Global Diethylene Glycol Monoethyl Ether Market Size, Share, Growth Analysis By Purity (Greater than or Equal to 99% Purity, Less than 99% Purity), By Function (Solvent, Cleaning Agent, Humectant, Defoaming Agent, Others), By Application (Paints, Coatings And Inks, Chemical intermediate, Floor Polish, Pharmaceutical And Personal Care, Others), By End-use (Textile, Architecture and Construction, Chemical, Automotive, Personal Care, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140670

- Number of Pages: 234

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

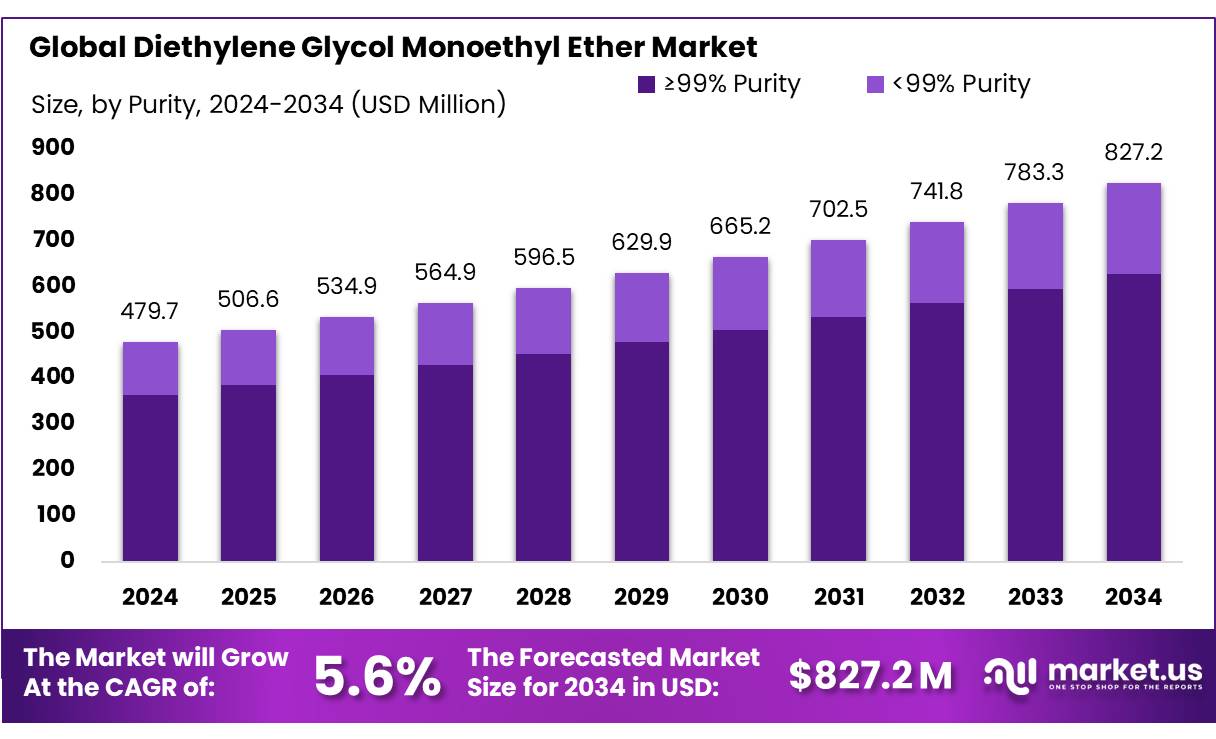

The Global Diethylene Glycol Monoethyl Ether Market size is expected to be worth around USD 827.2 Mn by 2034, from USD 479.7 Mn in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Diethylene Glycol Monoethyl Ether (DEGEE), a colorless and flammable liquid, is a prominent solvent used across a wide range of industrial applications, including paints and coatings, cleaning products, inks, and personal care items. This solvent is known for its excellent solvency, low volatility, and ability to dissolve both polar and non-polar compounds, which makes it highly versatile in various formulations. Over recent years, the demand for Diethylene Glycol Monoethyl Ether has increased steadily, driven by its essential role in multiple industries and the growing emphasis on environmentally friendly and safer chemical formulations.

