Global Instrument Transformer Market Size, Share, And Business Benefits By Type (Current, Potential, Combined), By Product Type (Conventional Instrument Transformer, Non-Conventional Instrument Transformer), By Voltage Type (Medium Voltage (1-52kV), Extra High Voltage Transmission (220/380kV), Low Voltage (Less Than 1kV), Ultra High Voltage Transmission (Greater Than 380kV), High Voltage Transmission (60/110 kV)), By Dielectric Medium (Liquid, SF6, Solid), By Enclosure (Indoor, Outdoor), By Application (Transformer and Circuit Breaker Bushing, Metering, Switchgear Assemblies, Relaying, Others), By End-User (Power Utilities, Power Generation, Railways and Metros, Industries and OEMs, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141719

- Number of Pages: 300

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By Product Type Analysis

- By Voltage Type Analysis

- By Dielectric Medium Analysis

- By Enclosure Analysis

- By Application Analysis

- By End-User Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

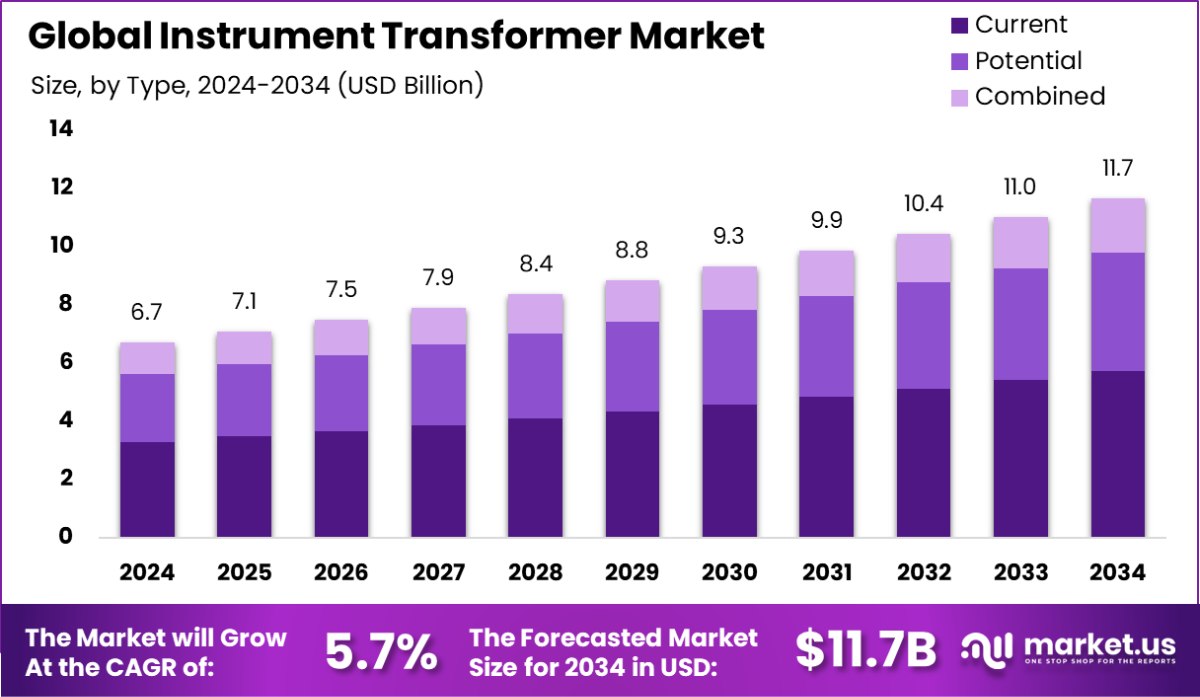

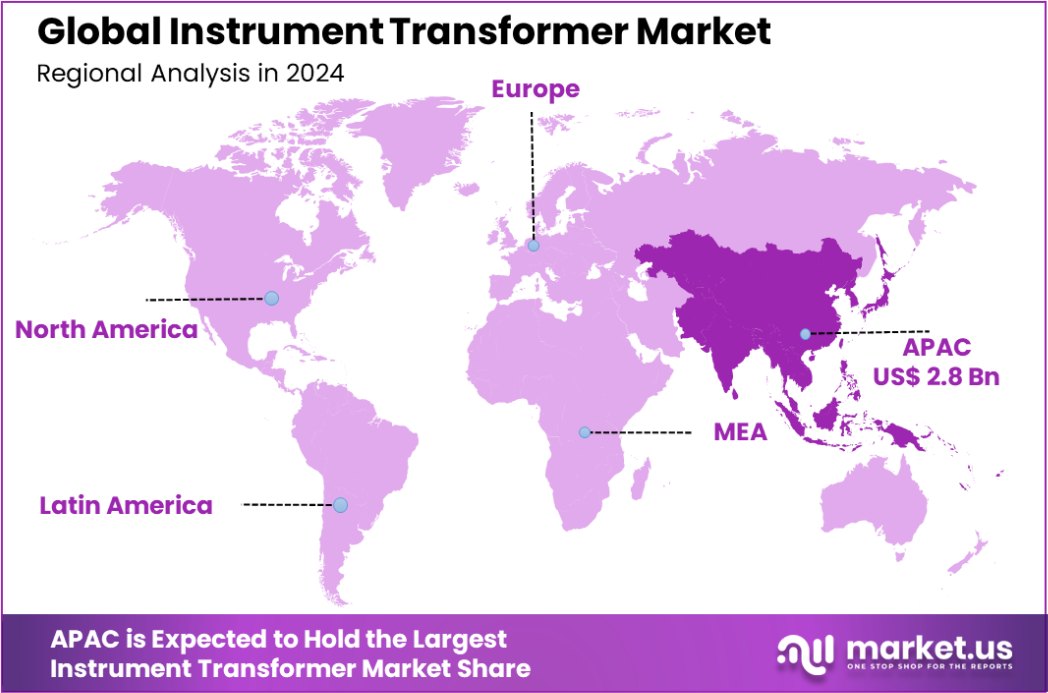

Global Instrument Transformer Market is expected to be worth around USD 11.7 billion by 2034, up from USD 6.7 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. Asia-Pacific will lead the Instrument Transformer Market in 2024, commanding a significant 42.3% market share, amounting to USD 2.8 billion.

An instrument transformer is a specialized device that transforms electrical quantities, such as voltage or current, to lower levels. These transformers are primarily utilized in the measurement and protection of electrical systems, allowing high voltage currents to be measured safely using standard measuring instruments. They play a crucial role in accurately monitoring and managing power supply systems by ensuring the reliability and safety of electrical grids.

