Global SOFC Market Size, Share, And Business Benefits By Type (Planar, Tubular), By Component (Stack, Balance of plant), By Application (Stationary, Transport, Portable), By End-use (Commercial and Industrial, Residential, Military and Defense, Data Centers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2025

- Report ID: 141404

- Number of Pages: 352

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

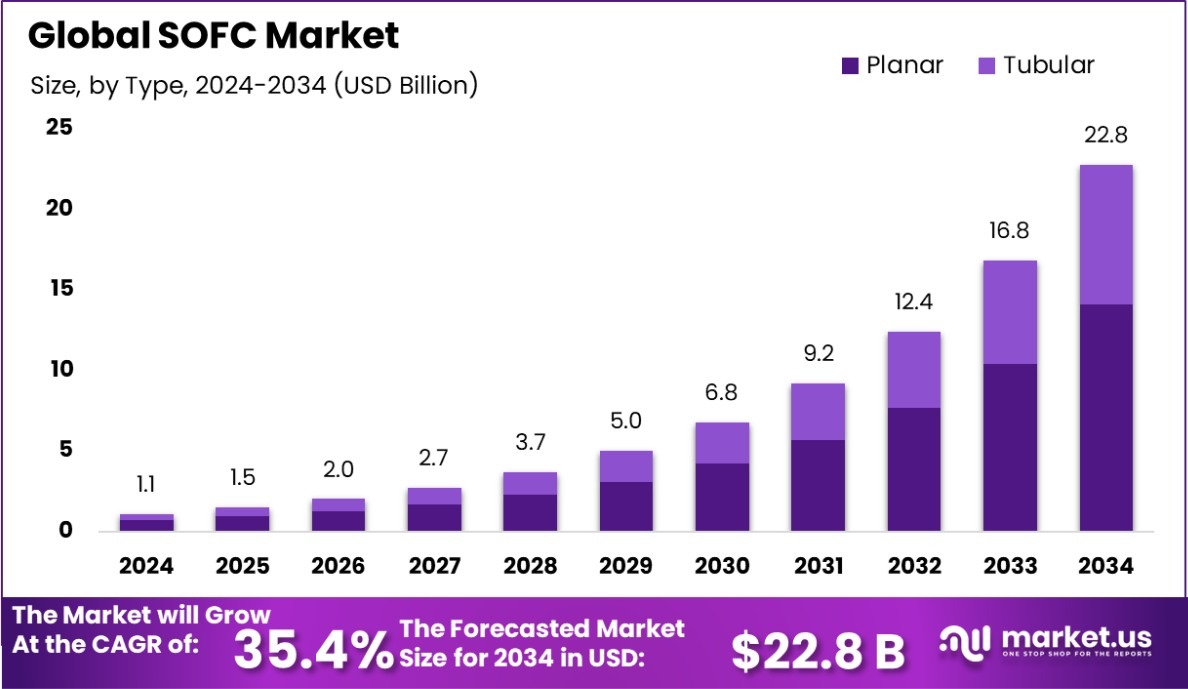

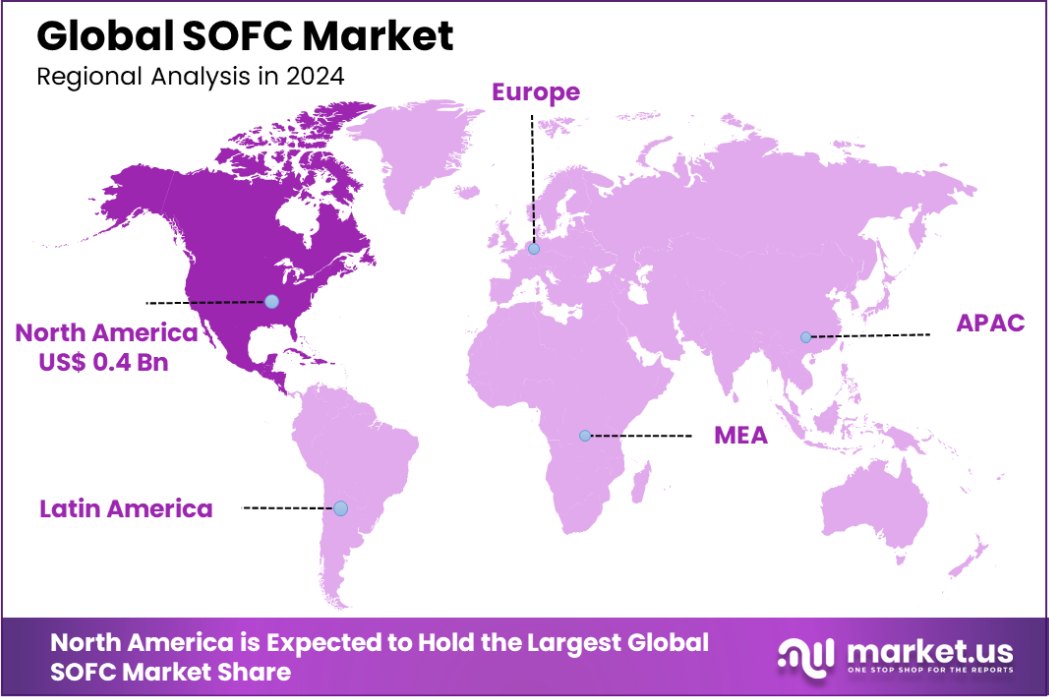

Global SOFC Market is expected to be worth around USD 22.8 billion by 2034, up from USD 1.1 billion in 2024, and grow at a CAGR of 35.4% from 2025 to 2034. In 2024, North America held a 37.6% share of the SOFC market, valued at USD 0.4 Bn.

A Solid Oxide Fuel Cell (SOFC) is a type of electrochemical cell that converts chemical energy from a fuel, typically hydrogen or natural gas, directly into electricity. This is achieved through a high-temperature solid ceramic electrolyte, which enables efficient energy conversion with minimal emissions.

SOFCs are renowned for their high efficiency, fuel flexibility, and ability to scale from small to large power applications, making them an attractive choice for both stationary and mobile energy solutions.

The growing emphasis on reducing greenhouse gas emissions and transitioning to cleaner energy sources is propelling the growth of the SOFC market. Increasing demand for renewable energy solutions, coupled with technological advancements, is leading to the adoption of SOFCs in various applications.

For example, Bosch is advancing the industrialization of its stationary solid-oxide fuel cell (SOFC) systems, branded as “Bosch Power Units.” The company will receive a grant of €160.7 million from the federal government of Germany and the states of Baden-Württemberg, Bavaria, and Saarland to support this initiative.

The Bosch Power Units, when generating power, are designed with an efficiency of approximately 60% at the beginning of life. However, if the heat generated by the SOFC is utilized for productive purposes, the overall efficiency of the system can reach up to 90%. This showcases the potential for maximizing the efficiency and sustainability of SOFC technologies.

Key Takeaways

- Global SOFC Market is expected to be worth around USD 22.8 billion by 2034, up from USD 1.1 billion in 2024, and grow at a CAGR of 35.4% from 2025 to 2034.

- Planar SOFCs dominate the market, accounting for 62.3% of global sales and growth.

- SOFC stacks lead the market at 67.2%, driving efficiency and energy conversion improvements.

