Companion Animal Diagnostics Market By Animal (Dogs, Cats, Horses and Other Companion Animals), By Technology (Clinical Biochemistry, Immunodiagnostics, Hematology, Molecular diagnostics, Urinalysis and Others), By Application (Clinical Pathology, Bacteriology, Virology, Parasitology and Others), By End Use (Diagnostic Laboratories, Veterinary Hospitals and Clinics, Point-Of-Care/In-House Testing and Research Institutes and Universities), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 137939

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Animal Analysis

- Technology Analysis

- Application Analysis

- End Use Analysis

- Key Market Segments

- Drivers

- Restrains

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Players Analysis

- Top Key Players in the Companion Animal Diagnostics Market

- Recent Developments

- Report Scope

Report Overview

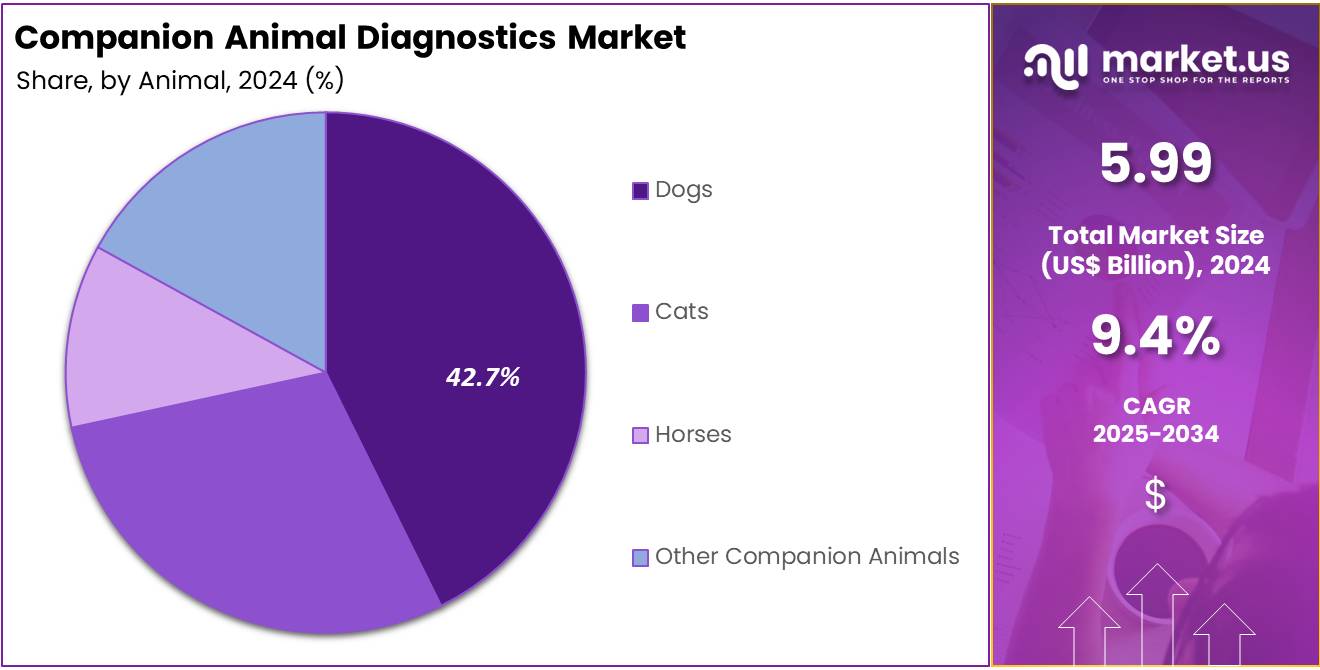

The Global Companion Animal Diagnostics Market Size is expected to be worth around US$ 14.7 Billion by 2034, from US$ 6 Billion in 2024, growing at a CAGR of 9.4% during the forecast period from 2025 to 2034.

The expansion of the veterinary diagnostics market is primarily fueled by the increasing number of pet owners in major countries like the U.S., Brazil, and China. As more households adopt pets, there is a heightened emphasis on early diagnosis, preventative measures, and tailored treatments. This shift is crucial in combating the growing incidence of zoonotic diseases among companion animals. Consequently, veterinary diagnostics are essential in preserving pet health and are becoming increasingly integral to the global healthcare framework.

