Global Specialty Malt Market By Type (Pale Malt, Caramel Malt, Crystal Malt, Roasted Malt, Munich Malt, Vienna Malt), By Organic (Organic Specialty Malt, Conventional Specialty Malt), By Extract Type (Dry, Liquid, Malt Flours), By Extraction Rate (Low Extraction Rate Malt, Medium Extraction Rate Malt, High Extraction Rate Malt), By Application (Brewing, Baking, Distilling), By Packaging (Bags, Sacks, Bulk) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140028

- Number of Pages: 382

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

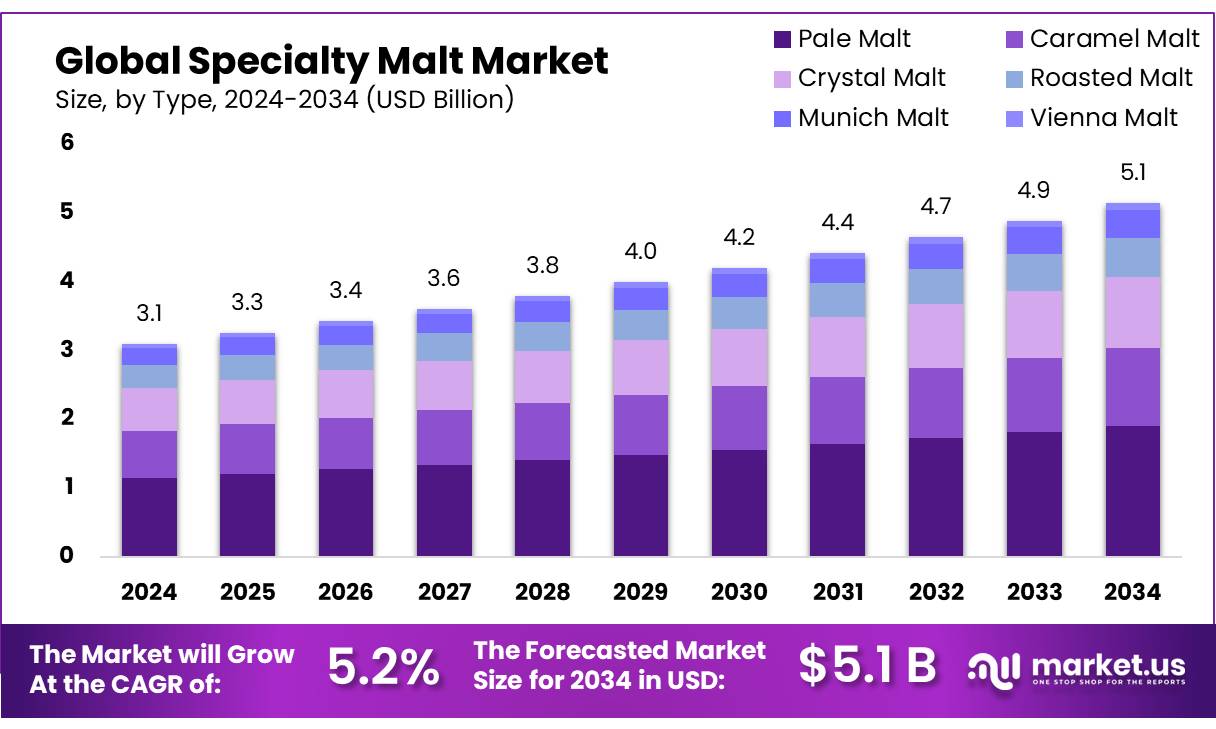

The Global Specialty Malt Market size is expected to be worth around USD 5.1 Bn by 2034, from USD 3.1 Bn in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034.

Specialty malt is a key ingredient in the production of craft beer, spirits, and various food products. It is produced through the malting process, where cereal grains are soaked in water, germinated, and then dried to develop distinct flavors, colors, and aromas. These malts are specifically designed to impart unique characteristics, including varying levels of sweetness, bitterness, and color intensity, which enhance the flavor profiles of beverages and food.

