Global Air-Cooled Generator Market Size, Share, And Business Benefits By Type (Portable, Stationary), By System (Enclosed System, Open Ventilated System), By Power Output (Below 1 kW, 1-5 kW, 5-10 kW, 10-50 kW, 50-100 KW, Above 100 kW), By Fuel Type (Gasoline, Diesel, Natural Gas, Propane), By Application (Residential, Commercial, Industrial, Power Generation), By End-User (Homeowners, Businesses, Utilities, Government Agencies), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142127

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Type Analysis

- By System Analysis

- By Power Output Analysis

- By Fuel Type Analysis

- By Application Analysis

- By End-User Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

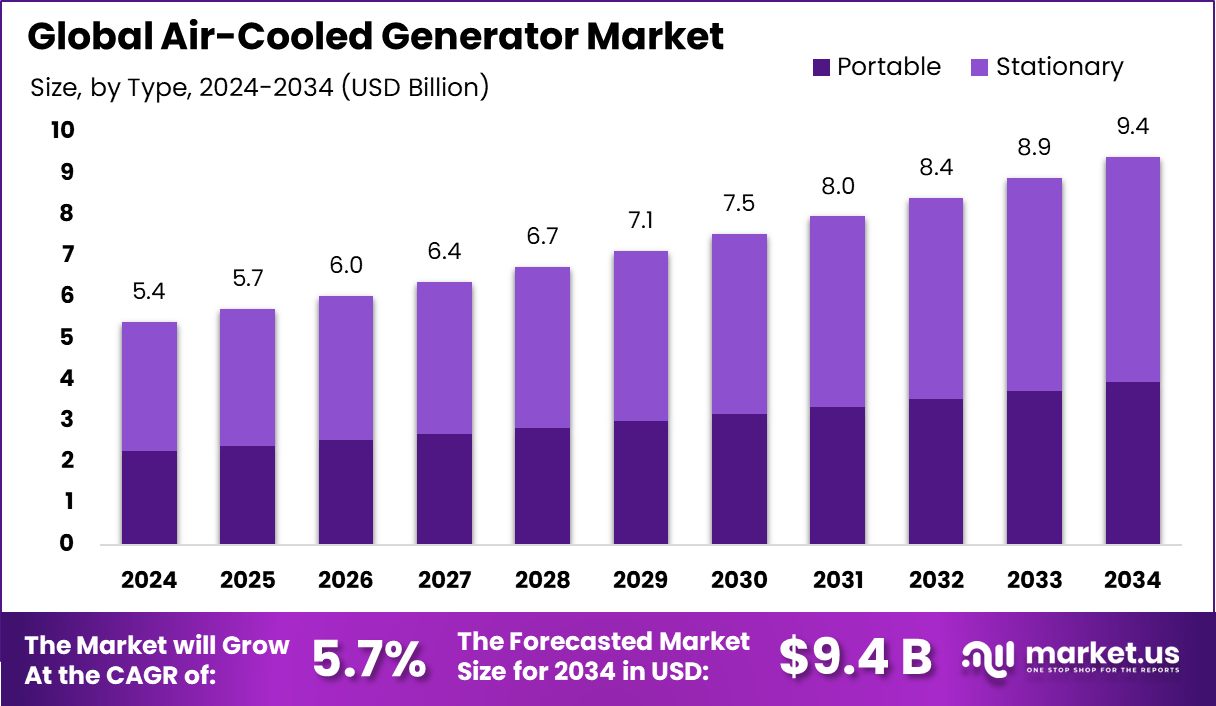

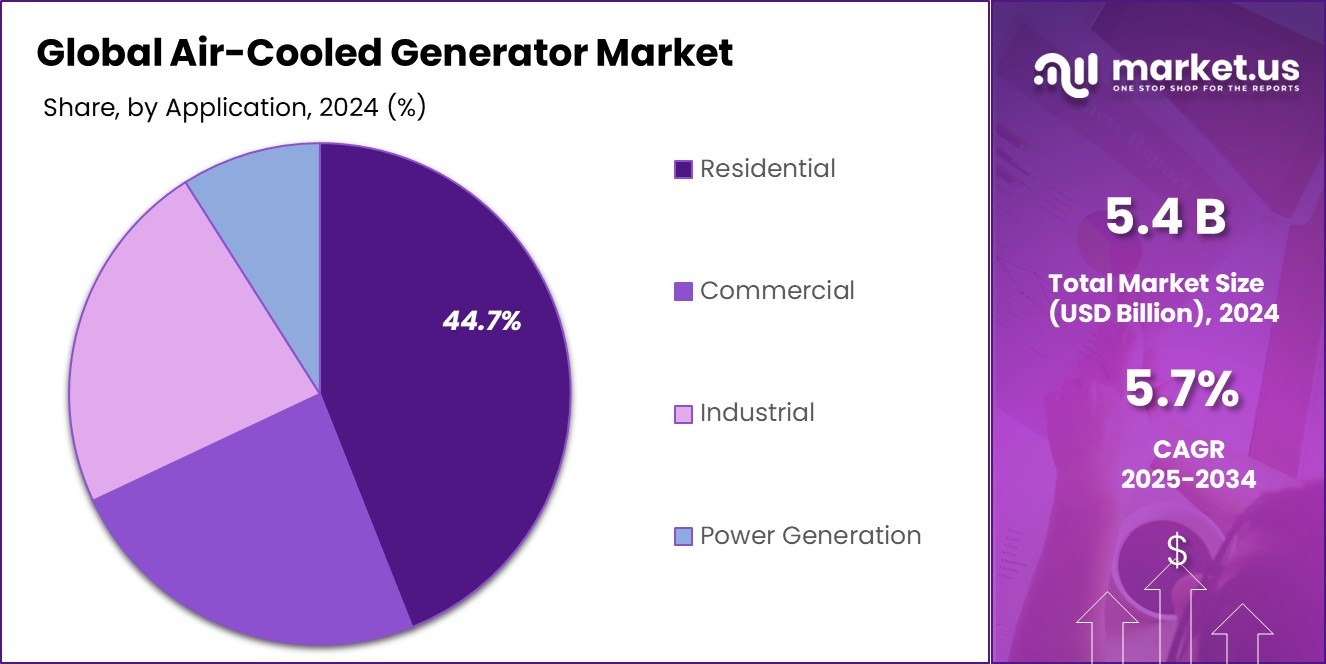

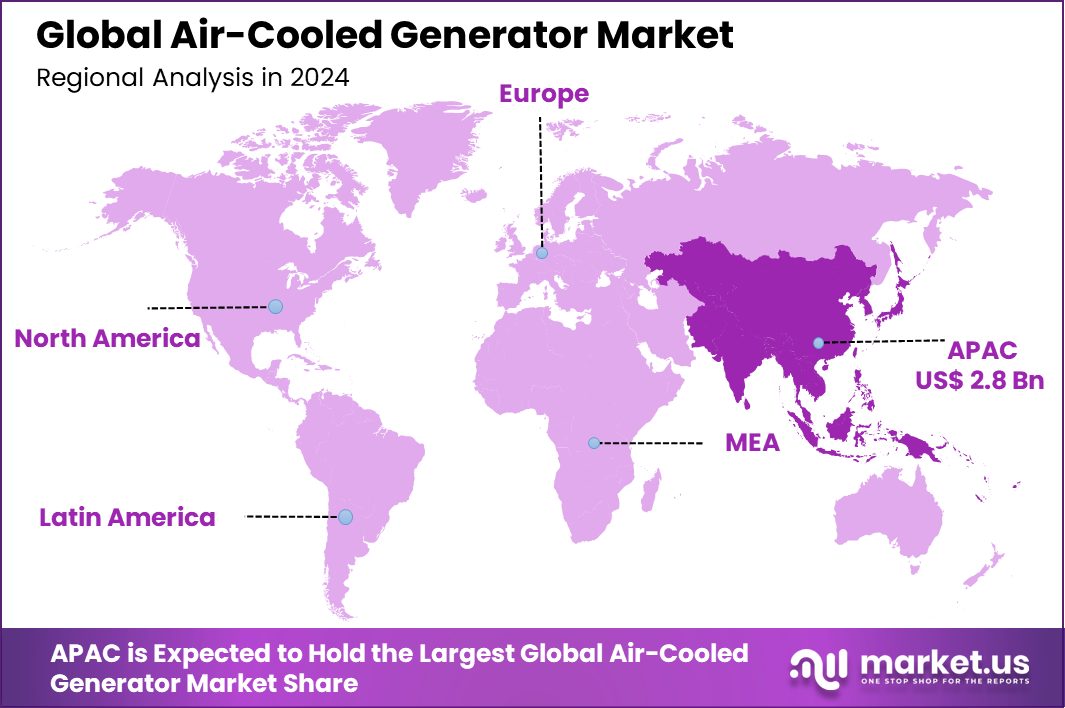

Global Air-Cooled Generator Market is expected to be worth around USD 9.4 billion by 2034, up from USD 5.4 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. With a commanding 52.5% market share, Asia-Pacific’s Air-Cooled Generator Market is notably valued at USD 2.8 billion.

