Global Variable Frequency Drives Market By Product Type (AC Drives, DC Drives, and Servo Drives), By Power Ranges (Micro (0-5 kW), Low (6-40 kW), and Others), By Application(Pumps, Electric Fans, Conveyors, HVAC, Extruders, Others), By End-Use(Oil & Gas, Power Generation, Industrial, Infrastructure, Automotive, Food & Beverages, Others), and by Region and Companies Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033.

- Published date: Nov 2023

- Report ID: 39386

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

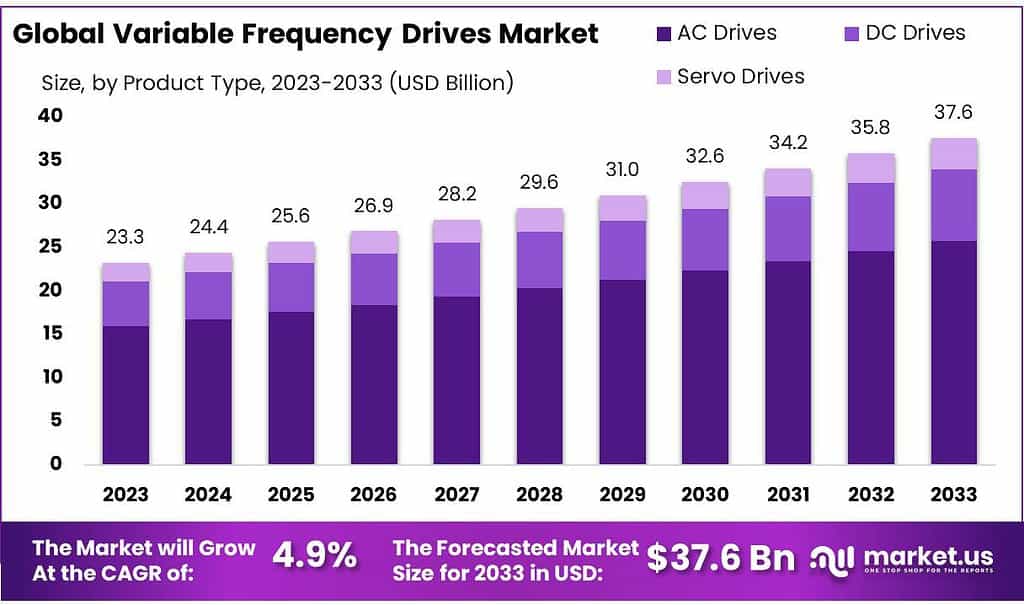

The global Variable Frequency Drives market size is expected to be worth around USD 37.6 billion by 2033, from USD 23.3 billion in 2023, growing at a CAGR of 4.9% during the forecast period from 2023 to 2033.

This market research report is expected to grow due to the increasing penetration of connected devices across commercial, residential, automotive, industrial sectors, and infrastructure sectors. In addition, infrastructure investment is driving a high demand for Heating, Ventilation, and Air Conditioning systems. This will have a positive impact on the Variable Frequency Drives market’s annual growth rate.

Note: Actual Numbers Might Vary In the Final Report

Key Takeaways

- Market Size Projected Growth: The VFD market is set to expand significantly, from USD 23.3 billion in 2023 to an estimated worth of USD 37.6 billion by 2033. And a (CAGR) of 4.9% during 2023-2033 indicates steady expansion.

- Product Type Insights AC Drives Domination: AC Drives hold the major share (68.6%) due to their widespread use across industries, particularly in food and beverage, power generation, and automotive sectors. DC Drives Potential: Expected to grow at a faster pace (6.1% CAGR) from 2023 to 2032, although facing limitations due to maintenance issues and energy inefficiency.

