Global Fish Nutrition Market Size, Share, And Business Benefits By Product Type (Fish Oil, Fish Collagen, Fish Gelatin, Fish Protein Powder, Fish Protein Isolates, Fish Paste, Others), By Application (Dietary Supplements, Animal Feed, Pharmaceuticals, Food, Fertilizers, Skin Care, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145395

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

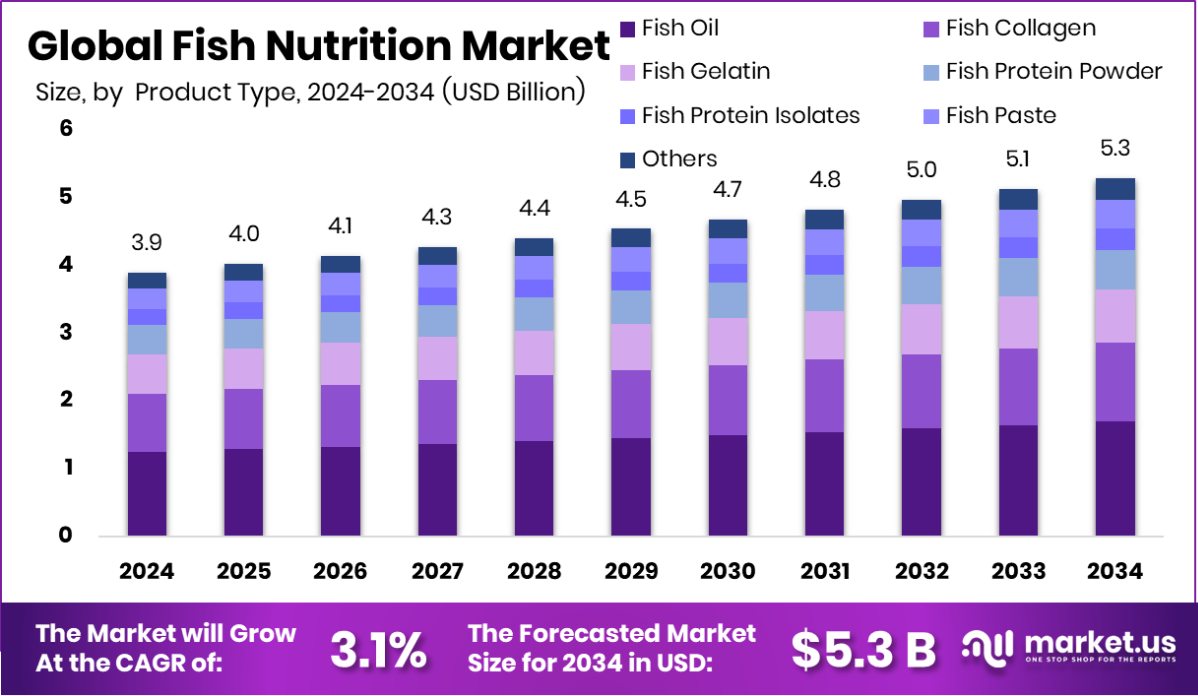

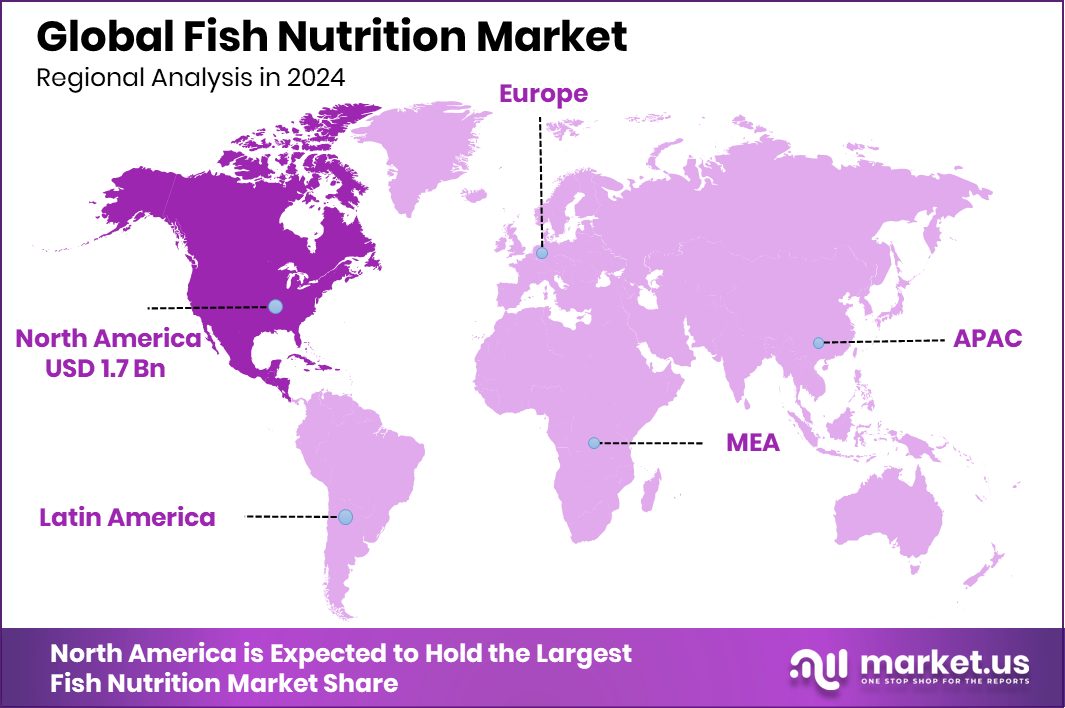

The Global Fish Nutrition Market is expected to be worth around USD 5.3 billion by 2034, up from USD 3.9 billion in 2024, and grow at a CAGR of 3.1% from 2025 to 2034. Rising health awareness boosts fish nutrition demand across North America’s USD 1.7 billion market.

Fish nutrition refers to the study and application of a balanced diet for fish, aiming to optimize their health, growth, and reproduction. It involves understanding the specific dietary needs of various fish species, which include proteins, fats, carbohydrates, vitamins, and minerals. Proper fish nutrition is crucial in aquaculture, ensuring that farmed fish are healthy and have high survival rates while also supporting their development and the quality of the fish products.