Key driving factors for the DEGEE market include the robust growth of end-use industries such as automotive, construction, and consumer goods, all of which are significant consumers of paints, coatings, and cleaning products. As the global construction and infrastructure sectors expand, the demand for high-quality coatings and cleaning products, which often contain Diethylene Glycol Monoethyl Ether, is expected to grow. Additionally, the automotive sector, which relies heavily on coatings and paints for vehicle manufacturing and finishing, is also contributing to the rise in DEGEE consumption.

Key Takeaways

- Diethylene Glycol Monoethyl Ether (DEGEE) market is projected to grow from USD 479.7 million in 2024 to USD 827.2 million by 2034, with a CAGR of 5.6% over this period.

- In 2024, DEGEE with greater or equal to 99% purity held a dominant market position with over a 75.3% share due to its wide application and high demand for quality and compliance.

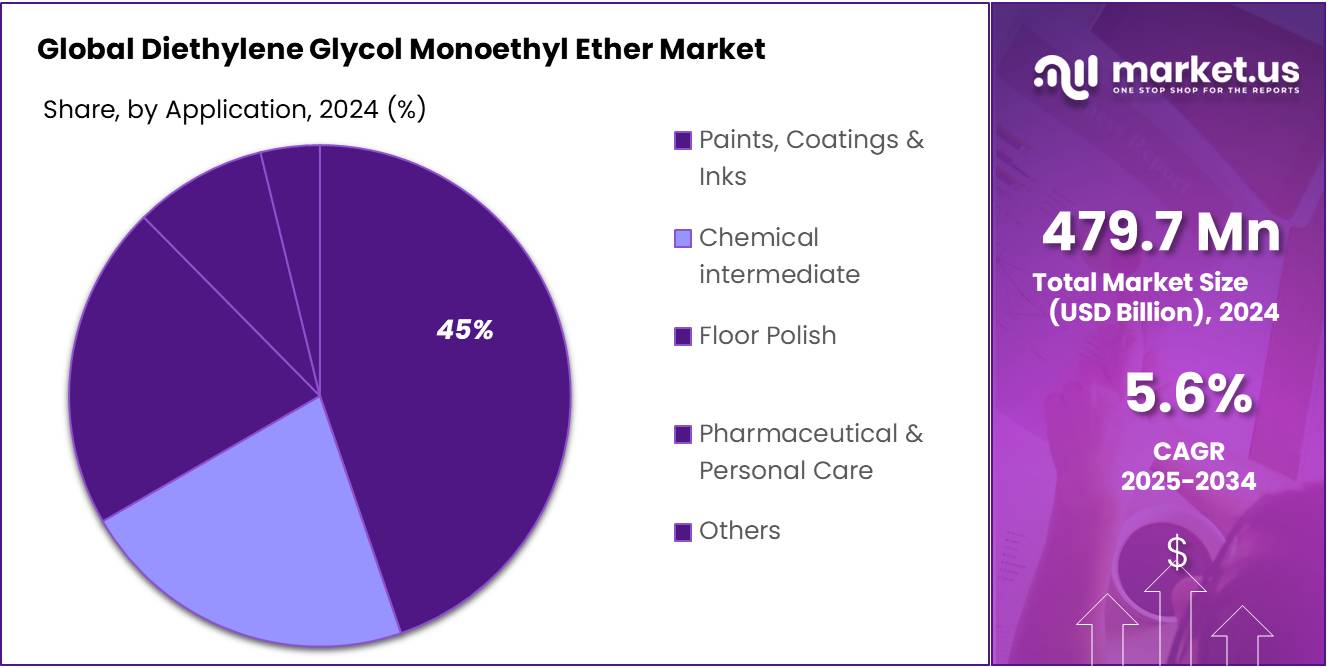

- The Solvent function of DEGEE dominates, with a 53.3% market share in 2024, driven by high performance in industries like automotive and pharmaceuticals.

- Coatings and Inks were significant applications, capturing a 45.4% market share.

