Global Beer Processing Market Size, Share, Growth Analysis By Brewery Type (Macro Brewery, Microbrewery, Brew Pubs), By Beer Type (Lager, Ale and Stout, Specialty Beer, Low Alcohol Beer), By Raw Material Type (Malt, Hops, Yeast, Water), By Processing Method (Brewing, Fermentation, Maturation, Filtration, Packaging), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141901

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

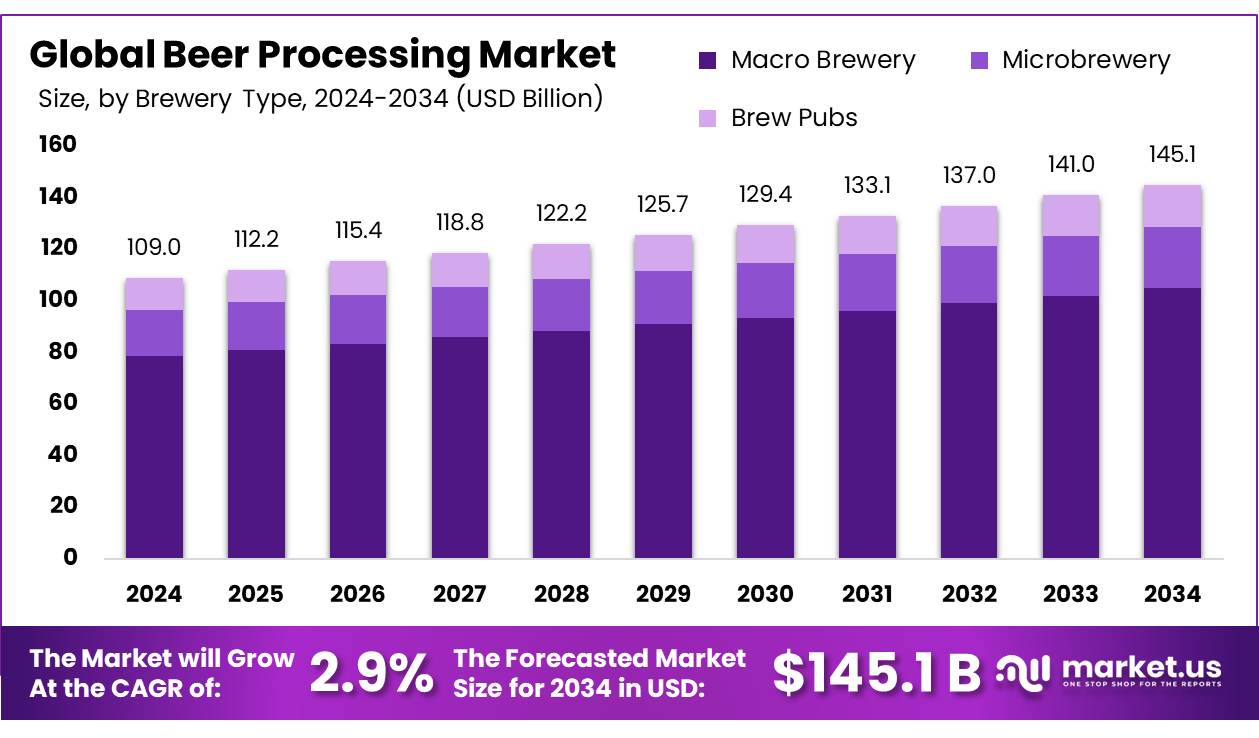

The Global Beer Processing Market size is expected to be worth around USD 145.1 Billion by 2034, from USD 109.0 Billion in 2024, growing at a CAGR of 2.9% during the forecast period from 2025 to 2034.

Beer processing is an important part of beer production. It involves the manufacturing of raw ingredients such as malted barley, water, hops, and yeast into the final beer product. The process includes essential stages such as malting, mashing, boiling, fermentation, conditioning, and packaging. Each step plays a crucial role in developing the beer’s flavor, texture, carbonation, and overall quality. The key chemical and microbial processes within these stages ensure the proper conversion of starches into fermentable sugars, the production of alcohol, and the formation of desired flavors and aromas.

Beer processing is widely used in both commercial and home brewing. In the commercial brewing industry, it ensures the consistent production of high-quality beer at scale, maintaining taste and quality across batches. In-home brewing, understanding these processes allows individuals to replicate or innovate beer styles at a smaller scale. Furthermore, advanced processing techniques, such as the use of enzymes or fermentation control, are applied to improve beer clarity, taste, and shelf-life.

