Global Bio-Seeds Market By Crop Type (Corn, Soybean, Canola, Wheat, Rice), By Form (Conventional Seeds, Certified Seeds, Hybrid Seeds, Genetically Modified Seeds), By Trait (Herbicide Resistance, Insect Resistance, Disease Resistance, Drought Tolerance, Nutrient Efficiency), By End Use (Agriculture, Biofuels, Pharmaceuticals, Cosmetics), By Distribution Channel (Retailers, Wholesaler, Cooperatives, Online Channels, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 140132

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

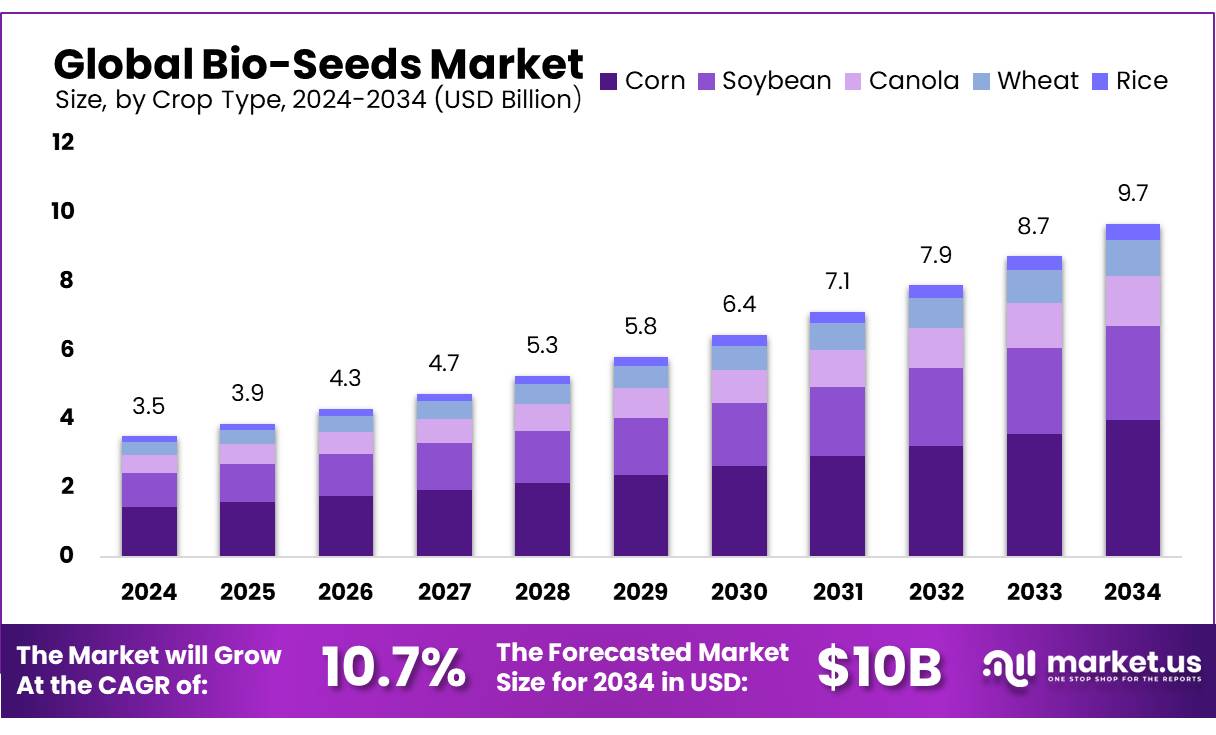

The Global Bio-Seeds Market size is expected to be worth around USD 9.7 Bn by 2034, from USD 3.5 Bn in 2024, growing at a CAGR of 10.7% during the forecast period from 2025 to 2034.

Bio-seeds are genetically enhanced seeds that integrate advanced biotechnological methods to improve agricultural productivity, resilience, and sustainability. These seeds are developed to resist pests, diseases, and environmental stresses, while also improving crop yield, quality, and nutritional content. Bio-seeds encompass genetically modified organisms (GMOs), hybrid varieties, and seeds produced using innovative techniques like CRISPR gene editing.