The instrument transformer market is driven by several growth factors. Increasing investments in power infrastructure, coupled with the modernization of aging grid systems, are key drivers. As countries worldwide push to expand and upgrade their electrical networks, the demand for instrument transformers rises to support enhanced grid reliability and efficiency. Additionally, the growing adoption of smart grids and smart metering technologies fuels the demand for advanced instrument transformers integrated with digital capabilities.

Another significant growth factor is the stringent regulatory standards for energy efficiency and safety. Governments and regulatory bodies are implementing stricter measures to ensure accurate and reliable power distribution and consumption monitoring, which increases the requirement for high-quality instrument transformers.

Opportunities in the instrument transformer market are vast. The shift towards renewable energy sources and the integration of distributed energy resources (DERs) into power grids present numerous opportunities. Instrument transformers are essential in these setups to ensure precise measurement and smooth operation. Moreover, the advancement in materials and technologies, like solid-state transformers, opens new possibilities for the development of more efficient and compact instrument transformers.

In October 2024, Standex International Corporation strategically enhanced its position in the Instrument Transformer Market by acquiring Amran Instrument Transformers (USA) and Narayan Powertech Pvt. Ltd. (India). The acquisitions, totaling approximately $462 million, significantly expand Standex’s footprint in the global electrical grid sector, reinforcing its competitive edge in key markets across the USA and India.

Key Takeaways

- Global Instrument Transformer Market is expected to be worth around USD 11.7 billion by 2034, up from USD 6.7 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- The Instrument Transformer Market by type shows current transformers holding a significant share at 49.1%.

- Conventional Instrument Transformers dominate the market with a 78.1% share by product type.

