Global Portable Power Station Market By Technology Type (Lithium-ion, Sealed Lead-acid, Others), By Operation Type (Direct power, Solar power, Others), By Power Source (Hybrid Power, Direct Power), By Sales Channel (Online Sales, Direct Sales), By Application (Emergency Power, Residential, Commercial, Off-grid Power, Automotive), By Capacity (0-100 Wh, 100-200 Wh, 200-400 Wh, 400-1,000 Wh, 1,000-1,500 Wh, 1,500 Wh and above) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141726

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

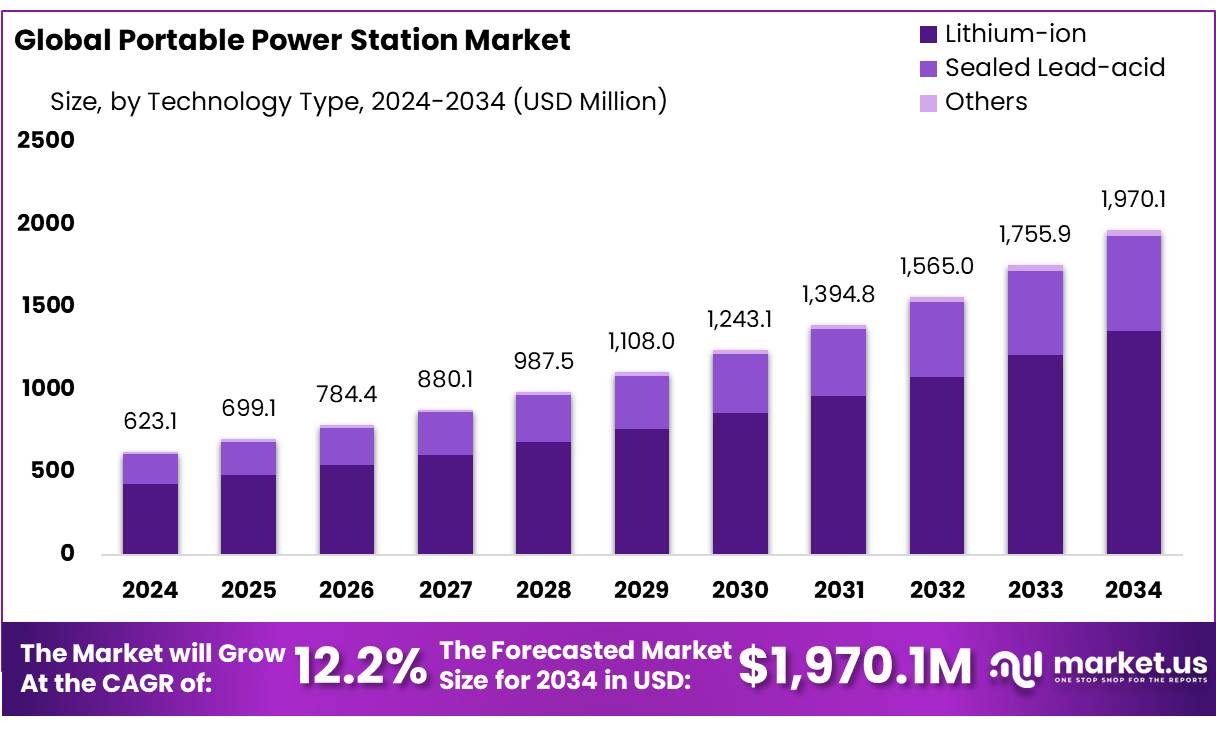

The Global Portable Power Station Market size is expected to be worth around USD 1970.1 Mn by 2034, from USD 623.1 Mn in 2024, growing at a CAGR of 12.2% during the forecast period from 2025 to 2034.

