity of data centers.

The growth in cloud computing, enterprise data services, and an increasing reliance on digital data storage have all contributed to the expanding footprint of data centers globally, which in turn drives demand for reliable power backup solutions.

Data centers require uninterrupted power to protect against data loss and ensure continuous operation, making them one of the largest consumers of UPS systems. The surge in data traffic and the move toward 24/7 digital connectivity mean that even the smallest amount of downtime can result in significant financial losses and erode customer trust. Consequently, the high adoption rate of UPS systems in data centers is fueled by the need to mitigate risks associated with power variability and outages.

Moreover, as data centers evolve with advancements in technology, the need for robust UPS systems that can provide not only backup power but also power quality management becomes increasingly important. This ensures that sensitive equipment is protected from power surges and spikes, thereby maintaining operational stability and prolonging the lifespan of the hardware.

Key Market Segments

By Type

- On-Line Double-Conversion

- Line Interactive

- Passive Standby

By Capacity

- Less than 10 kVA

- 10-100 kVA

- Above 100 kVA

By End-User

- Data Centers

- Telecommunication

- Industrial

- Medical

- Marine

- Residential and Commercial

- Others

Driving Factors

Increasing Reliance on Digital Infrastructure

The surge in digital transformation across various industries stands as the primary driving factor for the Uninterruptible Power Supply Market. As businesses increasingly migrate towards cloud-based platforms and data-centric operations, the dependence on stable and continuous power supply intensifies.

Organizations, ranging from large corporations to small enterprises, are bolstering their IT infrastructure to support real-time data processing, e-commerce transactions, remote working environments, and other critical digital activities.

This shift necessitates the adoption of reliable UPS systems to prevent data loss and service interruptions that can occur due to power outages. Consequently, the growing need to maintain operational continuity in the face of frequent power disturbances is pushing the demand for robust UPS solutions.

Restraining Factors

High Initial Investment Limits Market Expansion

One of the primary restraining factors for the Uninterruptible Power Supply Market is the high initial investment required for UPS systems. These systems, especially the more sophisticated ones needed for critical operations, come with significant upfront costs.

Small and medium-sized enterprises often find these costs prohibitive, which can deter them from implementing comprehensive power backup solutions. Additionally, the maintenance and eventual replacement of batteries, which are essential components of UPS systems, add to the total cost of ownership.

These economic barriers can prevent potential customers, particularly those in emerging markets or sectors with tighter budgets, from investing in UPS technology, thus limiting market growth in regions where it is needed most.

Growth Opportunity

Expansion into Renewable Energy Integrations Offers Opportunities

The integration of renewable energy sources with UPS systems presents a significant growth opportunity in the Uninterruptible Power Supply Market. As global awareness and commitment towards sustainability increase, businesses are looking for ways to reduce their carbon footprint while ensuring energy resilience.

UPS systems that can seamlessly integrate with solar panels, wind turbines, and other renewable sources not only provide reliable backup power but also enhance the green credentials of businesses.

This trend is especially appealing to sectors like data centers, healthcare, and telecommunications, where energy consumption is high and there is a strong push toward sustainability. By capitalizing on this shift, UPS manufacturers can tap into new markets and differentiate themselves in a competitive landscape.

Latest Trends

Smart UPS Systems Enhance Energy Efficiency Trends

A prominent trend in the Uninterruptible Power Supply Market is the development and adoption of smart UPS systems. These advanced systems are equipped with intelligent technology that enables real-time monitoring and management of power usage and system health.

Smart UPS solutions offer predictive analytics, which helps in anticipating failures or maintenance needs before they cause system downtime. This not only enhances operational reliability but also improves energy efficiency by optimizing power consumption and reducing waste.

As businesses continue to focus on cost-saving measures and operational efficiency, the demand for smart UPS systems is expected to rise, reflecting the market’s shift toward more technologically advanced, interconnected, and environmentally conscious power solutions.

Regional Analysis

The Asia-Pacific UPS market commands a 44.60% share, reaching a robust valuation of USD 4.9 billion.

In the Uninterruptible Power Supply Market, the Asia-Pacific region emerges as the dominant player, commanding a substantial 44.60% market share with a valuation of USD 4.9 billion. This dominance is primarily driven by rapid industrialization, significant investments in data center infrastructure, and increasing focus on digital transformation across major economies such as China, Japan, and India.

