Global HVDC Transmission System Market Size, Share, And Business Benefits By Type (High-power Rating Projects, Low-power Rating Projects), By Technology (Capacitor Commutated Converter (CCC), Voltage Source Converter (VSC), Line Commutated Converter (LCC)), By Deployment (Subsea, Underground, Overhead, Mixed), By Application (Bulk Power Transmission, Interconnecting Grids, Infeed Urban Areas), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142107

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

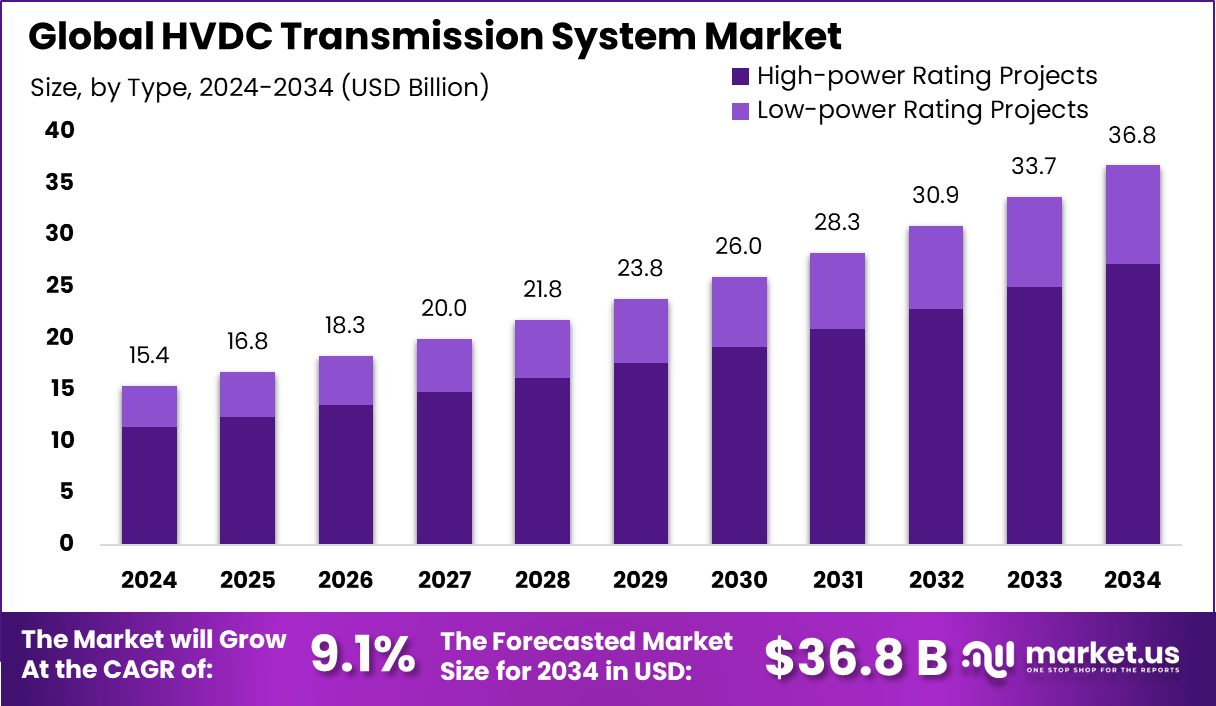

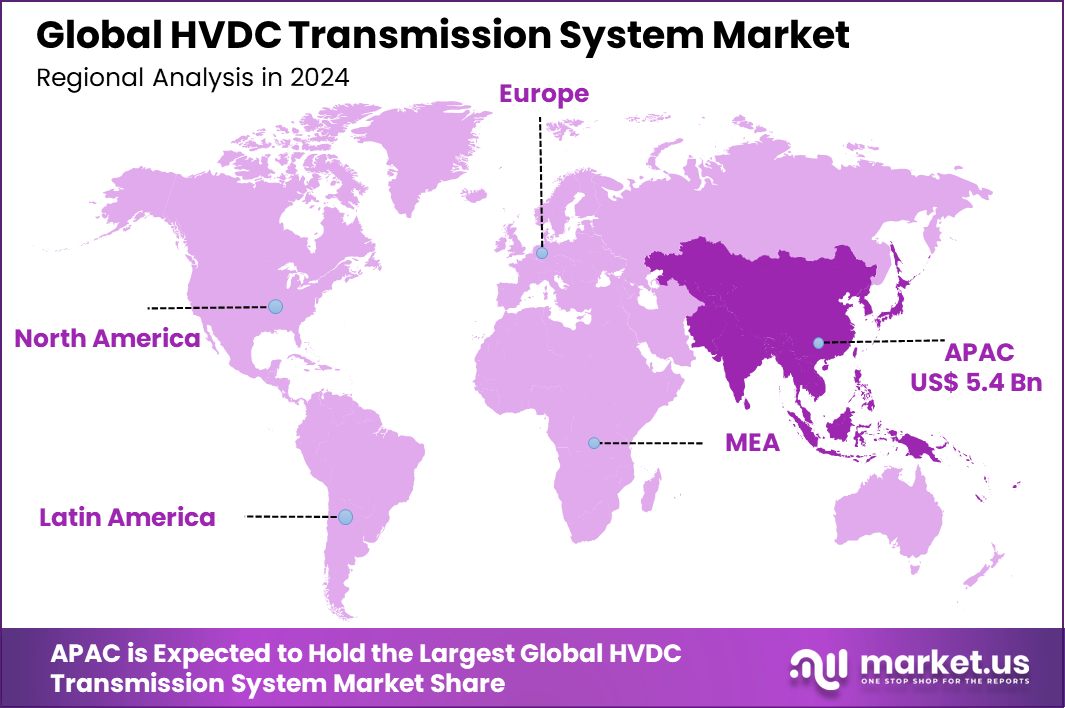

Global HVDC Transmission System Market is expected to be worth around USD 36.8 billion by 2034, up from USD 15.4 billion in 2024, and grow at a CAGR of 9.1% from 2025 to 2034. With a 35.2% market share, the Asia-Pacific HVDC Transmission System Market achieved USD 5.4 billion revenue growth.

High-voltage direct current (HVDC) transmission systems efficiently transmit electricity over long distances with minimal losses. Unlike traditional alternating current (AC) transmission, HVDC technology reduces power dissipation and enhances grid stability, making it ideal for integrating renewable energy sources. Governments and private stakeholders are increasingly investing in HVDC infrastructure to modernize power transmission networks and support clean energy transitions.

