Global Molten Salt Thermal Energy Storage Market Size, Share, And Business Benefits By Technology (Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage), By Type (Parabolic Trough Systems, Power Tower Systems, Others), By Storage Material (Sodium Nitrate, Potassium Nitrate, Calcium Nitrate, Others), By End-Use (Energy Generation (Solar Energy, Wind Energy, Others), Residential, Commercial (Hospitals, Hotels, Office Buildings, Others), Industrial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142216

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

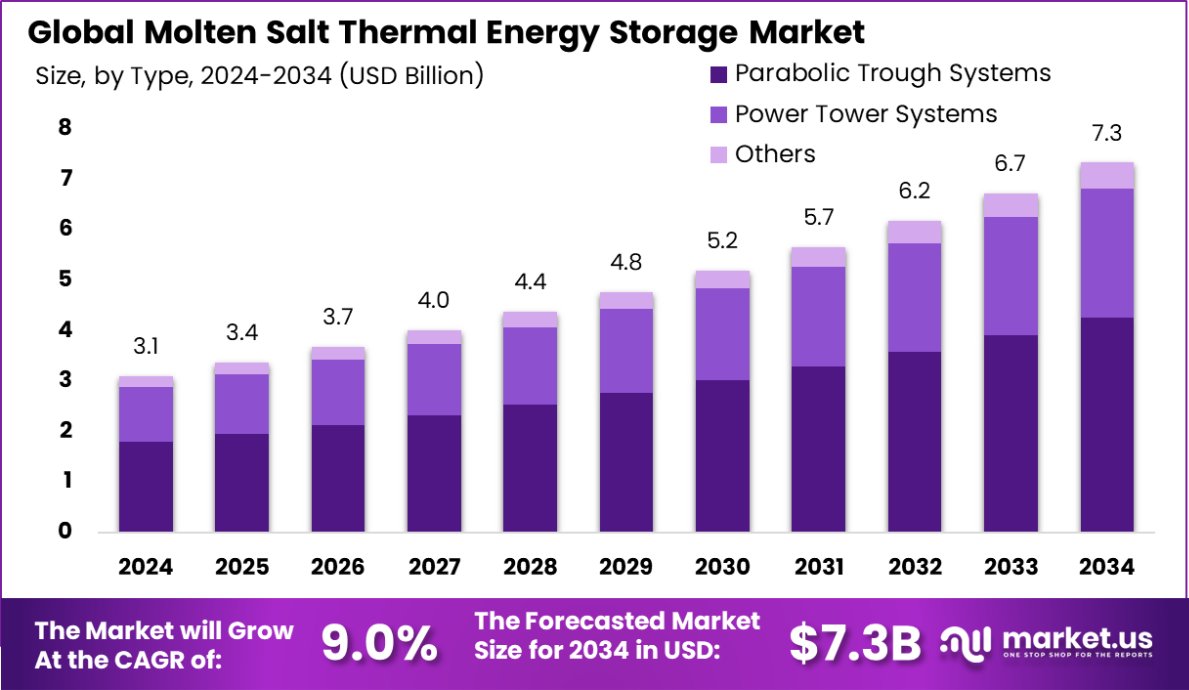

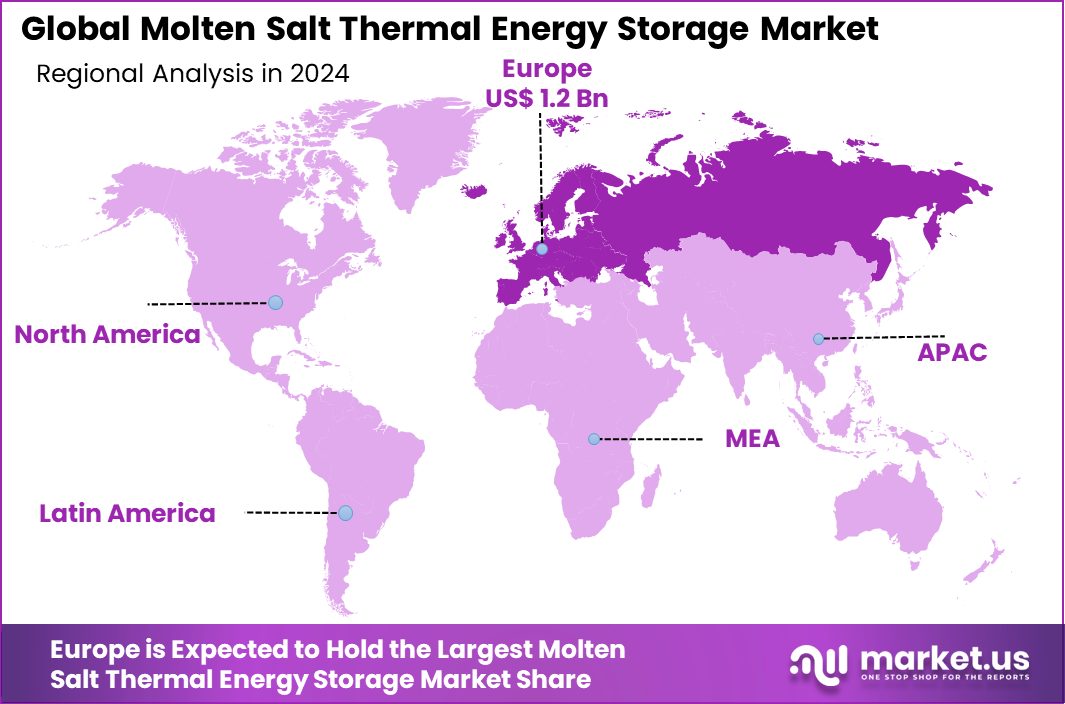

Global Molten Salt Thermal Energy Storage Market is expected to be worth around USD 7.3 billion by 2034, up from USD 3.1 billion in 2024, and grow at a CAGR of 9.0% from 2025 to 2034. In the Molten Salt Thermal Energy Storage Market, Europe stands out with 41.20% market share, reaching a value of USD 1.2 billion.

Molten Salt Thermal Energy Storage (MSTES) is a form of thermal energy storage technology that utilizes molten salt to store and release energy. This technology captures heat energy, often from solar thermal power plants, and stores it in a molten salt mixture at very high temperatures. The stored thermal energy can then be used to generate steam and produce electricity via a turbine, offering a reliable and efficient means of generating power even when the sun is not shining. This method is particularly effective for managing and balancing the supply and demand of energy in grid networks.

The MSTES market is experiencing significant growth due to its crucial role in enhancing the efficiency and reliability of renewable energy sources. One of the primary growth factors is the increasing investment in renewable energy projects, which demand stable and efficient energy storage solutions.

