Global Cocoa Powder Market Size, Share, And Business Benefits By Product Type (Natural Cocoa Powder, Dutch-Processed Cocoa Powder, Blended Cocoa Powder, Cocoa Rouge), By Cocoa Variety (Criollo, Forastero, Trinitario, Nacional), By Fat Content (High-Fat (20-22%), Medium-Fat (10-12%), Low-Fat (2-4%)), By Origin (Ghana, Ivory Coast, Indonesia, Nigeria), By End Use (Food and Beverage, Cosmetics and Personal Care, Pharmaceutical, Nutraceuticals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2023

- Report ID: 148203

- Number of Pages: 208

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- US Tariff Impact on Cocoa Powder Market

- By Product Type Analysis

- By Cocoa Variety Analysis

- By Fat Content Analysis

- By Origin Analysis

- By End Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

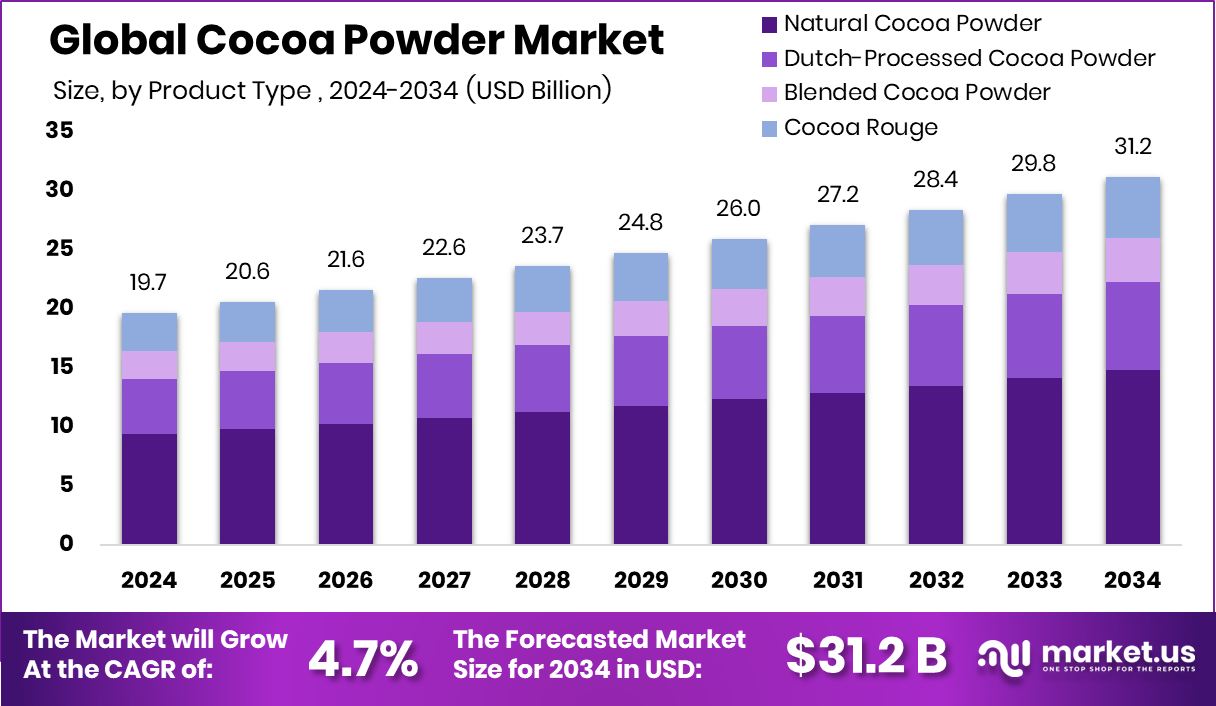

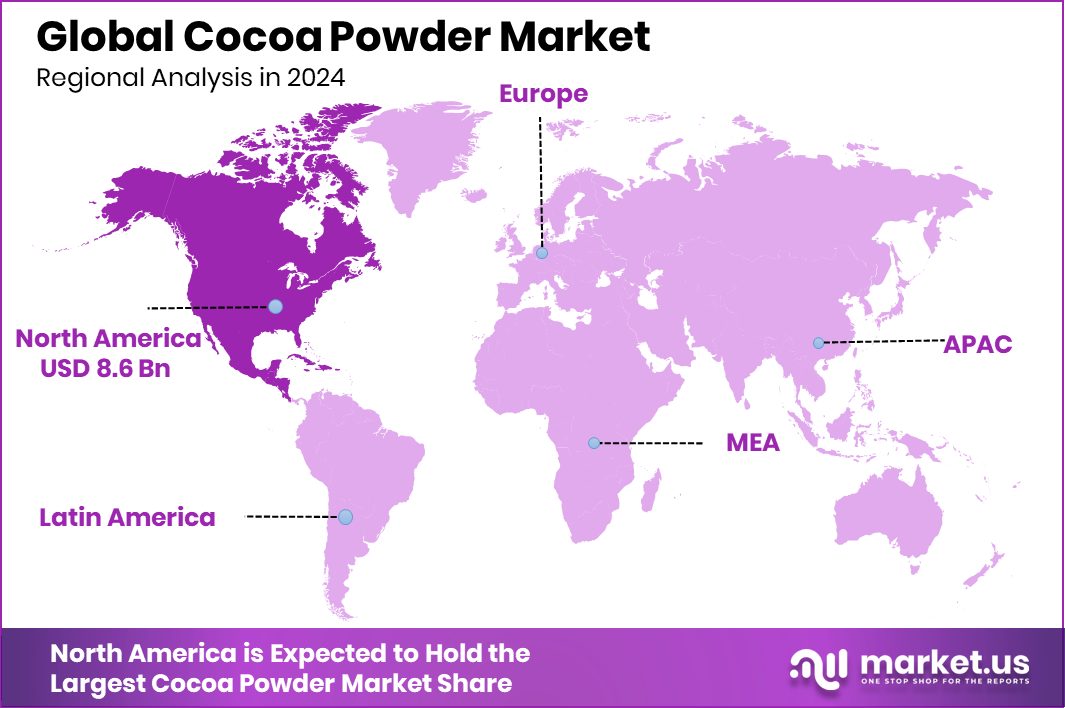

Global Cocoa Powder Market is expected to be worth around USD 31.2 billion by 2034, up from USD 19.7 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034. North America’s cocoa powder market dominance continues with USD 8.6 billion, 43.9% share.

Cocoa powder is a dry and unsweetened chocolate product derived from cocoa beans after the removal of cocoa butter. It is widely used in baking, beverages, and as a flavoring agent in various food products. The process involves fermenting, drying, roasting, and grinding cocoa beans to extract cocoa solids, which are then finely ground into powder. It is rich in antioxidants, flavonoids, and essential minerals, making it a popular ingredient in health-conscious and indulgent food items.