The Portable Power Station Market is experiencing robust growth, primarily driven by the escalating demand for dependable, off-grid power solutions suited for a variety of applications such as outdoor adventures, home backup power, and emergency situations due to natural disasters. These power stations are battery-operated generators designed to provide electricity in areas lacking stable grid access. They come equipped with multiple charging outputs including AC, DC, and USB ports to support a diverse range of devices and appliances.

The technological advancements in battery storage technology, especially lithium-ion batteries, have facilitated the development of portable power stations that are not only lighter but also more efficient and capable of higher storage capacities. This technological progress has significantly increased the utility of portable power stations across numerous applications.

According to the Energy Storage Association, investment in battery storage technology has seen a twofold increase over the past five years, reflecting strong growth and continuous innovation within the industry. Additionally, the U.S. Department of Energy has noted that power outages impose an annual cost of up to $70 billion on the U.S. economy, highlighting the critical value of reliable power solutions like portable power stations.

The capacity of a portable power station to store electricity is measured in watt-hours (Wh) or kilowatt-hours (kWh), where one watt of power usage over one hour equals one watt-hour. For example, using a 50W bulb for 10 hours consumes 500Wh of energy.

In a novel approach to product development, EcoFlow has actively engaged consumers in the research and development process through crowdfunding initiatives. Notably, the launch of its DELTA Pro model was propelled by a Kickstarter campaign that far exceeded its initial goal of $100,000, ultimately raising approximately $12.2 million. This strategy not only funded the development but also validated consumer interest and market demand for innovative portable power solutions.

Key Takeaways

- The global portable power station market is projected to grow from USD 623.1 million in 2024 to USD 1970.1 million by 2034, achieving a CAGR of 12.2% during the forecast period from 2025 to 2034.

- In 2024, lithium-ion technology dominated the market with a 69.1% share.

- Direct Power operation type held a 58.1% market share in 2024, favored for its immediate and straightforward energy access.

- Hybrid Power technology led the market in 2024 with a 68.3% share. The technology’s versatility and efficiency stem from integrating multiple energy sources.

- Direct Sales controlled the sales channel landscape in 2024, capturing 61.2% of the market.

