Global Trans-2,6-Dimethylmorpholine Market By Purity (Up to 97% and above 97%), By Application (Pharmaceutical, Agrochemicals, Electronic Chemical, And Material Science), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140857

- Number of Pages: 278

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

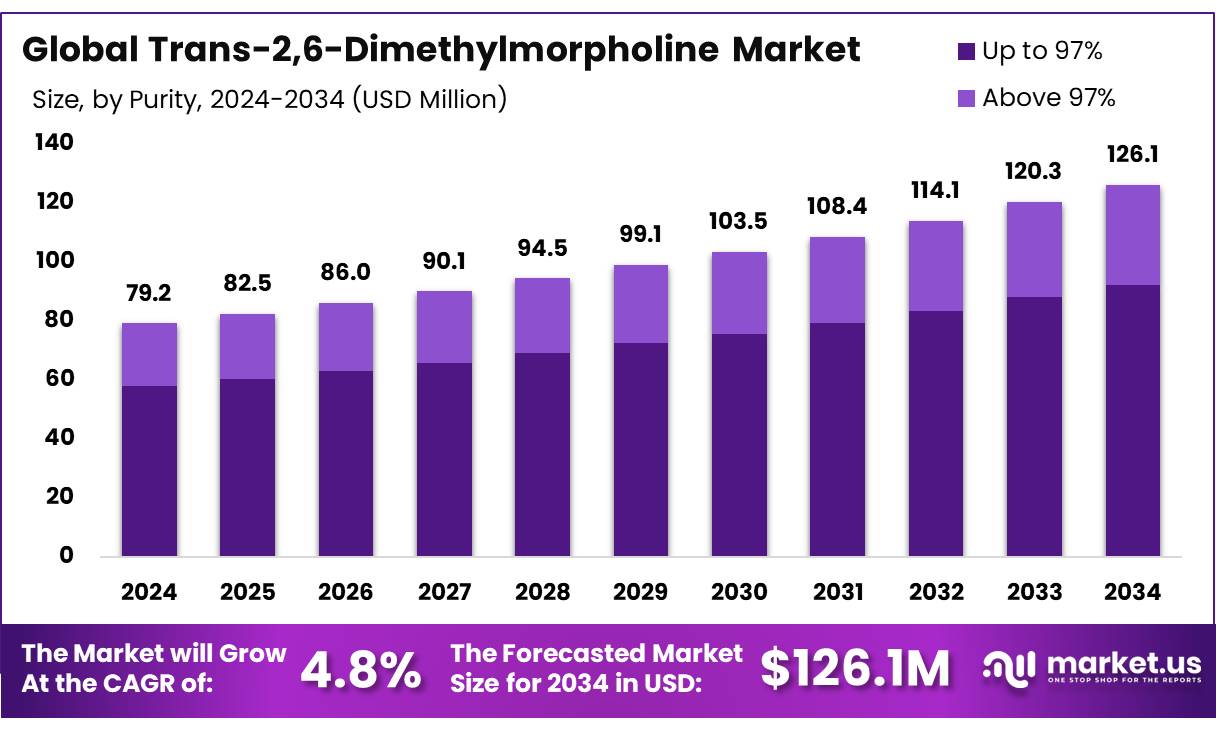

The Global Trans-2,6-Dimethylmorpholine Market size is expected to be worth around USD 126.1 Million by 2034, from USD 79.2 Million in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Trans-2, 6-Dimethylmorpholine Market, a key enantiomer of morpholine, plays an important role in the manufacturing of pharmaceutical formulations and chemical synthesis. Known for their efficiency and selectivity, they enhance drug design by targeting enantiomer-specific sensitivities, such as pH, temperature, and solvent type, improving the precision and effectiveness of pharmaceutical processes.

The (2S, 6S)-enantiomer of these compounds is optically pure, and widely used in reactions such as epoxidase catalysis and exhibits superior catalytic activity under varying conditions. Besides their pharmaceutical applications, trans-2, 6-dimethylmorpholine also serve as an effective chiral auxiliary for separating racemic mixtures and are integral to analytical processes such as chromatography. Its versatility makes it a vital component in pharmaceutical development, chemical synthesis, and analytical research, positioning it as a key player in these industries.

