Global Sunflower Seeds Market By Color (Bright Yellow, Green, Light Grey, Claret Red, Black, White), By Type (Oil Seed, Non-Oil Seed), By Breeding Technology (Hybrids, Open Pollinated Varieties and Hybrid Derivatives), By Application (Edible Oil, Bakery, Snacks, Products, Confectionery Products, Birdfeed), By Distribution Channel (Supermarkets, Retail Shops, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2024

- Report ID: 139945

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

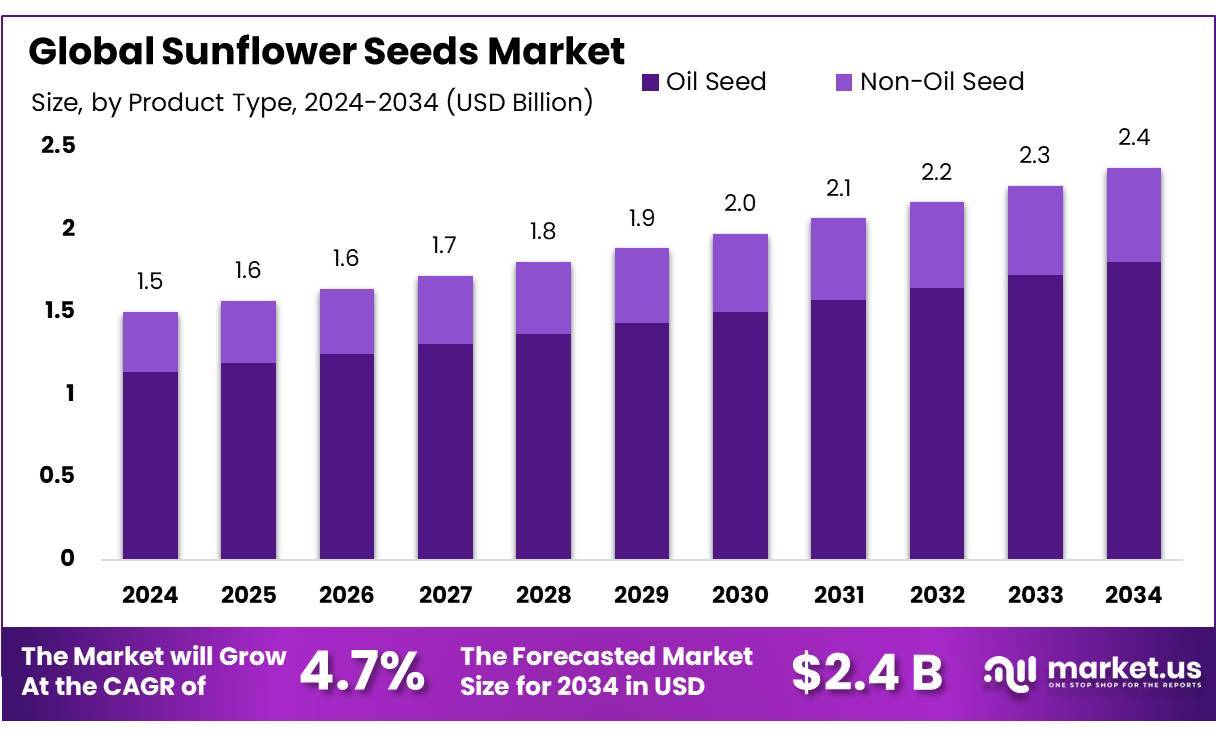

The Global Sunflower Seeds Market size is expected to be worth around USD 2.4 Bn by 2034, from USD 1.5 Bn in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The increasing demand for convenient, ready-to-eat foods and a growing preference for healthier snack alternatives have significantly contributed to the expansion of the sunflower seed market. These snacks, particularly sunflower seeds, are gaining popularity among athletes, especially baseball players, as a natural alternative to chewing tobacco. Given their high nutritional content, packaged sunflower seeds are expected to become a staple in the functional snack category in the coming years.