The fish nutrition market encompasses the industry involved in the production and distribution of fish feed and nutritional supplements tailored for different species and stages of fish development. This market is integral to the aquaculture industry and focuses on creating efficient, sustainable feeds that enhance the growth, health, and yield of fish, aligning with the rising demand for fish as a protein source globally.

Governments across the globe are increasingly supporting research in sustainable aquaculture and fish oil production. In India, the Union Budget for FY 2025–26 has introduced significant funding initiatives, including the Anusandhan National Research Fund with a massive corpus of ₹1 lakh crore (approximately USD 12 billion), aimed at boosting innovation across various sectors, fisheries included.

India holds the position of the world’s second-largest fish producer, with seafood exports valued at INR 60,000 crore (around USD 7.2 billion). To promote the sustainable exploitation of its marine resources, the government is focusing on its Exclusive Economic Zone. Additionally, the Kisan Credit Card (KCC) scheme provides fishermen with improved access to finance, offering loan limits up to INR 5 lakh for short-term requirements.

Key Takeaways

- The Global Fish Nutrition Market is expected to be worth around USD 5.3 billion by 2034, up from USD 3.9 billion in 2024, and grow at a CAGR of 3.1% from 2025 to 2034.

- The fish nutrition market sees fish oil commanding a 32.50% share by product type.