The global trans-2, 6-dimethylmorpholine market is experiencing steady growth, driven by its versatile applications across industries such as agrochemicals, pharmaceuticals, and material science. Trans-2, 6-dimethylmorpholine is a critical chemical intermediate and reagent valued for its unique structural properties, which include stability, solubility, and reactivity. These characteristics make them the preferred choice in the synthesis of complex organic compounds, boosting their demand in various industrial and research applications.

Key Takeaways

- The global Trans-2,6-Dimethylmorpholine market was valued at US$ 79.2 Million in 2024.

- The global Trans-2,6-Dimethylmorpholine market is projected to grow at a CAGR of 12.8% and is estimated to reach US$ 126.1 Million by 2034.

- Among purities, up to 97% accounted for the largest market share at 73.2%.

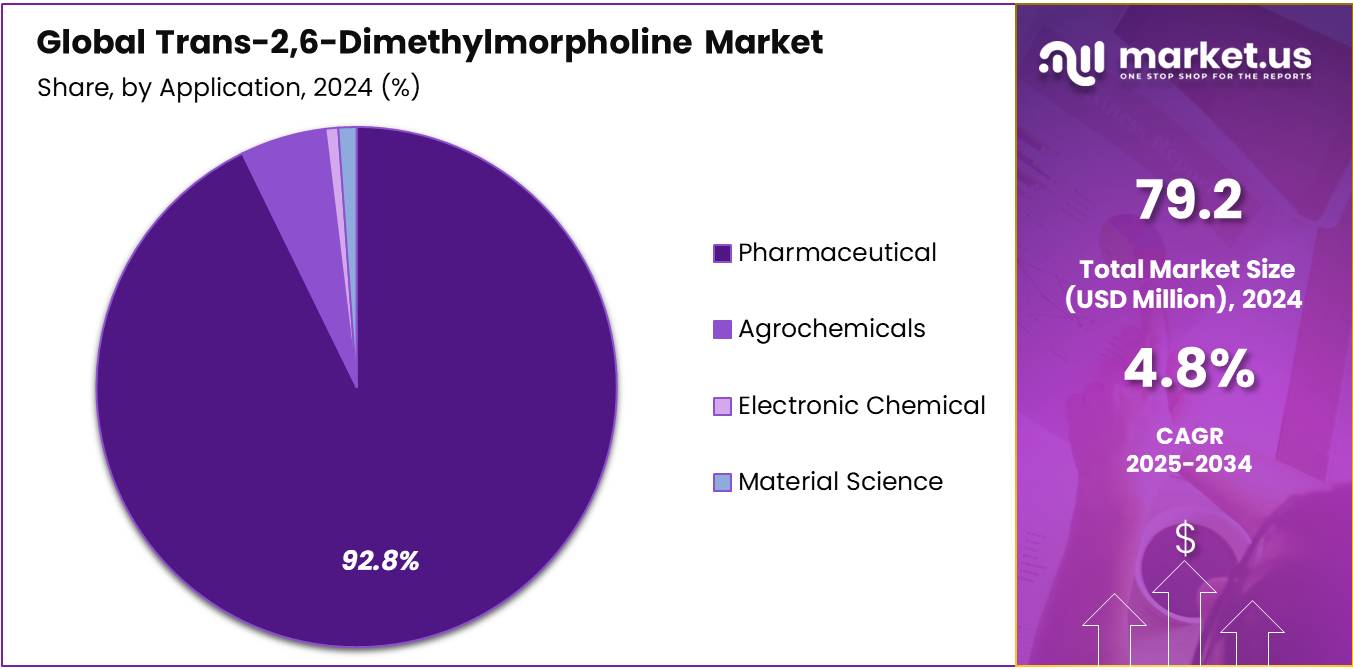

- Among applications, pharmaceuticals accounted for the majority of the market share at 92.8%.