For instance, the U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) announced $33 million in funding for solar-thermal fuels and thermal energy storage projects in July 2024. These investments are driving advancements in MSTES technologies, making them more accessible and cost-effective.

Demand for MSTES is primarily driven by the global shift toward renewable energy and the need for more stable and dependable power supplies. Energy storage technologies like MSTES play a pivotal role in balancing grid networks and ensuring a steady supply of power, especially during peak usage times or when solar generation is low. The anticipated 8 to 15 awards, ranging from $750,000 to $10 million for solar-thermal fuels and thermal energy storage projects, further indicate strong governmental support and a healthy market demand.

Opportunities in the MSTES market are bolstered by international funding and policy support. For example, the Spanish government launched €280 million (US$310 million) in grants for standalone energy storage projects, including thermal energy storage, with €30 million specifically allocated for thermal energy storage. These grants aim to accelerate the adoption and integration of energy storage technologies, opening new opportunities for market growth and innovation in regions actively promoting renewable energy initiatives.

Key Takeaways

- Global Molten Salt Thermal Energy Storage Market is expected to be worth around USD 7.3 billion by 2034, up from USD 3.1 billion in 2024, and grow at a CAGR of 9.0% from 2025 to 2034.

- Sensible heat storage dominates the Molten Salt Thermal Energy Storage Market with a share of 56.30%.

- Parabolic trough systems are the most used type, capturing 58.30% of the market segment.

- Sodium nitrate is the preferred storage material, constituting 43.40% of the materials used in the market.