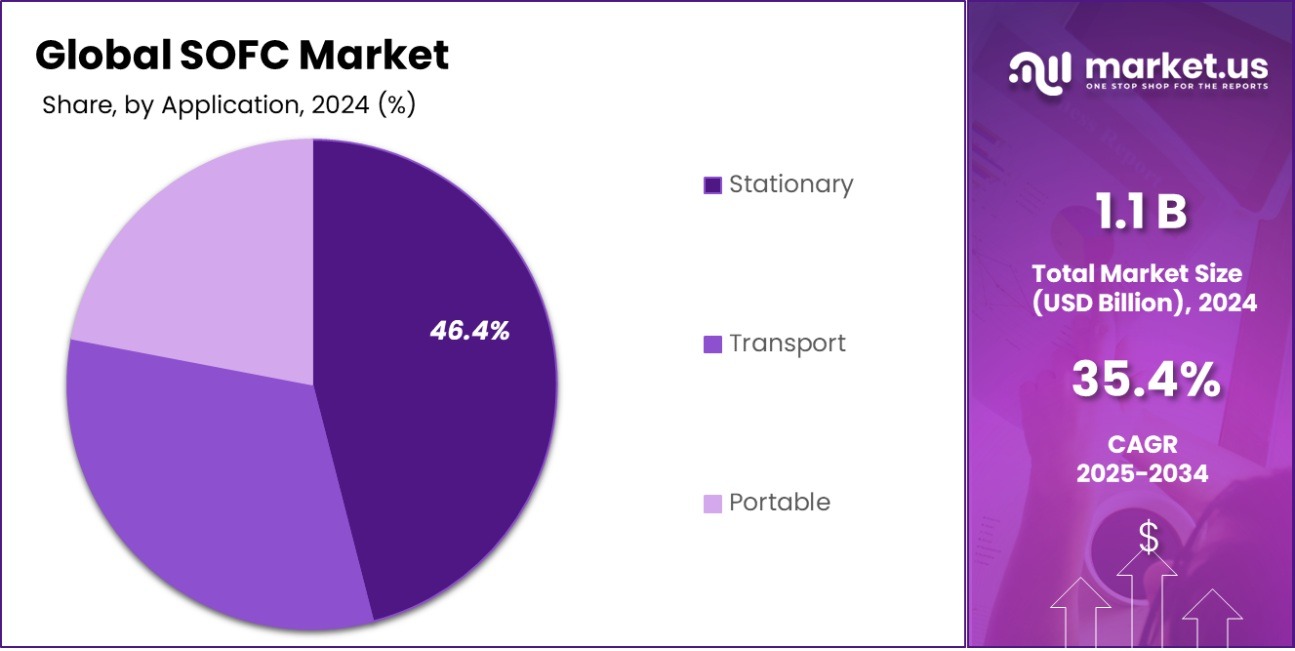

- Stationary SOFC systems represent 46.4% of the market, focusing on steady power generation needs.

- Commercial and industrial sectors account for 46.4% of SOFC market demand, prioritizing energy reliability.

- The growing demand for clean energy solutions contributed to North America’s 37.6% market share, reaching USD 0.4 Bn.

By Type Analysis

Planar SOFCs dominate the market, offering compact design and higher efficiency for a wide range of applications.

In 2024, Planar held a dominant market position in the By Type segment of the SOFC Market, with a 62.3% share. The Planar type of SOFC is widely adopted due to its relatively simple design and high performance in power generation applications.

The high efficiency and scalability of Planar SOFCs, particularly in residential and commercial sectors, have contributed significantly to this market share. This type is typically used in medium- to large-scale installations, where it provides reliable, on-site electricity generation with low emissions.

The strong preference for Planar SOFCs can be attributed to their ability to operate at high temperatures, offering a robust performance in various fuel options, including hydrogen and natural gas.

This has made Planar SOFCs a cost-effective solution for many industries looking to meet sustainability goals while ensuring long-term energy security. Their efficient design also reduces maintenance costs, further enhancing their appeal to end-users.

By Component Analysis

SOFC stacks are crucial, making up 67.2% of the market and driving energy generation through multiple cell layers.

In 2024, Stack held a dominant market position in the By Component segment of the SOFC Market, with a 67.2% share. The stack component, which serves as the core unit of a solid oxide fuel cell system, is crucial for ensuring the overall efficiency and performance of the fuel cell. This significant market share is driven by the growing demand for higher power output and reliability in both residential and industrial applications.

Stack components are central to the scalability and performance of SOFC systems, with their ability to operate at high temperatures and convert chemical energy efficiently into electricity. Due to their crucial role, advancements in stack technology, such as improved materials and manufacturing processes, have led to enhanced performance and longer operational lifespans, making them a preferred choice for energy providers and end-users.