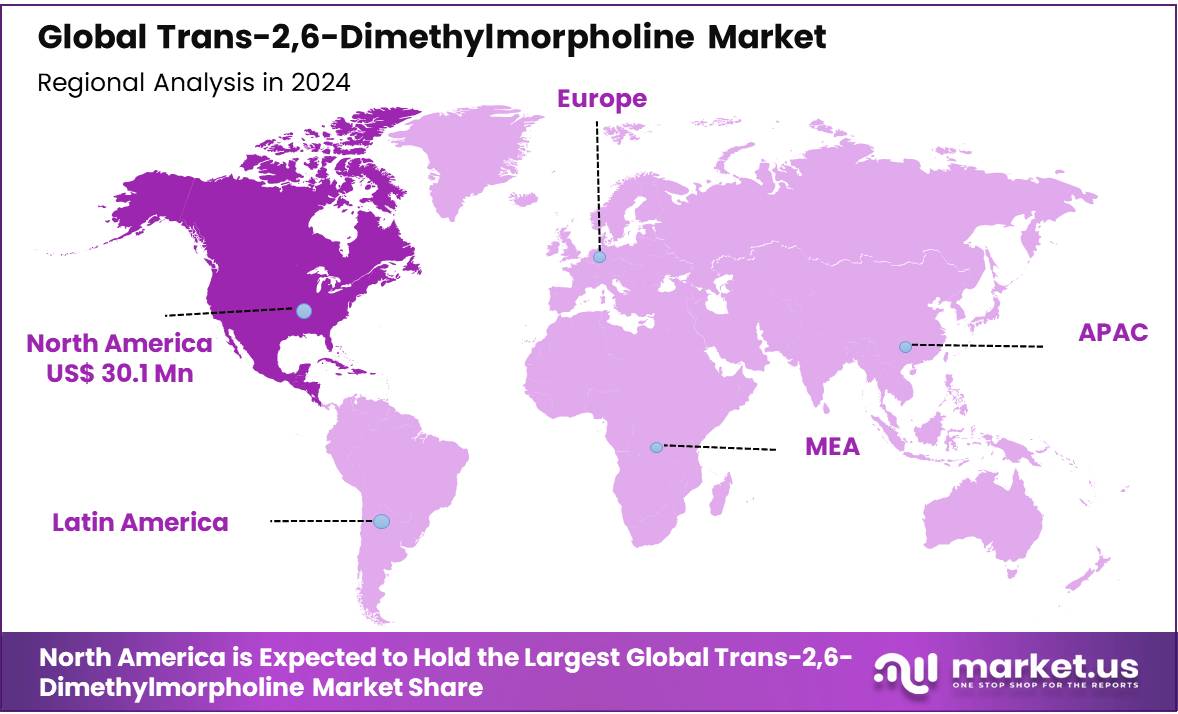

- North America is estimated as the largest market for Trans-2,6-Dimethylmorpholine with a share of 38.1% of the market share.

- Asia-Pacific is anticipated to register the highest CAGR of 5.3%.

- Europe with a revenue share of 36.2% in 2024 and expected to register a CAGR of 4.9%.

Purity Analysis

Up to 97% Pure Trans-2,6-Dimethylmorpholines Dominated the Market, Owing to Their Widespread Industrial Applications

The Trans-2,6-Dimethylmorpholine market is segmented based on up to 97% and above 97%. In 2024, the Trans-2,6-Dimethylmorpholine (TDM) market segment with up to 97% purity held a significant revenue share of 73.2%, primarily due to its widespread industrial applications and cost-effectiveness. TDM with up to 97% purity is widely used in chemical synthesis, polymer production, agrochemicals, and coatings, where ultra-high purity is not a critical requirement. This segment benefits from high demand across diverse industrial sectors, particularly in the manufacturing of intermediates for pharmaceuticals, pesticides, and specialty chemicals.

Several industrial processes can tolerate minor impurities, making the up to 97% purity grade a cost-efficient and viable option for large-scale production. Additionally, the relatively lower production cost of up to 97% purity TDM makes it more attractive to manufacturers who prioritize affordability and functional performance over ultra-pure grades. Its extensive availability, ease of handling, and adaptability in various formulations contribute to its dominant market share.