- In terms of voltage type, Medium Voltage (1-52kV) transformers make up 39.2% of the market.

- Liquid dielectric medium is preferred in 47.6% of instrument transformers, highlighting its widespread use.

- Outdoor enclosures are the most common for instrument transformers, capturing a 68.3% market share.

- For applications, 38.1% of the market involves transformer and circuit breaker bushing uses.

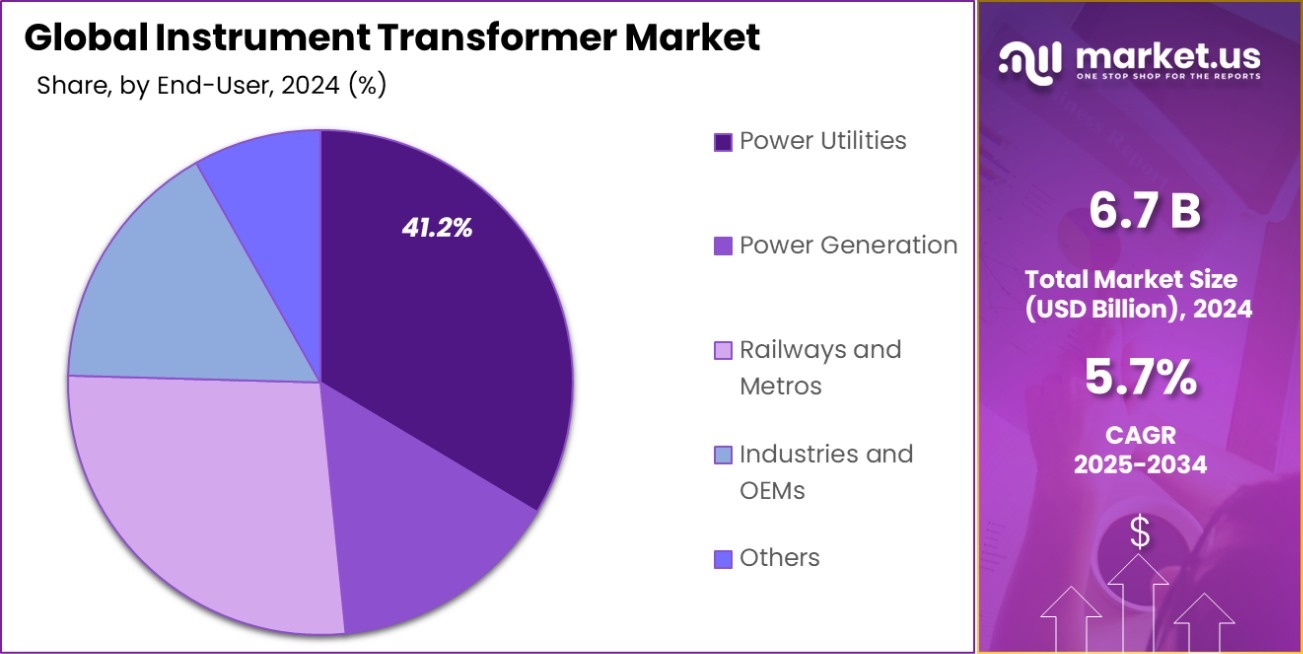

- Power utilities emerge as the largest end-users in the Instrument Transformer Market, with a 41.2% share.

- With a market value of USD 2.8 billion, Asia-Pacific captured 42.3% of the global Instrument Transformer Market in 2024.

By Type Analysis

The current type holds a 49.1% share in the instrument transformer market.

In 2024, Current transformers held a dominant market position in the “By Type” segment of the Instrument Transformer Market, commanding a 49.1% share. This significant market share is attributed to the widespread application of current transformers in both protection and control systems across various industries, including utilities, manufacturing, and energy.

These transformers are essential for accurate current measurement and safety, ensuring that high voltage currents can be effectively managed and monitored without posing risks to the measurement devices or operational personnel.

The dominance of current transformers is further bolstered by ongoing investments in electrical grid infrastructure, where these devices play a critical role in the integration of renewable energy sources. As grids become smarter and more capable of handling diverse energy inputs, the demand for reliable and precise current transformers grows.