The growing preference for craft brewing and diverse food formulations is significantly driving the demand for specialty malts across different regions. As consumers seek unique and high-quality products, the need for specialty malts that offer customized flavor and color profiles continues to rise, particularly in the craft beverage and premium food markets.

Several key factors are driving the growth of the specialty malt industry. First, the increasing global consumption of craft beer is a major contributor. The US craft beer market alone reached over 26 billion USD in retail sales in 2023, as reported by the Brewers Association, indicating a steady upward trend. This rise in craft beer consumption directly boosts the demand for specialty malts that provide distinctive flavor and color to these artisanal brews.

The future growth of the specialty malt market is closely tied to the expanding consumer base for premium alcoholic and non-alcoholic beverages, along with continuous innovations in the food industry. Manufacturers have significant opportunities to develop new malt varieties that cater to specific consumer preferences, offering enhanced flavors, aromas, and colors.

Key Takeaways

- Specialty Malt Market is projected to expand from USD 3.1 billion in 2024 to USD 5.1 billion by 2034, with a CAGR of 5.2%.

- Pale malt dominant a 37.4% market share.

- Conventional Specialty Malt held a dominant market position, capturing more than a 69.1% share.

- Dry specialty malts account for 48.1%.

- Medium Extraction Rate Malt held a dominant market position, capturing more than a 45.3% share.

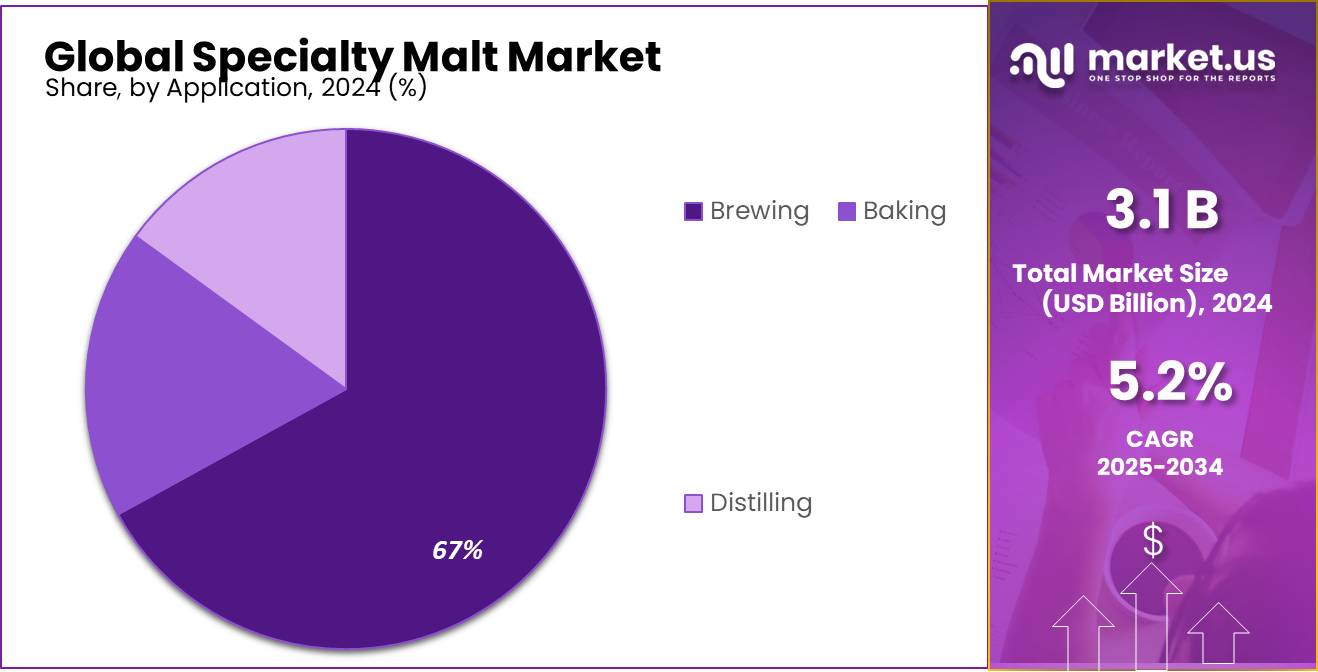

- Brewing applications dominate with a 67.2% share; bag packaging constitutes 39.2%.