Sunflower seed products, typically derived from a non-oilseed variety of sunflowers with distinctive black and white stripes, are available in both hulled and in-shell forms to cater to diverse consumer preferences. These snacks are rich in fat-soluble antioxidants, particularly vitamin E, healthy fats, and dietary fiber. A quarter-cup serving provides 80% of the recommended daily allowance (RDA) for vitamin E, making them a nutritious and appealing option for health-conscious consumers.

Major sunflower seed-producing countries, including Ukraine, Russia, China, Romania, Argentina, Bulgaria, Tanzania, Turkey, and Hungary, significantly contribute to the global supply. With their nutty texture and various health benefits, sunflower seeds are gaining popularity, especially among those seeking functional snacks or alternatives to traditional unhealthy options.

Key Takeaways

- The global sunflower seeds market is projected to grow from USD 1.5 billion in 2024 to USD 2.4 billion by 2034, with a (CAGR) of 4.7% from 2025 to 2034.

- The black sunflower seeds segment holds a significant market share, accounting for more than 37.1% due to their extensive use in oil production and as a popular snack.

- Oil seeds dominate the market, capturing more than 76.1% of the share, driven by the demand for sunflower oil in cooking and food production.

- Hybrids lead the sunflower seeds sector, holding over 67.2% of the market, favored for their higher yield and disease resistance.

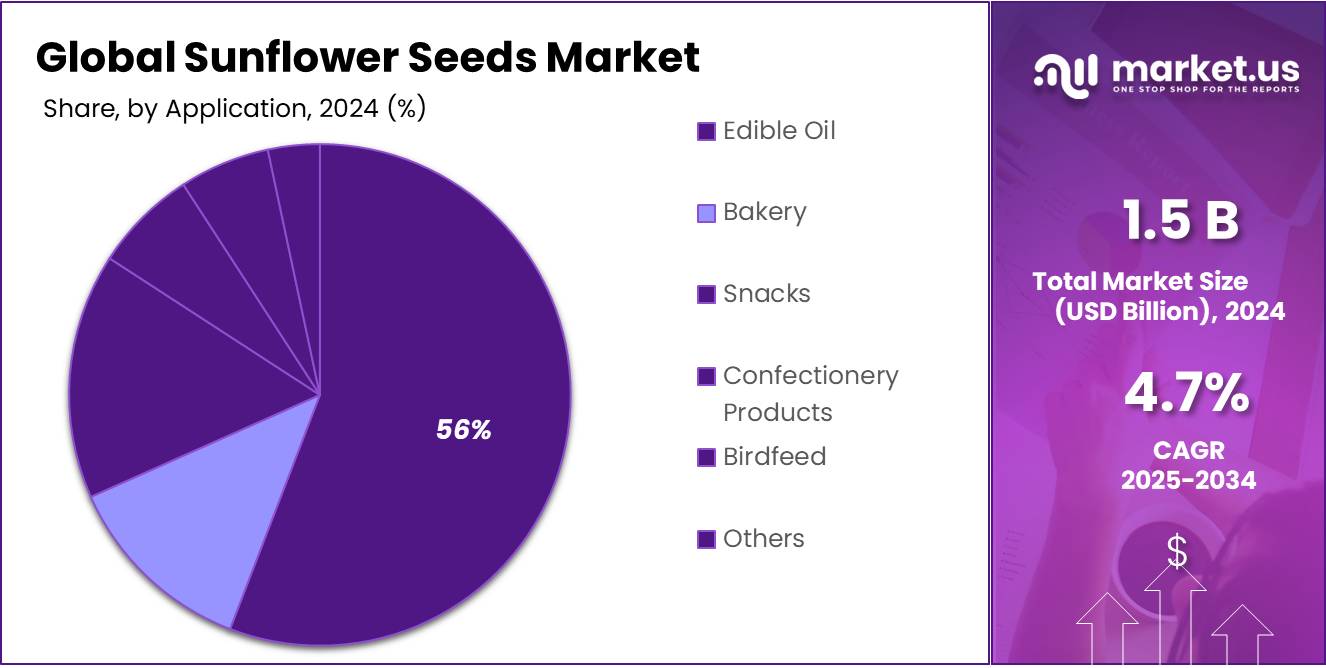

- The edible oil segment constitutes more than 56.1% of the market share, highlighting the popularity of sunflower oil for its health benefits, including high Vitamin E content and low saturated fats.

