Global Alcohol to Jet (ATJ) Market By Feedstock (Ethanol, N-butanol, Iso-butanol, Methanol), By Product (Jet fuel, Isooctane), By Process (GTL/FT process, HEFA process Technology, Dehydration, Oligomerization, Hydrogenation), By End-use (Commercial Aircraft, Regional Transport Aircraft, Military Aviation, Business and General Aviation, Unmanned Aerial Vehicles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141633

- Number of Pages: 364

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

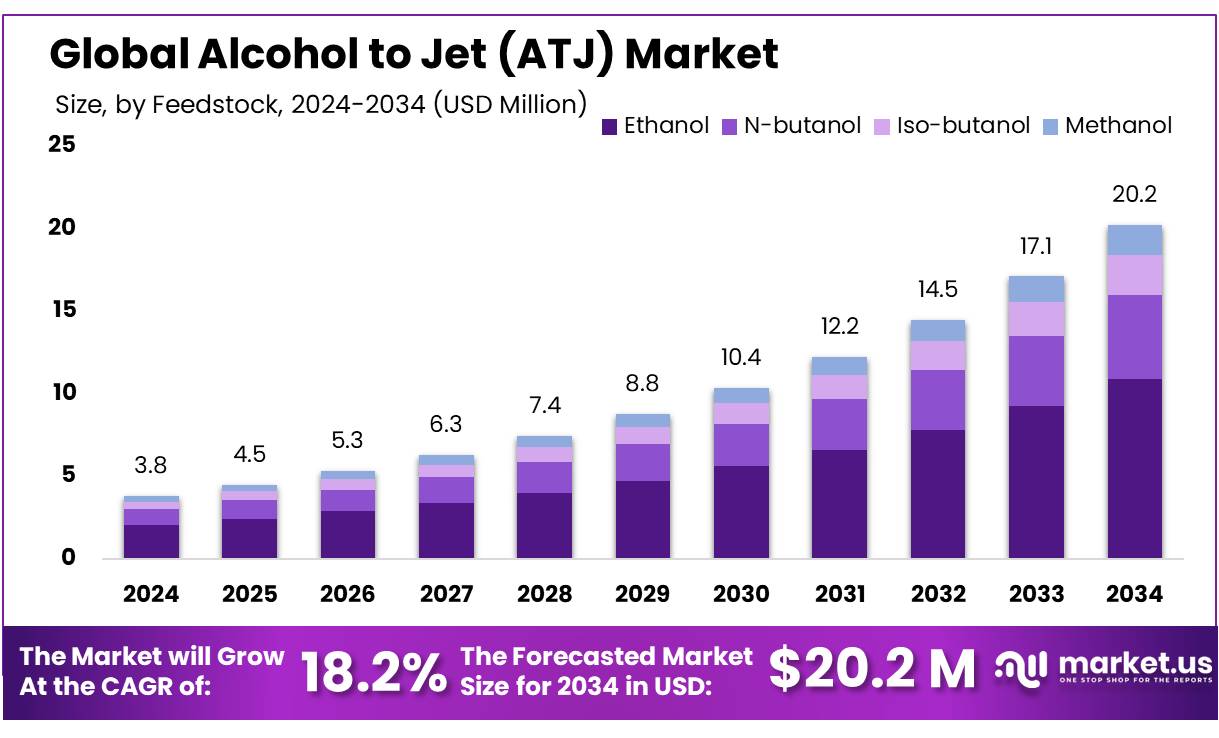

The Global Alcohol to Jet (ATJ) Market size is expected to be worth around USD 20.2 Mn by 2034, from USD 3.8 Mn in 2024, growing at a CAGR of 18.2% during the forecast period from 2025 to 2034.

Alcohol to Jet (ATJ) fuel technology is emerging as a promising solution for creating sustainable aviation fuel from renewable resources. This process involves transforming alcohols such as ethanol, butanol, and methanol into synthetic hydrocarbons that comply with the stringent specifications required for jet fuel. As the aviation industry contributes approximately 2% of global greenhouse gas emissions, ATJ technology aims to mitigate this impact by utilizing diverse alcohol feedstocks including biomass, waste materials, and agricultural residues.