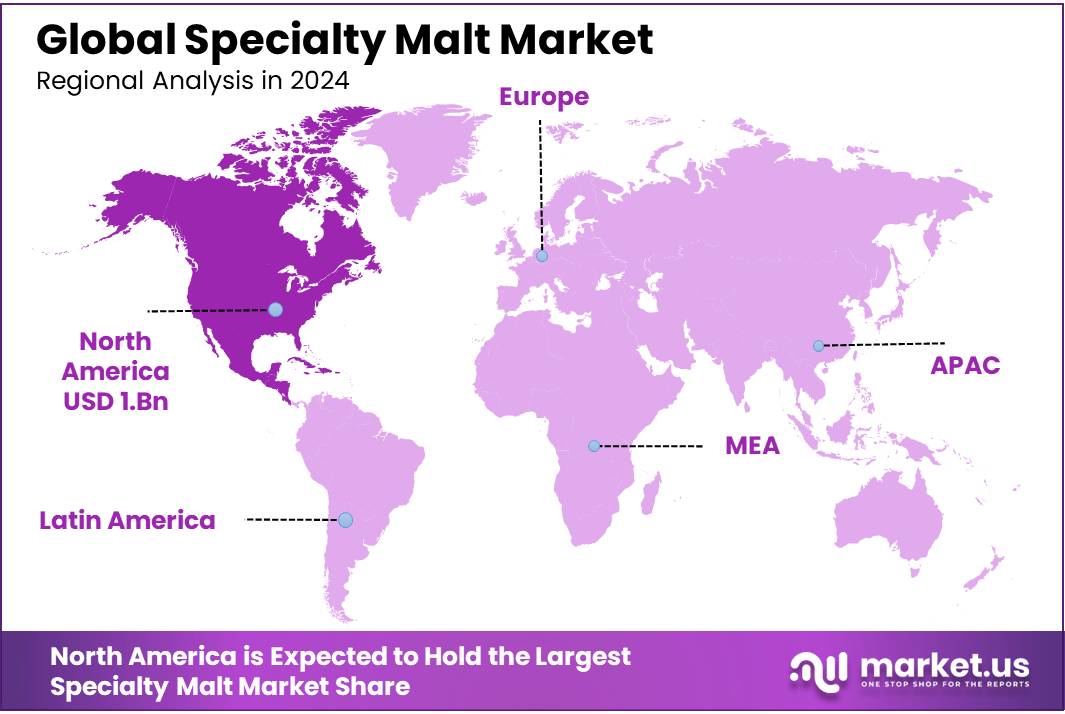

- North America leads with a 34.6% market share, driven by craft brewing trends.

By Type

In 2024, Pale Malt held a dominant market position in the specialty malt sector, capturing more than a 37.4% share. This type of malt is a staple in brewing, favored for its versatility and the mild, sweet flavors it imparts to beers, making it a popular choice for both commercial breweries and homebrewers. Pale malt serves as the foundation for many beer styles, providing the necessary enzymes and sugars for fermentation.

Caramel Malt also plays a significant role in the specialty malt market. It is highly valued for adding color, body, and flavors of caramel and toffee to various beer types. This malt’s ability to enhance the mouthfeel and complexity of brews makes it a preferred choice for crafting richer, more flavorful beers.

Crystal Malt is noted for its distinctive, shiny appearance due to its unique production process where the malt’s sugars are crystallized. It contributes deeper amber hues and richer caramel flavors compared to caramel malt, making it ideal for darker ales and lagers that require more pronounced malt profiles.

Roasted Malt, with its robust flavor profile, is essential for producing stouts and porters. It imparts dark colors and rich, coffee-like flavors, making it a key ingredient for beers that demand a strong roasted character.

Munich Malt is another significant variety, known for its rich, malty flavor. It is often used in darker lagers and ales to provide a smooth, malty base that supports the beer’s overall flavor complexity without overpowering other ingredients.