The increasing adoption of renewable energy is driving the demand for HVDC transmission systems worldwide. India’s Central Electricity Authority plans an investment of ₹4.25 trillion (~$50.55 billion) in additional transmission systems, including HVDC, between 2022 and 2027. In the U.S., the Department of Energy launched a $10 million funding opportunity in September 2023 to foster innovation in voltage source converter (VSC) HVDC technology, aiming to enhance efficiency and reduce costs.

The rapid expansion of renewable energy projects, especially offshore wind farms and remote solar plants, necessitates efficient transmission solutions. The Indian government approved an Interstate Transmission System (ISTS) to facilitate a 13 GW renewable energy project in Ladakh, incorporating 713 km of HVDC transmission lines. The Ladakh project will include two 5 GW HVDC terminals at Pang (Ladakh) and Kaital (Haryana), reinforcing India’s clean energy ambitions.

Multilateral financial institutions are playing a crucial role in HVDC expansion. The Asian Development Bank (ADB) approved a $600 million financing facility in March 2008 for India’s National Power Grid Development Investment Program. ADB’s first tranche of $400 million was fully utilized for HVDC transmission projects, while the second tranche was revised to $124 million, demonstrating ongoing financial backing for critical grid infrastructure.

HVDC technology offers opportunities to strengthen cross-border electricity trade and enhance energy security. Countries investing in grid modernization, like India and the U.S., are creating vast opportunities for equipment manufacturers and technology providers. With increasing financial support and policy incentives, HVDC transmission is set to become a backbone for global energy transition efforts.

