Global Graphene Battery Market Size, Share, Statistics Analysis Report By Type (Lithium-ion Graphene Battery, Graphene Supercapacitor, Lithium-Sulfur Graphene Battery, Others), By End-Use (Automotive, Consumer Electronics, Power, Industrial Robotics, Aerospace And Defence, Healthcare, Others) - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: March 2025

- Report ID: 142276

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

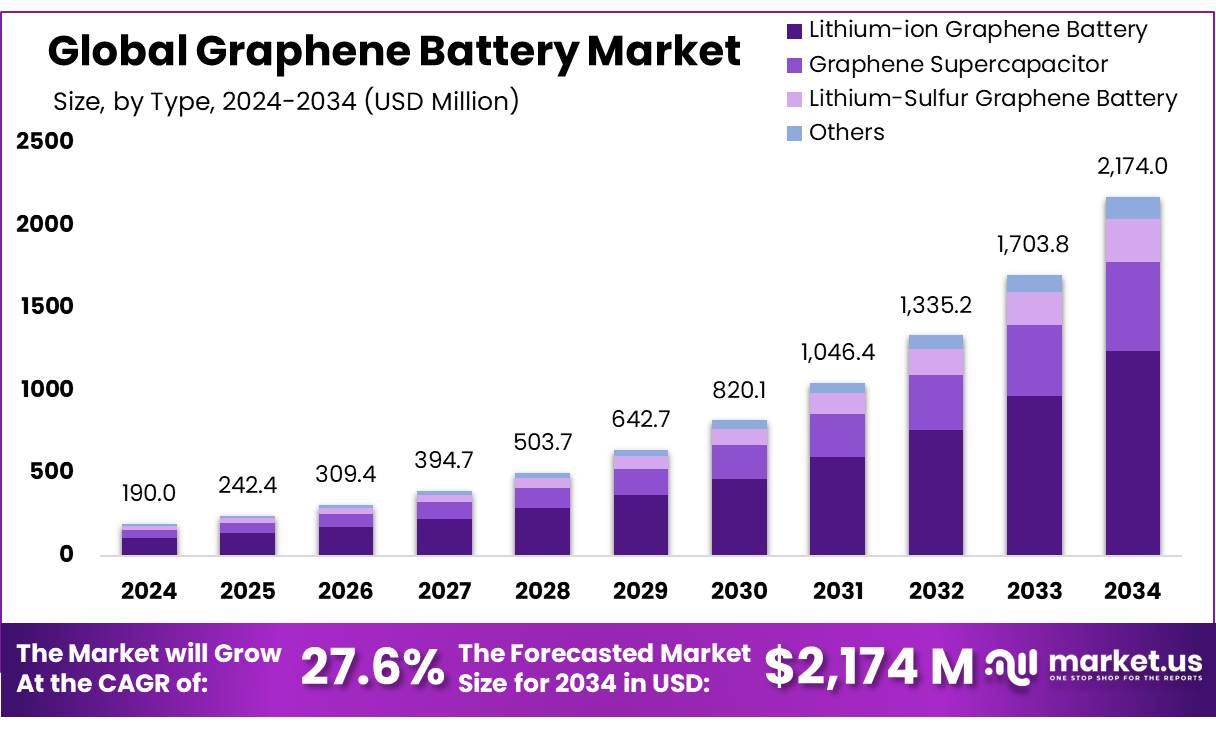

The Global Graphene Battery Market size is expected to be worth around USD 2174.0 Mn by 2034, from USD 190.0 Mn in 2024, growing at a CAGR of 27.6% during the forecast period from 2025 to 2034.

Advancements in electric vehicle industry and the ever-growing demand for high-performance electronics is expected to augment market growth. The U.S. is a leader in electric vehicle (EV) production and consumer electronics. As these industries prioritize longer range, faster charging times, and improved efficiency, graphene batteries become increasingly attractive.

Their potential for higher energy density and faster charging cycles aligns perfectly with these demands. Additionally, the U.S. has a strong focus on renewable energy storage solutions, and graphene batteries could play a significant role in grid storage and backup power due to their potential for faster charging and discharging cycles.

Government Initiatives are supporting the development of advanced battery technologies through funding and policy frameworks. For instance, the European Commission’s “Battery 2030+” initiative aims to foster battery innovation and manufacturing in the region.

The demand for lightweight, long-lasting batteries for devices such as smartphones, laptops, and wearables is increasing. Graphene’s ability to enhance battery life and reduce charging times makes it an ideal choice for these applications.