- According to Global Animal Health Association, over half of the global population is estimated to have pets at home. Families in the U.S., EU, and China collectively own more than half a billion dogs and cats. In the U.S., 70% of households had a pet in 2021, an increase from 68% in 2016.

- Worldwide, dogs are the most common pet, found in approximately one in three households, while nearly a quarter of pet owners have a cat.

- According to CDC, more than 60% of all known infectious diseases in humans can be transmitted from animals, and 75% of new or emerging infectious diseases in humans originate from animals.

The demand for companion animal diagnostics has surged due to increased animal health expenditures and the rising adoption of pet healthcare insurance. These trends highlight the growing commitment of pet owners to invest in their pets’ health. Timely and accurate diagnostic procedures are critical for preventing outbreaks and ensuring effective treatments.

This need has driven higher utilization of veterinary care services, medications, and pet insurance policies. A notable shift in consumer behavior is the adoption of portable testing kits for in-house diagnostics, enabling pet owners to make informed decisions and seek timely veterinary assistance.

- According to data from the Insurance Information Institute, the U.S. saw a significant uptick in pet insurance by the end of 2023. The number of insured pets climbed to approximately 5.7 million, reflecting a 17% increase from the previous year. On average, dog owners paid about $676 annually for accident and illness coverage, translating to $56 monthly. In contrast, cat owners spent $383 annually, or $32 monthly. California, New York, and Florida had the most insured pets, with dogs comprising 80% and cats 20% of the insured population.

Technological advancements have significantly bolstered the market. Innovations in diagnostic tools and equipment, including point-of-care portable diagnostics, are transforming veterinary healthcare by enabling rapid and accurate disease detection. These portable solutions have gained widespread popularity among pet owners, offering convenience and reliability. Moreover, the availability of diverse reagents, test kits, and assays has supported market growth, allowing diagnostic tests to be conducted in various settings, from veterinary clinics to homes.

Leading companies in the industry, such as Idexx Laboratories, continue to introduce innovative products and services, driving market expansion. For example, Idexx’s VetConnect PLUS Mobile App and Catalyst SDMA-Based Test are designed to enhance veterinary practices and streamline diagnostic processes. Such innovations foster higher adoption rates among veterinary professionals and pet owners alike.

Key Takeaways

- The Companion Animal Diagnostics Market generated a revenue of US$ 5.99 Billion in 2024 and is predicted to reach US$ 13.42 Billion, with a CAGR of 9.4%.

- Based on the Animal, the Dogs segment generated the most revenue for the market with a market share of 42.7%.

- Based on the technology, Clinical Biochemistry segment generated the most revenue for the market with a market share of 25.2%.

- By Application, the Clinical Pathology segment contributed the most to the market and secured a market share of 30.1%.

