Wind Turbine Components Market Size, Share And Growth Analysis By Type (Generator, Nacelle, Tower, Rotor Blades, Others), By Application (Utility, Industrial, Commercial, Residential), By Wind Turbine Type (Grid Connected, Standalone), By Location (Offshore Wind Energy, Onshore Wind Energy), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140974

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

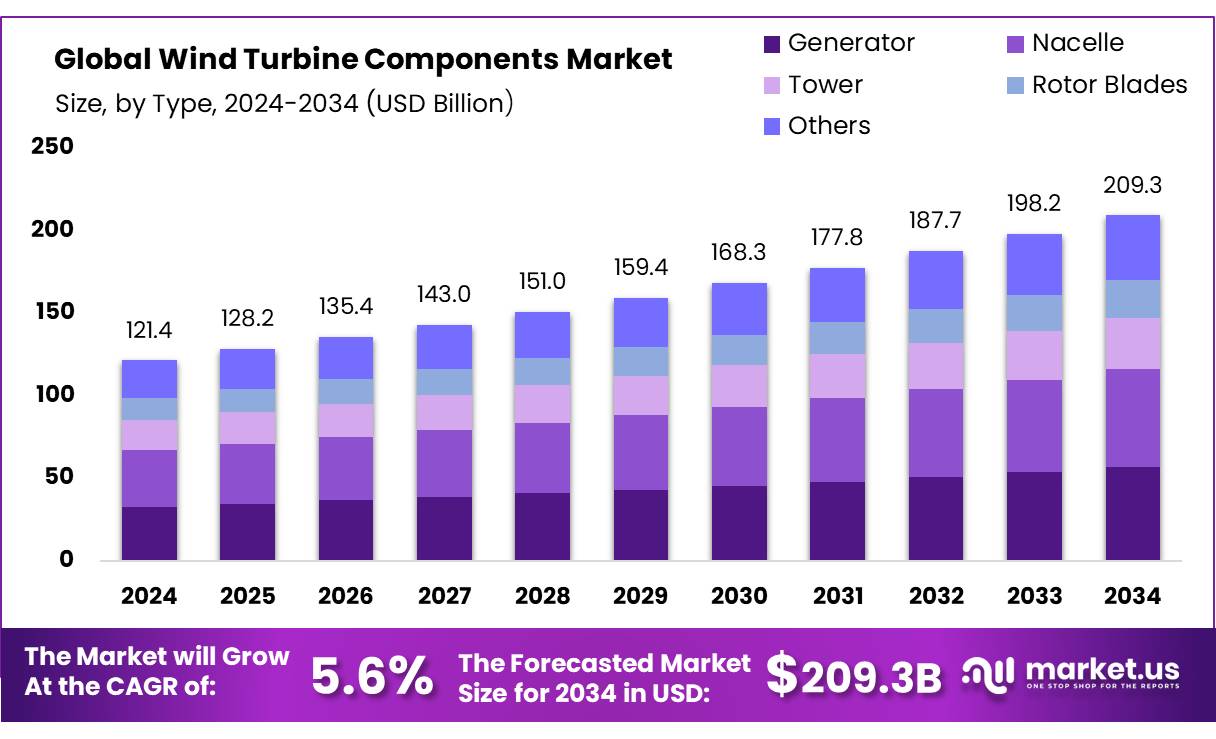

The Global Wind Turbine Components Market size is expected to be worth around USD 209.3 Billion by 2034, from USD 121.4 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The wind turbine components market has become one of the key drivers of the renewable energy industry. Wind energy, a growing segment in the global power sector, requires various components for the effective operation of wind turbines. These components include blades, nacelles, hubs, gearboxes, generators, and control systems. The increasing focus on sustainable energy sources and the global push toward reducing carbon emissions have elevated the demand for wind power as a reliable source of clean energy.

The global wind turbine components market is experiencing significant growth due to increasing investments in renewable energy and a rising number of wind turbine installations. Technological advancements in turbine design and manufacturing, along with cost reductions in turbine components, have contributed to the market’s expansion. The market is characterized by large-scale manufacturers such as Siemens Gamesa, GE Renewable Energy, Nordex, and Vestas, who dominate the production and supply of wind turbine components.

