Global Automotive Lead-acid Battery Market Size, Share, And Business Benefits By Construction Design (Flooded Lead-acid Battery, Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)), By Battery Type (Flooded, SLI, Absorbent Glass Mat (AGM), Enhanced Flooded Battery (EFB)), By Cycle (Deep Cycle Battery, Starter Battery), By Vehicle Type (Two Wheeler Battery, Three Wheeler Battery, Passenger Vehicles Battery, Commercial Vehicles Battery, Buses and Coaches Battery, Off-road Vehicles Battery, E-Ride Battery), By Sales Channel (ОЕМ, Aftermarket), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141774

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Construction Design Analysis

- By Battery Type Analysis

- By Cycle Analysis

- By Vehicle Type Analysis

- By Sales Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

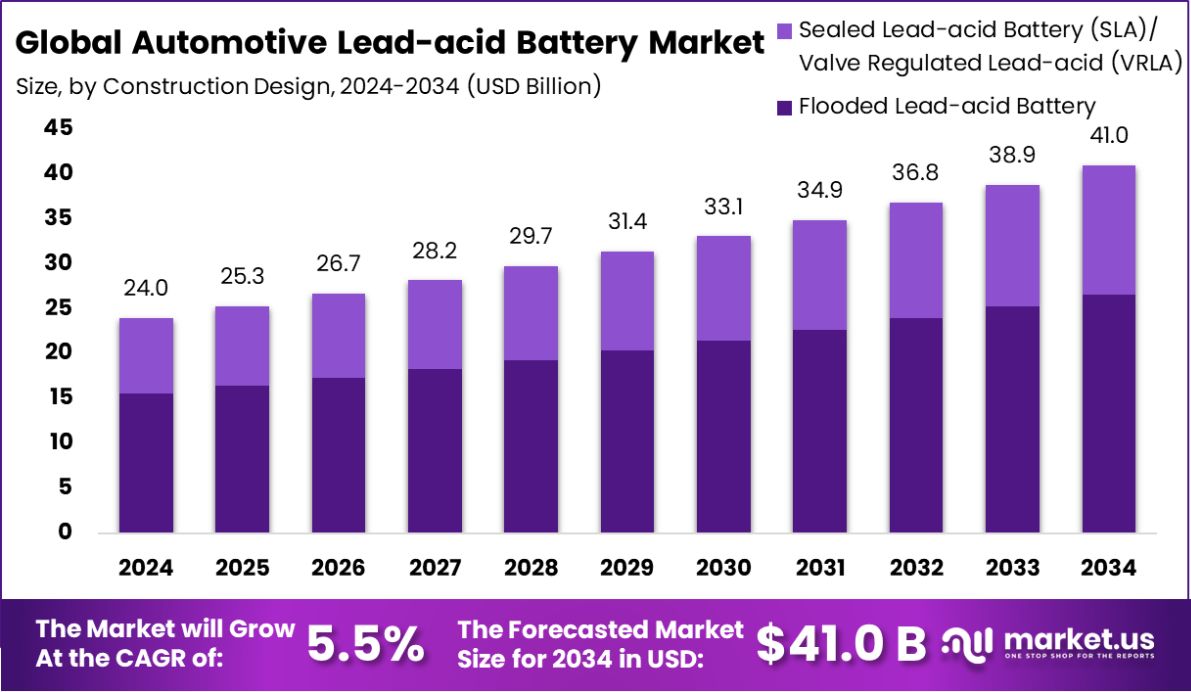

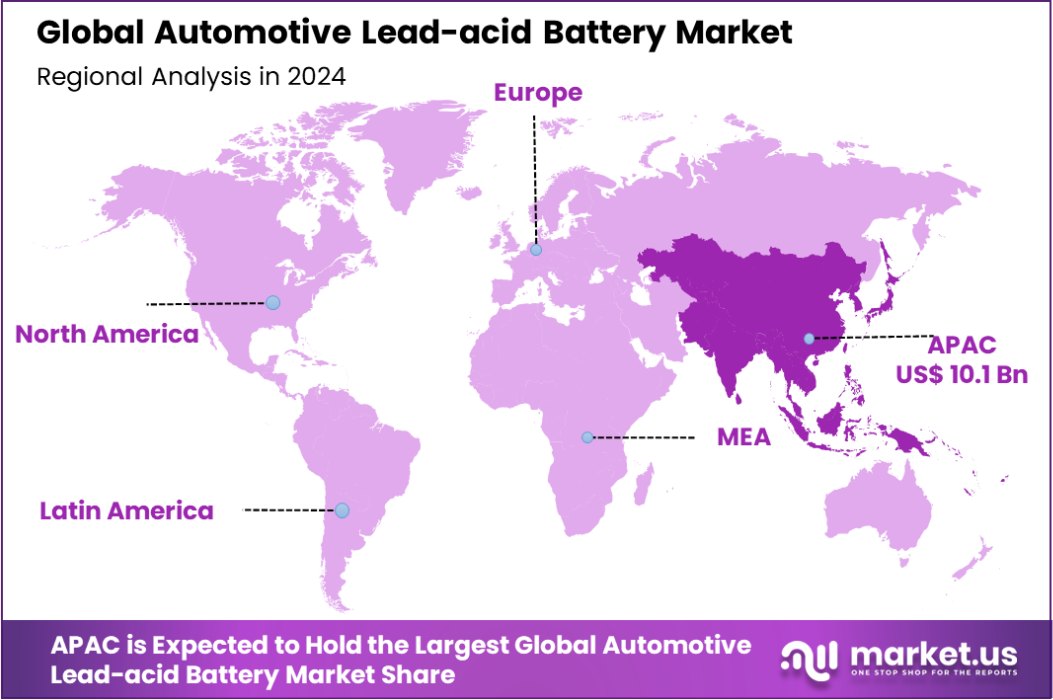

Global Automotive Lead-acid Battery Market is expected to be worth around USD 41.0 billion by 2034, up from USD 24.0 billion in 2024, and grow at a CAGR of 5.5% from 2025 to 2034. With a market value of USD 10.1 billion, Asia-Pacific dominates the Automotive Lead-acid Battery sector, accounting for 42.3%.

An automotive lead-acid battery is a type of rechargeable battery that is commonly used in vehicles. It supplies the electrical power necessary to start the engine and powers the electrical systems when the vehicle’s engine is off. Lead-acid batteries are favored for their reliability, ability to deliver high surge currents, and cost-effectiveness, making them a popular choice among automotive manufacturers.

The automotive lead-acid battery market encompasses the production, distribution, and sale of these batteries to automotive manufacturers and aftermarket suppliers. The market is driven by the high volume of vehicle production and the need for replacement batteries in the automotive sector. It includes various battery types such as SLI (starting, lighting, and ignition), deep cycle, and VRLA (valve-regulated lead-acid) batteries, catering to different vehicle requirements.