Key Takeaways

- Graphene Battery Market size is expected to be worth around USD2174.0 Mn by 2034, from USD 190.0 Mn in 2024, growing at a CAGR of 27.6%.

- Lithium-ion Graphene Battery segment held a dominant position in the graphene battery market, securing more than a 57.20% share.

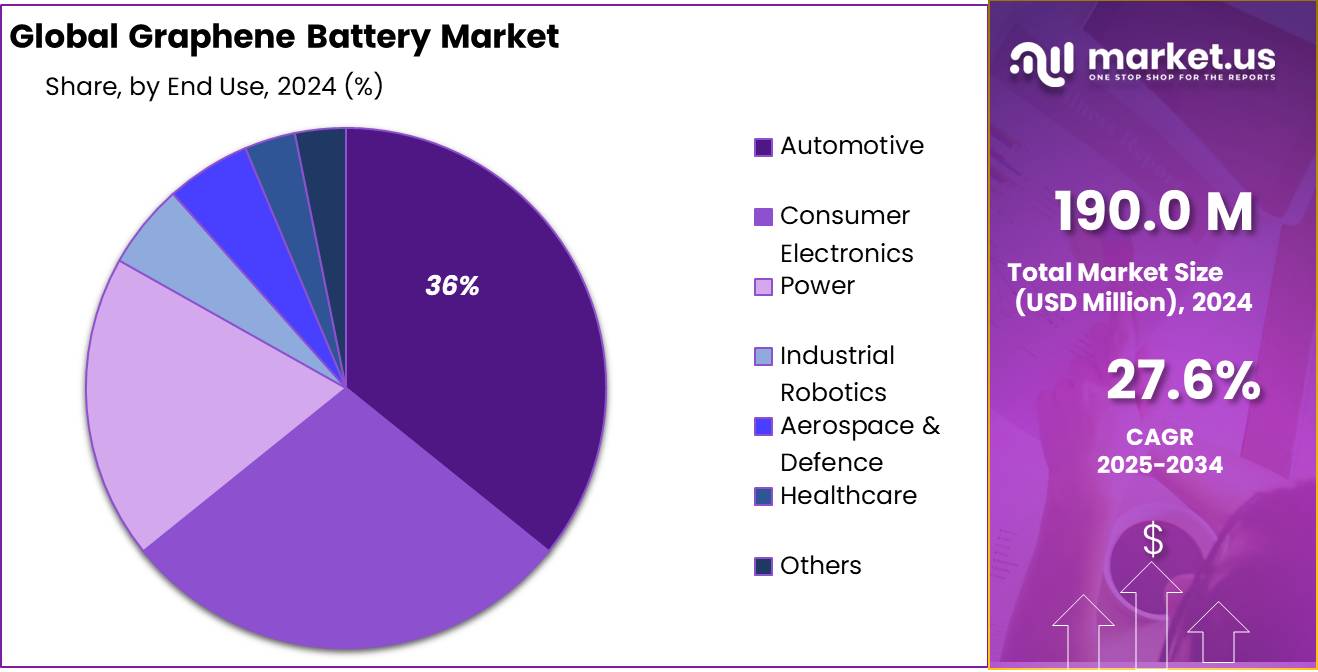

- Automotive sector held a dominant position in the graphene battery market, capturing more than a 36.70% share.