Additionally, the push toward digitalization in power networks has led to increased adoption of smart monitoring systems that rely on these transformers for real-time data analysis and decision-making support.

The market’s reliance on current transformers is expected to continue as technological advancements lead to the development of more sophisticated and compact units. This trend is likely to sustain their leading position in the market, driven by the ongoing need for efficient, reliable electrical infrastructure and grid modernization efforts.

By Product Type Analysis

Conventional instrument transformers dominate with a 78.1% market share by product type.

In 2024, Conventional Instrument Transformers held a dominant market position in the “By Product Type” segment of the Instrument Transformer Market, with a commanding 78.1% share. This substantial market presence is primarily due to their proven reliability and cost-effectiveness, which makes them a preferred choice for traditional power generation and distribution systems. These transformers are integral to ensuring accurate and safe operations, offering essential services in current and voltage measurement and protection in electrical systems.

The durability and simplicity of conventional instrument transformers contribute to their widespread adoption across various sectors, including industrial, commercial, and residential. Their capability to handle high voltages and currents without significant technological complications further reinforces their position as industry staples, particularly in regions with established electrical infrastructure and slow adoption of newer technologies.

As the energy sector continues to evolve, the role of conventional instrument transformers remains critical. Despite the gradual shift towards smart grids and digital solutions, the immediate dependability of conventional transformers supports ongoing large-scale projects and maintenance of existing installations. This enduring demand underpins their significant market share, ensuring their relevance in an increasingly technology-driven landscape.

By Voltage Type Analysis

Medium voltage instrument transformers account for 39.2% of the market by voltage type.

In 2024, Medium Voltage (1-52kV) transformers held a dominant market position in the “By Voltage Type” segment of the Instrument Transformer Market, securing a 39.2% share. This category’s significant presence is underscored by its pivotal role in regional distribution networks and industrial applications where medium voltage levels are commonly utilized. Medium voltage transformers are essential for effective power management and safety in these settings, facilitating the accurate measurement and safe distribution of electrical energy.

The preference for medium voltage transformers can be attributed to their versatility and efficiency in connecting local power generation to the grid and managing power supply within factories and large commercial complexes. This range is particularly crucial for integrating renewable energy sources into the grid, as many solar and wind installations produce power within this voltage range.

Furthermore, the ongoing upgrades to infrastructure in developing regions, aiming to improve reliability and efficiency of power distribution, significantly drive the demand for medium voltage transformers. As urbanization and industrialization progress, the need for robust and reliable energy distribution networks will continue to bolster the market dominance of medium voltage instrument transformers.

By Dielectric Medium Analysis

Liquid dielectric medium is preferred in 47.6% of instrument transformers by dielectric medium.

In 2024, Liquid dielectric transformers held a dominant market position in the “By Dielectric Medium” segment of the Instrument Transformer Market, with a 47.6% share. This dominance is primarily attributed to the superior insulation and cooling properties of liquid dielectrics, which are crucial in maintaining the transformer’s performance and longevity, especially under high electrical stress conditions. The use of liquids such as mineral oil, silicone, and less flammable bio-based oils helps enhance the operational reliability and efficiency of transformers.

The high market share of liquid dielectric transformers is also supported by their extensive application in outdoor installations where robust and durable solutions are necessary. These transformers are favored in environments that demand high load capacities and are susceptible to fluctuating temperatures and harsh conditions. Additionally, liquid dielectrics have a proven track record of effective fault protection, which is vital for critical power infrastructure and high-capacity industrial settings.

Ongoing technological advancements in liquid dielectric formulations aimed at reducing environmental impact and improving fire safety are likely to further solidify their position in the market. The push for more sustainable and safer energy solutions drives the continuous improvement and preference for liquid dielectric transformers in the global instrument transformer market.

By Enclosure Analysis

Outdoor enclosures are the most common, comprising 68.3% of the market by enclosure type.

In 2024, Outdoor enclosures held a dominant market position in the “By Enclosure” segment of the Instrument Transformer Market, with a 68.3% share. This prominence is largely due to the essential role outdoor transformers play in large-scale utility and industrial applications where robust and weather-resistant solutions are required. The outdoor setup allows for the accommodation of larger equipment necessary for the high-voltage transmission and distribution networks that span vast geographic areas.