Vienna Malt is characterized by its delicate and slightly toasty flavor, commonly used in amber and brown ales. It provides a light amber color and a subtle, malty sweetness, balancing the hop bitterness in many traditional European beer styles.

By Organic

In 2024, Conventional Specialty Malt held a dominant market position, capturing more than a 69.1% share. This segment continues to lead due to its widespread availability, cost-effectiveness, and established presence in the brewing industry. Conventional specialty malts are extensively used by large-scale breweries, craft brewers, and distillers, as they offer consistent quality, stable supply chains, and a variety of flavor profiles suitable for different beer styles.

On the other hand, Organic Specialty Malt is steadily gaining traction, driven by increasing consumer interest in organic and sustainable beer production. While still a niche market, the demand for organic malt is growing among craft brewers and premium beer brands that prioritize natural ingredients and eco-friendly farming practices. Organic specialty malts are cultivated without synthetic fertilizers or pesticides, appealing to health-conscious consumers and those who seek transparency in sourcing.

By Extract Type

In 2024, Dry specialty malt held a dominant market position, capturing more than a 48.1% share. The popularity of dry malt extracts stems from their long shelf life, ease of handling, and high concentration of fermentable sugars, making them a preferred choice for both commercial brewers and homebrewers. Dry malt extracts (DME) provide a consistent and convenient brewing solution, especially for those looking to enhance the body, flavor, and color of their beer without requiring complex mashing processes.

Liquid malt extracts follow closely, offering high-quality malt solutions with a richer, more caramelized flavor. These extracts are widely used in brewing, baking, and food production industries due to their ability to retain more natural malt characteristics. Liquid malt extracts (LME) are often preferred by professional brewers for their smooth integration into brewing processes, particularly in high-gravity brewing and specialty beer formulations.

Malt Flours represent a growing segment, primarily utilized in the baking and food industry for their ability to enhance flavor, texture, and enzymatic activity in baked goods. Malt flours are commonly used in bread, cereals, and confectionery, where they add natural sweetness, improve crust color, and aid fermentation.

By Extraction Rate

In 2024, Medium Extraction Rate Malt held a dominant market position, capturing more than a 45.3% share. This segment’s strong presence in the specialty malt market is attributed to its balanced efficiency in sugar extraction, making it an ideal choice for brewers aiming to optimize both yield and flavor. Medium extraction rate malts strike a perfect balance between high enzymatic activity and rich malt character, which is crucial in crafting beers with a well-rounded body and smooth taste.

Low Extraction Rate Malt remains a vital segment, particularly for craft brewers and artisanal distillers who prioritize flavor complexity over efficiency. These malts retain a higher proportion of husks and other grain components, contributing to deeper color and richer taste profiles. They are often used in darker beer styles such as stouts, porters, and traditional European ales, where malt character is more pronounced than sugar yield.

High Extraction Rate Malt, on the other hand, is favored by large-scale breweries and distilleries focused on maximizing sugar conversion and production efficiency. This type of malt is engineered for high fermentability, allowing brewers to achieve strong alcohol content and cleaner fermentation profiles. It is particularly useful in high-gravity brewing and industrial-scale alcohol production, where optimizing raw material usage is a key concern.

By Application

In 2024, Brewing held a dominant market position in the specialty malt sector, capturing more than a 67.2% share. This segment’s substantial market share is largely due to the critical role malt plays in beer production, where it provides the essential sugars needed for fermentation, as well as flavor, color, and body to the final product. Specialty malts, such as caramel and roasted malts, are particularly valued for their ability to impart unique tastes and aromas that differentiate craft beers from standard commercial brews.

The Baking segment also utilizes specialty malts, primarily for their ability to enhance flavor and color in baked goods. Malt flours are used in products like bread, cookies, and pastries, where they contribute to a richer taste and improved texture. Although smaller compared to the brewing segment, the use of malt in baking is on the rise, driven by consumer demand for natural and wholesome ingredients. This trend is particularly evident in health-conscious markets and in regions where artisanal baking practices are flourishing.