- Supermarkets are the leading distribution channel, with a market share exceeding 39.2%, attributed to their convenience and wide range of products.

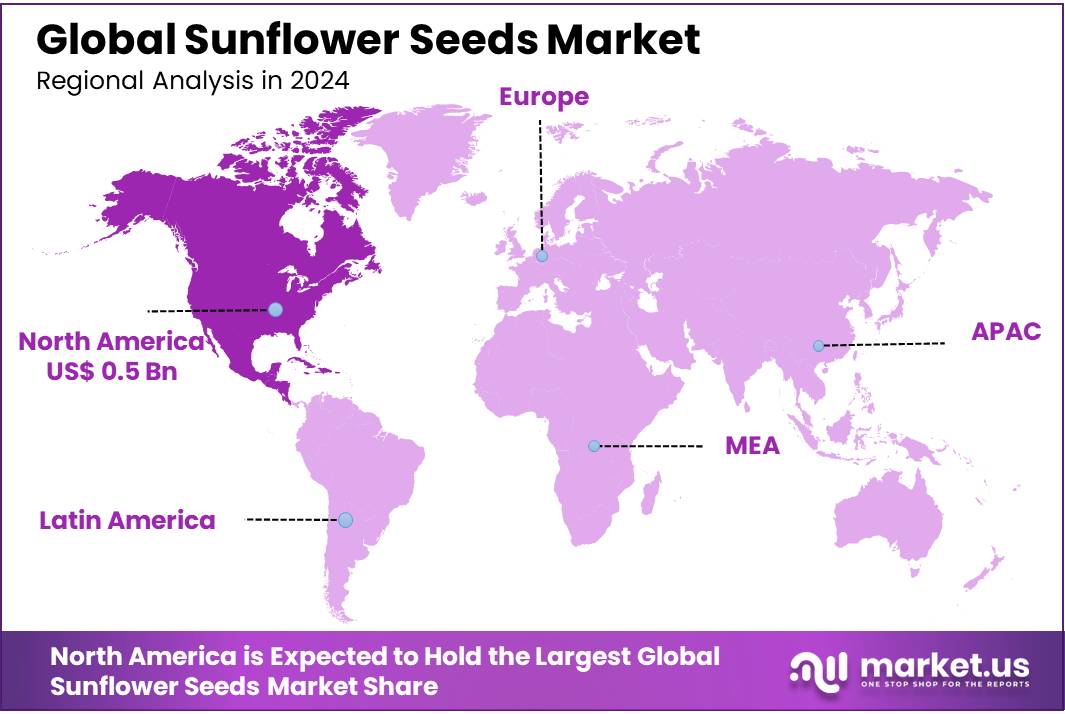

- North America is the dominant region in the sunflower seeds market, with a substantial 38.3% market share, valued at approximately USD 0.5 billion, bolstered by high consumer demand and extensive cultivation.

By Color

In 2024, the black sunflower seeds segment held a dominant position in the market, capturing more than a 37.1% share. This segment’s popularity can be attributed to its widespread use in the production of sunflower oil and as a snack. Black sunflower seeds are favored for their high oil content, making them ideal for processors aiming to maximize yield.

The bright yellow sunflower seeds, known for their vibrant color and large size, also represent a significant portion of the market. These seeds are primarily used in the bird feed industry, appealing to consumers looking to attract a variety of birds to their feeders. The visual appeal of bright yellow seeds makes them a popular choice in retail packages.

Green sunflower seeds are a niche market, valued for their unique appearance and slightly different taste profile. They are often marketed as a premium snack, sometimes with added flavors or as part of gourmet mixes. Their distinct color adds aesthetic value to mixes and specialty food products.