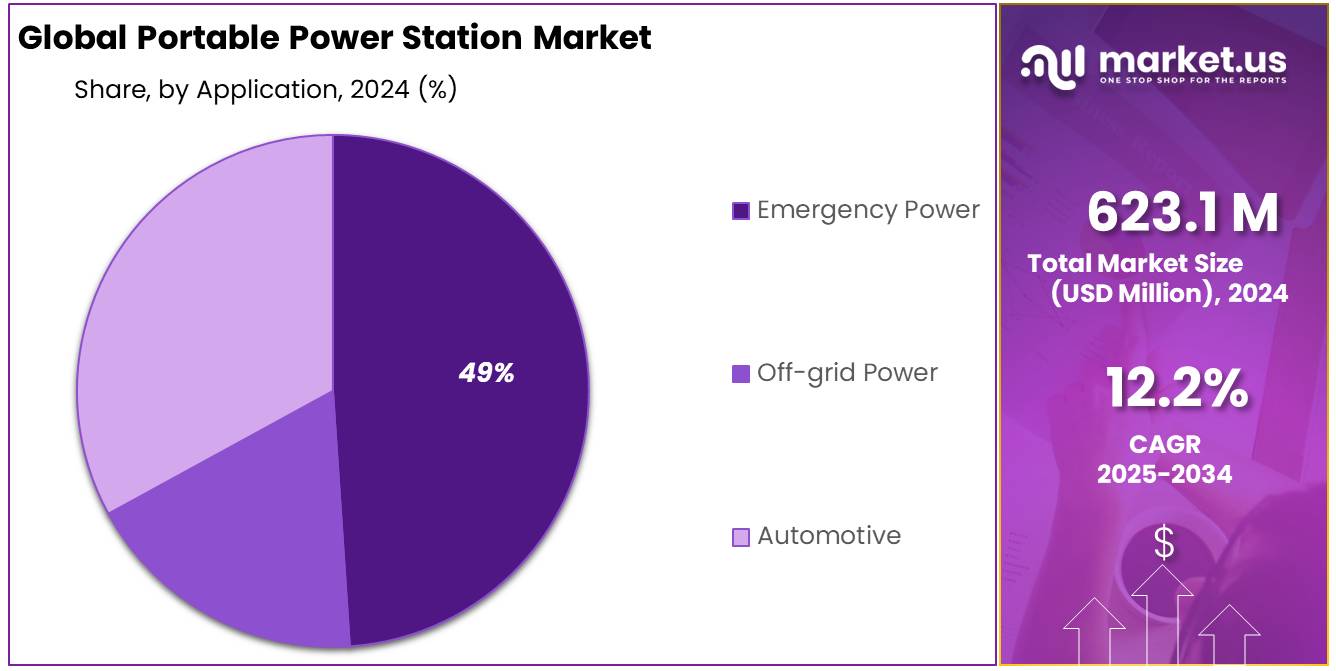

- Emergency Power applications dominated the market in 2024 with a 49.2% share, driven by growing reliance on portable power solutions for critical backup during power outages in residential.

- Portable power stations with a capacity range of 400-1,000 Wh dominated the market in 2024, holding a 29.2% share.

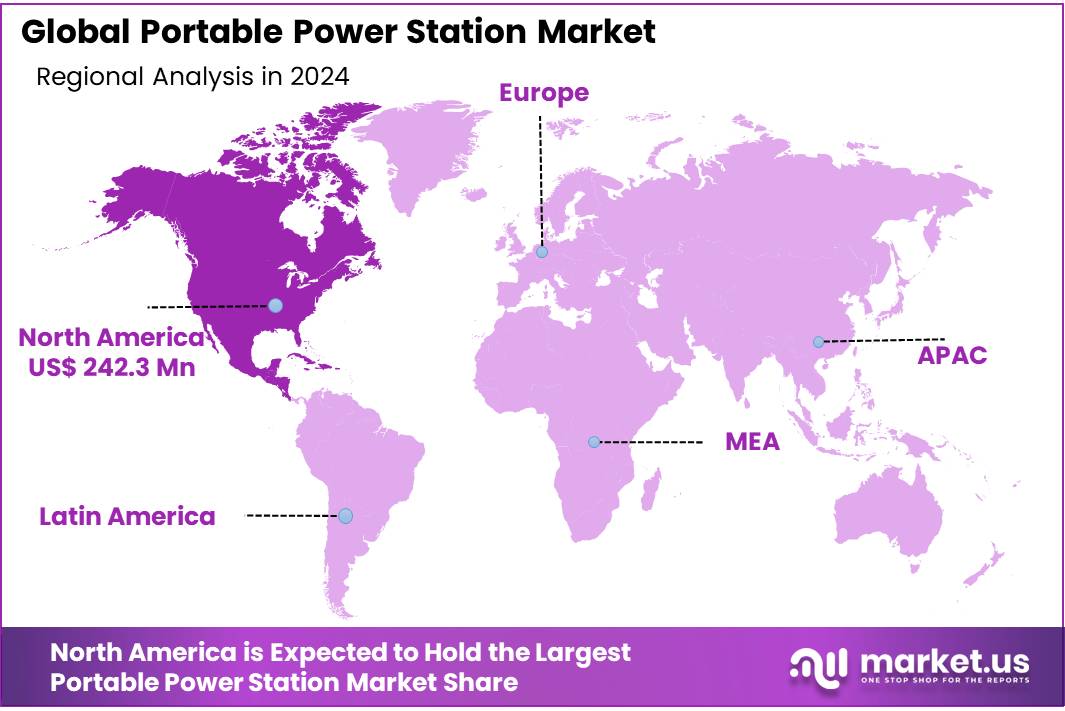

- In 2024, North America led the portable power station market with a 38.9% share, equivalent to approximately USD 242.3 million in revenue.