The primary drivers of the bio-seeds market are the need to enhance crop yields and ensure food security in the face of growing environmental challenges. The global agricultural sector is under pressure to produce more food using fewer resources, which has driven the adoption of bio-seeds that offer superior traits like drought tolerance, pest resistance, and faster maturation. These features are particularly important in regions prone to unpredictable weather patterns and water scarcity.

Government policies and regulations also play a significant role in driving the market. In countries like the U.S. and Canada, the regulatory framework for genetically modified crops has been relatively favorable, encouraging the adoption of GM seeds. Additionally, international agreements supporting sustainable agriculture and food security are further boosting the demand for bio-seeds.

The bio-seeds market is poised for significant expansion, with several opportunities on the horizon. One major growth area is the development of crops with enhanced nutritional content, such as bio-fortified seeds that increase the levels of essential vitamins and minerals. This trend aligns with global efforts to address malnutrition and food insecurity in developing nations.

Key Takeaways

- The Bio-Seeds Market will grow from USD 3.5 billion in 2024 to USD 9.7 billion by 2034 at a CAGR of 10.7%.

- Corn held 41.2% of the bio-seeds market share in 2024.

- Genetically Modified Seeds had a 52.2% market share in 2024.

- Herbicide Resistance captured 51.6% of the market by trait in 2024.

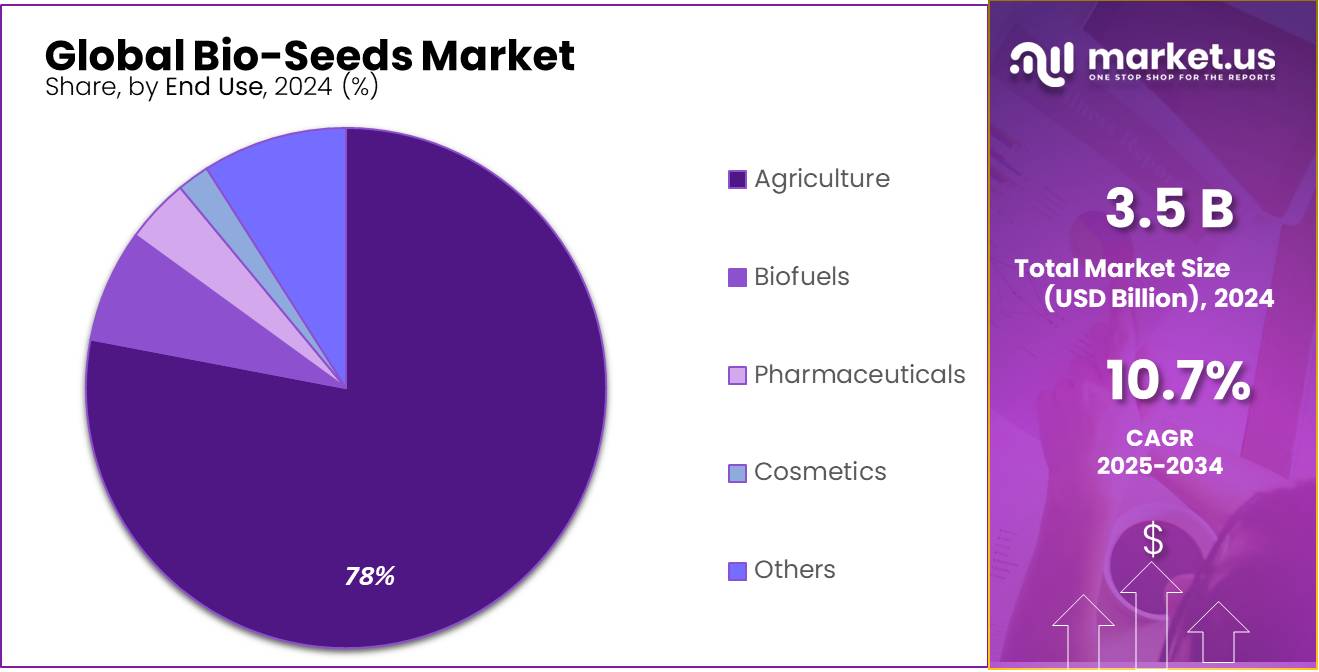

- Agriculture accounted for 78.3% of the bio-seeds end-use market in 2024.

- Retailers held a 43.3% share in the bio-seeds distribution channel in 2024.