The cocoa powder market is driven by increasing consumer demand for chocolate-flavored products, especially in the confectionery and bakery sectors. It is a versatile ingredient utilized in beverages, dairy products, and baked goods, offering rich cocoa flavor without added fats. Rising health awareness has also propelled the use of cocoa powder as a healthier alternative to processed chocolate, attracting health-conscious consumers. The market is further influenced by evolving consumption patterns in emerging economies, where cocoa-based products are gaining popularity.

The cocoa powder market benefits from the expanding food and beverage industry, particularly in the bakery and confectionery segments. With consumers increasingly seeking premium and natural flavors, cocoa powder has gained traction as a key ingredient. Additionally, the rise of plant-based and vegan diets has further driven the demand for cocoa powder as a dairy-free chocolate alternative.

The demand for cocoa powder is bolstered by its wide application in diverse food products, including beverages, ice creams, and snacks. Its natural antioxidant properties and potential health benefits, such as improving cardiovascular health, have made it a popular choice in health-focused products.

Key Takeaways

- Global Cocoa Powder Market is expected to be worth around USD 31.2 billion by 2034, up from USD 19.7 billion in 2024, and grow at a CAGR of 4.7% from 2025 to 2034.

- Natural cocoa powder holds a significant 47.5% market share, driven by its versatile applications.

- Forastero cocoa variety dominates the market with a substantial 76.9% share, favored for robust flavor.

- Low-fat cocoa powder, with 2-4% fat content, commands a dominant 67.3% market share globally.

- Ivory Coast-origin cocoa powder represents 46.8% of the market, leveraging its extensive cocoa production capabilities.