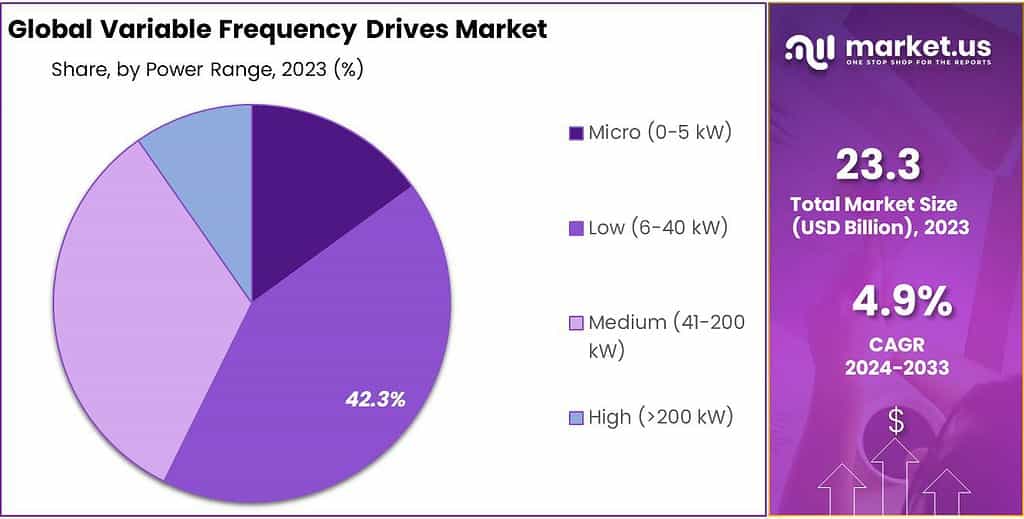

- Power Ranges Analysis Low Power Drives: Capture a significant share (42.3%) and are extensively used in applications like pumps and fans. Medium Power Range Growth: Anticipated to increase by 6.8% between 2023-2032, valued for operational flexibility and control functionalities in industries such as mining and petrochemicals.

- Application and End-Use Insights Pumps Dominance: Lead application-wise (30.2%), essential for various industries, with VFDs contributing to energy savings. Oil & Gas Influence: Major end-use sector (20.3%), heavily relying on VFDs for efficiency in processes like pumping, drilling, and refining.

- Drivers: Increased demand for energy-efficient tools, especially in industries like cement, chemicals, and mining.

- Restraints: Slow growth in oil and gas industries due to uncertain prices and environmental regulations.

- Opportunities: Rising demand for stronger power networks and system upgrades globally.

- Challenges: Disruptions caused by the COVID-19 pandemic affect the production of electric motors and VFD components.

