Global Commodity Plastics Market Size, Share, And Business Benefits By Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), Poly (Methyl Methacrylate) (PMMA)), By Application (Films, Bottles, Containers, Insulation Materials, Pipes, Others), By End-use Industry (Packaging, Automotive, Electronics, Consumer Goods, Construction, Textiles, Medical and Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137614

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

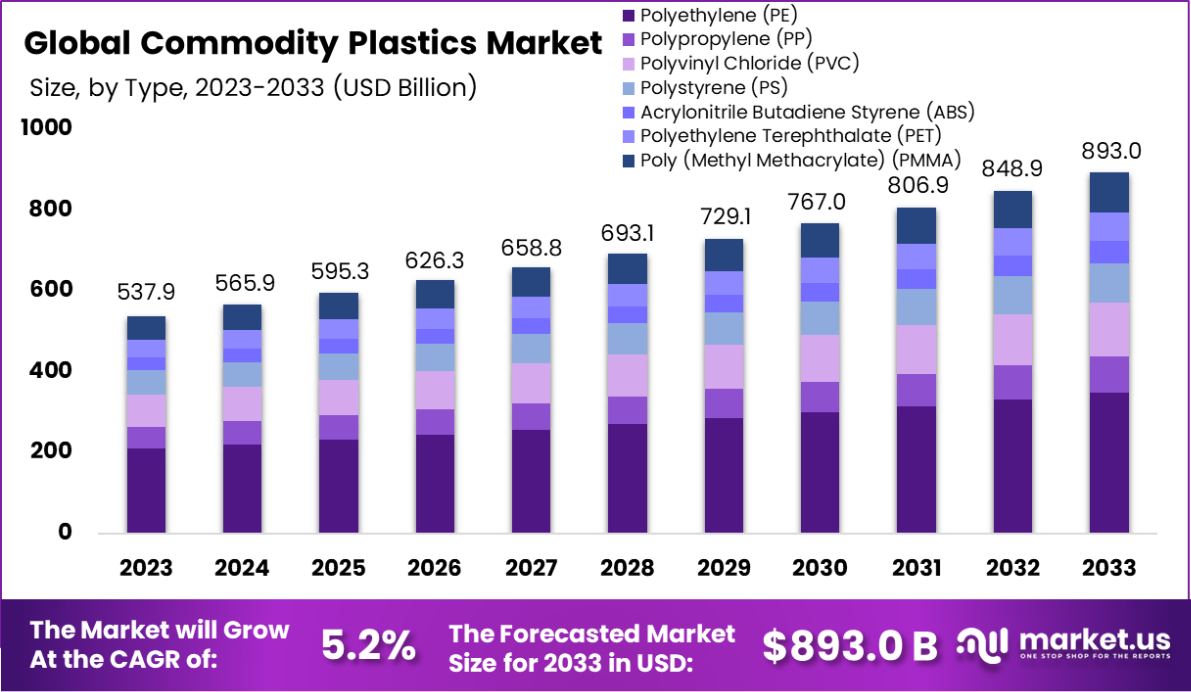

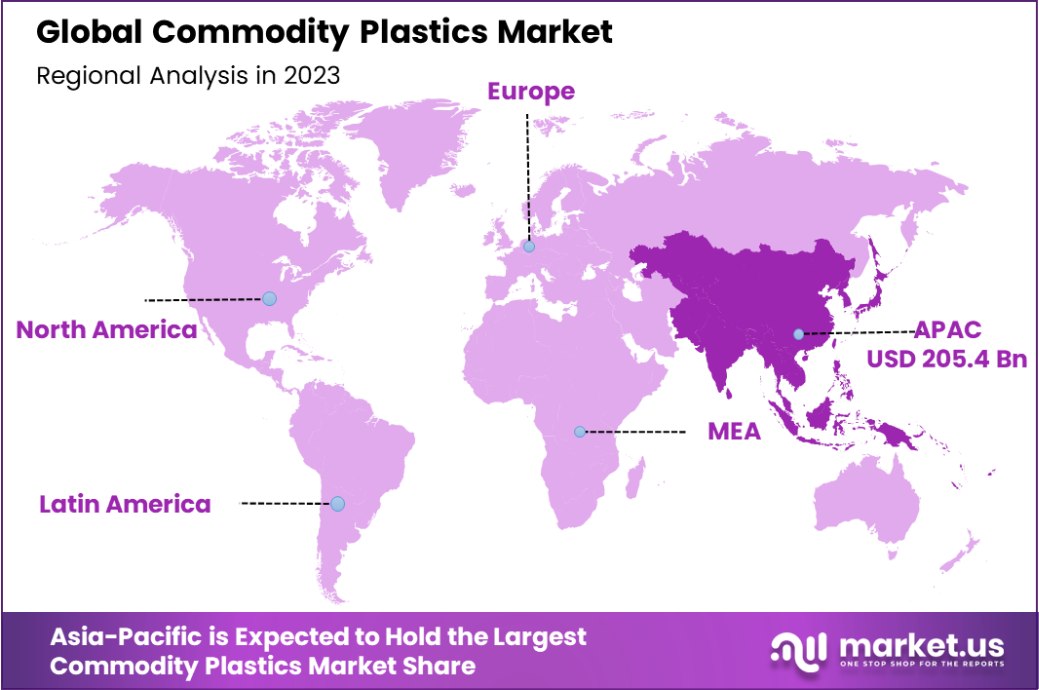

The Global Commodity Plastics Market is expected to be worth around USD 893.0 Billion by 2033, up from USD 537.9 Billion in 2023, and grow at a CAGR of 5.2% from 2024 to 2033. Asia-Pacific holds 38.2% of the commodity plastics market at USD 205.4 billion.

The commodity plastics market plays a pivotal role in industrial applications, including packaging, automotive, construction, and electronics. As a cornerstone material, it has witnessed robust growth owing to its versatility and cost-effectiveness. Key players in this market leverage advancements in polymer technology to meet diverse industrial needs.

The industrial scenario is shaped by increasing urbanization and industrialization, which drive the demand for durable and lightweight materials. The rise in e-commerce has further propelled the packaging segment, which accounts for a substantial share of the market. Regulatory policies encouraging the use of recyclable plastics have also spurred innovation, creating eco-friendly solutions.

Driving factors include the growth of the automotive industry, where lightweight plastics enhance fuel efficiency and reduce emissions. Similarly, infrastructure development in emerging economies boosts the consumption of construction-grade plastics. Trends such as bio-based plastics and circular economy practices are gaining traction, aligning with global sustainability goals.