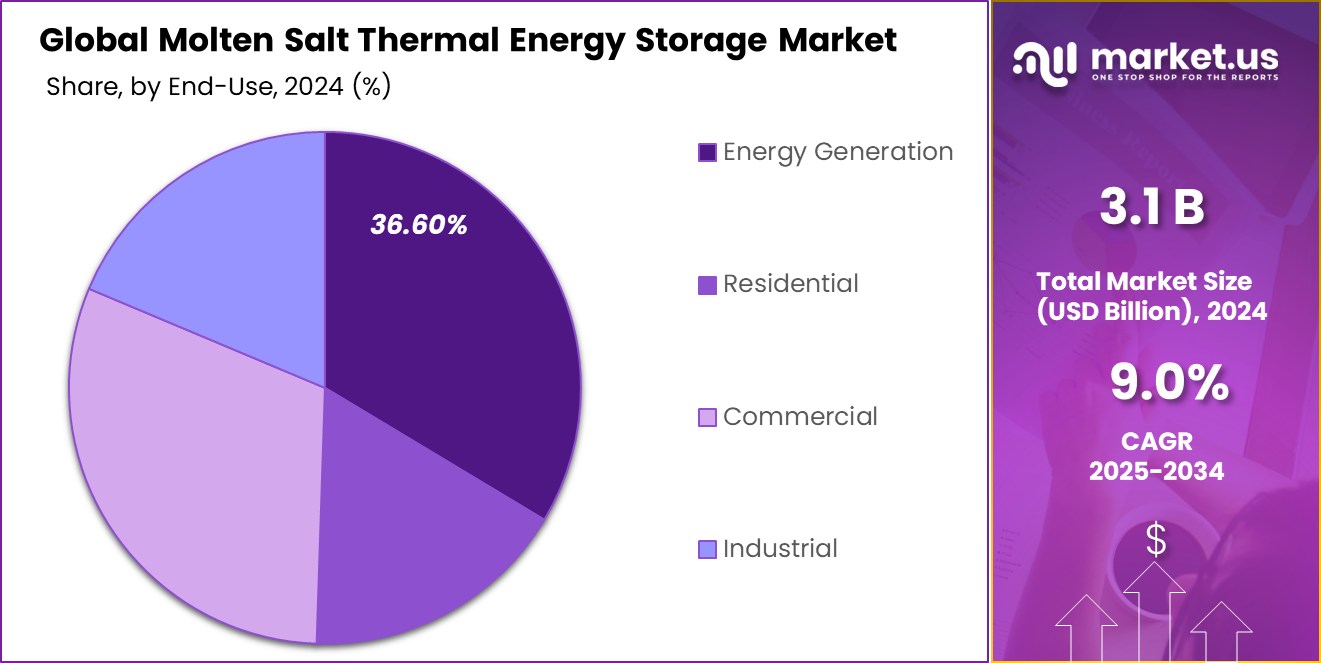

- In the market, energy generation emerges as the primary end-use, holding a 36.60% share.

- With a market share of 41.20%, Europe dominates the Molten Salt Thermal Energy Storage Market, totaling USD 1.2 billion.

By Technology Analysis

Sensible Heat Storage dominates, holding 56.30% of the market share.

In 2024, Sensible Heat Storage held a dominant market position in the By Technology segment of the Molten Salt Thermal Energy Storage Market, commanding a significant 56.30% share. This segment’s strong performance is largely attributed to its proven reliability and efficiency in high-capacity energy storage applications.

Sensible Heat Storage systems, which utilize molten salt as a heat storage medium, are particularly favored in large-scale solar thermal power plants where they facilitate extended energy storage and help stabilize energy supply by releasing stored heat to generate power during periods of low solar radiation.

The adoption of Sensible Heat Storage technology in the Molten Salt Thermal Energy Storage market is further driven by ongoing advancements that enhance its efficiency and reduce overall costs. This technology’s capacity to integrate seamlessly with existing power plant infrastructures also bolsters its market position, offering energy providers a cost-effective method to enhance grid reliability and increase the use of renewable energy sources.