Growth in the automotive lead-acid battery market is primarily fueled by the increasing demand for passenger vehicles in emerging economies. As urbanization accelerates and consumer purchasing power improves, more individuals are buying cars, which directly boosts the need for lead-acid batteries. Furthermore, innovations in battery technology that enhance battery life and performance also contribute to market growth.

Demand for automotive lead-acid batteries remains robust due to their cost advantage over alternative technologies like lithium-ion batteries. In regions with less stringent environmental regulations, lead-acid batteries are particularly prevalent. The aftermarket segment also significantly drives demand, as batteries require regular replacement due to wear and tear.

Opportunities in the automotive lead-acid battery market are linked to advancements in recycling technologies. Lead-acid batteries are highly recyclable, and improvements in recycling processes can reduce environmental impact and lower manufacturing costs. Additionally, the expansion of vehicle electrification may spur demand for more specialized lead-acid batteries, offering ample growth opportunities for manufacturers in hybrid vehicle applications.

Lead-acid batteries, used in automotive applications, boast a remarkable recycling rate of 99%, making them highly sustainable. The Levelized Cost of Storage (LCOS) for these batteries is competitively priced at approximately $0.87/kWh over a 10-year term, emphasizing their cost-effectiveness in the automotive sector.

Key Takeaways

- Global Automotive Lead-acid Battery Market is expected to be worth around USD 41.0 billion by 2034, up from USD 24.0 billion in 2024, and grow at a CAGR of 5.5% from 2025 to 2034.

- The flooded lead-acid battery holds a 65.4% share by construction design in the automotive market.

- In the automotive lead-acid battery market, the flooded type accounts for 53.4% of the market by battery type.

- Starter batteries dominate the cycle segment, comprising 68.6% of the automotive lead-acid battery market.

- Passenger vehicles’ batteries represent 47.5% of the market by vehicle type in the automotive sector.