Notably, the U.S. and Brazil alone produce over 60 billion gallons of ethanol annually, primarily from agricultural waste, which significantly surpasses the production volumes of fats and oils used in other Sustainable Aviation Fuel (SAF) processes like HEFA. By converting these agricultural residues into ethanol for ATJ fuel, the process also helps in reducing methane emissions from decomposing crop residues. The shift towards clean energy and the reduction of carbon emissions are key drivers behind the rapid development of the ATJ market.

Key Takeaways

- Alcohol to Jet (ATJ) Market size is expected to be worth around USD 20.2 Mn by 2034, from USD 3.8 Mn in 2024 to grow at a CAGR of 18.2% from 2025 to 2034.

- Ethanol is the leading feedstock due to its availability and cost-effectiveness, capturing over a 54.6% market share in 2024.

- Jet fuel derived from ATJ processes captured an 87.5% market share in 2024, highlighting its crucial role in transitioning to sustainable aviation.

- The HEFA process dominates the conversion technology front, with a 63.5% market share, owing to its efficiency in producing high-quality aviation fuel.

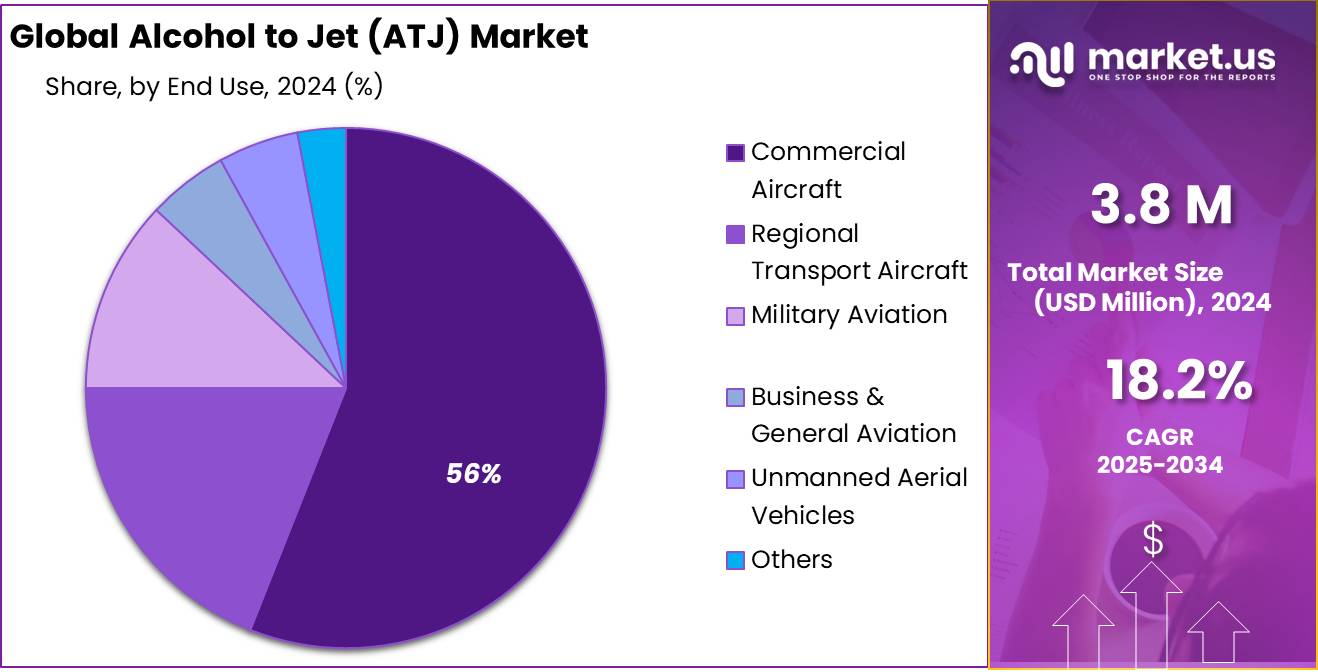

- Commercial aircraft are the primary end-users of ATJ fuels, accounting for 56.8% of the market in 2024.