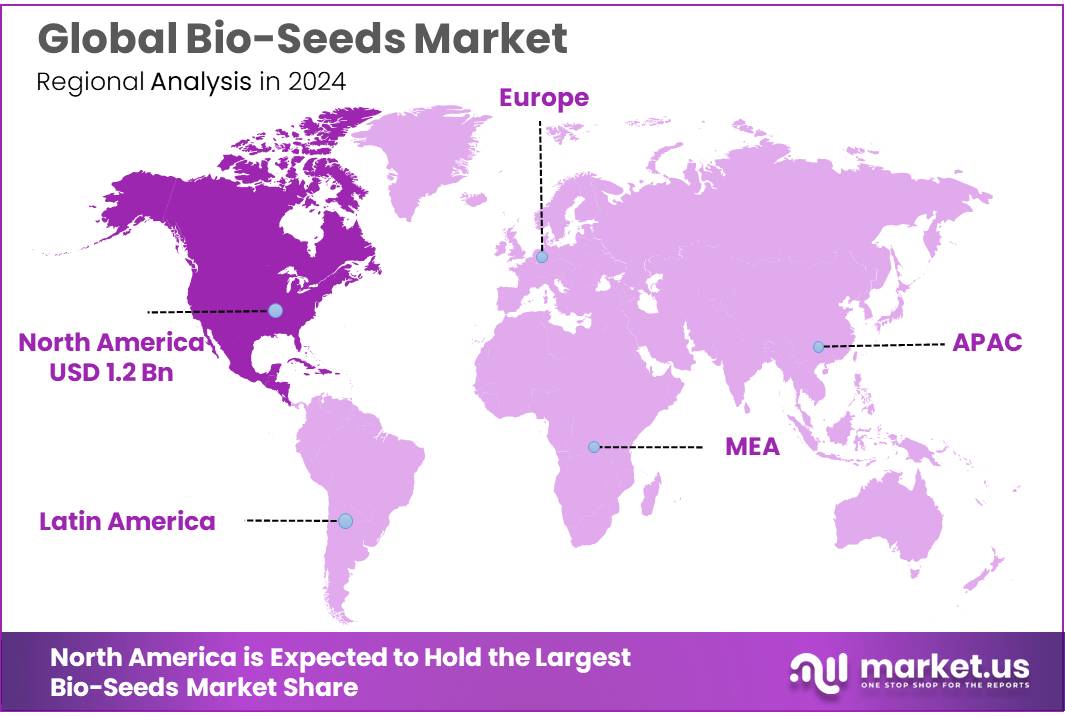

- North America captured 34.6% market share in 2024 with a value of approximately USD 1.2 billion.

By Crop Type

In 2024, Corn held a dominant market position, capturing more than a 41.2% share of the global bio-seeds market. This strong performance can be attributed to corn’s widespread use in both food and industrial applications, particularly in the production of biofuels and animal feed. Corn’s adaptability to different climatic conditions and its high yield potential make it a preferred crop for bio-seed adoption, further boosting its market share.

In 2025, Soybean is projected to hold a substantial market share, benefiting from its critical role in the global food and oilseed industries. As the demand for plant-based proteins and oils increases, soybean’s market position is likely to strengthen. With its versatile applications in both food and non-food sectors, soybean remains a key player in the bio-seeds market, with significant growth expected in regions like North America and Latin America, where soybean cultivation is widespread.

Canola, in 2024, accounted for a significant share in the market, benefiting from its use as a healthy oil alternative in cooking and as a high-protein animal feed source. In recent years, the demand for canola-based products has surged due to health-conscious consumer trends, leading to an increased adoption of canola bio-seeds in various agricultural regions, especially in Canada and Europe. This trend is expected to continue, with steady growth forecasted through 2025.

Wheat, in 2024, held a more moderate yet important position in the bio-seeds market. As a staple crop globally, wheat is crucial for food security, and its bio-seeds segment has seen gradual growth due to advancements in breeding technologies and increased interest in sustainable farming practices. With the rise in demand for high-yield and disease-resistant wheat varieties, the market share of wheat bio-seeds is expected to grow steadily in the coming years, with 2025 showing promising trends for further expansion.

Rice, while a staple in many parts of Asia and beyond, had a comparatively smaller share in the bio-seeds market in 2024. However, as efforts to enhance rice productivity and resistance to environmental stresses grow, the demand for bio-seeds in rice cultivation is expected to rise.