Key Takeaways

- Global HVDC Transmission System Market is expected to be worth around USD 36.8 billion by 2034, up from USD 15.4 billion in 2024, and grow at a CAGR of 9.1% from 2025 to 2034.

- High-power rating projects dominate the HVDC transmission system market, holding a significant 74.3% share.

- Line Commutated Converters (LCC) technology accounts for 63.1% of the HVDC transmission system technology market.

- Underground deployment methods are preferred in 42.1% of HVDC transmission system projects, reflecting infrastructure integration trends.

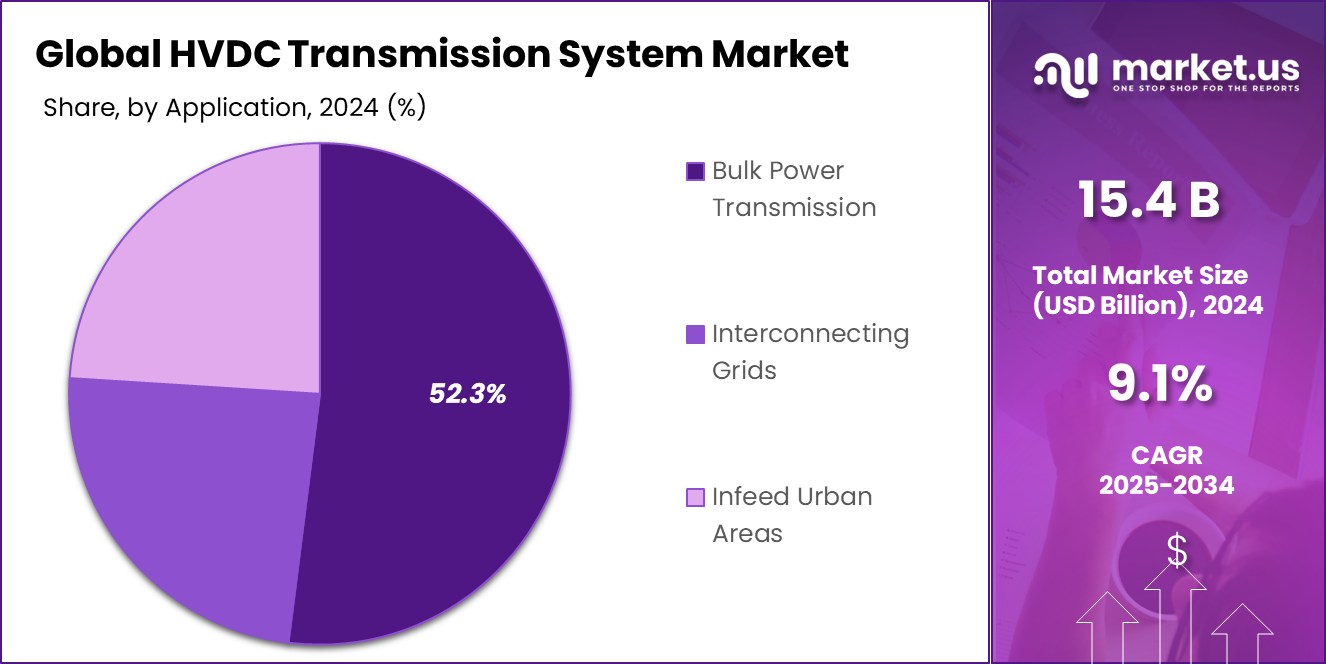

- Bulk power transmission applications lead in usage of HVDC systems, comprising 52.3% of the market.

- The Asia-Pacific region led the HVDC Transmission System Market, contributing USD 5.4 billion and holding 35.2% market share.

By Type Analysis

High-power rating projects dominate, holding 74.3% of the HVDC market.

In 2024, High-power Rating Projects held a dominant market position in the “By Type” segment of the HVDC Transmission System Market, capturing a substantial 74.3% share. This significant market presence can be attributed to the escalating demand for efficient power transmission systems capable of handling large-scale energy transfers over extended distances.