Government Initiatives and Policies: Strong policy frameworks, subsidies, and tax incentives for wind energy projects in key markets, such as the United States, China, and the European Union, have fueled demand for wind turbines. For instance, the U.S. has set ambitious renewable energy targets, aiming to achieve 100% clean energy by 2035, encouraging more wind energy installations.

The growing focus on energy storage technologies and hybrid systems involving wind and solar power is expected to create new business prospects in the wind turbine components sector. Emerging markets in Asia-Pacific and Latin America are also driving market expansion, with countries like India, Brazil, and South Korea increasing their wind energy investments.

Key Takeaways

- The market size for wind turbine components is expected to reach USD 209.3 billion by 2034, growing from USD 121.4 billion in 2024, at a compound annual growth rate (CAGR) of 5.6% from 2025 to 2034.

- In 2024, the generator segment captured more than 27.4% of the market and is projected to increase to around 28.1% in 2025.

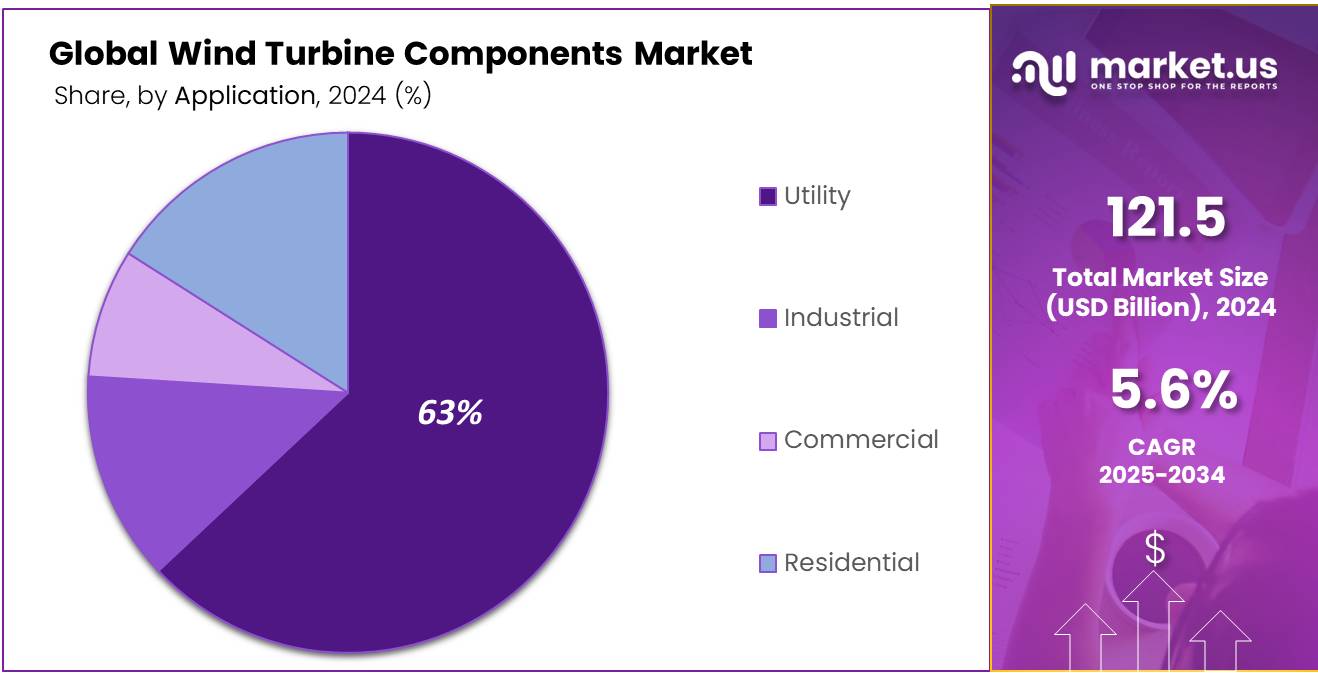

- The utility application held over 63.3% of the market share in 2024.