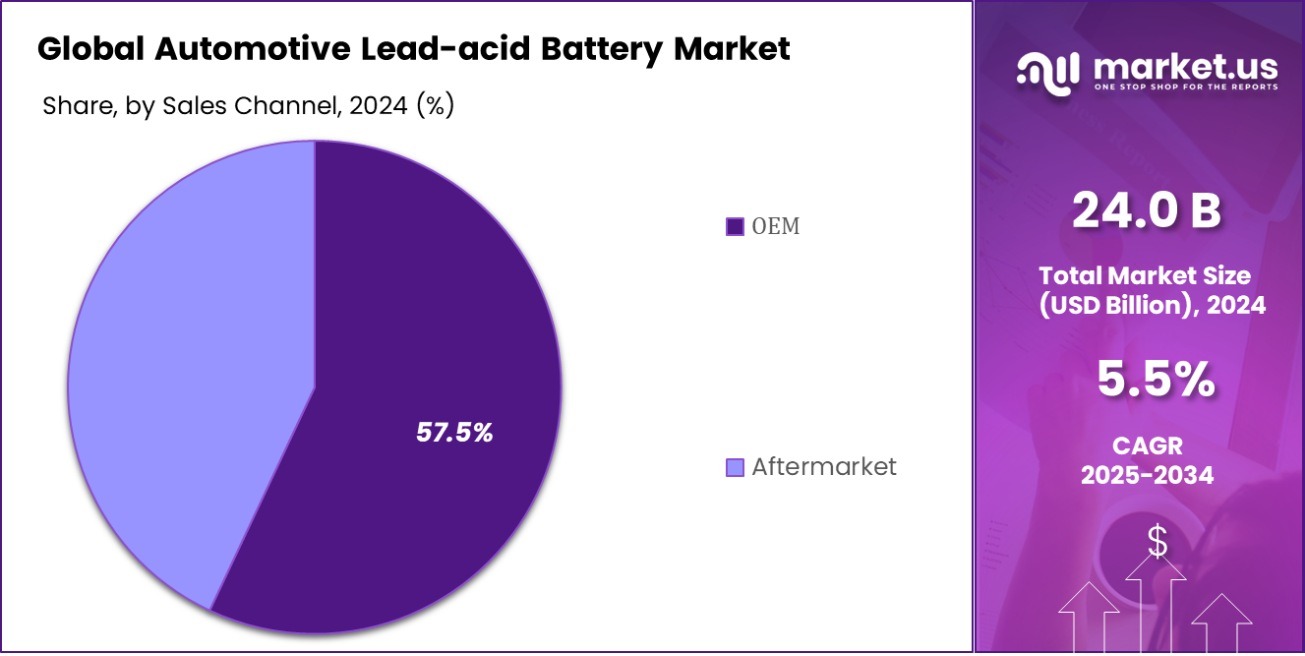

- The OEM sales channel leads with a 57.5% share in the automotive lead-acid battery market.

- In 2024, the Asia-Pacific region’s market share for Automotive Lead-acid Batteries reached 42.3%, totaling USD 10.1 billion.

By Construction Design Analysis

Flooded lead-acid batteries hold 65.4% of the market by construction design.

In 2024, the Flooded Lead-acid Battery held a dominant market position in the By Construction Design segment of the Automotive Lead-acid Battery Market, capturing a significant 65.4% share. This segment’s prominence is attributed to the widespread adoption of flooded lead-acid batteries in traditional internal combustion vehicles, where robust and reliable energy storage solutions are essential for starting, lighting, and ignition purposes.

The technology’s resilience in extreme weather conditions and its cost-effectiveness compared to alternative battery technologies have bolstered its adoption across various automotive sectors.

Flooded lead-acid batteries are particularly favored in markets with less stringent environmental regulations and in regions where affordability is a critical purchasing factor. The segment’s strength is further supported by an extensive and well-established supply chain that facilitates production efficiency and market reach.

As the automotive industry continues to rely on proven technologies that offer reliability at a competitive cost, the flooded lead-acid battery is expected to maintain a strong market presence. However, as technological advancements and environmental concerns drive the industry towards more sustainable solutions, the segment may face challenges from emerging battery technologies in the future.

By Battery Type Analysis

Flooded batteries dominate the market type segment with a 53.4% share.

In 2024, Flooded batteries held a dominant market position in the By Battery Type segment of the Automotive Lead-acid Battery Market, with a substantial 53.4% share. This commanding presence is primarily due to the reliability and cost-effectiveness of flooded lead-acid batteries in automotive applications, especially in standard passenger vehicles and commercial transportation. Their ability to deliver high surge currents makes them indispensable for starting engines and running primary vehicle functions.

