Global Chocolate Market Size, Share Analysis Report By Type (Dark Chocolate, White Chocolate, Milk Chocolate, Filled Chocolate), By Form (Bars and Blocks, Powder, Pralines, Spread, Others), By Application (Bakery Products, Confectionery, Beverages, Ice Cream and Desserts, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146311

- Number of Pages: 259

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

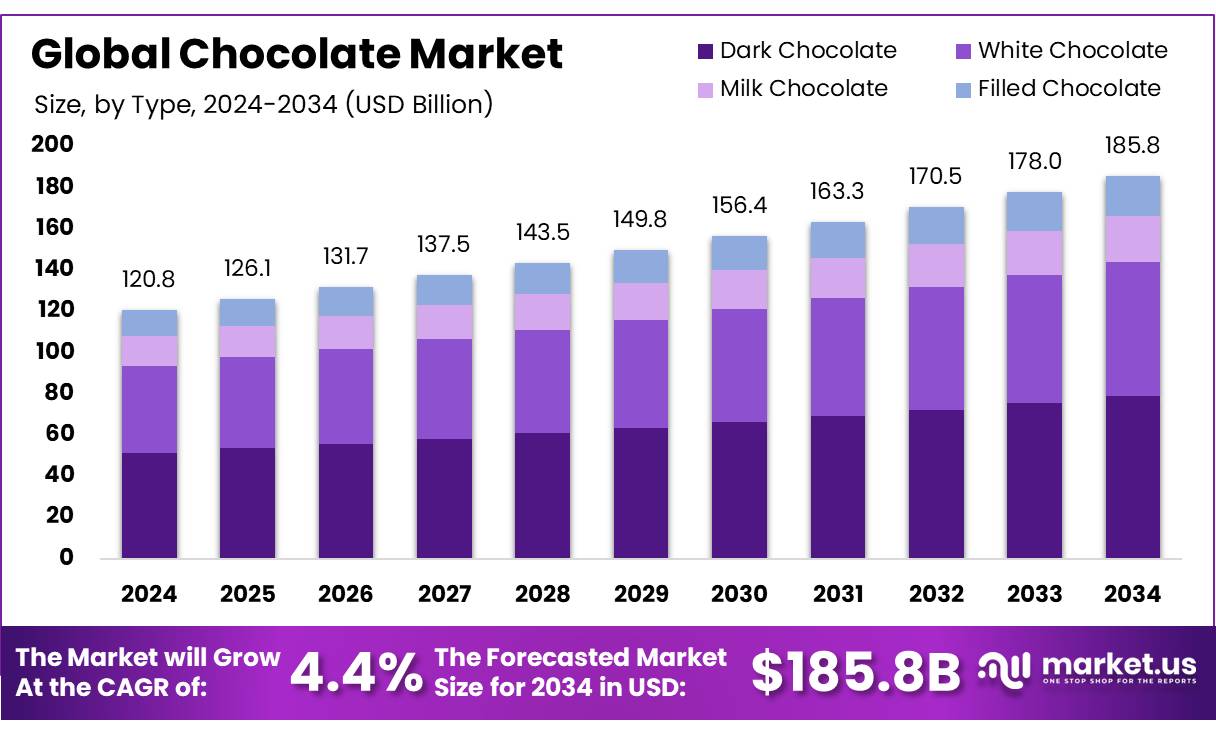

The Global Chocolate Market size is expected to be worth around USD 186 Bn by 2034, from USD 120.8 Bn in 2024, growing at a CAGR of 4.4% during the forecast period from 2025 to 2034.

Chocolate is a sweet treat made from cocoa beans, which are roasted, ground, and combined with sugar, milk, and other ingredients such as wheat flour, starches, and flavoring agents. It is available in various forms, including candies, bars, beverages, and baked goods, catering to diverse consumer demands. Popular varieties of chocolate include dark, milk, white, ruby, bittersweet, semisweet, couverture, unsweetened, cocoa powder, gianduja, and blonde chocolate, each offering distinct flavors, textures, and culinary applications ranging from rich cocoa intensity to creamy and caramelized products.