- Grid-connected turbines had an 82.2% market share in 2024.

- Onshore wind energy accounted for more than 69.5% of the market share in 2024.

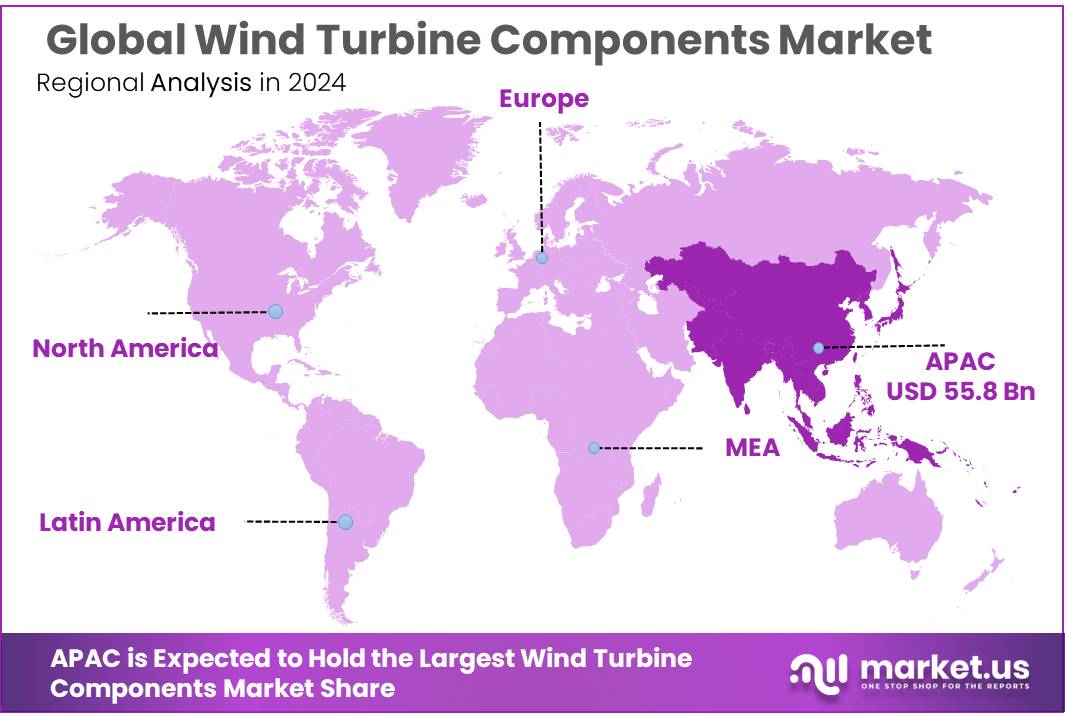

- The Asia-Pacific region holds a dominant market share of 45.8%, valued at approximately USD 55.8 billion.

By Type

In 2024, the Generator segment held a dominant market position, capturing more than a 27.4% share of the global wind turbine components market. This dominance can be attributed to the critical role that generators play in converting mechanical energy into electrical power within wind turbines. As the wind turbine industry continues to scale up, especially with the rise of larger and more efficient turbine models, the demand for high-performance generators has grown significantly.

The generator market is expected to see steady growth in the coming years, driven by technological advancements aimed at improving energy conversion efficiency and reliability. In 2025, the segment is projected to maintain its leadership, with its market share likely increasing to around 28.1%. This growth is closely tied to the rising adoption of both onshore and offshore wind energy projects. Offshore wind farms, in particular, require advanced generator technologies due to the harsher environmental conditions and the larger turbine sizes deployed in these settings.

By Application

In 2024, Utility held a dominant market position, capturing more than a 63.3% share of the global wind turbine components market. This large share is primarily driven by the significant demand for wind energy in utility-scale power generation. Utilities are the primary purchasers of large wind turbines, as they are responsible for meeting the increasing energy needs of entire regions and countries. Wind power, as a renewable source, is seen as a key solution to achieving energy transition goals, leading to widespread investment in wind energy infrastructure.