The preference for flooded lead-acid batteries is particularly strong in markets focused on cost efficiency and durability. These batteries are well-suited to the rigorous demands of automotive use, providing a balance of performance and affordability that is critical in price-sensitive markets. Their widespread use is supported by a mature manufacturing and recycling ecosystem, which further solidifies their position in the market.

However, as the automotive industry evolves with increasing emphasis on sustainability and advanced technology, flooded batteries face potential competition from more modern battery technologies that offer higher energy densities and longer life cycles. Despite these challenges, the established reliability and low cost of flooded lead-acid batteries ensure their continued relevance and dominance in the automotive sector through 2024.

By Cycle Analysis

Starter batteries lead by cycle type, comprising 68.6% of the market.

In 2024, the Starter Battery segment held a dominant market position in the by-cycle segment of the Automotive Lead-acid Battery Market, with a commanding 68.6% share. This dominance is primarily attributed to the critical role that starter batteries play in powering the ignition systems of automobiles. As essential components for initiating engine operation, starter batteries are indispensable in both new vehicle manufacturing and the aftermarket sector, where battery replacement is routine due to wear and tear.

The robust market share of starter batteries reflects their widespread acceptance across various vehicle types, including passenger cars, commercial vehicles, and motorcycles. Their ability to provide high bursts of power necessary to start engines efficiently under various climatic conditions contributes to their preferred status among automotive manufacturers and consumers alike.

Despite the growing interest in alternative energy sources and advanced battery technologies, the proven reliability, cost-effectiveness, and ready availability of starter batteries ensure their continued prominence in the automotive sector. Their significant market share is supported by extensive distribution networks and a well-established global supply chain catering to both emerging and mature automotive markets.

By Vehicle Type Analysis

Passenger vehicle batteries account for 47.5% of the market by vehicle type.

In 2024, the Passenger Vehicles Battery segment held a dominant market position in the By Vehicle Type segment of the Automotive Lead-acid Battery Market, securing a 47.5% share. This significant market share underscores the crucial role of lead-acid batteries in the passenger vehicle industry, where they are extensively utilized for starting, lighting, and ignition purposes. The reliance on these batteries in passenger vehicles is driven by their cost-effectiveness, reliability, and well-established supply chain infrastructure.

The dominance of lead-acid batteries in passenger vehicles is further bolstered by the consistent demand in the automotive sector, particularly in emerging markets where affordability plays a crucial role in consumer choice. Additionally, the robust nature of lead-acid batteries, capable of withstanding varied operational demands and environmental conditions, makes them a preferred option among vehicle manufacturers and consumers alike.

However, the segment faces growing competition from newer battery technologies that offer longer life spans and are more environmentally friendly. Despite these challenges, the widespread availability and economic advantage of lead-acid batteries continue to drive their adoption in passenger vehicles, maintaining their strong position in the market through 2024.

By Sales Channel Analysis

OEM sales channels represent 57.5% of the automotive lead-acid battery market.

In 2024, the OEM (Original Equipment Manufacturer) channel held a dominant market position in the By Sales Channel segment of the Automotive Lead-acid Battery Market, commanding a 57.5% share. This prominence is indicative of the critical role that OEMs play in the initial installation of batteries in new vehicles. OEMs prefer lead-acid batteries for their reliability and cost-effectiveness, which aligns with the manufacturing needs for mass-market automotive production.

This substantial market share highlights the trust that automotive manufacturers place in lead-acid batteries, relying on them to provide the necessary power for starting, lighting, and ignition in new cars. The partnership between battery manufacturers and vehicle OEMs is strengthened by long-term supply contracts and the integration of supply chain operations, which ensure a steady demand for lead-acid batteries directly from the manufacturers.

Moreover, the dominance of OEMs in the sales channel landscape is bolstered by the global expansion of automotive production capacities, particularly in emerging markets where cost considerations significantly influence manufacturing choices. Despite growing interest in alternative technologies, the established performance metrics and cost structure of lead-acid batteries ensure their continued preference by OEMs in the foreseeable future.