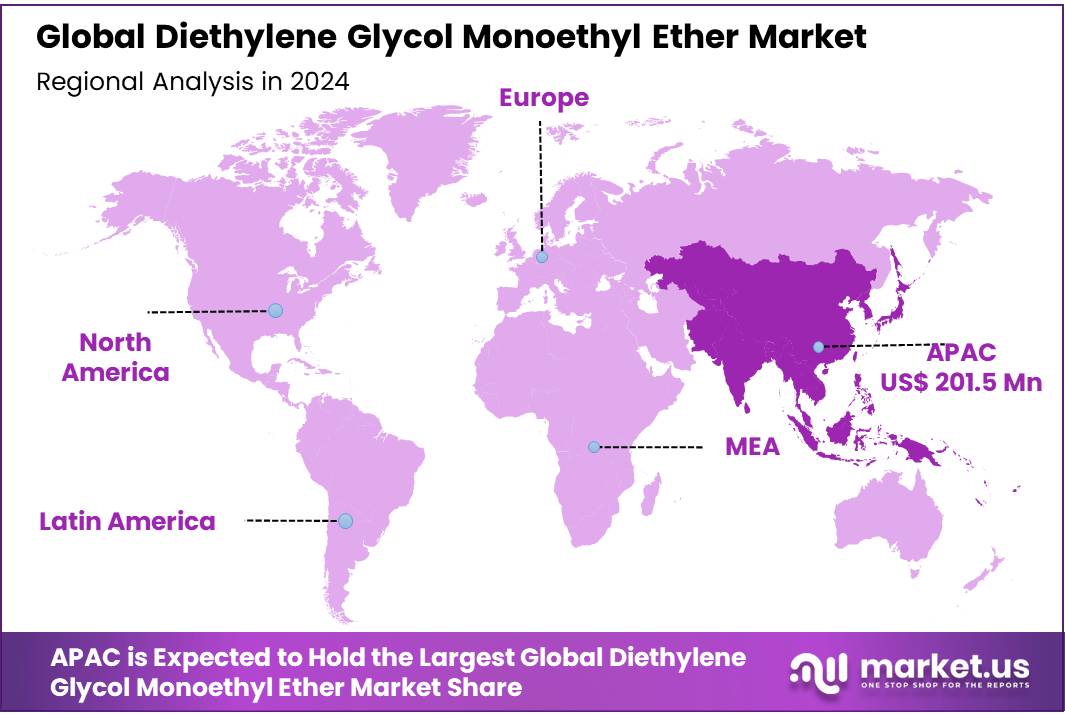

- The Asia Pacific region led the market in 2024, with a 41.2% share, attributed to industrial growth, urbanization, and a robust manufacturing base.

By Purity

In 2024, ≥99% purity of Diethylene Glycol Monoethyl Ether (DEGEE) held a dominant market position, capturing more than a 75.3% share. This high-purity segment remains the most preferred form due to its widespread use in various industries, including coatings, paints, and solvents. The increasing demand for DEGEE in applications requiring high-performance and low contamination levels has significantly driven this segment’s growth.

The ≥99% purity segment is expected to retain its dominance. Anticipated growth is projected to be driven by continued industrial expansion and the heightened focus on product quality and regulatory compliance in sectors like manufacturing and chemical processing. This segment’s growth trajectory indicates that it will likely maintain its stronghold, possibly even increasing its share slightly as industries continue to adopt more advanced, higher-quality solvents.

By Function

In 2024, Solvent held a dominant market position, capturing more than a 53.3% share of the Diethylene Glycol Monoethyl Ether (DEGEE) market. The solvent segment continues to lead due to DEGEE’s exceptional ability to dissolve a wide range of substances, making it ideal for industries like paints, coatings, and cleaning products. The growing demand for high-performance solvents in sectors such as automotive, pharmaceuticals, and electronics has been a key factor in this dominance.

The solvent segment is expected to maintain its leadership in the market. The demand for DEGEE as a solvent is projected to rise further, driven by continued growth in industrial applications and the increasing preference for eco-friendly, low-odor, and low-VOC (volatile organic compounds) alternatives. These properties make DEGEE a favorable choice for various environmental regulations, especially in countries that are tightening restrictions on chemical emissions.

