Global Chocolate Beer Market By Product Type (Dark Chocolate Beer, Milk Chocolate Beer, White Chocolate Beer, Chocolate Stout, Chocolate Porter, Others), By Packaging Type (Bottles, Cans, Kegs, Draft), By Distribution Channel (Online Retail, Supermarkets, Liquor Stores, Specialty Stores), By Alcohol Content (Medium Alcohol, Low Alcohol, High Alcohol), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145590

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

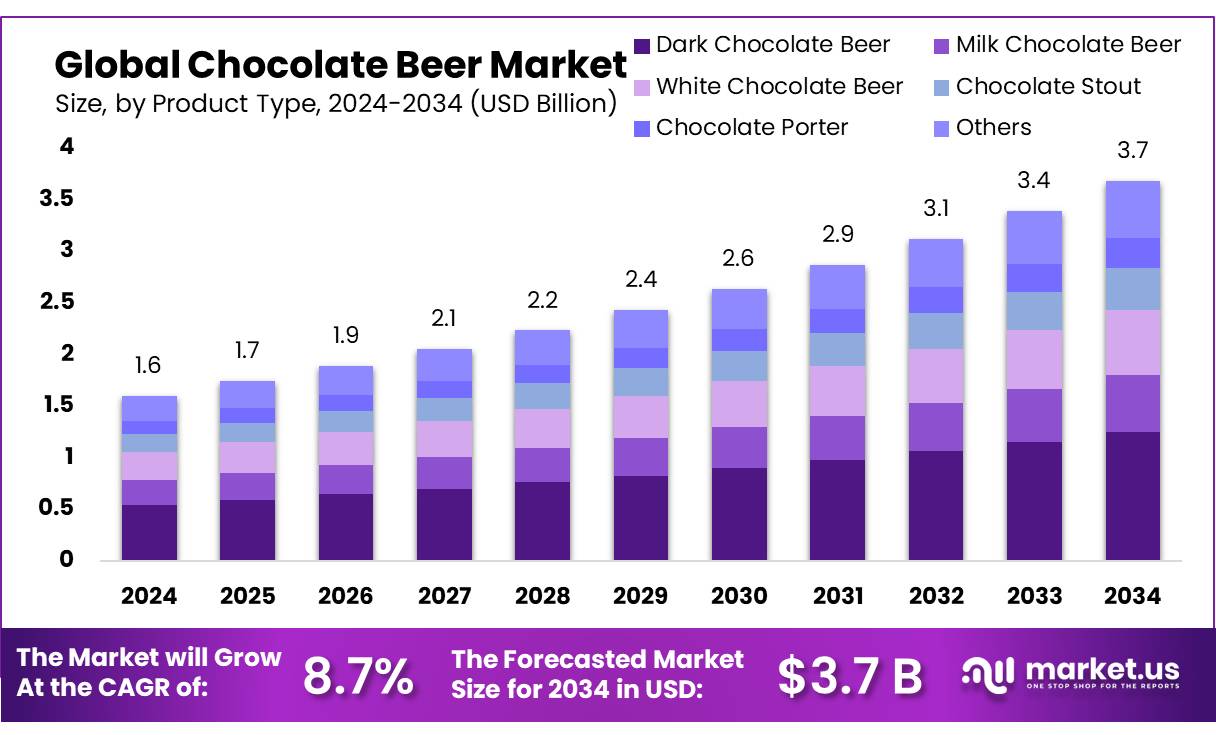

The Global Chocolate Beer Market size is expected to be worth around USD 3.7 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034.

Chocolate beer, a unique fusion of the craft beer and confectionery industries, represents a growing niche segment within the broader alcoholic beverages market. This specialty product combines the rich flavors of chocolate with traditional beer, resulting in a diverse range of products that appeal to a wide consumer base looking for innovative and flavor-rich drinking experiences.

The chocolate beer is buoyed by the increasing consumer interest in artisanal and craft beverages. According to the Brewers Association, craft beer sales in the United States grew by approximately 8% in volume in the last year, indicating a robust interest in specialty beer categories, including flavored varieties such as chocolate beer.

Additionally, Europe has seen a similar trend, with craft beer sales increasing by 9% across key markets such as the UK and Germany. This growth is supported by a strong network of microbreweries and brewpubs innovating with flavors and brewing techniques. Government initiatives promoting small-scale breweries through tax incentives also support this market segment. For example, the U.S. government’s Craft Beverage Modernization and Tax Reform Act has provided tax relief to small brewers, which has encouraged new product developments including chocolate beer variants.