Additionally, the increasing focus on beer as a functional beverage, with potential health benefits due to bioactive compounds, highlights the application of specific brewing processes that enhance the nutritional content of beer.

Key Takeaways

- The global beer processing market was valued at USD 109.0 Billion in 2024.

- The global beer processing market is projected to grow at a CAGR of 2.9% and is estimated to reach USD 145.1 Billion by 2034.

- Among brewery types, macro breweries accounted for the largest market share of 72.3%.

- Among beer types, lager accounted for the majority of the market share at 68.5%.

- By raw material type, malt accounted for the largest market share of 68.4%.

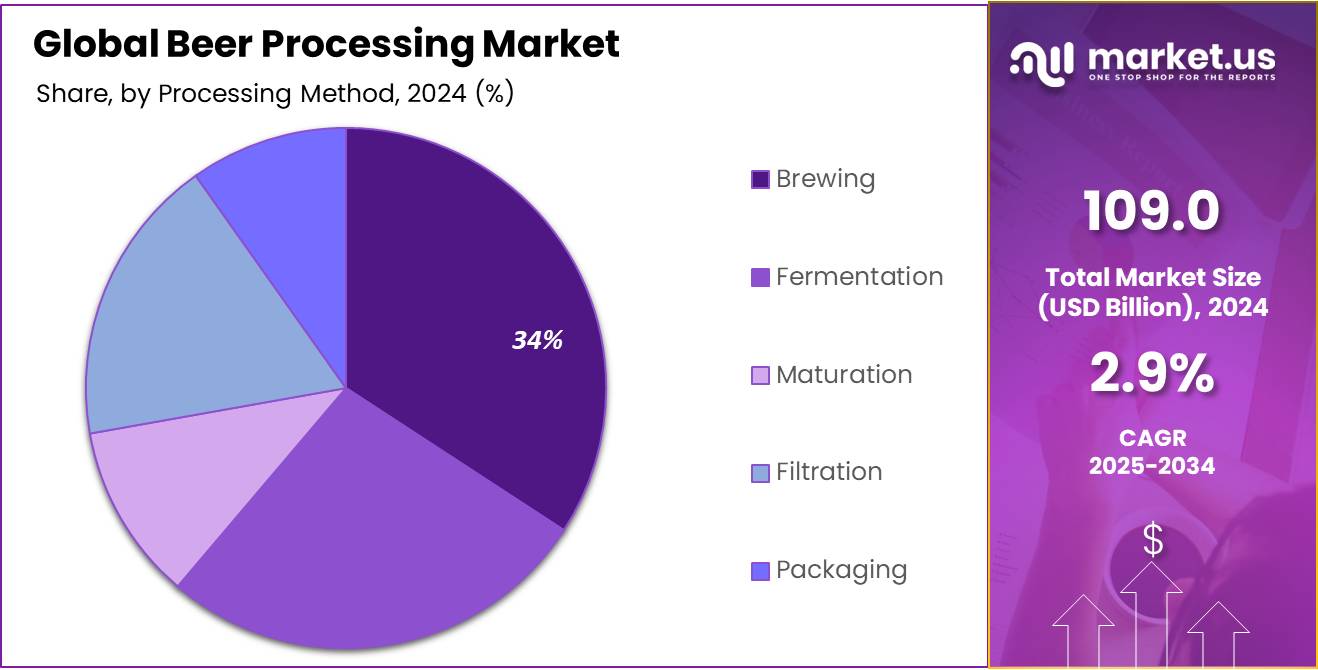

- By processing method, brewing accounted for the majority of the market share at 34.2%.