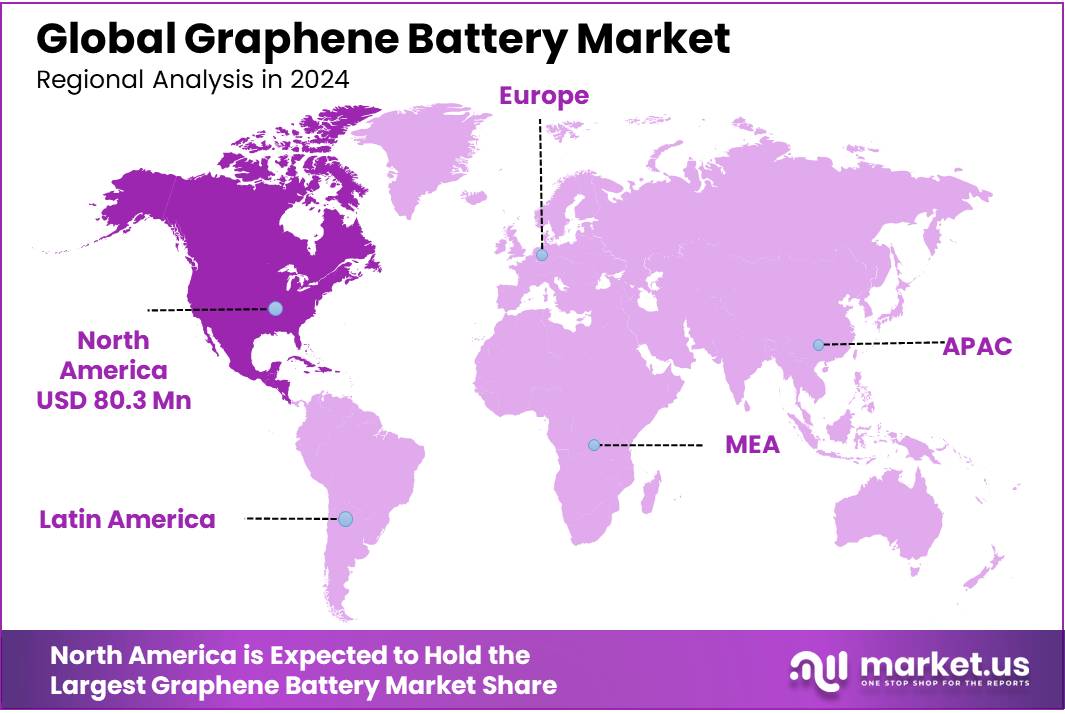

- North America held a dominant position in the graphene battery market, accounting for approximately 42.30% of the total market share, valued at an estimated USD 80.3 million.

By Type

In 2024, the Lithium-ion Graphene Battery segment held a dominant position in the graphene battery market, securing more than a 57.20% share. This significant market share is attributed to the superior properties of lithium-ion graphene batteries, such as higher energy density and faster charging capabilities compared to traditional batteries. These batteries are increasingly favored in applications requiring high energy efficiency and quick recharge times, such as electric vehicles and portable electronic devices.

The market’s enthusiasm for lithium-ion graphene batteries stems from their enhanced performance metrics, which include extended battery life and improved sustainability. As industries push for greener alternatives and longer-lasting energy solutions, lithium-ion graphene batteries are expected to see increased adoption. This trend is anticipated to continue into 2025, with projections suggesting further market penetration, especially in the automotive and consumer electronics sectors.

By End-Use

In 2024, the automotive sector held a dominant position in the graphene battery market, capturing more than a 36.70% share. This significant market share is largely due to the growing demand for electric vehicles (EVs) that require advanced battery technology for enhanced performance and longer range. Graphene batteries, known for their quick charging times and high energy capacity, are particularly suited to meet these demands, making them a favored choice among automotive manufacturers.

The push towards more sustainable and efficient vehicles has led automotive industry leaders to invest in graphene technology to improve battery performance. This trend is anticipated to gain even more momentum going into 2025, as environmental regulations become stricter and consumer preferences shift towards eco-friendly vehicles.

Key Market Segments

By Type

- Lithium-ion Graphene Battery

- Graphene Supercapacitor

- Lithium-Sulfur Graphene Battery

- Others

By End-Use

- Automotive

- Consumer Electronics

- Power

- Industrial Robotics

- Aerospace & Defence

- Healthcare

- Others

Drivers

Government Initiatives Supporting Graphene Battery Development

One of the major driving factors behind the growth of the graphene battery market is the increasing support from governments worldwide. As countries aim to transition towards cleaner energy solutions, the development of advanced battery technologies like graphene has received significant attention. In particular, many governments are prioritizing the adoption of electric vehicles (EVs) and renewable energy solutions, which require high-performance, long-lasting batteries. The shift towards sustainability has prompted various policy incentives and funding programs for battery innovation.

For example, in the European Union, the European Commission launched the “European Battery Alliance” in 2017 to reduce the EU’s dependency on foreign-made batteries. This initiative aims to support the development of a competitive battery industry, including advanced technologies like graphene, to power electric cars and renewable energy storage solutions. The EU has allocated significant funding to encourage research and development in battery technologies, with an emphasis on improving energy density, longevity, and sustainability. By 2030, the EU aims to produce 30 million electric vehicles, and graphene batteries could play a key role in achieving this target.