Future opportunities lie in the development of advanced recycling technologies and biodegradable plastics. Investments in research to enhance polymer properties will pave the way for their adoption in high-performance applications.

The Commodity Plastics Market is experiencing a consistent upward trend, highlighted by Mexico’s performance as a key player. In 2022, Mexico’s plastic production was valued at approximately 28.22 billion USD. The following year, this figure slightly increased to 28.73 billion USD, reinforcing a pattern of steady growth.

This rise is part of a broader trend observed since 2018 when Mexico’s annual plastic production growth rate averaged 5.27%. This persistent expansion reflects a robust market environment, supported by evolving industrial applications and a resilient manufacturing sector. Such trends suggest that the market’s future may continue to benefit from these developmental trajectories, despite global economic fluctuations.

Integrating the latest data from trade.gov and the International Trade Administration into this analysis further solidifies the viewpoint of sustained growth within the Commodity Plastics Market.

The consistent increase in Mexico’s production capabilities not only underscores the country’s importance in the global plastics industry but also indicates a potentially steady demand trajectory moving forward.

Key Takeaways

- The Global Commodity Plastics Market is expected to be worth around USD 893.0 Billion by 2033, up from USD 537.9 Billion in 2023, and grow at a CAGR of 5.2% from 2024 to 2033.