Chocolates Rich source of carbohydrates that provide quick energy, making it a beloved delicacy enjoyed by people of all ages. Its versatility and delicious taste have made it a key ingredient in various food products such as cakes, cookies, puddings, and confections.

- According to a recent report from the National Confectioners Association, 94% of people occasionally buy chocolate for personal enjoyment, and 72% associate it with a happy, balanced lifestyle. As a result, 21% of consumers are consuming more chocolate than the previous year, reinforcing its status as a beloved treat in daily life.

The global chocolate market has experienced significant growth, driven by rising consumer demand and increased awareness of the health benefits associated with chocolate. Typically derived from cocoa beans, dark chocolate with its higher antioxidant content, has gained popularity among health-conscious consumers. Additionally, emerging markets, particularly in the Asia-Pacific region, are witnessing a surge in chocolate consumption as disposable incomes rise and more consumers seek functional foods. The popularity of chocolate is attributed to its rich taste, historical significance, and ability to blend with various ingredients, making it a versatile and globally beloved food product.

- According to a new report from the National Confectioners Association, chocolate accounted for $21.4 billion in confectionery sales, marking a new high over the past year, with 65% of consumers turning to chocolate as an affordable treat.

Key Takeaways

- The global chocolate market was valued at USD 120.8 billion in 2024.

- The global chocolate market is projected to grow at a CAGR of 4.4% and is estimated to reach USD 186 billion by 2034.

- Among types, dark chocolate accounted for the largest market share of 42.4%.

- Among forms, bars & blocks accounted for the majority of the market share at 46.7%.

- By application, confectionery accounted for the largest market share of 43.3%.