By Technology Type

In 2024, lithium-ion technology maintained a dominant position in the portable power station market, capturing more than a 69.1% share. This significant market share can be attributed to lithium-ion’s high energy density, which offers longer battery life and higher power capacity in a more compact and lightweight package compared to other technologies. These attributes make lithium-ion batteries particularly suitable for portable power stations used in outdoor activities, emergency power backups, and increasingly in renewable energy systems.

The growing adoption of renewable energy sources has also played a crucial role in the expansion of the lithium-ion segment. As consumers and businesses alike seek sustainable and reliable energy solutions, lithium-ion batteries’ efficiency in energy storage and capability to provide power during off-grid conditions have driven their demand. Moreover, advancements in lithium-ion technology have continually improved their cost-effectiveness and performance, further cementing their utility and popularity in the portable power sector.

By Operation Type

In 2024, Direct Power operation type held a dominant position in the portable power station market, capturing more than a 58.1% share. This prominent market share is largely due to the immediate and straightforward energy access that Direct Power stations provide, making them highly favored for a variety of applications ranging from outdoor recreational uses to emergency power backup solutions.

Direct Power stations are particularly valued for their ease of use and reliability, offering consumers a plug-and-play experience that eliminates the need for complex setup procedures. This simplicity is crucial during emergencies or when quick power deployment is necessary. The efficiency of Direct Power stations in converting stored energy into electrical output without significant loss also contributes to their popularity, ensuring maximum usability of the stored charge.

By Power Source

In 2024, Hybrid Power technology in the portable power station market held a dominant market position, capturing more than a 68.3% share. This substantial market share is primarily attributed to the versatility and efficiency of hybrid power systems, which combine multiple sources of energy to provide a more reliable and consistent power supply. Hybrid power stations typically integrate solar with traditional battery storage or even fuel-based generators, allowing for greater flexibility in energy production and usage.

The adaptability of hybrid power stations makes them exceptionally suitable for a variety of applications, including remote fieldwork, camping, and emergency power backup, where access to continuous power is crucial. The ability to harness solar energy reduces reliance on fossil fuels and enhances the eco-friendliness of these units, aligning with the growing consumer preference for sustainable solutions.

By Sales Channel

In 2024, Direct Sales held a dominant market position in the portable power station market, capturing more than a 61.2% share. This leading position can be attributed to the effectiveness of direct selling channels in providing detailed product information and personalized customer service, which is particularly valued in the market for high-investment goods like portable power stations. Direct sales enable manufacturers to build stronger relationships with their customers, offering them in-depth demonstrations and immediate answers to their queries, which helps in instilling confidence among buyers.

Additionally, the direct sales approach allows manufacturers to control the branding and marketing of their products effectively, ensuring that the product’s value proposition is communicated clearly. This method also bypasses intermediary costs, potentially lowering prices for end consumers and increasing the manufacturer’s margin. As consumers increasingly seek reliable and immediate purchasing avenues with robust after-sales support, direct sales channels are likely to continue their dominance in the portable power station market, driven by their direct engagement with the end-user and enhanced customer buying experience.

By Application

In 2024, the Emergency Power application held a dominant market position in the portable power station market, capturing more than a 49.2% share. This notable share is primarily due to the increasing reliance on portable power solutions for emergency scenarios across residential, commercial, and industrial sectors. Emergency power portable stations are essential for providing critical backup during power outages caused by natural disasters, technical failures, or other disruptions. Their ability to ensure continuity of operations and safety in homes and businesses during emergencies underscores their significant market share.

The demand for portable power stations for emergency power is driven by their convenience, reliability, and ease of use, allowing them to be deployed quickly when traditional power sources fail. Additionally, advancements in battery technology and energy storage solutions have enhanced the efficiency and capacity of these portable stations, making them even more integral to emergency preparedness strategies.