- In the Commodity Plastics Market, Polyethylene (PE) holds a substantial 39.3% share by type.

- Films, as an application in the Commodity Plastics Market, represent 29.1% of the market.

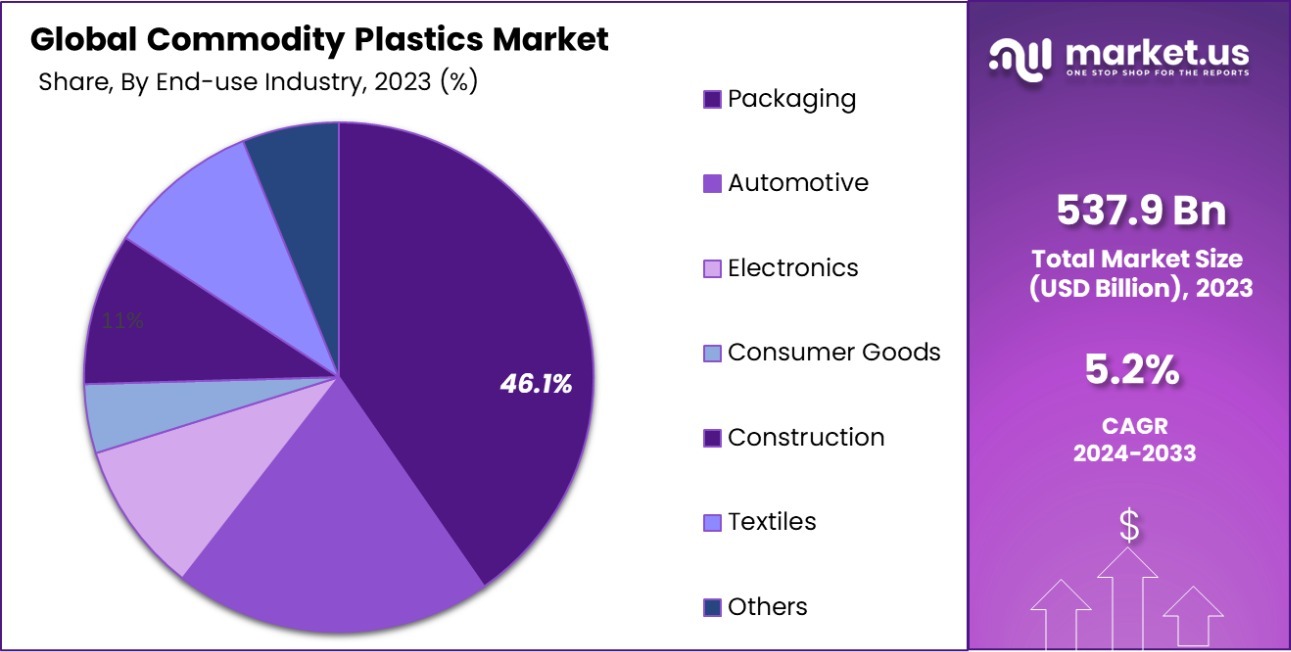

- Packaging dominates the end-use industry segment in the Commodity Plastics Market with 46.1%.

- The Asia-Pacific commodity plastics market holds 38.2% with a value of USD 205.4 billion.

Business Benefits of Commodity Plastics Market

The commodity plastics market offers substantial business benefits, primarily driven by its role in various recycling and sustainable practices that support economic development, environmental protection, and resource efficiency.

Commodity plastics contribute significantly to economic growth by supporting jobs, generating wages, and producing tax revenues. For example, the recycling of materials like plastics not only conserves resources but also supports over 681,000 jobs, which in turn contributes to the economic health of the sector.

Furthermore, advancements in plastic recycling technologies have reduced energy consumption and costs by over 50% compared to the production of virgin plastics, enhancing the overall efficiency and sustainability of the plastics industry.

The increased adoption of recycled plastics also helps reduce the environmental impact by minimizing the volume of waste that reaches landfills and natural environments, thereby preserving ecosystems and reducing pollution.