Light grey sunflower seeds, while less common, are sought after in certain culinary applications. They are typically smaller and have a firmer texture, making them suitable for bakery products like breads and muffins, where they provide a subtle flavor and crunch.

Claret red sunflower seeds, with their unique hue, cater to specialty markets that prioritize visual distinction for decorative purposes or artisanal food products. They are often used in craft foods, giving a special touch to products that appeal to niche consumer segments.

By Type

In 2024, Oil Seed held a dominant market position, capturing more than a 76.1% share. The strong demand for oil seeds is primarily driven by their extensive use in sunflower oil production, which remains a staple in the food industry. Sunflower oil is widely used in cooking, processed foods, and the production of margarine, making oil seeds a highly sought-after segment. The growing preference for healthier cooking oils with a high unsaturated fat content has further contributed to the expansion of this segment.

The non-oil seed segment accounted for a smaller market share in 2024 but continues to witness steady demand, particularly in the snack and confectionery industries. Non-oil sunflower seeds are widely consumed as roasted and flavored snacks, making them popular among health-conscious consumers due to their high protein and nutrient content. The demand for sunflower seeds as an ingredient in bakery products, cereals, and energy bars is also increasing.

By Breeding Technology

In 2024, hybrids held a dominant market position in the sunflower seeds industry, capturing more than a 67.2% share. This substantial market share can be attributed to their enhanced traits such as greater yield, improved disease resistance, and better oil content, which make them highly preferred by both commercial growers and agricultural corporations.

Open pollinated varieties (OPVs) also play a crucial role in the sunflower seeds market. These seeds are favored by small-scale farmers and in regions where seed access is limited or where farmers save seeds from one planting season to the next. OPVs are appreciated for their genetic diversity and adaptability to various environmental conditions.

Hybrid derivatives represent an emerging segment in the market, offering a blend of traits from both hybrids and open pollinated varieties. These seeds are designed to provide farmers with robust options that combine the hardiness of OPVs with some of the advantageous traits of hybrids, such as improved resistance to pests and varying climatic conditions.

By Application

In 2024, the edible oil segment held a dominant position in the sunflower seeds market, capturing more than a 56.1% share. This segment’s strength is largely due to the high demand for sunflower oil, which is prized for its health benefits, including a high content of Vitamin E and low saturated fat levels. Sunflower oil is a staple in many kitchens and is widely used in both cooking and in prepared foods, which contributes to its large market share.

The bakery products segment also utilizes sunflower seeds significantly, incorporating them as a healthy ingredient in breads, muffins, and other baked goods. Sunflower seeds add a nutty flavor and crunchy texture to bakery items, making them popular among health-conscious consumers looking to enhance their diet with nutritious seeds.

Sunflower seeds in the snacks segment have seen growing popularity as consumers increasingly seek healthier snacking options. Roasted and salted sunflower seeds or those seasoned with various flavors are common in this category, often consumed as standalone snacks or included in trail mixes.

In the confectionery products segment, sunflower seeds are used in the production of candies and chocolate bars, providing a crunchy texture and nutty flavor that complements the sweetness of confections. They are often found in granola bars, energy bars, and other health-related snack items.

By Distribution Channel

In 2024, supermarkets held a dominant market position in the distribution of sunflower seeds, capturing more than a 39.2% share. Supermarkets are a preferred shopping destination for consumers seeking convenience and a wide range of food products, including sunflower seeds. Their ability to offer a variety of brands and packaging sizes at competitive prices makes them a go-to option for many shoppers.

Retail shops also play a significant role in the distribution of sunflower seeds. These stores, often located in neighborhoods and smaller communities, provide accessibility to consumers who may not frequent larger supermarkets. Retail shops typically offer a selection of local and artisan brands, catering to consumers looking for specialty products or supporting local businesses.