Furthermore, the increasing global shift toward cleaner and more sustainable energy solutions has contributed to the rise in the adoption of SOFCs equipped with advanced stack components. With their ability to integrate with various fuels, including natural gas and hydrogen, stack-based systems are becoming more prevalent in decentralized energy generation solutions.

By Application Analysis

Stationary applications account for 46.4% of SOFC use, focusing on power generation in fixed locations like buildings.

In 2024, Stationary held a dominant market position in the By Application segment of the SOFC Market, with a 46.4% share. The stationary application of SOFCs has gained significant traction due to the increasing demand for efficient, reliable, and clean power generation for residential, commercial, and industrial sectors. These systems are used for a variety of purposes, including backup power, cogeneration, and grid support, making them highly versatile for both large-scale and decentralized energy generation.

The large market share in this segment is driven by the need for sustainable energy solutions that reduce carbon footprints while maintaining high efficiency. Stationary SOFC systems, with their ability to operate on a wide range of fuels such as hydrogen and natural gas, are becoming a preferred choice for stationary power generation. Their high thermal efficiency, long operational life, and low maintenance requirements further contribute to their widespread adoption.

In addition, the global push toward renewable energy sources and energy independence has accelerated the demand for stationary SOFC systems. Governments and industries are increasingly looking to incorporate cleaner technologies into their infrastructure, and stationary SOFCs are seen as a key solution for achieving these goals.

By End-Use Analysis

Commercial and industrial sectors represent 46.4% of SOFC adoption, seeking reliable and efficient energy solutions for operations.

In 2024, Commercial and Industrial held a dominant market position in the By End-use segment of the SOFC Market, with a 46.4% share. This segment has seen strong growth due to the increasing demand for reliable, cost-effective, and environmentally friendly power solutions within commercial and industrial applications. SOFCs offer high efficiency and flexibility, making them ideal for large-scale energy needs such as powering manufacturing plants, office complexes, and industrial facilities.

The substantial market share in this segment can be attributed to the growing need for energy security, reduced operational costs, and compliance with stringent environmental regulations. Commercial and industrial enterprises are increasingly adopting SOFC systems for combined heat and power (CHP) generation, which provides both electricity and useful thermal energy, further improving overall energy efficiency.

Moreover, the scalability of SOFC systems, along with their ability to run on a variety of fuels including hydrogen, natural gas, and biogas, has made them a highly attractive solution for businesses seeking sustainable energy alternatives. The market share dominance is also bolstered by the financial incentives and government policies promoting clean energy adoption in industrial settings.

Key Market Segments

By Type

- Planar

- Tubular

By Component

- Stack

- Balance of plant

By Application

- Stationary

- Transport

- Portable

By End-use

- Commercial and Industrial

- Residential

- Military and Defense

- Data Centers

- Others

Driving Factors

Increasing Demand for Clean Energy Solutions

The demand for cleaner, more sustainable energy solutions is one of the top driving factors for the growth of the SOFC market. As concerns over climate change and environmental degradation intensify, both governments and industries are investing heavily in green technologies to reduce carbon emissions and reliance on fossil fuels.

Solid Oxide Fuel Cells (SOFCs) play a crucial role in this transition due to their high efficiency and low environmental impact. SOFCs produce electricity with minimal greenhouse gas emissions, making them an attractive option for power generation.

This demand is especially strong in sectors such as industrial power, residential energy, and commercial applications, where SOFCs offer reliable and eco-friendly energy alternatives. The global push for cleaner, renewable energy sources continues to accelerate, positioning SOFCs as a key technology in the shift towards a more sustainable energy landscape.

Restraining Factors

High Initial Cost and Capital Investment

One of the major restraining factors for the SOFC market is the high initial cost associated with the technology. The production and installation of SOFC systems often require significant capital investment, which can be a barrier for both businesses and residential users.

The high cost stems from advanced materials, complex manufacturing processes, and the need for specialized components such as ceramic electrolytes. Although SOFCs offer long-term efficiency and savings, the upfront financial burden can deter potential adopters.