Industries such as rubber processing and adhesives also utilize this segment due to its effectiveness as a chemical catalyst and stabilizer. On the other hand, TDM with purity above 97% is typically required in specialized applications such as pharmaceuticals and high-performance chemical formulations, where stringent purity standards are essential. However, the higher production cost and limited application scope of this ultra-pure grade have restricted its market share compared to the more commercially viable up to 97% purity segment.

Global Trans-2,6-Dimethylmorpholine Market, By Purity, 2020-2024 (USD Mn)

Purity 2020 2021 2022 2023 2024 Up to 97% 50.60 52.15 53.88 55.73 57.97 Above 97% 18.62 19.14 19.75 20.41 21.23 Application Analysis

The Trans-2,6-Dimethylmorpholine Market Was Dominated By the Pharmaceutical Industry.

Based on application, the market is further divided into pharmaceutical, agrochemicals, electronic chemicals, & material science. The Trans-2,6-Dimethylmorpholines (TDM) market, particularly within the pharmaceutical sector, exhibited a commanding 92.8% market share in 2024, a reflection of its critical role in the synthesis of various pharmaceutical compounds. TDM is an essential building block in the production of numerous drugs, especially those used in treating central nervous system disorders and other specialized medical conditions. The chemical’s unique molecular structure makes it invaluable in the creation of morpholine derivatives, which are prevalent in a wide range of therapeutic categories.

This substantial market share is further underscored by the increasing demand for more sophisticated and targeted medical treatments. Innovations in drug development, driven by a deeper understanding of diseases at the molecular level, have led pharmaceutical companies to seek specific, high-performance chemical intermediates like TDM. Its versatility in synthesis processes aligns with the pharmaceutical industry’s push towards more efficient and effective drug delivery mechanisms, which often require complex, chemically stable intermediates capable of enhancing the bioavailability and efficacy of pharmaceuticals.

Moreover, the global rise in healthcare standards and the expanding pharmaceutical sector in emerging markets contribute significantly to the dominance of TDM in the industry. As these markets develop, the demand for advanced pharmaceuticals escalates, thereby driving up the demand for essential chemical intermediates used in their production. The robust regulatory framework and stringent quality control measures in the pharmaceutical industry further ensure that high-purity, high-quality chemical intermediates like TDM are in constant demand, maintaining their high market share.

Additionally, the ongoing investment in pharmaceutical R&D, supported by both private and public funding, perpetuates the high utilization rates of TDM. This investment is not only a testament to the sector’s commitment to advancing healthcare solutions but also highlights the strategic importance of maintaining a stable, reliable supply chain for critical chemical intermediates that underpin drug development and manufacturing processes worldwide.

Global Trans-2,6-Dimethylmorpholine Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 Pharmaceutical 64.29 66.20 68.35 70.67 73.47 Agrochemicals 3.58 3.71 3.86 4.02 4.20 Electronic Chemical 0.56 0.57 0.59 0.60 0.63 Material Science 0.78 0.81 0.83 0.86 0.89 Key Market Segments

By Purity

- Up to 97%

- Above 97%

By Application

- Pharmaceutical

- Agrochemicals

- Electronic Chemical

- Material Science

Drivers

Growing Demand in Pharmaceutical Applications is Estimated to Boost The Trans-2,6-Dimethylmorpholine Market.

The Trans-2,6-Dimethylmorpholine (TDM) market is poised for substantial growth, primarily driven by escalating demands within the pharmaceutical sector. TDM, recognized for its efficacy as a chemical intermediate, plays a pivotal role in synthesizing a broad array of pharmaceutical compounds. This chemical’s utility is particularly pronounced in the development of drugs targeting neurological disorders and other specialized therapeutic areas where precision and efficacy are paramount.

As global health challenges intensify and the prevalence of chronic and acute diseases rises, the pharmaceutical industry is under increasing pressure to innovate and deliver effective treatments rapidly. This surge in demand necessitates robust production capabilities for key intermediates such as TDM. Further amplifying this demand is the pharmaceutical industry’s ongoing innovation streak, particularly in personalized medicine and targeted drug delivery systems. These advanced therapeutic products often require specialized, high-quality chemical intermediates during their manufacturing process. TDM’s role in enhancing the stability and bioavailability of these pharmaceuticals makes it indispensable, directly linking its market growth to pharmaceutical advancements.