Driving factors for the growth of the chocolate beer market include the rising popularity of craft beers and the consumer shift towards premiumization in alcoholic beverages. The trend of experiential dining and the integration of unique flavors in food and beverages have significantly contributed to the demand for chocolate beer. Furthermore, the growth in the chocolate market itself, which, according to Euromonitor, has seen a global increase in sales by 5% year-over-year, synergistically boosts the chocolate beer segment. The blend of these industries taps into both chocolate lovers and beer enthusiasts, broadening the consumer base.

Another significant driver is the increasing number of collaborations between breweries and renowned chocolatiers. These collaborations often result in limited-edition products that create buzz and boost sales through exclusivity and novelty. For instance, a notable European brewery reported a 15% increase in sales volume after launching a seasonal chocolate stout, developed in partnership with a local chocolate manufacturer. Government statistics from Japan and South Korea indicate a 20% growth in craft beer imports over the past two years, with flavored beers gaining significant traction among younger demographics.

Key Takeaways

- Chocolate Beer Market size is expected to be worth around USD 3.7 Bn by 2034, from USD 1.6 Bn in 2024, growing at a CAGR of 8.7%.

- Dark Chocolate Beer held a dominant market position, capturing more than a 34.50% share.

- Bottles held a dominant market position in the packaging types for chocolate beer, capturing more than a 47.40% share.

- Liquor stores held a dominant market position in the distribution channels for chocolate beer, capturing more than a 42.30% share.

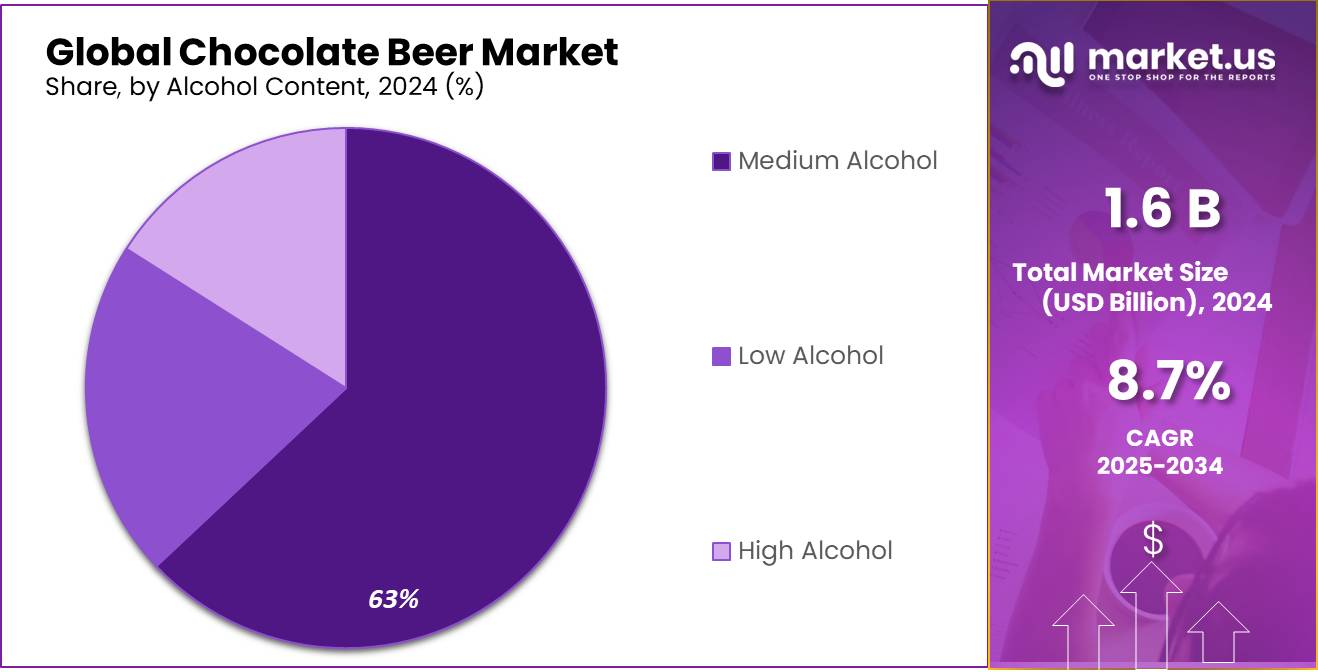

- Low alcohol chocolate beer held a dominant market position, capturing more than a 63.30% share.