The online distribution channel has shown remarkable growth, particularly appealing to the tech-savvy consumer base that values the convenience of home delivery. Online platforms offer a broad assortment of sunflower seed products, including organic and non-GMO options, which are not always available in brick-and-mortar stores.

Key Market Segments

By Color

- Bright Yellow

- Green

- Light Grey

- Claret Red

- Black

- White

By Type

- Oil Seed

- Non-Oil Seed

By Breeding Technology

- Hybrids

- Open Pollinated Varieties & Hybrid Derivatives

By Application

- Edible Oil

- Bakery

- Snacks

- Products

- Confectionery Products

- Birdfeed

By Distribution Channel

- Supermarkets

- Retail Shops

- Online

- Others

Drivers

Rising Health Awareness and Consumer Demand for Nutritious Foods

One of the major driving factors for the growth of the sunflower seeds market is the increasing consumer awareness of health and wellness. As more people seek healthier dietary choices, sunflower seeds have become popular due to their nutritional benefits. They are rich in essential fatty acids, protein, fiber, vitamins, and minerals, making them an excellent addition to a balanced diet.

The rise in health consciousness is reflected in the growing popularity of plant-based and nutrient-dense foods. According to the Food and Agriculture Organization (FAO), seeds like sunflower are increasingly recognized for their health benefits, which include lowering cholesterol levels and improving heart health. This has spurred demand across various consumer segments, from young adults looking for healthy snack options to older populations aiming to enhance their diet with nutrient-rich foods.

Additionally, government initiatives promoting healthy eating habits have significantly impacted the consumption patterns of seeds. For instance, the U.S. Department of Agriculture (USDA) includes seeds as an important part of a healthy eating plan in their dietary guidelines, encouraging the inclusion of a variety of protein sources, including plant-based ones like sunflower seeds.

The combined effect of public health campaigns and educational efforts by trusted organizations has not only increased the consumption of sunflower seeds but also bolstered the market for sunflower-derived products such as oil and snacks. Consumers are now more informed about the dietary sources that offer multiple health benefits, and sunflower seeds fit well into this category, being both versatile and nutritious.

Restraints

Climatic Vulnerabilities Impacting Sunflower Seed Production

A significant restraining factor for the sunflower seeds market is the crop’s sensitivity to weather conditions. Sunflowers require specific climatic conditions to thrive, including well-distributed rainfall during the growing season and plenty of sunshine during the flowering and seed maturation phases. Unpredictable weather patterns, including prolonged periods of drought or excessive rainfall, can severely affect crop yields.

According to the United States Department of Agriculture (USDA), sunflower seeds are particularly vulnerable to drought, which can drastically reduce both the quality and quantity of the harvest. For example, during periods of water stress, sunflower plants may develop smaller seeds or a reduced number of seeds per head, directly impacting the total output available for the market.

Moreover, in regions where sunflowers are a major agricultural product, such as parts of Eastern Europe and Russia, unexpected early frosts or heavy rains during the harvest period can cause significant losses. These climatic challenges not only affect the direct production of sunflower seeds but also influence market prices and availability, creating volatility in the market that can deter investment and expansion.

Government initiatives aimed at improving agricultural resilience to climate change are crucial in addressing these challenges. Programs that support the development of drought-resistant crop varieties and improved farming practices can help stabilize sunflower seed production. For instance, the European Union’s Common Agricultural Policy includes measures to support agricultural research and innovation, which are vital for developing more resilient sunflower cultivars and sustainable farming techniques.

Opportunity

Expansion into Plant-Based Product Markets

A major growth opportunity for the sunflower seeds market lies in the burgeoning demand for plant-based products. As consumers increasingly turn towards vegetarian and vegan diets, sunflower seeds are gaining prominence not only as a snack but also as a key ingredient in various plant-based food formulations. Their versatility makes them an excellent base for developing dairy alternatives, meat substitutes, and other vegan-friendly products that require a nutty flavor and substantial texture.