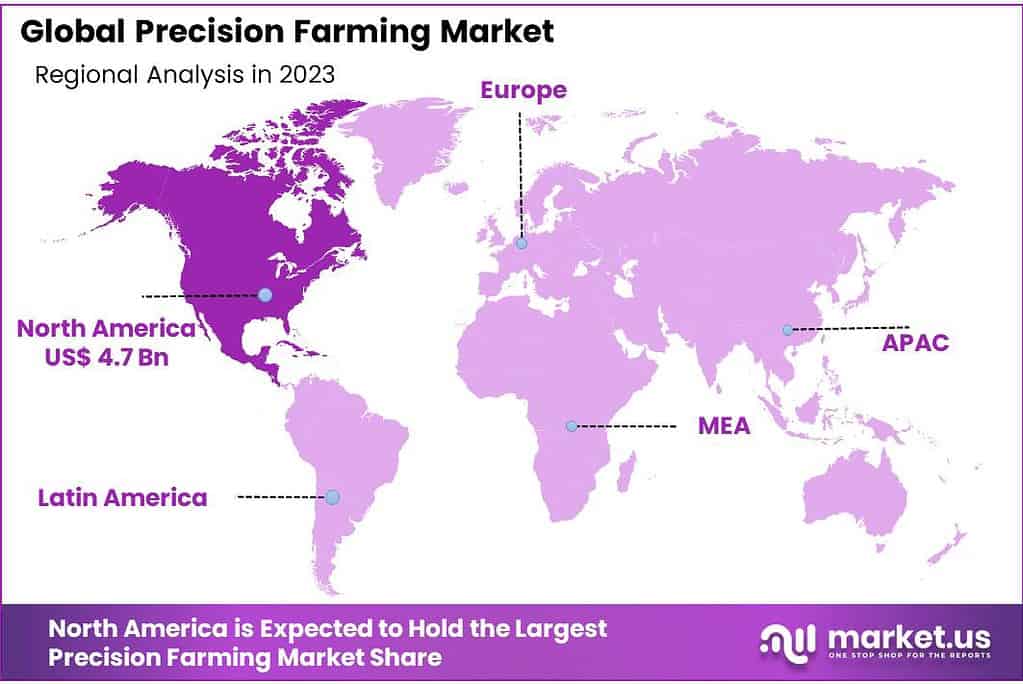

- Regional Analysis Asia-Pacific Dominance: Valued at USD 8.27 billion in 2023 and expected to remain a key growth driver due to rapid industrialization and increased demand in countries like India, China, and Japan.

- Key Players: ABB Ltd, Siemens AG, and Danfoss A/S, among others, have dominated the VFD market, emphasizing customer base expansion and new product development.

Product Type Analysis

In 2023, AC Drives were at the top, owning about 68.6% of the market. They’re like the big players in this game, used widely in various industries to control the speed of electric motors, making things run smoothly.

These advantages are appealing to many industries, including food and beverage, power generation, and automotive. The segment’s fastest growth is expected to be supported by a high demand for AC drives.

The DC drive segment is expected to see the fastest growth in the target markets and will register a 6.1% CAGR from 2023 to 2032. Because of its high maintenance services, DC drive technology is not widely used in industries.

DC drive technology cannot be used in extreme conditions and is therefore not energy-efficient. These factors could hinder the fastest growth of the infrastructure sector.

Power Ranges Analysis

In 2023, Low Power drives took charge, snagging over 42.3% of the market. They’re the middleweights, used in lots of everyday applications like pumps and fans, where moderate power is needed.

It is used to operate equipment such as pumps, fans, centrifugals, and pumps. Manufacturers are making huge investments in developing compact, low-voltage drives, high-performance, medium-voltage drives, and low-temperature.

Due to the widespread adoption of low voltage frequency driving market growth across various industry verticals and increased R&D investment, this segment is expected to dominate the development of the industrial investment and infrastructure sector.

A large portion of the revenue came from medium electric power range frequency drives. This is expected to increase by 6.8% between 2023-2032. The medium power range frequency drive provides greater operational flexibility and better control functionality. It is a popular choice in many industries such as mining, wastewater treatment, and petrochemicals. This oil and gas segment is on the rise. This is due to the Petrochemical Industry’s high demand.

Note: Actual Numbers Might Vary In the Final Report

Application Analysis

In 2023, Pumps surged ahead, claiming over 30.2% of the market. They’re the driving force behind various industries, ensuring fluids move smoothly through pipelines and systems.

Variable frequency drives are a great way to reduce energy prices and save money. Variable frequency drives can be used to adjust speeds without the need for a gearbox.

Variable frequency drives are a hot commodity within the oil and gas, oil treatment plant, and oil and gas sectors. VFDs can help support Variable Frequency Drives market growth strategy by increasing efficiency and reducing growth rates.

However, the variable frequency drive market is highly competitive as well as regional players offering cost-competitive products it is expected to create immense opportunities for the growth of the variable frequency drive market during the forecast period.

Market Opportunities: Recently, are expected to remain preferred, owing to growing power requirements by key end-use industries. Other industry verticals, such as infrastructure power generation, have also experienced a negative impact due to delays in projects and reduced electricity demand.

Between 2023-2032, the Heating, Ventilation, and Air Conditioning segment will see a 5.9% increase in revenue and account for a substantial largest share of that segment’s overall revenue. Due to rapid economic growth in commercial and residential construction, the demand for HEATING, VENTILATION, AND AIR CONDITIONING systems is expected to increase. VFDs can be attached to Heating, Ventilation, and Air Conditioning systems to increase renewable energy efficiency and control the speed of pumps, blowers, or compressors.