Distilling is another significant application for specialty malts, especially in the production of whiskey and other malt-based spirits. In distilling, malts are chosen for their enzyme richness and flavor profiles, which are crucial for developing the desired spirit character. High-quality specialty malts are essential for crafting premium spirits, and the growth of the craft distilling movement has led to increased demand for distinctive malt varieties that offer unique flavor nuances.

By Packaging

In 2024, Bags held a dominant market position in the specialty malt sector, capturing more than a 39.2% share. This packaging format’s popularity is due to its convenience and efficiency in handling, storage, and transportation, particularly for small to medium-scale brewers and bakers. Malt stored in bags is easier to distribute and manage, making it ideal for operations that require specific quantities or that do not have the facilities to handle bulk deliveries.

Sacks are also a common packaging option, particularly for larger quantities of malt. Similar to bags but typically larger and more robust, sacks are favored by operations that need malt in substantial volumes but do not necessarily require the bulk shipment infrastructure. Sacks can be efficiently stacked and stored in a variety of settings, making them versatile for both production facilities and retail environments.

Bulk packaging continues to be essential, especially for major breweries and distilleries that consume large amounts of malt. Bulk systems provide a cost-effective solution for handling large volumes, reducing packaging waste and the overall cost per unit of malt. This type of packaging is integral to operations with high production rates and is supported by specialized equipment that allows for the direct transfer of malt from delivery trucks to storage silos or production areas.

Key Market Segments

By Type

- Pale Malt

- Caramel Malt

- Crystal Malt

- Roasted Malt

- Munich Malt

- Vienna Malt

By Organic

- Organic Specialty Malt

- Conventional Specialty Malt

By Extract Type

- Dry

- Liquid

- Malt Flours

By Extraction Rate

- Low Extraction Rate Malt

- Medium Extraction Rate Malt

- High Extraction Rate Malt

By Application

- Brewing

- Baking

- Distilling

By Packaging

- Bags

- Sacks

- Bulk

Drivers

Craft Brewing Boom

The significant growth of the specialty malt market in recent years, particularly in 2024, is largely driven by the expanding craft brewing industry. As the demand for craft beers continues to surge, brewers are increasingly seeking high-quality specialty malts that provide unique flavors and enhance the overall beer profile. These malts are crucial for developing distinctive and complex beer flavors that differentiate craft beers from mainstream offerings.

Specialty malts, such as roasted, crystal, and dark malts, are preferred for their ability to impart deep colors, rich flavors, and desired textures to craft beers. The variety and uniqueness of these malts allow craft brewers to experiment with new recipes and cater to a diverse palate, pushing the boundaries of traditional beer profiles.

Furthermore, the rise in consumer preference for premium and flavorful beers has fueled the demand for these specialty ingredients. Consumers are becoming more discerning about the quality and origin of the beer they consume, which in turn drives breweries to source the best ingredients to meet these expectations.

The market for specialty malts is expected to continue its robust growth, supported by the thriving craft beer segment and the ongoing trend towards premiumization in the beverage industry. As breweries expand their product lines to include a wider range of beer styles, the role of specialty malts becomes even more central, ensuring sustained demand and market expansion.

Restraints

Volatility in Raw Material Prices

One significant restraining factor for the specialty malt market is the volatility in raw material prices, particularly barley, which is the primary grain used in malt production. Fluctuations in the cost of barley can have a considerable impact on the overall production expenses for malt producers. These price variations are often driven by changes in weather conditions, agricultural yields, and global supply chain disruptions, which can lead to unpredictable market conditions.

For example, adverse weather conditions such as droughts or excessive rainfall can drastically affect barley yields, leading to shortages and increased prices. Additionally, global market dynamics, including trade policies and economic fluctuations, further compound the instability of raw material costs. This unpredictability makes it challenging for malt producers to manage costs effectively and plan long-term investments and production strategies.

Moreover, the specialty malt market also contends with the rising costs of energy and production inputs, which are exacerbated by the unstable prices of raw materials. These factors collectively contribute to higher operational costs, potentially leading to increased prices for end consumers in the brewing and food industries.