Key Market Segments

By Construction Design

- Flooded Lead-acid Battery

- Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)

By Battery Type

- Flooded

- SLI

- Absorbent Glass Mat (AGM)

- Enhanced Flooded Battery (EFB)

By Cycle

- Deep Cycle Battery

- Starter Battery

By Vehicle Type

- Two Wheeler Battery

- Three Wheeler Battery

- Passenger Vehicles Battery

- Commercial Vehicles Battery

- Buses and Coaches Battery

- Off-road Vehicles Battery

- E-Ride Battery

By Sales Channel

- ОЕМ

- Aftermarket

Driving Factors

Rising Vehicle Production in Emerging Economies

The automotive lead-acid battery market is significantly driven by the increasing production of vehicles in emerging economies. As countries like China, India, and Brazil continue to experience economic growth, there is a surge in the middle-class population, leading to higher demand for personal vehicles.

This demographic shift results in a robust increase in automotive manufacturing to meet the growing consumer demand. Lead-acid batteries, known for their cost-effectiveness and reliability, are the preferred choice for many manufacturers in these regions due to their proven track record in automotive applications.

The demand is particularly strong for vehicles that require durable and efficient batteries at a lower cost, ensuring that the automotive lead-acid battery market continues to expand in these fast-developing markets.

Restraining Factors

Environmental Concerns Limiting Lead-acid Battery Adoption

Environmental regulations and growing eco-consciousness are major restraining factors for the automotive lead-acid battery market. As governments worldwide tighten environmental laws and set ambitious carbon reduction targets, the pressure increases on automotive manufacturers to adopt more sustainable technologies. Lead-acid batteries, while cost-effective, involve the use of lead and sulfuric acid, materials that pose significant environmental risks if not properly managed.

This concern drives the automotive industry towards alternatives like lithium-ion and nickel-metal hydride batteries, which offer greater energy efficiency and environmental friendliness. The shift is particularly evident in developed markets where sustainability standards are more stringent, leading to a gradual decline in the preference for lead-acid batteries despite their lower cost and reliability.

Growth Opportunity

Expansion into Hybrid Vehicle Applications Offers Growth

A significant growth opportunity for the automotive lead-acid battery market lies in expanding into hybrid vehicle applications. As the global automotive industry shifts toward more sustainable solutions, hybrid vehicles have become increasingly popular due to their ability to reduce emissions and increase fuel efficiency.

Lead-acid batteries, known for their reliability and cost-effectiveness, are well-positioned to play a critical role in hybrid systems, particularly in providing ancillary power for vehicle electrical systems.

By leveraging their established technology in a new application area, battery manufacturers can tap into the growing hybrid market. This strategy not only extends the life cycle of lead-acid technology but also opens new revenue streams in a sector that is rapidly evolving towards greener alternatives.

Latest Trends

Advancements in Recycling Technologies Propel Market Growth

One of the latest trends in the automotive lead-acid battery market is the significant advancement in recycling technologies. As environmental regulations become stricter and the global focus on sustainability intensifies, the ability to efficiently recycle used batteries has become a crucial aspect of the lead-acid battery industry.

Improved recycling processes help in reducing environmental impact and lowering the costs associated with the production of new batteries. These advancements are making lead-acid batteries more attractive to both manufacturers and consumers who are increasingly looking for eco-friendly automotive solutions.

This trend not only supports the circular economy but also enhances the sustainability credentials of lead-acid batteries, giving them a competitive edge in a market that is gradually shifting toward more sustainable practices.

Regional Analysis

Asia-Pacific leads the Automotive Lead-acid Battery Market, holding 42.3% with a robust valuation of USD 10.1 billion.

The Automotive Lead-acid Battery Market is distinctly segmented across various global regions, each demonstrating unique growth dynamics. Asia-Pacific emerges as the dominant region, accounting for 42.3% of the market with a valuation of USD 10.1 billion. This significant market share is driven by robust vehicle production in countries like China and India, coupled with increasing automotive sales due to rising disposable incomes and urbanization.

In contrast, North America and Europe show a steady demand influenced by stringent environmental regulations and a high rate of vehicle replacements requiring new batteries. These regions are also seeing a gradual shift towards more environmentally friendly battery alternatives, which moderates the growth of the lead-acid battery market.

The Middle East & Africa, and Latin America regions, though smaller in market size, are experiencing growth due to expanding automotive sectors and infrastructural developments. These regions offer potential growth opportunities due to increasing economic stability and consumer purchasing power, which drive the demand for both new and replacement batteries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Automotive Lead-acid Battery Market is significantly shaped by the strategic activities of key players such as Clarios, EnerSys, East Penn Manufacturing Company, GS Yuasa International Ltd., Exide Industries Ltd., and C&D Technologies, Inc. These companies are pivotal in driving innovation and market expansion through their extensive product portfolios and global distribution networks.