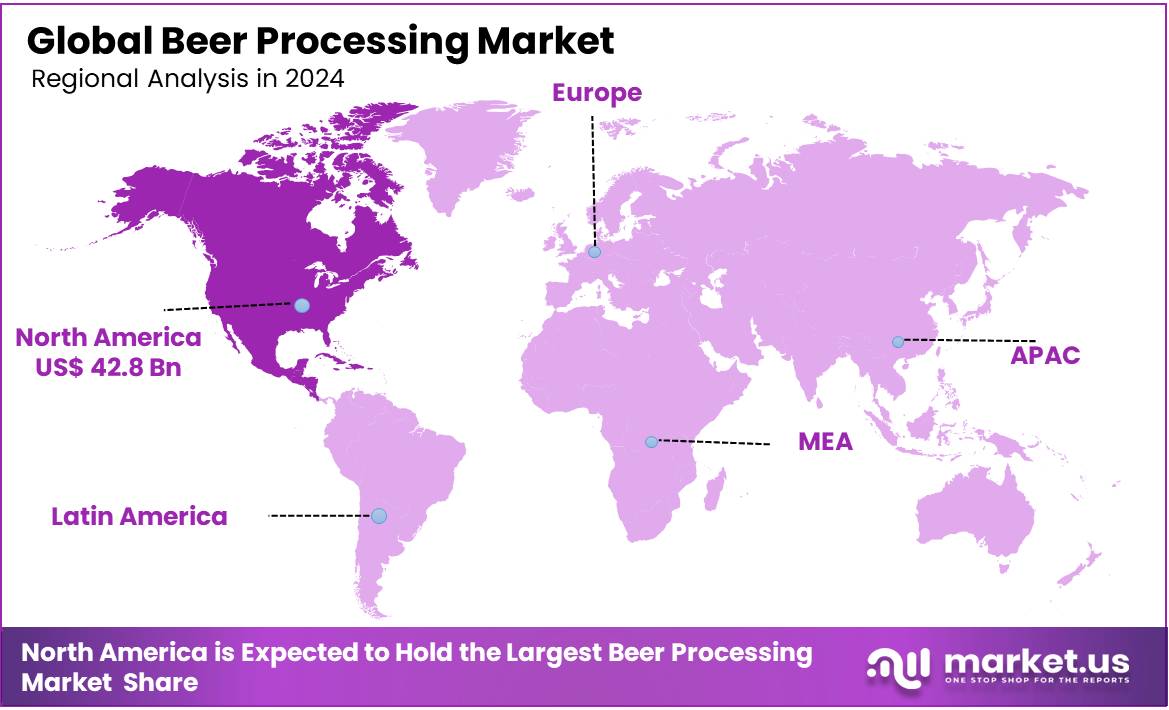

- North America is estimated as the largest market for Beer Processing with a share of 39.3% of the market share.

Brewery Type Analysis

The beer processing market is segmented based on brewery type into macro brewery, microbrewery, and brew pubs. In 2024, the macro brewery segment held a significant revenue share of 72.3%. Due to its large-scale production capabilities, established supply chains, and ability to cater to mass-market demand. These breweries benefit from economies of scale, allowing them to produce beer at a lower cost per unit, which helps them maintain a competitive advantage in terms of pricing and distribution.

Additionally, macro breweries dominate global markets, leveraging their extensive brand recognition and market reach. Furthermore, microbreweries focus on small-scale, craft beer production, offering unique, high-quality brews with a strong emphasis on local or regional appeal. They often use traditional brewing methods, premium ingredients, and innovative recipes, catering to niche markets. Brew Pubs, on the other hand, combines beer brewing with dining, providing a fresh, on-site beer experience alongside food offerings. They serve as community hubs, targeting local customers and promoting craft beer diversity. Both segments emphasize sustainability, community engagement, and catering to consumers seeking personalized and unique beer experiences.

Beer Type Analysis

Based on beer type, the market is further divided into lager, ale & stout, specialty beer, and low-alcohol beer. The predominance of the lager, commanding a substantial 68.5% market share in 2024 due to its widespread popularity and mass appeal. Lagers are known for their smooth, crisp flavor and versatility, making them a preferred choice among beer drinkers globally. Their consistent taste and lower production costs compared to other beer types have contributed to their dominance.

Additionally, lagers are commonly produced by large-scale breweries, which further boosts their market share. The global popularity of larger brands, such as Heineken, Budweiser, and Corona, also supports its dominant position in the beer processing market.

Raw Material Type Analysis

Based on raw material type, the market is further divided into malt, hops, yeast, and water. The malt segment held a substantial 68.4% market share in 2024 due to its essential role in the brewing process as the primary source of fermentable sugars. Malt provides the base for beer’s flavor, color, and body, making it a critical ingredient in nearly all beer types, especially in lagers and ales.