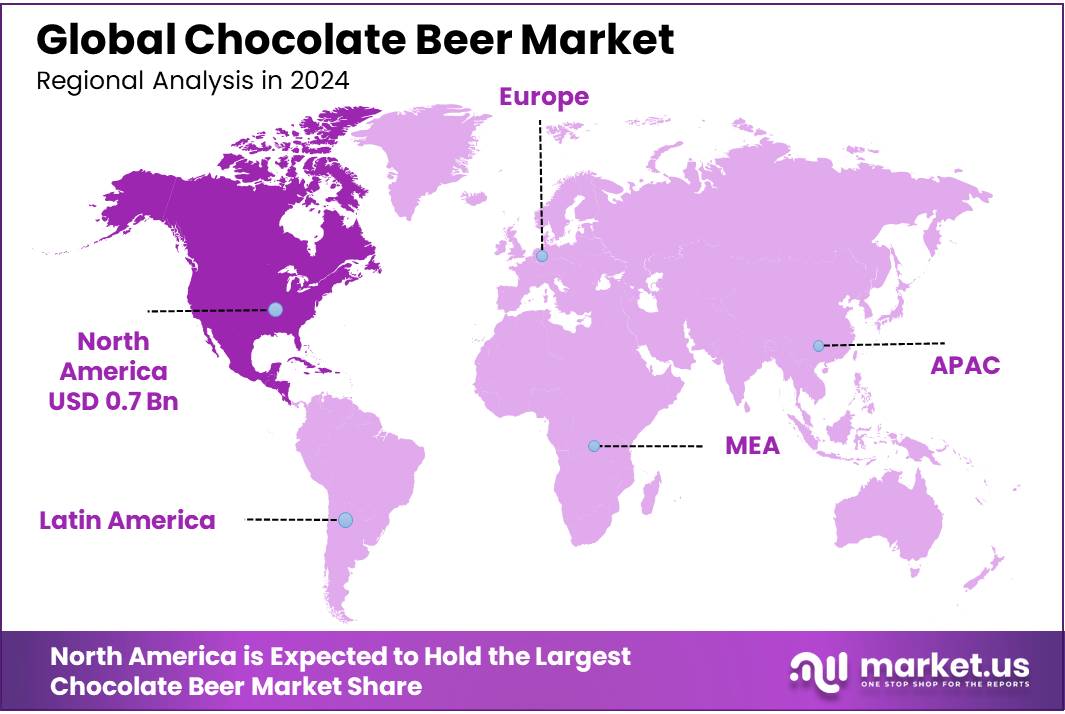

- North America emerged as the leading region in the chocolate beer market, commanding an impressive 47.10% market share and generating revenues of approximately USD 0.7 billion.

By Product Type

Dark Chocolate Beer Leads the Market with a 34.50% Share Due to Its Rich Flavor and Growing Popularity

In 2024, Dark Chocolate Beer held a dominant market position, capturing more than a 34.50% share. This segment’s strong performance can be attributed to the increasing consumer preference for rich, indulgent flavors combined with the traditional bitterness of beer. The unique taste profile of dark chocolate beer has made it a favorite among craft beer enthusiasts who are continually seeking new and unique flavor experiences.

As breweries expand their product lines to include more specialized variants, dark chocolate beer continues to stand out as a popular choice, driving its substantial market share. This trend is reflective of the broader movement towards gourmet and artisanal alcoholic beverages, where consumers are willing to experiment with different ingredients and brewing techniques.

By Packaging Type

Bottles Lead Chocolate Beer Packaging with a 47.40% Market Share for Enhanced Portability and Preservation

In 2024, bottles held a dominant market position in the packaging types for chocolate beer, capturing more than a 47.40% share. This preference for bottles is primarily due to their ability to preserve the quality and taste of beer over extended periods, which is crucial for maintaining the delicate balance of flavors in chocolate beer.

Additionally, bottles are favored for their convenience and portability, allowing consumers to easily transport their beer to various settings, from casual gatherings to more formal events. The traditional appeal of glass bottles, combined with these practical benefits, continues to make them a popular choice among both brewers and consumers, securing their leading position in the market.