Clarios stands out as a leader in sustainability and innovation. The company’s focus on producing high-efficiency, low-maintenance batteries aligns with the global shift toward more environmentally friendly automotive solutions. Their advanced recycling programs set industry standards for sustainability, making them a preferred choice among environmentally conscious consumers.

EnerSys excels in the industrial segment, providing robust solutions for automotive applications. Their research and development in power solutions enhance the performance and longevity of lead-acid batteries, catering to the evolving needs of both traditional and electric vehicles.

East Penn Manufacturing Company maintains its competitive edge through technological advancements and a strong commitment to quality. Its diversified offerings ensure reliability across various automotive applications, strengthening its market presence.

GS Yuasa International Ltd. leverages its expertise in energy storage solutions to innovate within the automotive sector. Their developments in battery technology focus on increasing energy density and reducing environmental impact, which is crucial for market growth in stringent regulatory environments.

Exide Industries Ltd. focuses on expanding its reach in emerging markets, where the demand for automotive batteries is rising rapidly. Their strategic investments in production capacity and local market initiatives position them well in competitive regions.

C&D Technologies, Inc. specializes in integrated power solutions, which are critical for the performance of advanced automotive systems. Their products are designed to meet the high standards required in both commercial and passenger vehicles, ensuring reliability and performance.

Top Key Players in the Market

- Clarios

- EnerSys

- East Penn Manufacturing Company

- GS Yuasa International Ltd.

- Exide Industries Ltd.

- C&D Technologies, Inc.

- Camel Group Co., Ltd.

- Tianneng Rechargeable Battery Manufacturers

- Reem Batteries

- Century Batteries Indonesia

- Leoch International Technology Limited Inc

- Robert Bosch LLC

- Stryten Energy

- Exide Technologies

- Amara Raja Energy & Mobilty Limited

- The Furukawa Battery Co., Ltd.

- Crown Battery

- Fiamm Energy Technology S.p.A.

- CSB Energy Technology Co., Ltd.

- Moura Accumulators

Recent Developments

- In November 2024, Leoch International Technology Limited acquired a 70% stake in Yuasa Battery (Guangdong) Co., Ltd., expanding its presence in the Chinese market.

- In January 2024, GS Yuasa Corporation launched a new line of high-performance lead-carbon batteries designed for automotive use. These batteries feature enhanced cycle life and faster charging capabilities, catering to the evolving needs of the automotive industry.

Report Scope

Report Features Description Market Value (2024) USD 24.0 Billion Forecast Revenue (2034) USD 41.0 Billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Construction Design (Flooded Lead-acid Battery, Sealed Lead-acid Battery (SLA)/ Valve Regulated Lead-acid (VRLA)), By Battery Type (Flooded, SLI, Absorbent Glass Mat (AGM), Enhanced Flooded Battery (EFB)), By Cycle (Deep Cycle Battery, Starter Battery), By Vehicle Type (Two Wheeler Battery, Three Wheeler Battery, Passenger Vehicles Battery, Commercial Vehicles Battery, Buses and Coaches Battery, Off-road Vehicles Battery, E-Ride Battery), By Sales Channel (ОЕМ, Aftermarket) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clarios, EnerSys, East Penn Manufacturing Company, GS Yuasa International Ltd., Exide Industries Ltd., C&D Technologies, Inc., Camel Group Co., Ltd., Tianneng Rechargeable Battery Manufacturers, Reem Batteries, Century Batteries Indonesia, Leoch International Technology Limited Inc, Robert Bosch LLC, Stryten Energy, Exide Technologies, Amara Raja Energy & Mobilty Limited, The Furukawa Battery Co., Ltd., Crown Battery, Fiamm Energy Technology S.p.A., CSB Energy Technology Co., Ltd., Moura Accumulators Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Automotive Lead-acid Battery MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Automotive Lead-acid Battery MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Clarios

- EnerSys

- East Penn Manufacturing Company

- GS Yuasa International Ltd.

- Exide Industries Ltd.

- C&D Technologies, Inc.

- Camel Group Co., Ltd.

- Tianneng Rechargeable Battery Manufacturers

- Reem Batteries

- Century Batteries Indonesia

- Leoch International Technology Limited Inc

- Robert Bosch LLC

- Stryten Energy

- Exide Technologies

- Amara Raja Energy & Mobilty Limited

- The Furukawa Battery Co., Ltd.

- Crown Battery

- Fiamm Energy Technology S.p.A.

- CSB Energy Technology Co., Ltd.

- Moura Accumulators