An air-cooled generator uses air as the primary cooling medium to regulate the temperature of the internal components, particularly the engine and alternator. Unlike liquid-cooled generators, which use a coolant and a radiator system, air-cooled generators rely on fans or natural air flow, making them generally lighter and more compact. This type of generator is commonly used for small to medium applications where the power demands are not excessively high.

The air-cooled generator market is driven by a combination of factors, including affordability, ease of maintenance, and suitability for small-scale operations. Their lower cost compared to liquid-cooled models makes them attractive for residential and small business use, particularly in areas prone to frequent power outages.

One significant growth factor for the air-cooled generator market is the increasing incidence of power fluctuations and outages, particularly in developing regions. These generators provide a reliable power backup solution, ensuring continuity in daily activities and business operations.

Demand for air-cooled generators is also bolstered by supportive government initiatives. For instance, in Tamil Nadu, India, a Generator Subsidy scheme offers a 25% subsidy on the cost of generators up to 320 KVA capacity, with a maximum subsidy of ₹5,00,000 for micro, small, and medium manufacturing enterprises. Such incentives make air-cooled generators more accessible and affordable.

Opportunities in the air-cooled generator market are expanding with the growing focus on sustainable practices. The Rural Energy for America Program, for example, provides a 50% federal grant share for projects that produce zero greenhouse gas emissions at the project level, encouraging the adoption of environmentally friendly backup power solutions.

Furthermore, additional subsidies in India, like a 25% discount on generator costs up to 125 KVA capacity with a maximum subsidy of Rs. 1.50 lakhs for smaller manufacturing enterprises, stimulate market growth by reducing initial investment barriers and promoting widespread usage. This financial supports play a crucial role in accelerating the deployment and accessibility of air-cooled generators across various sectors.

Key Takeaways

- Global Air-Cooled Generator Market is expected to be worth around USD 9.4 billion by 2034, up from USD 5.4 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034.

- In the Air-Cooled Generator Market, stationary types dominate with a significant 58.4% share.

- Enclosed systems are preferred, making up 68.3% of the market by system type.

- Generators with a power output between 10 and 50 kW account for 32.4% of the market.

- Gasoline is the most common fuel type, used in 46.5% of air-cooled generators.

- Residential applications lead the usage, constituting 44.7% of the market by application.

- Homeowners are the primary end-users, representing 37.8% of the market.

- Holding 52.5% of the market, Asia-Pacific leads in air-cooled generators, achieving a substantial USD 2.8 billion in sales.

By Type Analysis

Stationary air-cooled generators dominate the market at 58.4% of total sales.

In 2024, the Stationary segment held a dominant market position in the By Type category of the Air-Cooled Generator Market, capturing a significant 58.4% share. This substantial market share underscores the robust demand for stationary air-cooled generators across various industries where consistent and reliable power is critical. These generators are extensively used in settings such as healthcare facilities, manufacturing plants, and data centers, where power interruptions can lead to severe operational disruptions and financial losses.

The preference for stationary air-cooled generators is primarily driven by their dependability and the capacity to provide long-term, continuous power solutions. These systems are often integrated into permanent installations and are valued for their resilience against varying climatic conditions and their relatively low maintenance requirements compared to their liquid-cooled counterparts. The economic advantages of air-cooled systems, including lower initial investment and operating costs, further contribute to their dominance in the market.

As industries continue to expand and infrastructure develops, particularly in emerging economies, the demand for reliable power solutions such as stationary air-cooled generators is expected to remain strong. This trend is likely to sustain the growth momentum of the Stationary segment within the air-cooled generator market in the foreseeable future.

By System Analysis

Enclosed systems are preferred, making up 68.3% of the air-cooled market.

In 2024, the Enclosed System segment held a dominant market position in the By System category of the Air-Cooled Generator Market, with an impressive 68.3% share. This dominance is reflective of the widespread preference for enclosed air-cooled generators across various applications, particularly in environments requiring noise reduction and protection from environmental factors.

