Global Cultured Meat Market By Source (Poultry, Pork, Beef, Seafood, Duck, Others), By Application (Nuggets, Burgers, Meatballs, Sausages, Hot Dogs, Others), By End-use (Household, Food Services), By Distribution Channel (Hypermarkets and Convenience Stores, Food and Drink Specialty Stores, Online Retail, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: June 2025

- Report ID: 142925

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

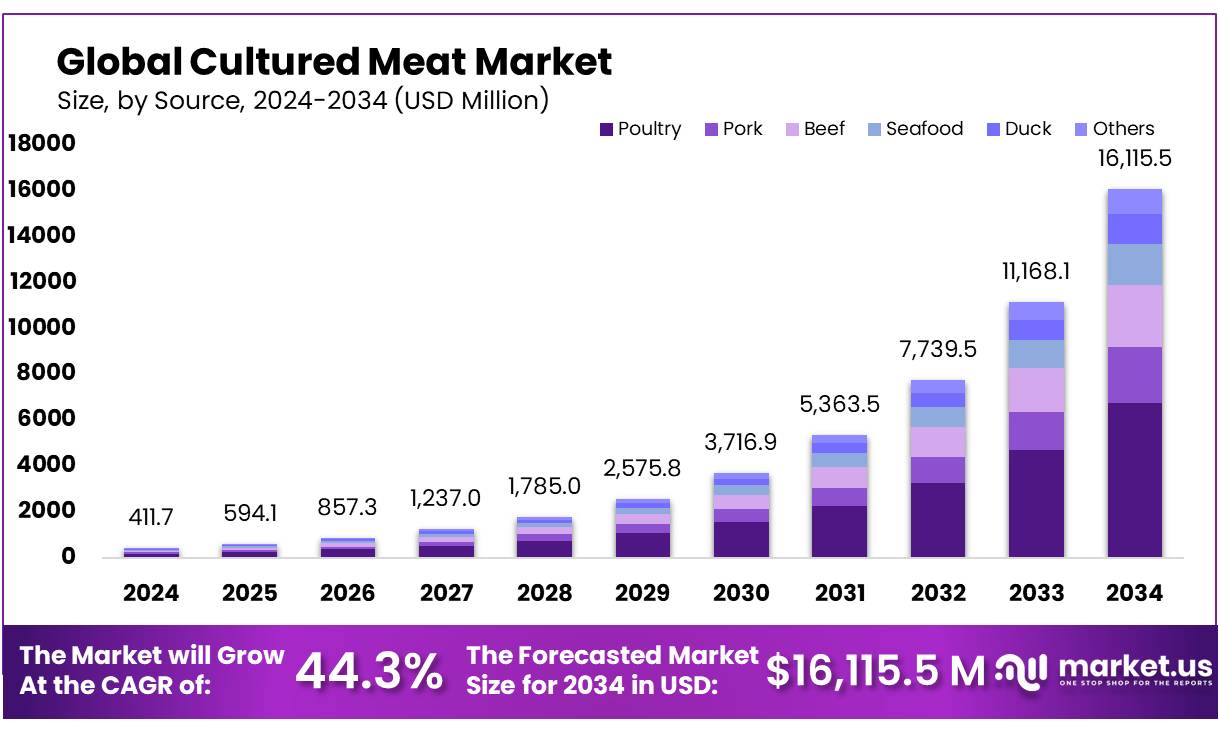

The Global Cultured Meat Market size is expected to be worth around USD 16115.5 Mn by 2034, from USD 411.7 Mn in 2024, growing at a CAGR of 44.3% during the forecast period from 2025 to 2034.

Cultured meat, often referred to as lab-grown or clean meat, is a breakthrough in food technology aimed at producing meat from animal cells without traditional farming methods. This approach not only addresses ethical concerns regarding animal welfare but also mitigates environmental issues such as unsustainable land and water use and significant greenhouse gas emissions associated with conventional meat production. With the food industry at a critical juncture due to the effects of climate change and global pandemics, cultured meat offers a promising alternative that could revolutionize our food supply system.