According to industry analysis by Food and Drink Europe, there is a rising trend in using sunflower seeds for making sunflower seed butter, plant-based cheeses, and as a protein-rich addition in meat substitutes. This shift is primarily driven by the growing consumer awareness about the environmental and health benefits of reducing animal product consumption. Sunflower seeds, with their high protein and essential fatty acid content, are perfectly positioned to meet these dietary shifts.

Governments and health organizations are also supporting the movement towards more plant-based diets. For instance, the World Health Organization (WHO) has highlighted the importance of incorporating more plant-based foods to combat non-communicable diseases and promote sustainability. Initiatives like these not only encourage consumers to explore plant-based options but also support agricultural sectors focused on sustainable crops like sunflower seeds.

Furthermore, innovations in food technology are enabling manufacturers to extract maximum value from sunflower seeds, developing products that are both nutritious and appealing to a broad consumer base. This includes the production of sunflower lecithin, an emulsifier that is becoming a popular alternative to soy-based lecithin, appealing to those with soy allergies or sensitivities.

Trends

The Rise of Organic and Non-GMO Sunflower Seeds

One of the latest trends shaping the sunflower seeds market is the increasing consumer preference for organic and non-GMO products. This shift is driven by a growing awareness of health, environmental concerns, and food safety issues associated with genetically modified crops and conventional agricultural practices. Consumers are now more inclined to seek out products that are labeled as organic or non-GMO, believing these to be healthier and safer for both themselves and the environment.

Recent reports from organizations like the Organic Trade Association highlight that the demand for organic seeds, including sunflower seeds, has seen significant growth. This is part of a broader trend where organic food sales are rising steadily, reflecting consumer desires for products that are free from synthetic pesticides and fertilizers. Organic sunflower seeds are particularly appealing because they are often used in health-focused products such as multi-grain bread, nutrition bars, and natural snacks, which are sectors also experiencing substantial growth.

Furthermore, government initiatives globally are supporting the expansion of organic farming by providing grants and subsidies to farmers who choose to go organic, thereby encouraging the production of organic sunflower seeds. For example, the European Union’s Common Agricultural Policy offers financial aid to organic farmers, which not only helps to increase the organic sunflower seed supply but also stabilizes market prices, making it easier for consumers to choose organic options.

The trend towards organic and non-GMO sunflower seeds is not just a passing fad but a significant movement that is likely to continue growing. It aligns with the broader societal push towards sustainability and health-conscious eating, offering considerable opportunities for producers and marketers of sunflower seeds to capitalize on this niche yet expanding market segment. This shift promises not only to meet consumer demands but also to contribute to more sustainable agricultural practices worldwide.

Regional Analysis

In the global sunflower seeds market, regional dynamics significantly influence market trends and consumer preferences. North America emerges as the dominating region, holding a substantial 38.3% market share, valued at approximately USD 0.5 billion. This prominence is largely due to the widespread cultivation of sunflower seeds in the U.S. and Canada, coupled with high consumer demand for sunflower-based products like oils and snacks.

Europe also plays a crucial role in the sunflower seeds market, particularly in Eastern European countries where sunflower seeds are not only a popular snack but also a major agricultural commodity used for oil production. The region’s focus on sustainable and non-GMO crop varieties has enhanced its market position, catering to the growing consumer demand for organic and traceable products.

The Asia Pacific region is witnessing rapid growth in the sunflower seeds market, driven by increasing health awareness and changing dietary habits. Countries like China and India are seeing a rise in the consumption of sunflower seeds as snacks and cooking oil, which is further propelled by urbanization and rising income levels.

In the Middle East & Africa, the market is developing steadily. The use of sunflower seeds in traditional cuisines and as a healthful snack option is gaining popularity, supported by an increasing focus on health and wellness among consumers.

Latin America, though smaller in comparison, is seeing growth in the cultivation and consumption of sunflower seeds, driven by dietary diversification and the natural adaptability of sunflower crops to the varied climates in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The sunflower seeds market features a diverse array of key players, each contributing to the global supply and innovation in cultivation techniques and product offerings. Companies such as Advanta Seeds – UPL, Corteva Agriscience, and Syngenta Group are prominent for their significant investment in research and development. These firms focus on producing high-yield, disease-resistant sunflower varieties, catering to both the agricultural and consumer markets.