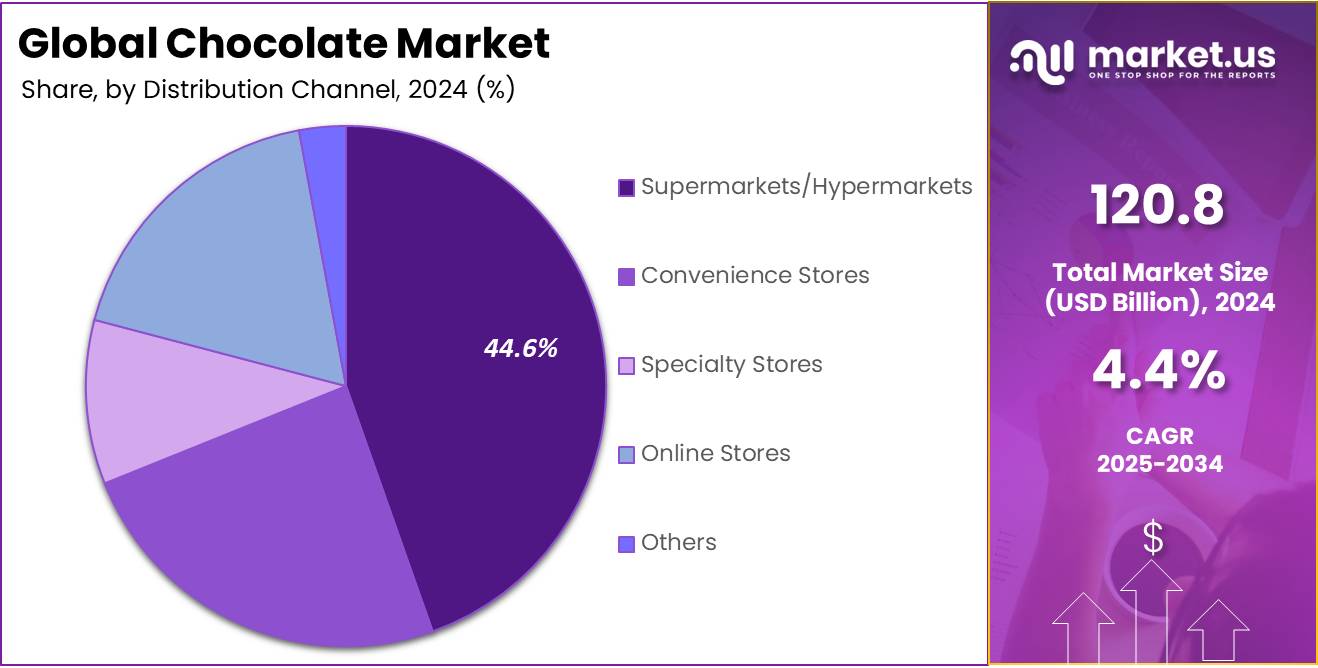

- By distribution channel, supermarkets/hypermarkets accounted for the largest market share of 44.6%.

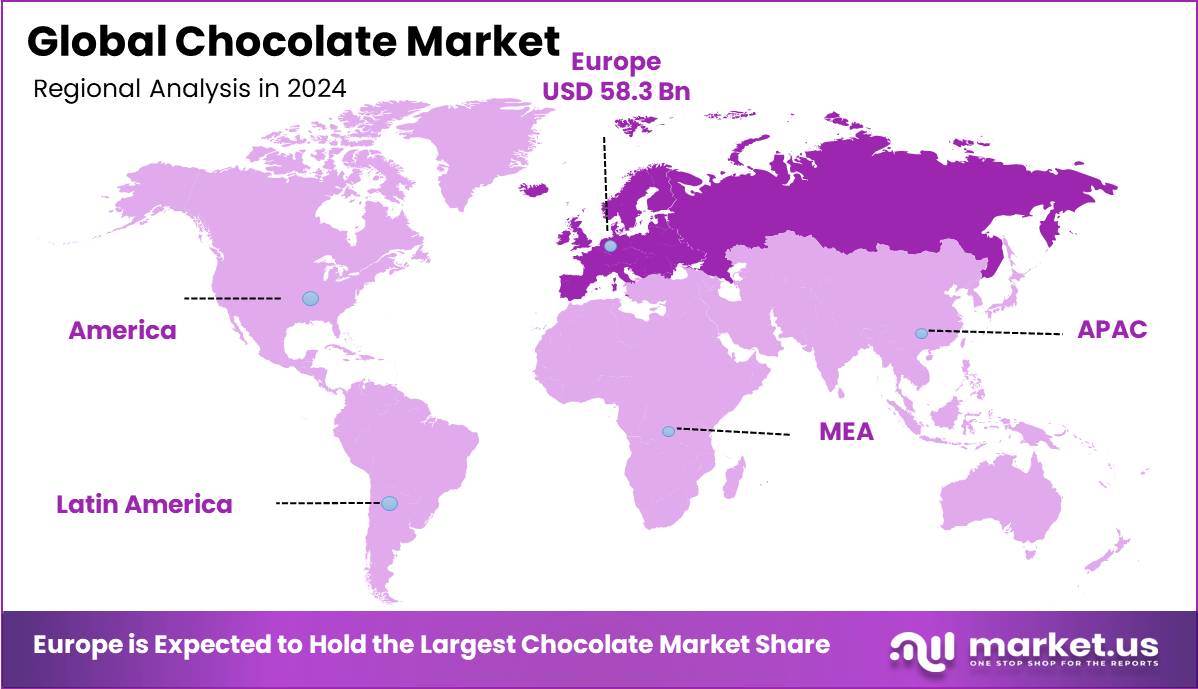

- Europe is estimated as the largest market for chocolate with a share of 48.3% of the market share.

Type Analysis

Dark Chocolate Leads Market in 2024 Due to Growing Consumer Preference for Healthier Options.

The Chocolate market is segmented based on Type into Dark Chocolate, White Chocolate, Milk Chocolate, and Filled Chocolate. In 2024, the Dark Chocolate segment held a significant revenue share of 42.4%. This can be attributed to its growing popularity among health-conscious consumers who prefer higher cocoa content for potential health benefits, such as antioxidants. Additionally, its richer taste and lower sugar content make it a favored choice over sweeter alternatives. The trend towards healthier, premium chocolate options has boosted Dark Chocolate’s market share.