The high percentage share reflects the ongoing expansion and upgrading of power transmission infrastructure globally. As nations strive to enhance their energy efficiency and expand renewable energy distribution, outdoor instrument transformers are indispensable in effectively stepping down voltages for general consumption while ensuring safety and reliability in harsh environmental conditions.

Moreover, outdoor transformers are designed to withstand environmental challenges such as moisture, dust, extreme temperatures, and chemical pollutants, which are common in remote installations and heavy industrial settings. This durability ensures long-term reliability and reduces maintenance costs, factors that are critical for the energy sector’s operational efficiency. The continued preference for outdoor enclosures is expected to remain strong, driven by global trends toward improving and expanding electrical grid capabilities.

By Application Analysis

In applications, 38.1% of instrument transformers are used in transformer and circuit breaker bushing.

In 2024, Transformer and Circuit Breaker Bushing applications held a dominant market position in the “By Application” segment of the Instrument Transformer Market, with a 38.1% share. This substantial market share can be attributed to the critical role that bushings play in ensuring the safe operation and isolation of high-voltage electrical equipment. Bushings provide reliable pathways for electrical currents to enter and exit devices such as transformers and circuit breakers, preventing faults and ensuring operational stability across electrical networks.

The demand for these applications is bolstered by increasing investments in electrical infrastructure and the ongoing need for the modernization of aging power systems. As the electrical grid becomes more complex and interconnected, the need for effective voltage regulation and fault protection grows, thereby driving the demand for transformer and circuit breaker bushings.

Additionally, the growth in renewable energy projects and the integration of distributed energy resources have further amplified the need for reliable bushing solutions. These components are essential in managing the dynamic load and voltage fluctuations associated with renewable energy sources, thus ensuring continuous and uninterrupted power supply. The focus on enhancing grid reliability and reducing outage frequencies continues to fuel the dominance of transformer and circuit breaker bushing applications in the instrument transformer market.

By End-User Analysis

Power utilities are the leading end-users, with a 41.2% share in the instrument transformer market.

In 2024, Power Utilities held a dominant market position in the “By End-User” segment of the Instrument Transformer Market, with a 41.2% share. This leading position is indicative of the crucial role instrument transformers play in the utility sector, primarily used for measurement and protective relay functions within electrical grids. Power utilities rely on these devices for accurate current and voltage measurements, which are essential for effective power distribution and grid stability.

The significant market share enjoyed by power utilities is driven by the ongoing global efforts to upgrade electrical infrastructure and integrate renewable energy sources. As grids are modernized to handle increased loads and variable energy inputs from renewables like solar and wind, the demand for reliable and precise instrument transformers grows. These transformers are integral to the expansion and efficient operation of smart grids, which require high-quality data and fault detection to optimize energy flow and minimize downtime.

Furthermore, regulatory pressures and standards for energy efficiency and safety continue to push utilities toward technologies that ensure accurate monitoring and control. This regulatory environment, combined with the technological advancements in grid management, ensures that power utilities will continue to be the largest market segment for instrument transformers, leveraging their capabilities to meet the demands of a dynamic energy landscape.

Key Market Segments

By Type

- Current

- Potential

- Combined

By Product Type

- Conventional Instrument Transformer

- Non-Conventional Instrument Transformer

By Voltage Type

- Medium Voltage (1-52kV)

- Extra High Voltage Transmission (220/380kV)

- Low Voltage (Less Than 1kV)

- Ultra High Voltage Transmission (Greater Than 380kV)

- High Voltage Transmission (60/110 kV)

By Dielectric Medium

- Liquid

- SF6

- Solid

By Enclosure

- Indoor

- Outdoor

By Application

- Transformer and Circuit Breaker Bushing

- Metering

- Switchgear Assemblies

- Relaying

- Others

By End-User

- Power Utilities

- Power Generation

- Railways and Metros

- Industries and OEMs

- Others

Driving Factors

Increasing Demand for Grid Modernization Drives Growth

As energy needs expand globally, the demand for modernizing aging power grids is one of the top driving factors in the instrument transformer market. The move towards upgrading electrical infrastructure is essential to handle the increased load from rising urbanization and industrial activities. Modern grids are equipped with advanced metering and control technologies that depend heavily on instrument transformers for precise measurements and reliable data transmission.