The versatility of malt, which can be roasted to achieve different flavors and colors, further contributes to its dominance. Additionally, the brewing industry’s reliance on malt for consistent quality and production volume supports its large market share. The growing demand for both traditional and craft beers, which often highlight malt-driven flavors, reinforces its prominence in the market.

Processing Method Analysis

Based on the processing method, the market is further divided into brewing, fermentation, maturation, filtration, and packaging. The brewing commanded a substantial 34.2% market share in 2024, due to its foundational role in the beer production process. Brewing is the first and most critical step, where malt, hops, water, and yeast are combined to create wort, which undergoes the necessary chemical reactions to form beer. This stage directly impacts the flavor, aroma, and overall quality of the beer, making it essential for both large-scale and craft breweries.

Additionally, brewing requires significant investment in equipment, and the ongoing demand for diverse beer styles has kept brewing processes central to the market. The continuous innovations in brewing techniques also contribute to its dominant market share, helping brewers create unique and high-quality beers.

Key Market Segments

By Brewery Type

- Macro Brewery

- Microbrewery

- Brew Pubs

By Beer Type

- Lager

- Ale & Stout

- Specialty Beer

- Low Alcohol Beer

By Raw Material Type

- Malt

- Hops

- Yeast

- Water

By Processing Method

- Brewing

- Fermentation

- Maturation

- Filtration

- Packaging

Driver

Increasing Beer Consumption

Increasing beer consumption is one of the key drivers of global beer processing market growth, beer drinking is becoming more widespread, especially in emerging economies, and the demand for brewing and processing technologies is rising. While beer consumption in traditionally beer-dominant countries such as Ireland, Belgium, and the UK has seen slight declines, it remains a significant segment of the market.

In contrast, countries like Russia, China, and Spain, traditionally focused on spirits or wine, are now experiencing a shift toward beer consumption. This surge in global beer demand necessitates enhanced production capacity, prompting breweries to adopt more advanced and efficient brewing technologies, equipment, and infrastructure to meet the growing consumer demand.

- For instance, reports published by the World Brewing Alliance (WBA), in collaboration with Oxford Economics, reported that the beer sector contributed a remarkable $878 billion to the global GDP in 2023, accounting for 0.8% of the global economy. This economic impact underscores the growing significance of the beer industry, including the beer processing market.

Moreover, flavor and customization in beer are major factors driving the growth of the beer processing market, as breweries invest heavily in specialized brewing equipment and processing technologies. Advanced brewing systems allow producers to experiment with different ingredients, such as rare hops, exotic fruits, and unique malts, to create custom flavors. Breweries have adopted more flexible, smaller-scale brewing technologies that allow them to produce distinctive batches, allowing for limited-edition releases and seasonal offerings. These innovations give brewers the ability to cater to niche markets and regional tastes, further driving the customization of beer products.

- According to Penn State Extension survey reports, with 35% of consumers preferring beer over other alcoholic beverages and 51% of beer drinkers consuming it weekly, there is significant growth in the beer processing market.

Restraints

Stringent Government Regulation

The global beer processing market is facing increasing challenges due to stringent government regulations, especially in areas such as food safety, environmental compliance, and alcohol-related laws. The implementation of regulations like the FDA’s Food Safety Modernization Act (FSMA) in the United States has expanded the scope of food safety standards to include alcoholic beverages, requiring breweries to adopt Good Manufacturing Practices (GMPs).

These additional regulations have forced breweries to invest in compliance measures, which can be costly and time-consuming, particularly for smaller operations. Furthermore, environmental regulations are also creating challenges for the beer processing industry. Breweries are under pressure to reduce their carbon footprint and water usage, with many jurisdictions enforcing stricter waste management, water usage, and carbon emission standards.

Meeting these regulations requires significant investment in technology and process improvements, such as adopting energy-efficient equipment or implementing advanced wastewater treatment systems. For many small and mid-sized breweries, these compliance costs can limit growth potential.

Opportunity

Recent advances in the malting and brewing industry

Recent advances in the malting and brewing industry have significantly boosted the beer processing market, offering new growth opportunities. The integration of biotechnology, such as the development of genetically modified yeast strains and advancements in enzyme chemistry, has allowed brewers to create beers with unique flavor profiles and improve fermentation efficiency. The ability to precisely control fermentation conditions through automated systems enhances product consistency, energy efficiency, and waste reduction, making brewing processes more sustainable and cost-effective. These innovations are driving the development of new beer varieties and improving overall production quality.