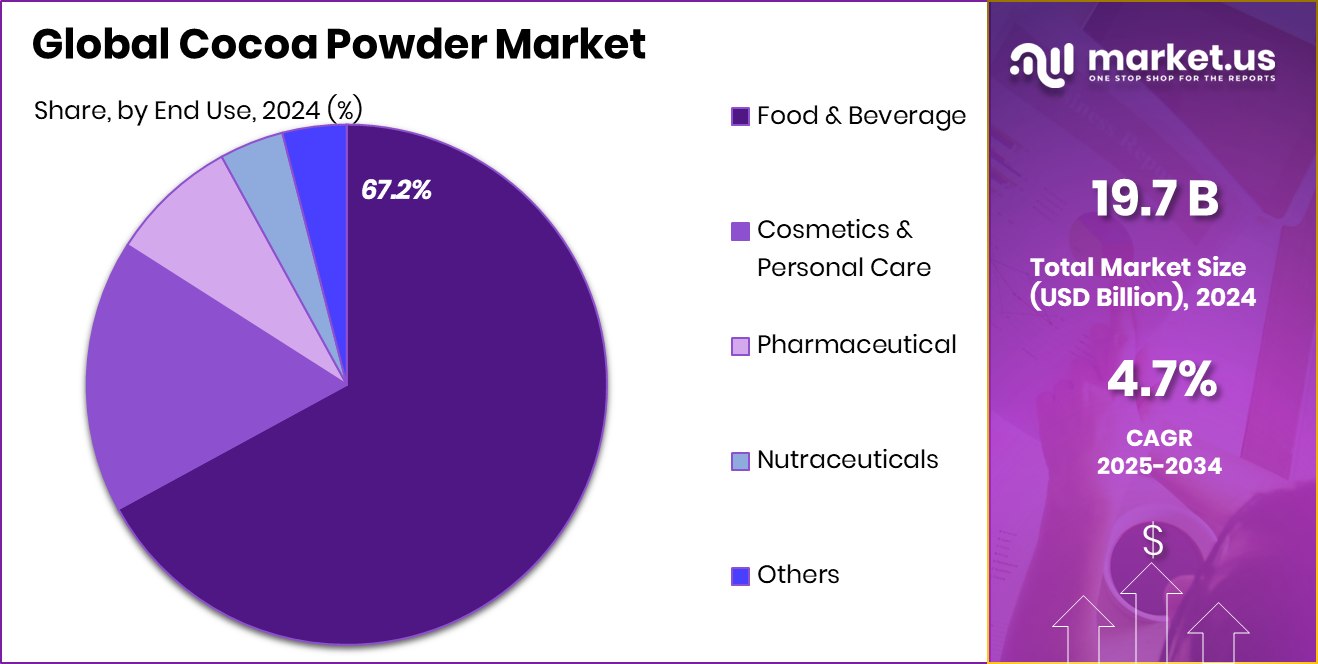

- Food and beverage applications account for 67.2% of cocoa powder demand, driven by rising confectionery consumption.

- The 43.9% share underscores North America’s strong cocoa powder demand, totaling USD 8.6 billion.

US Tariff Impact on Cocoa Powder Market

The tariff announcement significantly impacted the cocoa industry. The U.S. imposed a 21% tariff on cocoa beans from the Ivory Coast and a 10% tariff on those from Ghana. Additional tariffs included 32% on cocoa butter from Indonesia, 24% from Malaysia, and 20% on cocoa powder from the Netherlands.

These measures affected the U.S., which imported nearly $4 billion in chocolate and cocoa products in 2023, including $3 billion in processed chocolate. The International Cocoa Association projected a global cocoa deficit of 478,000 tonnes in January, the largest in over 60 years, primarily due to weather and disease-related crop failures in Ivory Coast and Ghana.

By Product Type Analysis

Natural Cocoa Powder accounts for 47.5%, highlighting its strong market demand globally.

In 2024, Natural Cocoa Powder held a dominant market position in the By Product Type segment of the Cocoa Powder Market, with a 47.5% share. The increasing demand for natural cocoa powder can be attributed to its rich flavor profile and widespread application in confectionery and bakery products. This segment continues to witness substantial growth as consumers prioritize natural and minimally processed food ingredients.

Moreover, the growing awareness regarding the health benefits of cocoa, such as its antioxidant properties, has further propelled the consumption of natural cocoa powder across various food and beverage applications. The market’s shift toward clean-label products is expected to sustain the demand for natural cocoa powder, reinforcing its leading position in the product type segment.