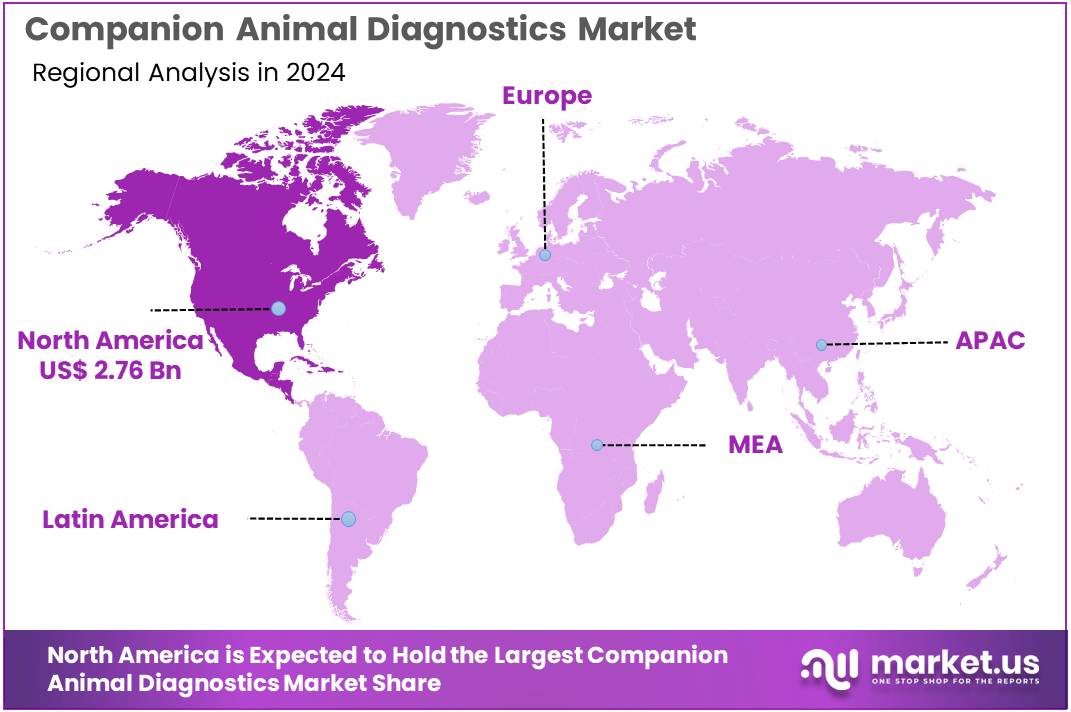

- Region-wise North America remained the lead contributor to the market, by claiming the highest market share, amounting to 46.10%.

Animal Analysis

In 2024, the dog segment dominated the Companion Animal Diagnostics Market, accounting for 42.7% of the total market share. This dominance is attributed to the increasing prevalence of zoonotic diseases, obesity, cancer, and skin disorders in dogs. The American Veterinary Medical Association reports that approximately one in four dogs develop neoplasia, and nearly half of dogs aged over ten suffer from cancer. This significant incidence underlines the crucial role of diagnostic services in effective canine health management.

The growing adoption of dogs as companion animals has also propelled this market segment. As dogs are increasingly seen as part of the family, pet owners are becoming more attentive to their health needs. This shift has led to an enhanced demand for advanced veterinary healthcare services. Owners are now more likely to invest in sophisticated health monitoring and diagnostic solutions to ensure their pets’ well-being.

On the other hand, the cat segment is poised for rapid growth and is projected to register the highest compound annual growth rate (CAGR) during the forecast period. Cats are becoming more popular as companion animals due to their emotional and psychological support and relatively low maintenance needs. This rising popularity is driving increased awareness and demand for advanced diagnostic tools in feline healthcare.

As more individuals choose cats as pets, there is a growing emphasis on health, diagnosis, and treatment. This trend is catalyzing the adoption of cutting-edge diagnostic technologies such as hematology analyzers, clinical biochemistry tests, and molecular diagnostics. The expanding market for cat diagnostics reflects a broader trend of enhanced healthcare provision for companion animals, highlighting the sector’s potential for continued growth.

Technology Analysis

Clinical biochemistry led the market in 2024, driven by a rise in zoonotic diseases and chronic conditions like diabetes, liver, and kidney disorders. Increasing awareness among pet owners of the value of clinical biochemistry tests has boosted this segment. These tests provide critical insights into an animal’s organ function and metabolic status, helping diagnose various diseases.

The market offers a broad array of reagents and consumables for clinical biochemistry, supporting its dominance. The high precision of these analyzers makes them the preferred choice for veterinarians and pet owners. They seek fast, reliable results for effective disease management and monitoring.

The urinalysis segment is poised for substantial growth during the forecast period. Its rapid, non-invasive nature makes it ideal for point-of-care diagnostics. Urinalysis is crucial for evaluating kidney function, detecting urinary tract infections, and monitoring general health, facilitating quick assessments at veterinary practices.

Advancements in urinalysis technology, such as automated analyzers and dipstick tests, have simplified the diagnostic process. These innovations ensure accurate and timely results, enhancing veterinary care. This technological progress benefits both veterinary professionals and pet owners by improving diagnostic efficiency.

Application Analysis

In 2024, the clinical pathology segment led the market with a 30.1% share, fueled by the increasing demand for comprehensive pet insurance. This trend has spurred greater investment in diagnostic services to support early disease detection and effective treatment. Clinical pathology tests have become more affordable and accessible, contributing to the segment’s growth.