Government initiatives and policy changes related to agriculture and trade can sometimes mitigate these impacts by stabilizing market conditions or offering support to farmers and producers. However, the inherent nature of agricultural dependency on weather and global economic conditions continues to pose a risk to the stability and growth of the specialty malt industry.

Opportunity

Expansion into Emerging Markets

A significant growth opportunity for the specialty malt market lies in its expansion into emerging markets, particularly in Asia-Pacific and Latin America. These regions are experiencing rapid growth in their brewing and distilling industries, fueled by increasing consumer affluence and a growing interest in craft and premium beverages. As these markets develop, the demand for diverse malt products, which provide unique flavors and characteristics, is also rising.

For instance, countries like China and India have shown a burgeoning interest in craft beers, with consumers increasingly willing to explore new flavors and beer styles. This shift presents a lucrative opportunity for specialty malt producers to introduce their high-quality malts to these new audiences. The unique properties of specialty malts, such as enhanced flavors and colors, make them ideal for brewers looking to differentiate their products in competitive markets.

Additionally, government initiatives aimed at boosting agricultural outputs and supporting local brewing and distilling sectors in these regions provide a conducive environment for the growth of the specialty malt industry. These initiatives often include subsidies for agricultural inputs, tax incentives for small and medium enterprises, and support for export activities, which can help malt producers establish a foothold in these promising markets.

Furthermore, the global trend towards healthier and natural ingredients is another driver supporting the growth of the specialty malt market in emerging regions. As health-conscious consumers seek out beverages with natural and organic ingredients, the demand for specialty malts, often produced with minimal processing and sustainable practices, is expected to rise.

Trends

The Rise of Organic and Gluten-Free Specialty Malts

One of the latest trends in the specialty malt market is the increasing demand for organic and gluten-free malts. This shift is largely driven by the growing consumer preference for healthier and more sustainable products, which align with broader trends in the food and beverage industry. As people become more health-conscious, they are seeking out products that not only enhance their health but also have a minimal environmental impact.

Organic specialty malts are produced without the use of synthetic pesticides and fertilizers, appealing to consumers who are concerned about the presence of chemicals in their food and drinks. The organic malt segment is flourishing, as these malts cater to the craft brewers and distillers who emphasize quality and sustainability in their product narratives. The demand for organic malts is expected to see a substantial rise, supported by the increasing number of breweries and distilleries that are adopting organic certification to meet consumer expectations.

Furthermore, gluten-free specialty malts, made from grains like sorghum, rice, and millet, are gaining traction in the market. These malts are crucial for producing gluten-free beers, a segment that has seen significant growth due to the rising prevalence of gluten intolerance and celiac disease among the global population. Gluten-free malts provide a way for individuals with dietary restrictions to enjoy beer without compromising on taste or quality.

These trends are not only reshaping the specialty malt market but also encouraging producers to innovate and expand their offerings to include malts that meet these specific consumer needs. As the demand for healthier and environmentally friendly products continues to grow, the specialty malt market is likely to see a diversification of products aimed at health-conscious consumers.

Regional Analysis

North America dominates the global specialty malt market with a substantial 34.6% share, translating to approximately USD 1.0 billion in revenue. This region’s market prominence is underpinned by a strong craft beer culture, particularly in the United States and Canada, where there is a significant demand for unique and high-quality malt types to produce diverse beer flavors. The growth in North America is also supported by advanced agricultural technologies and robust supply chains that ensure the availability and quality of malt grains.

Europe follows closely, recognized for its deep-rooted brewing traditions and the increasing popularity of craft breweries across its countries. Europe’s market is driven by a preference for premium malts used in traditional brewing and the rising trend of experimenting with new flavors and beer types. Countries like Germany, the UK, and Belgium are key contributors, leveraging their long-standing brewing heritage to innovate within the specialty malt space.

Asia Pacific is identified as a rapidly growing segment of the specialty malt market, thanks to expanding economic conditions and changing consumer preferences towards more premium beverage options. The region is experiencing an increase in microbreweries and craft spirit producers, particularly in countries like China, Japan, and Australia, which are increasingly utilizing specialty malts to cater to a more discerning consumer base.