This is especially true in emerging markets where affordability is a key concern. To overcome this challenge, manufacturers are focusing on reducing production costs through technological advancements and economies of scale. However, until the cost is lowered, the widespread adoption of SOFCs may be limited.

Growth Opportunity

Expansion of Hydrogen Infrastructure and Adoption

A significant growth opportunity in the SOFC market lies in the expansion of the hydrogen infrastructure. As hydrogen emerges as a clean alternative fuel, its growing adoption for power generation, transportation, and industrial processes presents a promising avenue for

SOFCs.Solid Oxide Fuel Cells can efficiently use hydrogen as a fuel source, offering high efficiency and low emissions. With governments and industries increasingly focusing on hydrogen as part of their clean energy strategies, the development of hydrogen production, storage, and distribution infrastructure is set to grow.

This, in turn, will drive demand for SOFC systems, as they can seamlessly integrate with hydrogen-based energy systems. The combination of supportive policies, technological advancements, and market incentives is creating an ideal environment for SOFCs to capitalize on this opportunity.

Latest Trends

Integration of SOFCs with Renewable Energy Systems

A key trend in the SOFC market is the growing integration of Solid Oxide Fuel Cells with renewable energy sources like solar and wind. As the world transitions to a low-carbon economy, hybrid systems combining SOFCs with solar or wind power are gaining traction.

These systems can provide reliable, continuous power, even when renewable energy sources are intermittent. SOFCs complement renewable energy by storing excess power and providing backup during periods of low generation, improving grid stability. This trend is particularly strong in off-grid and remote areas, where energy security is a top priority.

The ability to harness multiple energy sources in a single, integrated system is driving increased interest and investment in SOFC technology, positioning it as a critical player in future energy solutions.

Regional Analysis

With strong government incentives and sustainability goals, North America’s SOFC market reached a valuation of USD 0.4 Bn.

In 2024, North America held a dominant position in the SOFC market, accounting for 37.6% of the market share, valued at USD 0.4 billion. The region’s strong growth is driven by robust governmental support for renewable energy technologies, alongside increasing investments in sustainable power generation solutions. The growing shift toward clean energy and the adoption of hydrogen fuel cells have further accelerated the demand for SOFCs.

Europe follows closely as a key player in the market, with a rising emphasis on decarbonizing industrial and residential power generation. Increasing governmental initiatives, such as carbon reduction targets and renewable energy incentives, are expected to drive SOFC adoption in the coming years. Asia Pacific is emerging as a promising market, with rapid industrialization and increasing energy demand propelling market growth. However, high capital investment remains a challenge in some regions.

In the Middle East & Africa, the adoption of SOFC technology is gaining traction due to an increasing focus on sustainable energy solutions, although the region still faces hurdles in terms of infrastructure development. Meanwhile, Latin America is gradually embracing SOFC technology, with particular interest in off-grid power solutions and renewable energy integration.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AISIN Corporation is well-positioned in the global SOFC market, leveraging its strong engineering capabilities and expertise in automotive and energy solutions. The company has been focusing on advancing its SOFC technology, particularly for industrial and residential power generation.

AISIN’s efforts in developing efficient and cost-effective SOFC systems align with the growing global demand for clean energy solutions. As a result, the company is expected to expand its market presence, particularly in Japan and other Asia Pacific regions, where demand for SOFC technology is on the rise.

FuelCell Energy Inc. stands out as a leading player in the SOFC market with its innovative solid oxide fuel cell solutions, which offer high efficiency and low emissions for large-scale power applications. The company has made significant strides in commercializing SOFC technology for both stationary power generation and industrial applications.

FuelCell Energy’s strategic focus on hydrogen-based energy systems and collaboration with various government bodies positions it well for continued market leadership, particularly in North America and Europe.

General Electric (GE) has a strong foothold in the global SOFC market, owing to its expertise in energy and power generation systems. GE’s commitment to sustainable energy solutions and its ongoing investments in next-generation fuel cell technologies, including SOFCs, have allowed it to maintain a competitive edge.