Moreover, the expansion of healthcare infrastructure and services in emerging economies is another catalyst propelling the TDM market. As more regions invest in healthcare and gain access to advanced medical treatments, the requirement for pharmaceuticals escalates, subsequently boosting the demand for pharmaceutical intermediates. This trend is complemented by the global demographic shifts towards an aging population, which typically sees an increase in medication consumption, further straining pharmaceutical supply chains and amplifying the need for TDM.

The regulatory landscape also plays a crucial role in this dynamic market environment. With stricter regulations and higher standards for drug safety and efficacy, pharmaceutical companies are increasingly reliant on high-quality and compliant chemical intermediates like TDM. This ensures sustained demand, as regulatory compliance becomes synonymous with market access and consumer trust.

Restraints

High Production Cost May Hinder The Growth Of The Market to a Certain Extent

The growth of the Trans-2,6-Dimethylmorpholine (TDM) market, while robust, faces potential hindrances from high production costs that may dampen its expansion to a certain extent. TDM, as a specialized chemical intermediate used predominantly in pharmaceutical applications, requires stringent synthesis and purification processes to meet the high-quality standards demanded by the pharmaceutical industry. These processes involve complex chemical reactions and the use of expensive catalysts and raw materials, which significantly elevate the overall production costs. Moreover, the production of TDM must be conducted in facilities that adhere to strict regulatory standards for safety and environmental impact, adding further to the operational overhead.

The high cost of compliance with environmental regulations is particularly impactful. TDM synthesis involves volatile organic compounds and hazardous chemicals that must be handled and disposed of by stringent environmental protection standards. The equipment and processes required to mitigate environmental risks are costly, and the need for ongoing investment in technology to improve efficiency and reduce waste contributes to the elevated cost structure. Additionally, the energy-intensive nature of chemical manufacturing also plays a role, with energy costs accounting for a significant portion of the total production expenses.

These high production costs are inevitably passed down the supply chain, affecting the pricing of pharmaceuticals and potentially limiting the accessibility of advanced medical treatments in less affluent markets. While the demand for pharmaceuticals continues to grow, particularly for high-efficacy treatments in developed and emerging economies alike, the ability of market participants to absorb these costs can vary, potentially restraining market growth in regions where cost sensitivity is more prominent.

Opportunity

Expansion in Agrochemicals and Material Science Is Anticipated To Create Lucrative Opportunities

The expansion of the Trans-2,6-Dimethylmorpholine (TDM) market into agrochemicals and material science sectors is anticipated to create significant opportunities, heralding a new growth frontier for this chemical compound. In the agrochemical industry, TDM can be used to synthesize novel pesticides and fungicides that offer enhanced efficacy and reduced environmental impact. The global push towards sustainable agriculture intensifies the need for such innovative solutions that can safely increase crop yield and disease resistance without harming the ecosystem.

As agrochemical companies continue to seek out advanced intermediates that align with evolving regulatory landscapes favoring environmental sustainability, TDM’s role becomes increasingly vital, providing it with substantial market expansion potential. Similarly, in the material science domain, TDM is finding applications in the development of advanced polymers and composites. These materials are crucial for various high-tech industries, including automotive, aerospace, and electronics, which demand materials that provide superior performance, durability, and lighter weight.

TDM’s chemical properties make it an excellent candidate for producing these next-generation materials, which are often characterized by improved thermal stability, chemical resistance, and mechanical strength. The ongoing innovation in material science, spurred by the drive towards more efficient and sustainable materials, aligns well with the capabilities offered by TDM.

Moreover, both sectors are on trajectories of rapid growth driven by technological advancements and increasing regulatory and consumer demands for higher performance and sustainability. As these industries expand, the demand for TDM is expected to rise in tandem, driven by its ability to meet the stringent specifications required by new applications. This not only promises increased revenue streams for producers of TDM but also encourages further investments in research and development to enhance the efficiency and applications of TDM. Thus, the expansion into agrochemicals and material science not only diversifies the markets for TDM but also opens up new avenues for growth and innovation, making it a lucrative prospect for stakeholders in the chemical industry.