Enclosed systems are especially favored in residential areas, commercial spaces, and industrial settings where noise levels and space utilization are significant considerations.

The enclosed design not only helps in dampening the noise during operation but also extends the lifespan of the generator by protecting its components from dust, debris, and adverse weather conditions. This makes enclosed air-cooled generators a reliable choice for both indoor and outdoor applications, enhancing their appeal in markets that prioritize durability and minimal maintenance.

Furthermore, the higher adoption rate of enclosed systems can be attributed to their versatility and safety features, which are crucial for compliance with stringent regulatory standards in many regions. As urbanization continues to rise and industrial activities increase, the demand for enclosed air-cooled generators is expected to grow, ensuring the sustained prominence of this segment in the air-cooled generator market.

By Power Output Analysis

The most common power output range is 10-50 kW, accounting for 32.4%.

In 2024, the 10-50 kW range held a dominant market position in the By Power Output segment of the Air-Cooled Generator Market, capturing a 32.4% share. This segment’s leading position highlights the widespread adoption of medium-sized generators suited for both residential and small business applications.

Generators within this power range are particularly favored for their balance between affordability and capability, offering sufficient power for emergency outages or as a backup for primary power sources without the extensive cost and installation complexity associated with larger units.

The popularity of 10-50 kW air-cooled generators stems from their versatility in various applications, including small manufacturing units, residential complexes, healthcare facilities, and retail establishments, where uninterrupted power is essential, but the demand does not justify larger, more expensive systems. Additionally, these generators are compact, making them ideal for locations with limited space.

Moreover, as businesses and consumers increasingly focus on cost-efficiency and reliability, the 10-50 kW segment continues to grow. This trend is supported by technological advancements that enhance the operational efficiency and environmental compliance of these generators, making them an even more attractive option in the air-cooled generator market.

By Fuel Type Analysis

Gasoline is the leading fuel type, used in 46.5% of generators.

In 2024, Gasoline held a dominant market position in the By Fuel Type segment of the Air-Cooled Generator Market, with a 46.5% share. This substantial market share is indicative of the widespread preference for gasoline-powered generators due to their cost-effectiveness and wide availability. Gasoline generators are particularly popular among residential users and small businesses where the initial cost and ease of fuel procurement are crucial decision-making factors.

The preference for gasoline in air-cooled generators is also driven by the portability these units offer, making them ideal for temporary power needs at events, construction sites, and during emergency power outages. Their simple design and operation facilitate easy maintenance, which is highly valued by users who require reliable power solutions without the complexities associated with alternative fuels.

However, while gasoline generators dominate the market, there is growing concern over environmental impacts and fuel efficiency, which could influence future market dynamics. Nonetheless, for many users, the immediate availability and lower upfront costs continue to make gasoline-powered, air-cooled generators a preferred choice, maintaining their leading position in the market.

By Application Analysis

Residential applications are prominent, comprising 44.7% of the market demand.

In 2024, the Residential segment held a dominant market position in the By Application category of the Air-Cooled Generator Market, commanding a 44.7% share. This leading position highlights the critical role that air-cooled generators play in providing backup power solutions for homes. The reliance on these generators has increased significantly due to the rising occurrences of power outages caused by extreme weather events and aging power grid infrastructures.

Residential users predominantly choose air-cooled generators for their affordability, ease of installation, and straightforward maintenance. These factors make them an accessible option for many households looking to ensure an uninterrupted power supply for essentials such as heating, cooling, and refrigeration during outages. The compact nature of air-cooled generators also suits residential settings where space may be limited.

This segment’s growth is further fueled by the increasing number of homes that are being equipped with smart technology and sensitive electronic devices, which require constant power to function optimally. As the trend towards home automation continues to expand, the demand for reliable backup power solutions like air-cooled generators in residential applications is expected to maintain a strong growth trajectory.

By End-User Analysis

Homeowners are the primary end-users, representing 37.8% of the market share.

In 2024, Homeowners held a dominant market position in the By End-User segment of the Air-Cooled Generator Market, securing a 37.8% share. This significant portion underscores the essential role air-cooled generators play in residential settings, where homeowners increasingly rely on these units for emergency power solutions. The preference among homeowners is driven by the necessity to maintain power during frequent outages caused by natural disasters, severe weather, or grid failures.