By Form

In 2024, Genetically Modified Seeds held a dominant market position, capturing more than a 52.2% share of the global bio-seeds market. This significant market share reflects the growing adoption of genetically modified (GM) crops due to their high yield potential, resistance to pests and diseases, and adaptability to different environmental conditions.

Conventional Seeds, in 2024, represented a considerable portion of the bio-seeds market, holding a share driven by traditional farming practices and consumer preference for non-GM crops. While the growth rate of conventional seeds has slowed in some regions due to the rise of genetically modified varieties, they continue to be favored in organic farming and by those who are concerned about the environmental and health impacts of GM crops.

Certified Seeds, in 2024, played an important role in the bio-seeds market, accounting for a significant market share. These seeds are produced under strict guidelines and certifications, ensuring quality and purity, making them highly sought after by farmers who prioritize consistency and reliability in their crops. The demand for certified seeds is expected to grow in 2025 as more farmers seek assurance of high-quality seed stock that guarantees superior crop performance and increased yield potential.

Hybrid Seeds, in 2024, captured a notable share of the bio-seeds market, benefiting from their ability to deliver higher yields, better disease resistance, and improved resilience to adverse environmental conditions. Hybrid seeds are particularly popular in the cultivation of fruits, vegetables, and field crops, where maximizing output is crucial.

By Trait

In 2024, Herbicide Resistance held a dominant market position, capturing more than a 51.6% share of the bio-seeds market. The growing demand for herbicide-resistant crops has been driven by the need for more efficient weed management in large-scale farming operations. These crops allow farmers to control weeds effectively without damaging the crops themselves, which can lead to higher yields and reduced labor costs.

Insect Resistance, in 2024, represented a significant portion of the bio-seeds market, driven by the increasing threat of pest damage to crops. By incorporating insect-resistant traits, crops can naturally defend against harmful insects, reducing the need for chemical pesticides and minimizing crop loss. As the global demand for sustainable farming practices continues to rise, the market for insect-resistant seeds is anticipated to grow steadily in 2025, particularly in regions where pests such as corn borers and aphids are a persistent challenge.

Disease Resistance, in 2024, also held a strong position in the bio-seeds market, as farmers seek ways to combat the growing risk of plant diseases that can devastate entire harvests. Seeds with disease resistance traits, particularly against fungi, bacteria, and viruses, are gaining traction for their ability to protect crops from such threats, ensuring healthier yields and reducing the reliance on chemical treatments. This segment is expected to experience consistent growth in 2025, as plant diseases continue to be a major concern, especially with changing climate conditions fostering new disease pressures.

Drought Tolerance, in 2024, had a growing share in the bio-seeds market, reflecting the increasing challenges posed by climate change. With water scarcity becoming a critical issue in many parts of the world, drought-tolerant crops offer a solution by maintaining their yield even under water-stressed conditions. The demand for these crops is expected to rise in 2025, particularly in regions with frequent droughts, such as parts of Africa, Asia, and the United States.

Nutrient Efficiency, in 2024, was a smaller but steadily growing segment in the bio-seeds market. Crops with nutrient-efficient traits are designed to better utilize soil nutrients, which can lead to reduced fertilizer usage and lower production costs for farmers.

By End Use

In 2024, Agriculture held a dominant market position, capturing more than a 78.3% share of the bio-seeds market. This vast share reflects the central role of bio-seeds in enhancing crop production globally. As farmers look for ways to boost yield, improve disease resistance, and reduce input costs, bio-seeds tailored for agriculture have become essential.

In 2024, the Biofuels segment showed notable growth, albeit with a smaller share compared to agriculture. The demand for biofuels as a cleaner energy source has increased, and bio-seeds are pivotal in meeting this demand. Crops such as corn, soybeans, and canola are being increasingly utilized for biofuel production due to their high oil content and renewable nature.

Pharmaceuticals, in 2024, held a more modest share of the bio-seeds market, but this segment is growing steadily. Bio-seeds used for the production of medicinal plants and compounds are gaining attention due to their potential to provide high-quality raw materials for drug development. This is particularly important in the production of natural extracts and therapeutic products.