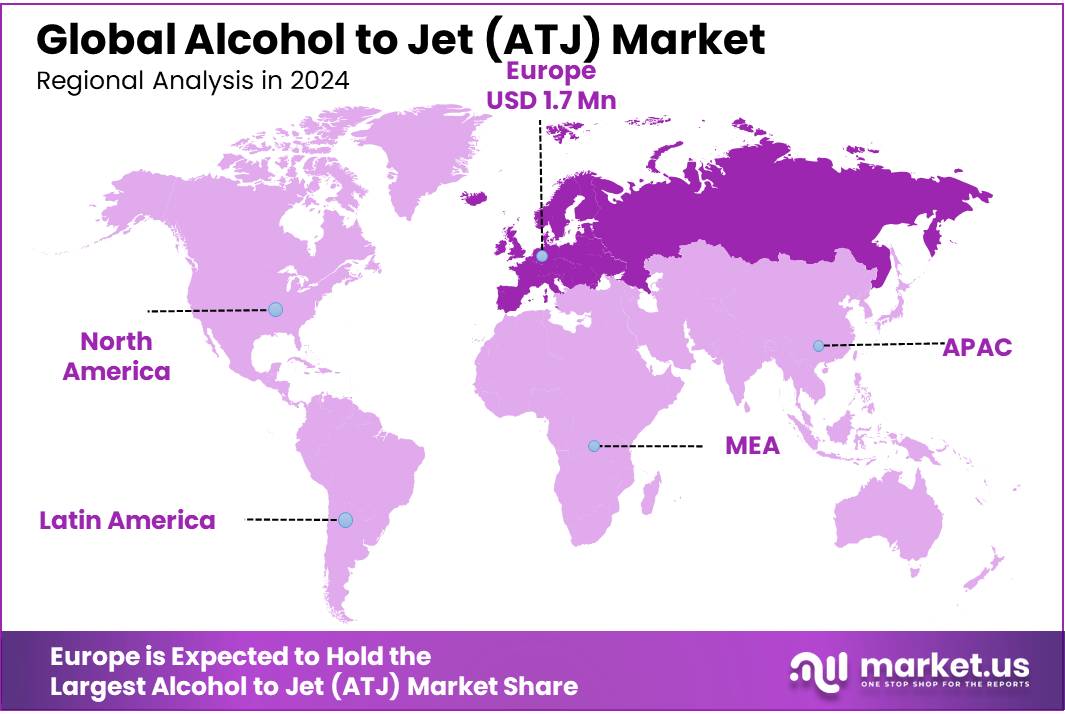

- Europe has established itself as a dominating region, holding a significant market share of 47.3% with an output reaching USD 1.7 million.

By Feedstock

In 2024, ethanol held a dominant market position in the Alcohol to Jet (ATJ) market, capturing more than a 54.6% share. This substantial market share can be attributed to ethanol’s widespread availability and its established supply chain infrastructure. Ethanol, derived primarily from biomass such as sugarcane and corn, has been a preferred feedstock for ATJ fuel production due to its relatively lower cost and high energy efficiency. Moreover, the conversion technology to transform ethanol into jet fuel is well-developed, enhancing its appeal to fuel producers aiming for sustainable aviation solutions.

The reliance on ethanol as a primary feedstock for ATJ is expected to grow further. This growth is driven by increasing regulatory pressures on the aviation industry to reduce carbon emissions and the ongoing global push for more sustainable fuel sources. Additionally, advancements in conversion technologies are expected to improve the yield and cost-efficiency of ethanol-based jet fuel, making it even more attractive to both producers and consumers in the aviation sector.

By Product

In 2024, jet fuel held a dominant market position in the Alcohol to Jet (ATJ) market, capturing more than an 87.5% share. This significant share underscores the critical role jet fuel plays in the aviation industry, particularly in its transition towards sustainable energy sources. Jet fuel derived from ATJ processes is increasingly favored because it integrates seamlessly with existing fuel infrastructure and aircraft technologies, requiring no additional modifications.

The market for ATJ-derived jet fuel is poised for further expansion. This trend is driven by the aviation sector’s ongoing efforts to decrease its carbon footprint and meet international emissions standards. The growing demand is also spurred by the aviation industry’s recovery post-pandemic, with increased flights and fuel usage expected to rise correspondingly.