End-Use Analysis

In 2023, Oil took the lead, grabbing over 20.3% of the market. It’s a big player, using variable frequency drives extensively in processes like pumping, drilling, and refining within the oil and gas industry.

Oil & Gas makes heavy use of motors and pumps at its production site. These are used for many purposes, including pumping, extraction, distribution, and so on. The variable-frequency drive can be combined with motors to increase output and reduce power consumption, and energy consumption.

VFD demand will increase because players want to maximize profits and improve efficiency. Industrial activities will generate a significant amount of the target market’s revenue.

The infrastructure segment will experience a 6.8% CAGR between 2023 and 2032. This is due in part to an increase in the industrial segment worldwide. VFDs will be in high demand because of the construction of different industry verticals which is looking to replace mechanical drives with electric motors.

Market Segments

By Product Type

- AC Drives

- DC Drives

- Servo Drives

By Power Range

- Micro (0-5 kW)

- Low (6-40 kW)

- Medium (41-200 kW)

- High (>200 kW)

By Application

- Pumps

- Electric Fans

- Conveyors

- HVAC

- Extruders

- Other Applications

By End-Use

- Oil & Gas

- Power Generation

- Infrastructure

- Other End-Uses

Drivers

Industries and big projects need energy-efficient tools. Variable frequency drives (VFDs) are like smart helpers that control motors, making them work just right. They’re used a lot in places like cement, chemicals, mining, and even in making paper.

Countries like China, India, the US, and others have huge projects coming up. Places where they’re building a lot—like houses, roads, and big buildings—need tons of cement. India especially is going to use a whole bunch of it soon.

China’s really good at making paper. China makes a ton of paper, and they’re really good at it! They make almost half of the world’s paper! So, they need machines that work smoothly, and VFDs help with that.

All over the world, there are millions and millions of motors running machines. VFDs can make these motors use less energy by adjusting how fast they work. This saves a lot of power and money too. As more industries grow and people want to save energy, the demand for VFDs keeps going up. They’re like the heroes making industries more efficient and saving power at the same time!

Restraints

The oil and gas industries, which use a lot of variable frequency drives, haven’t been growing much lately. That’s because there’s been less searching for new oil and gas and not as much production happening.

These special drives are super important in the oil and gas world. When companies are hunting for new oil or making it, they rely on these drives a lot. But when oil and gas prices are unpredictable and keep changing, companies get hesitant. They don’t want to spend a bunch of money on these drives when they’re unsure if the prices will stay low for a long time. This uncertainty might make them delay or cancel big projects.

Governments everywhere are setting rules to reduce greenhouse gases. This makes oil and gas companies keep an eye on how much they’re polluting. They need to report how much greenhouse gas they’re making. All these rules might make it harder for these companies to grow and might make them use fewer of these drives.

So, because of less oil and gas work and these new rules, the demand for these drives in this industry might slow down.

Opportunities

As we use more energy, we need better and stronger power networks. In certain spots, the old power setups struggle with sudden power changes, especially in the US where there are more power outages than in other advanced places. This hits businesses hard, costing them a bunch of money every year.

Canada’s electricity networks also need a bunch of money for improvements. Even though we’re getting better at using energy wisely, we still need more electricity.

To fix this, countries are making rules to reduce the number of power cuts and improve their old power networks. This upgrade in the power system is great news for the companies that make variable frequency drives. It means there will be more demand for these drives, making it a good opportunity for the companies that sell them.

Challenges

Regional Analysis

The Asia Pacific market size was valued at USD 8.27 Billion in 2023. Over the next few decades, it will continue to dominate the Variable Frequency Drives market. It is expected that the region’s rapid industrialization will be supported by favorable government policies, increased construction activity, and improved government policies. The expected increase in demand for energy consumption will also support the region’s fastest growth.

Due to the rapid commercialization of large automotive, food, and drink manufacturers in countries such as India, China, and Japan, strong and steady economic growth is expected to be supported by increased VFD demand. This will increase working efficiency, decrease demand for energy efficiency, and boost employment.