Similarly, in the United States, the Department of Energy (DOE) has been investing heavily in next-generation battery technologies through initiatives like the “Battery500 Consortium.” This program seeks to develop advanced batteries, including graphene-based solutions, to enable electric vehicles to travel longer distances with fewer recharges. The DOE has committed millions of dollars to these efforts, recognizing that energy storage plays a crucial role in achieving net-zero emissions by 2050.

Restraints

High Production Costs and Scalability Challenges

One of the major restraining factors for the widespread adoption of graphene batteries is the high production cost and challenges related to scalability. Although graphene offers numerous advantages in terms of performance—such as faster charging, higher energy density, and greater longevity—the cost of manufacturing graphene-based batteries remains a significant hurdle. Currently, the production of graphene itself is expensive, and scaling up its production to meet the demand for battery applications poses additional challenges.

The cost of producing graphene is largely influenced by the methods used to extract and refine it. While there are different techniques, such as chemical vapor deposition and liquid-phase exfoliation, each method comes with its own set of cost-related limitations. For instance, a report from the International Energy Agency (IEA) highlighted that the cost of graphene production can range between $100 to $1,000 per gram, depending on the quality and method used. This high cost has made it difficult for manufacturers to produce graphene batteries at a price point that is competitive with traditional lithium-ion batteries, which are already widely used in industries like automotive and consumer electronics.

In addition to production costs, the scalability of graphene battery technology remains a concern. While laboratory-scale production has demonstrated promising results, translating these successes into mass production is a complex process. Scaling up production without compromising the quality of the graphene or the battery’s performance is an ongoing challenge. For example, a 2023 report from the U.S. Department of Energy indicated that achieving cost-effectiveness in graphene battery production will require significant advancements in manufacturing techniques and infrastructure. As of now, graphene battery production is not yet efficient enough to compete on a large scale with established battery technologies like lithium-ion.

Opportunity

Growing Demand for Electric Vehicles (EVs) and Renewable Energy Storage

A major growth opportunity for graphene batteries lies in the increasing demand for electric vehicles (EVs) and renewable energy storage. As global efforts to reduce carbon emissions intensify, both the automotive and energy sectors are shifting towards greener solutions. Graphene batteries, with their superior energy density, faster charging capabilities, and longer lifespan, are well-positioned to capitalize on this growing demand.

In the electric vehicle industry, the global EV market is expected to grow rapidly in the coming years. According to the International Energy Agency (IEA), the number of electric cars on the road is set to surpass 200 million by 2030, up from approximately 10 million in 2020. This represents an enormous shift towards electric mobility, creating a massive demand for high-performance batteries that can meet the needs of long-range EVs with shorter charging times. Graphene batteries, which promise to improve the efficiency and performance of EV batteries, offer a unique advantage in this space.

Additionally, the renewable energy sector is witnessing an unprecedented rise in investment, with governments worldwide setting ambitious targets for solar and wind energy generation. These renewable energy sources require advanced energy storage solutions to ensure a stable supply of power, even when the sun isn’t shining or the wind isn’t blowing.

Graphene batteries, with their ability to store more energy and last longer than conventional batteries, are becoming a preferred choice for large-scale energy storage systems. The U.S. Department of Energy’s Office of Energy Efficiency and Renewable Energy projects that the demand for energy storage systems will grow to over 200 gigawatt-hours by 2040. This represents a significant opportunity for graphene batteries to play a key role in the energy transition.

Trends

Integration of Graphene Batteries in Consumer Electronics

One of the latest trends in the graphene battery market is the increasing integration of graphene-based technology in consumer electronics. As the demand for smarter, more powerful devices grows, manufacturers are turning to advanced battery solutions that can offer faster charging, higher capacity, and longer life cycles. Graphene batteries are emerging as a promising alternative to traditional lithium-ion batteries, particularly in high-end smartphones, laptops, and wearables.

In the consumer electronics industry, companies are continually looking for ways to improve the performance and durability of their products. With graphene’s superior conductivity and energy storage capabilities, devices equipped with graphene batteries can charge faster and last longer than those using conventional lithium-ion batteries. For example, smartphones using graphene batteries can potentially reduce charging times by up to 70%, providing consumers with quicker and more convenient device use.

This trend has gained momentum, with leading electronics manufacturers such as Samsung and Huawei already exploring the integration of graphene batteries into their products. Samsung, for instance, has been investing in graphene research to enhance the performance of its mobile devices. A report from Samsung’s Advanced Institute of Technology (SAIT) in 2020 indicated that graphene batteries could allow smartphones to charge in just 12 minutes, compared to the hours required with traditional lithium-ion batteries.