Investment in the cultured meat sector is on the rise, driven by both startups and established companies. For instance, Memphis Meats and Mosa Meat have raised significant funds, with Memphis Meats alone securing $161 million in its latest round to enhance its production capabilities. This influx of capital highlights the growing confidence in the potential of cultured meat to become a mainstream food option.

The industry’s growth is further supported by a growing consumer consciousness about environmental sustainability and animal welfare. According to the United Nations Food and Agriculture Organization, traditional livestock farming is responsible for about 14.5% of all human-induced greenhouse gas emissions. Cultured meat significantly reduces these emissions and the sector’s ecological footprint by using less land and water.

Regulatory support is also pivotal for the advancement of cultured meat. Singapore set a precedent in December 2020 by becoming the first country to approve the sale of cultured meat, allowing Eat Just, Inc. to market its lab-grown chicken. This regulatory milestone is likely to accelerate similar approvals globally as other nations work on establishing frameworks to ensure the safe and transparent introduction of cultured meat products into the market.

Looking ahead, the cultured meat industry is poised for rapid growth, with predictions suggesting it could reach a market value of $25 billion by 2030. As technology advances, leading to more efficient bioreactor designs and cheaper cell culture media, the cost of cultured meat is expected to decline, making it competitive with traditional meat products. However, consumer acceptance remains a critical hurdle, necessitating ongoing public education and marketing efforts to emphasize the benefits of cultured meat.

Key Takeaways

- Cultured Meat Market size is expected to be worth around USD 16115.5 Mn by 2034, from USD 411.7 Mn in 2024, growing at a CAGR of 44.3%.

- Poultry held a dominant market position in the cultured meat industry, capturing more than a 42.40% share.

- Nuggets held a dominant market position within the cultured meat industry, capturing more than a 33.20% share.

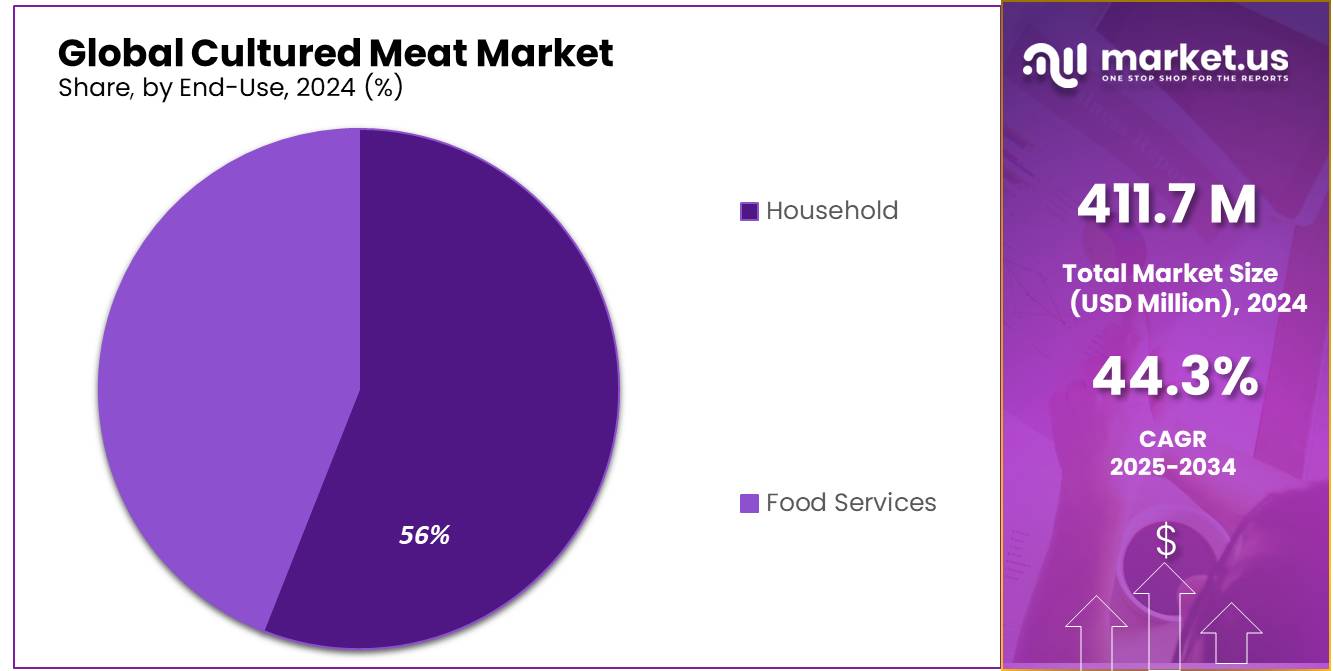

- Household segment held a dominant market position in the cultured meat sector, capturing more than a 56.40% share.