Furthermore, the integration of advanced technologies such as the Internet of Things (IoT) and artificial intelligence (AI) is also transforming the beer industry. IoT provides real-time monitoring of the brewing process, allowing for immediate adjustments and ensuring product quality at every stage. AI and machine learning provide brewers with the tools to analyze large volumes of data, optimize fermentation, and predict outcomes, enhancing both efficiency and creativity in recipe development. As these technologies become more prevalent, they are driving innovation in beer production, allowing for faster and more customizable products to meet evolving consumer preferences.

As the beer industry embraces innovations like advanced fermentation technologies, AI-driven insights, and sustainable practices, the beer processing market is set for continued growth. These advancements improve operational efficiency and enhance the consumer experience. With progress in enzyme research and brewing techniques, the industry is well-positioned to explore new opportunities, develop unique products, and meet the demands of modern consumers.

- For instance, recently Evodiabio developed a method to produce hop aromas from yeast, using patented technology to generate key aromatic molecules during fermentation. This process allows them to impart distinct flavors to their non-alcoholic beers, showcasing how advanced fermentation techniques are enhancing flavor profiles and meeting consumer demand for more sophisticated, high-quality brews.

Trends

Expansion of hard seltzers and beer-based cocktails

The expansion of hard seltzers and beer-based cocktails has significantly contributed to the growth of the beer processing market. With the rise in popularity of hard seltzers, consumers, particularly health-conscious younger generations like Millennials and Gen Z, are seeking low-calorie, low-sugar, and low-ABV options. This shift in preferences towards “better-for-you” drinks has led breweries to incorporate hard seltzers and beer-based cocktails into their product lines. Craft breweries, in particular, are diversifying their offerings to stay competitive, fostering innovation in brewing processes to develop new flavor profiles and drink formats.

As the demand for innovative and diverse drinking experiences continues to grow, beer-based cocktails, which combine beer with spirits, flavorings, and mixers, are gaining popularity at bars and restaurants. This trend is pushing breweries to experiment with new ingredients, technologies, and production methods, expanding the range of products available to consumers. With the rise of ready-to-drink (RTD) beverages, including pre-mixed cocktails and hard seltzers, the market is seeing increased interest in convenient, efficiently produced options. These trends are expected to shape the future of the beer processing market, ensuring that hard seltzers and beer-based cocktails remain a significant part of the alcoholic beverage industry.

Geopolitical Impact Analysis

Geopolitical factors, such as trade tensions, political instability, and regulations, impact the beer processing industry by affecting raw material availability, costs, and market demand.

Geopolitical factors play a significant role in shaping the global beer processing industry, affecting everything from supply chains to market demand. Trade tensions, tariffs, and political instability can disrupt the flow of raw materials, such as barley and hops, essential for beer production. For instance, trade conflicts between major beer-producing nations, such as the U.S. and the European Union, can lead to increased tariffs on imported goods, raising the cost of ingredients for breweries. This can squeeze margins, especially for smaller breweries that rely on global sourcing for specialized ingredients. Moreover, geopolitical instability in key regions can disrupt supply chains, affecting the availability of critical raw materials.

For example, a barley-producing country such as India, China, and Mexico faces political instability, which could lead to a reduced supply of barley, raising prices and forcing breweries to find alternative sources. This could potentially lead to higher production costs and lower profit margins for breweries worldwide.

Furthermore, geopolitical factors such as economic sanctions, national regulations, and changing trade policies can influence consumer preferences and demand. In some regions, restrictions on alcohol production and consumption, or changes in excise taxes, can result in reduced demand for beer. Conversely, political stability and favorable trade relations can boost beer exports, providing opportunities for growth in international markets.

Regional Analysis

North America Held the Largest Share of the Global Beer Processing Market

In 2024, North America dominated the global beer processing market, accounting for 39.3% of the total market share, driven by evolving consumer preferences and a burgeoning craft beer segment. Traditional beer continues to be the dominant alcoholic beverage in the region, but trends such as health-conscious choices, the demand for lower-calorie, lower-ABV beverages, and the rise of beer-based cocktails and hard seltzers are reshaping the landscape. Breweries are responding to these shifts by diversifying their offerings to meet consumer demands for innovative, lighter options and more complex flavor profiles. This is particularly evident in the increasing popularity of craft beers, where small-scale breweries are leveraging creative brewing techniques and unique ingredients to capture the attention of consumers.