As industries continue to seek sustainable and stable energy solutions, the prominence of Sensible Heat Storage in the market is expected to maintain its upward trajectory, underscored by its substantial market share in 2024.

By Type Analysis

Parabolic Trough Systems are preferred, with a significant 58.30% market presence.

In 2024, Parabolic Trough Systems held a dominant market position in the By Type segment of the Molten Salt Thermal Energy Storage Market, with a commanding 58.30% share. This significant market share reflects the widespread adoption and efficiency of parabolic trough systems in harnessing and storing solar energy. These systems utilize parabolic mirrors to focus sunlight onto a receiver pipe running along the focal line of the trough, where molten salt flows and absorbs the concentrated solar heat.

The preference for parabolic trough systems can be attributed to their maturity in the solar power industry and their proven scalability for large-scale energy projects. They are particularly effective in regions with high solar insolation, which enhances their ability to generate and store substantial amounts of thermal energy. The efficiency of parabolic trough systems in reducing carbon footprints and providing a reliable source of renewable energy bolsters their dominance in the market.

Additionally, ongoing technological advancements and cost reductions in the components used in parabolic trough systems contribute to their sustained market dominance. As the global energy sector continues to shift toward more sustainable solutions, the robust market share held by parabolic trough systems in 2024 underscores their critical role in the transition to renewable energy infrastructures.

By Storage Material Analysis

Sodium Nitrate is a key storage material, constituting 43.40% of the market.

In 2024, Sodium Nitrate held a dominant market position in the By Storage Material segment of the Molten Salt Thermal Energy Storage Market, with a significant 43.40% share. This prominence is primarily due to sodium nitrate’s superior thermal storage properties, which make it an ideal choice for molten salt thermal energy storage systems. Its ability to store heat at high temperatures without degrading adds to its reliability and efficiency in energy storage applications.

Sodium nitrate’s cost-effectiveness, coupled with its availability and ease of handling, further strengthens its position in the market. These attributes make it a preferred choice among energy storage developers looking for durable and economically viable storage materials. Moreover, the environmental safety of sodium nitrate, being non-toxic and stable, aligns well with the increasing regulatory and sustainability mandates in the energy sector.

The strong market share of sodium nitrate in 2024 underscores its crucial role in supporting the deployment of renewable energy technologies, particularly in solar power plants, where molten salt thermal energy storage systems are essential for managing intermittent energy supplies and ensuring continuous power availability.

As the market continues to evolve, sodium nitrate’s role as a key storage material is expected to grow, driven by ongoing advances in thermal energy storage technology and increasing investments in renewable energy infrastructure.

By End-Use Analysis

In energy generation, MSTES is crucial, accounting for 36.60% of the use.

In 2024, Energy Generation held a dominant market position in the By End-Use segment of the Molten Salt Thermal Energy Storage Market, with a 36.60% share. This leadership is indicative of the critical role that energy generation sectors, particularly renewable energy, play in integrating thermal storage technologies.

Molten salt thermal energy storage is especially beneficial in settings where there is a need to balance grid demand with supply, such as during peak usage hours or variable weather conditions affecting renewable outputs.

The substantial market share held by the Energy Generation segment is driven by the increasing global shift towards sustainable energy solutions. Molten salt thermal storage systems offer a viable solution for continuous energy production, significantly reducing dependency on fossil fuels and helping to stabilize electricity prices.

Additionally, the capability of these systems to store large amounts of heat and convert it back into electrical power efficiently makes them invaluable to energy generation projects focusing on solar and wind power.

The robust performance of the Energy Generation segment in 2024 also reflects broader trends in energy policy and investment, where governments and private entities are progressively funding renewable projects. As these trends continue, the role of molten salt thermal energy storage in ensuring the viability and reliability of renewable energy generation is expected to expand, further solidifying its market share.