- Hypermarkets and convenience stores held a dominant market position in the distribution of cultured meat, capturing more than a 46.80% share.

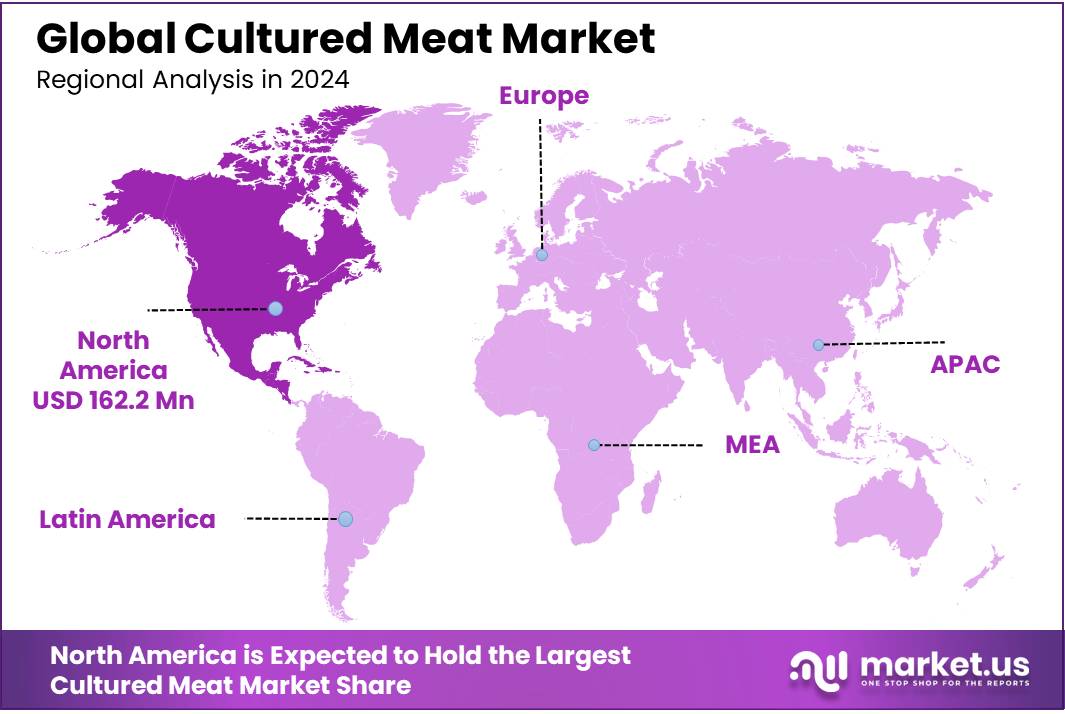

- North America currently dominates the region with a 39.40% market share, translating to a value of approximately $162.2 million.

By Source

Poultry-Derived Cultured Meat Dominates with Over 42% Market Share in 2024

In 2024, poultry held a dominant market position in the cultured meat industry, capturing more than a 42.40% share. This significant portion of the market can be attributed to several factors. Firstly, the familiarity of poultry as a primary source of protein for consumers globally encourages acceptance and adoption of its cultured counterpart.

Additionally, technological advancements in cellular agriculture have made it easier and more cost-effective to cultivate chicken cells, compared to other types of meat. This economic efficiency not only attracts investments into poultry-based cultured meat ventures but also makes the final product more accessible to a broader consumer base. As consumer awareness and regulatory landscapes continue to evolve, the poultry segment of cultured meat is expected to maintain its lead, driven by sustainability concerns and the increasing demand for ethical alternatives to traditional meat production.