Cosmetics, in 2024, represented a smaller yet expanding segment of the bio-seeds market. With an increasing demand for natural and organic products in the beauty industry, bio-seeds play a crucial role in providing key ingredients for skincare and haircare products. Plant-based oils, extracts, and essential compounds derived from bio-seeds are increasingly used for their beneficial properties, such as moisturizing and anti-aging effects.

By Distribution Channel

In 2024, Retailers held a dominant market position, capturing more than a 43.3% share of the bio-seeds market. Retail outlets, including specialized agricultural stores and large retail chains, remain the most popular channel for farmers and consumers to purchase bio-seeds. These stores offer a wide variety of seed options, ranging from conventional to genetically modified varieties, catering to both commercial and small-scale farmers.

Wholesalers, in 2024, accounted for a significant share of the market as well, serving as a crucial intermediary between seed producers and retailers or large-scale farms. Wholesalers typically handle bulk transactions, ensuring that a wide variety of bio-seeds are distributed across regions and made available to smaller agricultural businesses and retailers.

Cooperatives, in 2024, also represented a notable portion of the bio-seeds market. Many farmers prefer to purchase seeds through cooperatives, as these organizations often offer seeds at lower prices, provide expert recommendations, and cater to the specific needs of local farmers. Cooperatives help to aggregate demand and supply bio-seeds in a more community-oriented and affordable way.

Online Channels, in 2024, made up a smaller yet steadily growing share of the bio-seeds market. With the increasing penetration of the internet and e-commerce platforms, more farmers and consumers are turning to online stores to purchase bio-seeds. The convenience of doorstep delivery, the ability to compare different seed varieties, and the growth of digital agricultural platforms are driving this trend.

Key Market Segments

By Crop Type

- Corn

- Soybean

- Canola

- Wheat

- Rice

By Form

- Conventional Seeds

- Certified Seeds

- Hybrid Seeds

- Genetically Modified Seeds

By Trait

- Herbicide Resistance

- Insect Resistance

- Disease Resistance

- Drought Tolerance

- Nutrient Efficiency

By End Use

- Agriculture

- Biofuels

- Pharmaceuticals

- Cosmetics

By Distribution Channel

- Retailers

- Wholesaler

- Cooperatives

- Online Channels

- Others

Drivers

Government Initiatives and Sustainability Goals Driving the Bio-Seeds Market

One of the major driving factors for the growth of the bio-seeds market is the increasing support and initiatives from governments around the world to promote sustainable agriculture. As global food security becomes more critical, countries are turning to bio-engineered seeds to meet the challenges of climate change, population growth, and resource limitations. Governments are providing incentives, subsidies, and regulatory frameworks that encourage the adoption of bio-seeds, particularly those that promise higher yields, pest resistance, and drought tolerance.

For instance, the Food and Agriculture Organization (FAO) of the United Nations has long recognized the role of biotechnology in achieving food security. In their reports, FAO suggests that biotechnology, including the use of genetically modified crops, can play a critical role in feeding the growing world population while minimizing the environmental impact of traditional farming methods.

In addition, countries like India and Brazil have also launched government programs to support the cultivation of genetically modified (GM) crops, particularly in regions facing drought or pest challenges. For example, India has heavily promoted Bt cotton, a genetically modified variety designed to resist pests, which has helped improve cotton yields by up to 30% in some regions. The Indian government’s policies, like the National Mission on Agricultural Extension and Technology, support the widespread use of advanced seed technologies, which include bio-seeds.

Restraints

Regulatory Challenges and Public Concerns Restraining the Bio-Seeds Market

Despite the growing popularity of bio-seeds, one of the major restraining factors in their widespread adoption is the regulatory hurdles and public concerns surrounding genetically modified (GM) crops. While many governments have embraced biotech advancements, the approval process for bio-seeds remains complex and often lengthy, particularly in regions with strict regulations on genetically modified organisms (GMOs).

For instance, the European Union (EU) has been known for its cautious approach to GM crops, and as of 2023, only a few GM crops are approved for cultivation within EU countries. According to the European Commission, only a handful of GM crops are authorized for cultivation, while many others face significant regulatory delays. As of 2021, there were only three GM crops approved for food and feed use within the EU. This restrictive regulatory environment has led to slower adoption of bio-seeds in Europe compared to other regions like North America or parts of Asia.