Regional Analysis

In 2024, North America held a dominant position in the graphene battery market, accounting for approximately 42.30% of the total market share, valued at an estimated USD 80.3 million. This strong market presence is primarily driven by the rapid adoption of electric vehicles (EVs) and the growing demand for high-performance batteries in consumer electronics and renewable energy sectors. The United States, in particular, has been at the forefront of technological innovation and battery research, with substantial investments in the development of advanced energy storage solutions.

Government initiatives such as the U.S. Department of Energy’s support for battery research and the push towards achieving net-zero emissions by 2050 have significantly contributed to the growth of the graphene battery market in the region. The U.S. has allocated billions of dollars for energy storage research and development, with a particular focus on next-generation technologies, including graphene batteries. Additionally, the rise of electric vehicle manufacturers and the expanding network of EV charging infrastructure across the country further stimulate the demand for graphene-based solutions.

Canada is also witnessing a surge in interest, particularly in the development of clean energy storage solutions. Canadian companies are increasingly investing in graphene battery technology to cater to the needs of their growing electric vehicle market and to support the country’s commitment to reducing carbon emissions.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cabot Corporation is a leading player in the graphene battery market, known for its advanced materials and innovations in nanotechnology. The company focuses on producing high-performance graphene-based materials that enhance battery performance, including energy density, stability, and conductivity. With a strong presence in North America and Europe, Cabot Corporation plays a significant role in developing graphene batteries for various applications, including consumer electronics and electric vehicles, backed by robust R&D efforts.

Grabat Graphenano Energy, a joint venture between Graphenano S.L. and the Spanish company Grabat, is one of the prominent players in the graphene battery market. The company specializes in manufacturing graphene-based lithium batteries that provide faster charging times and longer lifespans compared to traditional lithium-ion batteries. Their innovative approach has attracted attention from various industries, particularly electric vehicles, where they offer enhanced performance and efficiency, positioning Grabat Graphenano Energy as a leader in the battery innovation space.

Graphene NanoChem plc is a UK-based company that specializes in the development of advanced graphene-based materials for use in energy storage systems, including batteries. By leveraging their expertise in nanotechnology, Graphene NanoChem is working to commercialize graphene-enhanced batteries that offer superior performance, such as higher energy density and faster charge times. Their focus on innovation and commitment to sustainability makes them a significant player in the graphene battery market, with applications ranging from industrial to consumer electronics.

Top Key Players in the Market

- Cabot Corporation

- Global Graphene Group

- Grabat Graphenano Energy

- Graphenano S.L.

- Graphene NanoChem plc

- Graphenea Group

- Huawei Technologies Co., Ltd.

- Hybrid Kinetic Group Ltd.

- Log 9 Materials Scientific Private Limited

- Nanotech Energy

- Targray Group

- Vorbeck Materials Corp.

- XG Sciences, Inc.

Recent Developments

Cabot Corporation, alongside other industry leaders such as Samsung SDI, Huawei Technologies, and Log9 Materials, has been instrumental in driving innovations aimed at enhancing battery performance, particularly in applications like consumer electronics and electric vehicles.

Graphenano’s focus on developing graphene polymer-based batteries aims to significantly enhance electric vehicle (EV) performance, with potential ranges of up to 500 kilometers after a five-minute recharge.

Report Scope

Report Features Description Market Value (2024) USD 190.0 Bn Forecast Revenue (2034) USD 2174.0 Bn CAGR (2025-2034) 27.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Lithium-ion Graphene Battery, Graphene Supercapacitor, Lithium-Sulfur Graphene Battery, Others), By End-Use (Automotive, Consumer Electronics, Power, Industrial Robotics, Aerospace And Defence, Healthcare, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cabot Corporation, Global Graphene Group, Grabat Graphenano Energy, Graphenano S.L., Graphene NanoChem plc, Graphenea Group, Huawei Technologies Co., Ltd., Hybrid Kinetic Group Ltd., Log 9 Materials Scientific Private Limited, Nanotech Energy, Targray Group, Vorbeck Materials Corp., XG Sciences, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cabot Corporation

- Global Graphene Group

- Grabat Graphenano Energy

- Graphenano S.L.

- Graphene NanoChem plc

- Graphenea Group

- Huawei Technologies Co., Ltd.

- Hybrid Kinetic Group Ltd.

- Log 9 Materials Scientific Private Limited

- Nanotech Energy

- Targray Group

- Vorbeck Materials Corp.

- XG Sciences, Inc.