The utility segment’s expansion is further supported by favorable governmental policies and incentives for renewable energy projects. Many countries are setting ambitious renewable energy targets, including the installation of offshore and onshore wind farms. This push for clean energy has made wind power increasingly attractive for utilities, which in turn drives the demand for turbines and their components. With the increasing focus on sustainability and decarbonization, the utility sector’s role in the wind turbine components market is expected to become even more central.

By Wind Turbine Type

In 2024, Grid Connected held a dominant market position, capturing more than an 82.2% share of the global wind turbine components market. This high share is largely attributed to the growing demand for wind turbines that are integrated into existing power grids, ensuring a stable electricity supply and contributing to national energy networks. Grid-connected wind turbines allow for the efficient distribution of wind-generated power across various regions, making them the preferred choice for large-scale energy producers and utilities.

In addition, advancements in grid management technologies, such as energy storage systems and smart grid infrastructure, are enhancing the ability to manage wind power effectively, further driving the adoption of grid-connected turbines. These technological improvements help mitigate challenges like intermittent power generation from wind, ensuring that electricity is reliably supplied even during periods of low wind activity.

By Location

In 2024, Onshore Wind Energy held a dominant market position, capturing more than a 69.5% share of the global wind turbine components market. This large share is primarily driven by the widespread deployment of onshore wind farms, which are more cost-effective and easier to develop compared to offshore projects. Onshore wind energy continues to be the most common form of wind power generation, particularly in regions with abundant wind resources and supportive regulatory environments, such as the United States, China, and several European countries.

In addition, technological advancements in turbine design and construction are allowing for more efficient and larger turbines to be installed onshore, further boosting their performance and energy output. These innovations are helping reduce the levelized cost of energy (LCOE) for onshore wind, which makes it even more competitive against other energy sources.

Key Market Segments

By Type

- Generator

- Nacelle

- Tower

- Rotor Blades

- Others

By Application

- Utility

- Industrial

- Commercial

- Residential

By Wind Turbine Type

- Grid Connected

- Standalone

By Location

- Offshore Wind Energy

- Onshore Wind Energy

Drivers

Government Support and Investment in Renewable EnergyOne of the major driving factors for the growth of wind turbine components is the increasing government support and investment in renewable energy. Governments worldwide are intensifying their efforts to reduce carbon emissions, promote clean energy solutions, and meet sustainability goals. This support comes in various forms, including subsidies, tax incentives, and long-term financial commitments to renewable energy projects.

For instance, the U.S. government has been a key player in encouraging wind energy development through the Production Tax Credit (PTC), which offers a tax incentive for wind energy projects. According to the U.S. Department of Energy (DOE), wind energy accounted for about 9.2% of total U.S. electricity generation in 2022, a significant increase from previous years. The country has set ambitious targets, aiming to double renewable energy generation by 2030 and achieve a carbon-free grid by 2035. These policies not only incentivize the construction of wind farms but also drive demand for wind turbine components like blades, nacelles, and towers.

Similarly, in Europe, the European Union has launched the Green Deal, which aims to reduce greenhouse gas emissions by at least 55% by 2030, compared to 1990 levels. This ambitious plan promotes the development of renewable energy infrastructure, including wind energy. According to the European Wind Energy Association (EWEA), Europe added around 15.4 GW of new wind energy capacity in 2021 alone, helping to power millions of homes and industries.

Restraints

High Initial Capital Investment

One of the major restraints affecting the growth of the wind turbine components market is the high initial capital investment required for wind energy projects. While wind energy offers long-term environmental and economic benefits, the upfront costs associated with the installation of wind turbines—such as the purchase of turbine components, land acquisition, and construction of infrastructure—can be prohibitively expensive, particularly for developing regions or smaller companies.