Additionally, emerging markets in regions such as Asia-Pacific and Latin America are anticipated to provide lucrative growth opportunities, driven by increasing consumer preference for natural cocoa-based products. The dominance of natural cocoa powder underscores its stronghold in the market, driven by expanding consumer awareness and growing demand for premium, natural ingredients in the food and beverage industry.

By Cocoa Variety Analysis

Forastero variety dominates with 76.9%, establishing itself as the preferred cocoa bean choice.

In 2024, Forastero held a dominant market position in the By Cocoa Variety segment of the Cocoa Powder Market, with a 76.9% share. Forastero’s robust share can be attributed to its widespread cultivation and high yield, making it a preferred variety for cocoa powder production globally. The variety’s distinct flavor profile, characterized by its strong, bold taste, continues to drive its demand in mass-market cocoa powder products.

Additionally, Forastero cocoa beans are more resilient and less susceptible to diseases, resulting in cost-effective production, which further strengthens their market penetration. The dominance of Forastero is particularly evident in regions with significant cocoa processing industries, where manufacturers prioritize cost-efficiency and consistent quality. The continued preference for Forastero variety by large-scale cocoa processors and chocolate manufacturers is expected to sustain its leading position in the market.

Furthermore, the growing demand for cocoa powder in the bakery and confectionery sectors reinforces Forastero’s market leadership, driven by its favorable processing characteristics and high availability. The dominance of Forastero underscores its critical role in meeting the global demand for cocoa powder, positioning it as a staple in the cocoa processing industry.

By Fat Content Analysis

Low-Fat Cocoa Powder holds 67.3%, driven by increasing health-conscious consumer preferences.

In 2024, Low-Fat (2-4%) held a dominant market position in the By Fat Content segment of the Cocoa Powder Market, with a 67.3% share. The growing consumer inclination toward healthier dietary options has significantly driven the demand for low-fat cocoa powder, positioning it as the preferred choice in various food and beverage applications. This segment benefits from its versatility in producing reduced-fat chocolate products, bakery items, and nutritional supplements without compromising the cocoa flavor.

Additionally, the rising awareness regarding weight management and calorie reduction further boosts the demand for low-fat cocoa powder, particularly among health-conscious consumers. The segment’s substantial market share is also supported by its extensive use in low-fat dairy products, protein shakes, and dietary snacks.

Manufacturers are capitalizing on the trend by offering low-fat cocoa powder variants that cater to the increasing demand for healthier and lower-calorie cocoa-based products. As the global market continues to emphasize health and wellness, the dominance of the Low-Fat (2-4%) segment is expected to remain strong, underpinned by its nutritional benefits and growing application across multiple end-use sectors.

By Origin Analysis

Ivory Coast leads production with 46.8%, reinforcing its position as a key supplier.

In 2024, Ivory Coast held a dominant market position in the By Origin segment of the Cocoa Powder Market, with a 46.8% share. The country’s leadership in the cocoa powder market is driven by its robust cocoa production capabilities, making it the largest cocoa-producing nation globally.

The consistent supply of high-quality cocoa beans from Ivory Coast has positioned it as a key supplier for cocoa powder manufacturers, contributing significantly to the segment’s market share. Additionally, the region’s well-established cocoa processing infrastructure supports large-scale production, ensuring a steady output of cocoa powder to meet global demand.

The prominence of Ivory Coast in the origin segment is further bolstered by its competitive pricing structure and extensive distribution networks, making it a preferred sourcing destination for cocoa processors. The country’s favorable climatic conditions and extensive cocoa plantations enable sustained cocoa bean production, reinforcing its dominance in the cocoa powder market.

As demand for cocoa powder continues to rise, particularly in emerging markets, Ivory Coast is expected to maintain its market leadership, driven by its strong supply chain and expansive cocoa cultivation base.

By End Use Analysis

Food and Beverage sector secures 67.2%, showcasing the market’s primary consumption segment.

In 2024, Food and Beverage held a dominant market position in the By End Use segment of the Cocoa Powder Market, with a 67.2% share. The widespread use of cocoa powder in confectionery, bakery, and dairy products has significantly driven the segment’s dominance. Cocoa powder’s application in producing chocolates, cakes, biscuits, and beverages continues to fuel demand, making the food and beverage sector a key consumer.

The segment also benefits from the rising consumer preference for cocoa-infused products, particularly in regions with established chocolate manufacturing industries. Additionally, the increasing trend of incorporating cocoa powder in nutritional supplements, protein shakes, and functional foods further bolsters the demand within the food and beverage sector.