The region’s robust manufacturing sector, coupled with its burgeoning IT and telecommunications industries, further fuels the demand for reliable power supply systems to prevent operational disruptions and data loss.

Conversely, regions like North America and Europe also show significant activity in the UPS market, driven by advanced technological adoption and stringent regulations regarding data security and energy efficiency. These regions focus on upgrading existing infrastructure and integrating smart grid technologies, which complements the growth of the UPS market.

Meanwhile, the Middle East, Africa, and Latin America are experiencing gradual growth, attributed to increasing awareness of the critical nature of uninterrupted power in preventing economic losses in various sectors, including healthcare, industrial, and commercial. These regions present a promising opportunity for expansion as they continue to develop infrastructure and increase focus on renewable energy sources, aligning with global sustainability trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Uninterruptible Power Supply (UPS) market saw significant contributions from key players like ABB Ltd, AEG Power Solutions, Aspex Inc., Borri S.p.A., and Clary Corporation, each bringing unique strengths to the sector.

ABB Ltd, a powerhouse in electrical engineering, continues to lead with its technologically advanced UPS systems, focusing on energy efficiency and reliability. Their strong global footprint and reputation for high-quality solutions make them a preferred choice for large-scale industrial applications, underpinning their leadership in the market.

AEG Power Solutions stands out with its robust product offerings tailored for demanding environments like renewable energy and industrial markets. Their commitment to integrating renewable energy sources into their UPS systems aligns well with the global shift toward sustainability, making them a pivotal player in the evolution of the UPS market.

Aspex Inc. has carved a niche in providing customized UPS solutions, especially for data centers and IT networks. Their agility in adapting to client-specific needs and the rapid deployment of cutting-edge technology enhance their competitive edge in these fast-growing segments.

Borri S.p.A., with its European engineering excellence, offers reliable and efficient power solutions that cater to a wide range of sectors, including healthcare and telecommunications. Their focus on innovation in modular UPS design is instrumental in driving their growth and market penetration.

Lastly, Clary Corporation specializes in high-quality, durable UPS systems designed for military and critical applications, ensuring performance under extreme conditions. Their dedication to reliability and customer-specific solutions strengthens their position in specialized markets.

Top Key Players in the Market

- ABB Ltd

- AEG Power Solutions

- Aspex Inc.

- Borri S.p.A.

- Clary Corporation

- Cyber Power Systems Inc.

- Delta Electronics Inc.

- EATON Corporation PLC

- Emerson Electric Co.

- ENERSYS

- Fuji Electric Co., Ltd.

- Huawei Digital Power Technologies Co., Ltd.

- Kohler Co.

- Legrand

- Mitsubishi Electric Corporation

- Panduit Corp.

Recent Developments

- In February 2025, Eaton showcased advanced smart power management solutions at Elecrama 2025, including the 9395 XR Uninterruptible Power Supply (UPS) system. This system is designed to maximize energy efficiency and enhance reliability for mission-critical infrastructure.

- In April 2022, AEG Power Solutions launched the Protect 1 LCD series, a new generation of 10 to 20 kVA transformerless UPS systems. These systems offer high efficiency and flexibility, with the ability to connect up to three units in parallel for scalability and redundancy.

Report Scope

Report Features Description Market Value (2024) USD 11.1 Billion Forecast Revenue (2034) USD 17.1 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (On-Line Double-Conversion, Line Interactive, Passive Standby), By Capacity (Less than 10 kVA, 10-100 kVA, Above 100 kVA), By End-User (Data Centers, Telecommunication, Industrial, Medical, Marine, Residential and Commercial, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd, AEG Power Solutions, Aspex Inc., Borri S.p.A., Clary Corporation, Cyber Power Systems Inc., Delta Electronics Inc., EATON Corporation PLC, Emerson Electric Co., ENERSYS, Fuji Electric Co., Ltd., Huawei Digital Power Technologies Co., Ltd., Kohler Co., Legrand, Mitsubishi Electric Corporation, Panduit Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Uninterruptible Power Supply MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Uninterruptible Power Supply MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd

- AEG Power Solutions

- Aspex Inc.

- Borri S.p.A.

- Clary Corporation

- Cyber Power Systems Inc.

- Delta Electronics Inc.

- EATON Corporation PLC

- Emerson Electric Co.

- ENERSYS

- Fuji Electric Co., Ltd.

- Huawei Digital Power Technologies Co., Ltd.

- Kohler Co.

- Legrand

- Mitsubishi Electric Corporation

- Panduit Corp.