Form Analysis

Bars & Blocks Dominates the Chocolate Market in 2024 Due to Consumer Preference for Convenient, Ready-to-Eat Formats

Based on form, the market is further divided into bars & blocks, powder, pralines, spread, and others. The predominance of the bars & blocks, commanding a substantial 56.7% market share in 2024. This dominance is driven by consumer preferences for convenient, ready-to-eat products.

Additionally, bars and blocks are easy to package, transport, and store, making them a favored choice among manufacturers and consumers. The segment’s popularity is also fueled by the broad appeal of various chocolate types in bar and block formats, catering to diverse tastes and preferences.

Application Analysis

The Confectionery Segment Dominates the Chocolate Market, Due To The High Demand For Chocolates In Various Sweet Products.

Based on Application, the market is further divided into Bakery Products, Confectionery, Beverages, Ice Cream & Desserts, and Others. The predominance of the Confectionery commanding a substantial 43.3% market share in 2024. This dominance is driven by the high demand for chocolates in candy bars, bonbons, truffles, and other confectionery products, which are enjoyed by consumers of all ages.

The versatility of chocolate as an ingredient in various sweets and its ability to be paired with other flavors have further boosted its widespread adoption in the confectionery industry. This segment’s strong market position is also influenced by the growing consumer preference for indulgent treats and premium chocolate offerings.

Distribution Channel Analysis

The Supermarkets/Hypermarkets Segment Dominated The Chocolate Market In 2024 Due To Their Widespread Reach And Consumer Preference For In-Store Shopping.

Based on the distribution channel, the market is further divided into supermarkets/hypermarkets, convenience stores, specialty stores, online stores, and others. The predominance of the Supermarkets/Hypermarkets commanding a substantial 44.6% market share in 2024. This is due to their extensive reach and convenience for consumers, offering a wide variety of chocolate products under one store.

Consumers often prefer shopping in these large retail spaces for ease of access, promotional offers, and the ability to see and choose from multiple chocolate brands. Additionally, supermarkets and hypermarkets often cater to both local and international brands, further boosting their market share.

Key Market Segments

By Type

- Dark Chocolate

- White Chocolate

- Milk Chocolate

- Filled Chocolate

By Form

- Bars & Blocks

- Powder

- Pralines

- Spread

- Others

By Application

- Bakery Products

- Confectionery

- Beverages

- Ice Cream & Desserts

- Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Stores

- Others

Drivers

Emerging popularity of dark chocolate option due to health benefits

The growing demand for dark chocolate, driven by its health benefits, is a major driver of global chocolate market growth. As consumers become more health-conscious, dark chocolate is gaining popularity due to its recognized antioxidant, anti-inflammatory, and heart-protective benefits. This factor fueling the demand for dark chocolate as a delicious beneficial treat is attracting health-focused consumers, making dark chocolate a preferred choice. This shift toward healthier, functional foods is significantly boosting the global chocolate market.

- According to the United States Department of Agriculture (USDA), a 101-gram bar of dark chocolate with 70–85% cocoa solids provides 604 calories, 7.87 g of protein, 43.06 g of fat, 46.36 g of carbohydrates, 11.00 g of dietary fiber, 24.23 g of sugar, 12.02 mg of iron, 230 mg of magnesium, and 3.34 mg of zinc.

Additionally, dark chocolate’s ability to increase insulin sensitivity and support cognitive function strengthens its status as a functional food. As consumer preferences shift toward healthier, nutrient-dense options, the demand for dark chocolate, especially varieties with 70% or more cocoa content, has surged. Furthermore, its cardiovascular benefits enhancing vascular function, reducing LDL cholesterol, and boosting HDL cholesterol further contribute to the growing appeal of dark chocolate. This trend is a key driver of the global chocolate market’s growth, as consumers seek out products that offer both indulgence and health benefits.

- According to The Journal of Nutritional Biochemistry, the consumption of 85% cocoa dark chocolate has been found to improve mood, which is associated with changes in gut microbiota in healthy adults.