According to the International Renewable Energy Agency (IRENA), the cost of building a wind farm can range between $1.3 million to $2.6 million per MW of installed capacity. These costs are primarily influenced by the prices of turbine components, including blades, nacelles, and towers, as well as logistical expenses associated with transporting and installing them. This initial investment is a significant barrier to entry, especially in markets where access to financing or government incentives is limited.

Opportunity

Technological Advancements in Wind Turbine Efficiency

A significant growth factor for the wind turbine components market is the rapid advancement in turbine technology, which has led to increased efficiency and reduced costs. Technological innovations, such as larger turbine sizes, improved materials, and advanced aerodynamic designs, have greatly enhanced the performance and energy output of wind turbines, making them more competitive with other energy sources.

According to the U.S. Department of Energy, turbine efficiency has improved significantly over the past few decades. For example, the average capacity factor (the ratio of actual output to maximum possible output) of wind turbines in the U.S. has risen from about 30% in the early 2000s to over 40% in recent years. This improvement is largely due to larger rotor blades and higher hub heights, which allow turbines to capture more wind energy, even in areas with lower wind speeds. These advancements have enabled wind farms to generate more electricity and become a more reliable energy source.

Trends

Growth of Offshore Wind Energy

One of the major emerging factors driving the wind turbine components market is the rapid growth of offshore wind energy. Offshore wind farms, which are located in bodies of water like oceans or large lakes, have the potential to generate much more power than onshore turbines due to stronger and more consistent winds. This has led to significant investments and technological advancements aimed at making offshore wind energy more viable and cost-effective.

According to the Global Wind Energy Council (GWEC), offshore wind capacity increased by 10.3 GW in 2021 alone, with Europe leading the charge. As of the end of 2021, Europe had a total offshore wind capacity of around 29 GW, with the U.K., Germany, and Denmark being the largest contributors. The offshore wind market is expected to keep expanding rapidly, with the U.K. targeting 40 GW of offshore wind capacity by 2030, while the U.S. aims to install 30 GW by the same year. This growth is creating a rising demand for specialized wind turbine components designed to withstand the unique challenges of offshore environments.

Regional Analysis

The wind turbine components market in the Asia-Pacific (APAC) region is experiencing robust growth, driven by rapid advancements in renewable energy infrastructure and increasing investments in wind power. APAC, accounting for a dominant share of the market with 45.8% of the global wind turbine component market, represents a significant hub for wind energy development, valued at approximately USD 55.8 billion.

This region is home to several emerging economies with large-scale renewable energy ambitions, such as China, India, and Japan, which are driving both the demand and manufacturing of wind turbine components. China stands out as the largest contributor, with its government heavily investing in wind energy projects and setting ambitious targets for renewable energy capacity expansion. India, too, is witnessing an increase in wind energy installations due to favorable government policies and initiatives aimed at reducing dependency on fossil fuels.

The dominance of APAC can be attributed to the region’s competitive manufacturing landscape, cost-effective production capabilities, and high investments in wind energy infrastructure. Moreover, a growing focus on reducing carbon emissions and increasing energy independence has led to an enhanced focus on wind energy in the region.

The increasing integration of advanced technologies and innovations in turbine components such as more efficient blades, gearboxes, and generators further reinforces the market’s growth trajectory. As the APAC market continues to expand, it is expected to maintain its leadership in the global wind turbine components market, fueled by strong government support, technological advancements, and growing environmental concerns.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Aerodyn Energiesysteme GmbH is a German engineering firm specializing in wind turbine design and development. Known for its innovative aerodynamic solutions, it provides consulting, prototyping, and testing services to enhance turbine efficiency. With a focus on lightweight components and advanced technology, Aerodyn supports manufacturers in optimizing rotor blades and nacelles. Its expertise contributes to the global push for sustainable energy, serving both onshore and offshore markets with tailored, high-performance solutions.

- Doosan Heavy Industries & Construction, a South Korean leader, excels in manufacturing high-performance wind turbines, particularly for offshore applications. It produces flagship models like the 8MW DS205-8MW, emphasizing wind farm engineering and energy production management. Doosan’s robust supply chain and technological advancements bolster South Korea’s renewable energy expansion, offering reliable components such as towers and generators to meet the growing global demand for sustainable power solutions.