High-power HVDC systems are increasingly favored in projects that involve the integration of renewable energy sources from remote locations into national grids. These systems are essential for transmitting power from offshore wind farms and vast solar arrays to high-demand urban centers without substantial losses.

The robust market share is also reflective of global investment trends focusing on enhancing grid capabilities to incorporate diverse power sources while maintaining stability and reducing transmission losses. High-power HVDC projects are crucial in regions where the extension of conventional AC transmission systems is either impractical or cost-prohibitive.

Moreover, governments and private sectors are prioritizing the adoption of HVDC technology to achieve energy security and meet environmental targets, further driving the segment’s dominance. As the push for renewable energy continues to grow, high-power HVDC projects are set to maintain their leading position in the market, driven by both technological advancements and strategic energy policies.

By Technology Analysis

Line Commutated Converter technology leads with 63.1% market share in HVDC.

In 2024, the Line Commutated Converter (LCC) technology held a dominant market position in the “By Technology” segment of the HVDC Transmission System Market, with a 63.1% share.

This prevalence is primarily due to the LCC’s established reliability and cost-effectiveness in long-distance, high-voltage transmissions. The technology’s robust design, which allows for high power capacity and fault tolerance, makes it ideal for connecting isolated power networks and for bulk power transfers across countries and continents.

The continued preference for LCC technology in HVDC systems is also bolstered by its maturity in the market, having been developed and refined over decades. Utilities and energy companies favor LCC for its proven track record in operational stability and its compatibility with existing power infrastructure, which reduces integration costs.

Furthermore, the ability of LCC systems to operate effectively under varying network conditions supports their widespread adoption, particularly in regions with established but aging power transmission infrastructures.

As the energy sector continues to evolve with increasing focuses on sustainability and efficiency, LCC technology’s capacity to handle large-scale renewable integrations effectively will likely sustain its significant market share. Moreover, ongoing technological enhancements aimed at improving the efficiency and reducing the environmental impact of LCC systems are expected to further secure its position in the market.

By Deployment Analysis

Underground deployment represents 42.1% of HVDC transmission system installations.

In 2024, the Underground deployment category held a dominant market position in the “By Deployment” segment of the HVDC Transmission System Market, with a 42.1% share. This leading stance is largely driven by the increasing need for space-efficient and aesthetically non-intrusive transmission methods in densely populated or environmentally sensitive areas.

Underground HVDC systems offer the advantage of lower visual impact compared to overhead lines, which is a critical consideration in urban or scenic regions where space is at a premium and the visual landscape must be preserved.

The preference for underground deployment is further supported by advancements in cable technology, which have significantly reduced the costs and technical challenges associated with installing underground HVDC transmission lines. These advancements make it a viable option for crossing under bodies of water and other geographical barriers where overhead lines are not feasible.

Additionally, the underground deployment method is favored for its lesser susceptibility to weather-related disruptions and security concerns, ensuring more stable and reliable power transmission. This reliability is particularly valued in critical infrastructure projects and by nations seeking to enhance their energy security.

As urbanization continues to increase and the push for minimal environmental disruption grows stronger, the market share for underground HVDC deployment is expected to maintain its prominence.

By Application Analysis

Bulk power transmission is a major application, accounting for 52.3% in HVDC.

In 2024, Bulk Power Transmission held a dominant market position in the “By Application” segment of the HVDC Transmission System Market, with a 52.3% share. This dominance is primarily attributed to the growing global demand for efficient power transmission over long distances, especially in cases where transferring large amounts of electricity from renewable sources to high-demand urban areas is necessary.

HVDC systems are particularly suited for bulk power transmission due to their ability to maintain stability over long-distance connections and minimize energy losses, which is critical in maximizing the utility of power plants located far from load centers.

The substantial market share of bulk power transmission applications is also reinforced by the escalating need for grid interconnections to enhance reliability and prevent blackouts. Countries are increasingly investing in cross-border energy exchange capabilities, which require robust systems like HVDC for optimal performance.

Furthermore, as the integration of renewable energy sources such as wind, solar, and hydroelectric power continues to expand, the requirement for HVDC systems that can handle high-capacity transfers efficiently is expected to grow. This trend is likely to continue bolstering the market segment as nations strive to meet their energy needs while reducing carbon footprints.