This upgrade is critical not just for enhancing the capacity and efficiency of the grid but also for integrating renewable energy sources effectively. As countries focus on sustainable energy solutions, the role of instrument transformers in facilitating a smooth transition becomes increasingly significant, driving continuous growth in this market segment.

Restraining Factors

High Installation and Maintenance Costs Limit Market Expansion

One of the primary restraining factors in the instrument transformer market is the high cost associated with their installation and ongoing maintenance. Instrument transformers are critical for high voltage operations, and they require precision manufacturing and robust materials to ensure safety and efficacy.

The initial setup, including the costs of engineering, procurement, and construction, can be prohibitively expensive, particularly for utilities and industries operating within tight budget constraints.

Additionally, the maintenance of these transformers involves regular inspections, testing, and replacements to prevent failures, which adds to the overall operational costs. These financial burdens can deter investment in new technology and slow down the upgrading of existing systems, thereby restraining market growth in regions with limited financial resources.

Growth Opportunity

Renewable Energy Integration Offers Significant Market Opportunities

The integration of renewable energy sources presents a significant growth opportunity for the instrument transformer market. As the world shifts towards sustainable energy solutions, the need for reliable grid infrastructure capable of handling intermittent renewable sources like solar and wind energy is increasing.

Instrument transformers play a vital role in this transition by ensuring accurate voltage and current measurements, which are crucial for balancing and distributing renewable energy efficiently across the grid.

This capability is essential for minimizing energy loss and maximizing the use of generated renewable energy. The growing commitment of governments and private sectors worldwide to increase their renewable energy capacity is expected to drive substantial demand for advanced instrument transformers, positioning this segment for continued growth in the coming years.

Latest Trends

Digitalization of Grids Propels Smart Instrument Transformer Adoption

The ongoing digitalization of electrical grids is a prevailing trend that significantly impacts the instrument transformer market. As utilities aim to enhance grid reliability and efficiency, there is a growing adoption of smart instrument transformers equipped with digital capabilities. These advanced transformers facilitate real-time data monitoring, analysis, and remote management, which are key to optimizing grid operations and response times.

The ability to monitor grid performance with high accuracy and in real time enables utilities to prevent outages, reduce operational costs, and improve service quality. This trend toward smarter, more connected grids is driving the demand for instrument transformers that can seamlessly integrate into digital infrastructures, highlighting a major shift in how energy networks are managed and maintained.

Regional Analysis

In 2024, the Asia-Pacific region dominated the Instrument Transformer Market, holding a 42.3% share, valued at USD 2.8 billion.

The Instrument Transformer Market exhibits significant regional diversity with Asia-Pacific, North America, Europe, Middle East & Africa, and Latin America all contributing to the global landscape.

Asia-Pacific emerges as the dominant region, holding a 42.3% share of the market, translating to a value of USD 2.8 billion. This leadership is driven by extensive infrastructure developments, particularly in China and India, where there is a rapid expansion of both renewable and conventional power generation capacities.

In North America, the focus on upgrading aging power grids and integrating renewable energy sources continues to drive the demand for advanced instrument transformers. Europe, similarly, benefits from stringent regulations regarding energy efficiency and emissions, prompting utilities to invest in reliable and accurate grid technologies.

Meanwhile, the Middle East & Africa region is experiencing growth due to increasing investments in energy infrastructure to support economic diversification away from oil-based economies.

Latin America, though smaller in comparison, is seeing gradual growth influenced by incremental investments in grid modernization and renewable installations. Each region’s unique drivers underscore the diverse applications and growth prospects within the global Instrument Transformer Market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Instrument Transformer Market was significantly shaped by the activities and innovations of key players such as ABB Ltd., ALCE Elektrik San. Tic. A.Ş., Arteche, and Bharat Heavy Electricals Limited (BHEL).

ABB Ltd. has consistently led with technological advancements and a broad portfolio that includes both conventional and digital instrument transformers. Known for its robust R&D capabilities, ABB has focused on integrating smart grid technology, which is crucial for the digitalization of energy networks. The company’s strong global presence and established reputation have helped it maintain a leadership position in various regions, making it a pivotal player in driving market standards and innovations.