- Enercon GmbH, a German pioneer in wind energy, is renowned for its gearless turbine technology, enhancing reliability and efficiency. It specializes in rotor blades, towers, and generators, serving both onshore and offshore markets. With a strong emphasis on innovation, Enercon’s E-138 EP3 model exemplifies its commitment to high-output, sustainable energy solutions. The company’s global presence and focus on durability make it a key player in the wind turbine components market.

- Gamesa, now part of Siemens Gamesa Renewable Energy, is a Spanish-German giant in wind turbine manufacturing. It excels in producing advanced rotor blades, nacelles, and control systems for onshore and offshore use. Known for the SG 14.0-222 turbine, Gamesa leverages cutting-edge technology to boost energy output. Its global reach and focus on cost-efficiency solidify its position as a leading supplier of wind turbine components worldwide.

- General Electric, through GE Renewable Energy, is a global powerhouse in wind turbine components, producing blades, towers, and generators. Renowned for its Haliade-X offshore turbine, GE drives innovation in large-scale renewable energy. With a strong focus on efficiency and scalability, it supports utility-scale projects worldwide. GE’s extensive R&D and manufacturing capabilities ensure it remains a dominant force in the wind energy market, meeting diverse energy needs.

Top Key Players in the Market

- Aerodyn Energies

- Doosan Heavy Industries Construction

- Enercon GmbH

- Gamesa

- General Electric

- Goldwind Technology

- Guodian United Power Technology Company

- LM Wind Power

- Ming Yang Smart Energy Group

- Mitsubishi Heavy Industries

- Nordex SE

- Senvion

- Siemens Gamesa Renewable Energy

- Sinovel Wind Groups Co. Ltd.

- Suzlon Group

- TPI Composites

- Vestas Wind System A/S

- Windey

Recent Developments

- Doosan Heavy Industries & Construction is a South Korean powerhouse making waves in this space. These folks are big on crafting hefty stuff like towers, generators, and turbines, especially for offshore wind farms. In 2024, they’re pushing hard with their 8MW DS205-8MW model, a beast designed for tough sea conditions, and it’s helping them grab a solid chunk of the growing renewable energy pie.

- Gamesa, now part of Siemens Gamesa Renewable Energy, is a big name in this space. This Spanish-German company is a powerhouse, churning out key parts like rotor blades, nacelles, and control systems for both onshore and offshore wind turbines. What stands out is their focus on massive, efficient turbines—like the SG 14.0-222, a beast of a machine pushing 14 MW.

Report Scope

Report Features Description Market Value (2024) USD 121.4 Billion Forecast Revenue (2034) USD 209.3 Billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Generator, Nacelle, Tower, Rotor Blades, Others), By Application (Utility, Industrial, Commercial, Residential), By Wind Turbine Type (Grid Connected, Standalone), By Location (Offshore Wind Energy, Onshore Wind Energy) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aerodyn Energies, Doosan Heavy Industries Construction, Enercon GmbH, Gamesa, General Electric, Goldwind Technology, Guodian United Power Technology Company, LM Wind Power, Ming Yang Smart Energy Group, Mitsubishi Heavy Industries, Nordex SE, Senvion, Siemens Gamesa Renewable Energy, Sinovel Wind Groups Co. Ltd., Suzlon Group, TPI Composites, Vestas Wind System A/S, Windey Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Wind Turbine Components MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Wind Turbine Components MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aerodyn Energies

- Doosan Heavy Industries Construction

- Enercon GmbH

- Gamesa

- General Electric

- Goldwind Technology

- Guodian United Power Technology Company

- LM Wind Power

- Ming Yang Smart Energy Group

- Mitsubishi Heavy Industries

- Nordex SE

- Senvion

- Siemens Gamesa Renewable Energy

- Sinovel Wind Groups Co. Ltd.

- Suzlon Group

- TPI Composites

- Vestas Wind System A/S

- Windey