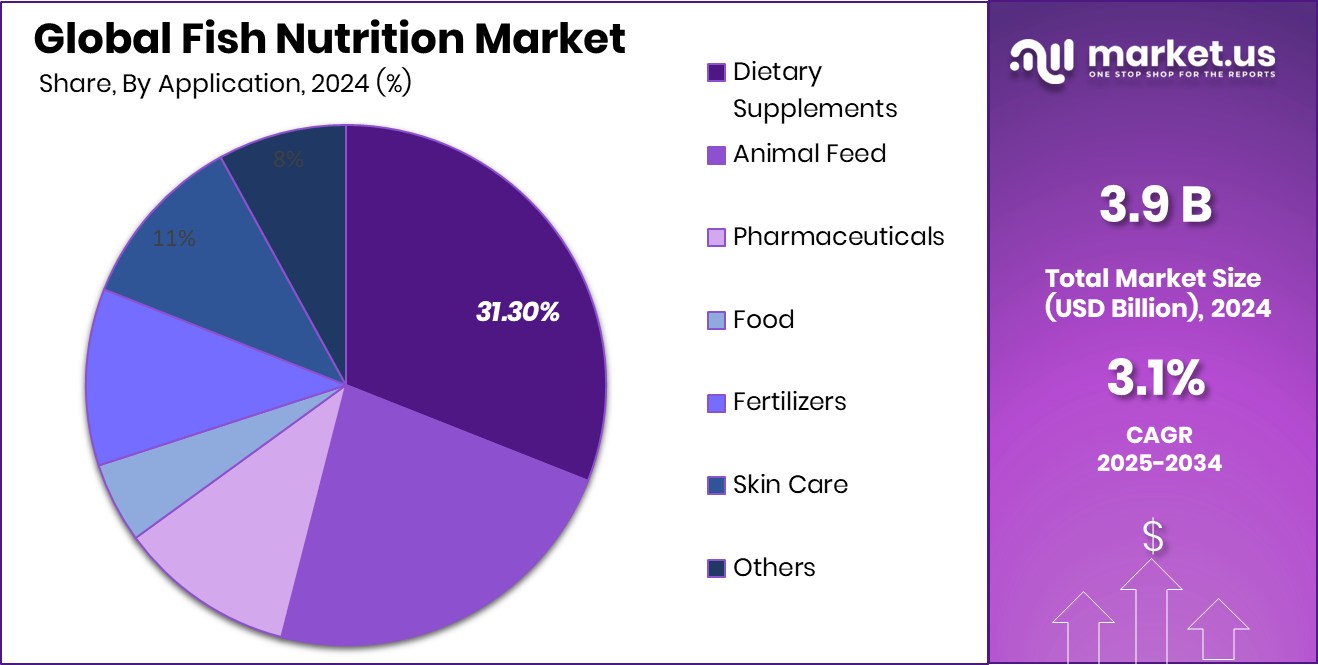

- Dietary supplements hold a significant 31.30% share by application in the fish nutrition market.

- The fish nutrition market in North America reached USD 1.7 billion in value.

By Product Type Analysis

Fish oil holds a 32.50% share in the fish nutrition market.

In 2024, Fish Oil held a dominant market position in the By Product Type segment of the Fish Nutrition Market, commanding a 32.50% share. This significant portion underscores the critical role that fish oil plays as a primary ingredient in fish feed formulations.

Fish oil is highly valued for its rich content of omega-3 fatty acids, which are essential for the growth and health of aquatic animals. The demand for fish oil has been propelled by the increasing knowledge of these health benefits, particularly in enhancing fish immunity and improving the overall quality of seafood.

The market dominance of fish oil is also influenced by its utilization across various aquaculture sectors, including salmon and trout farming, which are among the largest consumers of high-quality fish feed. As aquaculture producers continue to seek efficient and sustainable feed options, fish oil remains a top choice due to its proven effects on fish growth rates and feed efficiency.

By Application Analysis

Dietary supplements command a 31.30% application share in the fish nutrition market.