ALCE Elektrik, a lesser-known yet dynamic competitor, has carved out a niche in the market with its specialized offerings, particularly in medium and high-voltage transformers. Based in Turkey, ALCE Elektrik’s strategic focus on quality and customization allows it to cater effectively to both local and international markets, enhancing its footprint and competitive edge in the Eurasian region.

Spanish company Arteche has shown impressive growth by leveraging its expertise in both instrument transformers and substation automation solutions. Arteche’s strategic emphasis on renewable energy projects and the modernization of electrical infrastructure in Europe and the Americas positions it well within the growing demand for energy efficiency and reliability.

Bharat Heavy Electricals Limited, an Indian state-owned enterprise, plays a crucial role in the Asia-Pacific market, driven by regional demand for electrical infrastructure and industrialization. BHEL’s involvement in India’s massive grid expansion and rural electrification projects provides it with substantial opportunities within the domestic market, which is reflected in its expansive project portfolio and government-backed initiatives.

Top Key Players in the Market

- ABB Ltd.

- ALCE Elektrik San. Tic. A.

- Arteche

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions Ltd.

- Dayihu

- ELEQ B.V.

- ENPAY

- Epoxy House

- GENERAL ELECTRIC

- Hitachi, Ltd.

- Instrument Transformer Equipment Corporation, Inc.

- Mitsubishi Electric Corporation

- Narayan Powertech Pvt.Ltd.

- Nissin Electric Co., Ltd.

- Pfiffner Group

- Pragati Electricals Pvt Ltd.

- Ritz Instrument Transformers

- Schneider Electric

- Siemens AG

Recent Developments

- In April 2024, Hitachi Energy announced a $1.5 billion investment to expand global transformer manufacturing capacity by 2027, addressing growing demand driven by electrification and renewable energy projects.

- In February 2024, Bharat Heavy Electricals Limited (BHEL) partnered with Hitachi Energy to establish HVDC transmission systems for renewable energy evacuation in India.

Report Scope

Report Features Description Market Value (2024) USD 6.7 Billion Forecast Revenue (2034) USD 11.7 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Current, Potential, Combined), By Product Type (Conventional Instrument Transformer, Non-Conventional Instrument Transformer), By Voltage Type (Medium Voltage (1-52kV), Extra High Voltage Transmission (220/380kV), Low Voltage (Less Than 1kV), Ultra High Voltage Transmission (Greater Than 380kV), High Voltage Transmission (60/110 kV)), By Dielectric Medium (Liquid, SF6, Solid), By Enclosure (Indoor, Outdoor), By Application (Transformer and Circuit Breaker Bushing, Metering, Switchgear Assemblies, Relaying, Others), By End-User (Power Utilities, Power Generation, Railways and Metros, Industries and OEMs, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., ALCE Elektrik San. Tic. A., Arteche, Bharat Heavy Electricals Limited, CG Power and Industrial Solutions Ltd., Dayihu, ELEQ B.V., ENPAY, Epoxy House, GENERAL ELECTRIC, Hitachi, Ltd., Instrument Transformer Equipment Corporation, Inc, Mitsubishi Electric Corporation, Narayan Powertech Pvt.Ltd., Nissin Electric Co., Ltd., Pfiffner Group, Pragati Electricals Pvt Ltd., Ritz Instrument Transformers, Schneider Electric, Siemens AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Instrument Transformer MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Instrument Transformer MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- ALCE Elektrik San. Tic. A.

- Arteche

- Bharat Heavy Electricals Limited

- CG Power and Industrial Solutions Ltd.

- Dayihu

- ELEQ B.V.

- ENPAY

- Epoxy House

- GENERAL ELECTRIC

- Hitachi, Ltd.

- Instrument Transformer Equipment Corporation, Inc.

- Mitsubishi Electric Corporation

- Narayan Powertech Pvt.Ltd.

- Nissin Electric Co., Ltd.

- Pfiffner Group

- Pragati Electricals Pvt Ltd.

- Ritz Instrument Transformers

- Schneider Electric

- Siemens AG