By Distribution Channel

Liquor Stores Dominate Chocolate Beer Distribution with a 42.30% Market Share for Accessibility and Variety

In 2024, liquor stores held a dominant market position in the distribution channels for chocolate beer, capturing more than a 42.30% share. This prominence is largely due to the accessibility and convenience that liquor stores offer, providing consumers with a wide variety of beer options, including niche products like chocolate beer.

Liquor stores have become a preferred shopping destination for both casual buyers and connoisseurs looking for specialized brews, contributing significantly to their market share. Their ability to cater to diverse consumer tastes with extensive selections, along with the expert advice often available on-site, has solidified their status as a key player in the distribution of chocolate beer.

By Alcohol Content

Low Alcohol Chocolate Beer Captures a 63.30% Market Share, Favored for Its Moderate Intoxication Level

In 2024, low alcohol chocolate beer held a dominant market position, capturing more than a 63.30% share. This significant preference for low alcohol variants stems from the growing consumer trend towards moderate drinking. Health-conscious consumers, particularly those seeking to enjoy the flavor of beer without the heavy effects of higher alcohol content, are increasingly turning to low alcohol options.

This shift is influenced by a broader movement towards healthier lifestyle choices, including lower calorie intake and reduced alcohol consumption. The ability of low alcohol chocolate beer to offer a rich, indulgent taste while keeping alcohol levels minimal makes it a leading choice in the market, appealing to a wide audience looking to balance indulgence with wellness.

Key Market Segments

By Product Type

- Dark Chocolate Beer

- Milk Chocolate Beer

- White Chocolate Beer

- Chocolate Stout

- Chocolate Porter

- Others

By Packaging Type

- Bottles

- Cans

- Kegs

- Draft

By Distribution Channel

- Online Retail

- Supermarkets

- Liquor Stores

- Specialty Stores

By Alcohol Content

- Medium Alcohol

- Low Alcohol

- High Alcohol

Drivers

Expanding Craft Beer Popularity Fuels Growth in the Chocolate Beer Market

One of the major driving factors for the growth of the chocolate beer market is the expanding popularity of craft beers. Over recent years, there has been a noticeable shift in consumer preferences towards craft and specialty beers, which often include unique and diverse flavor profiles such as chocolate. According to the Brewers Association, the craft beer industry saw a volume growth of approximately 8% in 2023, demonstrating a strong and growing interest in artisanal and flavor-rich beers among consumers.

This trend is supported by the rise in consumer demand for innovative and premium alcoholic beverages. Chocolate beer, with its complex flavor dynamics and artisanal appeal, fits well within this demand, attracting both seasoned beer enthusiasts and new drinkers eager to explore different taste experiences. The inclination towards these specialty products is not just a trend but is becoming entrenched as part of a broader cultural shift towards personalization and quality in food and beverage consumption.

Furthermore, government initiatives aimed at supporting small breweries have also played a crucial role in boosting the craft beer market, indirectly benefiting the chocolate beer segment. For instance, various states in the U.S. have passed laws that reduce tax burdens on small-scale breweries, enabling them to invest more in product innovation and marketing. Such support not only fosters growth at a local level but also elevates the profile of craft beers on national and international stages.

The combination of evolving consumer tastes, a growing interest in craft beer, and supportive government policies create a favorable environment for the continued popularity and growth of chocolate beer. This segment’s growth is underpinned by a cultural shift towards more diverse and quality-focused drinking experiences, making chocolate beer a significant player in the evolving landscape of the beer industry.

Restraints

Regulatory Challenges and Health Concerns Slow Down Chocolate Beer Market Growth

A significant restraining factor in the chocolate beer market is the stringent regulatory environment surrounding alcoholic beverages, combined with growing health concerns among consumers. Governments around the world have been tightening regulations on alcohol marketing and labeling to combat excessive alcohol consumption and its associated health risks. For instance, many countries require detailed labeling on alcoholic products, including health warnings and alcohol content, which can deter consumers from purchasing if they are increasingly health-conscious.

Moreover, the global push towards healthier lifestyles has led to a decline in alcohol consumption in several key markets. According to the World Health Organization, there has been a noticeable trend in reducing alcohol intake as part of broader public health campaigns aimed at reducing the burden of alcohol-related diseases. These health initiatives strongly influence consumer behavior, particularly among younger generations who are more health-aware and may view alcoholic products like chocolate beer with caution.