The appeal of air-cooled generators among homeowners can be attributed to their affordability, operational simplicity, and the convenience of gasoline or diesel fuel usage, which are readily available. These generators provide a critical power backup for essential home appliances, medical equipment, heating and cooling systems, and security systems, ensuring comfort and safety during power disruptions.

Furthermore, the growing trend toward home automation and the increased ownership of high-tech home appliances have heightened the need for reliable backup power solutions to protect sensitive electronics from sudden power cuts. As the number of technologically equipped homes rises, the reliance on air-cooled generators by homeowners is expected to continue growing, solidifying their market dominance in this segment.

Key Market Segments

By Type

- Portable

- Stationary

By System

Enclosed System

Open Ventilated SystemBy Power Output

- Below 1 kW

- 1-5 kW

- 5-10 kW

- 10-50 kW

- 50-100 KW

- Above 100 kW

By Fuel Type

- Gasoline

- Diesel

- Natural Gas

- Propane

By Application

- Residential

- Commercial

- Industrial

- Power Generation

By End-User

- Homeowners

- Businesses

- Utilities

- Government Agencies

Driving Factors

Rising Demand for Reliable Backup Power Solutions

The primary driving factor for the Air-Cooled Generator Market is the increasing demand for reliable backup power solutions. As power outages become more frequent due to aging infrastructure, natural disasters, and higher energy demands, homeowners and businesses alike are seeking dependable power sources to ensure continuity. Air-cooled generators are particularly attractive due to their cost-effectiveness and ease of maintenance.

These generators are essential in providing immediate power during outages, preventing disruption in daily activities and operations. This need for uninterrupted power supply is propelling the market growth as more consumers invest in air-cooled generators for peace of mind and operational security.

Restraining Factors

Environmental Concerns Over Gasoline-Powered Generator Emissions

A significant restraining factor for the Air-Cooled Generator Market is the environmental concern associated with the emissions from gasoline-powered generators. As global awareness and regulatory standards for environmental protection increase, the emissions from these generators, which often run on gasoline or diesel, are coming under scrutiny.

These fuels produce carbon dioxide and other harmful pollutants that contribute to air pollution and climate change. This environmental impact is prompting both consumers and regulators to seek cleaner, more sustainable alternatives, which could limit the growth of the traditional air-cooled generator market that heavily relies on fossil fuels.

Growth Opportunity

Integration with Renewable Energy Systems Expands Market

One significant growth opportunity for the Air-Cooled Generator Market lies in the integration with renewable energy systems. As the push for sustainable energy solutions intensifies, combining air-cooled generators with solar panels or wind turbines presents a viable solution.

This hybrid approach not only reduces reliance on fossil fuels but also enhances energy reliability during inconsistent weather conditions or renewable resource availability.

By adapting air-cooled generators to work seamlessly with renewables, manufacturers can cater to a broader market seeking environmentally friendly and efficient energy solutions. This integration represents a promising frontier for growth in a more sustainability-focused energy landscape.

Latest Trends

Increasing Adoption of Smart Monitoring Technologies Trend

A notable trend in the Air-Cooled Generator Market is the increasing adoption of smart monitoring technologies. Modern air-cooled generators are being equipped with advanced sensors and IoT (Internet of Things) capabilities that allow for real-time monitoring and control. This technology enables users to efficiently manage generator performance, anticipate maintenance needs, and optimize fuel usage from remote locations.

The integration of smart technologies enhances the overall user experience by improving reliability and reducing operational costs. As consumers and businesses grow more technologically savvy, the demand for generators with smart features is expected to rise, shaping future market dynamics.

Regional Analysis

The Asia-Pacific region dominates the Air-Cooled Generator Market with a 52.5% share, valued at USD 2.8 billion.

In the Air-Cooled Generator Market, the Asia-Pacific region is the clear leader, commanding a dominating 52.5% market share with a valuation of USD 2.8 billion. This substantial market presence is driven by rapid industrialization, increased infrastructure development, and the growing need for backup power solutions in emerging economies such as China and India. Additionally, the region’s frequent power outages due to natural disasters and an overburdened grid system contribute to the high demand for air-cooled generators.

In comparison, North America and Europe also show significant market activity, with advanced economies emphasizing the reliability of power for critical sectors such as healthcare and IT. However, their market shares are smaller due to higher penetration of alternative power sources and stringent environmental regulations that sway preference towards less polluting systems.