Additionally, changing preferences, the North America beer processing industry is benefiting from technological advancements. Automation in the brewing process and digital tools to monitor and improve efficiency are helping breweries produce higher-quality beer at a lower cost. These technologies also enable companies to maintain consistency, which is crucial in meeting the demands of both large-scale and craft beer consumers. Also, the market has seen an uptick in the demand for specialty beers, including gluten-free, organic, and non-alcoholic options, prompting breweries to invest in new processing methods and ingredients to cater to these niche segments.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

To Maintain Global Dominance, Leading Beer Processing Companies Focus On Innovation, Sustainability, Strategic Acquisitions, And Technological Advancements.

To maintain their dominance at the global level, leading companies in the beer processing market employ various strategies, including innovation, sustainability initiatives, strategic acquisitions, and technological advancements. Companies like Diageo PLC and Heineken focus on investing in cutting-edge brewing technologies, such as automation and AI, to streamline production and enhance efficiency. They also prioritize sustainability by reducing carbon emissions, optimizing water usage, and using eco-friendly packaging to appeal to environmentally-conscious consumers. Through strategic acquisitions and partnerships, these companies expand their product portfolios and market reach, ensuring a presence in emerging markets.

The following are some of the major players in the industry

- Alfa Laval

- Anheuser-Busch InBev

- Asahi Group Holdings, Ltd.

- Carlsberg A/S

- Carlsberg Group

- China Resources Snow Breweries Limited

- Diageo PLC

- Dogfish Head Craft Brewery

- GEA Group

- Heineken N.V.

- Krones

- LEHUI

- Molson Coors Brewing Company

- Ningbo Lehui International Engineering Equipment Co Ltd

- Paul Mueller Company

- Praj Industries

- Sierra Nevada Brewing Co.

- Squatters Pub

- The Boston Beer Company, Inc.

- TSINGTAO BEER

- United Breweries Group

- Yanjing Brewery

Recent Development

- In December 2024 – Geist Brewing Co. plans to boost its production capacity to 500,000 liters per month within three years and increase sales by 30% by FY25. The company is also expanding its product range, including new low-ABV crawler variants.

- In February 2025- Chicago Fire FC and Revolution Brewing renewed their partnership, making Revolution’s Cold Time the Official Craft Beer of the Fire. Cold Time, a premium lager with a 4.8% ABV, will be featured at Fire home matches and events. Revolution will also sponsor the “Cold Time Halftime” segment during games, and collaborate with the club on custom content and fan experiences.

Report Scope

Report Features Description Market Value (2024) USD 109.0 Bn Forecast Revenue (2034) USD 145.1 Bn CAGR (2025-2034) 2.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Brewery Type (Macro Brewery, Microbrewery, Brew Pubs), By Beer Type (Lager, Ale & Stout, Specialty Beer, Low Alcohol Beer), By Raw Material Type (Malt, Hops, Yeast, Water), By Processing Method (Brewing, Fermentation, Maturation, Filtration, Packaging), Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Alfa Laval, Anheuser-Busch InBev, Asahi Group Holdings, Ltd., Carlsberg A/S, Carlsberg Group, China Resources Snow Breweries Limited, Diageo PLC, Dogfish Head Craft Brewery, GEA Group, Heineken N.V., Krones, LEHUI, Molson Coors Brewing Company, Ningbo Lehui International Engineering Equipment Co Ltd, Paul Mueller Company, Praj Industries, Sierra Nevada Brewing Co., Squatters Pub, The Boston Beer Company, Inc., TSINGTAO BEER, United Breweries Group, Yanjing Brewery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alfa Laval

- Anheuser-Busch InBev

- Asahi Group Holdings, Ltd.

- Carlsberg A/S

- Carlsberg Group

- China Resources Snow Breweries Limited

- Diageo PLC

- Dogfish Head Craft Brewery

- GEA Group

- Heineken N.V.

- Krones

- LEHUI

- Molson Coors Brewing Company

- Ningbo Lehui International Engineering Equipment Co Ltd

- Paul Mueller Company

- Praj Industries

- Sierra Nevada Brewing Co.

- Squatters Pub

- The Boston Beer Company, Inc.

- TSINGTAO BEER

- United Breweries Group

- Yanjing Brewery