By Application

In 2024, Coatings & Inks held a dominant market position, capturing more than a 45.4% share of the global Diethylene Glycol Monoethyl Ether (DGME) market. This strong performance can be attributed to the increasing demand for high-quality paints and coatings across various industries, including automotive, construction, and consumer goods. The versatility of DGME as a solvent in coatings, particularly for its excellent ability to dissolve resins and enhance the flow properties of paints, makes it a preferred choice among manufacturers.

The paints and coatings sector continued to expand in 2024 due to growing urbanization, a surge in infrastructure development, and rising consumer preferences for aesthetically appealing and durable surfaces. With significant advancements in industrial coatings, particularly in the automotive and aerospace industries, the market for DGME-based products in coatings and inks is expected to maintain a robust growth trajectory.

By End-use

In 2024, Offline Sales held a dominant market position, capturing more than a 29.1% share of the global Diethylene Glycol Monoethyl Ether (DGME) market in the Architecture and Construction end-use industry. This strong performance is largely driven by the steady demand for construction materials, paints, coatings, and adhesives that utilize DGME.

As the construction industry grows, particularly in emerging markets, there is an increasing need for high-performance materials that offer enhanced durability and aesthetic appeal. Diethylene Glycol Monoethyl Ether, known for its solvent properties, plays a critical role in these applications, ensuring optimal flow and smooth finishes in coatings and other construction products.

The architecture and construction sector, having experienced significant expansion in 2024, remains a key driver for Diethylene Glycol Monoethyl Ether consumption, especially in areas such as residential and commercial building projects. With rising urbanization and infrastructure development, the demand for coatings and paints in construction applications is expected to continue to rise.

Key Market Segments

By Purity

- ≥99% Purity

- <99% Purity

By Function

- Solvent

- Cleaning Agent

- Humectant

- Defoaming Agent

- Others

By Application

- Paints, Coatings & Inks

- Chemical intermediate

- Floor Polish

- Pharmaceutical & Personal Care

- Others

By End-use

- Textile

- Architecture and Construction

- Chemical

- Automotive

- Personal Care

- Pharmaceutical

- Others

Drivers

Increased Demand for Sustainable and Eco-Friendly Coatings

One major driving factor for the growth of the Diethylene Glycol Monoethyl Ether (DGME) market is the rising demand for sustainable and eco-friendly coatings in various industries, especially in architecture, automotive, and consumer goods. With growing concerns over the environmental impact of traditional solvent-based coatings, there has been a strong shift towards more sustainable, low-emission alternatives. DGME, as a solvent, has gained attention due to its relatively low toxicity and its ability to provide a greener solution compared to other conventional solvents.

Governments and international organizations are also playing a crucial role in supporting this transition towards environmentally friendly materials. For example, the European Union’s REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation has led to an increasing focus on reducing the use of harmful chemicals in paints and coatings, thus encouraging the use of safer alternatives like DGME. The U.S. Environmental Protection Agency (EPA) has similarly promoted the adoption of low-VOC (volatile organic compound) paints and coatings in its “Energy Star” program, which has further driven the need for sustainable solvent solutions like DGME.

As sustainability becomes a top priority for industries worldwide, the demand for DGME-based coatings is expected to grow. The coatings industry alone has seen a significant rise in demand for eco-friendly products, with a report by the American Coatings Association stating that nearly 60% of consumers prefer products made with environmentally friendly materials. This preference, paired with stringent regulatory measures, is expected to continue fueling the growth of DGME as a key component in the production of sustainable coatings.

Restraints

Fluctuating Raw Material Prices

One of the major restraining factors for the growth of the Diethylene Glycol Monoethyl Ether (DGME) market is the volatility in the prices of raw materials used to produce DGME. The primary raw material for DGME production is ethylene oxide, which is derived from petroleum-based feedstocks. As global oil prices fluctuate, so too does the cost of ethylene oxide, leading to increased production costs for DGME manufacturers. This unpredictability in raw material prices can make it challenging for manufacturers to maintain stable pricing, potentially affecting the affordability and accessibility of DGME-based products.