- According to the Fine Chocolate Industry Association, the U.S. chocolate industry has grown by 21%, with consumer spending increasing from $2.28 billion to $2.88 billion annually. While milk chocolate remains the top choice, older consumers are increasingly opting for darker, more bitter varieties, with 71-75% cacao dark chocolate becoming the preferred choice.

The growing awareness of dark chocolate’s health benefits is boosting its popularity, especially in health-conscious regions like North America and Europe. In emerging markets, rising incomes and wellness trends are driving demand for premium chocolate. Known for supporting heart health, blood sugar control, and brain function, dark chocolate is becoming a key driver of growth in the global chocolate market.

- According to health experts, consuming around 30-60 grams of dark chocolate daily is healthy.

Restraints

Health Concerns Over High Sugar And Fat Content

The Chocolate market has seen significant growth, one of the major restraints that could impact its future growth is the increasing Health concern over high sugar and fat content among consumers, as well as the growing prevalence of dietary restrictions. Health-conscious consumers are placing more emphasis on balanced, nutritious diets, and this shift in eating habits could limit the demand for certain types of chocolates, particularly those that are considered high in sugar or calories.

Additionally, dietary restrictions such as gluten intolerance, dairy allergies, and the rise of plant-based eating have led many consumers to limit their consumption of products that may not meet their dietary needs. As consumers become more educated about the impact of food on their health, there may be greater scrutiny of the ingredients used in chocolates. Furthermore, rising concerns over obesity and diabetes are prompting many consumers to reduce their intake of processed foods, which could potentially limit the market for high-fat, high-sugar chocolates.

Opportunity

Expansion into the Baking Industry

The expansion of chocolate into the baking industry presents a significant growth opportunity for the global chocolate market. As chocolate moves beyond traditional confections, becoming an essential ingredient in both sweet and savory dishes, the demand for a wide range of chocolate types—such as dark, milk, and white—continues to rise. Chefs and home bakers are increasingly incorporating chocolate into innovative recipes, from decadent cakes and brownies to gourmet truffles and chocolate-filled pastries, creating new avenues for chocolate sales.

- For instance, Cargill’s Wilbur 72% Bittersweet Chocolate Drop offers a rich, roasted cocoa flavor with red fruit and bitter notes, making it an ideal addition to gourmet desserts, bakery items, and snacks for a decadent touch.

Moreover, the demand for premium and versatile chocolate products has led to the development of innovative offerings like cocoa powders, filled inclusions, and high-quality baking chocolates. These products enhance both flavor and texture, contributing to the growth of the market. With consumers continually seeking indulgent, high-quality food experiences, particularly in desserts, the increasing use of chocolate in baking fuels the expansion of chocolate-based products. This trend presents a favorable opportunity for both established and emerging chocolate brands to capitalize on the booming baking industry and cater to evolving consumer preferences.

Trends

Innovation in Flavours and Varieties

Innovation in chocolate flavors and varieties is transforming the growth of the global chocolate market, driven by evolving consumer preferences, trends in innovation, health-conscious choices, and sustainability. As consumers become more adventurous, flavor innovation is at the forefront, with exotic spice pairings such as chili and lavender, along with savory combinations like sea salt and herbs, gaining popularity. Health-conscious consumers are fueling the demand for low-sugar, organic, and vegan chocolates, as well as options made with plant-based ingredients, aligning with the growing shift toward cleaner, more sustainable eating habits.

- Tcho’s vegan milk chocolate line reflects growing consumer awareness of health, environmental crises, and the benefits of fermentation, aligning with the trend toward healthier, mood-enhancing options.

Furthermore, the integration of functional ingredients like protein, adaptogens, and superfoods is positioning chocolate as a functional food with added health benefits. Consumers are also prioritizing ethically sourced and organic chocolates, reflecting the increasing demand for fair trade practices and sustainable production. Regional and cultural flavors are adding diversity to the market, offering new and exciting taste experiences. These trends are shaping the future of the chocolate market, driving continued growth and broadening its appeal across diverse consumer segments worldwide.