Companion animals like cats and dogs often suffer from chronic conditions such as diabetes and kidney disorders. This has led owners to depend more on clinical pathology for accurate diagnosis and management. The expanding veterinary healthcare sector and a rising number of veterinary professionals are also driving the demand for clinical pathology labs and test kits.

The parasitology segment is poised for significant growth in the coming years. This growth is driven by the increasing occurrence of parasitic diseases among companion animals. There has been a notable rise in zoonotic illnesses caused by parasites like roundworms, tapeworms, and hookworms, which has boosted the demand for parasitology testing.

Portable and rapid diagnostic tools now enable veterinarians to perform on-site parasitology tests, offering immediate solutions to pet owners. Additionally, major companies are ramping up investments to develop effective drugs and treatments for parasitic diseases. This investment is expected to further propel the growth of the parasitology market segment.

End Use Analysis

In 2024, the veterinary diagnostic hospitals and clinics segment dominated the market with a 34.7% share. This growth is driven by the increasing adoption of technological innovations like point-of-care diagnostics (POCD), which enable faster, more accurate testing. These advancements allow for quicker detection and treatment of diseases, improving overall veterinary care. Notable examples include Symmetrical Dimethylarginine (SDMA) test kits, enhanced by artificial intelligence (AI), to assess kidney function in dogs and cats. Such technologies significantly enhance diagnostic capabilities in veterinary practices.

Rising awareness of zoonotic diseases, which can be transmitted between animals and humans, has further boosted demand for diagnostic services. As the threat of these diseases becomes more recognized, there is a growing need for reliable tests to detect and manage infections. Veterinary diagnostic hospitals and clinics play a crucial role in safeguarding both animal and human health by providing early detection and treatment. This growing awareness has expanded the market for diagnostic services, especially for zoonotic disease management.

Global organizations like the World Organisation for Animal Health (OIE) have been instrumental in setting standards to improve animal health and veterinary services. These initiatives encourage investments in diagnostic infrastructure, providing both public and private sectors with clear guidance. The increased focus on animal health standards is supporting market growth, driving technological innovation and improving diagnostic capabilities. As a result, the veterinary diagnostics market is expected to see continued growth, particularly in the context of zoonotic disease management and technological advancements.

Key Market Segments

By Animal

- Dogs

- Cats

- Horses

- Other Companion Animals

By Technology

- Clinical Biochemistry

- Immunodiagnostics

- Hematology

- Molecular diagnostics

- Urinalysis

- Others

By Application

- Clinical Pathology

- Bacteriology

- Virology

- Parasitology

- Others

By End Use

- Diagnostic Laboratories

- Veterinary Hospitals and Clinics

- Point-Of-Care/In-House Testing

- Research Institutes and Universities

Drivers

Humanization of Pets

The humanization of pets is a significant driver of the global companion animal diagnostics market, as pet owners increasingly regard their animals as family members. This cultural shift has led to greater spending on pet health, including advanced diagnostic tools and preventive care. According to the American Pet Products Association (APPA), pet care spending in the U.S. alone reached $136.8 billion in 2022, a significant portion of which was allocated to veterinary services and diagnostics.

This trend has driven demand for specialized diagnostic tests such as blood panels, imaging, and genetic screenings to ensure early detection and effective treatment of diseases. For instance, pet owners are now more inclined to invest in diagnostics for chronic conditions like diabetes or kidney disease, which were previously underdiagnosed.

The rise in pet insurance adoption further supports this growth. As of 2022, North America saw a 22% increase in insured pets, enabling owners to afford advanced diagnostics. Additionally, technological innovations, such as wearable devices that monitor pet health and AI-powered diagnostics, cater to this growing demand for precision care. In emerging markets like India and China, rising disposable incomes and the adoption of Western pet care practices are accelerating the adoption of companion animal diagnostics, further boosting market growth.

Restrains

Limited Veterinary Infrastructure

In developing countries, inadequate veterinary facilities and a shortage of trained professionals significantly hinder the growth of the companion animal diagnostics market. Limited access to advanced diagnostic equipment and well-equipped laboratories makes it challenging to provide accurate and timely veterinary care. For example, many rural and semi-urban areas in countries like India and Nigeria lack specialized veterinary centers, forcing pet owners to rely on basic or unqualified services.