By Application

Cultured Meat Nuggets Claim Over 33% Market Share in 2024

In 2024, nuggets held a dominant market position within the cultured meat industry, capturing more than a 33.20% share. This substantial market presence is primarily driven by consumer preferences for convenient and familiar food forms. Cultured meat nuggets, mimicking traditional chicken nuggets, have been particularly popular in quick-service restaurants and in retail for home cooking.

Their ease of preparation and appeal to all age groups make them a staple in the fast-growing sector of alternative proteins. Technological innovations in texture and flavor enhancement have also played a crucial role, making cultured nuggets nearly indistinguishable from their conventional counterparts. As the market for sustainable and ethical food options expands, cultured meat nuggets are set to remain a favorite, aligning with global shifts towards environmentally friendly and animal-free dietary choices.

By End-use

Cultured Meat Gains Traction in Households with Over 56% Market Share in 2024

In 2024, the household segment held a dominant market position in the cultured meat sector, capturing more than a 56.40% share. This notable dominance reflects a growing consumer shift towards sustainable and ethical eating practices within the home. As cultured meat becomes more available and its benefits more widely understood, families are increasingly choosing it as a regular part of their meals, seeing it as a viable alternative to traditional meat due to its lower environmental impact and absence of animal welfare concerns.

Innovations in product development have also made cultured meat more appealing by improving taste, texture, and variety, which are critical factors for household consumers. This trend is supported by increased availability in supermarkets and online grocery platforms, making it easier for households to access these products. As awareness and availability continue to increase, the household consumption of cultured meat is expected to grow, further cementing its place in kitchens around the world.

By Distribution Channel

Hypermarkets & Convenience Stores Lead Cultured Meat Distribution with 46.8% Market Share in 2024

In 2024, hypermarkets and convenience stores held a dominant market position in the distribution of cultured meat, capturing more than a 46.80% share. This significant presence can be attributed to the extensive reach and accessibility of these retail formats. Hypermarkets and convenience stores are often the primary shopping destinations for a diverse range of consumers, offering the advantage of immediate availability and the opportunity to reach a broad audience.

The ability to physically evaluate products before purchase and the convenience of combining shopping for cultured meat with other grocery needs have contributed to their leading position in the market. As these outlets continue to expand their offerings of alternative proteins, including cultured meat, their role in shaping consumer preferences and enhancing product accessibility is expected to strengthen further.

Key Market Segments

By Source

- Poultry

- Pork

- Beef

- Seafood

- Duck

- Others

By Application

- Nuggets

- Burgers

- Meatballs

- Sausages

- Hot Dogs

- Others

By End-use

- Household

- Food Services

By Distribution Channel

- Hypermarkets & Convenience Stores

- Food and Drink Specialty Stores

- Online Retail

- Others

Drivers

Environmental Sustainability Drives Adoption of Cultured Meat

One major driving factor for the adoption of cultured meat is its environmental sustainability. Traditional livestock farming is well-known for its substantial environmental footprint, contributing significantly to greenhouse gas emissions, land degradation, and water consumption. In contrast, cultured meat offers a promising reduction in these impacts.

According to the Food and Agriculture Organization (FAO), livestock accounts for about 14.5% of all anthropogenic greenhouse gas emissions. Cultured meat production, however, is projected to potentially reduce these emissions by up to 96%, land use by up to 99%, and water use by up to 96% compared to conventional beef production.

Governments and environmental organizations are increasingly recognizing these benefits. Initiatives aimed at reducing the environmental impact of food production are seeing cultured meat as a viable solution. For example, the European Union has funded research projects under its Horizon 2020 program, aiming to advance the scalability and sustainability of cultured meat technologies. Such endorsements highlight the role of cultured meat in achieving environmental targets and the shift towards more sustainable consumption patterns.

Consumer awareness of these environmental benefits is also growing, spurred by campaigns from trusted sources like the World Wildlife Fund (WWF) and global climate change reports that underscore the urgency of reducing our environmental footprint. As more consumers become aware of the environmental costs associated with traditional meat production, the appeal of cultured meat as a low-impact alternative increases.