Additionally, the market for commodity plastics is evolving with an increased focus on biodegradable and plant-based plastics, which are expected to capture a larger market share as production costs decrease. This shift not only aligns with global sustainability trends but also opens up new markets and opportunities for innovation in the plastics sector.

By Type Analysis

In the Commodity Plastics Market, Polyethylene (PE) dominates with a 39.3% share.

In 2023, Polyethylene (PE) held a dominant market position in the “By Type” segment of the Commodity Plastics Market, with a 39.3% share. As a versatile and widely used material, PE is favored for its durability, flexibility, and resistance to moisture, making it ideal for packaging, containers, and household goods.

Polypropylene (PP) secured the second-largest share in the market, valued for its stiffness and resistance to chemicals. It is extensively used in automotive parts, textiles, and consumer packaging, demonstrating versatility across various industries.

Polyvinyl Chloride (PVC) is renowned for its strength and rigidity, as well as its resistance to moisture and corrosion, capturing a significant market segment. It is predominantly used in construction for pipes, doors, windows, and in healthcare applications like tubing and containers.

Polystyrene (PS) is recognized for its ability to be molded into various shapes and its excellent insulation properties. It is commonly used in food service packaging and building insulation, benefiting from its lightweight and cost-effectiveness.

Acrylonitrile Butadiene Styrene (ABS) combines toughness with rigidity, making it a preferred material for high-impact tools, automotive components, and consumer electronics. Its blend of properties ensures continued demand in high-performance applications.

Polyethylene Terephthalate (PET) is primarily used in the packaging industry, especially for producing bottles and containers for beverages and other liquid consumables. Its strength, thermo-stability, and recyclability contribute to its popularity in sustainable packaging solutions.

Poly (Methyl Methacrylate) (PMMA) offers transparency and resistance to UV light and weather conditions, making it an ideal alternative to glass. Used in automotive, construction, and lighting applications, PMMA continues to grow in demand for its aesthetic flexibility and durability.

By Application Analysis

Films lead applications in the Commodity Plastics Market at 29.1%.

In 2023, Films held a dominant market position in the “By Application” segment of the Commodity Plastics Market, with a 29.1% share. Films are extensively used across packaging, agricultural, and construction industries due to their versatility in protection and barrier properties, contributing to high demand.

Bottles, primarily made from PET and PE, captured a significant market segment. Their widespread use in beverage, pharmaceutical, and personal care industries is driven by the materials’ strength, lightweight nature, and recyclability.

Containers, crafted from materials like PP and PE, are essential in food service and storage applications. Their durability, resistance to chemicals, and safety in food contact applications ensure their continued market relevance.

Insulation Materials, primarily composed of PS and PU, are vital in building and construction for their thermal and acoustic insulation properties. The push for energy efficiency in residential and commercial buildings drives their demand.

Pipes, predominantly made from PVC and PE, are crucial in infrastructure for water supply and sewage systems. Their long lifespan, corrosion resistance, and cost-effectiveness make them a preferred choice in municipal and industrial applications.

By End-Use Industry Analysis

Packaging is the top end-use industry, claiming 46.1% of the market.

In 2023, Packaging held a dominant market position in the By End-Use Industry segment of the Commodity Plastics Market, with a 46.1% share. This segment benefits from the widespread use of plastics in food and beverage packaging due to its cost-effectiveness and versatility in protecting and preserving products.

Automotive followed with a 17.8% share, leveraging plastics to reduce vehicle weight and enhance fuel efficiency. The use of plastics in automotive components such as bumpers, dashboards, and door panels continues to drive demand in this sector.

Electronics accounted for 11.6% of the market, with plastics being integral in manufacturing lightweight and durable consumer electronics. The demand for plastics in this segment is propelled by the production of smartphones, computers, and other electronic devices.

Consumer Goods made up 9.4% of the market, utilizing plastics for a variety of products ranging from household items to sports equipment. Plastics’ adaptability and moldability make it ideal for a wide array of consumer goods.