In 2024, Dietary Supplements held a dominant market position in the By Application segment of the Fish Nutrition Market, with a 31.30% share. This substantial market share reflects the growing emphasis on enhancing fish health and productivity through specialized nutrition. Dietary supplements in the fish nutrition sector are designed to provide a balanced blend of vitamins, minerals, and other essential nutrients that support the physiological needs of various fish species.

The prominence of dietary supplements in the market is driven by the increasing adoption of precision aquaculture practices, where the goal is to maximize yield and quality while minimizing environmental impacts. These supplements are crucial in promoting better feed utilization, boosting immune responses, and improving reproductive performance, which are key concerns in commercial aquaculture operations.

Moreover, the rising consumer demand for high-quality seafood has spurred aquaculture farms to focus on the nutritional content of their fish, further fueling the demand for effective dietary supplements. As regulatory standards for aquaculture products continue to tighten, the reliance on these supplements to ensure compliance with quality and safety standards is expected to keep driving their market share upward.

Key Market Segments

By Product Type

- Fish Oil

- Fish Collagen

- Fish Gelatin

- Fish Protein Powder

- Fish Protein Isolates

- Fish Paste

- Others

By Application

- Dietary Supplements

- Animal Feed

- Pharmaceuticals

- Food

- Fertilizers

- Skin Care

- Others

Driving Factors

Increasing Health Awareness Boosts Fish Nutrition Demand

The fish nutrition market is primarily driven by growing health consciousness among consumers worldwide. As people become more aware of the health benefits associated with consuming fish, such as high omega-3 fatty acids and lean protein, the demand for nutritious fish products has surged.

This trend is particularly noticeable among individuals seeking healthier dietary options to prevent lifestyle diseases like obesity, heart disease, and diabetes. As a result, both direct fish consumption and the use of fish-based supplements have increased significantly.

This rising consumer focus on health and wellness is prompting producers to develop and market a wider variety of fish nutrition products, which is, in turn, propelling the market growth.

Restraining Factors

Environmental Concerns Limit Expansion of Fish Nutrition

One of the main factors holding back the growth of the fish nutrition market is the increasing concern over environmental sustainability. The process of raising fish, especially in aquaculture settings, often involves practices that can be harmful to the environment, such as overuse of water resources and contamination of local ecosystems with feed and waste.

These environmental issues not only affect local wildlife and water quality but also raise concerns among consumers who are environmentally conscious consumers. As a result, some potential customers hesitate to buy farmed fish products, preferring wild-caught options that are perceived as more sustainable.

This shift in consumer preference poses a significant challenge to the expansion of the fish nutrition market, particularly in regions with strict environmental regulations.

Growth Opportunity

Expanding Markets in Developing Countries Offer Opportunities

The fish nutrition market has a significant growth opportunity in developing countries, where economic growth is increasing disposable incomes and changing dietary habits. As people in these regions earn more, they are looking for more nutritious and protein-rich foods, which include fish and fish-based products.

This shift is supported by urbanization and the expansion of retail infrastructure, making it easier for consumers to access various types of fish products. Additionally, governments in many developing countries are promoting aquaculture as a sustainable way to boost food security and create jobs, further fueling market growth.

This scenario presents a lucrative opportunity for companies in the fish nutrition sector to expand their presence and cater to a new, growing customer base in these markets.

Latest Trends

Innovative Fish Feed Formulas Enhance Market Growth

A significant trend in the fish nutrition market is the development of innovative fish feed formulations that enhance fish growth and health while reducing environmental impact. These advanced formulas often include alternative protein sources, such as algae and insect-based proteins, which are more sustainable compared to traditional fishmeal.

Additionally, the incorporation of functional ingredients like probiotics and prebiotics in fish feed is gaining popularity. These ingredients help improve the gut health of fish, leading to better nutrient absorption and overall health, which in turn produces higher-quality fish products.

This trend is not only making fish farming more sustainable but is also catering to the rising consumer demand for ethically produced and environmentally friendly products.

Regional Analysis

North America holds a 43.50% market share in fish nutrition, showing strong dominance.