By Process

In 2024, the HEFA (Hydroprocessed Esters and Fatty Acids) process held a dominant market position in the Alcohol to Jet (ATJ) market, capturing more than a 63.5% share. This prominence is largely due to the HEFA process’s ability to efficiently convert vegetable oils, wastes, and residues into high-quality sustainable aviation fuel. The process benefits from a mature technological base and strong regulatory support, particularly in regions aggressively pursuing carbon reduction targets in aviation.

The HEFA process is expected to maintain its lead in the ATJ market. The ongoing expansion of feedstock availability, including the use of non-food biomass and recycled waste oils, is likely to enhance the HEFA process’s appeal and feasibility. Additionally, improvements in process efficiency and reductions in production costs are anticipated as technology advances and scales up.

By End-use

In 2024, commercial aircraft held a dominant market position in the Alcohol to Jet (ATJ) market, capturing more than a 56.8% share. This substantial market share reflects the growing demand for sustainable fuel options within the commercial aviation sector, driven by increasing environmental awareness and stringent global emissions regulations. The adoption of ATJ fuels by commercial airlines is an essential part of their strategy to reduce carbon footprints and meet sustainability targets.

The ongoing commitment of major airlines to reduce greenhouse gas emissions and the support from international regulatory bodies for sustainable aviation fuels also play crucial roles in driving the adoption of ATJ fuels. This trend underlines the significant and growing impact of sustainable fuel technologies in shaping the future of commercial aviation, positioning ATJ fuels as a key component of the industry’s green transition.

Key Market Segments

By Feedstock

- Ethanol

- N-butanol

- Iso-butanol

- Methanol

By Product

- Jet fuel

- Isooctane

By Process

- GTL/FT process

- HEFA process Technology

- Dehydration

- Oligomerization

- Hydrogenation

By End-use

- Commercial Aircraft

- Regional Transport Aircraft

- Military Aviation

- Business & General Aviation

- Unmanned Aerial Vehicles

- Others

Drivers

Increasing Demand for Sustainable Aviation Fuels

One of the major driving factors for the Alcohol to Jet (ATJ) market is the increasing global demand for sustainable aviation fuels (SAF). This surge is primarily fueled by the aviation industry’s commitment to reducing its carbon footprint. According to the International Air Transport Association (IATA), the industry aims to cut its net carbon emissions in half by 2050 compared to 2005 levels. This ambitious target has significantly propelled the development and adoption of ATJ fuels as a viable alternative to conventional jet fuels.

Government initiatives across the world further strengthen the market for ATJ fuels. For instance, the United States’ Environmental Protection Agency (EPA) supports the Renewable Fuel Standard (RFS) program, which mandates a certain volume of transportation fuel sold in the U.S. to be renewable. This policy directly benefits the ATJ market by encouraging the production and use of renewable fuels, including those derived from alcohol.

Furthermore, the European Union has also been proactive, with its inclusion of aviation fuels in the Renewable Energy Directive (RED II). The directive aims for a 10% renewable energy target in the transport sector by 2020, and this has been extended with more stringent goals set for 2030. Such policies are instrumental in driving the research, development, and deployment of SAFs, including ATJ fuels.

Adding to this momentum are reports from leading food organizations, like the Food and Agriculture Organization (FAO), which note that ethanol, a primary feedstock for ATJ, can be sustainably sourced from various biomass materials without competing with food crops. This alignment of sustainable practices with fuel production not only enhances the appeal of ATJ fuels but also aligns with global sustainability objectives.

Restraints

High Production Costs of ATJ Fuels

One of the significant restraining factors for the growth of the Alcohol to Jet (ATJ) market is the high cost of production associated with these fuels. Despite the environmental benefits and the growing demand for sustainable aviation fuels (SAF), the economic aspects present substantial challenges. Producing ATJ fuels involves complex chemical processes, including the dehydration of ethanol to ethylene and subsequent oligomerization, which require substantial energy inputs and sophisticated technology.