Additionally, the high calorie and sugar content of chocolate beer can also be a deterrent. As consumers become more calorie-conscious, the appeal of chocolate-flavored alcoholic beverages, known for their higher caloric content compared to traditional beers, may diminish. This aspect is particularly challenging as it aligns with broader dietary trends that prioritize low-calorie and low-sugar diets.

These regulatory and health-related hurdles pose challenges to the growth of the chocolate beer market. Brewers must navigate these constraints while trying to capitalize on the craft beer trend and the unique appeal of chocolate beer. Balancing innovation in flavor with health and regulatory compliance is becoming an essential strategy for sustaining growth in this niche market segment.

Opportunity

Seasonal and Festive Marketing: A Boon for Chocolate Beer Market Expansion

A major growth opportunity for the chocolate beer market lies in the strategic marketing during seasonal and festive periods. Leveraging times like Christmas, Valentine’s Day, and other significant cultural or festive events can significantly boost the demand for chocolate beer. During these periods, consumers are more open to trying novel and thematic products, making it an ideal time for breweries to introduce and promote chocolate-flavored beers.

For example, during the winter holiday season, many consumers indulge in richer, more decadent foods and beverages, setting a perfect stage for chocolate beers. Breweries can capitalize on this trend by releasing limited-edition seasonal offerings that attract gift buyers and party hosts looking for unique and festive beverages. Valentine’s Day offers another prime opportunity, where the association of chocolate with romance can be leveraged to market chocolate beer as an innovative gift or celebration drink.

Additionally, according to a report by the National Retail Federation, holiday sales have seen a consistent uptick, indicating robust consumer spending during key festive seasons. This trend suggests that timely, seasonal marketing initiatives can effectively tap into the consumer’s readiness to spend on specialty products, thereby driving higher sales volumes for chocolate beer.

Furthermore, aligning chocolate beer promotions with local and international food and drink festivals can enhance visibility and acceptance among a broader audience. These festivals often attract food enthusiasts eager to explore different culinary trends, including craft beers with unique flavors like chocolate.

Breweries that harness these seasonal marketing strategies can not only boost their sales but also build a stronger brand presence in the competitive craft beer market. By associating chocolate beer with celebration and indulgence, companies can create lasting impressions that translate into year-round consumer interest and loyalty.

Trends

Collaboration with Artisan Chocolatiers: A Trend Stirring Innovation in the Chocolate Beer Market

One of the most captivating trends in the chocolate beer market is the collaboration between breweries and artisan chocolatiers. This trend is driven by the desire to create a more authentic and refined chocolate flavor in beers, appealing to both craft beer aficionados and chocolate lovers. These collaborations allow for the infusion of high-quality, often locally sourced chocolate or cocoa, which elevates the taste profile of the beer beyond traditional brewing ingredients.

Such partnerships are not only about enhancing product offerings but also about storytelling, which resonates well with today’s consumers who appreciate transparency and authenticity. By showcasing the origins of the chocolate and the expertise of both brewers and chocolatiers, companies can craft a compelling narrative that attracts more customers and differentiates their products in a crowded market.

The popularity of these collaborations is mirrored in the rise of consumer interest in craft and specialty foods. According to a survey by the Specialty Food Association, there has been a significant increase in consumer spending on specialty foods, indicating a broader trend towards products that offer unique flavors and artisanal quality. This consumer behavior points to a fertile ground for chocolate beers that can promise and deliver a novel drinking experience.

Moreover, these collaborations often lead to limited edition releases, which can generate buzz and urgency among consumers, encouraging them to purchase while supplies last. This strategy not only boosts sales but also enhances brand visibility and loyalty as consumers eagerly await new releases.

Embracing this trend, breweries have a tremendous opportunity to innovate and expand their market reach. By aligning with skilled chocolatiers, they can continue to captivate the palates of consumers and stand out in the evolving landscape of the craft beer industry.

Regional Analysis

North America Dominates the Chocolate Beer Market with a 47.10% Share and $0.7 Billion in Revenue

In 2024, North America emerged as the leading region in the chocolate beer market, commanding an impressive 47.10% market share and generating revenues of approximately USD 0.7 billion. This robust market presence is supported by a well-established craft beer culture and a growing affinity for innovative and flavored alcoholic beverages among North American consumers.