The Middle East & Africa, as well as Latin America, are also notable markets with potential growth driven by infrastructural developments and increasing energy demands in remote areas. These regions are gradually adopting modern power solutions, including air-cooled generators, to ensure an uninterrupted power supply amidst growing industrial activities and improving living standards.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the global Air-Cooled Generator Market in 2024, key players such as Atlas Copco, Baker Hughes Company, Briggs & Stratton Corporation, Caterpillar, Cummins Inc., and Deutz played pivotal roles in shaping industry dynamics. Each company brought unique strengths to the market, driving innovation and competition.

Atlas Copco continued to excel in integrating cutting-edge technologies with their air-cooled generators, focusing on energy efficiency and reduced emissions, aligning with global sustainability trends. Their robust global distribution network ensured widespread market penetration, particularly in emerging markets where demand for reliable power solutions is rapidly growing.

Baker Hughes Company emphasized its commitment to durable and reliable power equipment, capitalizing on its strong foothold in the oil and gas sector, where air-cooled generators are essential for safe and efficient operations. Its focus on customizing products to meet specific industry needs has allowed it to maintain a competitive edge.

Briggs & Stratton Corporation leveraged its extensive experience in producing small to medium-sized generators. Their products are particularly favored in residential and small business segments, benefiting from the brand’s reputation for reliability and user-friendly designs.

Caterpillar and Cummins Inc., known for their robust and high-performance machinery, focused on expanding their air-cooled generator offerings to include more versatile and portable models. These adaptations catered to a broader range of commercial and industrial applications, driving their growth in diverse sectors.

Deutz stood out for its advancements in eco-friendly technologies within the air-cooled segment. By developing generators that offer improved fuel efficiency and lower noise levels, Deutz addressed the increasing market demand for environmentally conscious power solutions.

Top Key Players in the Market

- Atlas Copco

- Baker Hughes Company

- Briggs & Stratton Corporation

- Caterpillar

- Cummins Inc.

- Deutz

- Doosan

- GE Vernova

- Generac Power Systems, Inc.

- Hatz

- Himoinsa

- Honda India Power Products Ltd.

- Hyundai Heavy Industries

- Ingersoll Rand

- JCB

- Kohler

- Mecc Alte

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- TOSHIBA CORPORATION

- Wartsila

- Yamaha Motor Co., Ltd.

- Yanmar

Recent Developments

- In December 2024, Doosan Enerbility received orders for their upgraded 380 MW DGT6-300H.S2 gas turbine, featuring higher turbine inlet temperature and improved efficiency. The first order was for Korea Midland Power’s Boryeong New Combined Cycle Power Plant.

- In May 2024, Deutz successfully tested a stationary power generation system based on its TCG 7.8 H2 hydrogen engine in partnership with RheinEnergie AG. This project demonstrates the potential for decentralized, climate-neutral urban energy supply.

Report Scope

Report Features Description Market Value (2024) USD 5.4 Billion Forecast Revenue (2034) USD 9.4 Billion CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Portable, Stationary), By System (Enclosed System, Open Ventilated System), By Power Output (Below 1 kW, 1-5 kW, 5-10 kW, 10-50 kW, 50-100 KW, Above 100 kW), By Fuel Type (Gasoline, Diesel, Natural Gas, Propane), By Application (Residential, Commercial, Industrial, Power Generation), By End-User (Homeowners, Businesses, Utilities, Government Agencies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Atlas Copco, Baker Hughes Company, Briggs & Stratton Corporation, Caterpillar, Cummins Inc., Deutz, Doosan, GE Vernova, Generac Power Systems, Inc., Hatz, Himoinsa, Honda India Power Products Ltd., Hyundai Heavy Industries, Ingersoll Rand, JCB, Kohler, Mecc Alte, Mitsubishi Heavy Industries, Ltd., Siemens Energy, TOSHIBA CORPORATION, Wartsila, Yamaha Motor Co., Ltd., Yanmar Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Air-Cooled Generator MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Air-Cooled Generator MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Atlas Copco

- Baker Hughes Company

- Briggs & Stratton Corporation

- Caterpillar

- Cummins Inc.

- Deutz

- Doosan

- GE Vernova

- Generac Power Systems, Inc.

- Hatz

- Himoinsa

- Honda India Power Products Ltd.

- Hyundai Heavy Industries

- Ingersoll Rand

- JCB

- Kohler

- Mecc Alte

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy

- TOSHIBA CORPORATION

- Wartsila

- Yamaha Motor Co., Ltd.

- Yanmar