Furthermore, the shortage of trained veterinary professionals exacerbates the issue. The World Organisation for Animal Health (OIE) estimates a significant gap in veterinary workforce capacity, particularly in Asia and Africa. This shortage limits the availability of skilled personnel to conduct diagnostic procedures, reducing the adoption of advanced diagnostics in these regions.

Additionally, economic constraints and low awareness about pet healthcare further discourage investments in diagnostics. For instance, in many developing countries, routine veterinary visits are rare, and diagnostics are only sought during severe illnesses. These challenges collectively suppress market penetration and slow the adoption of modern diagnostic solutions. Addressing these barriers through government incentives, public-private partnerships, and educational initiatives could help bridge the gap and drive market growth.

Opportunities

Growth in Telemedicine

The growth of telemedicine, including remote diagnostics and virtual consultations, is revolutionizing the companion animal diagnostics market, particularly after the COVID-19 pandemic. As social distancing measures restricted in-person veterinary visits, telemedicine emerged as a practical solution for pet care, allowing pet owners to consult veterinarians remotely and receive preliminary diagnoses from the safety of their homes.

Telemedicine platforms such as Vetster and Pawp experienced significant growth during and after the pandemic. For example, Vetster reported a 300% increase in users between 2020 and 2022. These platforms enable video consultations, prescription services, and remote monitoring, bridging the gap between pet owners and veterinary professionals.

The integration of digital tools, like wearable devices and mobile apps, further supports remote diagnostics. Devices such as pet activity trackers can monitor vital signs, behavior, and activity levels, transmitting data directly to veterinarians for analysis.

Additionally, telemedicine is expanding accessibility in rural and underserved regions, where veterinary services are scarce. This innovation reduces barriers to care, enhances early disease detection, and fosters continued growth in the companion animal diagnostics market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global companion animal diagnostics market, affecting its growth dynamics and operational landscape. Economic fluctuations, inflation, and disposable income levels directly impact pet ownership rates and spending on veterinary care. In regions facing economic downturns, pet owners may prioritize essential care over advanced diagnostics, limiting market growth. For instance, during periods of economic instability, demand for routine and preventive diagnostic services often declines.

Geopolitical tensions and trade restrictions also play a crucial role. Disruptions in global supply chains due to conflicts, such as the Russia-Ukraine war, have impacted the availability and cost of diagnostic equipment and raw materials. This results in higher prices for veterinary services, creating affordability issues in cost-sensitive markets. Additionally, government policies and regulatory frameworks vary across regions, influencing market accessibility. Stricter import/export regulations or changes in veterinary healthcare policies can delay product launches and market entry for diagnostic companies.

Conversely, increased government focus on public health and zoonotic disease control is driving investments in veterinary infrastructure, particularly in emerging markets. For example, initiatives in Asia-Pacific and Africa to control diseases like rabies have boosted the adoption of diagnostics. Overall, macroeconomic stability and geopolitical cooperation are critical for sustaining the growth of the companion animal diagnostics market globally.

Trends

The global companion animal diagnostics market is witnessing transformative trends driven by innovation, consumer awareness, and expanding geographic reach. Technological advancements are at the forefront, with tools like PCR testing, biosensors, and microfluidics enhancing diagnostic precision and efficiency. AI integration is further revolutionizing diagnostics, enabling predictive analytics and improved disease management. Point-of-care testing has gained popularity, offering portable devices for rapid, on-site results, which reduce wait times and facilitate timely treatments.

Post-pandemic, telemedicine has become a key trend, with platforms such as Vetster incorporating remote diagnostics and virtual consultations, ensuring accessible care even in underserved regions. Preventive healthcare is also gaining momentum, as pet owners increasingly prioritize early detection and routine wellness screenings to enhance their companions’ quality of life. Emerging markets in Asia-Pacific and Latin America are experiencing significant growth due to rising pet ownership, improved veterinary infrastructure, and increased disposable incomes.

Additionally, genetic testing is gaining traction as owners seek breed-specific insights and personalized health solutions for their pets. These trends highlight a dynamic market landscape, characterized by rapid technological innovation, evolving consumer expectations, and expanding opportunities across developed and emerging economies. This evolution is setting the stage for sustained growth in the companion animal diagnostics sector.