Restraints

High Production Costs Challenge Cultured Meat Market Growth

A significant restraining factor for the growth of the cultured meat market is the high cost of production. Despite the promising benefits of cultured meat in terms of sustainability and animal welfare, the current technology and processes involved remain expensive, making it challenging to scale production and reduce prices to competitive levels with conventional meat.

Cultured meat production involves complex biotechnological processes, including cell culture media, bioreactors, and scaffolding methods, which are still under development and require substantial investment. The price of growth media, particularly the nutrients needed to grow animal cells outside the body, is one of the major cost drivers. Early estimates from industry analyses suggest that the cost of producing a single cultured meat burger was around $325,000 in 2013, which has since been reduced significantly but still remains high compared to traditional meat products.

Efforts are being made globally to address these challenges. For instance, government-funded initiatives in countries like Japan and Singapore are supporting research into reducing the cost of cell culture media and improving the efficiency of production processes. These initiatives aim to make cultured meat a more economically viable option in the future.

Furthermore, industry leaders and startups are actively seeking innovative ways to lower costs through technological advancements and better production techniques. Despite these efforts, the economic feasibility of mass-producing cultured meat at a cost comparable to conventional meat is still a work in progress. Consumer acceptance may also be impacted by these higher costs, as price remains a crucial factor in food choices for many households.

Opportunity

Expanding Market Opportunities in Asia-Pacific Region

The Asia-Pacific region presents significant growth opportunities for the cultured meat market, driven by shifting consumer preferences, increasing concerns about food security, and supportive government policies. The region’s rapidly growing population, coupled with rising income levels and urbanization, is creating a surge in demand for protein-rich foods. Cultured meat offers a sustainable and efficient solution to meet this demand while addressing the environmental concerns associated with traditional livestock production.

Governments in the Asia-Pacific are recognizing the potential of cultured meat to contribute to food sustainability and are implementing supportive policies. For example, Singapore became the first country in the world to approve the sale of cultured meat in 2020, demonstrating a proactive approach to food innovation. This landmark decision has set a precedent in the region, encouraging other governments to consider similar regulatory frameworks to facilitate the commercialization of cultured meat products.

Moreover, the region is home to several high-growth economies with consumers who are increasingly health-conscious and open to trying new food technologies. This consumer base is likely to be receptive to cultured meat, viewing it as a healthier and more ethical alternative to traditional meat. According to industry forecasts, the Asia-Pacific cultured meat market is expected to experience robust growth over the next decade, with companies and investors keen to tap into this burgeoning market.

Additionally, collaborations between global cultured meat companies and local firms in the Asia-Pacific could accelerate market entry and consumer acceptance. These partnerships can leverage local market knowledge and distribution networks, further enhancing the growth potential of cultured meat in the region.

Trends

Diversification of Cultured Meat Products Gains Momentum

A significant and exciting trend in the cultured meat industry is the diversification of products, extending far beyond the initial offerings of simple burger patties. Companies are now developing a variety of cultured meat products, including steaks, seafood, and even exotic meats, which cater to a broader range of culinary tastes and traditions. This trend is not only capturing the interest of consumers but also of chefs and foodies who are keen to explore new culinary experiences without the environmental and ethical costs associated with traditional animal farming.

Recent advancements in cellular agriculture have made it possible to replicate the complex textures and flavors of different types of meat. For instance, startups have successfully introduced cultured chicken, duck, and even fish products, which are gaining attention in both the gastronomy and retail sectors. The ability to engineer fat and muscle cells to mimic conventional meat textures and nutrition is proving pivotal in making cultured meats indistinguishable from their traditional counterparts.

Government initiatives across the globe are also playing a crucial role in supporting this trend. Regulatory bodies are increasingly facilitating the pathway for market entry of cultured meat products by establishing clear guidelines and safety standards. For example, countries like the United States and Israel are investing in research and development through grants and public-private partnerships, aiming to accelerate the commercial viability of cultured meats.