Key Market Segments

By Technology

- Sensible Heat Storage

- Latent Heat Storage

- Thermochemical Heat Storage

By Type

- Parabolic Trough Systems

- Power Tower Systems

- Others

By Storage Material

- Sodium Nitrate

- Potassium Nitrate

- Calcium Nitrate

- Others

By End-Use

- Energy Generation

- Solar Energy

- Wind Energy

- Others

- Residential

- Commercial

- Hospitals

- Hotels

- Office Buildings

- Others

- Industrial

Driving Factors

Increasing Adoption of Renewable Energy Sources

The primary driving factor for the Molten Salt Thermal Energy Storage Market is the increasing adoption of renewable energy sources globally. As countries and companies alike strive towards reducing carbon footprints and achieving sustainability goals, the integration of efficient energy storage solutions like molten salt thermal energy storage has become critical.

This technology enables solar and wind facilities to store excess energy during peak production times and release it during demand spikes or lower production periods.

The ability to stabilize and provide a reliable energy supply not only supports the grid but also enhances the economic feasibility of investing in renewable projects. With more regions prioritizing green energy, the demand for advanced storage solutions such as molten salt systems continues to surge, driving market growth significantly.

Restraining Factors

High Initial Investment Costs Limit Market Growth

A significant restraining factor for the Molten Salt Thermal Energy Storage Market is the high initial investment required to deploy these systems. Setting up molten salt thermal energy storage involves substantial costs associated with the procurement of materials like sodium and potassium nitrate, as well as the construction of specialized facilities capable of handling high temperatures and maintaining thermal efficiency.

These financial requirements can be prohibitive for smaller energy producers or regions with limited funding for renewable energy projects. Additionally, the complexity of integrating these systems into existing energy infrastructures may further escalate upfront costs, discouraging rapid adoption. This financial barrier often delays or deters the implementation of molten salt thermal energy storage solutions, impacting the market’s overall growth potential.

Growth Opportunity

Expansion Opportunities in Emerging Renewable Energy Markets

One of the most promising growth opportunities for the Molten Salt Thermal Energy Storage Market lies in the expansion into emerging renewable energy markets. As developing countries increase their investments in renewable energy sources to meet growing energy demands and environmental targets, the need for reliable energy storage solutions becomes more pronounced.

Molten salt thermal energy storage, with its capability to store large amounts of energy for extended periods, is ideally suited to support these burgeoning markets. It ensures that the intermittent power generated from solar and wind resources can be effectively managed and utilized to stabilize local energy grids. The affordability of this technology, with costs potentially reducing to less than $15/kWh-th, coupled with round-trip efficiencies greater than 93%, makes it an increasingly attractive option.

By targeting these new markets, companies in the molten salt thermal energy storage sector can tap into a significant growth vector, enhancing global energy sustainability and business profitability. The working temperature range of these systems, from 150°C to 600°C, allows for versatile applications across different climates and needs.

Furthermore, with advanced molten salt power towers projected to reach operating temperatures of 700°C and 55% gross efficiency by 2030, the potential for market expansion and technological impact is substantial.

Latest Trends

Advancements in Molten Salt Storage Material Technology

Molten nitrate salt, composed of 60% NaNO3 and 40% KNO3, is a key component in commercial Concentrated Solar Power (CSP) plants worldwide, providing gigawatt-hours of thermal energy storage. This blend allows molten salt thermal storage systems to operate at temperatures up to ~600°C without pressurization due to its low vapor pressure, which is crucial for maintaining system integrity and safety at high operational temperatures.

CSP plants equipped with molten salt storage can achieve impressive capacity factors of 70-80%, offering dispatchable energy that is reliable and predictable. This capability is essential for integrating solar power into the energy grid more seamlessly and ensuring that energy supply meets demand during peak and non-peak hours.

A leading trend in the Molten Salt Thermal Energy Storage Market is the technological advancement in storage material formulations. Researchers and companies are continuously innovating to improve the efficiency and durability of the molten salts used in these storage systems. New formulations are being developed that can operate at higher temperatures with greater thermal stability, thereby enhancing the overall efficiency of energy storage and retrieval.

These advancements not only reduce the cost of the materials but also extend the lifespan of the storage systems, making the technology more accessible and cost-effective for wider adoption. This trend is pivotal in driving the scalability of molten salt thermal energy storage solutions, enabling them to support a broader range of renewable energy applications.

Regional Analysis

Europe leads the Molten Salt Thermal Energy Storage Market, holding 41.20% of the market share, valued at USD 1.2 billion.