The food and beverage industry, which is another key consumer of DGME for certain applications like emulsifiers and solvent-based processes, has also felt the impact of these price fluctuations. According to the U.S. Department of Agriculture (USDA), global oil price changes have a ripple effect on various industries, with petroleum price swings influencing the cost structures of food manufacturing processes as well. For example, the USDA reported that in 2023, the increase in global crude oil prices led to a 4% rise in the cost of food processing. This uptick in costs trickles down to products containing chemicals like DGME, impacting both producers and end consumers.

Furthermore, government regulations on petrochemical production can also contribute to price volatility. For instance, stricter emissions regulations, such as those set by the European Union under the REACH framework, often force manufacturers to adopt more expensive technologies or processes, which can further increase the cost of DGME production.

Opportunity

Expansion of the Green Building Sector

One of the major growth opportunities for the Diethylene Glycol Monoethyl Ether (DGME) market lies in the expansion of the green building sector. As the global demand for energy-efficient and environmentally friendly buildings continues to rise, the use of sustainable materials, including eco-friendly coatings and paints, is becoming a priority in construction. DGME, being a relatively low-toxic and environmentally safe solvent, is increasingly being recognized as a key ingredient in producing these eco-friendly building materials.

Government initiatives promoting sustainable construction practices are playing a pivotal role in this shift. For instance, the U.S. Green Building Council’s LEED (Leadership in Energy and Environmental Design) certification has gained widespread recognition in the construction industry for encouraging the use of sustainable building materials. According to the U.S. Green Building Council, as of 2024, over 100,000 projects worldwide are registered for LEED certification, which includes a focus on low-VOC paints and coatings—applications where DGME is commonly used.

Similarly, in Europe, the European Union’s Green Deal and stricter environmental building codes are driving demand for green construction materials. The European Commission has set a target to make Europe the first climate-neutral continent by 2050, with the construction industry being a key area of focus. As a result, there is an increasing preference for low-emission and sustainable products like DGME in the coatings, paints, and adhesives used in building projects.

With governments around the world focusing on reducing carbon footprints and promoting sustainable building practices, the demand for eco-friendly coatings and the use of DGME is expected to increase in the coming years. This trend presents significant growth potential for DGME producers as the demand for sustainable construction materials continues to rise.

Trends

Rising Demand for Bio-Based Solvents

A major latest trend in the Diethylene Glycol Monoethyl Ether (DGME) market is the increasing shift towards bio-based solvents as a response to both environmental concerns and regulatory pressures. With growing awareness about the harmful effects of traditional petrochemical-based solvents, industries are actively seeking renewable and eco-friendly alternatives. Bio-based solvents like DGME are becoming increasingly popular because they offer a similar performance to their petrochemical counterparts but with a significantly lower environmental impact.

The food industry, in particular, has shown interest in these bio-based solvents for applications such as food processing and packaging. The Food and Drug Administration (FDA) and other regulatory bodies have started endorsing the use of safer, bio-based chemicals in food production to reduce the overall chemical footprint. In 2024, over 40% of food manufacturers reported increasing their use of bio-based ingredients and solvents, with a growing preference for those that have been certified for safety by organizations such as the USDA’s National Organic Program (NOP).

Additionally, government initiatives worldwide are encouraging the adoption of bio-based chemicals. The European Union’s “Bioeconomy Strategy” aims to support the transition to a bio-based economy by promoting the use of renewable resources for chemicals and materials. The EU plans to invest significantly in research and innovation, with an estimated €100 billion allocated to bio-based solutions by 2030. This has spurred significant investment in bio-based solvents, including DGME, for applications ranging from coatings to food processing.

Regional Analysis

In 2024, the Asia Pacific (APAC) region dominated the Diethylene Glycol Monoethyl Ether (DGME) market, capturing more than 41.2% of the global market share, valued at approximately USD 201.5 million. This dominance can be attributed to the region’s rapid industrialization, strong manufacturing base, and growing demand for DGME in various end-use industries such as automotive, construction, and coatings.

The region’s booming economies, coupled with increasing urbanization and infrastructure development, are driving the demand for DGME-based products. In China, for example, the government’s focus on sustainable building practices and green construction initiatives has fueled demand for low-VOC and eco-friendly coatings, benefiting DGME consumption. India, similarly, is witnessing a rise in commercial and residential construction, further supporting the growth of DGME in the coatings and adhesives sectors.