In addition to regulatory concerns, there is also significant public resistance to GM crops, often driven by fears over potential health risks, environmental impacts, and ethical considerations. Consumer advocacy groups argue that there is not enough long-term research on the safety of GM crops. The World Health Organization (WHO), however, has stated that “currently available food derived from GM crops is no more risky than conventional food.” Yet, public perception remains a challenge.

These regulatory barriers and public concerns are key factors holding back the global expansion of bio-seeds, particularly in regions where consumer sentiment and stringent regulations shape the agricultural landscape. The slow pace of regulatory approvals and the challenge of public acceptance could continue to restrain the growth of the bio-seeds market in the coming years.

Opportunity

Expansion of Bio-Seeds in Developing Markets

One of the most promising growth opportunities for the bio-seeds market lies in the expansion of bio-seed adoption in developing countries. As these regions face rising challenges due to population growth, climate change, and food insecurity, the demand for high-yield, drought-tolerant, and pest-resistant crops is increasing. Bio-seeds can help address these challenges by providing solutions that improve crop productivity and resilience, which are critical in regions where traditional farming methods are no longer sufficient to meet the growing food demand.

The Food and Agriculture Organization (FAO) has emphasized the importance of biotechnology, including bio-seeds, in enhancing food security. According to their reports, biotechnology has the potential to increase agricultural productivity by up to 30% in countries where crop yields are limited by environmental stresses such as drought and pests.

This is particularly important in regions like Sub-Saharan Africa, parts of South Asia, and Latin America, where food insecurity remains a significant issue. For example, in Africa, where drought is a recurring challenge, bio-seeds with drought-tolerant traits could make a big difference. FAO data shows that the population of Sub-Saharan Africa is expected to double by 2050, intensifying the pressure on local food production.

Governments in developing nations are beginning to recognize the potential of bio-seeds to address these issues. For instance, in India, the government has been actively promoting the use of genetically modified (GM) crops, such as Bt cotton, which has helped farmers significantly increase their yields. The Indian government has invested in research and development for bio-seeds, with the aim of improving agricultural sustainability and reducing dependency on water and chemical inputs.

Trends

Rise of Climate-Resilient Bio-Seeds

One of the latest trends in the bio-seeds market is the increasing focus on climate-resilient seeds, designed to withstand extreme weather conditions such as drought, floods, and heat waves. As the effects of climate change become more apparent, farmers around the world are looking for solutions to protect their crops from unpredictable weather patterns. Climate-resilient bio-seeds, which include drought-tolerant, flood-resistant, and heat-resistant varieties, are gaining traction as a way to ensure stable food production in increasingly volatile environments.

The Food and Agriculture Organization (FAO) has highlighted the role of biotechnology in developing crops that can adapt to climate stress. According to FAO, “climate change will increase the vulnerability of agriculture, particularly in developing countries, where the risk of crop failure due to extreme weather is highest.” The organization points out that climate-resilient crops are critical to maintaining food security in regions that are already facing challenges from water scarcity and fluctuating temperatures. For example, crops like drought-tolerant maize and rice are being developed to help farmers in sub-Saharan Africa and Southeast Asia maintain yields during dry spells.

Governments and international bodies are increasingly supporting the development of these crops. For instance, the International Food Policy Research Institute (IFPRI) has reported that public investments in crop breeding programs, especially those focusing on climate resilience, are seeing higher returns. In India, the government has launched initiatives such as the National Mission on Sustainable Agriculture, which includes promoting seeds that can withstand environmental stressors. The Indian Council of Agricultural Research (ICAR) is leading research on developing climate-resilient varieties, particularly in water-scarce regions.

Regional Analysis

In 2024, North America dominated the bio-seeds market, capturing a significant share of 34.6%, valued at approximately USD 1.2 billion. The region’s leadership is driven by advanced agricultural practices, high adoption rates of genetically modified (GM) crops, and substantial investments in agricultural biotechnology. The United States, in particular, remains a key contributor, with GM crops such as corn, soybean, and cotton widely cultivated across the country.

Europe follows with a relatively smaller market share, as the region has a more cautious approach to GM crops due to stringent regulations and public resistance. However, countries like Spain and Portugal have seen increased adoption of GM crops, particularly maize, which is boosting the overall bio-seeds market in Europe. The European Union’s regulatory environment, while stringent, is gradually evolving, with increased focus on sustainable agricultural solutions and bio-seed innovations.