The global fish nutrition market demonstrates varied performance across regions, with North America leading in terms of revenue share. North America dominates the market, accounting for 43.50% and reaching a valuation of USD 1.7 billion, driven by high demand for quality aquafeed and a well-established aquaculture sector. The region’s emphasis on nutritional science, sustainability, and health-conscious consumer behavior further supports its leading position.

Europe follows closely, backed by strong regulatory frameworks and increasing investment in sustainable fish farming practices. The Asia Pacific region also represents a significant market, fueled by expanding aquaculture activities in countries like China, India, and Vietnam, although no specific data is available in this context.

In the Middle East & Africa, the market remains emerging, supported by growing interest in fish farming to meet rising protein demand. Latin America shows moderate growth, supported by natural water resources and export-driven aquaculture in countries like Chile and Brazil.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global fish nutrition market remains dynamic, with leading companies like BioMar Group, Alltech Inc., and ADM strategically shaping the industry’s direction. Each brings distinct capabilities and innovations that strengthen their market positioning and respond to evolving aquaculture demands.

BioMar Group continues to lead with its commitment to sustainability and species-specific feed formulations. The company’s investment in research and development, particularly in functional feeds, underscores its strategy to improve fish health and growth performance while minimizing environmental impact. BioMar’s presence in key aquaculture hubs gives it a competitive edge in swiftly scaling innovations.

Alltech Inc. leverages its core strength in biotechnology and nutrition science to offer solutions tailored for optimal fish health and immune support. The company’s emphasis on natural feed additives and gut health enhancers aligns well with the growing preference for antibiotic-free aquaculture practices. Alltech’s integrated approach, combining feed innovation with digital aquaculture platforms, enhances its value proposition among premium fish producers.

ADM’s expanding role in the fish nutrition segment signals its intent to become a major player in the broader animal nutrition arena. With strong capabilities in plant-based protein and amino acid technologies, ADM capitalizes on the trend toward alternative, sustainable feed ingredients. Its global sourcing network and R&D infrastructure enable cost-effective scaling and customization for diverse aquaculture species and regions.

Top Key Players in the Market

- Cargill, Incorporated

- Nutreco N.V. (Skretting)

- Charoen Pokphand Group (CP Foods)

- BioMar Group

- Alltech Inc.

- ADM

- Evonik

- Adisseo

- Novus Inteational

- DSM

- AngelYeast

- SPAROS I&D

- Kemin Industries

- Zoetis

- BASF Nutrition

Recent Developments

- In February 2025, Cargill introduced the Effective Energy program, a new salmon feed concept designed to optimize nitrogen utilization while improving fish performance, health, and cost-efficiency for farmers. By leveraging commercial data and integrating with Cargill’s digital platform, this program offers customized nutritional strategies tailored to specific farming conditions.

- In May 2024, Skretting introduced AmiNova, a new feed formulation concept that enhances precision in fish nutrition. By focusing on an ideal digestible amino acid profile, AmiNova improves nutrient utilization, leading to better fish growth and reduced environmental impact.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 5.3 Billion CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Fish Oil, Fish Collagen, Fish Gelatin, Fish Protein Powder, Fish Protein Isolates, Fish Paste, Others), By Application (Dietary Supplements, Animal Feed, Pharmaceuticals, Food, Fertilizers, Skin Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Incorporated, Nutreco N.V. (Skretting), Charoen Pokphand Group (CP Foods), BioMar Group, Alltech Inc., ADM, Evonik, Adisseo, Novus Inteational, DSM, AngelYeast, SPAROS I&D, Kemin Industries, Zoetis, BASF Nutrition Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill, Incorporated

- Nutreco N.V. (Skretting)

- Charoen Pokphand Group (CP Foods)

- BioMar Group

- Alltech Inc.

- ADM

- Evonik

- Adisseo

- Novus Inteational

- DSM

- AngelYeast

- SPAROS I&D

- Kemin Industries

- Zoetis

- BASF Nutrition