South America is expected to grow at 7.1% CAGR during the region’s forecast period. This is due to Brazil and Mexico’s privatization and urbanization. This is due to the increased demand from the end-user industry like pulp, cement, gas industry, and chemicals.

Note: Actual Numbers Might Vary In the Final Report

Кеу Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

Key Players Analysis

ABB, Eaton Corporation, General Electric, Hitachi Group, Honeywell International, Rockwell Automation Inc., Schneider Electric, Siemens AG, The Danfoss Group, WEG S.A., Hitachi Ltd., Yaskawa Electric Corporation, and Other Prominent Players are the key trends in the Variable Frequency Drives market ABB, Eaton, digital solutions and General Electric dominated the market in 2021. Hitachi Ltd was the leading player.

They are focused on increasing their customer base and enhancing their business by introducing new product development. Emerson Electric Co., which is a global manufacturer of electric components, announced 2021 the launch of Copeland Variable Frequency Drives. This new product launch will attract new customers and increase the company’s customer base. The following are some of the most prominent players in global variable frequency driving dominant Variable Frequency Drives market share.

Маrkеt Кеу Рlауеrѕ

- ABB Ltd

- Siemens AG

- Danfoss A/S

- Rockwell Automation

- GE Power

- Toshiba International Corporation

- Schneider Electric

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Emerson Industrial Automation

- Fuji Electric Co. Ltd

- Johnson Controls Inc.

- Eaton PLC

- Hitachi Ltd.

- Nord Drive Systems

- Eaton

Recent Development

Around early 2022, the Variable Frequency Drives (VFDs) market was doing well. People were making these drives smarter, focusing on using less energy and making them work better. They were also getting better at watching and controlling them from far away, using the internet.

Report Scope

Report Features Description Market Value (2023) USD 23.3 Billion Forecast Revenue (2033) USD 37.6 Billion CAGR (2023-2032) 4.9% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (AC Drives, DC Drives, and Servo Drives), By Power Ranges (Micro (0-5 kW), Low (6-40 kW), and Others), By Application(Pumps, Electric Fans, Conveyors, HVAC, Extruders, Others), By End-Use(Oil & Gas, Power Generation, Industrial, Infrastructure, Automotive, Food & Beverages, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape ABB Ltd, Siemens AG, Danfoss A/S, Rockwell Automation, GE Power, Toshiba International Corporation, Schneider Electric, Mitsubishi Electric Corporation, Honeywell International Inc., Emerson Industrial Automation, Fuji Electric Co. Ltd, Johnson Controls Inc., Eaton PLC, Hitachi Ltd., Nord Drive Systems, Eaton Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What are Variable Frequency Drives (VFDs)?Variable Frequency Drives, also known as VFDs or variable speed drives, are electronic devices used to control the speed and torque of an electric motor by varying the frequency and voltage supplied to the motor.

What are the primary applications of Variable Frequency Drives?VFDs find extensive use in various industries such as manufacturing, HVAC (Heating, Ventilation, and Air Conditioning), oil and gas, water and wastewater treatment, and renewable energy. They help regulate motor speed, reduce energy consumption, and enhance operational efficiency.

What benefits do Variable Frequency Drives offer?VFDs offer several advantages, including energy savings by controlling motor speed to match demand, improved process control and automation, reduced wear and tear on equipment, quieter operation, and better motor protection against overload and overheating.

How do Variable Frequency Drives contribute to energy efficiency?VFDs optimize energy usage by adjusting motor speed based on the actual requirements of the equipment or process. They eliminate the need for mechanical control methods like throttling valves or dampers, reducing energy wastage during partial loads.

Variable Frequency Drives MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample

Variable Frequency Drives MarketPublished date: Nov 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd

- Siemens AG

- Danfoss A/S

- Rockwell Automation

- GE Power

- Toshiba International Corporation

- Schneider Electric

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Emerson Industrial Automation

- Fuji Electric Co. Ltd

- Johnson Controls Inc.

- Eaton PLC

- Hitachi Ltd.

- Nord Drive Systems

- Eaton