GE is poised to capitalize on the growing demand for clean, decentralized power generation, with a particular emphasis on industrial-scale applications in North America and Europe. Their extensive market reach and technological advancements position them as a key player in the SOFC industry.

Top Key Players in the Market

- ADELAN

- AISIN CORPORATION

- AVL

- Bloom Energy

- Ceres

- Clara Venture Labs

- Convion Ltd.

- Cummins Inc.

- Doosan Fuel Cell Co., Ltd.

- Edge Autonomy

- Elcogen AS

- ENERGY

- FuelCell Energy Inc.

- General Electric

- h2e Power

- Hitachi Zosen Corporation

- KYOCERA Corporation

- Mitsubishi Power Ltd.

- MIURA CO., LTD.

- NGK SPARK PLUG CO., LTD

- Ningbo Suofuren Energy Technology Co., Ltd.

- POSCO

- Robert Bosch GmbH

- SolydEra SpA

- Special Power Sources

- Sunfire GmbH

- Upstart Power, Inc.

- Watt Fuel Cell Corporation

- WEICHAI POWER CO., LTD

- ZTEK Corporation, Inc.

Recent Developments

- In November 2024, Bloom Energy announced the world’s largest fuel cell installation in history. The 80 MW project, developed with SK Eternix, will power two ecoparks in North Chungcheong Province, South Korea, and is expected to begin commercial operations in 2025.

- In August 2024, HD Hydrogen acquired Finnish fuel cell specialist Convion Oy for €72 million ($79.8 million). This acquisition aims to secure key technologies in the growing hydrogen fuel cell market.

- In January 2024, Ceres signed its first SOEC (Solid Oxide Electrolyzer Cell) license partner, Delta Electronics in Taiwan. The agreement includes a revenue of £43 million through technology transfer, development license fees, and engineering services.

- In January 2024, Adelan announced a collaboration with plant hire firms and construction sustainability managers to roll out a fuel-cell-powered mobile lift. This hybridized fuel cell cherry picker aims to decarbonize mobile construction lifts.

Report Scope

Report Features Description Market Value (2024) USD 1.1 Billion Forecast Revenue (2034) USD 22.8 Billion CAGR (2025-2034) 35.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Planar, Tubular), By Component (Stack, Balance of plant), By Application (Stationary, Transport, Portable), By End-use (Commercial and Industrial, Residential, Military and Defense, Data Centers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADELAN, AISIN CORPORATION, AVL, Bloom Energy, Ceres, Clara Venture Labs, Convion Ltd., Cummins Inc., Doosan Fuel Cell Co., Ltd., Edge Autonomy, Elcogen AS, ENERGY, FuelCell Energy Inc., General Electric, h2e Power, Hitachi Zosen Corporation, KYOCERA Corporation, Mitsubishi Power Ltd., MIURA CO., LTD., NGK SPARK PLUG CO., LTD, Ningbo Suofuren Energy Technology Co., Ltd., POSCO, Robert Bosch GmbH, SolydEra SpA, Special Power Sources, Sunfire GmbH, Upstart Power, Inc., Watt Fuel Cell Corporation, WEICHAI POWER CO., LTD, ZTEK Corporation, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADELAN

- AISIN CORPORATION

- AVL

- Bloom Energy

- Ceres

- Clara Venture Labs

- Convion Ltd.

- Cummins Inc.

- Doosan Fuel Cell Co., Ltd.

- Edge Autonomy

- Elcogen AS

- ENERGY

- FuelCell Energy Inc.

- General Electric

- h2e Power

- Hitachi Zosen Corporation

- KYOCERA Corporation

- Mitsubishi Power Ltd.

- MIURA CO., LTD.

- NGK SPARK PLUG CO., LTD

- Ningbo Suofuren Energy Technology Co., Ltd.

- POSCO

- Robert Bosch GmbH

- SolydEra SpA

- Special Power Sources

- Sunfire GmbH

- Upstart Power, Inc.

- Watt Fuel Cell Corporation

- WEICHAI POWER CO., LTD

- ZTEK Corporation, Inc.