The segment’s stronghold is also supported by the growing popularity of premium cocoa-based products, driven by the rising disposable income and changing consumer preferences. As cocoa powder remains a vital ingredient in various food formulations, the segment is expected to sustain its dominant market position.

Moreover, the expansion of the global food and beverage industry and the growing penetration of cocoa-based products in emerging markets are anticipated to further reinforce the segment’s leadership in the cocoa powder market.

Key Market Segments

By Product Type

- Natural Cocoa Powder

- Dutch-Processed Cocoa Powder

- Blended Cocoa Powder

- Cocoa Rouge

By Cocoa Variety

- Criollo

- Forastero

- Trinitario

- Nacional

By Fat Content

- High-Fat (20-22%)

- Medium-Fat (10-12%)

- Low-Fat (2-4%)

By Origin

- Ghana

- Ivory Coast

- Indonesia

- Nigeria

By End Use

- Food and Beverage

- Cosmetics and Personal Care

- Pharmaceutical

- Nutraceuticals

- Others

Driving Factors

Rising Demand for Chocolate Products Drives Growth

The increasing demand for chocolate products globally is a key driving factor in the Cocoa Powder Market. Consumers’ preference for cocoa-based confectionery, bakery items, and beverages has surged, fueled by the popularity of chocolate-flavored products across all age groups.

Additionally, cocoa powder is widely used in the production of chocolates, desserts, and flavored drinks, further boosting its demand. The rise of premium and artisanal chocolate products, especially in emerging markets, has also contributed to the market’s expansion.

Moreover, the growing trend of gifting premium chocolate products during festive seasons and special occasions continues to elevate cocoa powder consumption. This demand surge is expected to drive consistent market growth in the coming years.

Restraining Factors

Fluctuating Cocoa Prices Impact Market Stability

The volatility in cocoa prices is a major restraining factor for the Cocoa Powder Market. Cocoa bean prices are influenced by unpredictable weather patterns, political instability in cocoa-producing regions, and fluctuating demand levels.

When cocoa prices surge, the cost of cocoa powder production increases, impacting profit margins for manufacturers and resulting in higher retail prices for end consumers. Additionally, supply chain disruptions and export restrictions in key cocoa-producing countries can further exacerbate price fluctuations, leading to market instability.

The high dependence on cocoa beans as the primary raw material makes the cocoa powder market highly susceptible to price variations, posing challenges for both manufacturers and end consumers. This factor continues to hinder the market’s steady growth.

Growth Opportunity

Expanding Demand for Cocoa in Emerging Markets

The Cocoa Powder Market is experiencing significant growth, primarily driven by the escalating demand in emerging markets. Countries in Asia-Pacific and Latin America are witnessing a surge in the consumption of chocolate and cocoa-based products, fueled by rising disposable incomes, urbanization, and changing dietary preferences.

This trend is particularly evident in nations like China, India, and Brazil, where the middle-class population is expanding, leading to increased spending on confectionery and bakery items.

The growing awareness of the health benefits associated with cocoa, such as its antioxidant properties, is also contributing to its popularity in these regions. Furthermore, the proliferation of Western-style cafes and bakeries is introducing a variety of cocoa-infused products to new consumer bases.

Latest Trends

Growing Popularity of Organic Cocoa Powder Products

In 2024, the cocoa powder market witnessed a significant trend towards organic products. Consumers are increasingly seeking healthier and more natural food options, leading to a surge in demand for organic cocoa powder. This shift is driven by heightened awareness of the health benefits associated with organic cocoa, such as its rich antioxidant content and absence of synthetic additives.

Additionally, the emphasis on sustainable and environmentally friendly farming practices has bolstered the appeal of organic cocoa powder. Manufacturers are responding to this trend by expanding their organic product lines and obtaining relevant certifications to meet consumer expectations.

The growing preference for organic cocoa powder is not only influencing product offerings but also shaping marketing strategies, with brands highlighting organic and health-focused attributes to attract health-conscious consumers. This trend is expected to continue, contributing to the overall growth and diversification of the cocoa powder market.

Regional Analysis

In 2024, North America’s cocoa powder market reached USD 8.6 billion, capturing 43.9%.