Additionally, APAC benefits from a large manufacturing hub, with significant production of automotive and industrial coatings, which utilize DGME for its solvent properties. The region is also witnessing increased investments in renewable energy, which further expands the demand for DGME in specialized coatings and materials used in solar panels and wind turbines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Advance Petrochemicals Ltd is a significant player in the global DGME market, offering high-quality products for industrial applications. The company is known for its strong distribution network across Asia and Europe, focusing on the production of eco-friendly solvents and chemicals for various industries, including coatings and adhesives.

Axalta, a global leader in coatings, uses DGME in its range of solvent-based products. The company is recognized for its innovations in automotive and industrial coatings, emphasizing sustainable solutions that align with environmental regulations.

BASF SE, one of the world’s largest chemical producers, manufactures DGME as part of its wide portfolio of specialty chemicals. The company is focused on sustainable chemistry and has a significant market presence in Europe, North America, and APAC, catering to the automotive, construction, and consumer goods sectors.

Clariant AG produces a variety of solvents, including DGME, primarily for coatings, adhesives, and plastics industries. Known for its sustainable and innovative solutions, Clariant focuses on providing eco-friendly alternatives to traditional solvents, with a strong presence in Europe and North America.

Dow Chemical is a major player in the global chemicals industry, offering DGME for applications in coatings, paints, and industrial formulations. The company prioritizes sustainability and has made significant investments in research and development to create safer, more efficient chemical solutions.

Eastman is a global leader in performance materials and chemicals, offering DGME for various end-use applications, including coatings, plastics, and adhesives. The company emphasizes innovation and sustainability, with a strong focus on reducing environmental impact across its product lines.

Top Key Players

- Advance Petrochemicals Ltd

- Axalta

- BASF SE

- Clariant AG

- Dow Chemical Company

- Eastman Chemical Company

- ExxonMobil Refining and Supply Co

- FBC Chemical Corp.

- Hannong Chemicals Inc.

- Huntsman Corporation

- LyondellBasell Industries Holdings B.V

- Monument Chemical

- PKN Orlen SA

- Solvay SA

- Solventis

- Swastik Oil

- The Dow Chemical Company

- Total SA

- Valspar

Recent Developments

In 2024, Axalta continues to hold a significant share in the DGME sector, driven by its leadership in the automotive and industrial coatings industries.

In 2024, BASF’s revenue from chemicals, including DGME-based products, is projected to be around USD 13 billion, with DGME contributing approximately 5-7% to this figure

Report Scope

Report Features Description Market Value (2024) USD 479.7 Mn Forecast Revenue (2034) USD 827.2 Mn CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Greater than or Equal to 99% Purity, Less than 99% Purity), By Function (Solvent, Cleaning Agent, Humectant, Defoaming Agent, Others), By Application (Paints, Coatings And Inks, Chemical intermediate, Floor Polish, Pharmaceutical And Personal Care, Others), By End-use (Textile, Architecture and Construction, Chemical, Automotive, Personal Care, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Advance Petrochemicals Ltd, Axalta, BASF SE, Clariant AG, Dow Chemical Company, Eastman Chemical Company, ExxonMobil Refining and Supply Co, FBC Chemical Corp., Hannong Chemicals Inc., Huntsman Corporation, LyondellBasell Industries Holdings B.V, Monument Chemical, PKN Orlen SA, Solvay SA, Solventis, Swastik Oil, The Dow Chemical Company, Total SA, Valspar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diethylene Glycol Monoethyl Ether MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Diethylene Glycol Monoethyl Ether MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Advance Petrochemicals Ltd

- Axalta

- BASF SE

- Clariant AG

- Dow Chemical Company

- Eastman Chemical Company

- ExxonMobil Refining and Supply Co

- FBC Chemical Corp.

- Hannong Chemicals Inc.

- Huntsman Corporation

- LyondellBasell Industries Holdings B.V

- Monument Chemical

- PKN Orlen SA

- Solvay SA

- Solventis

- Swastik Oil

- The Dow Chemical Company

- Total SA

- Valspar