The region’s dominance is further bolstered by the presence of numerous microbreweries and craft beer establishments that are continually experimenting with flavor profiles, including chocolate. These breweries are tapping into the consumer’s increasing interest in unique and premium drinking experiences. North America’s strong market position is also supported by its extensive distribution networks and well-developed retail sectors, which ensure wide availability and accessibility of chocolate beers across the United States and Canada.

Moreover, regional festivals and craft beer events frequently feature chocolate beer, helping to cultivate a community of enthusiasts and regular consumers. These events not only promote chocolate beer but also educate consumers about the diverse brewing techniques and flavor infusions, enhancing consumer engagement and loyalty.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Deschutes Brewery, based in Bend, Oregon, is a pioneer in the craft beer industry and a key player in the chocolate beer market. Known for its richly flavored beers, Deschutes has gained acclaim for its Black Butte Porter, which features chocolate notes. The brewery’s commitment to quality and innovation has helped it maintain a strong presence in the market, appealing to both traditional beer enthusiasts and those seeking unique flavor experiences.

BrewDog, a Scottish brewery renowned for its bold and experimental beers, has made significant inroads into the chocolate beer segment with offerings like the Cocoa Psycho, a Russian Imperial Stout. BrewDog’s aggressive marketing strategies and global expansion have bolstered its reputation and market share, making it a formidable competitor in the chocolate beer market.

New Belgium Brewing, known for its Fat Tire Amber Ale, has also embraced the chocolate beer trend with its creatively crafted cocoa blends. Located in Fort Collins, Colorado, New Belgium is celebrated for its sustainable brewing practices and innovative product line, which resonates well with environmentally conscious consumers and those seeking distinct flavors.

North Coast Brewing Company, situated in Fort Bragg, California, offers a variety of acclaimed beers, including the Old Rasputin Russian Imperial Stout, which incorporates rich chocolate flavors. The brewery’s focus on classic brewing techniques and high-quality ingredients has established it as a leader in the chocolate beer market, appealing to a niche audience that appreciates artisanal beers.

Top Key Players

- Deschutes Brewery

- BrewDog

- New Belgium Brewing

- North Coast Brewing Company

- Sierra Nevada Brewing Co

- Samuel Adams

- Lakewood Brewing Company

- Anderson Valley Brewing Company

- Young’s Beers

- Sweetwater Brewing Company

- Ommegang Brewery

- Yuengling & Sons

- Stone Brewing

- Bell’s Brewery

- Dogfish Head Craft Brewery

Recent Developments

In 2024, Deschutes Brewery maintained a strong presence in the chocolate beer market, capitalizing on the craft beer movement’s momentum. The brewery, well-known for its innovative approach to beer making, has successfully harnessed the increasing consumer demand for unique and complex flavors. Deschutes has been at the forefront of integrating rich chocolate nuances into some of their beers, catering to a niche but rapidly growing segment of beer enthusiasts who appreciate both traditional and experimental brews.

In 2024, BrewDog continued to make significant strides in the chocolate beer market, building on its reputation for bold and innovative craft beers. Known for its unconventional approach and “punk-inspired” ethos, BrewDog has effectively harnessed the growing consumer interest in unique beer flavors. Their offerings in the chocolate beer segment include creatively infused brews that have captured the attention of both new and existing customers.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Bn Forecast Revenue (2034) USD 3.7 Bn CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Dark Chocolate Beer, Milk Chocolate Beer, White Chocolate Beer, Chocolate Stout, Chocolate Porter, Others), By Packaging Type (Bottles, Cans, Kegs, Draft), By Distribution Channel (Online Retail, Supermarkets, Liquor Stores, Specialty Stores), By Alcohol Content (Medium Alcohol, Low Alcohol, High Alcohol) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Deschutes Brewery, BrewDog, New Belgium Brewing, North Coast Brewing Company, Sierra Nevada Brewing Co, Samuel Adams, Lakewood Brewing Company, Anderson Valley Brewing Company, Young’s Beers, Sweetwater Brewing Company, Ommegang Brewery, Yuengling & Sons, Stone Brewing, Bell’s Brewery, Dogfish Head Craft Brewery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Deschutes Brewery

- BrewDog

- New Belgium Brewing

- North Coast Brewing Company

- Sierra Nevada Brewing Co

- Samuel Adams

- Lakewood Brewing Company

- Anderson Valley Brewing Company

- Young's Beers

- Sweetwater Brewing Company

- Ommegang Brewery

- Yuengling & Sons

- Stone Brewing

- Bell’s Brewery

- Dogfish Head Craft Brewery