The Molten Salt Thermal Energy Storage Market showcases diverse regional dynamics, with Europe emerging as the dominant region, holding a substantial 41.20% market share and valued at USD 1.2 billion. This dominance is primarily driven by Europe’s aggressive renewable energy targets and the extensive integration of solar power plants that utilize molten salt for energy storage.

The region’s commitment to reducing carbon emissions and increasing investment in renewable technologies supports the extensive deployment of molten salt thermal energy storage systems.

In contrast, North America is steadily growing in the market, driven by technological innovations and increasing governmental support for sustainable energy solutions. Asia Pacific also presents significant growth potential, fueled by rapid industrialization and expanding renewable energy projects, particularly in countries like China and India.

Meanwhile, the Middle East & Africa, and Latin America are experiencing gradual growth due to rising awareness of renewable energy’s benefits and the nascent development of infrastructure capable of supporting advanced energy storage solutions.

Each region’s market dynamics are shaped by local energy policies, technological readiness, and investment in renewable energy infrastructures, making Europe the clear leader in molten salt thermal energy storage implementation.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Molten Salt Thermal Energy Storage Market is significantly shaped by the activities and strategic developments of key companies such as Abengoa, Acciona, ACWA, BrightSource Energy, and Enel Green Power. Each of these players has contributed to the technological advancements and expansion of the market, leveraging their unique strengths and capabilities.

Abengoa stands out as a pioneer in the development of thermal storage technologies, particularly in integrating these systems within concentrated solar power (CSP) plants. The company’s extensive expertise in engineering and project management allows it to undertake large-scale projects that demonstrate the effectiveness of molten salt storage in enhancing the reliability of renewable energy sources.

Acciona has been instrumental in pushing forward the renewable energy agenda, integrating molten salt thermal storage systems into their renewable projects to increase efficiency and provide a stable energy supply. Their commitment to sustainability and innovation makes them a key player in driving the market forward.

ACWA Power, with its strategic investments in the Middle East and North Africa, highlights the role of molten salt thermal energy storage in regions with high solar potential. The company’s focus on cost-effective solutions helps in making renewable energy more accessible and reliable.

BrightSource Energy’s focus on solar thermal technology, coupled with advanced molten salt storage solutions, positions it as a leader in the field, particularly in markets like the United States and Israel. Their technology enhances grid stability and maximizes the utility of solar energy.

Lastly, Enel Green Power has been expanding its renewable portfolio by incorporating molten salt thermal energy storage to harness and store solar and wind energy efficiently. Their global presence and commitment to innovation support widespread adoption and technological advancement in the market.

Top Key Players in the Market

- Abengoa

- Acciona

- ACWA

- BrightSource Energy

- Enel Green Power

- MAN Energy Solutions

- Schott AG

- SENER Grupo de Ingenieria

- SolarReserve

- Yara International ASA

- Engie SA

Recent Developments

- In February 2025, Enel Green Power North America sold its geothermal and small solar plant portfolio to ORMAT Technologies for €250 million.

- In July 2024, the Southwest Research Institute (SwRI) was awarded a $1.2 million grant by the U.S. Department of Energy to enhance molten salt thermal energy storage research.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 7.3 Billion CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Sensible Heat Storage, Latent Heat Storage, Thermochemical Heat Storage), By Type (Parabolic Trough Systems, Power Tower Systems, Others), By Storage Material (Sodium Nitrate, Potassium Nitrate, Calcium Nitrate, Others), By End-Use (Energy Generation (Solar Energy, Wind Energy, Others), Residential, Commercial (Hospitals, Hotels, Office Buildings, Others), Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abengoa, Acciona, ACWA, BrightSource Energy, Enel Green Power, MAN Energy Solutions, Schott AG, SENER Grupo de Ingenieria, SolarReserve, Yara International ASA, Engie SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Molten Salt Thermal Energy Storage MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Molten Salt Thermal Energy Storage MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abengoa

- Acciona

- ACWA

- BrightSource Energy

- Enel Green Power

- MAN Energy Solutions

- Schott AG

- SENER Grupo de Ingenieria

- SolarReserve

- Yara International ASA

- Engie SA