Construction represented 7.5% of the market. Plastics in this segment are crucial for applications such as piping, insulation, and vinyl siding, which are favored for their durability and resistance to environmental factors.

Textiles had a 4.5% share, where plastics are used in the production of synthetic fibers like polyester and nylon. These materials are essential for their versatility and performance in various textile applications.

Medical and pharmaceuticals accounted for 3.1% of the market. In this sector, plastics are critical for creating sterile packaging and disposable syringes, as well as various medical devices, offering safety, reliability, and sanitation benefits.

Key Market Segments

By Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene Terephthalate (PET)

- Poly (Methyl Methacrylate) (PMMA)

By Application

- Films

- Bottles

- Containers

- Insulation Materials

- Pipes

- Others

By End-use Industry

- Packaging

- Automotive

- Electronics

- Consumer Goods

- Construction

- Textiles

- Medical and Pharmaceutical

- Others

Driving Factors

Expanding Packaging Industry Boosts Plastic Demand

The packaging sector heavily influences the commodity plastics market, as these plastics are widely used in packaging goods due to their durability and cost-effectiveness. As e-commerce sales rise and consumer preferences shift towards convenient packaging, the demand for commodity plastics such as polyethylene and polypropylene continues to surge.

This trend is supported by the ongoing innovation in packaging technologies, which aims to make packaging safer and more resilient, thereby driving the consumption of commodity plastics in this segment.

Consumer Goods Production Increases Plastic Usage

Rapid urbanization and increasing disposable incomes globally are leading to higher consumer goods production, which in turn boosts the demand for commodity plastics. These plastics are integral in manufacturing various consumer products like household containers, toys, and appliances due to their versatility and affordability.

As living standards improve and populations grow, especially in developing countries, the need for these everyday items rises, significantly pushing up the consumption of commodity plastics in the consumer goods industry.

Automotive Sector’s Shift to Lightweight Materials

The automotive industry’s ongoing shift towards lightweight materials to improve fuel efficiency and reduce emissions is prominently driving the demand for commodity plastics. Plastics such as ABS and polypropylene are being used increasingly to replace heavier materials like metal and glass.

This transition not only supports environmental sustainability efforts but also enhances vehicle performance by reducing weight. The continuous advancements in automotive design and manufacturing technologies further cement the role of commodity plastics in modern vehicles.

Restraining Factors

Environmental Regulations Tighten on Plastic Use

Growing environmental concerns and subsequent regulatory actions are major hurdles for the commodity plastics market. Governments worldwide are imposing stricter controls on plastic production and usage to combat pollution and encourage sustainability.

These regulations not only limit the volume of plastics that can be produced and used but also push companies towards developing alternatives like biodegradable plastics. Such environmental policies are reshaping industry dynamics, compelling plastic manufacturers to innovate and adapt, which may slow down the growth pace of the commodity plastics sector.

Competition from Biodegradable Plastics Gains Momentum

The rise of biodegradable plastics as an alternative to commodity plastics poses a significant challenge to the market. As consumer awareness about environmental sustainability grows, there is a notable shift towards eco-friendly materials.

This trend is supported by innovations in biodegradable plastics, which are designed to reduce environmental impact without compromising on the functional benefits that traditional plastics offer. The increasing popularity and adoption of these alternatives could restrain the demand for commodity plastics, especially in applications where biodegradability is a valued feature.

Volatile Raw Material Prices Impact Production Costs

The commodity plastics market faces ongoing challenges due to the volatility in raw material prices, primarily derived from petroleum. Fluctuations in oil prices can lead to unpredictable costs for raw materials like ethylene and propylene, which are crucial for producing commodity plastics.

This unpredictability makes it difficult for manufacturers to maintain stable production costs and pricing strategies, affecting profitability. The reliance on petroleum-based raw materials also exposes the market to broader economic and geopolitical tensions that can further exacerbate price volatility.