Regional Analysis

North America Dominated the Global Companion Animal Diagnostics Market

North America currently dominates the global companion animal diagnostics market, driven by several key factors such as high pet ownership, advanced veterinary infrastructure, and increasing demand for premium pet care. In the United States, pet ownership has surged, with more than 67% of households owning a pet, according to the American Pet Products Association (APPA).

This rise in pet ownership has fueled the need for more comprehensive and specialized veterinary services, including advanced diagnostic tests. The region also benefits from a well-established healthcare system, which enables greater accessibility to cutting-edge diagnostic tools and treatments. Furthermore, the presence of major market players and significant investment in research and development (R&D) has fostered innovation in diagnostic technologies, such as PCR testing, AI-powered tools, and point-of-care devices.

Telemedicine, a trend accelerated by the COVID-19 pandemic, has also expanded the reach of veterinary care, contributing to the market’s growth in North America. Additionally, the increasing humanization of pets, with owners seeking better health management and early detection for their pets, has further driven demand for diagnostic services. With its robust infrastructure, high consumer spending on pet healthcare, and focus on preventive care, North America is expected to maintain its dominant position in the companion animal diagnostics market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the global companion animal diagnostics market is characterized by the presence of several key players, ranging from established multinational companies to emerging startups. Major market players like Idexx Laboratories, Zoetis, and Mars Petcare dominate the market, offering a wide range of diagnostic products such as blood testing, imaging systems, and molecular diagnostics.

These companies invest heavily in research and development to innovate and introduce advanced technologies, including AI-powered diagnostic tools and point-of-care devices. Additionally, smaller, specialized companies like AniCon and Heska Corporation are also contributing to market growth by focusing on niche diagnostics such as genetic testing and disease-specific solutions.

Strategic partnerships, mergers, and acquisitions are common in this competitive environment, as companies seek to expand their product portfolios and geographic reach. The market is also witnessing increasing consolidation, with larger companies acquiring emerging players to strengthen their position and gain access to cutting-edge technologies. This competitive dynamic drives innovation and enhances the quality of diagnostic offerings across regions.

Top Key Players in the Companion Animal Diagnostics Market

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

- BIOMÉRIEUX

- Heska Corporation

- Idvet

- Neogen Corporation

- Qiagen

- Randox Laboratories Ltd.

- Thermo Fisher Scientific Inc.

Recent Developments

- In June 2024, IDEXX Laboratories, Inc. launched the Catalyst Pancreatic Lipase Test, a single-slide diagnostic solution for pancreatitis in dogs and cats. This test utilizes a load-and-go workflow on Catalyst analyzers, delivering rapid results that improve patient outcomes.

- In January 2024, Zoetis enhanced its Vetscan Imagyst diagnostic platform with the addition of an AI-powered Urine Sediment analysis feature. This new capability allows veterinarians to conduct precise, in-clinic sediment analysis of fresh urine, helping them make more accurate treatment decisions.

Report Scope

Report Features Description Market Value (2024) US$ 5.99 Billion Forecast Revenue (2034) US$ 13.42 Billion CAGR (2024-2033) 9.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal- Dogs, Cats, Horses and Other Companion Animals, By Technology- Clinical Biochemistry, Immunodiagnostics, Hematology, Molecular diagnostics, Urinalysis and Others, By Application- Clinical Pathology, Bacteriology, Virology, Parasitology and Others, By End Use- Diagnostic Laboratories , Veterinary Hospitals and Clinics, Point-Of-Care/In-House Testing and Research Institutes and Universities. Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IDEXX Laboratories, Inc., Zoetis, Antech Diagnostics, Inc. (Mars Inc.), Agrolabo S.p.A., Embark Veterinary, Inc., Esaote SPA, Thermo Fisher Scientific, Inc., Innovative Diagnostics SAS, Virbac, FUJIFILM Corporation, BIOMÉRIEUX, Heska Corporation, Idvet, Neogen Corporation, Qiagen, Randox Laboratories Ltd. and Thermo Fisher Scientific Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Companion Animal Diagnostics MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Companion Animal Diagnostics MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

- BIOMÉRIEUX

- Heska Corporation

- Idvet

- Neogen Corporation

- Qiagen

- Randox Laboratories Ltd.

- Thermo Fisher Scientific Inc.