In 2024, North America held a dominant position in the regional segmentation of the Cocoa Powder Market, accounting for 43.9% share and reaching a market value of USD 8.6 billion. The region’s substantial share is driven by the strong demand for cocoa-based products, particularly in the United States and Canada, where chocolate consumption remains high.

Europe follows closely, propelled by its well-established confectionery industry and the rising demand for premium cocoa powder in bakery and dairy products. The Asia Pacific region is witnessing significant growth, fueled by increasing disposable incomes and the expanding chocolate processing industry in countries such as China and India.

Meanwhile, Latin America, a key cocoa-producing region, leverages its cocoa bean production capabilities to supply cocoa powder domestically and globally. The Middle East & Africa segment is experiencing moderate growth, supported by rising consumer awareness of cocoa powder’s health benefits and the expansion of the bakery and confectionery sector.

As demand for cocoa powder continues to rise across these regions, North America’s leadership position remains strong, driven by its large consumer base and established cocoa product manufacturing sector.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Blommer Chocolate Company, Cocoa Processing Company, and ECOM Agroindustrial played pivotal roles in shaping the global Cocoa Powder Market.

Blommer Chocolate Company, a prominent cocoa processor in North America, leveraged its extensive supply chain to maintain a steady output of cocoa powder, meeting the rising demand from the confectionery and bakery sectors. The company’s strategic focus on sustainable cocoa sourcing and its established relationships with major food manufacturers enabled it to maintain a competitive edge in the market.

Cocoa Processing Company, a key player in Africa, capitalized on the region’s abundant cocoa bean supply to produce high-quality cocoa powder for both domestic and international markets. The company’s emphasis on refining its production processes to enhance product quality and consistency positioned it as a preferred supplier for various applications, particularly in the food and beverage industry.

Meanwhile, ECOM Agroindustrial maintained its stronghold as a global commodity trader, effectively navigating volatile cocoa bean prices to secure raw materials for cocoa powder production. Its global distribution network and extensive cocoa sourcing capabilities allowed the company to serve diverse regional markets, reinforcing its market presence amid fluctuating cocoa prices.

Top Key Players in the Market

- Barry Callebaut

- Belcolade

- Blommer Chocolate Company

- Cargill Hershey

- Cocoa Processing Company

- Cocoacraft

- ECOM Agroindustrial

- Ghirardelli

- Guittard Chocolate Company

- Indcresa

- JB Foods

- Meiji

- Mondelez International

- Nestle

- Newtown Foods USA

- Olam International

- Plot Enterprise

- Puratos

Recent Developments

- In March 2025, ECOM participated in the World Cocoa Foundation’s Partnership Meeting held in São Paulo. The event brought together industry leaders, producers, and stakeholders to address challenges in the cocoa sector, focusing on resilience, collaboration, and sustainable supply chains. ECOM’s involvement underscores its commitment to building a smarter, more sustainable cocoa industry.

- In March 2024, Cargill introduced its NatureFresh Professional range at AAHAR 2024 in New Delhi. This range includes cocoa powders, block chocolates, and chocolate chips, tailored for the Indian bakery and confectionery market.

Report Scope

Report Features Description Market Value (2024) USD 19.7 Billion Forecast Revenue (2034) USD 31.2 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Natural Cocoa Powder, Dutch-Processed Cocoa Powder, Blended Cocoa Powder, Cocoa Rouge), By Cocoa Variety (Criollo, Forastero, Trinitario, Nacional), By Fat Content (High-Fat (20-22%), Medium-Fat (10-12%), Low-Fat (2-4%)), By Origin (Ghana, Ivory Coast, Indonesia, Nigeria), By End Use (Food and Beverage, Cosmetics and Personal Care, Pharmaceutical, Nutraceuticals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Barry Callebaut, Belcolade, Blommer Chocolate Company, Cargill Hershey, Cocoa Processing Company, Cocoacraft, ECOM Agroindustrial, Ghirardelli, Guittard Chocolate Company, Indcresa, JB Foods, Meiji, Mondelez International, Nestle, Newtown Foods USA, Olam International, Plot Enterprise, Puratos Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Barry Callebaut

- Belcolade

- Blommer Chocolate Company

- Cargill Hershey

- Cocoa Processing Company

- Cocoacraft

- ECOM Agroindustrial

- Ghirardelli

- Guittard Chocolate Company

- Indcresa

- JB Foods

- Meiji

- Mondelez International

- Nestle

- Newtown Foods USA

- Olam International

- Plot Enterprise

- Puratos