Trends

Growing Shift Towards Green Chemistry

The Trans-2,6-Dimethylmorpholine (TDM) market is experiencing a pivotal shift towards green chemistry, emerging as a significant trend driven by both regulatory pressures and a growing societal commitment to sustainability. This shift is largely influenced by the increasing awareness of the environmental and health impacts associated with traditional chemical production processes, which typically involve hazardous materials and generate substantial waste. Green chemistry aims to design chemical products and processes that reduce or eliminate the use and generation of hazardous substances, and this philosophy is becoming integral to the TDM market’s evolution.

One of the key elements of this shift is the development and implementation of new synthesis pathways that are more environmentally benign. These methods focus on reducing energy consumption, minimizing waste, and using safer, renewable materials wherever possible. For TDM, this might involve the adoption of catalysts that operate under milder conditions and are reusable, thereby not only reducing harmful by-products but also enhancing efficiency. Such innovations not only comply with stringent environmental regulations but also resonate with consumers and stakeholders increasingly demanding eco-friendly practices.

Additionally, the push towards green chemistry in the TDM sector is further supported by economic incentives. Reducing waste and energy use can lead to significant cost reductions over time, which is a critical factor in an industry where production costs are a major concern. Moreover, companies adopting green practices are often viewed more favorably in the market, enhancing brand reputation and potentially leading to increased market share. Furthermore, regulatory bodies worldwide are tightening environmental standards, compelling chemical manufacturers to rethink their production techniques and invest in green technology. This regulatory environment is creating a market where sustainability is not just beneficial but essential for compliance and survival.

Geopolitical Impact Analysis

Geopolitical Tensions And Disruptions In The Global Supply Chain Have A Negative Impact On The Growth Of The Trans-2,6-Dimethylmorpholine Market.

The pharmaceutical APIs industry, heavily reliant on stable raw material supplies, faced delays and reduced manufacturing efficiency due to the limited availability of precursors such as Trans-2,6-Dimethylmorpholine. Consequently, this drove up costs for APIs, leading to an estimated 8-12% price increase across key pharmaceutical segments during this period. Furthermore, stricter regulations in Europe for sourcing sustainable raw materials intensified challenges for chemical suppliers, prompting a shift toward localized production to mitigate risks. This evolving landscape underscored the need for robust supply chain resilience in the market.

Prominent disruptions halted trade disputes and sanctions involving major chemical-producing nations, which led to uncertainties in raw material availability and price volatility. For instance, sanctions on Russia, a key supplier of petroleum products that are critical for chemical synthesis, led to increased costs and supply shortages. This situation was exacerbated by the pandemic recovery phase, where demand surged unexpectedly while supply lines were still stabilizing. The pharmaceutical sector, heavily reliant on a stable supply of APIs and intermediates such as Trans-2,6-Dimethylmorpholine, faced challenges in maintaining production rates, especially for essential medications.

Regional Analysis

North America Held the Largest Share of the Global Trans-2,6-Dimethylmorpholine Market

In 2024, North America emerged as the dominant force in the global Trans-2,6-Dimethylmorpholine (TDM) market, securing a substantial 38.1% share, largely due to its advanced pharmaceutical sector and robust chemical manufacturing infrastructure. The region’s leadership in the market can be attributed to several key factors that interplay to support the demand and production of TDM. Initially, North America, particularly the United States, hosts a large number of global pharmaceutical giants and biotech firms intensely focused on research and development of new therapeutic drugs.

This concentration of pharmaceutical innovation drives a high demand for specialized chemical intermediates like TDM, which are crucial in the synthesis of various medications, especially those used in treating complex diseases. The continuous push for novel medical treatments supports a steady demand for TDM, reinforcing its market presence in the region. Furthermore, the robust industrial infrastructure and technological prowess of North America facilitate the efficient production of high-quality TDM.

The region benefits from cutting-edge chemical processing technologies and stringent regulatory frameworks that ensure the production of superior-quality chemical products. This capability not only meets the internal demands of the pharmaceutical sector but also positions North America as a key exporter of TDM to global markets, enhancing its market share. Moreover, the presence of a well-established regulatory environment in North America ensures that all chemical production adheres to strict safety and environmental standards, thereby maintaining high trust and reliability in the quality of TDM produced.