In the Asia Pacific region, the bio-seeds market is rapidly growing, driven by countries like India, China, and Japan. Asia’s large agricultural base and the need to address food security challenges, including drought, pests, and diseases, are key factors propelling market growth. India’s adoption of Bt cotton and other bio-engineered crops is noteworthy, with the market expected to see substantial growth through 2025.

The Middle East & Africa and Latin America are emerging markets for bio-seeds. Latin America, in particular, is seeing strong growth, with Brazil and Argentina leading the adoption of bio-seeds for crops like soybean and maize, contributing to the region’s expanding market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The bio-seeds market is highly competitive, with several key players dominating the landscape, including BASF, Bayer, Corteva Agriscience, and DuPont. These companies are at the forefront of seed innovation, focusing heavily on research and development to produce genetically modified (GM) crops that offer improved yields, pest resistance, and climate resilience.

Bayer Crop Science, for example, leverages its extensive biotechnology and crop protection expertise to offer a wide range of bio-seeds, while Corteva Agriscience continues to lead in developing high-performance seeds for global agriculture. DuPont‘s longstanding reputation in agricultural biotechnology further strengthens its position in the bio-seeds market, particularly with its advanced GM and hybrid seed offerings.

Other notable players in the market include Syngenta, Monsanto (now part of Bayer), and Pioneer HiBred. These companies are recognized for their innovations in GM and hybrid crops, including major products like Bt cotton and Roundup Ready soybeans. Companies such as Groupe Limagrain, KWS SAAT SE Co. KGaA, and Vilmorin Cie are also significant contributors to the bio-seeds market, especially in Europe, where they focus on both conventional and biotech seed varieties across a broad range of crops.

Nuseed and Sakata Seed Corporation are carving out a niche in specialty seeds, such as those for biofuels and horticulture, while FMC Corporation and RAGT Semences continue to expand their bio-seed portfolios, targeting both traditional and emerging markets.

Top Key Players

- BASF

- Bayer

- Bayer Crop Science

- Corteva Agriscience

- DuPont

- FMC Corporation

- Groupe Limagrain

- KWS SAAT SE Co. KGaA

- Limagrain

- Monsanto

- Nuseed

- Pioneer HiBred

- RAGT Semences

- Sakata Seed Corporation

- Syngenta

- Takii Co.

- Vilmorin Cie

Recent Developments

In 2023, BASF’s Agricultural Solutions segment generated approximately €9.6 billion in sales, and it is investing heavily in the development of climate-resilient and sustainable crop varieties.

In 2023, Bayer’s Crop Science division generated €23.2 billion in sales, with a substantial portion driven by their bio-seeds business.

In 2023, DuPont’s Crop Protection and Seed business saw a 9% growth in seed sales, demonstrating strong demand for both its conventional and biotech offerings.

Report Scope

Report Features Description Market Value (2024) USD 3.5 Bn Forecast Revenue (2034) USD 9.7 Bn CAGR (2025-2034) 10.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Crop Type (Corn, Soybean, Canola, Wheat, Rice), By Form (Conventional Seeds, Certified Seeds, Hybrid Seeds, Genetically Modified Seeds), By Trait (Herbicide Resistance, Insect Resistance, Disease Resistance, Drought Tolerance, Nutrient Efficiency), By End Use (Agriculture, Biofuels, Pharmaceuticals, Cosmetics), By Distribution Channel (Retailers, Wholesaler, Cooperatives, Online Channels, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF, Bayer, Bayer Crop Science, Corteva Agriscience, DuPont, FMC Corporation, Groupe Limagrain, KWS SAAT SE Co. KGaA, Limagrain, Monsanto, Nuseed, Pioneer HiBred, RAGT Semences, Sakata Seed Corporation, Syngenta, Takii Co., Vilmorin Cie Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF

- Bayer

- Bayer Crop Science

- Corteva Agriscience

- DuPont

- FMC Corporation

- Groupe Limagrain

- KWS SAAT SE Co. KGaA

- Limagrain

- Monsanto

- Nuseed

- Pioneer HiBred

- RAGT Semences

- Sakata Seed Corporation

- Syngenta

- Takii Co.

- Vilmorin Cie