According to the International Renewable Energy Agency (IRENA), the production cost of ATJ fuels is currently higher than that of conventional jet fuels. This is primarily due to the advanced technology needed for the conversion processes and the scale of production, which has not yet reached the level of economic feasibility seen in other energy sectors. The high cost of initial setup and operation can deter new entrants and limit the expansion of existing producers.

Government initiatives aimed at subsidizing renewable energy technologies have helped but are often insufficient to bridge the gap in production costs. For example, the U.S. Department of Energy has funded several projects under its Bioenergy Technologies Office to reduce costs and improve efficiencies in biofuel production, yet the price parity with fossil fuels remains a distant goal.

Moreover, the sustainability of feedstock supply is another cost-related concern. While organizations like the Food and Agriculture Organization (FAO) advocate for the use of non-food biomass for ethanol production to avoid competition with food supply, the logistics of sourcing and transporting these materials can further add to the costs, complicating the economic landscape for ATJ fuels.

Opportunity

Expansion into Emerging Markets: A Growth Opportunity for ATJ Fuels

A major growth opportunity for the Alcohol to Jet (ATJ) market lies in expanding into emerging markets, particularly in Asia and Africa, where aviation sectors are experiencing rapid growth. As these regions witness increased air travel driven by economic growth, urbanization, and rising middle-class populations, the demand for sustainable aviation fuels (SAF) offers a significant market potential for ATJ fuels.

Governments in these regions are beginning to implement policies that encourage the adoption of greener technologies. For instance, India’s Biofuel Policy aims to increase the usage of biofuels in the transportation sector, setting a target to blend 20% ethanol with petrol by 2030. Such initiatives provide a conducive environment for ATJ technologies by fostering a supportive regulatory framework and potentially offering financial incentives for sustainable fuel production.

Moreover, according to the International Air Transport Association (IATA), the Asia-Pacific region is expected to become the biggest market for air travel over the next two decades, with more than half of the new passenger traffic globally. This surge in air travel creates a substantial opportunity for the deployment of ATJ fuels to meet new demands for sustainability in aviation, aligning with global emission reduction goals.

Additionally, the availability of feedstocks for producing ethanol—a primary input for ATJ fuel—in these regions is abundant, especially with agricultural residues and non-food biomass, which can be utilized without impinging on food security. This aspect is crucial in maintaining the sustainability of the ATJ production chain and is supported by organizations like the Food and Agriculture Organization (FAO), which promotes the use of agricultural waste for bioenergy without competing with food crops.

Trends

Integration of Renewable Energy in ATJ Production Processes

A significant trend in the Alcohol to Jet (ATJ) market is the increasing integration of renewable energy sources into the production processes of ATJ fuels. This shift is driven by the dual goals of enhancing sustainability and reducing the carbon footprint of biofuel production. As the global focus on climate change intensifies, the use of renewable energy in the manufacturing of sustainable aviation fuel (SAF) is becoming a critical factor in the industry’s sustainability initiatives.

Governments worldwide are supporting this trend through various initiatives. For instance, the European Union’s Renewable Energy Directive (RED II) mandates a substantial increase in the use of renewable energy across all sectors, including biofuel production. This policy encourages ATJ fuel producers to adopt greener technologies and processes that minimize environmental impact.

Additionally, leading food and agriculture organizations highlight the potential of using renewable energy to power biofuel production facilities. According to the Food and Agriculture Organization (FAO), integrating solar, wind, or hydropower with biofuel production not only reduces greenhouse gas emissions but also enhances the energy security of the production process, making it less dependent on fossil fuels.

The trend towards renewable energy use in ATJ production is further supported by technological advancements that allow better integration of these energy sources into existing infrastructure. For example, solar thermal systems can provide the necessary heat for chemical processes involved in converting ethanol to jet fuel, thereby reducing the reliance on traditional energy sources.

Regional Analysis

In the Alcohol to Jet (ATJ) market, Europe has established itself as a dominating region, holding a significant market share of 47.3% with an output reaching USD 1.7 million. This leadership is underpinned by a combination of stringent environmental regulations, a strong push towards achieving carbon neutrality, and the presence of advanced technological infrastructure. European nations have been at the forefront of integrating sustainability into their aviation sectors, supported by policies such as the European Green Deal and the inclusion of aviation fuels in the Renewable Energy Directive (RED II). These regulations mandate a substantial increase in the use of renewable energy sources, including sustainable aviation fuels.