Growth Opportunity

Expansion into Emerging Markets Opens New Avenues

Emerging markets offer vast opportunities for the expansion of the commodity plastics industry. As countries in Asia, Africa, and Latin America experience economic growth, urbanization, and an increase in consumer spending, the demand for commodity plastics in these regions is expected to rise.

This trend presents a substantial opportunity for manufacturers to establish a presence in new markets where the demand for packaging, construction materials, and consumer goods is growing. Capitalizing on these opportunities can lead to significant market share gains and increased revenue for companies in the commodity plastics sector.

Advancements in Recycling Technologies Enhance Market Sustainability

Advancements in recycling technologies provide a major growth opportunity for the commodity plastics market. By improving the efficiency and effectiveness of plastic recycling processes, manufacturers can reduce reliance on virgin materials, decrease production costs, and mitigate environmental impact.

This not only helps in complying with regulatory standards but also appeals to the growing consumer base that favors sustainable products. As technology evolves, the ability to recycle plastics more comprehensively could lead to an expansion in their use, especially in environmentally sensitive applications.

Innovation in Plastic Formulations to Meet Industry Needs

There is significant potential for growth in the commodity plastics market through innovation in plastic formulations. Developing new plastics that are stronger, more durable, and have lower production costs can open up new applications across various industries, including automotive, construction, and electronics.

For instance, creating plastics that can withstand higher temperatures or offer better resistance to chemicals would meet specific industry needs, leading to broader usage. Such innovations could position commodity plastics as a more attractive option in sectors where they haven’t been traditionally dominant.

Latest Trends

Increasing Use of Plastics in Electric Vehicle Manufacturing

The electric vehicle (EV) industry is increasingly adopting commodity plastics to reduce vehicle weight and improve battery efficiency. Plastics like polypropylene and ABS are used extensively in interiors, exteriors, and under-the-hood components, facilitating lighter and more energy-efficient designs.

This trend is driven by the global shift towards electric vehicles as part of the move to decrease carbon emissions. As the EV market continues to expand, the demand for commodity plastics in automotive applications is expected to rise, presenting a significant opportunity for growth within this sector.

Shift Towards Sustainable and Recycled Plastics

There is a noticeable shift in the plastics industry towards the production and use of sustainable and recycled plastics. Manufacturers are increasingly focusing on integrating recycled materials into their production processes to meet both consumer demand for sustainability and regulatory requirements.

This trend is not only improving the environmental footprint of plastic products but also enhancing the public perception of plastic manufacturers. As recycling technologies advance, the use of recycled commodity plastics is set to become more prevalent, impacting the overall dynamics of the market.

Integration of Smart Technology in Plastic Production

Smart technology integration into plastic production processes is becoming a prominent trend. Manufacturers are employing advanced sensors and IoT (Internet of Things) technology to optimize manufacturing efficiency and product quality.

This technology enables real-time monitoring and control of production parameters, leading to higher yield rates, reduced waste, and improved consistency in product properties. As smart technologies continue to evolve, their integration is expected to transform production methods in the commodity plastics industry, enhancing both operational efficiency and competitiveness.

Regional Analysis

In Asia-Pacific, the commodity plastics market holds a 38.2% share, valued at USD 205.4 billion.

The Commodity Plastics Market exhibits diverse dynamics across different global regions. In Asia-Pacific, the market is the most dominant, holding a substantial 38.2% share valued at USD 205.4 billion. This region benefits from rapid industrial growth, a burgeoning population, and increasing consumer spending, particularly in China and India, which are pivotal in driving demand for packaging, consumer goods, and electronics applications.

In North America, the market is propelled by innovation in product design and a robust manufacturing base, especially in the automotive and packaging industries. This region emphasizes the adoption of sustainable and high-performance materials, which supports steady market growth.

Europe follows a similar trajectory with a strong focus on sustainability and recycling. The region’s stringent environmental regulations drive the demand for eco-friendly commodity plastics in the automotive and packaging sectors, positioning Europe as a leader in innovative plastic solutions.