This diversification is crucial not only for consumer acceptance but also for the economic sustainability of the cultured meat industry. As more products enter the market, it helps in educating consumers and normalizing the consumption of cultured meats as part of a regular diet. Furthermore, the expansion of product lines allows companies to tap into different market segments, enhancing their growth potential and resilience against market fluctuations.

Regional Analysis

In the cultured meat market, Europe is emerging as a pivotal player, driven by strong consumer interest in sustainable and ethical food choices, alongside progressive regulatory frameworks. While North America currently dominates the region with a 39.40% market share, translating to a value of approximately $162.2 million, Europe is rapidly catching up due to its robust initiatives and investments in food technology.

European consumers are increasingly aware of the environmental and ethical implications of traditional meat production, which has led to greater acceptance of alternative proteins including cultured meat. This shift is supported by extensive research and development activities, particularly in countries like the Netherlands, which is home to some of the earliest cultured meat startups, and Germany, where consumer readiness for alternative proteins is notably high.

Governments across Europe are also playing a crucial role by facilitating supportive policies and funding for cultured meat research. The European Union’s Horizon Europe program, for instance, continues to fund projects that enhance cultured meat technologies, aiming to reduce production costs and improve scalability. These efforts are expected to increase the market’s growth potential in the region significantly.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Founded in Israel, Aleph Farms stands out for its commitment to creating non-GMO cultured beef steaks that mimic traditional meat in both structure and taste. Their production method, which closely replicates the natural muscle tissue growth occurring in cows, emphasizes sustainability and animal welfare. The company has made significant strides in scalability and cost reduction, aiming to provide a more ethical and environmentally friendly alternative to conventional beef.

Based in Hong Kong, Avant Meats specializes in cultivating fish products tailored to Asian culinary preferences. Their technology focuses on cell-based methods to produce fish proteins without harming marine life, addressing overfishing and pollution issues. Avant Meats targets high-end cuisine markets, emphasizing product quality and safety, and is poised to revolutionize seafood consumption with their sustainable practices.

A Turkish startup, Biftek INC is known for its innovative approach to cultured meat by focusing on cost-effective growth medium supplements. These supplements are designed to reduce the overall expense of cultured meat production, potentially solving one of the biggest challenges in the industry. Their work contributes significantly to making cultured meat more accessible and affordable on a global scale.

Top Key Players in the Market

- Aleph Farms

- Avant Meats Company Limited

- Biftek INC

- Mosa Meat

- BlueNalu, Inc.

- WildType

- Shiok Meats Pte Ltd

- SuperMeat

- Meatable

- Finless Foods, Inc

- Fork & Good, Inc.

- Future Meat Technologies Ltd

- UPSIDE Foods

- Mission Barns

Recent Developments

In 2024 Aleph Farms, the company achieved a significant milestone by receiving the world’s first regulatory approval from Israel’s Ministry of Health for its cultivated beef products. This approval marked a pivotal moment for the industry, demonstrating a strong governmental endorsement of cultured meat as a sustainable food source.

Avant Meats Company Limited has successfully raised substantial funds to support its growth, including over $10.8 million in a recent funding round led by S2G Ventures.

Report Scope

Report Features Description Market Value (2024) USD 411.7 Mn Forecast Revenue (2034) USD 16115.5 Mn CAGR (2025-2034) 44.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Poultry, Pork, Beef, Seafood, Duck, Others), By Application (Nuggets, Burgers, Meatballs, Sausages, Hot Dogs, Others), By End-use (Household, Food Services), By Distribution Channel (Hypermarkets and Convenience Stores, Food and Drink Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Aleph Farms, Avant Meats Company Limited, Biftek INC, Mosa Meat, BlueNalu, Inc., WildType, Shiok Meats Pte Ltd, SuperMeat, Meatable, Finless Foods, Inc, Fork & Good, Inc., Future Meat Technologies Ltd, UPSIDE Foods, Mission Barns Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aleph Farms

- Avant Meats Company Limited

- Biftek INC

- Mosa Meat

- BlueNalu, Inc.

- WildType

- Shiok Meats Pte Ltd

- SuperMeat

- Meatable

- Finless Foods, Inc

- Fork & Good, Inc.

- Future Meat Technologies Ltd

- UPSIDE Foods

- Mission Barns