The European ATJ market is further bolstered by extensive research and development initiatives led by both governmental and private entities aiming to reduce the carbon footprint of aviation fuels. For instance, significant investments have been made in developing and scaling up innovative technologies that convert alcohol to jet fuel efficiently and sustainably. Europe’s focus on circular economy principles also supports the utilization of local biomass and recycled waste materials as feedstocks, aligning with broader environmental goals.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Air bp: Air bp, a division of BP specializing in aviation fuels, is actively involved in the Alcohol to Jet (ATJ) market. They focus on developing and supplying sustainable aviation fuels, including ATJ, to help meet the aviation industry’s carbon reduction goals. Air bp’s commitment is evident in their investments in biorefineries and partnerships with technology developers to enhance ATJ fuel availability and commercialization.

British Airways: British Airways is pioneering efforts in the ATJ market by integrating sustainable aviation fuels into its operations. The airline is committed to reducing its carbon emissions and has participated in several initiatives and partnerships to promote the use of ATJ fuels. Their proactive approach aims to transform the environmental impact of their flights, emphasizing cleaner, renewable sources of energy.

Delta Air Lines: Delta Air Lines has embraced the ATJ market by investing in sustainable aviation fuels to decrease its environmental footprint. Delta’s strategy includes forming alliances with biofuel producers and investing in technology to increase the efficiency and availability of ATJ fuels in its daily operations, aiming to lead by example in the aviation sector’s transition to sustainability.

ExxonMobil: ExxonMobil, one of the world’s largest publicly traded oil and gas companies, is extending its energy expertise into the ATJ market. The company focuses on researching and developing scalable renewable energy sources, including ATJ fuels. Their involvement includes collaborations with biotech firms to engineer more efficient pathways for converting alcohol into jet fuel, contributing to the broader adoption of sustainable aviation fuels.

Top Key Players

- Air bp

- British Airways

- Delta Air Lines

- ExxonMobil

- Fulcrum BioEnergy

- Gevo Inc

- Honeywell

- KBR, Inc.

- KLM

- Lanxess

- Lanza Tech

- Lufthansa

- Masdar

- Neste

- Qantas

- SkyNRG

- Sustainable Aviation Fuel

- Thyssenkrupp

- Total

- Total Energies

- United Airlines

- World Energy

Recent Developments

British Airways aims to integrate ATJ fuels into its operations, starting with SAF deliveries from LanzaJet’s commercial-scale plant in Georgia, USA.

Delta plans to acquire a substantial volume of sustainable aviation fuel (SAF)—specifically, 525 million gallons over a seven-year period—from Colorado-based renewable energy group Gevo. This move is aimed at increasing the airline’s SAF usage to support 10% of its flights by 2030.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Mn Forecast Revenue (2034) USD 20.2 Mn CAGR (2025-2034) 18.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Feedstock (Ethanol, N-butanol, Iso-butanol, Methanol), By Product (Jet fuel, Isooctane), By Process (GTL/FT process, HEFA process Technology, Dehydration, Oligomerization, Hydrogenation), By End-use (Commercial Aircraft, Regional Transport Aircraft, Military Aviation, Business and General Aviation, Unmanned Aerial Vehicles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air bp, British Airways, Delta Air Lines, ExxonMobil , Fulcrum BioEnergy, Gevo Inc , Honeywell , KBR, Inc. , KLM, Lanxess, Lanza Tech , Lufthansa, Masdar , Neste, Qantas, SkyNRG , Sustainable Aviation Fuel, Thyssenkrupp , Total, Total Energies , United Airlines, World Energy Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alcohol to Jet (ATJ) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Alcohol to Jet (ATJ) MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Air bp

- British Airways

- Delta Air Lines

- ExxonMobil

- Fulcrum BioEnergy

- Gevo Inc

- Honeywell

- KBR, Inc.

- KLM

- Lanxess

- Lanza Tech

- Lufthansa

- Masdar

- Neste

- Qantas

- SkyNRG

- Sustainable Aviation Fuel

- Thyssenkrupp

- Total

- Total Energies

- United Airlines

- World Energy