Latin America and the Middle East & Africa regions, while smaller in comparison, are starting to show potential for growth. These regions benefit from developing beverage industries and a growing middle class that is starting to embrace craft brewing and distilling practices. Innovations and investments in agriculture in these regions are expected to enhance the availability and variety of specialty malts, fostering market growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The specialty malt market is characterized by a diverse array of key players who contribute to the industry’s dynamism and innovation. Among these, Cargill and Malteurop are notable for their extensive global presence and substantial production capacities. Cargill, with its broad range of malt products, serves a wide array of brewing and distilling needs, supporting everything from large-scale beverage manufacturers to artisanal breweries.

European malt producers such as Weyermann and Boortmalt are recognized for their specialized malts that cater to craft brewers looking for unique flavor profiles. Weyermann, in particular, is renowned for its wide range of base and specialty malts which are crucial for producing traditional and craft beers. Boortmalt’s acquisition of Prairie Malt underscores its strategy to expand its footprint and enhance its offerings globally.

In the UK, companies like Simpsons Malt and Crisp Malting Group play critical roles in the market. Simpsons Malt is lauded for its premium malts that supply breweries and distilleries across the world, known for consistency and quality. Crisp Malting Group aligns with similar values, providing a spectrum of malt products that support both traditional brewing practices and innovative brewing trends.

Top Key Players

- Axereal

- Baird’s

- Bestmalz

- Boortmalt

- Canada Malting

- Cargill

- Crisp Malting Group

- Dingemans

- Epiphany

- GrainCorp

- Great Western

- IREKS

- Ireks GmbH

- Lallemand Inc.

- Malteurop

- Weyermann

- Mangrove Ltd

- Munton’s

- Murphy Son

- Patagonia

- Prairie Malt / Boortmalt

- Proximity

- Rahr

- Simpsons Malt

- Soufflet Group

- The Swaen

- Viking Malt

Recent Developments

In 2024, Axereal’s commitment to sustainability is evident in its management of 45,000 hectares of low-carbon agriculture in France, demonstrating a proactive stance in reducing environmental impact while enhancing product quality.

In 2024, Bairds Malt has demonstrated significant growth and innovation within the specialty malt sector, particularly highlighted by their expansion plans in Inverness, Scotland. This development includes an addition of 57,000 metric tons to their annual production capacity, emphasizing their commitment to meet the increasing demand from the Scottish distilling industry.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Bn Forecast Revenue (2034) USD 5.1 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pale Malt, Caramel Malt, Crystal Malt, Roasted Malt, Munich Malt, Vienna Malt), By Organic (Organic Specialty Malt, Conventional Specialty Malt), By Extract Type (Dry, Liquid, Malt Flours), By Extraction Rate (Low Extraction Rate Malt, Medium Extraction Rate Malt, High Extraction Rate Malt), By Application (Brewing, Baking, Distilling), By Packaging (Bags, Sacks, Bulk) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Axereal, Baird’s, Bestmalz, Boortmalt, Canada Malting, Cargill, Crisp Malting Group, Dingemans, Epiphany, GrainCorp, Great Western, IREKS, Ireks GmbH, Lallemand Inc., Malteurop, Weyermann, Mangrove Ltd, Munton’s, Murphy Son, Patagonia, Prairie Malt / Boortmalt, Proximity, Rahr, Simpsons Malt, Soufflet Group, The Swaen, Viking Malt Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Axereal

- Baird's

- Bestmalz

- Boortmalt

- Canada Malting

- Cargill

- Crisp Malting Group

- Dingemans

- Epiphany

- GrainCorp

- Great Western

- IREKS

- Ireks GmbH

- Lallemand Inc.

- Malteurop

- Weyermann

- Mangrove Ltd

- Munton's

- Murphy Son

- Patagonia

- Prairie Malt / Boortmalt

- Proximity

- Rahr

- Simpsons Malt

- Soufflet Group

- The Swaen

- Viking Malt