- According to the National Confectioners Association, 47% of consumers prefer chocolate with ingredients like caramel, peanut butter, and nuts, driving the expansion of flavor varieties in the market. Millennials favor adventurous flavor combinations, while Gen Z tends to prefer chocolate in its pure form. This trend highlights the growing demand for diverse and unique chocolate flavors, fueling innovation and market growth.

Health-Conscious Chocolate Trends

As consumers become more health-conscious, there is a growing demand for healthier chocolate options. Low-sugar and sugar-free chocolates are gaining popularity as people seek to reduce sugar intake. Vegan and dairy-free chocolates are also on the rise, catering to those with plant-based diets or dairy allergies. Additionally, organic and ethically sourced chocolates are increasingly preferred, as consumers prioritize sustainability and fair trade practices. These trends reflect the shift toward healthier, more ethical chocolate choices in the global market.

Geopolitical Impact Analysis

Geopolitical factors, such as sustainability regulations and trade disputes, are influencing the chocolate market by increasing costs, disrupting supply chains, and potentially raising chocolate prices.

The geopolitical dynamics surrounding cocoa trade regulations and certifications have a direct impact on the global chocolate market. As the EU and other regions implement stricter sustainability laws, chocolate companies may face higher costs and supply chain disruptions as producers in countries like Ivory Coast and Ghana adjust to meet new standards. These changes could lead to increased production costs for chocolate manufacturers, potentially driving up prices for consumers and reducing demand for premium products. Additionally, trade tensions arising from these regulations could cause fluctuations in cocoa supply, further influencing the price stability of chocolate products.

- According to World Bank data, global cocoa production dropped by 14% in the 2023-24 season, primarily due to reduced output in Côte d’Ivoire and Ghana, which together account for over 60% of the world’s cocoa supply. Highlights the significant impact of production slowdowns on the cocoa market, affecting global supply and potentially leading to price increases.in 1-2 lines

Furthermore, the growing emphasis on certifications like Fair Trade and Rainforest Alliance is shifting consumer preferences toward ethically sourced chocolate. As consumers become more conscious of sustainability and labor practices, chocolate companies are increasingly investing in certified cocoa to appeal to ethically-minded buyers. While this can improve trade relationships and support more sustainable practices, it may also lead to higher costs for manufacturers, as certified cocoa tends to be more expensive. Ultimately, the political and regulatory landscape plays a critical role in shaping both the cost and demand for chocolate products globally.

Regional Analysis

Europe Held the Largest Share of the Global Chocolate Market

In 2024, Europe dominated the global chocolate market, accounting for 48.30% of the total market share, Driven by a combination of tradition, innovation, and evolving consumer preferences. Europe remains the largest chocolate market globally, with key chocolate-producing countries such as Switzerland, Belgium, France, and Germany leading the way. The demand for premium and artisanal chocolates is growing, fueled by consumers’ increasing preference for high-quality products, including dark chocolate, organic, and fair-trade options. Additionally, the rising trend of health-conscious eating has sparked a surge in the demand for healthier chocolate alternatives, such as low-sugar, vegan, and clean-label products.

- According to a report published by Eurostat, in 2023, EU members exported 867,000 tonnes of chocolate and chocolate bars to countries outside the EU, marking a 2% increase compared to 2022 (852,000 tonnes) and a 35% rise compared to 2013, reflecting the continued growth of the European chocolate market.

Ethical sourcing and sustainability practices have become critical drivers of the market’s expansion. European consumers are more focused on the traceability and transparency of the chocolate production process, pushing for chocolates made from ethically sourced cocoa. The shift toward plant-based and allergen-free products further supports the growth of the market. Furthermore, innovation in flavors, such as the introduction of exotic spices and savory combinations, is attracting new consumers and keeping the market vibrant. As a result, the European chocolate market is expected to continue its upward trajectory, driven by a mix of consumer demand for high-quality, sustainable, and innovative chocolate products.