The markets in the Middle East & Africa and Latin America are smaller but growing. These regions are witnessing increased demand due to urbanization and economic development. Investments in infrastructure and consumer goods sectors are key drivers, with these regions offering new opportunities for market expansion due to less saturated markets compared to North America and Europe.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global commodity plastics market remains highly competitive, with key players striving to consolidate their positions and expand their market footprint. Companies such as LG Chem, SABIC, Exxon Mobil Corporation, and LyondellBasell Industries Holdings B.V. are prominent due to their extensive product portfolios and strategic global presence.

These companies benefit from robust production capacities and strong technological advancements, which allow them to meet the growing demands of diverse industries ranging from packaging to automotive.

LG Chem and SABIC, for instance, are leveraging their capabilities in high-performance plastics to cater to sectors that require durable and lightweight materials. Exxon Mobil Corporation continues to excel in producing polyethylene and polypropylene, benefiting from its integrated supply chain and expertise in chemical engineering. Similarly, LyondellBasell not only leads in volume but also in the development of new plastic formulations that offer better performance characteristics and environmental benefits.

Furthermore, companies like BASF SE and DuPont focus on innovation to create more sustainable plastic solutions, which resonate well with the increasing consumer and regulatory push for environmentally friendly products. This approach not only helps in maintaining regulatory compliance but also in building a sustainable brand image.

On the other hand, players like Borealis AG and Braskem are expanding their reach in emerging markets, which presents them with growth opportunities in regions that are currently under-served. Chevron Phillips Chemical Company, LLC, and INEOS are enhancing their logistics and distribution strategies to effectively serve global markets.

Top Key Players in the Market

- Lg Chem

- Sumitomo Chemical

- Sabic

- Exxon Mobil Corporation

- Chevron Phillips Chemical Company, LLC

- BASF SE

- Dow

- DuPont

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Braskem

- Eni S.p.A

- Formosa Plastics Corporation

- Sumitomo Chemical Co., Ltd.

- Hanwha Group

- INEOS

Recent Developments

- In 2023, LG Chem advanced its commodity plastics sector by focusing on sustainability, enhancing eco-friendly product offerings, and integrating chemical recycling to maintain product quality while using sustainable raw materials. They operationalized a new pyrolysis oil plant, underscoring their commitment to environmental responsibility.

- In 2023, SABIC, a key player in the commodity plastics sector, focused on advancing sustainability within the industry. The company invested over $1 billion in more than 90 projects aimed at enhancing operational efficiency and reducing energy consumption as part of the Saudi Energy Efficiency Program.

Report Scope

Report Features Description Market Value (2023) USD 537.9 Billion Forecast Revenue (2033) USD 893.0 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), Polyethylene Terephthalate (PET), Poly (Methyl Methacrylate) (PMMA)), By Application (Films, Bottles, Containers, Insulation Materials, Pipes, Others), By End-use Industry (Packaging, Automotive, Electronics, Consumer Goods, Construction, Textiles, Medical and Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lg Chem, Sumitomo Chemical, Sabic, Exxon Mobil Corporation, Chevron Phillips Chemical Company, LLC, BASF SE, Dow, DuPont, LyondellBasell Industries Holdings B.V., Borealis AG, Braskem, Eni S.p.A, Formosa Plastics Corporation, Sumitomo Chemical Co., Ltd., Hanwha Group, INEOS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Commodity Plastics MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample

Commodity Plastics MarketPublished date: January 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lg Chem

- Sumitomo Chemical

- Sabic

- Exxon Mobil Corporation

- Chevron Phillips Chemical Company, LLC

- BASF SE

- Dow

- DuPont

- LyondellBasell Industries Holdings B.V.

- Borealis AG

- Braskem

- Eni S.p.A

- Formosa Plastics Corporation

- Sumitomo Chemical Co., Ltd.

- Hanwha Group

- INEOS