This regulatory advantage attracts further investment into the chemical sector, bolstering the region’s dominance in the market. Additionally, significant investments in healthcare and pharmaceutical R&D, supported by both public and private funding, propel the usage of TDM. The region’s commitment to advancing healthcare solutions, coupled with the economic capability to invest in high-cost production processes and technologies, supports the sustained demand and production of TDM.

Global Trans-2,6-Dimethylmorpholine Market, By Application, 2020-2024 (USD Mn)

Application 2020 2021 2022 2023 2024 North America 26.65 27.37 28.18 29.06 30.14 Europe 24.90 25.68 26.57 27.52 28.67 Asia Pacific 13.51 13.99 14.53 15.10 15.79 Middle East & Africa 2.31 2.36 2.42 2.48 2.56 Latin America 1.84 1.88 1.93 1.97 2.03 Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Major Companies Are Employing Various Strategic Initiatives That Focusing On Innovation, Expansion, Partnerships, And Operational Efficiency.

To maintain a competitive edge in the Trans-2,6-Dimethylmorpholine (TDM) market, major companies focus on a variety of strategic initiatives. Key among these are innovation and significant investments in research and development to improve synthesis processes and develop new applications for TDM, particularly in the burgeoning pharmaceutical sector. Additionally, expanding production capacity and enhancing supply chain efficiencies are crucial for meeting the increasing global demand and reducing operational costs. Companies also prioritize entering new markets and strengthening their presence in existing ones through strategic partnerships and collaborations, which help in sharing technology, accessing new customer bases, and navigating complex regulatory landscapes.

Ensuring stringent compliance with international safety and quality standards is another cornerstone strategy, critical for building trust and maintaining long-term relationships with clients. Together, these strategies help companies in the TDM market to stay competitive and responsive to the dynamic needs of their customers.

The following are some of the major players in the industry

- Shandong Mopai Biotechnology Co., Ltd.

- Henan Tianfu Chemical Co., Ltd.

- Hairui Chemical

- Henan Yufu New Materials Co., Ltd

- Shanghai SABO Biochemical Technology Co., Ltd.

- Acros Pharma

- Hunan Huateng Pharmaceutical Co., Ltd.

- Win-Win Chemical CO., Limited

- Accela ChemBio Inc.

- abcr GmbH

- Synthonix, Inc.

- Hefei TNJ Chemical Industry Co., Ltd.

- HUNAN Chemfish Pharmaceutical Co., Ltd

- Other Key Players

Report Scope

Report Features Description Market Value (2024) US$ 79.2 Mn Market Volume (2024) XX Ton Forecast Revenue (2034) US$ 126.1 Mn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Purity (Up to 97% and above 97%), By Application (Pharmaceutical, Agrochemicals, Electronic Chemical, & Material Science) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Shandong Mopai Biotechnology Co., Ltd., Henan Tianfu Chemical Co., Ltd., Hairui Chemical, Henan Yufu New Materials Co., Ltd, Shanghai SABO Biochemical Technology Co., Ltd., Acros Pharma, Hunan Huateng Pharmaceutical Co., Ltd., Win-Win Chemical CO., Limited, Accela ChemBio Inc., abcr GmbH, Synthonix, Inc., Hefei TNJ Chemical Industry Co., Ltd., HUNAN Chemfish Pharmaceutical Co., Ltd & Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Trans-2,6-Dimethylmorpholine MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Trans-2,6-Dimethylmorpholine MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Shandong Mopai Biotechnology Co., Ltd.

- Henan Tianfu Chemical Co., Ltd.

- Hairui Chemical

- Henan Yufu New Materials Co., Ltd

- Shanghai SABO Biochemical Technology Co., Ltd.

- Acros Pharma

- Hunan Huateng Pharmaceutical Co., Ltd.

- Win-Win Chemical CO., Limited

- Accela ChemBio Inc.

- abcr GmbH

- Synthonix, Inc.

- Hefei TNJ Chemical Industry Co., Ltd.

- HUNAN Chemfish Pharmaceutical Co., Ltd

- Other Key Players