In addition to agriculture-focused companies, the market also includes specialized players like GIANT Snacks and American Meadows, who cater to specific consumer needs. GIANT Snacks, for instance, is known for its premium, snack-sized sunflower seeds, popular in North America for their quality and flavor. On the other hand, American Meadows is involved in the retail of sunflower seeds for gardening, appealing to home gardeners and landscape designers with a variety of sunflower types.

Furthermore, multinational corporations like CONAGRA FOODS and DuPont play a significant role in processing and distributing sunflower products at a global scale, ensuring sunflower seeds and their derivatives are accessible to a broad consumer base.

These companies, along with regional specialists like KENKKO CORPORATION in Asia and Euralis Semences in Europe, underline the global reach and strategic market positioning necessary to meet the growing demand for sunflower seeds across different regional markets. These key players not only drive innovation but also strengthen market stability through their extensive distribution networks, ensuring that sunflower seeds continue to be a valuable commodity in the global agricultural and consumer markets.

Top Key Players

- Advanta Seeds – UPL

- American Meadows

- CHS Inc

- CONAGRA FOODS

- Corteva Agriscience

- DuPont

- Euralis Semences

- GIANT Snacks

- Ike Enterprises Inc

- KENKKO CORPORATION

- KWS SAAT SE & Co. KGaA

- Land O’Lakes Inc.

- Limagrain UK Ltd

- Mahyco Seeds Company Ltd

- Martin US Enterprises

- Nufarm

- Nuseed

- RAGT Group

- Royal Barenbrug Group

- S&W Seed Co.

- Sakata Seed America

- Syngenta Group

Recent Developments

In November 2024 Advanta’s commitment to innovation and quality has enabled it to capture a significant share of the global sunflower seed market, Alpha Wave Global agreed to acquire a 12.5% minority stake in Advanta Seeds from UPL Limited for USD 350 million, underscoring the company’s value and growth potential.

In 2024, American Meadows continued to be a prominent retailer in the sunflower seed market, offering a diverse range of varieties to cater to gardening enthusiasts. Their selection includes popular options like the Earthwalker Sunflower Seeds, priced at $9.95 per 1/4 pound, and the Sunflower Seed Mix, available at $15.95 per 1/4 pound.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 2.4 Bn CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Color (Bright Yellow, Green, Light Grey, Claret Red, Black, White), By Type (Oil Seed, Non-Oil Seed), By Breeding Technology (Hybrids, Open Pollinated Varieties and Hybrid Derivatives), By Application (Edible Oil, Bakery, Snacks, Products, Confectionery Products, Birdfeed), By Distribution Channel (Supermarkets, Retail Shops, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Advanta Seeds – UPL, American Meadows, CHS Inc, CONAGRA FOODS, Corteva Agriscience, DuPont, Euralis Semences, GIANT Snacks, Ike Enterprises Inc, KENKKO CORPORATION, KWS SAAT SE & Co. KGaA, Land O’Lakes Inc., Limagrain UK Ltd, Mahyco Seeds Company Ltd, Martin US Enterprises, Nufarm, Nuseed, RAGT Group, Royal Barenbrug Group, S&W Seed Co., Sakata Seed America, Syngenta Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Advanta Seeds - UPL

- American Meadows

- CHS Inc

- CONAGRA FOODS

- Corteva Agriscience

- DuPont

- Euralis Semences

- GIANT Snacks

- Ike Enterprises Inc

- KENKKO CORPORATION

- KWS SAAT SE & Co. KGaA

- Land O'Lakes Inc.

- Limagrain UK Ltd

- Mahyco Seeds Company Ltd

- Martin US Enterprises

- Nufarm

- Nuseed

- RAGT Group

- Royal Barenbrug Group

- S&W Seed Co.

- Sakata Seed America

- Syngenta Group