Key Market Segments

By Type

- High-power Rating Projects

- Low-power Rating Projects

By Technology

- Capacitor Commutated Converter (CCC)

- Voltage Source Converter (VSC)

- Line Commutated Converter (LCC)

By Deployment

- Subsea

- Underground

- Overhead

- Mixed

By Application

- Bulk Power Transmission

- Interconnecting Grids

- Infeed Urban Areas

Driving Factors

Expanding Renewable Energy Adoption Drives Demand

The top driving factor for the HVDC Transmission System Market is the expanding adoption of renewable energy sources. As governments and corporations worldwide intensify their efforts to combat climate change, there is a significant shift toward sustainable energy practices.

Renewable energy sources like solar and wind farms are often located in remote areas, far from the main consumption centers. HVDC systems are crucial in these scenarios because they efficiently transmit electricity over long distances with minimal losses.

This capability is essential for effectively integrating dispersed renewable energy sources into the national grid. As the reliance on renewables grows, so does the demand for HVDC technology, making it a key driver in the market’s expansion.

Restraining Factors

High Initial Costs Limit HVDC Market Expansion

One of the primary restraining factors for the HVDC Transmission System Market is the high initial investment required to implement these systems. HVDC technology involves substantial upfront costs, including expensive converter stations and the installation of specialized underwater and underground cables.

This financial barrier can deter many potential users, especially in developing countries or regions with budget constraints, from adopting HVDC solutions despite their long-term benefits in efficiency and reliability.

The significant investment required not only covers the physical components but also encompasses the integration and upgrading of existing power infrastructures to accommodate HVDC technology. This factor often slows down the decision-making process and can limit market growth in regions that are unable to secure the necessary funding.

Growth Opportunity

Technological Advancements Open New Market Opportunities

A key growth opportunity in the HVDC Transmission System Market lies in ongoing technological advancements. As technology evolves, the efficiency, reliability, and cost-effectiveness of HVDC systems are improving. Innovations such as Voltage Source Converters (VSCs) are making these systems more versatile and easier to integrate with renewable energy sources and existing AC networks.

These advancements also reduce the environmental impact and physical footprint of HVDC installations, making them more attractive to regions with stringent environmental regulations or limited space.

As technology continues to advance, the ability of HVDC systems to meet diverse and changing energy needs will likely drive further adoption, opening new markets and opportunities for expansion, particularly in developing regions seeking to improve their energy infrastructure.

Latest Trends

Rising Demand for Offshore Wind Energy Integration

A prominent trend in the HVDC Transmission System Market is the rising demand for integrating offshore wind energy. As offshore wind farms become increasingly popular due to their ability to generate substantial amounts of clean energy, the need for effective transmission solutions grows.

HVDC systems are ideal for this purpose because they can transmit electricity over long distances without significant losses, which is crucial for connecting remote offshore installations to mainland power grids.

This trend is driven by global efforts to increase renewable energy production and reduce carbon footprints. The expansion of offshore wind capacity, especially in Europe and Asia, is expected to continue pushing the demand for HVDC systems, highlighting their critical role in modern energy infrastructures.

Regional Analysis

In 2024, the Asia-Pacific HVDC Transmission System Market dominated with a 35.2% share, generating USD 5.4 billion.

The HVDC Transmission System Market is segmented across several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America, with Asia-Pacific leading the pack, commanding a substantial 35.2% market share and generating revenues of USD 5.4 billion.

This dominance is largely due to massive infrastructural developments and increasing investments in renewable energy projects, particularly in China and India, where there is a significant push towards integrating remote renewable energy sources with high-demand urban centers.

Europe also shows robust growth, driven by stringent environmental regulations and the region’s aggressive renewable energy targets, necessitating advanced energy transmission solutions like HVDC. North America follows, with investments geared toward modernizing aging power infrastructure and increasing the resilience of the grid against natural disasters.