By Capacity

In 2024, portable power stations with a capacity range of 400-1,000 Wh held a dominant market position, capturing more than a 29.2% share. This segment’s significant market share is attributed to the balance these units offer between portability and sufficient energy capacity to meet a wide range of consumer needs. Power stations within this capacity range are ideal for a variety of applications, including outdoor recreational activities, home backup power, and small-scale commercial use, where moderate power is necessary but the convenience of lightweight and easy-to-transport solutions is also valued.

The preference for 400-1,000 Wh units is particularly notable among consumers who require a reliable power source for camping trips, outdoor events, and emergency power during short-term power outages. These units are capable of charging multiple small devices, such as smartphones, tablets, and laptops, multiple times and can also power essential household appliances for hours, making them a versatile option for preparedness and spontaneous needs.

Key Market Segments

By Technology Type

- Lithium-ion

- Sealed Lead-acid

- Others

By Operation Type

- Direct power

- Solar power

- Others

By Power Source

- Hybrid Power

- Direct Power

By Sales Channel

- Online Sales

- Direct Sales

By Application

- Emergency Power

- Residential

- Commercial

- Off-grid Power

- Automotive

By Capacity

- 0-100 Wh

- 100-200 Wh

- 200-400 Wh

- 400-1,000 Wh

- 1,000-1,500 Wh

- 1,500 Wh and above

Drivers

Increased Demand for Outdoor and Recreational Activities

One major driving factor for the portable power station market is the increased demand for outdoor and recreational activities. With a surge in outdoor tourism and a growing preference for sustainable travel, portable power stations have become essential for campers, hikers, and outdoor enthusiasts who require reliable power sources in remote locations.

Government initiatives that promote national parks and outdoor activities further amplify this trend. For example, the U.S. National Park Service has been actively encouraging eco-friendly tourism, which complements the demand for portable power solutions that minimize environmental impact. Additionally, the rise in RV camping and the expansion of facilities that support such lifestyles contribute significantly to the market growth. According to the Outdoor Industry Association, over 50% of the U.S. population participated in outdoor recreation at least once in 2024, highlighting a robust potential customer base for portable power products.

Moreover, the COVID-19 pandemic has shifted travel preferences towards less crowded spaces and nature-oriented getaways, further driving demand for portable power stations. These devices not only provide energy independence but also enhance safety and convenience, allowing users to maintain connectivity and power critical devices while off the grid.

The adoption of portable power stations is also supported by advances in technology that offer higher capacity and more compact designs, making them ideal for a range of applications from powering small appliances to charging digital devices. This intersection of lifestyle trends, technological advancement, and supportive government policies creates a dynamic environment for the growth of the portable power station market, indicating a strong upward trajectory in the coming years.

Restraints

High Cost of Advanced Battery Technologies

One major restraining factor for the growth of the portable power station market is the high cost associated with advanced battery technologies, primarily lithium-ion batteries, which are the most commonly used type in portable power stations. The production of lithium-ion batteries involves expensive materials and complex manufacturing processes that significantly raise the cost of the final product. This makes portable power stations less accessible to a broader audience, particularly in price-sensitive markets.

Governments and industry bodies have recognized the need to make energy storage solutions more affordable. For instance, initiatives like the U.S. Department of Energy’s Energy Storage Grand Challenge aim to reduce the cost of energy storage technologies, including batteries. They set the goal to decrease the cost of grid-scale energy storage by 90% within the decade. However, until such reductions are realized, the high upfront cost of portable power stations remains a barrier to their widespread adoption.

Furthermore, the volatility in the prices of raw materials, such as cobalt and lithium, also contributes to cost instability in the market. This fluctuation can deter potential customers who are wary of investing in technologies that may become more affordable in the near future. The economic uncertainty brought about by global events like the COVID-19 pandemic has exacerbated this issue, as economic downturns make consumers more hesitant to make significant investments in non-essential goods.