- In 2023, Germany led EU chocolate exports to non-EU countries with 221,000 tonnes (26% of total exports), followed by the Netherlands (123,000 tonnes), Poland (115,000 tonnes), Belgium (96,000 tonnes), and Italy (92,000 tonnes), together accounting for three-quarters of the total EU exports.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key players in the chocolate market focus on product innovation, strategic acquisitions, regional expansion, and sustainability initiatives to enhance their market presence and meet consumer demand.

Key players in the chocolate market include major companies like Nestlé, Mars Incorporated, Hershey, Mondelez International, and Ferrero Group. These companies including Nestlé and Mars focus on offering a wide range of chocolate products, including premium and health-conscious options, while Hershey continues to lead in the North American market with a strong portfolio of popular chocolate brands. Mondelez is expanding its presence in emerging markets through localized offerings, and Ferrero invests in sustainable sourcing practices, emphasizing quality and premium experiences.

Major Players in the Industry

- Cargill, Incorporated

- Nestlé S.A.

- Mondelez International, Inc.

- Cascade Chocolate Company

- Ferrero SpA

- The Hershey Company

- Lindt & Sprüngli AG

- Godiva Chocolatier

- Barry Callebaut Group

- Fazer Group

- Mars, Incorporated

- Meiji Co., Ltd.

- Ferrara Candy Company

- Lotte Confectionery Co., Ltd.

- Moonstruck Chocolate

- Other Key Players

Recent Development

- In September 2024 – Natra acquired Gudrun, a Belgian chocolate leader, to create a global chocolate platform focused on premium quality, innovation, and sustainability. The acquisition enhances Natra’s Belgian chocolate offerings and expands Gudrun’s reach through Natra’s global network.

- In September 2024 – Chocomel is launching its hot chocolate SKU into UK supermarkets, expanding beyond its European café presence to offer consumers the opportunity to enjoy the brand at home. This move marks a significant step in the brand’s retail expansion in the UK market.

- In May 2024 – Ferrero opened its first U.S. chocolate processing facility in Bloomington, Illinois, marking a significant expansion in North America. This 70,000-square-foot facility will produce chocolate for key brands like Ferrero Rocher, Butterfinger, and Crunch, strengthening the company’s regional presence.

- In September 2023 – Planet a Foods’ ChoViva brand launched a new series of oat mueslis featuring its innovative cocoa-free chocolate alternative. The new vegan flavors—Crunchy Waffle, Crunchy Hazel, and Crunchy Berry—will be available exclusively in REWE stores across Germany starting mid-September 2023, with a focus on sustainability, using up to 90% less CO2 in production compared to traditional chocolate.

- In March 2024 – Cronos Group launched Lord Jones® Chocolate Fusions, marking its entry into the chocolate edibles market. The new product features bite-sized chocolates with a chewy center, crunchy inclusions, and a creamy outer layer, offering a unique multi-texture experience for adult cannabis consumers.

Report Scope

Report Features Description Market Value (2024) USD 120.8 Bn Forecast Revenue (2034) USD 186 Bn CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dark Chocolate, White Chocolate, Milk Chocolate, Filled Chocolate), By Form (Bars & Blocks, Powder, Pralines, Spread, Others), By Application (Bakery Products, Confectionery, Beverages, Ice Cream & Desserts, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC- China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- GCC, South Africa, & Rest of MEA Competitive Landscape Cargill Incorporated, Nestlé S.A., Mondelez International Inc., Cascade Chocolate Company, Ferrero SpA, the Hershey Company, Lindt & Sprüngli AG, Godiva Chocolatier, Barry Callebaut Group, Fazer Group, Mars Incorporated, Meiji Co., Ltd., Ferrara Candy Company, Lotte Confectionery Co., Ltd., Moonstruck Chocolate, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Incorporated

- Nestlé S.A.

- Mondelez International, Inc.

- Cascade Chocolate Company

- Ferrero SpA

- The Hershey Company

- Lindt & Sprüngli AG

- Godiva Chocolatier

- Barry Callebaut Group

- Fazer Group

- Mars, Incorporated

- Meiji Co., Ltd.

- Ferrara Candy Company

- Lotte Confectionery Co., Ltd.

- Moonstruck Chocolate

- Other Key Players