The Middle East & Africa, and Latin America are emerging regions in this market. The Middle East & Africa are gradually adopting HVDC systems to support their growing renewable energy infrastructures, while Latin America is exploring HVDC to overcome geographical barriers in energy transmission, although at a slower pace compared to other regions.

These developments across the regions illustrate a dynamic and evolving HVDC Transmission System Market, with Asia-Pacific maintaining its lead due to continuous growth in energy demand and infrastructure advancements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global HVDC Transmission System Market continues to be shaped by major players, each contributing to technological advancements and large-scale infrastructure projects.

ABB Ltd. remains a dominant force, leveraging its expertise in HVDC Light and HVDC Classic technologies. The company’s focus on digitalization and grid automation solutions strengthens its market position, particularly in offshore wind and intercontinental power transmission projects.

CHINA XD GROUP plays a critical role in the Asian market, capitalizing on China’s aggressive investments in ultra-high-voltage (UHV) transmission. The company benefits from government-backed initiatives, allowing it to lead large-scale domestic projects while expanding its global footprint. Its cost-efficient solutions and strategic partnerships position it as a key competitor against its Western counterparts.

Electrobras continues to drive HVDC deployment in Latin America, particularly in Brazil, where long-distance power transmission from hydroelectric plants remains a priority. The company’s expertise in bulk power transfer projects enhances regional grid reliability, reinforcing its importance in South America’s growing energy landscape.

GE Vernova (GE Grid Solutions) and General Electric collectively maintain strong market influence, focusing on innovative converter station technologies and grid modernization solutions. Their commitment to integrating renewable energy sources, particularly in North America and Europe, positions them as essential players in the energy transition.

Top Key Players in the Market

- ABB Ltd.

- CHINA XD GROUP

- Electrobras

- GE Vernova (GE Grid Solutions)

- General Electric

- Hitachi Energy Ltd.

- Mitsubishi Electric Corporation

- NEXANS

- NKT

- NR Electric Co., Ltd.

- Prysmian Group.

- Schneider Electric

- Siemens AG

- TBEA Co., Ltd.

- Toshiba Energy Systems Solutions Corporation

- Vestas

- Xu Ji Group Co. Ltd

Recent Developments

- In January 2025, Nexans secured a 1 billion euro project agreement for LanWin 2 under the TenneT framework, involving 250 km of 525 kV HVDC XLPE cable systems.

- In December 2024, NKT awarded two turnkey projects in Germany under the existing multi-year framework agreement with TenneT, part of TenneT’s 2GW Program for energy transition in Europe.

- In October 2023, Nexans successfully achieved an electrical Type Test for 525 kV DC SF6 gas-free cable terminations, offering a safer and sustainable solution for HVDC cable connections.

Report Scope

Report Features Description Market Value (2024) USD 15.4 Billion Forecast Revenue (2034) USD 36.8 Billion CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (High-power Rating Projects, Low-power Rating Projects), By Technology (Capacitor Commutated Converter (CCC), Voltage Source Converter (VSC), Line Commutated Converter (LCC)), By Deployment (Subsea, Underground, Overhead, Mixed), By Application (Bulk Power Transmission, Interconnecting Grids, Infeed Urban Areas) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB Ltd., CHINA XD GROUP, Electrobras, GE Vernova (GE Grid Solutions), General Electric, Hitachi Energy Ltd., Mitsubishi Electric Corporation, NEXANS, NKT, NR Electric Co., Ltd., Prysmian Group., Schneider Electric, Siemens AG, TBEA Co., Ltd., Toshiba Energy Systems Solutions Corporation, Vestas, Xu Ji Group Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  HVDC Transmission System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

HVDC Transmission System MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Ltd.

- CHINA XD GROUP

- Electrobras

- GE Vernova (GE Grid Solutions)

- General Electric

- Hitachi Energy Ltd.

- Mitsubishi Electric Corporation

- NEXANS

- NKT

- NR Electric Co., Ltd.

- Prysmian Group.

- Schneider Electric

- Siemens AG

- TBEA Co., Ltd.

- Toshiba Energy Systems Solutions Corporation

- Vestas

- Xu Ji Group Co. Ltd