These financial barriers are not only a concern for individual consumers but also impact commercial and industrial sectors where the deployment of portable power stations could significantly enhance operations. The need for cost-effective, reliable, and sustainable power solutions is critical, and until the cost barriers associated with advanced battery technologies are overcome, the market growth for portable power stations may be restrained.

Opportunity

Integration with Renewable Energy Sources

A significant growth opportunity for the portable power station market lies in its integration with renewable energy sources, particularly solar energy. This integration not only enhances the eco-friendliness of these products but also broadens their application in off-grid and environmentally sensitive areas. The increasing affordability and efficiency of solar panels, coupled with the rising consumer interest in sustainable living, present a lucrative market for solar-compatible portable power stations.

Government incentives and subsidies for renewable energy solutions further boost this market segment. For example, several U.S. states offer rebates and tax incentives for solar panel purchases, which can extend to solar-powered portable power stations. These government-backed financial incentives make renewable energy products more accessible to a broader audience, thereby driving the adoption of solar-integrated portable power stations.

Moreover, the growing trend of eco-tourism and the increasing number of outdoor enthusiasts who prefer sustainable travel options fuel the demand for portable power solutions that utilize renewable energy. According to the World Tourism Organization, eco-tourism is one of the fastest-growing segments of the tourism industry, expanding by approximately 5% annually. Participants in this sector are likely to invest in portable power stations that align with their environmental values, such as those that offer solar charging capabilities.

As technology advances, the efficiency of portable solar panels and their integration with power stations are improving, making these products even more appealing to both end consumers and commercial users. These developments signify a promising growth trajectory for the portable power station market, particularly for models that offer seamless compatibility with renewable energy sources, underscoring a shift towards more sustainable energy solutions in various sectors.

Trends

Smart Connectivity and App Integration in Portable Power Stations

A major trend in the portable power station market is the integration of smart connectivity features and app-based controls, which enhance user convenience and functionality. These smart portable power stations allow users to monitor and manage power usage through mobile apps, offering features such as remote control, usage statistics, and real-time diagnostics. This trend is rapidly gaining traction as consumers increasingly seek devices that integrate seamlessly with their digital lifestyles.

Government and industry support for IoT (Internet of Things) technology also propels this trend forward. Initiatives like the Smart America Challenge by the U.S. government encourage the development of smart technologies that improve energy management and efficiency. This has led to increased investment in smart energy solutions, including portable power stations that can be controlled via smartphones.

The practical applications of these smart portable power stations are extensive. They are particularly appealing for outdoor enthusiasts who need to manage their energy sources remotely, as well as for homeowners who use these stations as part of a home emergency kit, enabling them to optimize power usage during outages without needing to physically interact with the device.

Moreover, market data indicates a growing consumer preference for smart home devices, with the global smart home market projected to grow significantly. The integration of portable power stations with home automation systems can provide a significant value proposition to tech-savvy consumers, making these products not just a source of backup power but a part of a connected home ecosystem.

As technology evolves, the potential for further advancements in smart portable power stations is vast, with future innovations likely to offer even more sophisticated features like AI-based energy management, predictive maintenance, and integration with multiple home devices, driving the market toward more connected and user-friendly energy solutions.

Regional Analysis

In 2024, North America held a commanding position in the portable power station market, capturing 38.9% of the global share, which translated to approximately USD 242.3 million in revenue. This dominant market position can be attributed to several factors, including the region’s high adoption rates of technological innovations, a well-established outdoor recreational culture, and the increasing frequency of extreme weather events leading to power outages.

The market in North America is further bolstered by a robust infrastructure for the distribution and sales of portable power stations, supported by both online and offline retail channels. Additionally, the region’s strong focus on emergency preparedness by both government entities and individual consumers drives demand for portable power solutions, ensuring households and businesses can maintain operations during electrical disruptions.

Moreover, the integration of smart technologies and renewable energy sources with portable power solutions is particularly pronounced in North America. Consumers in this region show a strong preference for products that not only provide energy independence but also align with eco-friendly values. The growing trend towards sustainable living has spurred the adoption of solar-powered portable power stations, which are increasingly popular among the environmentally conscious demographic.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Aimtom Aimtom specializes in portable power solutions that cater to outdoor enthusiasts and emergency preparedness. Their products are known for being rugged and versatile, designed to support activities ranging from camping to long road trips. Aimtom power stations are appreciated for their compact design and ability to power a variety of devices, making them a popular choice for consumers seeking reliable power on the go.

ALLPOWERS Inc ALLPOWERS Inc focuses on providing high-capacity solar and battery power solutions. Their portable power stations are solar-compatible, emphasizing eco-friendly energy solutions for outdoor activities and home backup systems. ALLPOWERS is recognized for innovative product designs that integrate solar technology to offer users more sustainable energy options.

Anker Innovations Anker Innovations is renowned for its range of consumer electronics, including portable power stations under its Anker and subsidiary brands. Known for smart charging technology, Anker’s portable power products combine functionality with high efficiency, catering to a tech-savvy audience that values power accessibility and device safety.

Bluetti Bluetti offers a wide array of high-capacity portable power stations that are particularly noted for their use in off-grid living, emergency backup, and as supplemental energy sources for home use. Their products are highly valued for their durability, large power capacity, and the inclusion of cutting-edge battery technology.

Top Key Players

- Aimtom

- ALLPOWERS Inc

- Anker Innovations

- Bluetti

- ChargeTech

- Drow Enterprise

- Duracell Power

- EcoFlow

- GOAL ZERO

- iForway

- Jackery Inc

- Klein Tools

- Lion Energy

- LIPOWER

- MIDLAND RADIO

- Milwaukee Tool

- Oukitel

- Rockpals

- Scott Electric Corporation

- Shenzhen Lipower Energy Co., Ltd

- Suaoki

Recent Developments

ALLPOWERS’ emphasis on solar energy integration has positioned them well within the market, appealing to a broad audience looking for energy independence and environmentally conscious power solutions.

Anker Innovations continues to invest in technology that drives portability and energy efficiency, positioning itself strongly in the competitive landscape of the portable power station market.

Report Scope

Report Features Description Market Value (2024) USD 623.1 Mn Forecast Revenue (2034) USD 1970.1 Mn CAGR (2025-2034) 12.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology Type (Lithium-ion, Sealed Lead-acid, Others), By Operation Type (Direct power, Solar power, Others), By Power Source (Hybrid Power, Direct Power), By Sales Channel (Online Sales, Direct Sales), By Application (Emergency Power, Residential, Commercial, Off-grid Power, Automotive), By Capacity (0-100 Wh, 100-200 Wh, 200-400 Wh, 400-1,000 Wh, 1,000-1,500 Wh, 1,500 Wh and above) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aimtom, ALLPOWERS Inc, Anker Innovations, Bluetti, ChargeTech, Drow Enterprise, Duracell Power, EcoFlow, GOAL ZERO, iForway, Jackery Inc, Klein Tools, Lion Energy, LIPOWER, MIDLAND RADIO, Milwaukee Tool, Oukitel, Rockpals, Scott Electric Corporation, Shenzhen Lipower Energy Co., Ltd, Suaoki Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Portable Power Station MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Portable Power Station MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Aimtom

- ALLPOWERS Inc

- Anker Innovations

- Bluetti

- ChargeTech

- Drow Enterprise

- Duracell Power

- EcoFlow

- GOAL ZERO

- iForway

- Jackery Inc

- Klein Tools

- Lion Energy

- LIPOWER

- MIDLAND RADIO

- Milwaukee Tool

- Oukitel

- Rockpals

- Scott Electric Corporation

- Shenzhen Lipower Energy Co., Ltd

- Suaoki